Abstract

The importance of entrepreneurship as a driver of economic development cannot be denied. Nevertheless, most developing countries still suffer from low and unsatisfactory in entrepreneurship level, partially explained the low economic growth. Given the main attribute of developing countries, which is highly-corrupted, this study empirically investigates the effect of corruption on entrepreneurship in 48 developing countries over nine (9) years from 2008 to 2016. By using the Generalized Methods of Moment (GMM) estimator, the results show that an increase in corruption will promote more new business start-ups. This is because, in highly corrupted countries, individual and potential entrepreneurs observed that “the only way” to start a business is to involve in a corrupted activity such as bribes. Therefore, a proactive role of government as a policy maker in effectively reducing and eventually eliminating corruption as well as promoting a more conducive environment for entrepreneurs to grow up is very critical.

Keywords: Corruptiondeveloping countriesentrepreneurshipGMM

Introduction

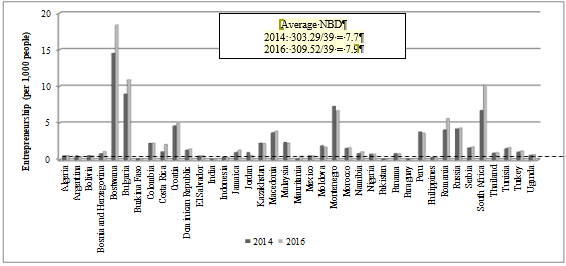

Policymakers, scholars and economists strongly believe that economic growth for both developed and developing countries can be improved by entrepreneurship activities ( Urbano & Aparicio, 2016; Stuetzer et al., 2018). Entrepreneurship significantly contributes to a country’s development in terms of providing employment opportunities and offering product varieties. Apart from creating new and more jobs, entrepreneurship also promotes social welfare through income distribution, encourage competition and promote technological change due to globalization, which signals increased productivity and economic stimulate ( Aparicio et al., 2016; Erken et al., 2016; Angulo-Guerrero et al., 2017). Figure

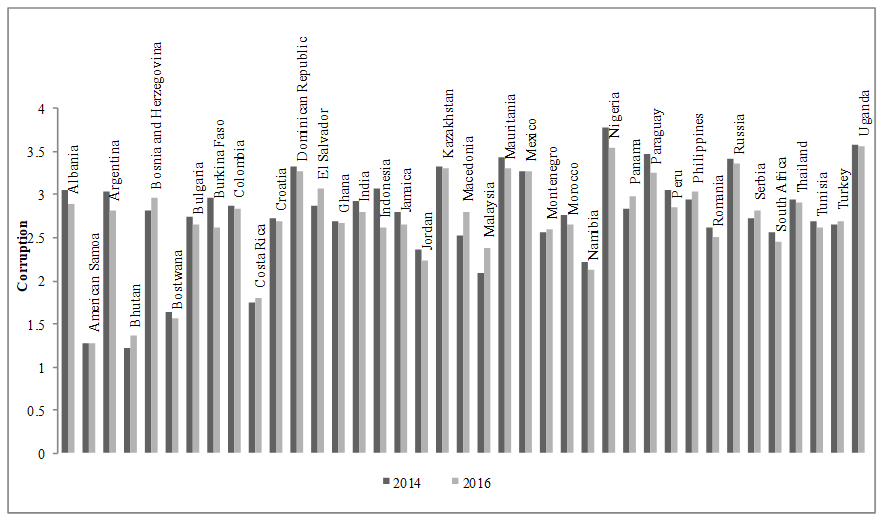

On the positive note, good progress of entrepreneurship in most developing countries can generally be observed, whereby many countries are able to register improvement in terms of the number of new business registration in 2016, as opposed to 2014. For instance, countries such as Botswana, Bulgaria and South Africa have recorded a significant improvement in 2016 as compared to 2014, accompanied by other developing countries such as Croatia, Macedonia, Romania and Russia, which recorded a slight upward trend. The nature of entrepreneurship in developing countries is a bit different from developed countries. Given the lack of uniqueness or less technology-oriented, apart from sensitive to the new entrances, entrepreneurs in developing countries are also susceptible to a sudden changes in the cost of production, particularly those due to corruption. In line with Masron and Nor ( 2013), several recent past studies have also suggest that lower level, although preferably the absence of corruption can ease promote and encourage more entrepreneurship activities as well as new business start-ups ( Avnimelech et al., 2014; Dutta & Sobel, 2016). Also, lower levels of corruption in most developed countries have been cited as among the promoting factors leading to the prosperity of entrepreneurship activities ( Avnimelech et al., 2014; Dutta & Sobel, 2016). Most of the developing countries are recording a decline in the corruption level (refer to Figure

Currently, some developing countries such as American Samoa and Bhutan are surprisingly capable to be below the average corruption index of developed countries and many others like Botswana, Costa Rica, Malaysia and Namibia are almost at par with the average index of developed countries. Other countries are expected to be able to emulate the experience of these developing countries.

Problem Statement

Although entrepreneurship in developing countries shows there is a significant improvement, currently most developing countries suffer low and unsatisfactory in the level of entrepreneurship as compared to developed countries. From Figure

Research Questions

Figure

Purpose of the Study

Although there are several past studies deal with the effect of corruption on entrepreneurship, most studies are at best using mixed sample of developed and developing countries. Given the tendency for developing countries to suffer seriously from high corruption, this study predicts that the results could be positive as opposed to commonly obtained results. Hence, this point justifies the need for re-estimation of the effect of corruption in purely developing countries case.

Research Methods

The empirical model is based on the Eclectic Theory of Entrepreneurship by Verheul et al. ( 2002). This study used panel data sample of 48 developing countries from 2008 to 2016 by utilizing the Generalized Method of Moment (GMM) to deal with endogeneity and bias as a result by explanatory variables that are not strictly exogenous ( Arellano & Bond, 1991; Arellano & Bover, 1995; Blundell & Bond, 1998). Since the nature of our data has a large number of countries

Findings

According to the descriptive analysis indicated in Table

Table

This section is meant for emphasizing the findings of this study, which focuses on the effect of corruption on entrepreneurship. To achieve the stated objective, this study has adopted the GMM technique to deal with the potential endogeneity in the models ( Choong, Baharumshah, Yusop & Habibullah, 2010). (This study notices that there is a potential for endogeneity issues to occur as the 2 dependent variables and 6 explanatory variables included in the analysis can influence each other. For instance, the variable entrepreneurship

Before interpreting the results of GMM, it is necessary to check the four specification tests, namely, lagged variable, first-order autocorrelation or AR(1), second-order autocorrelation or AR(2) and the Hansen test for the appropriateness of GMM estimator ( Arellano & Bond, 1991). The lagged dependent variables remain significant and positive across regression confirming the dynamic character of model specification. The AR(1) rejects the null hypothesis of no autocorrelation, the AR(2) fails to reject the null hypothesis of no autocorrelation and the Hansen test fails to reject the null hypothesis of no over-identification of restriction in all regressions implying that the instruments are valid. Hence, the Model in Table

The discussion will start with the effect of lagged entrepreneurship. The lagged entrepreneurship is found to be highly significant and have a positive effect on entrepreneurship. Apart from justifying the appropriateness of the dynamic panel model, the results also highlight the importance of past entrepreneurship in determining the current entrepreneurship in developing countries. Since we have difficulty to find the natural culture index at the national level, which varies across years, lagged entrepreneurship could be a good proxy. Past culture of entrepreneurship will have a strong bearing on today’s decision by the rest to be entrepreneurs ( Kristjánsdóttir et al., 2017; Shirokova et al., 2018).

Based on 2-step system-GMM, the coefficient of corruption

For the other factors, the discussion will start with the result of education

Investment

There is a significant and positive relationship between trade

Finally, unemployment

For further analysis, a robustness test is performed to confirm the findings. The most basic robustness tests initially with two different proxies of entrepreneurship and corruption being the only factor as shown in Table

Based on the findings in Table

Based on the 2-step system-GMM, notable similar findings for other factors such as education, investment, GDP, trade and unemployment are statistically significant determinants of entrepreneurship as presented in Table

Conclusion

While the results may misleadingly suggest that corruption is good, corruption remains not only a cost to entrepreneurs, but also creates uncertainty for their business. The positive effect simply suggests that the level of corruption is so critical and instead, it may hamper many attempts to be an entrepreneur. While the successful entrepreneurs might be there, the unsuccessful entrepreneurs could be more than those successful particularly to those with extremely limited capital to start with. The results stress the need to fight corruption to encourage entrepreneurship in the most conducive way. This study reinstates several policy recommendations to reduce corruption such as strengthening rule of law and regulatory quality as well as strategies towards developing higher individual integrity by such as conducting moral-related and value-enhancing programs, seeking to increase individual accountability and awareness as well as purify inner behaviour.

Appendix

-

List of countries having both NBD and GEI indicators (n=48): Albania Algeria, Argentina, Bangladesh, Bolivia, Bosnia and Herzegovina, Botswana, Brazil, Bulgaria, Burkina Faso, Colombia, Costa Rica, Croatia, Dominican Republic, El Salvador, Ethiopia, Ghana, Guatemala, India, Indonesia, Jamaica Jordan, Kazakhstan, Kenya, Madagascar, Macedonia, Malaysia, Malawi, Mauritania, Mexico, Moldova, Morocco, Montenegro, Namibia, Nigeria, Pakistan, Panama, Paraguay, Peru, the Philippines, Romania, Russia, Serbia, South Africa, Thailand, Tunisia, Turkey and Uganda.

-

List of countries with only NBD indicator (n=29): Armenia, Azerbaijan, Belarus, Belize, Bhutan, Congo Democratic Republic, Gabon, Georgia, Guinea, Haiti, Kyrgyz Republic, Laos, Lesotho, Mauritius, Mongolia, Nepal, Niger, Rwanda, Senegal, Sierra Leone, Sri Lanka, Suriname, Tajikistan, Timor-Leste, Togo, Tonga, Ukraine, Uzbekistan, Vanuatu and Zambia.

-

List of countries with only GEI indicator (n=17): Albania, Algeria, Angola, Benin, Botswana, Burundi, Cameroon, Chad, China, Cote D'Ivoire, Ecuador, Egypt, Gambia, Honduras, Iran, Lebanon, Liberia, Mali, Mozambique, Nicaragua, and Venezuela.

-

List of countries for BLS indicator (n=18): Argentina, Brazil, Bulgaria, Colombia, Croatia, India, Indonesia, Jordan, Kazakhstan, Malaysia, Mexico, Peru, Philippines, Romania, Russia, South Africa, Thailand and Turkey.

References

- Angulo-Guerrero, M.J, Perez-Moreno, S., & Abad-Guerrero, I.M. (2017). How economic freedom affects opportunity and necessity entrepreneurship in the OECD countries. Journal of Business Research, 73(1), 30-37.

- Aparicio, S., Urbano, D., & Audretsch, D. (2016). Institutional factors, opportunity entrepreneurship and economic growth: Panel data evidence. Technological Forecasting and Social Change, 102(1), 45-61.

- Arellano, M., & Bond, S.R. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277-297.

- Arellano, M., & Bover, O. (1995). Another look at the instrumental-variable estimation of error-components models. Journal of Econometrics, 68(1), 29-52.

- Avnimelech, G., Zelekha, Y., & Sharabi., E. (2014). The effect of corruption on entrepreneurship in developed vs non-developed countries. International Journal of Entrepreneurial Behavior and Research, 20(3), 237-262.

- Bloom, N., Draca, M., & Van Reenen, J. (2016). Trade induced technical change? The impact of Chinese imports on innovation, IT and productivity. The Review of Economic Studies, 83(1), 87-117.

- Blundell, R. W., & Bond, S. R. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115-143.

- Bologna, J., & Ross, A. (2015). Corruption and entrepreneurship: evidence from Brazilian municipalities. Public Choice, 165(1-2), 59-77.

- Choong, C. K., Baharumshah, A. Z., Yusop, Z., & Habibullah, M. S. (2010). Private capital flows, stock market and economic growth in developed and developing countries: a comparative analysis. Japan and the World Economy, 22(2), 107-117.

- Cueto, B., Mayor, M., & Suarez, P. (2015). Entrepreneurship and unemployment in Spain: a regional analysis. Applied Economics Letters, 22(15), 1230-1235.

- De Loecker, J., Goldberg, P. K., Khandelwal, A. K., & Pavcnik, N. (2016). Prices, markups, and trade reform. Econometrica, 84(2), 445-510.

- Dreher, A., & Gassebner, M. (2013). Greasing the wheels-the impact of regulations and corruption on firm entry. Public Choice, 155(3-4), 413-432.

- Dutta, N., & Sobel, R. (2016). Does corruption ever help entrepreneurship? Small Business Economics, 47(1), 179-199.

- Dvouletý, O. (2017). Determinants of Nordic entrepreneurship. Journal of Small Business and Enterprise Development, 24(1), 12-33.

- Erken, H., Donselaar, P., & Thurik, R. (2016). Total factor productivity and the role of entrepreneurship. Journal of Technology Transfer, 43(6), 1493-1521.

- Fritsch, M., Kritikos, A., & Pijnenburg, K. (2014). Business cycles, unemployment and entrepreneurial entry-evidence from Germany. International Entrepreneurship and Management Journal, 11(2), 267-286.

- Fuentelsaz, L., González, C., Maícas, J.P., & Montero, J. (2015). How different formal institutions affect opportunity and necessity entrepreneurship. BRQ Business Research Quarterly, 18(4), 246-258.

- Galindo, M.A., & Mendez, M.T. (2014). Entrepreneurship, economic growth and innovation: are feedback effects at work. Journal of Business Research, 67(5), 825-829.

- GEDI (2017). Global entrepreneurship index. Global Entrepreneurship Development Institute.

- Ghani, E., Kerr, W. R., & O'Connell, S. (2014). Spatial determinants of entrepreneurship in India. Regional Studies, 48(6), 1071-1089.

- Graevenitz, G. V., Harhoff, D., & Weber, R. (2010). The effects of entrepreneurship education. Journal of Economic Behavior and Organization, 76(1), 90-112.

- Hoogendoorn, B. (2016). The prevalence and determinants of social entrepreneurship at the macro level. Journal of Small Business Management, 54(S1), 278-296.

- Koellinger, P. M., & Thurik, A. R. (2012). Entrepreneurship and the business cycle. The Review of Economics and Statistics, 94(4), 1143-1156.

- Kristjánsdóttir, H., Guolaugsson, B. O., Guðmundsdóttir, S., & Aoalsteinsson, G. D. (2017). Hofstede national culture and international trade. Applied Economics, 49(57), 5792-5801.

- Masron, T. A., & Nor, E. (2013). FDI in ASEAN-8. Does institutional quality matter? Applied Economics Letters, 20(2), 186-189.

- Oosterbeek, H., Van Praag, M., & Ijsselstein, A. (2010). The impact of entrepreneurship education on entrepreneurship skills and motivation. European Economic Review, 54(3), 442-454.

- Shirokova, G., Tsukanova, T., & Morris, M. H. (2018). The moderating role of national culture in the relationship between university entrepreneurship offerings and student start-up activity: an embeddedness perspective. Journal of Small Business Management, 56(1), 103-130.

- Simon-Moya, V., Revuelto-Taboada, L., & Guerrero, R. F. (2014). Institutional and economic drivers of entrepreneurship: an international perspective. Journal of Business Research, 67(5), 715-721.

- Stuetzer, M., Audretsch, D. B., Obschonka, M., Gosling, S. D., Rentfrow, J. P., & Potter, J. (2018). Entrepreneurship culture, knowledge spillovers and the growth of regions. Regional Studies, 52(5), 608-618.

- Thai, M. T. T., & Turkina, E. (2014). Macro-level determinants of formal entrepreneurship versus informal entrepreneurship. Journal of Business Venturing, 29(4), 490-510.

- Urbano, D., & Aparicio, S. (2016). Entrepreneurship capital types and economic growth: international evidence. Technological Forecasting and Social Change, 102(1), 34-44.

- Verheul, I., Wennekers, S., Audretsch, D., & Thurik, R. (2002). An eclectic theory of entrepreneurship: policies, institutions and culture. In Audretsch, D., Thurik, R., Verheul, I., Wennekers, S. (Eds.), Entrepreneurship: Determinants and policy in a European-US comparison. Kluwer Academic Publishers.

- World Bank. (2017a). World Development Indicators. https://datacatalog.worldbank.org/dataset/world-development-indicators/

- World Bank. (2017b). Worldwide Governance Indicators. https://datacatalog.worldbank.org/dataset/worldwide-governance-indicators/

- World Bank. (2017c). Doing Business. https://datacatalog.worldbank.org/dataset/doing-business/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Rashid, S. A., Masron, T. A., & Abd Kader Malim, N. (2020). Corruption VS Entrepreneurship In Developing Countries. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 61-72). European Publisher. https://doi.org/10.15405/epsbs.2020.10.6