Abstract

Nowadays, HoReCa industry is in the top of the fastest growing business facilities in Russia. But despite the significant capacity of this market, its development in Russia is extremely heterogeneous in the regions: where the positions of some players are quite stable and this contributes to the stability of development, and in some regions the industry is so “precarious" that the hotel and restaurant business is forming extremely fragmented. However, there are a lot of changes in HoReCa segment, which are forcing market players in all regions to pay more and more attention to maintaining their competitive positions. This article proposes a matrix model for determining the competitive stability of HoReCa industry, which allows segmenting Federal Districts by this indicator. The key parameters that determine competitive stability are the resource landscape in the industry itself and the risk background of the external environment. The author's matrix of competitive stability can be used as a diagnostic tool for the development of the hotel and restaurant business in the region, contributing to the efficiency of functioning in the turbulent environment. The capabilities of the matrix allow proactively identifying crises of competitive stability, creating the prerequisites for the formation of proactive and adequate to the dynamics of the environment strategic decisions.

Keywords: HoReCa industry competitive sustainability matrix resource landscape risk background strategic decisions

Introduction

In Russia, HoReCa sector began to form actively about 12 years ago, despite the fact that the total revenue from the sale of food and beverages on HoReCa market in the USA amounted to more than $600 billion in 2019. An analysis of food distribution channels in the USA and Western Europe showed that by 2025 HoReca segment will have occupied a dominant market share (Kryukova et al., 2019): about 55% for 45% of food products groups to further sale franchising strategies and the development of multinational networks (Bondarenko et al., 2019). In turn, in Russia HoReCa is a dynamically developing and one of the fastest growing segments of the economy in the context of the formation of a culture of building relations between food producers and HoReCa enterprises.

People, not involving service market, often don’t know what HoReCa is. Even after learning the definition of this term, they feel misunderstanding of HoReCa processes: what it is and why it should be singled out as a separate business segment. The structure of Google and Yandex search queries showed that HoReCa is only gaining momentum in Russia with today's average monthly statistics of only about 18 thousand hits, with the bulk of queries related to furniture and exhibition sites.

HoReCa is a comprehensive concept that includes a lot of organizations that are somehow involved in the provision of services or the sale of hospitality products (Alnawas & Hemsley-Brown, 2019). The translation of the abbreviation HoReCa from English is the following: Ho - Hotel, Re - Restaurant, Ca – Catering.

Problem Statement

According to the Ministry of Industry and Trade (Ministry of Industry and Trade of the Russian Federation, 2020), Russia has enormous potential for the development of HoReCa: according to statistics, a new establishment in the hotel and restaurant business opens almost every day in Russia. However, even with such an intensity of development, this niche is not completely occupied. As a rule, even in large cities, the concentration of establishments in the center is much lower than existing needs, not to mention remote areas. Nevertheless, many formal signs indicate the development of HoReCa (an increase in the purchasing power of the population, an increase in gastronomic literacy, an increase in profit among market leaders, a decrease in the financial threshold for new players to enter the market), but many factors inhibit it and make development uneven (especially now under the conditions of a pandemic).

The unevenness of development is especially clearly visible in the context of regions: each of them has their own unique features of hospitality, features of the development of tourism business, features of national identity, regional cuisine, unusual restaurants and hotels. The heterogeneous industry profile of HoReCa raises the question of a certain segmentation of the territory of Russia, depending on the level of state of the parameters affecting its development and competitive stability.

Research Questions

The study of the competitive stability of HoReCa industry in the context of the Federal Districts of the Russian Federation is based on the study of a number of issues, both scientific and practical.

-

Definition of the term "competitive stability" and its structural parameters.

-

Identification of factors that form the structural parameters of competitive stability and their folding into aggregated indicators.

-

Development of a tool on the basis of aggregated indicators that allows identifying areas characterized by a certain level of competitive stability.

Purpose of the Study

It is assumed that the answers to the research questions will help to achieve the goal: segmentation of the Federal Districts of the Russian Federation depending on the level of parameters that affect the development and competitive stability of HoReCa industry and will contribute to the development of a comprehensive mechanism for the development of the hospitality industry based on a balance of business interaction and authorities.

Research Methods

According to Group of companies “Best”, in the 1st quarter of 2019, there were 1.4 closed establishments for each open ones (Group of companies «Best"»: Experts summed up the traditional results of the year in the restaurant business of St. Petersburg, 2019). That is, against the background of a fairly dynamic development of the hotel and restaurant business, there is daily exit of the market of the least competitive players. In these conditions, it is crucial for HoReCa segment to maintain its competitive stability, balancing between risks and shocks of the Russian services market and its own resource capabilities. In particular, regarding the Russian sector of HoReCa, it seems advisable to conduct a certain analysis and segmentation for its competitive stability. Carrying out such an analysis requires a certain amount of information of a retrospective nature, as well as information on the current state and development prospects. And this is a significant problem: Russian HoReCa does not work on aggregating data both for the country as a whole and for individual regions; each participant sees the market with his own eyes. Therefore, instead of a laconic and structured picture of the market, new players get different visions for this sector: extremely “optimistic” notes are heard in the speeches of regional authorities, while local industry experts adhere to pessimistic sentiments. Information from open official statistical sources is used and the total understanding of the problem is given. Based on statistical data, the average annual rate of change of parameters (RH - rate of change) is determined, and this allows:

-

giving the research more objective character (the use of absolute values will distort the results in view of the heterogeneity of the objects of study - they vary in size and geographical location);

-

studying the development of HoReCa industry in each research object in dynamics, which provides better assessment;

-

performing mathematical actions to aggregate various indicators into a single indicator.

In business practice, matrix models (Nikolskaya et al., 2018) are an effective tool that helps in differentiating objects by various indicators and parameters, as well as in visualizing information on this basis. As a rule, matrix methods are used to make strategic decisions at the level of individual market entities (BCG, GE, ADL, Hofer & Schendel, Ansoff and others). But the use of matrix tools is possible and appropriate at the level of markets, industries and even territories (Myrzaliyev et al., 2018). The objects of study in this case are the Federal Districts (FD) of the Russian Federation, the subject of the study is the competitive stability of HoReCa segment in each of these districts.

Definition of the term "competitive stability" and its structural parameters

The study of scientific sources on the issues of ensuring competitive stability (Cherkasov, 2014) leads to the conclusion that, despite a fairly wide range of approaches to understanding this definition, most researchers agree that competitive stability is the ability of an object to maintain its competitiveness during a long time. From this perspective, competitive sustainability of HoReCa is determined by two parameters: the competitiveness of the industry and its sustainability. In turn, competitiveness, as the ability to withstand competition, depends on internal capabilities (Arsenyev et al., 2019), i.e. from HoReCa resource landscape in each specific FD. And stability, as the ability to maintain the current state under the influence of external factors, depends on the level of risky background in the financial sector of FD.

Identification of factors forming the structural parameters of competitive stability and their folding into aggregate indicators

Accordingly, for the analysis of the resource landscape, it is necessary to use statistical parameters characterizing the main types of resources involved:

-

the average annual number of employees in HoReCa segment - HR - human resources;

-

the average annual value of fixed assets in HoReCa segment - MR - material resources;

-

the balanced financial result in HoReCa segment - FR - financial resources.

Then the indicator of changes in the resource landscape (IRL – Indicator of the resource landscape) can be calculated as follows:

,

where: RHHR is the average annual rate of change in the number of employees in HoReCa segment;RHMR is the average annual rate of change in the value of fixed assets in HoReCa;RHFR is the average annual rate of change of the balanced financial result.

A value of the indicator of changes in the resource landscape that is greater than or equal to 1.0 (IR ≥1,0) indicates the preservation and increase in the dynamics of HoReCa competitiveness

The value of the indicator of changes in the resource landscape of less than 1.0 (IRL<1,0) indicates a decrease in the dynamics of the competitiveness of HoReCa industry.

In turn, the level of risk background depends on a number of complex factors:

-

territorial (population of the territory (p – population) and its potential labor force (pw - population worker)) - TF - territorial factor:

,

where: RHTF is the average annual rate of change of the territorial factor;RHp is the average annual rate of change in population;RHpw is the average annual rate of change in labor.

-

socio-economic (level of population income (

r - revenue ) in a given territory and volumes of consumer spending (e-expenses )) -CEF - socio-economic factor :

,

where: RHCEF is the average annual rate of change of the socio-economic factor;RHr is the average annual rate of change in the population's cash income per month;RHe is the average annual rate of change in per capita consumer spending per month.

-

competition factor (the number of enterprises (q - quantity) in HoReCa segment and their turnover (t - turnover)) - CF - competitive factor:

,

where: RHCF is the average annual rate of change of the factor of competition;RHq is the average annual rate of change in the number of enterprises in HoReCa;RHt is the average annual rate of change in the turnover of enterprises in HoReCa segment.

Then the indicator of risk background change (IRB – Indicator of risk background) can be calculated as follows:

,

where: RHTF is the average annual rate of change of the territorial factor;RHCEF is the average annual rate of change of the socio-economic factor;RHCF is the average annual rate of change of the factor of competition.

A value of the indicator of changes in the risk background that is greater than or equal to 1.0 (IRB ≥ 1,0) indicates a decrease in the dynamics of risks in the external environment and the creation of additional opportunities for maintaining the stability of HoReCa industry.

The value of the indicator of changes in the risk background of less than 1.0 (IRB < 1,0) indicates an increase in the dynamics of risks in the external environment and the creation of threats to maintain the stability of HoReCa industry.

Development on the basis of aggregated indicators of a tool that allows identifying areas characterized by a certain level of competitive stability

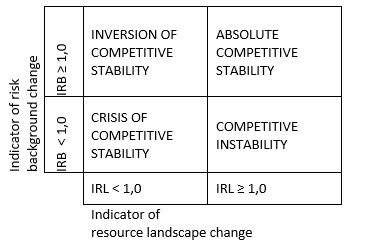

The combination of the values of the indicator of changes in the resource landscape (characterizing competitiveness) and the indicator of changes in the risky background (characterizing stability) allows creating a matrix of competitive stability for HoReCa segment, including 4 zones (Figure

-

Zone of absolute competitive stability (IRL ≥ 1,0; IRB ≥ 1,0).

-

Competitive instability zone (IRL ≥ 1,0; IRB < 1,0).

-

Competitive stability inversion zone (IRL < 1,0; IRB ≥ 1,0).

-

Competitive stability crisis zone (IRL < 1,0; IRB < 1,0).

The distribution of federal districts by matrix zones allows not only identifying the current status, but also identifying the most serious problems, the reasons for their occurrence and the path of stabilization/growth of HoReCa's competitive stability in the Federal District.

Findings

The research was carried out on the basis of state statistics published in the annual collection of scientific articles “Regions of Russia. Socio-economic indicators” (2020). The period of analysis of statistical indicators is from 2008 to 2018. There are two reasons for choosing the time interval: firstly, before 2008, HoReCa segment was poorly represented in Russia and data on its development are extremely fragmented; secondly, this period is the most indicative from the point of view of sustainability - it was saddles with both the global financial crisis (2008-2009), and economic sanctions (2014 to the present) and the subsequent food embargo (Bandalouski, 2018). A comparative assessment of competitive stability was carried out in eight federal districts of Russia (table

The following assumptions were taken into account:

-

North Caucasion Federal District was formed in 2010, so the study in this district was conducted for the period from 2010 to 2018.

-

Crimean Federal District was founded in 2015; therefore, it was not included in the list of research objects due to the insufficient array of statistical data.

Table

A detailed study of the dynamics of the resource component made it possible to map the strengths and weaknesses of HoReCa segment: in almost all FDs (with the exception of Central Federal District), profitability indicators or their absence are extremely low as a serious anchor that reduces competitive stability. HoReCa is one of the first to assume all the economic shocks (“data summaries” for the first weeks of isolation period in March-April 2020 caused by COVID-19 eloquently testify to this), and this creates the prerequisites not only for the deterioration of the competitive stability parameters, but also the possible "exit from the market" of the least stable players. Despite a significant increase in the dynamics of the property component in all districts and the preservation of growth in the number of employees (except for North-Western Federal District), the aggregate indicator of changes in the resource landscape indicates gaps in the possibilities of maintaining the competitive stability of HoReCa in different federal districts.

Table

Analysis of the dynamics of changes in external factors demonstrated a number of negative points. Firstly, from the territorial factor, in a number of districts, a decrease in the population over the study period is observed, and what is especially dangerous is that almost everywhere (except for Central and Southern Federal Districts) there is a noticeable drop in the labor force indicator (due to natural and migration reasons). Secondly, competition is intensifying, but the situation is ambiguous: RHq indicator shows a slowdown in the “quantitative” development of HoReCa, but at the same time, the rate of change in enterprise turnover (RHt) indicates stable growth in most districts. The reason for this lies in the transition of a significant part of HoReCa enterprises to “multi-format rails”: a lot of restaurant holdings grow with franchise projects, integrate with large hoteliers, and actively deploy networks in all regions of the country. Due to this, the market is becoming more consolidated, the number of players on it is decreasing, but they are becoming “stronger”, making the competition more severe, where every mistake is “replicated” to all the establishments of the network/holding, leading to a loss of competitive stability (Verevka, 2019). All these trends strengthen the risk background in a number of federal districts (North Caucasion, Volga, Ural, Siberian Districts), creating certain barriers for the active development of HoReCa industry.

As a good side, a positive trend of the socio-economic factor was noted (Vashko et al., 2018). Despite the instability of household incomes (during periods of crisis, the dynamics of real cash incomes naturally become negative), gastronomic literacy of the population is growing, interest in domestic tourism is increasing, and the structure of “consumption-accumulation” is changing. This leads to an increase in the potential capacity of HoReCa market, and creates additional opportunities for maintaining competitive stability (Bespal'ko, 2016).

To construct a competitive sustainability matrix, an additional parameter was calculated that demonstrates the level of development (Alekseev, 2019) of HoReCa in each of the Federal Districts. This is an indicator characterizing HoReCa turnover per one enterprise in this segment (table

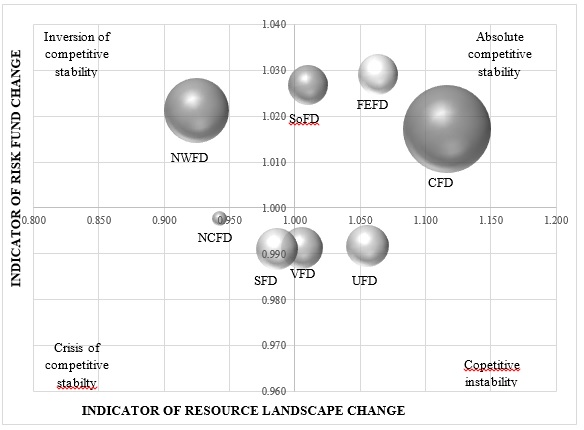

When constructing the matrix, the indicator of turnover per 1 enterprise served as the diameter of the circumference of each federal district, which equated not only to distribute all the districts in the corresponding zones, but also to visualize the volume of HoReCa industry in each of the districts (Figure

As a result of constructing the matrix, the following results were obtained:

1. The undisputed leader among federal districts is Central District. In this district, HoReCa segment not only has a stable competitive position, but also the largest turnover per enterprise - 12.945 million rubles/year. Also, HoReCa is confidently developing traditionally in Southern Federal District, which is greatly facilitated by the increased interest in domestic tourism in recent years, a warm climate (creating opportunities for almost year-round work of "summer terraces" in institutions), as well as a wave of internal migration to this region. The position of HoReCa in Far Eastern Federal District has become more competitive. The APEC summit held in Vladivostok in 2012, which entailed a significant expansion and updating of the hotel and restaurant business, became the point of strengthening positions in the region. An extensive tourist flow from China and Japan also creates favorable development opportunities (Ermakova, 2018).

2. In the zone of inversion of competitive stability, which characterizes the growth of concerns about development opportunities, North-West Federal District turned out to be. Being in the region of St. Petersburg, where there are 200 seats per restaurant market per 1000 inhabitants (while in Moscow there are only 45), does not “save the situation”. All other constituent entities of the district have a very weak level of development of the hotel and restaurant business, despite the rather stable "risk background”.

3. Ural and Volga Federal Districts entered the zone of “competitive instability”. In these districts, the stable development of HoReCa segment is threatened by a decline in the population and outflow of labor. A factor that significantly enhances the risk background is the fall in real incomes of the population in the districts, which immediately affects the work of HoReCa establishments, leading to a decrease in their competitive stability.

4. Siberian and North Caucasian Federal Districts entered the most dangerous zone, which is characterized by “crisis” trends. The main barrier to the development of HoReCa in Siberian Federal District is the geographical location of the district and low population density. The remoteness of the territory from the main traffic flows, poorly developed tourism and significant distances between settlements create certain problems for hotel and restaurant business owners not only in terms of its development, but also in terms of conservation (due to high transaction costs and relatively low turnover). As for North Caucasian Federal District, the reasons restraining the development of HoReCa are the low income level of the population and its mentality (“home” hospitality is extremely developed in the region, and the culture of visiting establishments is just beginning to take shape). In addition, all entities included in North Caucasian Federal District are subsidized, which also significantly weakens the opportunities for creating and developing business in HoReCa sphere.

Thus, in the course of the study, the federal districts of the Russian Federation were divided into zones, depending on the level of competitive stability of the hotel and restaurant business in them.

Conclusion

Today, the process of actively integrating the hotel and restaurant business into the Russian economy is almost complete and HoReCa segment has firmly taken its place. Most Western experts (Ermakova, 2018) attribute this area to the most promising business in the service economy. But in our country this is still virgin land, which has not been mastered by large companies, despite the fact that there are niches where small and medium-sized businesses can succeed. On the one hand, the domestic sector of HoReCa so far looks “decent” only in the capital and in several major cities, but on the other hand, the external information background is positive: there are more and more establishments, they are of different formats, focused on reaching different target audiences. New players are constantly coming into this business space; the industry is growing and entails the growth of the entire service sector.

In each federal district, the development of HoReCa follows its own path, depending on geographic, socio-economic, and regional features. And despite the current position in the matrix (see Figure

Acknowledgments

We would like to thank the anonymous reviewer for the constructive comments to improve the manuscript.

References

- Alekseev, S. B. (2019). A mechanism for ensuring the competitive stability of a trading enterprise. Bulletin of Institute for Economic Research, 2(14), 28-34.

- Alnawas, I., & Hemsley-Brown, J. (2019). Market orientation and hotel performance: investigating the role of high-order marketing capabilities. International Journal of Contemporary Hospitality Management, 31(4), 1885-1905.

- Arsenyev, Y., Potemkin, L., Filyppova, S., Bratus, H., & Nikola, S. (2019). Internal audit of activity results at enterprises of hotel and restaurant business. Academy of Accounting and Financial Studies Journal, 23(2).

- Bandalouski, A. M., Kovalyov, M. Y., Pesch, E. & Tarim, S. A. (2018). An overview of revenue management and dynamic pricing models in hotel business. RAIRO - Operations Research, 52(1), 119-141.

- Bespal'ko, V. A. (2016). Tools and methods for managing the competitive stability of industrial enterprises in product markets with limited and developed competition. (Doctoral Dissertation). St. Petersburg.

- Bondarenko, V. A., Efremenko, I. N., & Larionov, V. A. (2019). Marketing strategy for hotel and tourist complex companies. International Journal of Economics and Business Administration, 7, 388-394.

- Cherkasov, M. N. (2014). Formation of the concept of "competitive stability of the enterprise". Problems of the modern economy (Novosibirsk), 17, 161-165.

- Ermakova, A. M. (2018). Globalization of the hospitality industry: challenges and realities. Tourism industry: opportunities, priorities, problems and prospects, 12(3), 74-79.

- Group of companies «Best"»: Experts summed up the traditional results of the year in the restaurant business of St. Petersburg (2019). https://bestgroup.ru/news/eksperty-podveli-tradicionnye-itogi-goda-v-restorannom-biznese-sankt-peterburga.

- Kryukova, E., Bodneva, N., Sribnaya, T., Filimonova, N. & Vershinina, O. (2019). The development of the restaurant business in Russia. Journal of Environmental Management and Tourism, 10(2), 412-419.

- Ministry of Industry and Trade of the Russian Federation (2020, April 21). http://minpromtorg.gov.ru/press-centre/news/#!1340315304.

- Myrzaliyev, B. S., Nahipbekova, S. A., Dandaeva, B. M., Izzatullaeva, B. S., & Baibosynova, G. J. (2018). Formation and improvement of the hotel business quality management system in the countries with postsocialist economy. Espacios, 39(18), 23.

- Nikolskaya, E. Y., Lepeshkin, V. A., Kulgachev, I. P., Popov, L. A., Romanova, M. M., & Lebedev, K. A. (2018). Methodological approaches to assessing the innovative potential of enterprises in the hotel business. Espacios, 39(27).

- Regions of Russia. Socio-economic indicators. (2020, March 16). https://www.gks.ru/folder/210/document/13204

- Vashko, T. A., Zdrestova-Zaharenkova, S. V. & Maksimenko, I. A. (2018) Formation and development of the restaurant services market in Russia: an empirical study of factors that influence growth. Russian Entrepreneurship, 19(10), 3149-3162.

- Verevka, T. V. (2019). Development of industry 4.0 in the hotel and restaurant business. IBIMA Business Review, 2019, 324071.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Vashko, T., Grigor'eva, N., Zdrestova-Zaharenkova, S., & Maksimenko, I. (2020). Matrix Analysis Of Competitive Stability Of Horeca Industry In Federal Districts Of Russia. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 1537-1548). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.177