The Waqf-Takaful Compensation Operational Framework (WTCOF) Towards Strong Takaful Institutions Governance

Abstract

It is essential for Malaysians to embrace SDG 16, which emphasises the importance of elements of equal justice, sustainable development, and establishing transparency toward accountable inclusive institutions and societies at every level. The introduction of Waqf in the Takaful Compensation Scheme was in line with SDG 16 and significant to the need of protecting the health and wealth of the public. The Waqf-Takaful Compensation Operational Framework (WTCOF) in this study was developed based on 3 categories of matters: Documentation Matters (DCM), Operational Matters (OPM), and Governance Matters (GCM). The WTCOF was tested on 106 Takaful Agents of 4 Takaful Companies in Malaysia who were involved directly throughout the introduction of the Waqf-Takaful Compensation Scheme until 2022. The one-way ANOVA analysis revealed that the mean difference between the implementation of the WTCOF among the 4 Takaful companies in Malaysia; Etiqa Family Takaful Berhad, Zurich Takaful Malaysia Berhad, Takaful Malaysia Keluarga Berhad, and Takaful Ikhlas Family Berhad shown a significant effect on DCM and OPM. Takaful Ikhlas Family Berhad had the highest score in the implementation of the WTCOF. However, among the 3 themes of the WTCOF, the OPM score was the lowest with a mean score of 1.25 and below. Therefore, it can be concluded the WTCOF is related to one of the national agendas under SDG 16 where it creates a great contribution and supports the development of Socio-economic growth in Takaful Industries in Malaysia.

Keywords: Governance, Sustainability, SDG 16, Waqf –Takaful Compensation Scheme

Introduction

Syarikat Takaful Malaysia Berhad (STMB) initiated the introduction of Waqf in the Takaful Plan from 2002 until 2009.During the initial years of implementation, particularly from 2002 to 2004, the plan received positive feedback from participants. However, after seven years of operation, the plan was withdrawn from the market and its application was discontinued on February 9, 2009, as reported by Wan Ab Rahaman and Yaacob (2014).

In 2019, Syarikat Takaful Ikhlas Family Berhad introduced family Takaful, which included Waqf options for institutional beneficiaries. Perbadanan Waqf Selangor and Yayasan Waqf Malaysia were among the organisations eligible to receive these benefits. Others religious and welfare organisations that has been registered with the Companies Commission of Malaysia (SSM) or the Registration of Societies (ROS) are eligible to receive the beneficiaries. The beneficiaries are entitled to receive compensation and savings ranging from 5% to 30% in accordance with the Qias and Hadith (Wan Ab Rahaman & Yaacob, 2014). For examples Yayasan Islam Kelantan (YIK), Yayasan Addin Perak, Persatuan Insitusi Tahfiz Al Quran Selangor (PITAS), National Madrasah Tahfiz Al Quran Association (Permata Al-Quran), Kedah Religious School Affairs Organization (HESA), and other states Tahfiz Associations.

Waqf-Takaful was applied by Syarikat Takaful Ikhlas Family Berhad, where the Waqf component was included in their family takaful product as an optional requirement and not a necessity regulation. Etiqa Takaful Company also facilitates the distribution of funds to specific religious institutions through the way of preparing special letters to takaful companies to transfer the death compensation received to be given to specific religious organisations as required by the participant (Rosele & Johari, 2016).

The takaful market in Malaysia has the potential to grow if Muslims community supports sharia-compliant takaful products. Currently, the takaful market penetration is only 16.9% as of 2020 (Annual Report MTA, 2020). Bank Negara Malaysia reported in 2019 that the amount of compensation received by takaful participants was as much as RM5.345 billion (Bank Negara, 2020). The total amount of compensation issued, according to Financial Insurance and Takaful Report (2021) displayed the takaful death compensation for all takaful companies in Malaysia in that year was as much as RM809,632,862 which is close to RM810 million. This large figure has shown an increase in 2021 when total death claims by takaful institutions amount to RM1,023,743,130 as shown in Table 2.

If one third of the death compensation in 2020 and 2021 is taken, which is 30% of the total compensation of participants, this amount represents almost RM240 million in 2020 and RM300 million in 2021 from participant death benefits to religious institutions as shown in Table 1-2. However, if a minimum potential of 10% death compensation can be handed over to religious institutions, the amount is close to RM81 million in 2020 and RM100 million in 2021. This is a very large potential amount to be provided for waqf.

This initiative was taken by several companies based on the awareness and potential that this takaful waqf can be implemented. The company plays a role in extending benefits to religious institutions as beneficiaries of takaful waqf. The company will prepare an application form that contains the waqf element space to be selected by participants who wish to waqf part of the life compensation.

Today, there are various types of Takaful models that can be found in the Takaful market. These models include the Modified Wakalah Model, Hybrid Model, Mudharabah Model, Wakalah-Waqf Model, and Waqf-Takaful Model (Wahab, 2006). Among these models, the ones that particularly focus on the utilization of the Waqf fund in Takaful products are the Wakalah-Waqf Model and the Waqf-Takaful Compensation Model suggested by Mahbubi (2016).

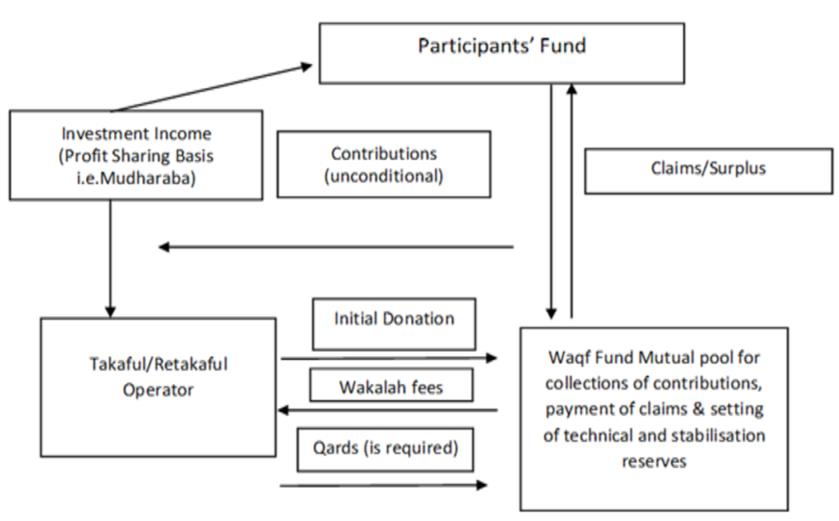

Ibrahim et al. (2016) introduced two models, the Waqf-Takaful Compensation Model and the Wakalah-Waqf Model which describe the concept of proportionate ownership of Tabarru (donation) for participants According to these models, if the Tabarru remains unused for claim payments, it is transferred to the Waqf fund. Subsequently, the Waqf fund allocates the funds to secure Shariah-compliant investment companies to generate profits. These profits are then utilized for the benefit of participants during unforeseen events and are also donated to charities approved by the Takaful company's Shariah board (Ahmad et al., 2022). In these models, the Takaful company acts as a wakeel and Mudharib on behalf of the participants for the Waqf fund. The Waqf fund with Takaful coverage required the participants to complete a standard form to obtain a certificate after making an unconditional donation. Both the participant and the Takaful company can reap the benefits offered by the Waqf fund, including providing Qardh Hassan and other Takaful benefits to participants. Figure 1 provides a visual representation of the process involved in both models. Therefore, this study will analyse the implementation of Waqf-Takaful Compensation Operational Framework (WTCOF) of 4 main Takaful companies in Malaysia; Etiqa Family Takaful Berhad, Zurich Takaful Malaysia Berhad, Takaful Malaysia Keluarga Berhad and Takaful Ikhlas Family Berhad for the year 2022.

The implementation of waqf in the Islamic Financial Services Act (IFSA) 2013 does not mention the existence of waqf elements. IFSA 2013 only outlines the delivery of takaful compensation benefits subject to the grant element in Waqf (Islamic Financial Services Act, 2013). The Standardization of the use of the terms hibah and waqf in the distribution of death were only mentioned in the waqf terms in the waqf assignment form only, but there are companies that only use grant forms without waqf terms in the form of cash donations to the institution involved. The use of the absolute assignment form is not extended in the context of institutional waqf. Handing out grants by takaful institutions is more likely to hand over benefits to certain organizations or individuals. But waqf needs to be delivered to religious institutions. Therefore, this needs to be standardized by Bank Negara Malaysia (BNM) and the Malaysian Takaful Association (MTA). The Standardization of state fatwas related to waqf takaful also differ. So far, only one company has given a commitment in the implementation of waqf to the state religious council. Takaful Ikhlas Family berhad has collaborated with the State Islamic Religious Council (MAIN) in Johor, Negeri Sembilan, Perak, Penang and Kedah in ensuring that takaful waqf implementation is approved by the respective State Fatwa Council, so that the terms of waqf are in line with state enactments.

The fundamental principle of Takaful in Islam is rooted by the idea of mutual assistance (Ta'awun), mutual security and responsibility (Tadhamun), and mutual protection and assurance, all of which are integrated into the concept of Tabarru' (donation) (Sulaiman et al., 2019). To ensure the effective functioning of the Waqf-Takaful Compensation, Sulaiman et al. (2019) emphasized the importance of having competent and knowledgeable professionals and management who possess a deep understanding of Waqf-Takaful systems since the Takaful Expert helped to the company to achieve overall operational efficiency and effectiveness in the implementation of the Waqf-Takaful Compensation framework.

A case study conducted by Hassan et al. (2018) examining Waqf Johor Unit (UWJ) and Waqf Selangor Corporation (PWS), revealed that effective management of Waqf institutions relies on five critical components: manpower, marketing, administration, information, and finances. These components play a vital role in ensuring the efficient operation and success of Waqf institutions. The development of Waqf product innovations was crucial since it will give great benefit to those who are in need.

Rosele and Johari (2016) examined the implementation of Waqf Takaful by Syarikat Takaful Malaysia Berhad (STMB), which offered two products: general takaful and family takaful. The findings revealed that STMB's managing to collect over 5,000 certificates Waqf Takaful products. However, in 2009, the product was discontinued from the market due to uncertainty in the terms of the warranty contract that exists in the plan.

Hashim and Halim (2018) who conducts interviews with several Takaful Agents personals found that the Waqf-Takaful Compensation plan did not receive good feedback from the public because most of the takaful agents are not aware of Waqf Takaful Compensation models existent but they were more consent on delivering the information to the customer regarding the benefits offered by the Waqf Takaful Compensation plan only.

Naim et al. (2018) claimed that to ensure the effectiveness of waqf funds the takaful company should develop it accordingly. The Waqf Takaful Compensation in Malaysia faces governance issues related to weak operational, administrative and management in Waqf development program and documentation system on Waqf land. A new framework of Waqf-Takaful Compensation needs to be developed and continuous training for Takaful agents is a must to ensure the Waqf Takaful is run efficiently by the takaful company in Malaysia. Therefore, this study will focus on the level of implementation of the Waqf-Takaful Compensation Model toward good governance practices and sustainability using a Waqf-Takaful Compensation Operational Framework (WTCOF). Therefore, the hypotheses were developed:

H1: There is a significant means difference between the implementation of Documentation Matters (DCM) of Waqf-Takaful Compensation Operational Framework (WTCOF) by Etiqa Family Takaful Berhad, Takaful Ikhlas Family Berhad, Takaful Malaysia Keluarga Berhad and Zurich Takaful Malaysia Berhad.

H2: There is a significant means difference between the implementation of Operational Matters (OPM) of Waqf-Takaful Compensation Operational Framework (WTCOF) by Etiqa Family Takaful Berhad, Takaful Ikhlas Family Berhad, Takaful Malaysia Keluarga Berhad and Zurich Takaful Malaysia Berhad.

H3: There is a significant means difference between the implementation of Governance Matters (GCM)of Waqf-Takaful Compensation Operational Framework (WTCOF) by Etiqa Family Takaful Berhad, Takaful Ikhlas Family Berhad, Takaful Malaysia Keluarga Berhad and Zurich Takaful Malaysia Berhad

Methodology

Quantitative research and the checklist of the Waqf-Takaful Compensation Operational Framework (WTCOF) were developed based on 3 categories of matters: Documentation Matters (DCM), Operational Matters (OPM) and Governance Matters (GCM). There were 4 Takaful companies in Malaysia (by Etiqa Family Takaful Berhad, Zurich Takaful Malaysia Berhad, Takaful Malaysia Keluarga Berhad and Takaful Ikhlas Family Berhad involved in this study. A Google Forms work as a checklist will be distributed to 150 respondents/takaful operators using SPSS statistics software to run the Descriptive Analysis and ANOVA. From 150 Takaful Agents involved in completing the checklist of the Waqf-Takaful Compensation Operational Framework (WTCOF) only 106 Takaful Agents samples were taken and used since there were missing data in the checklist that fail to be filled in by the agents Waqf-Takaful Compensation Operational Framework (WTCOF) was first developed based on the study done by Wan Ab Rahaman and Yaacob (2014), Hassan et al. (2018) and Hashim and Halim (2018). Some modifications were made to the above study to suit the main objectives. The finalized Waqf-Takaful Compensation Operational Framework (WTCOF) was developed with 15 items as mentioned in Table 1 after consulting with several experts who have more than 5 years of experience in the standard procedure of documentation for the Wakaf-Takaful Compensation Scheme employed in this study. The unweighted method scores adopted with several modification based on the study done by Said et al. (2009) , Ahmad et al. (2022) and Syahiza et al. (2012) were as follows:

WTCOF = nj∑ t=1 mij

nj*2

* WTCOF = Waqf-Takaful Compensation Operational Framework

*nj= number of items expected for the company nj ≥ items of each matter

*mij=“3” if the items were documented by the company, the score “2” given if the item was partially documented by the company, and “1” if it was not documented by the company.

The proposed Model of Waqf-Takaful Compensation Operational Framework (WTCOF) which were the Dependent variables were subdivided into 3 main components; Documentation Matters (DCM), Operational Matters (OPM) and Governance Matter (GCM) as presented in Table 3. All the items tested in this study were adopted with some modifications from previous studies done by Muhamat et al. (2017), Afif Muhamat et al. (2019) (2018) and Ahmad et al. (2022)

Discussion & Conclusion

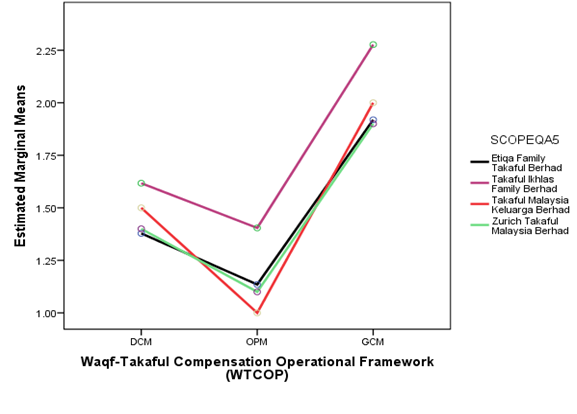

The descriptive analysis defined the means and the standard deviation of Documentation Matters (DCM), Operational Matters (OPM) and Governance Matters (GCM) in each takaful company. The Total Mean and standard deviation of Governance Matter (GCM) clarified to be the highest score by 2.076 and 0.628 followed by Documentation Matters (DCM) with a total mean score of 1.491 and a standard deviation of 0.621 whereas Operational Matters (OPM) total mean score is 1.245 and standard deviation 0.583.

The Estimated marginal means of the Waqf-Takaful Compensation Operational Framework (WTCOF) in Figure 2 reported that Takaful Ikhlas Family Bhd has the highest estimated marginal mean score at 1.617 for Documentation Matters (DCM), 1.401 for Operational Matters (OPM) and 2.277 for Governance Matter (GCM).

Takaful Malaysia Keluarga Bhd was found to have the lowest estimated marginal mean score on Operational Matters (OPM) at 1.0. However, the overall score for the estimated marginal means showed that most of the companies have low Operational Matters (OPM) but the highest estimated marginal mean score for Governance Matters (GCM).

Table 5 shows that the overall test of Homogeneity of Variances of 3 main components in the Waqf-Takaful Compensation Operational Framework (WTCOF) which were; Documentation Matters (DCM), Operational Matters (OPM) and Governance Matters (GCM) were significant which the Levene's test is less than 0.05 and this indicated that each component representing Waqf-Takaful Compensation Operational Framework (WTCOF) were significant difference between the variances.

The ANOVA result in Table 4 analyzed the mean square between groups and within the group of firms to reveal the finding of the hypotheses. It was found that the mean difference between the implementation of the Waqf-Takaful Compensation Operational Framework (WTCOF) among the 4 Takaful companies in Malaysia (Etiqa Family Takaful Berhad, Takaful Ikhlas Family Berhad, Takaful Malaysia Keluarga Berhad and Zurich Takaful Malaysia Berhad were significant, especially on the Operational Matters (OPM) (F=2.215, p:0.091, R2=35.6%) and Governance Matter (GCM) (F=3.077, p:0.031, R2=41.4%), therefore H2 and H3 were accepted. Whereas Documentation Matters (DCM) did not have a significant effect on the mean square between groups and within the group of the 4 takaful companies tested in this study and H1 was rejected.

The ANOVA result stated in Table 6 indicated that there is no significant difference between the means of the groups for DCM (F=1.201, p:0.313) since there is a variation within the groups larger than the variation between the groups. The OPM in this study showed a weak significant difference between the means of the groups for OPM (F=2.215, p:0.091) compare to GCM where the variation within the group were smaller than the variation between the groups and have statistically significant difference between the group means.

Based on the above findings, the hypotheses developed in this study where presented in Table 7. The significant means difference between the implementation of Operational Matters (OPM) of Waqf-Takaful Compensation Operational Framework (WTCOF) by Etiqa Family Takaful Berhad, Zurich Takaful Malaysia Berhad, Takaful Malaysia Keluarga Berhad and Takaful Ikhlas Family Berhad indicated that all the 4 takaful companies are implementing the standard operating procedure in handling Waqf-Takaful Compensation Scheme. All the companies are aware of the importance of Good Governance Practices of the Waqf-Takaful Compensation Scheme when this study found that there is a significant means difference between the implementation of Governance Matters (GCM) of Waqf-Takaful Compensation Operational Framework (WTCOF) by Etiqa Family Takaful Berhad, Zurich Takaful Malaysia Berhad, Takaful Malaysia Keluarga Berhad and Takaful Ikhlas Family Berhad.

The main objectives of this study is to examining the effect of the Waqf-Takaful Compensation Operational Framework (WTCOF) which consists of 3 important dimension which is Documentation Matters (DCM), Operational Matters (OPM) and Governance Matters (GCM) on the 4 Takaful companies in Malaysia (Etiqa Family Takaful Berhad, Zurich Takaful Malaysia Berhad, Takaful Malaysia Keluarga Berhad and Takaful Ikhlas Family Berhad). The finding indicated that there is a difference level of implementation of the Waqf-Takaful Compensation scheme in all the 4 companies. It can be concluded that Takaful institutions in the corporate sector often show seriousness in gaining profits through the promotion of the benefits obtained when participants contribute to takaful funds. This takaful industry players had tried to make a paradigm shift in promoting the very pure concept of taawun through the tabarru' system. However, this takaful companies need a sopport from the government through the Ministry of Finance (MOF) to highlight the concept of waqf in the takaful industry to be standardised in standard procedure, operational matters ang governance because it has a great impact in terms of worship in the Islamic religion in addition to helping religious institutions in the long term. Takaful operators seem to prioritise benefits to individuals but without examining the idea of handing over part of the benefits of takaful compensation to religious institutions, especially death claims. Every year, death claims show an increasing trend in line with the trend of contribution collection and income of takaful companies. In 2020, death claims totalled RM810 million, which then increased to more than RM1 billion in 2021 (Financial Insurance & Takaful Report, 2021). This shows that the Waqf-Takaful Compensation Scheme introduced by these 4 takaful companies can help Malaysian to move toward SDG 16 and implement a good governance framework.

Acknowledgments

This research work is supported and funded by the Ministry of Higher Education (MOHE) under Fundamental Research Grant Scheme (FRGS) under project FRGS/1/2021/SS01/UNISHAMS/03/1.

References

Ahmad, R., Ali, M. N., Said, R., Abu Bakar, M., Abdul Manan, F. N., & Albasri, S. H. (2022). Introduction to Waqf -Takaful Compensation Model: Adopting the Maqasid Shariah Concept for Socio-Economic Development in Malaysia. International Journal of Academic Research in Business and Social Sciences, 12(8). DOI:

Annual Report MTA. (2020). Annual Report Malaysian Takaful Association 2020. https://takaful4all.org/en/annual-reports/

Bank Negara. (2020). Bank Negara Annual Report 2020. https://www.bnm.gov.my/o/ar2020/index.html

Financial Insurance & Takaful Report. (2021). Financial Insurance & Takaful Report 2021. https://www.bnm.gov.my/documents/20124/10150236/fsr22h2_en_ch2b.pdf

Hashim, M. F. A. M., & Halim, M. N. A. (2018). The Tendency to Subscribe Takaful: A Proposed Conceptual Framework. International Journal of Academic Research in Business and Social Sciences, 7(12). DOI:

Hassan, N., Rahman, A. A., & Yazid, Z. (2018). Developing a New Framework of Waqf Management. International Journal of Academic Research in Business and Social Sciences, 8(2). DOI:

Ibrahim, S. S. B., Noor, A. H. B. M., Shariff, S. B. M., & Rusli, N. A. B. M. (2016). Analysis of corporate waqf model in Malaysia: An instrument towards Muslim’s economic development. International Journal of Applied Business and Economic Research, 14(5), 2931–2944.

Islamic Financial Services Act. (2013). lslamic Financial Services Act 2013. https://www.bnm.gov.my/documents/20124/8102422b-e6dd-d149-8db0-e3637e89ed5c

Muhamat, A. A., Ahmad, S. Z., Roslan, A., Abdul Karim, N., & Ali Azizan, N. (2019). The readiness of Takaful operators to adopt Waqf (endowment) as additional feature in Takaful policy. Journal of Academia, 7(1), 72-81. http://www.wakafselangor.gov.my/index.php/wakaf/terimaan-sumbangan-sws

Muhamat, A. A., Jaafar, M. N., & Alwi, S. F. S. (2017). General Takaful claims: An experience of Takaful operator in Malaysia. Journal of Emerging Economies and Islamic Research, 5(4), 18. DOI:

Naim, A. M., Isa, M. Y., & Rahim, A. K. A. (2018). Does the mutuality concept uphold the practices of the takaful industry? Al-Shajarah, Special Issue: ISLAMIC BANKING AND FINANCE, 149–170.

Rosele, M. I., & Johari, A. H. (2016). Aplikasi Takaful Model Wakaf Di Malaysia: Keperluan Dan Permasalahannya [Application of the Waqf Takaful Model in Malaysia: Needs and Challenges]. UMRAN - International Journal of Islamic and Civilizational Studies (EISSN: 2289-8204), 3(1). DOI:

Said, R., Hj Zainuddin, Y., & Haron, H. (2009). The relationship between corporate social responsibility disclosure and corporate governance characteristics in Malaysian public listed companies. Social Responsibility Journal, 5(2), 212-226. DOI:

Sulaiman, S., Hasan, A., Mohd Noor, A., Ismail, M. I., & Noordin, N. H. (2019). Proposed models for unit trust waqf and the parameters for their application. ISRA International Journal of Islamic Finance, 11(1), 62–81. DOI:

Syahiza, A., Rahayati, A., Roshima, S., & Haslinda, Y. (2012). Corporate Governance Mechanism and Islamic Corporate Social Responsibility (i-CSR) Disclosure in Shari’ah Compliant Companies. 16th Malaysian Finance Association Conference 2014 Sasana Kijang Bank Negara Kuala Lumpur (MFA 2014), 1–12.

Wahab, A. R. A. (2006). Takaful Business Models - Wakalah based on WAQF. International Symposium on Takaful, February, 1–22.

Wan Ab Rahaman, W. M. A. F., & Yaacob, S. E. (2014). Takaful Wakaf di Syarikat Takaful Malaysia Berhad: Sorotan Literatur. Islamiyyat, 36(2), 47–56. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 November 2023

Article Doi

eBook ISBN

978-1-80296-131-7

Publisher

European Publisher

Volume

132

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-816

Subjects

Accounting and finance, business and management, communication, law and governance

Cite this article as:

Ahmad, R., Said, R., Bakar, M. A., Ali, M. N., Manan, F. N. A., & Albasri, S. H. (2023). The Waqf-Takaful Compensation Operational Framework (WTCOF) Towards Strong Takaful Institutions Governance. In N. M. Suki, A. R. Mazlan, R. Azmi, N. A. Abdul Rahman, Z. Adnan, N. Hanafi, & R. Truell (Eds.), Strengthening Governance, Enhancing Integrity and Navigating Communication for Future Resilient Growth, vol 132. European Proceedings of Social and Behavioural Sciences (pp. 233-244). European Publisher. https://doi.org/10.15405/epsbs.2023.11.02.18