Abstract

Currently, it is important for Russia not only to maintain its position in the world market, but to actively promote non-resource exports. According to experts, representatives of non-resource production have a great export potential. Special attention is paid to the export of agricultural products. Agricultural products are the basis for goods exported from Russia abroad. The strategic objective of the state's export-oriented policy is the formation of competitive and efficient agricultural production, which will ensure the country's food security, increase the export of certain types of agricultural products and food. Further development of exports should be aimed at reorienting from the export of agricultural raw materials to the export of processed products, that is, with a higher added value, while world prices for the finished product are significantly higher than for raw materials. That is why the government regulation of this sector is necessary. It is extremely difficult for Russian agricultural producers, with little government support, to compete with goods that account for 40% of government investment. With the necessary support from the state, the export of food products will increase its potential in the near future. Russian exports of agricultural products have every reason to increase competition in the world arena. In modern conditions, the increase in production capacity and the export of agricultural products and food are a special opportunity for the Russian economy to show its export potential.

Keywords: Agribusiness, agriculture, export, market, organic product, state support

Introduction

The restructuring of the agribusiness into an "export vector" is taking place simultaneously with the complex process of integrating the country into world agriculture under the conditions of WTO membership. Protecting the interests of domestic agricultural producers and ensuring food security are guidelines for the export and import of agricultural products. So it is important to understand what instruments are currently regulating the agricultural food market and what is the role of the state in realizing export potential (Akmarov et al., 2021; Azzheurova, 2020).

Today, the strategic goal of the country's export potential is to become a tool for enhancing and strengthening the competitive advantages of the Russian economy in the international division of labor by entering the path of sustainable economic growth. The stability of growth and government support, as well as the quality characteristics of products determine the capabilities of the domestic agribusiness (Azzheurova, 2019; Grigorieva, 2020).

Problem Statement

With all the multidimensionality of the research to date, there remains a need to rethink the place of the agricultural sector in the structure of Russian exports. It is also of interest to assess the position of domestic products on international markets, to identify key commodity items in the export of which the country already occupies high positions and those that could bring great profits (Minakov & Azzheurova, 2020).

Research Questions

The hypothesis of the research is that not only the growth of agricultural and food production in the country, but also the means of state support for exports has a significant impact on the development of Russian exports of agricultural products. In accordance with this, in our opinion, it is advisable to consider the following issues:

- to consider the state, development trends and commodity structure of the export of Russian agricultural products and identify the most competitive ones;

- to assess the possibilities of changing the structure of Russian agricultural exports towards increasing the share of organic products;

- to justify the role and directions of state support in development of export opportunities for agribusiness products.

Purpose of the Study

The purpose of this study is to assess the state of Russian exports of agricultural products and justify the prospects for its development in the context of modern conditions.

Research Methods

The study used abstract logical, economic and statistical, methods of comparative and systemic analysis using a review of information and statistical data from the Federal Customs Service, the Federal State Statistics Service, the UN Food and Agriculture Organization, the World Bank and other sources (Azzheurova, 2020).

Findings

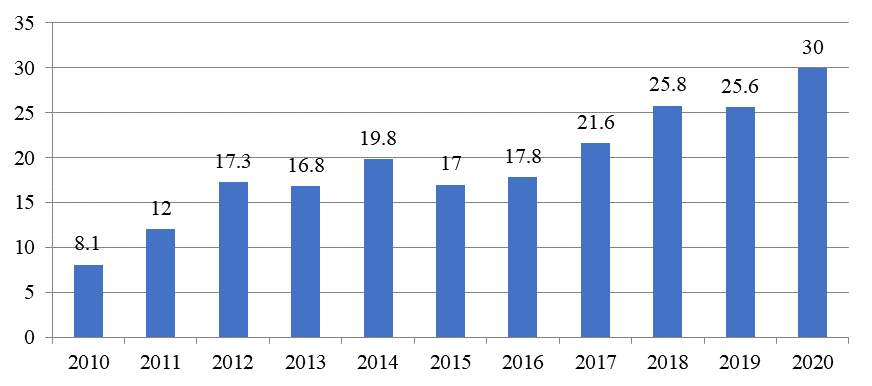

At the present stage, agriculture and food industry in Russia is 6% in the total structure of export supplies. Over the period from 2010 to 2020, the export of agricultural products increased from 8.1 to 30 billion US dollars, or 3.7 times (Figure 1). At the same time, its share in the structure of Russian exports is 6.0%. The total volume of food exports from Russia in 2020 amounted to a record $ 30 billion, however, the country's share in the world export volume is still too small (Minakov & Azzheurova, 2020). Despite the growth of imports of agricultural products in the past two decades, the assessment of official statistics allows us to note a positive trend in the development of the domestic agribusiness (Ivanova & Merkulova, 2018; Putivskaya et al., 2021). At the same time, agribusiness enterprises strive to firmly gain a foothold in the Chinese market. Exporters from Russia and around the world understand the importance of being in the Chinese market.

In the commodity structure of exports of agricultural products in value terms, the key positions are occupied by cereal crops (33.7%), fish and seafood (17.7%), fat and oil products (16.1%). Products of the food and processing industry, being products with high added value, account for 14.4% of agribusiness product export in Russia (Table 01) (Antsiferova et al., 2019).

A relatively new trend in the development of agriculture deserves special attention - the production of environmentally friendly products. The problem of expanding the food market with ecologically pure food products has become especially urgent all over the world, especially in Western countries. In order to take care of their health, consumers are increasingly choosing food products with the word "bio", "eco" or "organic" on the packaging in the hope of acquiring a high-quality and healthy product, but often fall only for marketing gimmicks, since the labeling does not oblige to meet environmental production standards.

Russia has great potential for the cultivation and production of environmentally friendly products, as it has colossal natural resources (Azzheurova, 2019). According to experts, the total export of organic products in value terms is about 1.5 billion rubles, or just over 20 million dollars (Azzheurova, 2020). The main crops exported are wheat, barley, oats, buckwheat, flax, peas, rapeseed, rye, triticale, soybeans, and field beans. There is also a high export potential for poultry and vegetable oil, as well as alcohol (organic vodka).

A significant increase in agricultural exports was due to an increase in the production of agricultural products and food in the Russian Federation (Table 02). Over the past ten years, grain production has increased from 61 to 121.2 million tons, or 2 times, sugar beet - from 22.2 to 54.4 million tons, or 2.5 times, oilseeds - from 7.5 to 22.8 million tons, or 3 times, poultry meat - from 3548 to 6309 thousand tons, or 77.8%. Achievement of such high indicators of agricultural production was facilitated by state support funds totaling more than 2 trillion rubles as part of the State Program implementation (Nikitin et al., 2020).

When entering foreign markets, Russian exporters face many difficulties associated with the promotion of agricultural products, while bans and sanctions are often imposed on the export of Russian agricultural products to other countries due to changes in the geopolitical situation (Shchutskaya, 2021).

In the Russian Federation, a complex export support system has been built, where the key role is played by the Russian Export Center JSC, whose main functions are project support for exporters through financial and non-financial instruments, implementation of priority export directions, as well as infrastructure support for exports (Kundius et al., 2021). This center has identified the main directions of state support for the export of agricultural products:

- analytics. Based on local databases, data from FAO, Rosstat, Federal Customs Service, information system of world agriculture, the data processing center has formed three analytical products for exporters: "Agrologist" for easy tracking, "Agroscop" with an information base of country exports and imports, "Agribusiness "- ERP and CRM systems for control of production, logistics and product marketing.

- development of a logistics system for wholesale distribution centers to control the movement of products from an agricultural holding to a trade office of the Russian Federation. Today, agricultural producers produce their products in the form of raw materials, and retail chains want to see the product already packaged, washed and packaged in the case of, for example, potatoes, cut and packaged in the case of meat. There is a certain gap between these requirements of wholesale consumers and the quality of agricultural products, but there is no "bridge" across it. The wholesale distribution center was created to fulfill this role between agricultural producers and buyers.

- formation of export cooperatives, whose purpose is to maximize the profitability of its members. The implementation of this goal is achieved through expanding sales markets by entering foreign markets, reducing the intermediary component and optimizing business processes among the participants. In world practice, the creation of cooperatives goes back to the beginning of the 20th century. CBH Group, an export cooperative in Australia and one of the world's largest exporters of wheat, was established in 1933. Up to 90% of the crop in Western Australia is exported by the CBH Group. Depending on the level of cooperation, state support for Russian exporters is manifested in various forms: subsidies, grants, construction of industrial infrastructure, loans and insurance, organization of exhibitions and fairs.

- organization of exhibitions and congresses. In this direction, four main tools were created. The first is reimbursement of part of the cost of renting exhibition space in accordance with the pre-approved list of international exhibitions and fairs. The second is reimbursement of part of the cost of transportation and installation of equipment, exhibition samples and other components of the exposition. The third is reimbursement of part of the cost of organizing congresses for exchange agribusiness goods, organization of gastronomic weeks for tasting promotional events. To participate in any of the exhibitions, it is enough to submit an application within the agreed time, and the state will cover a significant part of the costs;

- financial support for exporters through credit guarantee instruments and non-financial support in various forms of consultations with participants in foreign economic activity, in cooperation with the state on export support;

- branding and marketing. In order to promote Russian agricultural products on export markets, the Ministry of Agriculture of Russia is actively working to create a positive image of Russian agricultural products through the creation and promotion of regional sub-brands, such as Bashkir honey, Adyghe cheese, Kuban wine, Caucasian waters, Michurin apples, Vologda oil. The purpose of sub-branding is to create a unique selling proposition of Russian products as environmentally friendly, non-GMO and produced using modern agricultural technologies. The development of regional sub-brands will increase the added value of products supplied abroad, increase the recognition of products abroad, which in turn will affect the growth of the competitiveness of products and an increase in the volume of its exports. The main difficulties in promoting such products are associated with the lack of "ready-made" foreign markets, because it is unique by definition;

- the opening of foreign markets for the sale of Russian products, which requires an increase in the quality and safety of domestic agricultural products. In solving this problem, the legislative regulation of the certification mechanism for Russian exporting enterprises will help. An enterprise should be included in the register of exporters only if its products are manufactured taking into account the veterinary requirements of the importing country. This practice is used in most developed economies: EU, USA, Australia and Japan;

- negotiation activities, namely the promotion of the interests of Russian agricultural exporters within the framework of intergovernmental commissions and in international organizations. The government itself needs help in moving to world markets;

- using e-commerce channels to promote products. Promotion of agricultural products through e-commerce is a new direction. Like any product, agricultural products are manufactured for further sale. Optimal marketing strategy tailored to the specifics of agricultural products, such as seasonal production and limited storage, to maximize profits. To maximize profits, an optimal marketing strategy is required, taking into account the specifics of agricultural products, such as seasonality of production and limited shelf life. The organization of e-commerce channels will allow us to reach a new level in the promotion of domestic products on world markets. Electronic trading platforms are one of the easiest and fastest ways for a company to start exporting goods abroad. Export via e-commerce channels to Europe or North America is more transparent for a Russian manufacturer in terms of language, logistics and promotion platforms.

In October 2018, a new project "Export of agricultural products" was presented, according to which the agricultural sector faces a difficult task - to increase the supply of agricultural products abroad to $ 45 billion by 2024, which is more than twice as much as that in 2017 was. The priority of "Export of agricultural products" is to increase the sales of agricultural products with high added value (Minakov & Azzheurova, 2020).

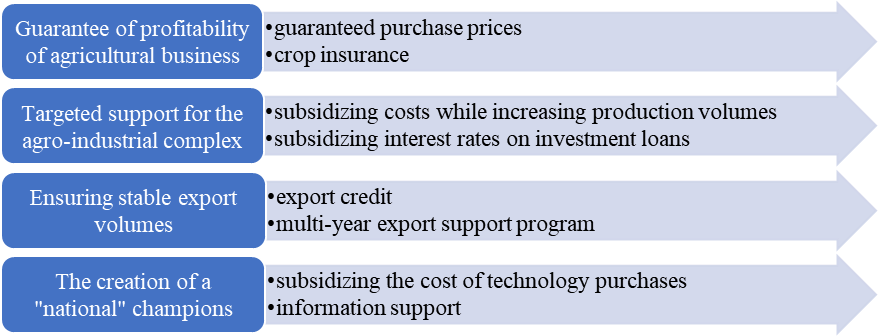

Further development of the domestic agribusiness is possible as a result of the implementation of a strategy focused on creating an export infrastructure and involving the development of mechanisms to support the production and export of agribusiness products (Figure 02).

It is believed that agribusiness is low-income due to its dependence on natural factors and the seasonally cyclical nature of activities. In many ways, this is what affects the availability of investments in the industry and stable players. Therefore, a guarantee of business stability and comparable profitability in the domestic and foreign markets is necessary. Ensuring stability in the volume of export shipments will allow manufacturers to be confident in the future and the correct choice of a strategy for developing the export direction. Consolidation of companies in agribusiness will prepare such players who will be able to compete on equal terms with world leaders.

Conclusion

Agribusiness has set very ambitious tasks in promoting products to foreign markets. This will allow manufacturers not only to establish new sales opportunities, but also to receive export earnings. For the country as a whole, this is an important opportunity to prove that there is potential not only in the raw energy sector of the economy, and grain is not the only position of the Russian agrarian industry that may be in demand outside the country. However, without proper support, it is difficult for a Russian manufacturer to cope with all the formalities that exist when entering the markets of other countries. Thus, support from government agencies in the development of export directions is extremely necessary.

The potential of agribusiness is so huge that the growing demand for Russian-made food inspires extremely positive forecasts, while it is important to provide the necessary support to producers and create an incentive to produce better, more and to develop new sales markets.

References

Akmarov, P. B., Knyazeva, O. P., & Tretyakova, E. S. (2021). Assessing the Potential of the Digital Economy in Agriculture. IOP Conference Series: Earth and Environmental Science, 666(4), 042036.

Antsiferova, O. Yu., Myagkova, E. A., & Tolstoshein, K. V. (2019). Formation of the development strategy of the agro-industrial complex of the Tambov region on the basis of the scenario approach. IOP Conference Series: Earth and Environmental Science, 274, 012084. DOI:

Azzheurova, M. V. (2019). State and features of sugar beet production development in the country. In Modern economy: problems, solutions, prospects: Proceedings of VI International Research and Practice Conference (pp. 9-12). Samara State Agricultural Academy.

Azzheurova, M. V. (2020). Possibilities for forming export-oriented agricultural economy. In Topical issues of economics and agribusiness: Proceedings of XI International Research and Practice Conference (pp. 13-18). Bryansk State Agrarian University.

Grigorieva, O. (2020). Current trends in Russia's cooperation in the global organic market (legal aspects). E3S Web of Conferences, 217, 07020.

Ivanova, E. V., & Merkulova, E. Y. (2018). Qualitative changes of the state regulation of reproduction processes in agriculture based on digital technologies. Quality-Access to Success, 19(S2), 130-134.

Kundius, V. A., Kovaleva, I. V., & Gorshkov, V. V. (2021). Innovative technologies and problems of ecological Agriculture of Russia. IOP Conference Series: Earth and Environmental Science, 677(2), 022050.

Minakov, I. A., & Azzheurova, М. V. (2020). State and prospects for the spatial development of vegetable growing in Russia. Economy of agricultural and processing enterprises, 2, 33-39.

Nikitin, A. V., Larshina, T. L., Voropayeva, V. A., Beketov, A. V., & Selyanko, D. V (2020). Assessment of fixed assets reproduction in agriculture. Revista inclusions, 7(Special Issue).

Putivskaya, T. B., Voloshchuk, L. A., Tkachev, S. I., & Podsevatkina, E. A. (2021). Formation of factors for the selection of criteria for environmental friendliness of organic products based on the implementation of an integrated eco-strategy. IOP Conference Series: Earth and Environmental Science, 723(4), 042047.

Shchutskaya, A. V. (2021). Innovations as a Factor of Agriculture Development in Russia. Lecture Notes in Networks and Systems, 160, 441-449.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Azzheurova, M. V., Kuvshinov, V. A., & Nuzhdova, E. N. (2022). State And Directions Of Agribusiness Product Export Development In Russia. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 328-335). European Publisher. https://doi.org/10.15405/epsbs.2022.02.41