Abstract

The financial sector is a special part of the business activity of society, within the framework of which many tasks are solved, among which the most important is the search for sources of financing for business processes. Banks and other credit institutions, carrying out their activities, represent one of the most important sources of financing for the economic activities of enterprises. Therefore, their regulation in all countries of the World Community is carried out by the Central Banks, through the implementation of the national monetary policy. Monetary policy by the Bank of Russia has undergone gradual reform in recent years. As part of the measures of the Central Bank of the Russian Federation to regulate Russian banking activities, there is currently a management of the key rate, the purpose of which is to establish the Central Bank of the Russian Federation loan interest for commercial banks and interest when they open deposit accounts with it. However, a change in the level of this rate significantly affects not only commercial credit institutions, but all spheres of the economy that use this type of sources of borrowed capital indirectly. In this regard, the article examines the main elements of the economic characteristics of the key rate and its impact on the development of the Russian economy, provides an analysis of dynamic data of various economic indicators and a forecast of possible options to solve the situation;

Keywords: Business, business activity, sources of financing, monetary policy, credit organization, key rate

Introduction

Today, all processes of society life represent a complex heterogeneous system – a state system, the regulation and management of which is the responsibility of state authorities.

The country's economy, as one of the most important parts of such a system, is divided into various spheres of economic activity, each of which has its own levels.

The financial sector of the economy is a sphere of economic activity in which the object of purchase and sale is not real goods and services, but monetary resources, currency, precious metals, securities, and so on. The Russian financial sector (due to the fact that the economic system in Russia is based on market principles) is divided into the following types of markets: credit, foreign exchange, insurance, investment, and stock.

In Russian realities, the most developed market is the credit one, since its formation and development in the economy of any country is much easier to carry out than the same with other types of financial sector markets during the transition from one economic system (planned economy) to another (market economy). Also, it should be noted that the credit market is one of the most affordable sources of financing for the economic activities of Russian organizations.

State control over credit institutions and the credit market as a whole, as well as over all other elements and members of the financial sector of the Russian Federation, is carried out by the Central Bank of Russia through the development and application of the national monetary policy. Credit (or monetary) policy is the policy of the state that affects the amount of money in circulation in order to ensure price stability, full employment of the population and growth in real output. The Central Bank implements the monetary policy (CBR, 2020).

Problem Statement

One of the most important tools used in the implementation of the concept of the national monetary policy of the Central Bank of the Russian Federation is the key rate, which is also its main banking indicator, the competent use of which, in combination with other economic indicators, makes it possible to access the state of the Russian economy (RF Government, 2002).

Key rateinterest rate on the main operations of the Bank of Russia to regulate the liquidity of the banking sector. Its change affects lending and economic activity within the state.

In the context of international interaction, the key rate of various member countries of the World Community is influenced not only by endogenous factors (economic development of the country, creditworthiness of national economy entities, etc.), but also by exogenous factors, one of the most significant is the rate of the world currency, in particular U.S. dollar.

Research Questions

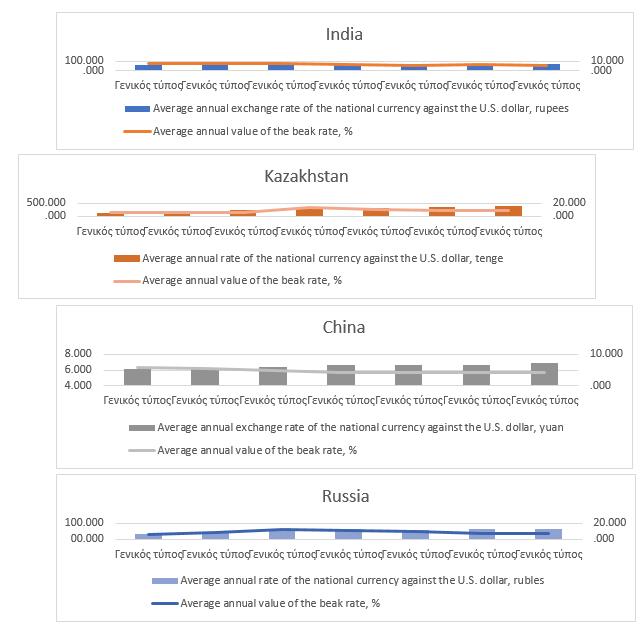

Fig. 1 shows a graphical representation of the dynamics of the average annual indicators of the key rate of various developing countries, set within the framework of the monetary policy of their respective central banks, as well as the dynamics of the U.S. dollar exchange rate against the national currencies of the countries under consideration, for the period 2013–2019. 2013 was chosen as the starting point for comparison, since it was in September of this year that the Central Bank of the Russian Federation made a decision to introduce a key rate in Russia to regulate monetary circulation.

When making this comparison, the following countries were selected: India (RBI, 2020) (in the period under review, an exchange rate of this country in relation to the U.S. dollar is practically comparable to the similar exchange rate of the Russian ruble), Kazakhstan (along with Russia is a member of the CIS) and China (the leading country among all developing countries by GDP).

As a result of the comparison of the information presented in Fig. 1, the following two main points can be distinguished:

All the countries represented in their monetary policy in the period under review adhered to the concept of lowering the key rate, which can be explained by the desire to stimulate their economies;

Two countries (Kazakhstan in 2015–2016, Russia in 2014–2015) increased their key rates due to a sharp drop in the exchange rate of national currencies against the US dollar, which was due to the need to reduce / stop the level of creditworthiness of the population in order to level a possible onset in the future risks of a credit hole.

The next step in comparing key rates in developing countries is to analyze their feasibility. Based on the factors presented in Table 1 and the information presented in Fig. 1, we will attempt to assess the soundness of the policy of the Central Banks of developing countries in relation to the change in the key rate.

Table 1 presents values of two factors: economic growth, a growth rate of nominal GDP in % and the average annual inflation rate of the U.S. dollar, also measured in %. Economic growth is one of the endogenous factors that determine the key rate of the national Central Bank; it is directly affected by the average annual inflation rate of the U.S. dollar, which is an exogenous factor.

Thus, if the country's annual economic growth rate exceeds the average annual inflation rate of the U.S. dollar, then the reduction of the key rate by the national Central Bank is justified by an attempt to accelerate it through cheap credit funds for all participants in the country's economy. In the case when the economic growth rate is lower than the average annual inflation rate of the U.S. dollar, decrease of the key rate cannot be considered justified by 100 % points, since there is no real growth in the economy and credit funds cheaper for all participants in the country's economy may lead to an increase in the probability or even the onset of the risk of a credit hole.

As a result of evaluating the data presented in Table 1 and Figure 1, we can conclude that in countries such as India, Kazakhstan and China, the policy pursued in relation to the key rate, namely its reduction (permanent for India and China, and for Kazakhstan at the end of the period), is justified from the point of view of a real growth GDP rate of these states (KzNationalbank, 2020).

In the case of dynamics validity of the key rate set by the Central Bank of the Russian Federation not everything is unambiguous: at the beginning of the period under review (in 2014–2015), the growth in value of the key rate is justified by the change in both depreciation of the national currency (Russian ruble) and resulting negative value of real GDP growth. From 2015 to 2019 there was a gradual decrease in the key rate of the Central Bank of the Russian Federation against the background of establishing the exchange rate of the national currency against the U.S. dollar. However, as it can be seen from Table 1, Russian real GDP had a positive trend only in 2018 and not throughout the entire period from 2015–2019. This means that the downward trend in the key rate in Russian monetary policy is risky for the monetary situation in the Russian Federation, which happens due to the future increase in inflationary risks and the risk of a national financial crisis caused by the possible onset of insolvency of both individuals and legal entities in Russia.

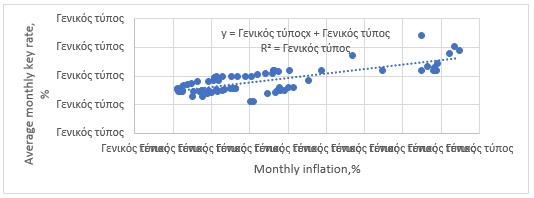

Central Bank of the Russian Federation in the period from 2013 to 2019 adhered to the strategy of setting the key rate in direct dependence on the dynamics of inflation in the Russian currency. In order to identify this dependence, Table 2 provides information on changes in the average monthly key rate of the Central Bank of the Russian Federation (the calculation was made using the weighted average method) and the rate of monthly inflation dynamics in the period under review.

According to Table 2, in the period from 2013 to 2019 the Bank of Russia reacted with restraint to changes in monthly inflation rates when adjusting the key rate. This is manifested in a somewhat slower dynamics of the key rate values compared to the dynamics of inflation indicators. With an increase in inflation rates, the key rate “catches up” with them, having a lower value for the same period of time. With a decrease, it “is late” being slightly higher than the inflation rate.

The article used correlation analysis to assess the relationship between these factors (Fig. 2). It didn’t use values of both indicators in 2013, since it was in this year that the key rate was introduced and the mechanism for its change was established to meet the conditions of the Russian economic situation.

As it can be seen from the information presented in Fig. 2, the relationship between change in inflation rates and dynamics of the key rate is indeed direct. According to the Pearson criterion, the relationship between them is strong (√R = r = 0.7590), which may indicate that inflation is the most significant factor why the key rate changes in Russia. This indicates that in this period it was dynamics of inflation of the national currency of the Russian Federation that was the main factor in its changes.

This is largely due to the critical dependence of the majority of subjects of financial relations, including the Central Bank of the Russian Federation to statistical data. It happens due to the averaged nature of the formation of the statistical inflation indicator.

In this regard, an important element of this study is the study of the reasons and methods for changing key rate indicators by the central banks of other countries, both developed (more advanced in the financial sector) and developing (to analyze factors in a comparable economic situation). For this, the following countries were selected: the United States (the world leader in the global financial system), Germany (one of the European developed countries), Japan (an example of an Asian developed country), as well as the states used as objects of research in Fig. 1 (China, India and Kazakhstan). Data on the study of strategies for setting the key rate of the studied countries are presented in Table 3.

After analyzing the data presented in Table 3, the following should be presented as a conclusion:

- In the period under review, the development of two directions for the implementation of monetary policy by states was clearly observed. The first was aimed at active economic growth, that is, the change in the key rate was due to an increase in business activity and economic development. The second is passive economic growth, as it is conditioned to a greater extent by the desire to stabilize or improve the socio-economic climate within the country.

- Developed countries given as an example, as well as China, when forming their key rate are guided by such a factor as economic growth (in Germany, it should be noted that the country is one of the key countries in the Eurozone and it depends on the development of its national economy monetary policy of the ECB). This indicates that leaders of these countries are interested in the active economy development;

- The most interesting situation is observed in the USA and Japan: both countries do not directly influence the establishment of interest rates by commercial banks but use the mechanism of market equilibrium. The United States is the only country in question that, when setting its key rate, does not pay special attention to inflation of its national currency (the U.S. Dollar), which is largely due to its use in most international settlements. Japan is the only country that had a negative key rate in the period under review. This is explained by the fact that the government of the country is interested in raising inflation to the normative values of other countries (about 2 % points) to stimulate the population to reduce money reserves to increase trade turnover and economic growth;

- India and Kazakhstan, when setting their key rates in the period under review (as well as Russia), were guided by the inflation rate of the national currency, which may indicate that these states are more concerned about the internal socio-economic climate.

Purpose of the Study

The aim of the study is to scientifically substantiate effectiveness of the monetary policy of the Bank of Russia, carried out using key rate to compare it with other countries of the world.

Research Methods

The research is based on a number of methods, including philosophical research methods: induction and deduction, analysis and synthesis, formalization, etc. General scientific methods of research work are also used: method of comparative analysis, method of statistical analysis, method of system analysis, method of computer analysis, economic and mathematical methods.

Findings

Summarizing the information obtained, we can conclude that Russia represented by the Central Bank of the Russian Federation used the correct factor (inflation) in formation of the main instrument of national monetary policy (key rate) in comparison to the total set of developing countries (the states most similar in direction and degree of economic development). This was a necessary condition for maintaining the socio-economic climate inside the country at a certain level (in this case, it is necessary to take into account that the raw materials industries during this period played a key role in the economy, and the dynamics of world prices for their products had a serious impact on inflationary processes within the state).

When compared with developed countries and China, the situation is somewhat different: the monetary policy of these countries is aimed primarily at economic growth and development of a largely real sector of the economy. In this regard, when assessing the criteria (factors) for changing the key rate of Russia and these states, it must be said that the orientation in the period under review by the Central Bank of the Russian Federation mainly towards inflation with a change in the key rate is somewhat incorrect (Bank of china, 2020).

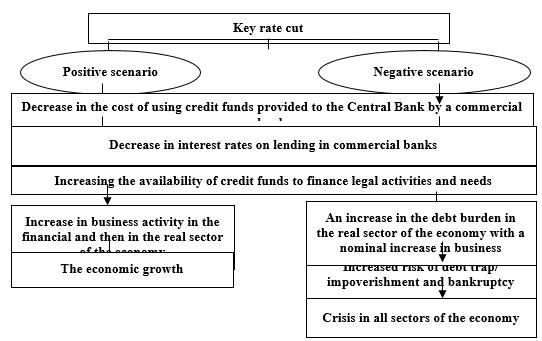

Thus, from the information presented above, it is clear that it is impossible to speak unequivocally and absolutely about validity of the policy of the Central Bank of the Russian Federation, aimed at a gradual reduction in the key rate in the wake of falling inflation, due to the ambiguity of the current situation and the complexity of the question posed. However, a necessary element of the study, according to the author, is a construction of opposing hypotheses (scenarios) on consequences of monetary policy development for the Russian economy (Figure 03).

A positive scenario for the development of the Russian economy as a result of the Bank of Russia's reduction of the key rate lies primarily in the effect of “cheap liquidity” – an increase in the possibility of obtaining borrowed funds by active participants in the real sector of the economy to finance their economic activities, due to similar processes in financial sphere of the country's economy. In the future, with an active turnover of borrowed funds and an increase in business activity, there will be an increase in positive trends in the economy and economic growth.

The negative scenario is the most unfavorable hypothesis of the Russian economy’ development under the influence of a decrease in the key rate, the main purpose of presenting which is to assess the situation from the most negative side in order to create preconditions for leveling the consequences of its occurrence.

An increase in the availability of credit funds for financing the activities of legal entities and the needs of individuals in modern conditions may entail an increase in the debt burden in the real sector with a nominal increase in business activity in the financial sector of the economy.

Individuals who receive credit funds, mainly to meet their needs, mostly people who have a poor understanding of economic processes, which, quite naturally, cannot adequately assess their financial capabilities. It means that with a decrease in loan rates, they will take borrowed funds in somewhat larger amounts than they will reasonably need later. Due to the lack of understanding of the economic situation and its dynamics, many of them in the future will not be able to pay off all their loan debts on time – there is a risk of increasing bankruptcy among individuals, as well as a decrease in demand for products of the real sector of the economy (CeicData, 2020).

The activity of legal entities is directly related to the purchasing power of both companies and households. However, in the end it depends on the ability of individuals to purchase and consume products, goods and services. This means that in the absence of positive dynamics in economic activity sufficiently (to cover all amounts of debt in the future), as well as due to a possible increase in the risk of reduced demand and the risk of increasing household bankruptcy, companies may inadequately and untimely adjust their activities and will continue to unreasonably increase the share of borrowed funds in their property, thereby increasing the risk of bankruptcy.

Credit institutions (banks) in the short term (at the beginning), as a result of a decrease in the key rate, will receive a slight increase in business activity due to an increase in lending volumes. However, in the long term, due to the risk of financial insolvency of both legal entities (related to the real sector of the economy) and individuals are also under the threat of the onset of risks. At the beginning, due to the bankruptcy of firms and households, banks' income from operating activities decreases (the risk of losing money transferred under credit agreements; in a more deplorable situation, there is a violation of debt payments already the banks themselves (the risk of bankruptcy of credit institutions), ultimately disrupting the operation of the entire financial sector, which will lead to an escalation of problems throughout the Russian economy.

To monitor the possible onset of a crisis situation associated with an increase in the availability of credit funds with a high probabilistic level of risk of a debt hole, it is necessary to analyze the dynamics of debt load (total credit / total income) of the population (Table 4), since it is it who is the final consumer in economic system. This will make it possible to assess the role of changes in the key rate in the period under review given existing economic rates of the state development.

It is important to note that for this analysis, we assumed the following: according to Rosstat data, the total income of the population consists of five parts (income from entrepreneurial and other production activities, wages of employees, social benefits, income from property and other monetary receipts). However, only wages of employees, social benefits are used for the analysis, since it is mainly citizens who receive these types of income who take loans to finance their needs.

As a result of the Table 4 analysis, it can be concluded that credit funds are a significant source of funds necessary to meet the vital needs of people. This is proved by the growth of the debt load ratio throughout the entire period (except for 2015–2016).

Individuals in the period under review tended to increase the volume of credit funds in a larger volume than the amount of their income. The dynamics of the indicator of individual debt load testifies to the fact that for each ruble earned, the country's population took on average about 1/3 of the ruble of credit. Based on this, it can be concluded that credit risks have arisen for individuals in the Russian Federation.

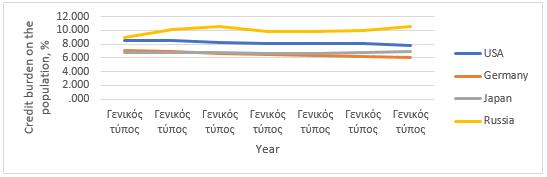

The next stage in assessing the possibility of a crisis situation in the Russian Federation (an unfavorable scenario of lowering the key rate) is to compare the indicator of the credit burden of the Russian population with a similar indicator in developed countries (Fig. 4). This comparison is due to the development of the Russian economy according to the market model, which means that it is necessary to focus on the leading countries of the capitalist system. For this we used the states previously presented in Table 3.

The credit burden of firms, as an indicator of the possibility of credit risks, is somewhat secondary since the onset of the risk of bankruptcy of individuals is more significant due to the ability to influence the position of all other subjects of economic relations.

As can be seen from the information presented in Fig. 4, the level of the debt burden of the population of the Russian Federation in the period under review was significantly higher than similar indicators in developed countries. Although, in developed countries the middle class prevails in society structure, actively using credit in its daily life. Based on this, it is necessary to draw a conclusion about the increased risk of a debt trap for Russian citizens.

Conclusion

The final stage in the study of the key rate of the Central Bank of the Russian Federation, its validity in the realities of the Russian economic situation, is the generalization and assessment of all the data obtained as a result of the analytical activities (Table 5) in order to try to identify the likelihood of any of the scenarios presented in Fig. 3. It is necessary to take into account the following point system:

absolutely correct (incorrect) – 4 points;

mostly correct (incorrect) – 3 points;

correct (incorrect) – 2 points;

to a lesser extent correct (incorrect) – 1 point;

pass "x" – 0 points.

The maximum sum of possible assessment points is 24 points, and the probability of the occurrence of scenarios was calculated as the ratio of the points received to their maximum total, multiplied by 100 percent.

Thus, the key rate of the Central Bank of the Russian Federation in the realities of the Russian economic situation was set somewhat unreasonably in 2013–2019 since the trends in the economic development of the Russian Federation under the influence of the policy of its establishment are more focused on a negative scenario.

It is also important that the key rate of the Central Bank of the Russian Federation regulates the cost of not only credit funds, but also deposits, which means that a decrease in this rate leads to a decrease in income received by bank depositors, which directly affects the volume of monetary resources in the banking system and can lead to their outflow in favor of more profitable instruments for saving money of the population. This can lead to disruptions to bank liquidity.

In conclusion, it should be noted that the key rate of the Central Bank of the Russian Federation, as the main instrument of monetary policy, is relatively new in Russian economic realities. Therefore, the mechanism of its formation will continue to improve.

References

People’s Bank of China (2019). Information about China's monetary policy: analytics of statistical information. People's Bank of China. https://www.bank-of-china.com/

Central Bank of Russia (2019). Information about the monetary policy of Russia: analytics of statistical information. Central Bank of Russia. https://cbr.ru/

CeicData (2020). Household Debt Service Ratio: Statistics of Developed Countries. Global databases. https://www.ceicdata.com/en

Deutsche Bundesbank (2019). Information about the monetary policy of Russia: analytics of statistical information. Bundesbank of Germany. https://www.bundesbank.de/en/statistics/public-finances

National Bank of Kazakhstan (2019). Information about the monetary policy of Kazakhstan: analytics of statistical information. National Bank of Kazakhstan. https://www.nationalbank.kz/?switch=rus

Reserve Bank of India (2019). Information about the monetary policy of India: analytics of statistical information. Reserve Bank of India. https://www.rbi.org.in/

RF Government (2002). On the Central Bank of the Russian Federation (Bank of Russia). Federal Law, dated 10.07.2002, no. 86-FZ (last edition). SPS Consultant Plus. http://www.consultant.ru

US Federal Reserve (2019). Information about the monetary policy of Russia: analytics of statistical information. Federal Reserve Supervision and Regulation Report. https://www.federalreserve.gov/publications/supervision-and-regulation-report.htm

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 May 2021

Article Doi

eBook ISBN

978-1-80296-106-5

Publisher

European Publisher

Volume

107

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2896

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Panteleeva, A. P., & Petrov, S. V. (2021). Regulation Of The Key Rate By The Central Bank Of Russia. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization - ISCKMC 2020, vol 107. European Proceedings of Social and Behavioural Sciences (pp. 1263-1275). European Publisher. https://doi.org/10.15405/epsbs.2021.05.167