Abstract

The article is devoted to the research of current trends and tendencies of investments attracted to the digital financial assets industry, in particular, to the field of cryptocurrencies. Modern tendencies of investments in innovative technologies are defined; the statistical analysis of the digital financial assets industry over a period of 2015-2019 is carried out. The aim of the following research is to overview the main spheres of application of cryptocurrency and digital assets; to analyze the impact of factors affecting the adoption of digital assets in different countries; to define the existing obstacles to further attraction of capital to the industry. The legislative aspects of ownership and usage of cryptocurrency in different countries were considered in the course of the research; the statistical model describing the factors influencing the population’s intention to make transactions with cryptocurrencies was built. Based on the results of the research the conclusion was made that the existing legal regulations are focused on restricting the function of the means of payment of cryptocurrencies, which damages the industry and slows its development. Instead of supporting DeFi tools, governments expect to emit their own crypto tokens to reduce the transactional costs. However, the results of the research show that the digital assets industry steadily expands year by year despite restrictive measures and negatively correlates with fiat currencies’ dynamics. The obtained results may be used in predicting further tendencies and prove that the industry will soon have a serious impact on the global financial system.

Keywords: Bitcoincorrelationcryptocurrencydigital financial assetsinnovative technologies

Introduction

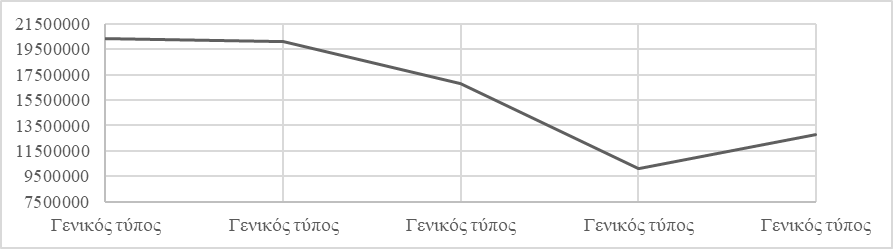

Nowadays investments are being transformed from capital into a new vision of the world and the process of creating value, in which the ability to be an innovator becomes the main thing. Innovative technologies are the basis of industrial development, which is aimed at constant renewal of each aspect of activity and at finding new ways to invent, promote, produce, trade, etc. (Pashtova, 2021). Most innovations are unique and, as a result, highly risky from the point of view of investment efficiency of their development and promotion to the market (Figure

Source: authors based on (Ossinger, 2020).

Also, the institutional investors around the world are wondering whether other existing cryptocurrencies besides bitcoin have any prospects for development. The speculative demand for digital assets created in 2020 by the pandemic must be backed up by fundamental reasons in order to maintain the stable price. Applicability is the most important characteristic for cryptocurrencies. Currently only several cryptocurrencies with the highest capitalization, such as Bitcoin, Litecoin and Ethereum, may be used in concluding smart contracts, and that is why they have real value for users. The vast majority of the cryptocurrencies, although they can be used by investors to diversify the portfolio and protect against volatility risks in the short term, so far have only an idea. However, since the beginning of the year, the Bitcoin Dominance Index has dropped from 68% to 58%, suggesting broader investor acceptance of other digital currencies.

The application question is being solved and new decisions are being introduced more and more frequently. In September 2020, the largest cryptocurrency exchange Binance announced the imminent launch of the Binance Card cryptocurrency debit card in the European Economic Area (EEA). The card functions on the basis of Visa and acts like other fiat cards.

A longer-term prospect for the use of cryptocurrencies implies the introduction of the Internet of Things (IoT) - the interaction of devices with each other within a single network (Liu et al., 2020). By using IoT, companies can significantly reduce logistics costs and fully automate business processes (Chen & Bellavitis, 2020), because this system can automatically gain data, determine the amount of deliveries and conditions of transportation, make a request of scarce goods, control labour productivity, etc.

One of key advantages of cryptocurrencies is the ability to use smart-contracts. DeFi technologies (decentralized finance), that are based on Blockchain, may give an opportunity to avoid human reliability problems and different mediators dealing with transactions and to boost business processes in companies (Chen & Bellavitis, 2020). Automatic contract execution in Blockchain is not connected with fiat money. This excludes risks of blocked bank accounts, cancelled transactions, etc. Reliability of the system is guaranteed by Blockchain, so this excludes risks of hacks and processes’ disruption. Mediators will become a history, if this technology is wide-spread all over the world. Thus, IKEA is already using Blockchain to optimize logistic costs (Sund et al., 2020).

Further improvement of DeFi tools, such as smart contracts, will make this system secure: the use of IoT technologies in combination with blockchain solves system security issues and allows systems to get rid of intermediaries and increase the speed of business processes, and cryptocurrencies will allow transactions between digital objects.

What is more, a number of companies have launched their own Blockchain platforms for different purposes. For instance, MasterCard launched its own platform for central banks of any countries to give them an opportunity to test the system, in case they decide to hold an IPO of their own national cryptocurrency. Considering Blockchain to be used more and more by companies, cryptocurrencies will become more convenient means of payment as they will be also based on blockchain, just like other instruments used by firms. In May, 2020 relatively young American Signature Bank in has launched its’ own Blockchain platform to make transactions in cryptocurrencies in collaboration with Bitstamp exchange and by July, 2020 total amount of deposits in cryptocurrencies amounted almost 8 bln USD.

Problem Statement

Cryptocurrencies are used all over the world today. Though they are not fully accepted by the majority of countries, economists are already thinking about them, especially because there is a probable opportunity that some cryptocurrencies may significantly affect international trade and currency exchange markets. Definitely, the popularity of cryptocurrencies is highly dependent on countries: their governments, citizens. But the truth is that nowadays it is impossible to ignore these newborn assets (as they are called in some countries) anymore. Nevertheless, some governments treat them with suspicion or even ban their usage. This article is supposed to make inferences that adoption of cryptocurrencies, especially now, may boost economic growth even a little bit. But some countries do not recognize it or are alarmed by declining economic stability and the rising level of economic crimes that may come along with legalization of cryptocurrencies in national economies.

Research Questions

Blockchain has a wide range of prospects. There are numerous fields, where it can be utilized as a basis for a bunch of technologies from cryptocurrencies to Internet-of-things concepts. But all of them will be useless, if cryptocurrencies and Blockchain aren’t adopted in the majority of countries. For this reason, it was decided to conduct a research that is supposed to show the probability of cryptocurrencies’ adoption in a list of countries. In order to do this a series of the main questions was posed. First of all, Bitcoin exchange rate dynamics was analyzed. Then the main advantages of using cryptocurrencies were defined. The most important part of the work was to describe the factors influencing adoption of cryptocurrencies by building a statistical model.

Purpose of the Study

Blockchain technology has a variety of characteristics that can significantly increase security of modern economic processes: from protecting the confidentiality of companies’ internal information and investment in innovative technologies to provision of governments’ budgets transparency for citizens (Schmidt & Wagner, 2019). These characteristics - decentralization, immutability and cryptographic connection between all participants in each information chain - will become the basis for ensuring information security in the future. It is quite important as information has become one of the main resources in the world these days (Hewa et al., 2020).

Investment in innovative technologies is the key to progress in all spheres, but their development costs more and more every year. Leaders in this type of investment are big IT companies such as Google, Amazon, Facebook, etc. Financing innovative technologies is one of the most profitable ways to invest in a company's capital nowadays. But modern technologies require experts and some time to be adopted by society, so this investment is not the most beneficial.

“Innovative” investment is more suitable for the firms that have an opportunity to apply new technologies as frequently as they appear. That is why IT companies and the ones that provide services are leaders in this area. Other, more conservative companies, should search for the balance between development and profitability - this is the main reason why the majority of companies are reluctant to use Blockchain in their production process, since it is almost impossible to remain profit-making company and the most technologically advanced one, as modern technologies’ prices are constantly growing.

Moreover, investment in innovative technologies is affected by expectancy effect: companies that consider Blockchain as the future of the world still do not invest their capital in it, because they are waiting for a more appropriate moment to receive more benefits from implementing it “on time”. Nowadays the economic situation is quite uncertain and unstable, mainly because of the pandemic and political tensions all around the world. So, companies are not ready for such significant changes that Blockchain will bring. So, the purpose of the study is to check the hypothesis that cryptocurrencies’ adoption may stimulate economic growth in most of the cases; and to forecast the probability of adoption in each country and in the world in general. In addition, main dependencies related to cryptocurrencies in the world financial system will be highlighted.

Research Methods

Our research method is based on constructing an econometric model with the usage of ordered probit regression. The likelihood ratio chi-square of 86.94 with a p-value of 0.0000 can be interpreted as strong evidence that our model, on the whole, is statistically significant. Accurately, this means that our model fits substantially better than a model with no predictors. In this research a probability analysis was conducted to forecast the probability of cryptocurrencies adoption in reviewed countries on the basis of a number of variables.

Opportunities of implementation of such systems and concepts highly depends on their adoption by citizens. In order to assess what affects adoption of cryptocurrencies a statistical model was created. A hypothesis of the research is that cryptocurrencies are more common and demanded in developed countries with high levels of economic and technological progress (GDP and internet penetration factors). Five-year data for 36 countries that form a representative sample was analysed.

Dependent variable “crypto_adoption” may take 4 values: from 1 to 4, where 1 – transactions and operations with cryptocurrencies are least prevalent in a country, citizens are completely disinterested in popularization of them; 4 – conditions for cryptocurrencies are most favourable and the citizens appreciate its implementation the most. Each country was given a rating by indicators in overview of reputable agencies and based on information about cryptocurrencies transactions volumes during a year in each separate country (particularly, Bitcoin as it is the most common cryptocurrency).

The following variables were selected as factors influencing the population’s adoption of cryptocurrencies:

1. The position of states in relation to the legalization of cryptocurrencies (crypto_legalization) (1 stands for legalized, 0 means that there is no recognition of crypto assets in law and corresponding regulation does not exist). It reflects the existence of an appropriate official document that confirms the legal position of cryptocurrencies in the financial system of the state as a type of asset or digital currency.

2. The presence of a legal ban on banking activities related to cryptocurrencies (banking_ban) reflects whether the state encourages banking operations that facilitate public access to transactions for the purchase and sale of cryptocurrency assets.

3. The number of ATMs for exchanging fiat money for cryptocurrency (atm_number) is included in the model as an indicator of the development of cryptocurrency infrastructure in the country; ATMs allow the population to purchase digital currency for fiat funds.

4. The Big Mac Index (bigmac_currency_to_usd) is a float indicator reflecting the percentage of undervaluation or overvaluation of a country's currency relative to USD.

5. The percentage of the population of each country with access to electricity (electricity_access) and to the Internet (int_penetration) reflect the share of local inhabitants in a country who have stable access to electricity networks and use the Internet (The World Bank, 2020).

6. GDP nominal (gdp_nominal) and GDP per capita (gdp_capita) reflect the level of economic development of the country. GDP per capita is used to make clearer comparisons between large and small countries (The World Bank, 2020).

7. The inflation rate (inflation_rate) as one of the main macroeconomic indicators reflects the decline in the purchasing power of money in the country from year to year (The World Bank, 2020).

8. Indices of budget openness (transparency_ind) and corruption perception in the country (corruption_perception_ind). The first one reflects the state of the public finance sector, their transparency, expressed in the timely and complete publication of documents related to budget policy issues, and the possibility of participation in their management by the population; the other index reflects the level of corruption in the country and public opposition to it.

All calculations were performed using the Stata software and the implemented tool Ordered probit model. The alternate dependent variable’s values can be logically ordered in ascending order and the analysis results will be sensitive to the order of alternatives, so the ordered model was chosen. Theoretically, in this statistical model it is formally assumed that there is an underlying continuous latent variable yi*, the values of which are associated with the observed dependent variable yi. The error term εi in this case follows a standard normal distribution:

yi ∗ = x′iβ + εi , (1)

where εi|xi ∼ IID(0, σ2) is the assumption that the error term obeys the normal distribution.

The normalization should be imposed that . The conditional probabilities of each alternative will be calculated using the following formulas:

P(yi = 1 | xi ) = P(yi∗ ≤ 0 | xi) = P(x′iβ + εi ≤ 0 | xi) = P(εi ≤ −x′i β | xi ) = Φ(−x′iβ) (2)

P(yi = 2 | xi) = P(0 < yi∗ ≤ γ2 | xi) = P(yi∗ ≤ γ2 | xi)−P(yi∗≤ 0 | xi) = P(εi ≤ γ2 − x′i β | xi)−P(εi ≤ 0 − x′i β | xi) = Φ(γ2 − x′i β)−Φ(−x′i β) (3)

P(yi = 3 | xi) = P(γ2 < yi ∗ ≤ γ3 | xi) = Φ(γ3 − x′i β)−Φ(γ2 − x′i β) (4)

P(yi = 4 | xi ) = P(yi∗ > γ3 | xi ) = 1−P(yi∗ ≤ γ3 | xi) = 1−P(εi ≤ γ3 − x′i β | xi ) = 1−Φ(γ3 − x′i β) (5)

Summing up all the obtained probabilities, the answer will be equal to 1.

In addition, in order to assess the influence of each individual factor on the dependent variable, it is not enough to consider the values of the β parameters: their values are not informative and do not give an idea of a positive or negative impact on the result in the ordered probit model. Therefore, it is also necessary to calculate the margin effects. They are calculated using the formula:

(6)

(7)

(8)

(9)

Findings

In 2019, a significant number of investors considered it to be safe to invest in innovative technologies, including cryptocurrency. However, their expectations did not come true: when on March 12, 2020, the American S & P500 index fell by 10% due to panic among US investors because of the pandemic, the BTC rate dropped by more than 40% in one day (Figure

Source: authors based on (Ossinger, 2020).

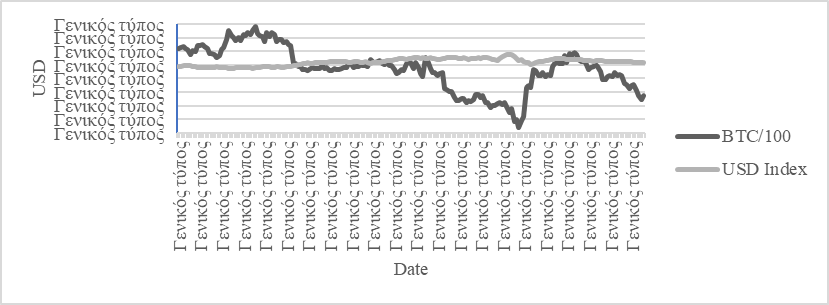

Also in 2020, another trend is notable: the rise in the bitcoin rate is increasingly associated with the weakening of the dollar. While expecting a worsening economic situation in the United States, investors are still starting to use bitcoin as one of their safe haven assets, despite the bad experience in March.

Calculations reflect that there is a strong negative correlation between these indicators. According to the estimations based on data obtained from the Bloomberg information and analytical system, Pearson's linear correlation coefficient between the US dollar index and the BTC rate over 9 months in 2020 was equal to -0.75 (Figure

Source: authors based on (Ossinger, 2020).

Thus, a strong negative correlation between the US dollar index and the Bitcoin exchange rate in the event of long-term political uncertainty and the continuation of the uncontrolled emission of the US currency may lead to the transition to cryptocurrency even in international trade, since Bitcoin makes it possible to hedge currency risks in transactions with the US dollar (Bouri et al., 2017). In other words, in terms of instability of the traditional financial system cryptocurrencies have an opportunity to become one of the most important tools in international trade in a few years.

In order to reduce the volatility of cryptocurrencies, it is possible to guarantee their price by linking them to a real asset. Such cryptocurrencies already exist on the market and are called stablecoins. While cryptocurrencies, prices for which are determined only by supply and demand, may become even more risky investments during a crisis, stablecoins are slightly less prone to such fluctuations, since their value is secured by real assets and equivalents, so they are a more reliable form of cryptocurrency to hedge the risks and save the invested capital in terms of crisis.

As it was mentioned earlier, the adoption of cryptocurrencies is the most important condition for their implementation and usage as an investment tool and means of payment. The statistical model in accordance with the previously specified methods was built (Table

The model includes 180 values, but after excluding the rows with the missing values of indicators the model takes into account 101 observations and reflects that at least one of the regression coefficients is not equal to 0 (Prob> chi2 = 0), which confirms that the model as a whole is statistically significant. It is noteworthy that the considered factors, except the level of Internet penetration (int_penetration), inflation (inflation_rate) and the open budget index (transparency_ind), are satisfying the 10% significance level (column 4 of Table

To reflect the real influence of factors it is necessary to separately calculate the marginal effects (Table

Nominal GDP and GDP per capita value (“gdp_nominal” and “gdp_capita”) have similar dynamics and a direct relationship with the adoption of cryptocurrencies by society: an increase in GDP per capita by $ 1000 reduces the likelihood of a country falling into the group with the citizens least welcoming digital currencies by 1.01%. This confirms the hypothesis that the level of economic development has a positive effect on the adoption of cryptocurrencies.

The undervaluation of the national currency in relation to the dollar (currency_bigmac_index_to_usd) also stimulates the population to use cryptocurrencies as a 1% decrease in the Big Mac index increases the likelihood of the country falling into the category of the most optimistic in relation to cryptocurrencies by 0.2%. Some currencies nowadays are seriously undervalued at the moment: for instance, Russian ruble in 2019 was undervalued against the dollar by more than 70%.

The presence of a registered exchange in the country - “local_exchange” - also turned out to be a serious factor influencing the adoption of cryptocurrencies by the population. In states that had a local exchange, it was much more likely that the population was interested in making transactions with digital assets (31.6% less likely to be in the least developed group and 13.4% more likely to be in the most welcoming cryptocurrencies group of countries).

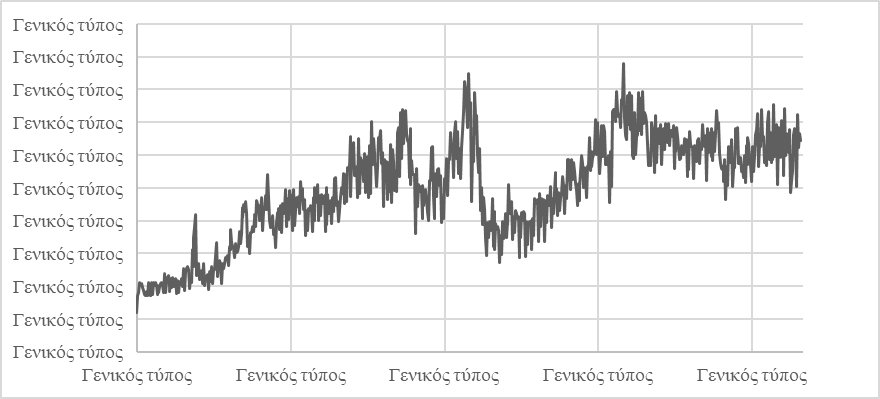

The dynamics over time - “year” - is also positive. From year to year, more and more countries are moving from the group with the least adoption of cryptocurrencies to a more developed stage, the volume of transactions around the world is increasing, which is also confirmed by publicly available statistics (Figure

Source: authors based on (Ossinger, 2020).

The dynamics of transactions involving cryptocurrencies made in the last 5 years shows that after a sharp decline in cryptocurrency market capitalization at the beginning of 2018 the number of transactions also reduced significantly, however, the main trend over the 5 years indicates a gradual and stable increase in the volume of transactions. It is also important to note that among statistically significant indicators, banking_ban has a significant marginal effect - a binary variable shows that if there is a ban in the country (the value is equal to 1), then the country's population is more actively using cryptocurrencies. The likelihood of a country with a ban on banking activities related to cryptocurrencies falling into the group with the least developed cryptocurrency industry is 20.1% lower, and the likelihood of falling into the group of countries with the population most encouraging the development of cryptocurrencies, on the contrary, is 8.5% higher. This trend is explained by the fact that the state authorities, observing the excitement from the population in the field of digital assets, often decide to limit the ways of acquiring cryptocurrencies through banking intermediaries in order to preserve the sovereignty of the country's Central Bank in the field of monetary policy.

The unexpected results are reflected by the govt_official_legalization factor: in countries where cryptocurrencies have their own specific legal regulation, society is less inclined to use them in transactions, such countries are 22% more likely to be in the least welcoming cryptocurrency category. This unusual trend can be explained by the strictness of the existing regulation: obviously, in order to understand the reasons for this phenomenon it is necessary to consider the existing legislative regimes in the industry.

According to the model, government regulation is an essential factor, which in its current state may slow down the whole industry because of unreasonable restrictions, so, to identify problems and determine the prospects for investments in such innovative technologies as digital financial assets the legislative framework in several countries was overviewed. For the international investors, the decisions of the SEC (Securities and Exchange Commission of the United States) are the most important, the Commission is actively developing the regulation of the sphere, relying on international experience. At the regional level Thailand, Japan, Canada, Switzerland, Russia and other countries encourage the introduction of cryptocurrencies into the financial system, primarily as an investment tool, which has its impact on SEC’s decisions. The main issue of hearings on the regulation of cryptocurrencies in the SEC, which were held several times in 2018, in July and September 2019, was Bitcoin-ETF - the creation of bitcoin exchange-traded funds that would attract the attention of large institutional investors and the public to cryptocurrencies. The question of ETF is extremely important for the entire market, since this form of investment in digital assets is the most attractive according to 65% of financial advisors. After a series of refusals over several years by the Commission, on September 22, 2020, the American exchange Nasdaq and the Brazilian fund Hashdex announced the launch of the world's first Bitcoin-ETF in the near future, which could significantly affect the popularization of digital currencies at the institutional level and could potentially raise billions of dollars in this market.

The work towards the legislative framework is actively pursued by the European Parliament. The latest edition of Markets in Crypto-assets act, published on September 24, 2020, is intended to treat cryptocurrency assets like other traditional financial instruments (European Commission, 2020). According to this document the token issuers will be supervised, service providers will be required to be registered as legal entities. The bill implements strict rules for stablecoins in order to preserve state sovereignty in the area of monetary policy and the stability of the EU financial system. At the same time experts warn that such measures will increase the outflow of invested capital from the European economic area and suppress innovation in the region.

The European Central Bank in its October 2020 Report on a digital euro (European Central Bank, 2020) recognizes the need to develop a digital euro. The decision on the issue has not yet been made, however, the growing demand for electronic payments and the decline in the popularity of cash are indicated. The "digital euro" will not replace the traditional currency, but will only supplement it.

In October 2020, Bank of Russia also announced the future release of the “crypto-ruble” in its Monetary policy report (Bank of Russia, 2020), the release and circulation of which will be fully controlled by the Central Bank. A 1:1 pegged to Russian ruble exchange rate and enhanced oversight of operations are expected. However, the term "blockchain" is mentioned only once in the report and it is not indicated what type of it is expected to be used, specific conditions of implementation are not referred to, which might mean the unreadiness of Russian regulators to introduce the digital ruble into the national financial system.

The International Monetary Fund's views on the future of cryptocurrencies are similar to those of government regulators (Bouveret, 2018). The fund already calls cryptocurrencies the next step in the evolution of money and evaluates them as extremely promising. The modern banking system may change significantly with the wider adoption of blockchain-based technologies. However, the IMF focuses mainly on the technology, but not on the existing cryptocurrencies: anonymity and volatility with respect to fiat money are significant disadvantages that, according to the Fund, prevent further development of the cryptocurrency industry and are unattractive for investors. This contradicts the opinion of potential users, who, on the contrary, often attribute the anonymity of payments and the decentralization of the system to the key advantages of blockchain and cryptocurrencies in general.

Conclusion

Based on the comparison of the approaches of the International Monetary Fund, the European Union and the Russian Federation, it is possible to identify general tendencies in attitudes towards investing in digital assets in different countries. On the one hand, state and intergovernmental bodies recognize the technological advantages of the technology in comparison with analogues existing within the framework of the modern banking system. However, at the current stage, attempts to restrict transactions with cryptocurrencies and tightly control private issuers are presented as plans for the Central Bank to develop a new form of fiat money using blockchain, which could reduce transaction costs of foreign exchange transactions and at the same time would give even greater control over civil circulation. In general, the ideas of both national Central Banks and the International Monetary Fund in their current form contradict the interests of private issuers and users of cryptocurrencies and the community and need further refinement.

It is important for states to maintain control and monopoly in the field of monetary policy, therefore, it is unprofitable to legalize cryptocurrency as a means of payment and it is more rational from the standpoint of regulators to equate them with traditional forms of investment. However, investing in cryptocurrencies without the possibility of using them to pay for goods and services is not reasonable: unlike securities, cryptocurrencies do not provide stable dividend or coupon income, supply and demand for them is determined only by market conditions. Evaluating cryptocurrencies solely as an asset leads to defining them as a financial pyramid, the return on investment in which is possible with an increase in the current rate and their subsequent sale. That is why the bills of the European regulators and the Russian Federation are aimed only at maintaining the position of the state, but not the convenience for users and the advantages offered by cryptocurrencies.

Considering the above, cryptocurrencies are a promising investment tool, which can be recognized as the "technology of the Industry 4.0". Automation and speed of business processes will accelerate significantly with the implementation of blockchain and smart contracts, which will be beneficial for both entrepreneurs and final consumers. A decentralized cryptocurrency system allows to get rid of financial intermediaries and reduce the risks associated with the human factor.

Undoubtedly, acceptance by the population is a determining factor for the further spread of cryptocurrencies in the world. Gradually, the world community becomes more welcoming the digital assets, which is confirmed by the annual dynamics. Economic development is one of the factors favoring the adoption of cryptocurrencies in society. At the moment, the population of countries with more undervalued currencies and more developed economy is interested in the crypto industry, because in the future there is a prospect of replacing the US dollar in international trade and switching to digital currencies, which will increase stability, reduce transaction costs and reduce their dependence on the American economy.

However, at this stage, cryptocurrencies are a tool of the future, but for now, they benefit society in an extremely limited amount. Although smart contracts are beginning to be used by a number of large companies in a wide variety of industries, their impact on the modern banking system remains insignificant. In addition, for digital currency to become what it was conceived, it is necessary to take a number of steps in the field of legal regulation. Currently, active work is being made in this direction, however, it is necessary to find a compromise between private investors and state interests, since without this the further successful development of the industry is impossible. First of all, a clear definition of the legal status and scope of cryptocurrencies by a number of government bodies (parliaments, securities commissions, central banks, etc.) can radically change the situation. Unreasonable prohibitions can significantly slow down the development of the industry.

Acknowledgments

The authors express their gratitude to the Financial University, this study was carried out within the framework of scientific research of the university-wide complex topic of the Financial University under the Government of the Russian Federation "New paradigm of social development in the digital economy".

References

- Bank of Russia (2020). Monetary policy report. http://www.cbr.ru/collection/collection/file/29411/2020_04_ddcp_e.pdf

- Bouri, E., Molnár, P., Azzi, G., Roubaud, D., & Hagfors, L.I. (2017). On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters, 20, 192-198.

- Bouveret, A. (2018). Cyber risk for the financial sector: A framework for quantitative assessment. International Monetary Fund Working Paper. https://www.imf.org/en/Publications/WP/Issues/2018/06/22/Cyber-Risk-for-the-Financial-Sector-A-Framework-for-Quantitative-Assessment-45924

- Chainalysis Team (2020). The 2020 global crypto adoption index: Cryptocurrency is a global phenomenon. https://blog.chainalysis.com/reports/2020-global-cryptocurrency-adoption-index-2020

- Chen, Y., & Bellavitis, C. (2020). Blockchain disruption and decentralized finance: The rise of decentralized business models. Journal of Business Venturing Insights, 13, e00151.

- Dwita, M.C., Ekaputra, I.A., & Husodo, Z.A. (2020). Are bitcoin and ethereum safe-havens for stocks during the COVID-19 pandemic? Finance Research Letters, In press.

- European Central Bank (2020). Report on a digital euro. https://www.ecb.europa.eu/pub/pdf/other/Report_on_a_digital_euro~4d7268b458.en.pdf

- European Commission (2020). Regulation of the European Parliament and of the council on Markets in Crypto-assets, and amending Directive (EU) 2019/1937. Brussels, 24.9.2020. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020PC0593

- Hewa, T., Ylianttila, M., & Liyanage, M. (2020). Survey on blockchain based smart contracts: Applications, opportunities and challenges. Journal of Network and Computer Applications, In Press.

- Iqbal, N., Fareed, Z., Wan, G., & Shahzad, F. (2021). Asymmetric nexus between COVID-19 outbreak in the world and cryptocurrency market. International Review of Financial Analysis, 73, 101613.

- Liu, Y., Lu, Q., Chen, S., Qu, Q., O’Connor, H., Choo, K.-K., & Zhang, H. (2020). Capability-based IoT access control using blockchain. Digital Communications and Networks. In Press.

- Ossinger, J. (2020). Cryptocurrency tax guidance leaves big holes worldwide, PwC says. https://www.bloomberg.com/news/articles/2020-10-01/cryptocurrency-tax-guidance-leaves-big-holes-worldwide-pwc-says

- Pashtova, L. G. (2021). Special aspects of venture capital funding of innovations in Russia. In S. I. Ashmarina, J. Horák, J. Vrbka, & P. Šuleř (Eds.), Economic Systems in the New Era: Stable Systems in an Unstable World. Lecture Notes in Networks and Systems, 160 (pp. 692-701). Springer.

- Schmidt, C. G., & Wagner, S. M. (2019). Blockchain and supply chain relations: A transaction cost theory perspective. Journal of Purchasing and Supply Management, 25(4), 100552.

- Sund, T., Lööf, C., Nadjm-Tehrani, S., & Asplund, M. (2020). Blockchain-based event processing in supply chains—A case study at IKEA. Robotics and Computer-Integrated Manufacturing, 65, 101971.

- The World Bank (2020). World development indicators. https://databank.worldbank.org/source/world-development-indicators

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Pashtova, L., Klemenov, D., & Oseev, V. (2021). Investments In Innovative Technologies And Digital Financial Assets: Problems And Prospects. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1815-1828). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.216