Abstract

Current financial technologies and innovations have practically changed the financial sector. Technological progress has created new opportunities for financial organizations’ success and their financial safety. As the profit of traditional financial organizations has recently started to decrease, companies have to search for new approaches to survive. The traditional practice of financial institutions based on loan provision is now an integral part of companies’ commercial activities. Low quality of the loan portfolio becomes one of the main factors of bankruptcy for most financial companies. Therefore, the issues of developing new financial technologies in order to manage quality of the company's loan portfolio are currently relevant. Company’s success in the market and its financial safety depends on the degree of financial technology development in the matter of the loan portfolio. The study purpose is to identify the financial technology to manage the organization’s loan portfolio that can support its financial safety and successful functioning in the market. The object of the research is providing the company with financial safety. The authors analyzed loan portfolio management of PLC Sberbank. The key factors that help manage Sberbank loan portfolio were identified. Based on the data obtained, the authors established the financial technology for managing the company’s loan portfolio to support its safety and success.

Keywords: Financial institutionsfinancial safetyfinancial technologiesloan portfoliomarket

Introduction

Current financial technologies and innovations have practically changed the financial sector. Technological progress has created new opportunities for financial organizations’ success and their financial safety. As the profit of traditional financial organizations has recently started to decrease, companies have to search for new approaches to survive. World financial institutions are becoming more involved in developing new financing tools, products and services, as well as new technologies to develop activities and ensure their financial safety.

The traditional practice of financial institutions based on loan provision is now an integral part of companies’ commercial activities. The effectiveness of the credit policy provided by financial companies depends on loan portfolio quality. Low quality of the loan portfolio becomes one of the main factors of bankruptcy for most financial companies. Therefore, the issues of developing new financial technologies in order to manage quality of the company's loan portfolio are currently relevant. The company’s success and financial safety depends on the degree of financial technology development in the matter of the loan portfolio.

Problem Statement

Financial companies operate in a changing economic environment that, on the one hand, offers great opportunities but, on the other, is characterized by risks, which threaten traditional approaches to financial management and safety. Therefore, companies have to regularly analyze their financial performance in order to survive in the current market environment, resist competition from other financial institutions, maintain their economic growth, and ensure financial safety. The ability of financial institutions to function safely and productively in the economic environment depends on observation of regulations, standards, and financial obligations by organizations. It also depends on the ability to correlate the company’s management with its economic goals.

Andreeva et al. (2019) proposed the approach to improve productivity of the organization’s financial policy. The authors believe that the main elements of this approach are an internal control system and an assessment of the organization’s financial stability. Durband et al. (2019) studied classic and current theories on addressing financial problems, including critical areas of financial decision-making. Filatov (2019) deals with economic analysis and offers the method of the integral factor analysis, which makes it possible to draw the conclusion about changes in the financial position of the enterprise (Filatov, 2019). Guerard contributes to the most current methodologies related to the originals of portfolio theory and portfolio construction in financial markets (Guerard, 2017).

Morozko and Didenko (2019) prove the necessity of using modern financial technologies in corporate finance to solve specific issues and improve the efficiency of financial management. The authors determine the impact of financial technologies on the financial activities of corporations. They note that financial technologies are one of the most essential ways to provide companies with growth in the market Pichl et al. (2020) show that research contributions from different fields (finance, economics, computer sciences, and physics) can provide useful insights into key issues in financial markets. The initial hypothesis about the relation between the use of digital financial services and technologies is presented in the research of Rasumovskaya and Ovsyannikova (2020). In addition, the authors show the influence of users’ activity on the structure of monetary transactions.

Research Questions

The issues of applying the optimal financial technology to manage the quality of the financial institution's loan portfolio are relevant, since one of the main goals of financial companies is to develop ways to form the balanced loan portfolio (risk - return - liquidity).

The following trends were observed in the Russian financial system in 2019:

1.Loan portfolio of financial organizations decreased by 4.9% compared to 2018.

2.Corporate debt financing fell by 9.8%, and consumption loans went down by 3.9%.

3.Loan arrears increased by 0.7%.

4.Level of financial companies’ reserves decreased by 1.6%.

5.Bank investments in securities decreased by 1.6% (Sberbank, 2019).

Today, Russia continues to pursue the policy of improving the financial sector and eliminating financial institutions that have risky credit activities. As a result, the number of financial institutions that have a right to carry bank transactions decreased from 484 to 442 in 2019. The financial safety of many companies was under threat.

Therefore, there are questions that have to be answered:

1.What are the financial technology factors to manage loan portfolio?

2.Is the financial technology able to provide for the company's success in the market and its financial safety?

Purpose of the Study

The authors tried to identify the financial technology to manage the company’s loan portfolio that can support its safety and successful functioning in the market. The object of the research is providing the company with financial safety. The authors analyzed loan portfolio management of PLC Sberbank in the space of two years (2018-2019). The key factors that help manage Sberbank loan portfolio were identified. Based on the data obtained, the authors established the financial technology for managing the company’s loan portfolio to support its financial safety and success in the market. The research was based on financial reports and statistics of Russian and foreign financial institutions. The main theories and ideas from national and international scientific literature were used in the paper.

Research Methods

General scientific and special methods and techniques of economic research were used in this paper. The methodological basis of the study is a review and analysis of academic papers of national and foreign scientists and practitioners who are interested in the problems of financial development and financial safety. A theoretical analysis of the papers allowed the authors to identify the features of current financial processes in economy. Compilation of the best practices and scientists’ recommendations helped develop measures to enhance innovations in the financial sector. The trends in Russian financial companies’ development, the ways to improve financial safety, and the factors affecting them were determined through the use of economic and statistical methods. The research was based on official data from annual figures of financial companies. These data let establish the financial technology of loan portfolio management to provide companies with success and financial safety.

Findings

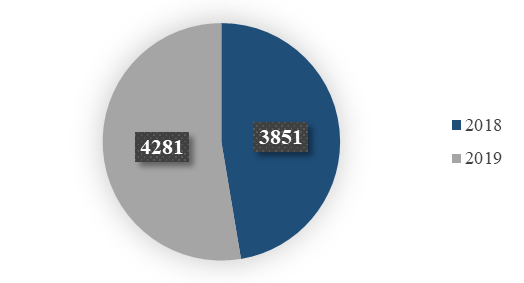

To identify the technology for managing the loan portfolio in order to ensure the company's success in the market and its financial safety, the authors analyzed PLC Sberbank loan portfolio in the space of two years (2018-2019). Sberbank remains one of the key suppliers of financial resources to the national economy. The company accounts for a third of the whole loan portfolio of the Russian financial system.

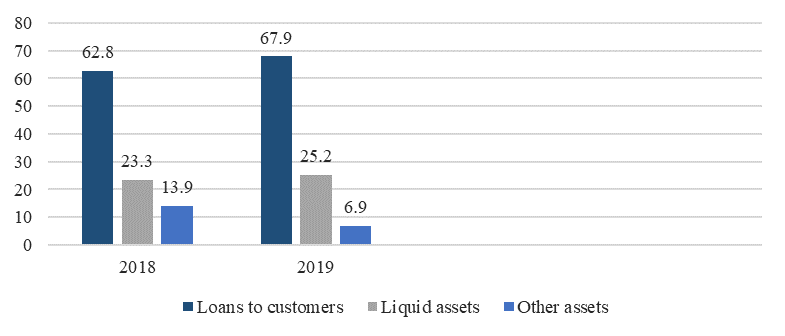

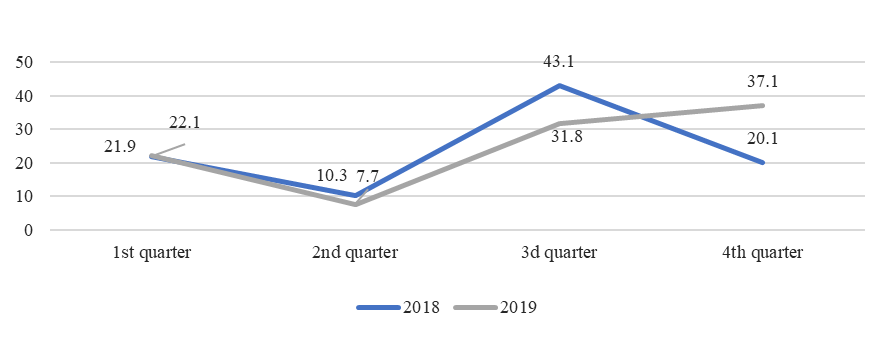

Loans to customers remain the largest part of Sberbank assets: they are 67.9% of total assets in 2019, consequently, there was an increase of 5.1% in the period under review (Sberbank, 2019). The company's liquid assets also increased by 1.9%. Other assets, on the contrary, decreased by 7% in 2019 compared to 2018 (Figure

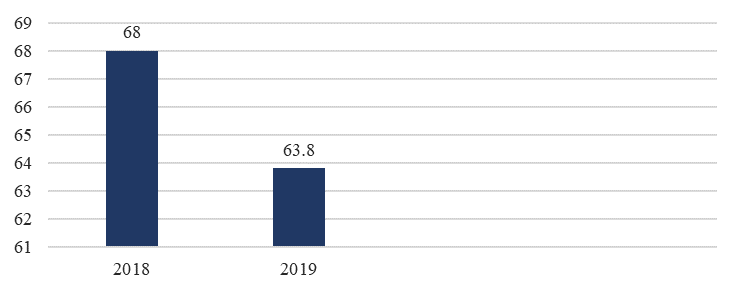

Corporate loans decreased by 4.2% compared to 2018 (Figure

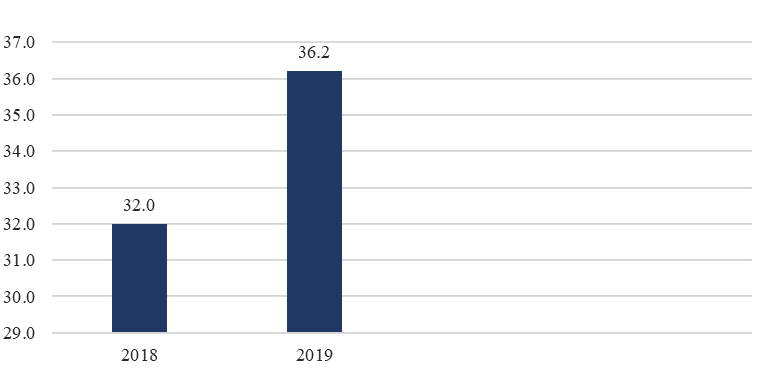

As for loans to private individual in the company’s loan portfolio in 2019, it increased by 4.2% in the period under review (Figure

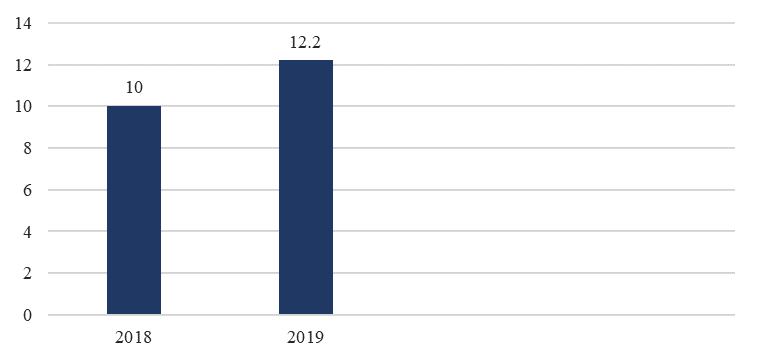

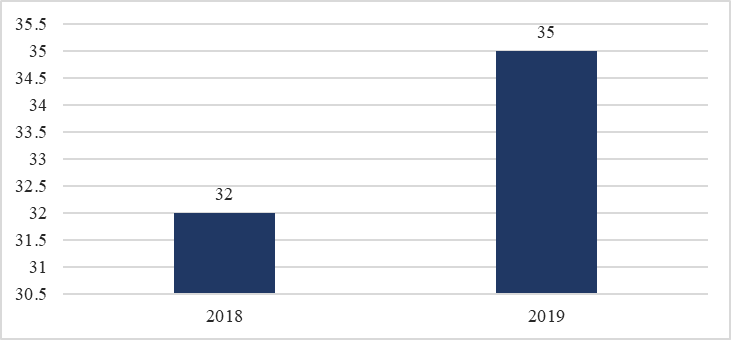

Consumption loans showed the highest growth in the period under review (Figure

Sberbank is one of the largest players in the Russian mortgage lending market with the portfolio market share of 54.0%. The mortgage loan portfolio grew by 11.4% in the period under review (Figure

Sberbank share in financing small and medium entrepreneurship increased by 3% (Figure

Sberbank expenses to develop reserves for credit impairments on the loan portfolio increased by 3.5% in 2019 (Figure

The authors identified two main factors that were taken into account by the company for optimal loan portfolio management: the macroeconomic situation and the specific one in the financial institution.

Loan portfolio quality is inseparably linked to several macroeconomic factors:

- annual GDP growth;

- real interest rate;

- annual inflation rate;

- annual unemployment rate;

- money quantity.

In addition to macroeconomic variables, there are specific factors that affect quality of loan portfolio management in the financial institution:

- size of a financial institution;

- profit;

- efficiency;

- profitability;

- lending terms;

- risk profile.

Based on the factors mentioned above, the financial technology of loan portfolio management provided Sberbank with success and financial safety in the market in 2019 (Table

Thus, the financial technology of loan portfolio management is a key element for the company's success and its financial safety in the market. The financial technology should include the following factors:

Competitiveness of the national economy. If this competitiveness is not at a high level, it can negatively affect the ability of borrowers to pay off the loan and as a result, affect financial performance of the company.

Productivity of the real economy when expanding the lending process. The share of non-performing loans will be higher during the periods of economic decline.

Expansion of macroeconomic monitoring which includes economic indicators in order to evaluate stability and strength of not only the loan portfolio, but also the whole financial system.

Return on assets when pricing loan products.

Planning the credit risk level through the assessment of the level of expected losses.

Developing reserves to cover possible losses on the loan portfolio.

Monitoring and control of the credit risk level in financial institutions.

Conclusion

Lending business is an income producing activity of financial companies. The indicator of the level of company’s lending business is loan portfolio quality, which is defined as a set of concluded contracts on loan transactions. Loan portfolio management penetrates the entire lending business in a financial company. Loan portfolio management begins with development of the company's credit policy and loan portfolio formation, which is based on this policy. The process continues through the procedures of analyzing the quality level of the loan portfolio, measures to improve it, and monitoring implementation of developed approaches and standards.

Loan portfolio management is aimed not only at the existing loan portfolio, but also at the planned one, as well as at adjusting the credit policy, goals, and objectives of a financial organization. Identifying the factors which are necessary to manage the company's loan portfolio in order to ensure its success and financial safety in the market is extremely relevant in Russia and abroad. The results of the study will provide for further development of the theoretical and methodological base, as well as at the daily work of financial institutions. The use of the financial technology described in this paper will increase the efficiency of Russian and foreign financial organizations.

References

- Andreeva, S. V., Popova, E. E., & Tarasova, T. M. (2019). Integration of the internal control system for financial stability of the organization. European Proceedings of Social and Behavioural Sciences, 57, 113-125.

- Durband, D. B., Law, R. H., & Mazzolini, A. K. (2019). Financial counseling. Springer.

- Filatov, E. A. (2019). Integral factor analysis of financial profitability by Filatovs method. European Proceedings of Social and Behavioural Sciences, 50, 356-363.

- Guerard, J. (2017). Portfolio construction, measurement, and efficiency. Springer.

- Morozko, N. I., & Didenko, V. Y. (2019). Cognitive approach in the analysis of using financial technologies in corporate finance. European Proceedings of Social and Behavioural Sciences, 57, 1075-1081.

- Pichl, L., Eom, C., Scalas, E., & Kaizoji, T. (2020). Advanced studies of financial technologies and cryptocurrency markets. Springer.

- Rasumovskaya, E. A., & Ovsyannikova, D. Y. (2020). Impact of the digital financial technology to the financial literacy of population. European Proceedings of Social and Behavioural Sciences, 79, 380-388.

- Sberbank. (2019). Sberbank annual report. https://www.sberbank.com/ru/investor-relations/reports-and-publications/annual-reports

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Kapustina, L., & Valieva, G. (2021). Loan Portfolio Management Technology As A Factor For Company's Financial Safety. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1-8). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.1