Abstract

The article considers issues of assessing the financial stability of insurance companies. Features of insurance services must be considered when assessing financial stability. The article shows the need and ability to take into account various factors affecting the financial stability of an insurance company. The authors identified two groups of indicators, which by their nature are classified into internal and external. It is shown that not only measurable, but and, difficult to assess traditionally, qualitative indicators can be determined. An expert method was used by the information collection tool. An approach using a balanced scorecard is proposed as an assessment tool. To determine the degree of influence of individual indicators, a multidimensional model is built. The result of the model is a comprehensive indicator of financial stability. This allowed us to identify a group of factors that have the greatest impact on the financial stability of the insurer. Assessment of the degree of influence showed that the greatest weight is occupied by indicators included in the group of internal factors “buyers” and external factors “economic factors”. Evaluation results create opportunities for making effective management decisions for company management.

Keywords: Insurancemarketstabilityfactors of financial stability

Introduction

In modern market conditions, the financial stability of any organization is the main factor ensuring its dynamic progressive development. First of all, this is a reflection of the organization's financial resources of the organization, which can be managed and effectively used. This ensures an uninterrupted process of production and sale of goods and services.

Insurance activity has social significance (Samarukha & Gulyaeva, 2011). Fulfillment of financial obligations is the key to the success of the insurance company. The financial stability of the insurance organization is influenced by many factors, both external and internal environment.

Some of them are subject to quantitative measurement: the amount of the authorized capital, insurance tariffs and reserves, as well as the volumes transferred to reinsurance. However, there are important factors that are difficult to quantify. In this regard, the issues of ensuring financial stability of insurance organizations require their development.

The authors propose an approach based on a balanced scorecard. It allows you to define groups of indicators that affect the financial stability of the insurer. For this, it is necessary to determine the indicators themselves, justify the mechanism for their assessment and determine their degree of influence on the integral indicator of financial stability. The result of the work is lies in developing an approach to assessing the impact of various groups on the financial stability of insurance organizations.

Problem Statement

The studied problem is associated with the search for an objective and visual method for assessing the financial stability of the insurer. Existing approaches consider individual indicators and do not provide a comprehensive assessment. Using an integral indicator will make the assessment simple and straightforward. Taking into account the degree of influence of various factors gives the company management the ability to manage risks with greater efficiency.

Research Questions

For the first time, the term "financial stability" was used in relation to the sustainability of the development of small farms in Western Europe. In domestic literature, the term "financial stability" appeared in the works of (Ovanesyan, 2017; Sheremet, 2005).

The essence of financial stability is considered by many Russian and foreign scientists. Table

The first approach defines financial stability as a certain state of the organization’s accounts and their structure. This condition is able to provide solvency and competitiveness at any time. This point of view is held by R.S. Sayfulin and G.A. Klementyev (as cited in Klementyev & Okorokov, 2010).

Other researchers (Savitskaya, 2005) consider financial stability from the perspective of a resource approach. In their opinion, this is the organization’s ability to provide an increase in financial resources and its own development in conditions of external and internal disturbances. The authors consider an important point a significant share of equity in the structure of financial resources that the organization uses. The purpose of this approach is the investment component. It is long-term financial stability that ensures the achievement of investment attractiveness over a long period.

The third approach to the definition of "financial stability" defines it from the position of a systematic approach. Vorobyov and Vorobyev (2015) considers it as a system that includes subsystems for generating income and expenses and the movement of financial resources. At the same time, financial stability acts as a subsystem to a system of a higher level and ensures the implementation of the main activity of the enterprise.

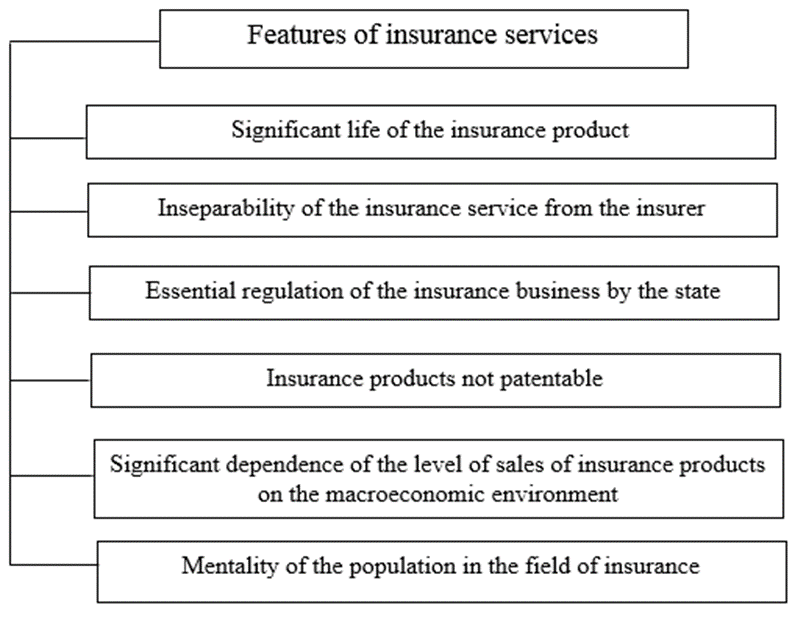

Insurance is characterized by features that are determined by the specifics of insurance activities and insurance services. Therefore, when assessing the financial stability of insurance companies, it becomes necessary to take this specificity into account (figure

The first feature explains the inverse nature of insurance services. The interaction between the insured and the insurer can last for a long time. Starting with a pre-insurance assessment of the insurance object and ending with the settlement of damage, in case of its occurrence. In addition, certain types of insurance (mainly from the list of life insurance) have an insurance period that goes far beyond 1 year. Claims can occur years and decades after the expiration of the insurance contract. This leads to the fact that the real profitability of the insurance product for the insured becomes tangible after a significant period. At the stage of execution of the insurance contract, the consumer is not able to adequately assess the quality of the provided insurance services.

The insurance service is inseparable from the manufacturer, in this case from the insurance company. The insurance company, upon conclusion of the contract, undertakes to fulfill all its obligations. This means that upon the occurrence of an insured event, compensation for damage to the insured is guaranteed, which confirms the fact of providing the insurance service (Kuznetsova, 2018).

The presence of a number of clear requirements for the properties of many insurance products is the third feature. This is especially true for compulsory insurance (insurance reserve standards: placement procedure and their size; licensing of tariffs and insurance conditions). The presence of this fact reduces the possibility of the use of marketing tools by the insurance organization (Shcherbakova, 2017).

The fourth feature leads to the rapid copying by competitors of successful insurance products. The fourth feature leads to the rapid copying by competitors of successful insurance products.

The dynamics of the development of insurance in any country is influenced by political and economic factors. Negative trends, as a rule, affect the volume of insurance portfolios of insurers in all types of insurance. Long-term life insurance contracts are particularly affected. Stability in the economy increases the level of public confidence in financial institutions. (Ageeva, 2016)

The population of our country shows a poor understanding of the essence of insurance. The reasons for this: lack of financial literacy, lack of habit of using insurance as a way to ensure financial security, distrust of insurance companies (Samarukha & Gulyaeva, 2011).

Among domestic insurance researchers, the concept of “financial stability of an insurance organization” is approached from the perspective of a resource and systematic approach. Taking into account the peculiarities of the activities of insurance companies, the resource approach is associated with the structure of obligations taking into account the risk component (Vorobyov & Vorobyev, 2015). The systematic approach is related to the fulfillment by the insurer of financial obligations in general. The elements of the system, in this case, are the subjects and objects of insurance, regulatory requirements for the reserves of the insurer, the volume of the insurance portfolio, etc. (Igonina, 2015).

However, that will ensure the desired state of financial stability of the insurance company is not investigated. According to the authors, to model the process of ensuring the financial stability of the insurer, it is necessary to identify and classify the factors affecting the company's ability to fulfill financial obligations. At the expense of them, the fulfillment of obligations to market entities and the sustainable development of the organization are ensured.

Purpose of the Study

The purpose of this study is to improve the method of assessing the financial stability of an insurance organization. Such a goal can be achieved when solving such problems as:

Determine the essence of financial stability of the insurance organization;

Show the need and benefits of an integrated assessment;

Build a model for assessing financial stability;

Determine the degree of influence of factors on the financial stability of the insurance organization.

Research Methods

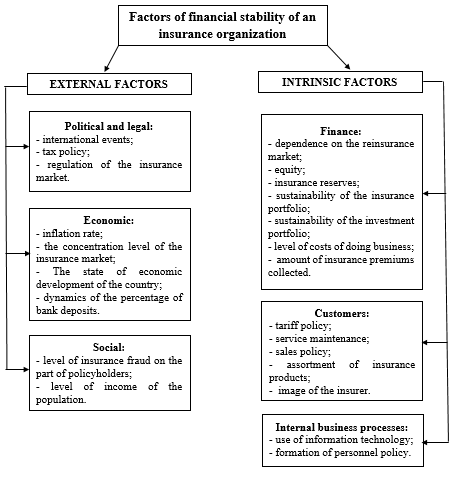

All factors can be divided into two groups according to the nature of their occurrence: external and internal.

Most of the factors that influence the financial stability of an insurance organization are qualitative and not subject to formal assessment. Therefore, to assess the impact of these indicators, we use a multidimensional model, the result of which will be a complex indicator. The mechanism for the formation of this indicator will be the sum of groups of factors. In this case, the weight coefficients will be an assessment of the impact of both quantitative and qualitative factors.

The degree of influence of factors is defined as:

where

The degree of influence of factors was assessed using an expert approach. His choice is due to the presence of qualitative factors that are difficult to formalize (Pogorelova, 2015). The experts were employees of insurance companies. Experts estimated the degree of influence of the identified factors on the financial stability of insurance companies on a scale of 1 to 10 (from minimal impact to maximum impact). Expert group responses are presented in table

Next, select 10 significant factors and group them about the criteria: the nature of occurrence and belonging. (table

We see that financial stability is a derivative mainly of internal factors. They represent the subgroups “finance” and “customers”.

The calculation of the significance level of factors is presented in table

The degree of influence of groups of factors indicator Kсk, calculated as follows:

– for a subgroup of factors

– the obtained values are normalized, thus forming the specific degree of influence of subgroups of factors on the financial stability of the insurance organization.

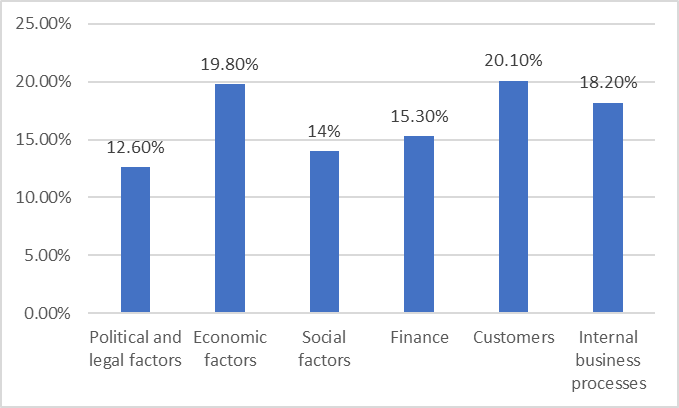

The results of calculating the degree of influence of subgroups of factors on the financial stability of the insurance organization are presented in table

Findings

The financial stability of the insurance organization can be represented in the form of a multidimensional model. The result of its implementation is an additive integral indicator. It represents the sum of the products of groups of factors by the corresponding weight indicator of a particular group. According to the calculation results, the financial stability assessment model takes the following form.

Kсk = 0.126F1 + 0.198F2 + 0.14F3 + 0.153F4 + 0.21F4 + 0.182F4

The ranking of the subgroups of factors by the degree of influence on the financial stability of the insurance organization is shown below (figure

It is advisable to control a group of factors “customers” and pay attention to business processes in the insurance organization given the proportion of the degree of influence. In addition, it is necessary to take into account the external group of factors determining the macroeconomic situation.

Conclusion

The financial stability of the insurance company is the key to its successful development. Based on the results of the study, a mechanism for assessing the financial stability of an insurance company is proposed. For this, groups of factors influencing the integral indicator were determined. It is the sum of the groups of indicators with an assessment of the degree of influence of each group. According to the results of the assessment, the greatest impact on the financial stability of insurance organizations is exerted by such subgroups of factors as “Clients” (internal factors) with a 20.1 % share of influence and “Economic factors” (external factors) with a 19.8 % share of influence. The significant influence of these groups poses challenges for the company’s management, the solution of which ensures the financial stability of the organization as a whole.

References

- Ageeva, E. V. (2016). Overview of the level of professional risk in Russia. Proc. of the XVII Int. sci. and pract. Conf. “The future of Russian insurance: estimates, problems, growth points” (pp. 268–273). Rostov-on-Don: South Federal University.

- Galaganov, V. P. (2012). Insurance business. Moscow: Academy.

- Igonina, L. L. (2015). Features of managing the financial stability of insurance organizations. Finance and credit, 5, 32, 37.

- Klementyev, G. A., & Okorokov, V. R. (2010). Strategy and mechanisms for ensuring the financial stability of organizations in the information economy. Science and technical Statement of SPbSPU, 5, 112, 115.

- Kuznetsova, N. V. (2018). On the issue of satisfaction with insurance services and the formation of demand for insurance. Economic and Entrepreneurshi, 3(92), 779, 783.

- Ovanesyan, S. S. (2017). The theory of sensitivity in cost management and breakeven. Actual issues of agricultural science, 24(55), 63.

- Pogorelova, T. G. (2015). Financial stability of economic entities and the impact of tax planning on it. Finance and Managment, 4(38), 82.

- Samarukha, V. I., & Gulyaeva, L. V. (2011). The role of the social sphere in improving the quality of life of the population. News of the Irkutsk State Economic Academic, 4(46), 50.

- Savitskaya, G. V. (2005). Economic analysis. Moscow: New knowledge.

- Shcherbakova, I. N. (2017). Pricing policy of Russia in modern conditions. Baikal Recourses Journal, 2, 12.

- Sheremet, A. D. (2005). Theory of Economic Analysis. Moscow: INFRA-M.

- Vorobyov, Yu. N., & Vorobyev, E. I. (2015). Financial sustainability of enterprises. Scientific Herald: finance, banks, investments, 1(5), 11.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Khitrova, E. M., Popova, E. S., & Khitrova, T. I. (2020). Impact Assessment Of Various Factors On Financial Stability Of Insurance Company. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 319-328). European Publisher. https://doi.org/10.15405/epsbs.2020.12.42