Abstract

This study examines factors that influence accounting undergraduates’ career path. The study uses questionnnaire survey for data collection purposes. The population of the study consists of accounting undergraduates from public and private universities. Simple random sampling was utilised to determine the respondents. Multiple regression was employed to determine factors influencing accounting undergraduates’ career path. The independent variables (predictors) were chosen based on previous literature. Results revealed that intrinsic motivation, influence of third party, career exposure and learning experience influenced accounting undergraduates’ career path, while extrinsic motivation did not influence their career path. The result suggests that accounting students’ decision on a career path is driven by interest and enjoyment of doing accounting, by advice from people they trust, by the exposure with practitioners and through knowledge gained during study, and not driven by wealth nor fame. Further, test of significant difference was administered to determine whether the students’ career path was the same across year of study. Result from the test concluded no significant difference was found across year of study. Results of the study provide crucial information to related parties to promote the accounting career by highlighting on non-extrinsic themes. Further, in line with MIA’s skill set requirements, institution of higher learning has to be proactive in updating and improving accounting undergraduates’ capabilities in line with industry needs.

Keywords: Accounting educationintrinsic & extrinsic motivationlearning experiencecareer path

Introduction

It is common for students who enrol to study in a particular field to not pursue a career in the same (similar) field. It is understandable that students may change their career intention after gaining further awareness and exposure all through their tertiary period. In the accounting field in particular, we see students shifting to other courses for various reasons; for instance, caused by inability to withstand the stress and difficulty of the course and its learning process. This phenomenon is becoming an issue, more so in Malaysia as we are short of qualified accountants (60,000 accountants by 2020) (Lee, 2018). Notwithstanding, brain drain to developed countries is also another issue faced. Thus, identifying factors influencing accounting undergraduates’ career path will enable related parties to motivate students to pursue accounting education and progress to the accounting profession.

Past studies claim that students who have high belief in accounting setting can offer a greater supply of work compared to other field of work (Kochanek & Norgaard, 1985; Owusu et al., 2018; Paolillo & Estes, 1982; Wen et al., 2015). According to them, this judgement plays a critical role in the selection of accounting major. Previous researches in a Malaysian setting revealed that the accounting field is still favoured by the undergraduates (Goon, 1975; Said et al., 2004). Goon (1975) for example, discovered that most of her respondents had selected accounting as a career. Further, Said et al. (2004) revealed that the accounting is ranked as the two most preferred professions of undergraduates. This study aims to investigate whether intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience influence accounting undergraduates’ career path. Further, this study looks at whether career path intention is significantly different across year of study.

Problem Statement

The decreasing popularity of the accounting profession as asserted by Russell et al. (2000) nearly 2 decades ago was due to dramatic change in the business landscape where technological development and competitiveness were very intense to which accounting education failed to adjust to. Further, over a decade ago, Smith (2005) claimed that the accounting profession had taken a back burner as a result of much “publicised financial frauds and irregularities” (p. 943).

Since then, the issue of accounting students changing courses, choosing to pursue other fields of study and not pursuing a career in accounting is quite common. These circumstances have partly affected the number of accountants being created in Malaysia. For instance, Mohd Khalid et al. (2018) discovered that approximately 75% of high school students who enrolled in accounting subject for SPM had the intention to pursue tertiary education in accounting after completion of their SPM. Further, Mohd Hanapiah et al. (2017) revealed that over 77% of accounting undergraduates intend to pursue a career in accounting after completing their tertiary education. Although the percentages are high, it is still insufficient to cover the demand for accountants in Malaysia.

And for the record, there are approximately 36,000 registered members of the Malaysian Institute of Accountants (MIA) currently (MIA, 2019), several thousand shorts of the 60,000 certified accountants required by 2020 (Lee, 2018); which is, incidentally, next year! This shortage is partly due to a steady stream of brain drain to Singapore and other neighbouring countries such as Vietnam, Cambodia and Hong Kong as well as other more developed countries that provide more lucrative incentive and compensation packages, whilst other reasons include a preference to opt for early retirement after marriage (Tan, 2018). Further, Lent et al. (1994) revealed that other influencing factors include intrinsic and extrinsic motivations, third party influence and career exposure

Research Questions

Further research is needed to determine students’ career path after completion of their tertiary education as there is still a need for qualified accountants in Malaysia. Thus, the research questions are:

1.Does intrinsic motivation, extrinsic motivations, third party influence, career exposure and learning experience influences accounting undergraduates’ career path?

2.Is there statistically significant difference in career path across year of study?

Research Objectives

1.To examine whether career path is influenced by intrinsic motivation, extrinsic motivations, influence of third party, career exposure and learning experience.

2.To ascertain whether there is significant difference in career path across year of study.

Purpose of the Study

The study refers career path as choice of profession that an undergraduate takes after the completion of his study. For an accounting undergraduate, this would mean a career path within the accounting field. A person plans his career path in the earliest part of his career journey (Yusoff et al. 2011). Thus, the purpose of this study is to analyse factors influencing accounting undergraduates' career path.

The contribution of the research may give benefits of enriching the current literature, providing insight to practitioners and policy makers. For instance, the MIA may be able to review their standards in order to improve the number of certified accountants.

Review of literature

We will present previous literature at this point covering career paths (dependent variable) as well as intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience (Independent variables).

Career Path

Joseph et al. (2012) define career path as an occupation that a person holds throughout his life. According to Joseph et al. (2012), career choice may be shaped by a person’s characteristics. Personal experience in doing work is also considered as career path according to Yusoff et al. (2011).

Previous literature used SCCT extensively in career path research. For example, Schoenfeld et al. (2017) used the SCCT to test the association of self-efficacy and intention to become a CPA. Ng et al. (2017) had also used SCCT to examine whether intrinsic and extrinsic motivations, influence of third party and career exposure influenced accounting students’ career choice. Further, James (2008) used the SCCT to try to discover why accounting is not a popular career choice among African American students.

The current study refers career path (or career choice) as choice of profession that an undergraduate take after the completion of his study. For an accounting undergraduate, this would mean a career path within the accounting field. Some of the accounting career information that the undergraduate students should consider before making this decision includes education requirements, tax accounting salary, typical career advancement, and duties performed.

Factors influencing career path

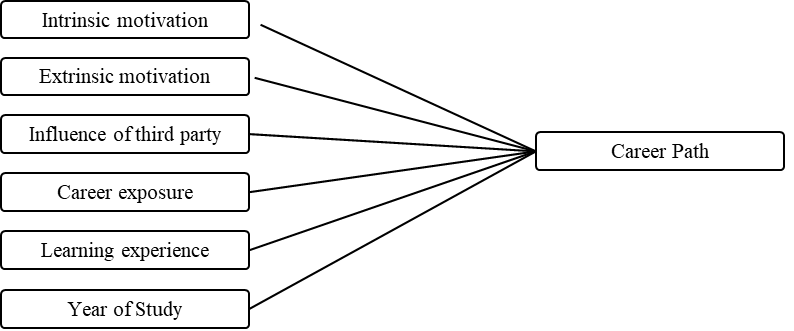

The independent variables that will be tested with career path are intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience, similar to Ng et al. (2017). We included learning experience as an additional variable as it was also tested as a factor that affects career path in previous literatures. Table

Theoretical Framework

The Social Cognitive Career Theory (SCCT) was used extensively by previous literature testing factors influencing undergraduate students’. SCCT by Lent et al (1994) stemmed from Bandura’s Social Cognitive Theory (1986) and was used to describe factors influencing career choice. SCCT is a framework that explains the process a person goes through in the pursuit of choosing a career. It relates both internal and external factors that may influence a person’s choice. There are three main variables in the SCCT namely: self-efficacy, outcome expectations and goals and these three variables are important to develop a person’s ability to achieve their outcome, however challenging it may be. In accomplishing tasks despite encountering countless obstacles, self-efficacy people tend to be the one placing great effort and accomplishing it (Chantara et al., 2011).

Hypotheses Development

The hypotheses development for the variables are based on previous literature as per Table

Research Methods

This research uses primary data (questionnaire survey) as data collection method.

Population and Sampling

The target population for the study was accounting undergraduates. A total of 312 questionnaires collected were found to be usable from the 500 distributed. Convenience sampling was used for data gathering to ensure that comparisons can be made among the degree in accounting students from the first to the final year. It would be interesting to analyse responses of these students as first year students may be lacking in career path exposure than their senior counterparts.

Data Collection Procedures

Questionnaire survey is the primary source of data for this study. This type of data source is suitable for the study as it is a descriptive study that is designed to describe the characteristics of persons, events or situations (Sekaran & Bougie, 2016), where the main objective of the research is to determine factors influencing accounting undergraduates’ career path.

The questionnaire survey for this study is adapted from Ng et al. (2017), and included one other independent variable, which is learning experience. The first part covers demographic data. The second part covers the independent variables and dependent variables consisting of 30 statements.

Pilot test was performed prior to questionnaire distribution to ensure the internal validity of the questionnaire, discard ambiguous questions so that respondents do not have any problems in answering the questions and accelerate data collection process (van Teijlingen & Hundley, 2001). The questionnaire’s reliability was also tested even though the instrument utilised was adopted from previous literature and had gone through reliability testing. Reliability test administered to the data provided very good results, where the Alpha (Cronbach) for all variables were between .808 - .886, showing high level of internal consistency.

Variable Measurements

The questionnaire is divided into three sections: demographics, the dependent variable and the independent variables. The demographics comprise of age, gender and year of study. The variable measurement for both dependent and independent variables is based on a 5-point Likert scale (1 = Strongly Disagree to 5 = Strongly Agree). This type of measurement is used to measure the distance between any two points on the scale and it also has equal distance between numbers. Also, it does not pressure the respondents to take a stand on a particular issue but allows them to reply in a degree of agreement. In this situation, it makes easier to the respondent to answer the questions.

Statistical Tests

This study uses regression analysis and test of significant difference to achieve the aims of the study. For example, regression analysis is used to identify predictors (intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience) of accounting undergraduates’ career path. Meanwhile, test of significant difference is used to determine whether career path intention is the same across year of study.

Findings

This part of the study presents results from statistical analysis performed using SPSS Version 24. There are two objectives of the study. Firstly, the study aims to determine predictors of accounting undergraduates’ career path using multiple regression test. Secondly, the study aims to identify whether the accounting undergraduates’ career path is different across year of study. Test of significant difference is carried out to establish whether significant difference is present.

Demographics

Demographics of the 312 respondents are tabled below (see table

Normality Test

Shapiro-Wilk test was used to determine data distribution. Results indicate that the data were not normally distributed (p<0.01).

Correlations

Spearman’s correlation coefficient was used to determine association of dependent and independent variables as the data is non-normally distributed. Results provide evidence that all independent variables were significantly correlated with career path at the 0.01 level.

Multiple regression test

Multiple linear regression test was performed to determine predictors of career path among the independent variables. The test is administered to determine the predictors (i.e. Intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience) that influence accounting undergraduates’ career path. However, it is important that the assumptions of multiple regression are to be complied with in order to ensure the appropriateness of the regression model.

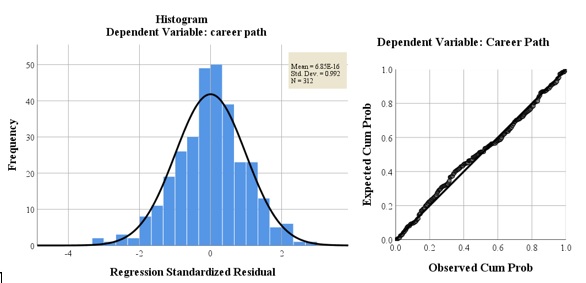

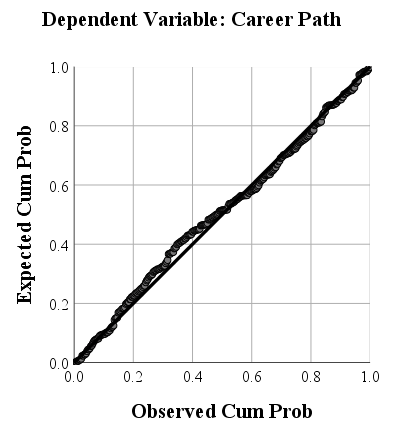

First, normality and linearity were inspected via the Histogram and Normal Probability Plot (refer Figure

Next, we determined that no multicollinearity problems were present in the residuals as the tolerance and VIF values observed were greater than 0.20 and less than 10 respectively (Field, 2009). The Durbin-Watson test was also used to check for autocorrelation presence in the residuals. The test value of 1.788 indicates that no autocorrelation were present.

Finally, scatter plot of residuals in Figure

In summary, based on the Table

Table

Results for intrinsic motivation (b=.304, p<.000) and career exposure (b=.133, p<.05) were statistically significantly consistent with Ng et al. (2017), Lukman and Juniati (2016) and Țicoi and Albu (2018). Significant affect was also found on influence of third party with career path (b=.149, p<.000) consistent with Lukman and Juniati (2016) but was inconsistent with Ng et al. (2017). Further, learning experience was found to affect students’ career path (b=.230, p<.000), consistent with Sugahara et al. (2009). Thus, H1,3,4,5 are supported.

The non-significant result for extrinsic motivation (b=.105, p>.05) is consistent with studies by Dibabe et al. (2015), Ahmad et al. (2015), Ng et al. (2017) and Srirejeki et al. (2019) but not consistent with Țicoi and Albu (2018). Thus, H2 is rejected. The summary of hypotheses can be referred to in Table

The general form of the equation to predict career path from intrinsic motivation, influence of third party, career exposure and learning experience is:

Predicted Career Pathi = b0 = b1 intrinsic motivationi + b2influence of third partyi + b3career exposurei

+ b4learning experiencei

= .318 + (.340intrinsic motivationi) + (.149influence of third partyi) +

(.133career exposurei) + (.230learning experiencei)

The beta value in the equation implies that a 1 unit increase in intrinsic motivation will result in an increase in the intention to pursue an accounting career path (DV) by .34 unit, when influence from third party increases by 1 unit, the respondents’ intention on accounting career path will increase by .15 unit; when career exposure increase by 1 unit, respondents’ career path intention will increase by .13 unit and when learning experience increase by 1 unit, intention to pursue accounting career will increase by .23 of a unit.

Test of significant difference

Kruskal-Wallis test was conducted to examine any significant difference in preference of career path across year of study. The test result found no significant difference in career path across year of study (retaining the null hypothesis at p>.05). Thus, H6 is rejected. The finding is consistent with Ahmad et al. (2015) but is contradictory to findings by Russell et al. (2000), Marriott and Marriott (2003) and Danziger and Eden (2007) who revealed that students’ attitudes towards accounting changed as they advance in their studies. The result corresponds with the earlier regression results indicating that accounting undergraduates will be motivated to choose accounting as a career when their level of self-efficacy increases in line with the SCCT theory.

Conclusion

The study has two objectives (1) to examine factors influencing accounting undergraduates’ career path, (2) to determine whether the accounting undergraduates’ career path is the same across year of study. Multiple regression test indicates that the predictors of career path are intrinsic motivation, influence of third party, career exposure and learning experience. Results imply that the greater the intrinsic motivation, the more encouragement given by third party, further career exposure and the longer duration the of study, the higher the chances of them choosing the accounting career path.

The result also reveals that accounting undergraduates do not consider extrinsic motivation (such as high salary, status, etc) as an important aspect when choosing a career path, contrary to findings over a decade ago (Jackling & Keneley, 2009; Tan & Laswad, 2006). The present findings provide a signal to parties involved to find new “selling points” of the accounting profession that are more appealing and can draw more interests to promoting the accounting career path. The MIA, practitioners and professional bodies have to play their parts to create more career exposures via seminars, events and roadshows as these may create more awareness and interests for the profession as early as during the school years.

Further, MIA strongly supports the adoption of technology in the advent of Industrial Revolution 4.0 (IR 4.0), as iterated by the CEO of MIA in her recent speech, “future accountants must be equipped with technological skills, communications and soft skills, critical thinking, strategic and analytical skills, and resilience as well as flexibility” (Mahzan, 2019, p. 12). This means that an increase in self-efficacy via intrinsic motivation through skill enhancement, as well as influence of third party (subjective norms) and more learning experience under their belts, more accounting undergraduates’ may intend to choose an accounting career path in the future.

The decreasing popularity of the accounting profession as asserted by Russell et al. (2000) nearly 2 decades ago was also due to dramatic change in the business landscape where technological development and competitiveness were very intense to which accounting education failed to adjust to. Over a decade ago, Smith (2005) claimed that the accounting profession had taken a back burner as a result of much “publicised financial frauds and irregularities” (p. 943). Thus, the accounting fraternity has to regain the public’s trust through highlighting intrinsic advantages of being an accountant and depicting a “virtue-based professional identity” (Lopez & Perry, 2018).

The limitation of this study is the sample size. Although assumptions of linear regression has been faithfully adhered to, the regression model may only be applicable in a Malaysian perspective for it to be generalised. Thus, future research may endeavour to improve the model in other settings. Further, as the study’s four predictors were only able to account for 44% of career path intention, other predictors such as cost of the program or duration of study, may be introduced for future research.

Acknowledgments

We would like to extend our appreciation to the students who have helped us in collecting data for our study.

References

- Ahmad, Z., Ismail, H., & Anantharaman, R. N. (2015). To be or not to be: an investigation of accounting students’ career intentions. Education+ Training, 57(3), 360-376.

- Ahmed, K., Alam, K. F., & Alam, M. (1997). An empirical study of factors affecting accounting students' career choice in New Zealand. Accounting Education, 6(4), 325-335.

- Baldwin, B. A., & Howe, K. R. (1982). Secondary-level study of accounting and subsequent performance in the first college course. Accounting Review, 619-626.

- Byrne, M., Willis, P., & Burke, J. (2012). Influences on school leavers’ career decisions–Implications for the accounting profession. The International Journal of Management Education, 10(2), 101-111.

- Chantara, S., Kaewkuekool, S., & Koul, R. (2011). Self-determination theory and career aspirations: A review of literature. Institutions, 7, 9.

- Danziger, N., & Eden, Y. (2007). Gender-related differences in the occupational aspirations and career-style preferences of accounting students: A cross-sectional comparison between academic school years. Career Development International, 12(2), 129-149.

- Dibabe, T. M., Wubie, A. W., & Wondmagegn, G. A. (2015). Factors that affect students’ career choice in accounting: A case of Bahir Dar University students. Research Journal of Finance and Accounting, 6(5), 146-153.

- Field, A. (2009). Discovering Statistics Using SPSS (3rd ed.). SAGE Publication Ltd.

- Goon, A. C. (1975). Career aspirations among the Secondary Urban School students. Unpublished dissertation.

- Hejazi, R., & Bazrafshan, A. (2013). The survey of graduated accounting students’ interest in management accounting: evidence of Iran. Open Journal of Accounting, 2(03), 87.

- Jackling, B., & Keneley, M. (2009). Influences on the supply of accounting graduates in Australia: a focus on international students. Accounting & Finance, 49(1), 141-159.

- James, K. L. (2008). Barriers to accounting as a career choice for African-American students. Research in Higher Education Journal, 1, 58-67.

- Joseph, D., Boh, W. F., Ang, S., & Slaughter, S. A. (2012). The career paths less (or more) traveled: A sequence analysis of IT career histories, mobility patterns, and career success.

- Keef, S. P. (1992). The effect of prior accounting education: some evidence from New Zealand. Accounting Education, 1(1), 63-68.

- Kochanek, R. F., & Norgaard, C. (1985). Student perceptions of alternative accounting careers--Part I. The CPA Journal (pre-1986), 55(000005), 36.

- Lee, M. K. (2018, March 1). The drive to double Malaysia's accountancy profession by 2020. Accounting & Business Magazine (Malaysia Edition). https://www.accaglobal.com/content/accaglobal/in/en/member/member/accounting-business/2018/03/practice/malaysia-2020.html

- Lent, R. W., Brown, S. D., & Hackett, G. (1994). Toward a unifying social cognitive theory of career and academic interest, choice, and performance. Journal of vocational behavior, 45(1), 79-122.

- Lopez, K. J., & Perry, S. M. (2018). The Importance of Virtue Ethics and the Role of Salience in the Accounting profession. Southern Journal of Business and Ethics, 10. https://www.questia.com/library/journal/1P4-2228578036/the-importance-of-virtue-ethics-and-the-role-of-salience

- Mahzan, N. (2019). Educating Future Accountants. Keynote address at The Kaplan Forum. Kuala Lumpur: Malaysian Institute of Accountants.

- Malaysian Institute of Accountants. (2019). Membership classification. https://www.mia.org.my/v2/membership/services/statistics/classification.aspx

- Marriott, P. R. U., & Marriott, N. (2003). Are we turning them on? A longitudinal study of undergraduate accounting students' attitudes towards accounting as a profession. Accounting education, 12(2), 113-133.

- Mohd Hanapiah, M. A. A, Joon, M. I., Abdul Razak, N. A., & Vijayandran, S. (2017). An empirical study of factors affecting accounting students' career choice in Malaysia. Unpublished manuscript. Universiti Tenaga Nasional, Malaysia.

- Mohd Khalid, F., Abdul Rauf, F. H., Ahmad Fuad, N. F., Saaibon, S., Mohd Asri, N. A., & Sharom, N. D. (2018). Factors Influencing High School Students to Major in Accounting. Global Business and Management Research, 10(3), 605.

- Myburgh, J. E. (2005). An empirical analysis of career choice factors that influence first-year accounting students at the University of Pretoria: a cross-racial study. Meditari Accountancy Research, 13(2), 35-48.

- Ng, Y. H., Lai, S. P., Su, Z. P., Yap, J. Y., Teoh, H. Q., & Lee, H. (2017). Factors influencing accounting students’ career paths. Journal of Management Development, 36(3), 319-329.

- Owusu, G. M., Essel-Anderson, A., Ossei Kwakye, T., Bekoe, R. A., & Ofori, C. G. (2018). Factors influencing career choice of tertiary students in Ghana: A comparison of science and business majors. Education+ Training, 60(9), 992-1008.

- Paolillo, J. G., & Estes, R. W. (1982). An empirical analysis of career choice factors among accountants, attorneys, engineers, and physicians. Accounting Review, 785-793.

- Porter, J., & Woolley, D. (2014). An examination of the factors affecting students’ decision to major in accounting. International Journal of Accounting and Taxation, 2(4), 1-22.

- Russell, K. A., Kulesza, C. S., Albrecht, W. S., & Sack, R. J. (2000). Charting the course through a perilous future. Management Accounting Quarterly, 2(1), 4-11.

- Said, J., Ghani, E. K., Hashim, A., & Mohd Nasir, N. (2004). Perceptions towards accounting career among Malaysian undergraduates. Journal of Financial Reporting and Accounting, 2(1), 17-30.

- Schoenfeld, J., Segal, G., & Borgia, D. (2017). Social cognitive career theory and the goal of becoming a certified public accountant. Accounting Education, 26(2), 109-126.

- Sekaran, U., & Bougie, R. (2016). Research methods for business: A skill building approach. John Wiley & Sons.

- Smith, G. (2005). Reversing the decreasing trend of students majoring in accounting. Managerial Auditing Journal, 20(9), 936-944.

- Solikhah, B. (2014). An application of Theory of Planned Behavior towards CPA career in Indonesia. Procedia-Social and Behavioral Sciences, 164, 397-402

- Srirejeki, K., Supeno, S., & Faturahman, A. (2019). Understanding the Intentions of Accounting Students to Pursue Career as a Professional Accountant. Binus Business Review, 10(1), 11-19.

- Sugahara, S., Hiramatsu, K., & Boland, G. (2009). The factors influencing accounting school students' career intention to become a Certified Public Accountant in Japan. Asian Review of Accounting, 17(1), 5-22.

- Tan, L. M., & Laswad, F. (2006). Students' beliefs, attitudes and intentions to major in accounting. Accounting Education: an international journal, 15(2), 167-187.

- Tan, R. (2018, August 7). Retaining talent despite shortage of accountants. The Star Online. https://www.thestar.com.my/business/smebiz/2018/08/07/retaining-talent-despite-shortage-of-accountants-silver-award-winner-for-best-employer-in-soba-2017

- Țicoi, C. F., & Albu, N. (2018). What factors affect the choice of accounting as a career? The case of Romania. Accounting & Management Information Systems/Contabilitate si Informatica de Gestiune, 17(1).

- Umar, I. (2014). Factors influencing students’ career choice in accounting: The case of Yobe State University. Research Journal of Finance and Accounting, 5(17), 59-62.

- van Teijlingen, E. R., & Hundley, V. (2001). The importance of pilot studies. Social Research Update, 35. http://sru.soc.surrey.ac.uk/SRU35.html

- Wen, L., Hao, Q., & Bu, D. (2015). Understanding the intentions of accounting students in China to pursue certified public accountant designation. Accounting Education, 24(4), 341-359.

- Yusoff, Y., Omar, Z.A., Awang, Y., Yusoff, R., & Jusoff, K. (2011). Does knowledge on professional accounting influence career choice? World Applied Sciences Journal, 12, 57-60.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Khalid, F. M., & Abdul Rauf, F. H. (2020). Factors Influencing Accounting Undergraduates’ Career Path: Evidence From Malaysia. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 246-258). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.26