Abstract

This study is to investigate the factors that influence the M-payment among young professionals in Malaysia. Perceived Ease of Use (PEOU), Perceived Usefulness (PU), Attitude (ATT), Subjective Norms (SN) and Perceived Behavioural Control (PBC) are used as independent variables (IV) to find out the relationship between those variables and the dependent variables. The given framework hypothesized that Trust (TRU) moderated the impact of those factors to influence the acceptance of M-payment among the young professionals. Quantitative approach has been used to conduct the research the fore survey questionnaires have been distributed among the general public in Malaysia with the filtering queries to get the data from young professionals. Total 220 responses received back from the overall distributions and among them 211 copies are selected for further analysis. The outcome of the study showed that Trust is a supporting moderating factor to the Attitude and Subjective norms. However, the independent variables Attitude and PBC were supporting the hypothesis, those were the factors influencing M-payment acceptance. From the study it has been concluded that attitude and PBC are the factors prompting young professionals to accept the M-payment service. Trust has, however, effectively improved the relationship between the proposed factors (SN and Attitude). So it is important for the marketers to consider the proposed factors in implementation, to further improve the usage of M-payment in Malaysia.

Keywords: M-paymentyoung PropessionalTAMTPB

Introduction

The use of mobile phones has increased in our daily life and this has led to the expansion of M-payment system and due to which there is growth in global economy and business. In today’s era where convenience being accentuated, M-payment system has gained its popularity as cashless business dealings have gained its favor amongst the customers and merchants globally. The expansion of this facility has brought benefits to the vendors and organizations worldwide (Price & Pilorge, 2009; Singh et al., 2017). In addition, by the development of this new technology, it has also gained an impressive opportunity on the global market and made our day to day transactions easier (Oztas, 2015).

Accordingly, the worldwide penetration of cellular phones and wireless internet has increased exponentially and the phenomenon is included Malaysia, according to the report of Malaysian Communications and Multimedia Commission (MCMC) in 2014 there were around 20 million mobile phone users in Malaysia and among them 60% were young generation age less than 40 years (MCMC, 2014). The usage of mobile phone increases in Malaysia, but there were only around 80% of them aware of the M-payment system, and on the other hand only 34% from this population has used the M-payment before that (Wong, 2017). Moreover, it has gained less trust among the users of M-payment system, because less than 50% of the users alleged that the M-payment system is trustable (The Sun Daily, 2017).

Furthermore, the M-payment system offered both parties more options in the current market and benefited them (Phonthanukitithaworn et al., 2016). In addition, the advent of the cellular phone which is ingenious creation of humans in 21st century, has developed better opportunities for the future of M-payment, therefore mobile phones and wireless internet is very important and has very strong bond with the M-payment service. As a result, it shows that rate of acceptance of M-payment system is significantly low due to deficiency of trustee and the conveniences of the system. Hence, this study is primarily designed to inspect the factor influencing the M-payment acceptance among the young professional in Malaysia.

M-Payment

A sales payment or transaction by means of broadband or internet signal in combination with mobile phone devices for the purpose of initiating, accepting or closing payment is known as M-payment (Apanasevic et al., 2016; Goeke & Pousttchi, 2010). Furthermore, in daily life transactions people are getting benefits from this advance technology with the help of smartphones and internet signals and this also increased the global business (Lembke, 2002). Meanwhile, M-payment is a type of payment where the user is credited or stored their cash in the electronic wallet which is in digital mode and acts in the same way as a wallet where users can pay their purchases without having to search for physical wallet and present cash to the dealers, but only using the electronic wallet, the payment can be made in a second. So, by using the M-payment, a customer can place the order in advance by paying the transaction in advance and later may receive their goods or services.

Conceptual Framework

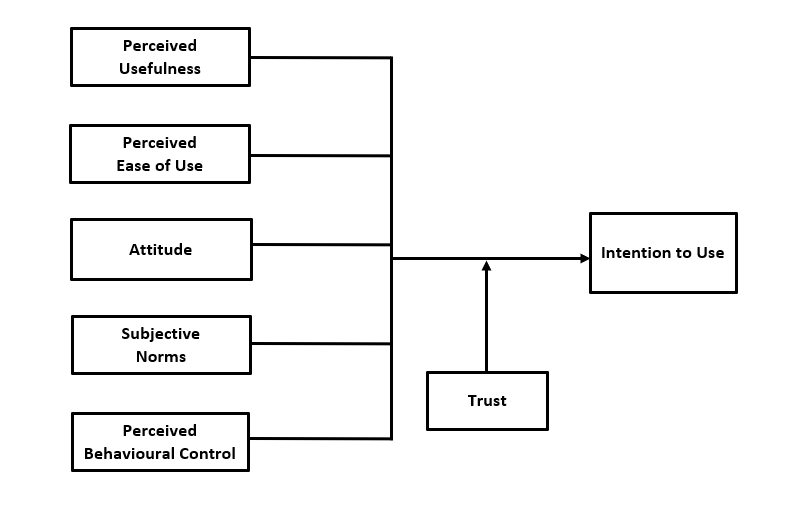

Figure

To examine the determinants (Perceived ease of use, Perceived usefulness, Attitude, Subjective norms and Perceived behavioural control) that influence the dependent variable (Intention to use) among the young professional.

To examine the moderating effect of the moderator variable (Trust) to the relationship between intention to use and its determinants (Perceived ease of use, Perceived usefulness, Attitude, Subjective norms and Perceived behavioural control).

There are multiple studies conducted to explain the consumer behavioural intention to adopt the M-payment system. Kamel et al. (2009) have indentified the most relevant theories which further elaborate the behavioural intention of consumers which are, Technology Acceptance Model (TAM) & Theory of Planned Behaviour (TPB). Both theories have an edifying way to explain the impact of intention to buy as an aspect of consumer behaviour. It is observed that Theory of Planned Behaviour is well suited for this research as compared to Technology Acceptance Model. TPB is ideal due to its extensive approach of consumer behaviour.

Technology Acceptance Model (TAM)

Technology Acceptance Model (TAM) was developed by Davis in 1989. It was a result of an observation for the rate of technology acceptance among individuals who have not been subjected before to the new technology. The observation was conducted on the basis of Theory of Reasoned Action (Ajzen & Fishbein, 1975). TAM enhances the availability of technology to consumers who wish to use it but have little to no access (Holden & Karsh, 2010). The model has been applied extensively by researchers and has produced substantial results (Phonthanukitithaworn et al., 2016).

TAM not only analyzes the consumer behaviour but also enables them to have an effective approach towards the potential technology. It examines the potential of consumers and their readiness to adopt the new technology of M-payment. Moreover, in TAM there are major two determinants which are helpful in determining the acceptance of innovation and its usage; Perceived Ease of Use (PEOU) & Perceived Usefulness (PU) are prime components which are further explained as well to be used for better understanding of consumer behaviour and TAM (Dastan & Gürler, 2016).

Perceived Ease of Use (PEOU)

Perceived Ease of Use is an assessment determinant of TAM model which is designed to get knowledge of the system and act as an inhibitor (Toh et al., 2009). It gives consumers the knowledge about the new system and enables them to decide whether they would like to adopt the new technology or not (Ozturk et al., 2017). Multiple researchers have found PEOU as a significant determinant in relationship to intention of use of new technology (Bailey et al., 2017). Therefore, to observe the impact of PEOU in terms of M-payment, first hypothesis is developed:

Perceived Usefulness (PU)

Perceived Usefulness is another assessment determinant of TAM which enables the consumers to make judgment about the purchase of new system while evaluating its usefulness in the long run (Singh et al., 2017). In terms of mobile application PU has been observed as having a significant impact on the intention to buy (Muñoz-Leiva et al., 2017). In light of research hypothesis 2 has been developed to check the significance of PU in term of M-payment model.

Theory of Planned Behaviour (TPB)

Elaborating the behavioural characteristic; the Theory of Planned Behaviour thoroughly elaborates the behavioural aspect of consumer buying power. The theory predicts that the behaviour highly influences the intention to use and buy new technology (Upadhyay & Jahanyan, 2016). The theory has been used by many researchers to evaluate the behaviour and its impact on the purchase of any new technology, behaviour has a profound influence and has proved to be a significantly positive role (Cameron, 2010)

There are three basic determinants in TPB; Attitude, Subjective norms and Perceived behaviour control (PBC). These three factors will aid in this research to find out the consumer’s perception in accordance to the espousal of M-payment method and to also forecast the intention to buy (Ting et al., 2016).

Attitude (ATT)

As evident from TPB Attitude is one of the most important determinant of consumer’s product perception (Ajzen, 1991). It is one factor which has both positive and negative impact that results in the perception of the consumer. Attitude influences control and further develops the perception of the consumer (Hussein, 2016; Triandis, 1971). If a consumer has a positive attitude it will result in a positive perception of the product which will in turn increase the intention to buy (Carvalho, 2007).

The same was concluded by Unal (2011), that the behaviour and intention to buy is eventually the result of positive attitude. To observe the impact of consumer’s attitude on the behaviour of intention to use the new technology, the third hypothesis has been developed.

Subjective Norms (SN)

According to Cobanoglu et al. (2015), people from your surrounding will try to influence when they are around and the individuals who accept the M-payment system have a tendency to influence by the society and situations close to them as the requirement from theirs peers to pay with the system they are applying for the conveniences (Narteh et al., 2017). Thus, SN is one of the important factor which determine the intention to use (Lai, 2017), it is also found that young generation has more tendency to get influenced from their surroundings and tend to accept and adopt the mobile payment services (Koenig-Lewis et al., 2015). So, SN is one of the major factors to evaluate the intention in using the M-payment system, whereas it also explains the behaviour intention that regarding new introduce technology system. Thus, it has been hypothesized from the given literature that:

Perceived Behavioural Control (PBC)

Another very important variable in TPB is Perceived behavioural control (PBC) which explains the human beliefs of control (Ting et al., 2016). Individuals who experienced better services previously would try to gain more by engaging them self in such activities (Cobanoglu et al., 2015). Balabanoff (2014) further explains that people who have gained higher self-efficacy would try to learn more about the devices and services and try to apply it. Meanwhile, due to the better services they will get influence easily (Nguyen et al., 2016) and this shows that there is positive and significant relationship between PBC and Intention to use of the services such as mobile payment. So, from the previous studies following hypothesis has been drawn on the relationship between PBC and intention to use.

Trust

Due to better services of the application it became very popular and is being used in daily life payments of different organizations and is also used for the billing transactions. But due to the lack of trust most of the customers hesitate to use mobile payment services (Lin, 2011; Masrek et al., 2014). Therefore, trust is an important element due to which the consumers will be able to accept the mobile payment service. It is also important for the parties to show any kind of certificate to their customers which is issued by relevant authorities so it will help them to gain the trust of general public at large scale (Eze et al., 2008). Another study shows that, for youth of Canada trust is very influential factor which motivates them to use the mobile payment (Shaw, 2015). Zhou (2014) explains that there is positive relationship of PU with trust towards intention to use. Furthermore, trust has also a positive relationship between Attitude and PU with the intention to use (Mangin et al., 2014). So, the proposed hypothesis is:

Problem Statement

The M-payment penetration rate is low as compared to traditional transaction approach. Based on the data, there was only around 20% of Malaysian have processed their transactions by using M-payment (Tan, 2018) that is widely accepted as payment method or payment tools in global market such as China market. As such, there were some of the concern and argument say that the acceptance of M-payment system is low because of the merchant for the adoption is less and there is a security concern.

Research Questions

The aim of this study is to analyze the behavioural intention of young professionals against the usage of M-payment. The research is based on following research questions:

To identify the factors which influence the consumers for the usage of M-payment?

Does the moderator positively strengthen the relationship between the independent variables and the Intention to use M-payment?

Purpose of the Study

According to the research background and problem statement, the objective of this study is to investigate the factors influence the intention to use mobile payment among young professional in Malaysia. Thus, this study aims is to examine the relationship between Perceived ease of use, Perceived usefulness, Attitude, Subjective norms, Perceived behavioural control and Intention to use. Besides that, the purpose this study is to examine the moderating effect of Trust in the relationship between factors (Perceived ease of use, Perceived usefulness, Attitude, Subjective norms and Perceived behavioural control) and Intention to use M-payment.

Research Methods

A survey questionnaire was designed to collect the data which was based on a five-point Likert scale, ranging from 1 (strongly disagree) to 5 (strongly agree). Online survey was conducted to examine the model than the questionnaire is distributed among the respondents (young professionals) in Malaysia to collect the data. The survey form was developed with filtering question to exclude and screen out the participants from the individuals that are characteristics of young professional. The age limit of targeted audience are those in the ages of 20-40 (20 is minimum ages to achieve the Diploma certificate). Secondly, they were youngsters who owned the graduation degree from diploma and above or equivalence professional qualification certification, and thirdly these were the group of people who currently serves in the professional field. A total of 220 participants have completed the survey, and 211 were useable responses.

Findings

The questionnaire is randomly distributed among the public to collect the data. Total 220 copies were collected back and among them 9 were rejected to proceed with the analysis. 211 were valid responses which fulfill the young professional criteria and thus they were used for analysis. The SPSS was used to perform the analysis.

Factor Analysis

Factor analysis is uses to verify the reality and significance of the existing variables. At this stage there were 42 items to be measured. It is important that during factor analysis, the value of the factor loading must be greater than 0.5 and if it is less than 0.5 will be removed from next analysis. From the result, it is found that only six factors have eigenvalues value greater than 1.0. This factors 78.8% explained of the total variance. Refer to Table

Regression Analysis

To find out the relationship between the determinants the regression analysis was carried out after the factor analysis, multiple regression was run for this analysis. The result are shown in the Table

Conclusion

The empirical evidences which were discussed in the previous section shows that there were only four hypotheses out of ten were supported, as shown in Table

In summary, there were two variables in current study that direct influence the young professional Intention to use M-payment. The Attitude and Perceived behavioural control were accepted, while Perceived ease of use, Perceived usefulness and Subjective norms were not significant in this study. However, Trust was a significant moderator variable that strengthen the relationship between Attitude and Subjective norms and Intention to use M-payment. As the result, TPB was observed a has more influences factor toward the acceptance of the M-payment among the young professional.

References

- Ajzen, I. (1991). Organizational Behaviour and Human Decision Processes. Elsevier, 50(2), 179-211.

- Ajzen, I., & Fishbein, M. A. (1975). Belief, Attitude, Intention and Behaviour: An Introduction to Theory and research. Addison-Wesley.

- Apanasevic, T., Markendahl, J and Arvidsson, N. (2016). Stakeholders’ Expectations of Mobile Payment in Retail: Lessons from Sweden. International Journal of Bank Marketing, 34(1), 37-61.

- Bailey, A.A., Pentina, I., Mishra, A.S. and Mimoun, M.S. (2017). Mobile Payments Adoption by US Consumers: An Extended TAM. International Journal of Retail & Distribution Management, 45(6), 626-640.

- Balabanoff, G. A. (2014). Mobile Banking Applications: Consumer Behaviour, Acceptance and Adoption Strategies in Johannesburg. South Africa (RSA), 5(27).

- Cameron, R. R. (2010). Ajzen's Theory of Planned Behaviour Apply to the Use of Social Networking by College Students. Honors Committee of Texas State University-San Marcos.

- Carvalho, C.A. (2007). Impact of Consumer Attitude in Predicting Purchasing Behaviour. https://www.semanticscholar.org/paper/Impact-of-Consumer-Attitude-in-Predicting-Behaviour-Carvalho/79e59ca03bad1570cb589b77266ea43762e00383?p2df

- Cobanoglu, C., Yang, W., Shatskikh, A., & Agarwal, A. (2015). Are Consumers ready for Mobile Payment? An Examination of Consumer Acceptance of Mobile Payment Technology in Restaurant Industry. FIU Hospitality Review, 31(4).

- Dastan, I., & Gürler, C. (2016). Factor Affecting the Adoption of Mobile Payment Systems: An Empirical Analysis. EMAJ: Emerging Markets Journal, 6(1), 17-24.

- Davis, F.D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 13(3), 319-340.

- Eze, U. C., Gan, G. G. G., Ademu, J., & Tella, S.A. (2008). Modelling User Trust and Mobile Payment Adoption: A conceptual Framework. Communications of the IBIMA, 3.

- Goeke, L., & Pousttchi, K (2010). A Scenario-based Analysis of Mobile Payment Acceptance. The Ninth International Conference on Mobile Business/Ninth Global Mobility Roundtable Proceeding. Athens, 13-15 June, pp.371-378.

- Holden, R. J., & Karsh, B.T. (2010). The Technology Acceptance Model: It’s Past and it’s Future in Health Care. Journal of Biomedical Informatics, 43, 159-172.

- Hussein, Z. (2016). Leading to Intention: The Role of Attitude in Relation to Technology Acceptance Model in E-Learning. Procedia Computer Science, 105, 159-164.

- Kamel, R., Ramayah, T., & Oh, S. M. (2009). User Acceptance of Internet Banking in Malaysia: Test of Three Competing Models. International Journal of E-Adoption, 1(1), 1-19.

- Koenig-Lewis, N., Marquet, M., Palmer, A., & Zhao, A.L. (2015). Enjoyment and Social Influence: Predicting Mobile Payment Adoption. The Service Industries Journal, 35(10), 537-554.

- Lai, P. C. (2017). The Literature Review of Technology Adoption Models and Theories for the Novelty Technology. JISTEM – Journal of Information Systems and Technology Management, 14(1), 21-38.

- Lembke, J. (2002). Mobile Commerce and the Creation of a Marketplace. info, 4(3), 50-56.

- Lin, H. F. (2011). An Empirical Investigation of Mobile Banking Adoption: The Effect of Innovation Attributes and Knowledge-based Trust. International Journal of Information Management, 31, 252-260.

- Mangin, J-P. L., & Bourgault, N., & Porral, C. C. (2014). The Moderating Role of Risk, Security and Trust Applied to the TAM Model in The Offer of Banking Finance Service in Canada. Journal of Internet Banking and Commerce, 19(2).

- Masrek, M. N., Mohamed, I. S., MohdDaud, N., & Omar, N. (2014). Technology Trust and Mobile Banking Satisfaction: A Case of Malaysian Consumers. Procedia – Social and Behavioural Science, 129, 53-58.

- MCMC (2014). Statistical Brief Number Seventeen. Hand Phone Users Survey 2014.

- Muñoz-Leiva, F., Climent-Climent, S., & Liebana-Cabanillas, F. (2017). Determinants of Intention to use the Mobile Banking Apps: An Extension of the Classic TAM Model. Spanish Journal of Marketing – ESIC (2017), 21, 25-38.

- Narteh, B., Mahmoud, M. A., & Amoh, S. (2017). Customer Behavioural Intentions towards Mobile Money Services Adoption in Ghana. The Service Industries Journal, 37(7-8), 426-447.

- Nguyen, T. N., Cao, T. K., Dang, P. L. & Nguyen, H. A. (2016). Predicting Consumer Intention to Use Mobile Payment Services: Empirical Evidence from Vietnam. Canadian Center of Science and Education. International Journal of Marketing Studies, 8(1).

- Oztas, Y. B. B. (2015). The Increasing Importance of Mobile Marketing in the Light of the Improvement of Mobile Phones, Confronted Problems Encountered in Practice, Solution Offers and Expectations. World Conference on Technology, Innovation and Entrepreneurship. Procedia – Social and Behavioural Sciences, 195, 1066-1073.

- Ozturk, A. B., Bilgihan, A., Salehi-Esfahani, S., & Hua, N. (2017). Understanding the Mobile Payment Technology Acceptance Based on Valence Theory: A Case of Restaurant Transactions. International Journal of Contemporary Hospitality Management, 29(8), 2027-2049.

- Phonthanukitithaworn, C., Sellitto, C., & Fong, W. L. (2016). An Investigation of Mobile Payment (m-payment) Service in Thailand. Asia-Pacific Journal of Business Administration, 8(1), 37-54.

- Price, K., & Pilorge, P. (2009). Mobile Money An Overview for Global Telecommunications Operators. Ernst & Young.

- Shaw, N. (2015). Youngster Persons are more likely to adopt the Mobile Wallet than Older Persons, or are they? The Moderating Role of Age. In Twenty-first Americans Conference on Information Systems, Puerto Ricao.

- Singh, N., Srivastava, S., & Sinha, N. (2017). Consumer Preference and Satisfaction of M-wallets: A Study on North Indian Consumers. International Journal of Bank Marketing, 35(6), 944-965.

- Tan, Y. (2018). E-wallet Race Heats Up. The Star Online. https://www.thestar.com.my/business/business-news/2018/03/17/ewallet-race-heats-up/

- The Sun Daily. (2017). E-wallet Boost for E-commerce. https://www.thesundaily.my/archive/e-wallet-boost-e-commerce-ITARCH497271

- Ting, H., Yacob, Y., Liew, L. and Lau, W-M. (2016). Intention to Use Mobile Payment System: A Case of Developing Market by Ethnicity. Procedia – Social and Behavioral Science, 224, 368-375.

- Toh, T-W., Marthandan, G., Chong, A. Y-L., Ooi, K-B., & Arumugum, S. (2009). What Drives Malaysian M-commerce Adoption? An Empirical Analysis. Industrial Management & Data Systems, 109(3), 370-388.

- Triandis, H. C. (1971). Attitude and Attitude Change (Foundations of Social Psychology). John Wileys & Sons Inc.

- Unal, S.A.K.E. (2011). Attitudes toward Mobile Advertising – A Research to determine the Differences between the Attitudes of Youth and Adults. 7th International Strategic Management Conference. Procedia Social and Behavioural Science, 24, 361-377.

- Upadhyay, P., & Jahanyan, S. (2016). Analyzing User Perspective on the Factors Affecting use Intention of Mobile Based Transfer Payment. Internet Research, 26(1), 38-56.

- Wong, E.L. (2017). 70% of Malaysians ready to adopt mobile payments, says Visa. The Edge Markets. https://www.theedgemarkets.com/article/70-malaysians-ready-adopt-mobile-payments-says-visa

- Zhou, T. (2014). Understanding the Determinants of Mobile Payment Continuance Usage. Industrial Management & Data Systems, 114(6), 936-948.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Lim, K. T., & Ariffin, S. K. (2020). Factors Influencing The M-Payment Acceptance Among Young Professional In Malaysia. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 592-603). European Publisher. https://doi.org/10.15405/epsbs.2020.10.52