Abstract

At the end of 2013 Xi Jimping presented an ambitious plan for ancient trade routes’ renewal which would link China with over 60 countries, via South-East Asia, Central Asia and countries of Middle East – the concept called Belt and Road Initiative (BRI) or the New Silk Road (NSR). The concept anticipates creation of the network of economic corridors network, which would link China with European Union member states, as well as with South-East Asia countries around 6 key trade routes. The aim of this paper is to present how railway freight infrastructure investments support supply chains’ links on the basis of Polish cross-border gateways. The construction and modernization of transport infrastructure within the economic zones, apart from stimulation of economic development of China provinces, as well as neighbouring countries, provides indirectly effective logistics services in order to guarantee appropriate coordination of supply chains. China since the announcement of Belt and Road Initiative has been systematically strengthening its global market position and continues its expansion. Chinese experts consider that intercontinental railway shipments should aim to have the second, the most substantial, besides the marine transport, share in goods’ transport between China and Europe – at the level of ca 20%. It has been assessed that substantial volume of goods could be transported by rail only in case of serious transport disruptions at the main marine route linking China and Europe.

Keywords: Belt and Road InitiativeNew Silk RoadPKPPolandsupply chain

Poland on the World transport map

Poland lies at the crossroads of transit routes from east to west and from south to north. Its

geographical location in the centre of Europe and its friendly, lowland terrain and temperate climate mean

that many transit routes of great intra- and intercontinental importance pass through it.

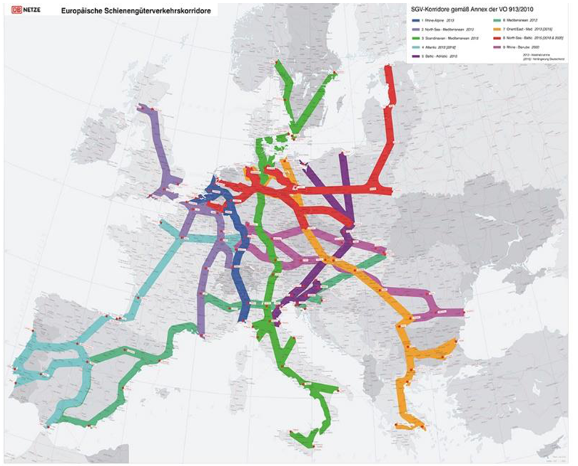

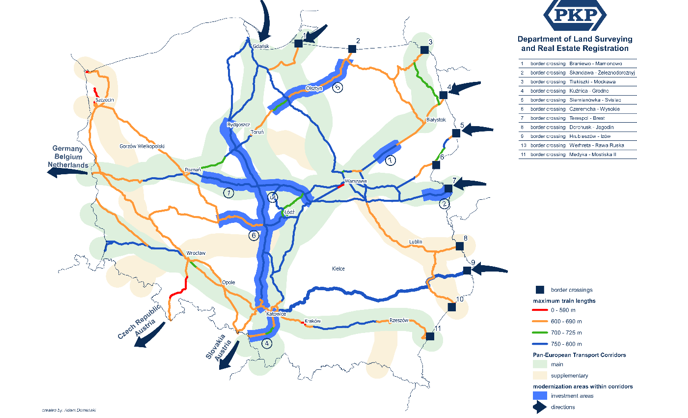

Four Pan-European Transport Corridors (TINA) numbered I, II, III and VI run through Poland, as well as

key EU freight corridors (Figure

8) within the meaning of the

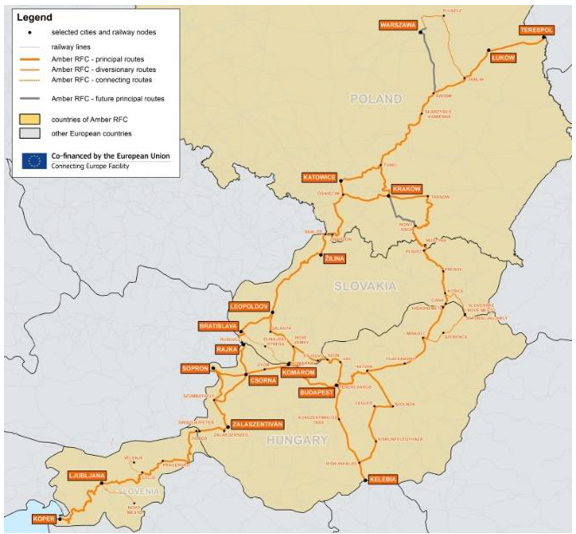

On 14 January 2019 Amber Rail Freight Corridor has been initiated no. 11 (see Figure

created on the basis of EU Regulation no. 913/2010 as of 22 September 2010 concerning European rail

network, directed towards competitive freights. In March 2016 Ministries of Transport of Poland,

Hungary, Slovakia and Slovenia directed a common letter of intent to European Commission to initiate

this corridor. In January 2017 European Commission issued a positive decision for its creation. The

ARFC links south-east Poland, Slovakia, Hungary and Slovenia with the Belarus border in Terespol

town, it entails also cities: Budapest, Bratislava and Ljubljana as well as industrial sites around Cracow

and Katowice cities (Upper Silesia Industrial Hub), Warsaw, Kosice and Miszkolec. The south far end of

the corridor reaches the port in Koper located in Slovenia. The corridor complements European network

of freight corridors due to its links with corridors no. 5, 6, 7, 8 and 9. In Poland the corridor no. 11 allows

for transportation via freight corridors of south and east part of the country, what further supports

widening of the network of no. 5 and no. 8 corridors (Antonowicz, Warsewicz, Sikora, & Jarzebowski,

2019).

The RFC 8 corridor, which is a natural extension of the New Silk Road rail route within the

territory of the European Union, is of particular importance for trade between China and the European

Union. China remains a world leader in foreign trade, both in terms of exports and imports (Koopman,

2018), Among the EU's trading partners, China was the largest partner for EU imports of goods, and the

second largest partner for EU exports of goods in 2017, while the European Union remains the main

trading partner of the China, accounting for 20 % of its international economic exchange (Eurostat &

Comext, 2019). Given the particular importance of the Polish infrastructure for rail freight between China

and the EU, the Polish authorities, with the support of the EU, carried out extensive measures to

modernize the existing linear and nodal infrastructure between 2007 and 2015. The financing of

investment projects approved in the "

by the EU budget from the Operational Programme Infrastructure and Environment in the amount of EUR

12.172 billion dedicated to the modernization of, among others, railway lines. Between 2007 and 2015,

the quality of rail transport infrastructure in Poland increased substantially. The proportion of lines in

good technical condition rose from 25 % to 55 %, while the share of lines in an unsatisfactory technical

condition fell from 28 % to 16 %. The large-scale of modernisation and revitalisation projects,

implemented with support from EU funds, have increased the attractiveness of rail freight in Poland

(Wolek, 2018). Poland has not only established better transport connections with neighbouring countries

of the European Union, but has also prepared a plan of coordinated actions in form of National Railway

Programme until 2023 (Polish Ministry of Development, 2015), which was adopted via a resolution of the

Council of Ministers from September 15, 2015 and updated in November 2016, to become a gateway to

the European Union.

From China to European Union

The entrances of the branches of the Northern and Middle Corridors are crucial for the European

Union. Both of these corridors currently form the Economic Silk Road Belt and this is where the largest

stream of goods flows; compared to this, the volumes transported along the Southern Corridor or the

alternative Trans-Caspian Corridor are of little importance.

The biggest "gateway to the European Union" is currently the Polish-Belarusian railway border

crossing Terespol (Małaszewicze) – Brest (Table

According to PKP CARGO, biggest cargo carrier in Poland, for 2018 container trains from China

to the European Union currently cross the Polish eastern border through 4 railway crossings:

1520/1435 mm:

Taking into account the number of border crossings through which containers transported to

Europe leave the Chinese territory (two Chinese-Kazakh: Alashankou - Dostyk, Khorgos - Altynkol,

Chinese - Mongolian: Erlian - Zamyn-Uud, and Chinese-Russian: Manzhouli - Zabaykalsk), focusing on

those 4 streams at one Belarusian-Polish border crossing point Brest-Terespol may result in a slowdown

in transport growth. The solution is to increase transport through the remaining available PKP border

crossing points, adapted to container transport (listed in Table

crossing point between Czeremcha and Vysokolitovsk, 45 km north of Terespol, is to be launched in the

autumn of this year, which should relieve some of the burden on the largest border crossing point on the

EU's eastern border. As for 2019, alternative transit routes include routes through Slovakia

(transshipments between 1520 mm and 1435 mm tracks at the terminal in Dobra near Košice), Lithuania

(transshipments between 1520 mm and 1435 mm tracks at terminals in Kaunas or in Shostakhov or

transshipments between 1520 mm track and sea way in Klaipėda), Kaliningrad Oblast (with

transshipments at terminals in Koenigsberg between 1520 mm and 1435 mm tracks or between 1520 mm

track and seaway (mainly to/from German Rostock), or via St. Petersburg or Ust-Luga port directly to EU

Baltic Sea ports. Despite the possibility of using the above mentioned routes, as much as 90 % of the rail

freight sent in 2018 by land between China and the European Union passed through the Brest (BC) -

Terespol (PKP) border crossing and served in the border "dry transshipment port" Małaszewicze.

UIC experts predict that in 2027 Brest/Malaszewicze will remain the main entry point to the

European Union with an estimated share of more than 50 %, but border-crossing terminals are in need of

expansion in order to avoid becoming a bottleneck of Eurasian rail freight (Berger, 2017). Therefore,

Poland has started intensive efforts to improve the quality of railway infrastructure, both of linear and

nodal type, and to increase the attractiveness of rail freight for freight operators in EU-Asia relations and

to maintain the highest competitiveness of connections passing through it in transit, which is discussed in

this article.

Impact of New Silk Road on trade value between China and the European Union

The European Union is China's largest trading partner, while China is the EU's second largest

trading partner. The EU and China are also each other's largest source of imports. In 2016 China

accounted for 20.2 % of EU imports (USA 14.5 %), while in 2016 the EU accounted for 13.1 % of

Chinese imports (García-Herrero, Kwok, Xiangdong, Summers, & Yansheng, 2017).

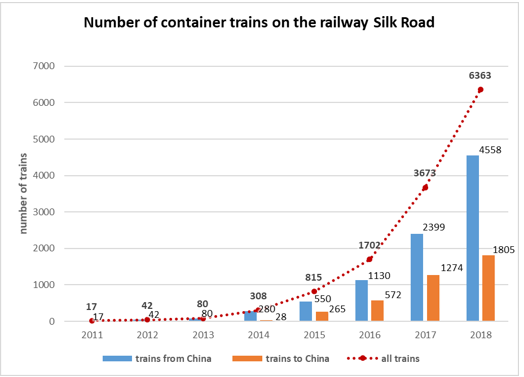

In 2018, the railways transported approximately 390000 of the total of 10 million TEU in freight

between China and the European Union; these shipments corresponded to 4% of the value of trade in

goods with China. In addition, 118 000 TEU were shipped between China and other countries, i.e.

(Vinokurov Lobyrev, Tikhomirov, & Tsukarev, 2018) Russia, Belarus, Turkey, Vietnam, Afghanistan

and Iran (Figure

04).

![Figure 03. Volume of container freight by

rail on the Silk Road 2011-2018 [in TEU]](https://www.europeanproceedings.com/files/data/article/118/6617/ISMC2019F014.fig.003.jpg)

Source: Mordor Intelligence market report 04.04.2019

In Poland, the majority of intermodal transport by rail is also carried out by direct sea freight

transport (from and to the Polish ports of Gdańsk, Gdynia and Szczecin-Świnoujście), but there is

a steady increase in the number of containers and the weight of cargo transported by land along the New

Silk Road route between China and the European Union.

Statistics and forecasts of railway traffic on the New Silk Road indicate a steady growth of the

container stream in the coming years. Official Chinese Government portal declares a 72 % y/y increase in

the number of containers transported on the New Silk Road in 2018 and up to 6363 trains in total to/from

China (The State Council Information Office of the PRC, 2018).

Bearing in mind the announcements of the Chinese side and looking at the percentage annual

growth, PKP CARGO confirms that the cargo flow from China to the European Union is growing by

about 20 % - 25 % per year and this trend should continue. However, the Chinese government is

increasingly convinced that the development of connections with Europe must be based on market

mechanisms in the long term and that subsidies are to be phased out gradually (Jakóbowski, Popławski, &

Kaczmarski, 2018).

The European perspective

Since 2014, when China announced BRI, the European Union has not undertaken to formulate its

own strategy for cooperation with China within the framework of the Belt and Road Initiative. China also

did not press for talks with representatives of EU bodies, and its efforts were directed towards bilateral

cooperation talks, mainly with the countries of Central and Eastern Europe.

In 2015, a Memorandum of Understanding on the EU-China Connectivity Platform to enhance

synergies between China's "One Belt One Road" initiative and the EU's connectivity initiatives such as

the Trans-European Transport Network policy (European Commission, 2018). The European Parliament

has also had prepared a Study on the New Silk Road (Steer Davies Gleave, 2018), which showed the

benefits and challenges for the EU in implementing this project, but the official cooperation strategy for

the BRI project has never been established.

As far as EU directives are concerned, extremely important regulations have been issued for the

railway sector in Poland, which require specific adjustment measures. The most important of these

are:

Directive 2012/34, i.e. Directive of the European Parliament and of the Council establishing a

single railway area;

Commission Regulation (EU) No. 1300/2014 of 18 November 2014 on the technical

specifications for interoperability relating to accessibility of the Union's rail system for persons with

disabilities and persons with reduced mobility;

White Paper. Roadmap to a Single European Transport Area - Towards a competitive and

resource efficient transport system of 23 March 2011.

They influenced the current shape of Poland's transport policy and the main legal acts determining

the current infrastructure investments. Poland based its policy on the Transport Development Strategy by

2020 (with a perspective by 2030), as well as the Master plan for railway freight in Poland by 2030 and

the National Railway Programme by 2023, where it addressed the most important challenges for the

development of Polish railway infrastructure presented by EU bodies (European Commission, 2011).

The Master Plan for railway freight defined the main strategic directions for the development of

railway freight from the point of view of the state. In fulfilling its international commitments, the

government has outlined the main lines of action in the sector, thus creating a stable and predictable

national railway policy.

Another document is the National Railway Programme. This is a multiannual programme covering

investments in railway lines on the basis of the objectives set out in Strategy for Responsible

Development (Polish Ministry of Development, 2015). The last revision took place in November 2016 in

order to improve the implementation and disbursement of the funds provided for therein. The main

objective of the updated Programme remains to strengthen the role of railway transport in the integrated

transport system of the country by creating a coherent and modern network of railway lines.

Poland, as one of the BRI partners, in 2015 signed a Memorandum of Understanding (MoU) with

China on cooperation in the New Silk Road project and in 2017 declared support for the public sector "to

increase the use of railway freight potential in the area of international transport (…) in the field of

intermodal transport in intercontinental routes (Silk Road)" (Polish Ministry of Development, 2017) by

including actions for the initiative in strategic documents.

From 20.04.2017 there is also a multilateral

operational and technical improvements in order to increase the efficiency of railway freight

transportations used for the exchange of goods between China and the European Union. Under the

provisions of this agreement, joint working groups have been set up to address the most relevant generic

groups of problems identified and expert working groups to assist them in developing recommendations

for improvements in the operation of container rail links between China and the EU.

In June 2017, in order to support the development of container transport on routes between

Kazakhstan and Poland, PKP LHS sp. z o.o. (a company from the PKP Group) has joined the

International Association of the Trans-Caspian International Transit Route; as an associate member.

The active attitude of Polish railway companies also concerned the area of infrastructural

investments in response to the challenges posed to Poland by the growing flow of goods along the New

Silk Road. Based on strategic EU documents and guidelines of the Polish government, the companies of

the PKP Group undertook a number of actions aimed at improving the quality of railway infrastructure

operation.

Investments a key to Polish role in New Silk Road development

For the purpose of this paper, a list of investment projects influencing the current freight corridors and

the development of railway freight on the New Silk Road has been created.

Infrastructure investments were divided into 3 main areas:

1. Modernization of railway lines;

2. Modernization of railway infrastructure near railway border crossings at the junction of

1520 mm and 1435 mm gauge tracks;

3. Modernization and construction of new intermodal terminals and logistics centres.

This shows how the planned investments fit into the existing linear and nodal infrastructure from the

perspective of increasing the throughput capacity of the railway network and intermodal transshipment

terminals for the benefit of intermodal freight.

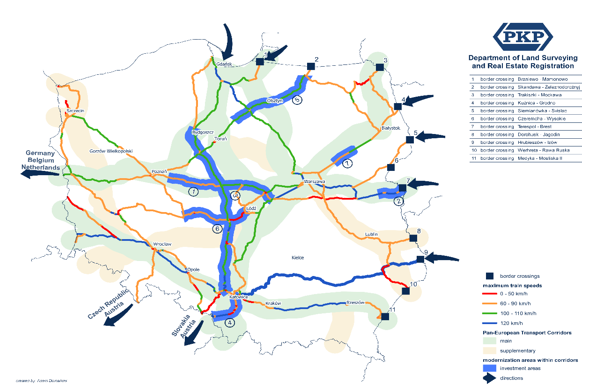

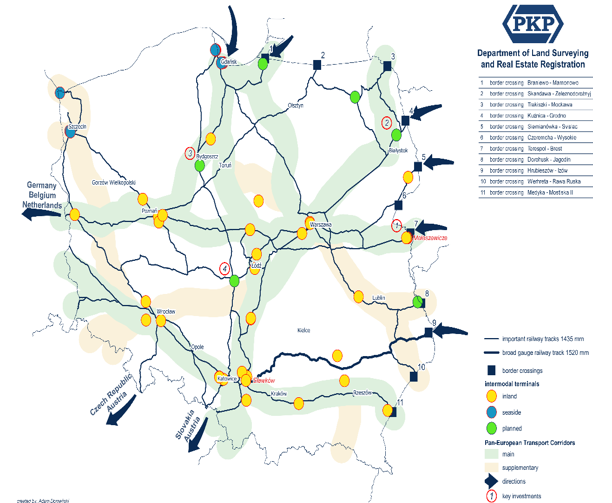

Maps (Figure

intermodal transport. It shows the key railway sections in the context of the pan-European corridors and

the TEN-T network, defines the maximum authorized speeds for freight trains and the maximum

authorized length of trains, identifying also the most important areas for upgrading.

speed Source: PKP S.A. own study based on data from PKP PLK S.A., PKP CARGO S.A. and PKP LHS sp. z o.o.

authorized length Source: PKP S.A. own study based on data from PKP PLK S.A., PKP CARGO S.A. and PKP

LHS sp. z o.o.

Within the paper 7 planned and pending investments in linear infrastructure affecting the rail

freight to/from China were indicated, with the effect of maximum speed at that section 120 km/h and

minimum length of station tracks - 740 m. After the completion of the above projects, it is expected that

the number of alternative routes of railway lines will be reduced, the quality of transport will be

improved, inter alia, by increasing the average speed of trains, increasing the throughput capacity of

railway lines, as well as increasing the safety of railway transport operations. Of the planned

modernization of the railway infrastructure near the railway border crossing points at the junction of

1520 mm and 1435 mm gauges, the key issue was the reconstruction of the Terespol-Brest border

crossing where the work performed is aimed at adjusting the parameters of the required railway lines,

both wide gauge and normal gauge, for border freight and passenger traffic. It is planned to build a

completely new group of tracks dedicated exclusively to freight traffic at the Terespol border station, which is to be connected to the Małaszewicze Loading Area by an additional track. The objective of the

comprehensive project is to improve the throughput capacity of the RFC 8 corridor in the area of the

European Union's eastern border with Belarus. This objective is to be achieved by increasing the

throughput capacity of the track systems for incoming and outgoing trains and rail safety by increasing

the average speed of trains and increasing the permitted axle load to 245 kN/axis, implementing a modern

railway traffic control system. In addition to the modernization of the Terespol-Brest crossing, there are

also projects aimed at modernising the remaining border stations. By 2023 the railway infrastructure in

the vicinity of 8 railway border crossings in the east of Poland will be modernized. PKP PLK will allocate

PLN 245 million for modernization of border stations. The company is also preparing further projects in

the area of border crossings with the prospect of implementation in the period of 3-5 years, of value

approximately PLN 300 million.

However, the most important point of the linear infrastructure for the Silk Road railway is the

railway junction in the Małaszewicze region. The infrastructure in this region is managed by

CARGOTOR.

The current transshipment capacity of goods for the region per day is 24 thousand tons. The broad-

gauge receiving point is located at the Kobylany station managed by CARGOTOR sp. z o.o., located in

the immediate vicinity of the Małaszewicze station, 5.1 km from the Terespol station in a westerly

direction. Currently, CARGOTOR is preparing plans for comprehensive infrastructure modernization,

including the construction of an additional group of delivery and reception tracks, the so-called

Kobylany-bis.

Modernization of the Terespol-Małaszewicze transshipment area is to enable the reception of

a larger number of container trains and logistics services on the Polish side of wide gauge freight trains

with a length of 1050 m, increasing the average speed of train traffic to 40 km/h and increasing the

permissible axle load of wagons on the track to 25 tons. Completion of the investment will allow to avoid

costs resulting from the necessity of splitting trains, unloading wagons or underloading wagons on the

non-Polish sections of tracks, and to improve the throughput capacity of the Małaszewicze Transshipment

Region.

PKP LHS is also making investments to increase the throughput capacity of the western most

broad gauge railway line 65. Company owned by PKP S.A. has an investment plan for 2019-2025

assumes, among others, the construction of modern systems (centres) for remote control of railway traffic

(the so-called LCS) and modernization of lines. By 2025, the company plans to increase the line

throughput capacity from 12 pairs of trains in 2019 to 16 pairs of trains per day (data from PKP LHS,

2019). Currently, trains with a maximum speed of up to 120 km/h and a length of 1050 m are allowed

along the entire line. According to PKP CARGO declarations, by 2026 the throughput capacity of this

largest dry port in Europe is to increase fourfold, even 55 pairs of trains per day (Antonowicz,

Warsewicz, Sikora, & Jarzebowski, 2019).

The key to the long-term significant increase in the attractiveness of container railway freight

through Poland is the creation of a network of high-quality, generally available terminals allowing for fast

and reliable inter-branch handling. These facilities should be available throughout Poland and not only in

a few regions, as is currently the case (currently there are 36 terminals in Poland adapted to the needs of

container handling). As regards modernization and construction of new intermodal terminals and logistics

centres, 4 investments are currently being implemented and planned. These are presented below (Figure

07) shows the current state of nodal infrastructure of key importance for intermodal transport along the New Silk Road.

Source: PKP S.A. own study based on data from PKP PLK S.A., PKP CARGO S.A. and PKP LHS sp. z o.o.

Currently, the Logistic Centre Małaszewicze intermodal terminal is being modernized and

extended by extending the loading front and storage yard "B" and installing a second wheeled crane to be

purchased. It is assumed that the annual transshipment capacity of the terminal will be increased to

172 000 (by 23%) TEU intermodal units. The current capacity is 148 000 TEU per year.

In the area of the border crossing Kuźnica Białostocka (PKP) - Bruzgi (BC) PKP CARGO plans to

build a container transshipment terminal in Geniusze near Białystok. The construction of dual gauge

1520 mm/1435 mm along the manoeuvring and storage yard with a reloading front length of 650 m was

assumed. The transshipment capacity of the planned terminal is estimated at around 70 000 TEU per year.

The planned date of completion of the investment task and obtaining the occupancy permit is July 2020. Additionally, the construction of further intermodal terminals in Emilianowo and Zduńska Wola is

planned.

PKP S.A. conducts works aimed at developing its real estate for the development of railway nodal

infrastructure facilities, including logistics centres and transshipment terminals. The company has

selected a portfolio of properties all over Poland, which may be used for the development of logistics

infrastructure, and in the near future it plans to develop these areas.

This action is also part of the initiative to create in Poland a logistics platform serving the markets

of Central and Eastern Europe, which would be able to handle the increasing flows of cargo transported

(not only by rail) between China and Europe.

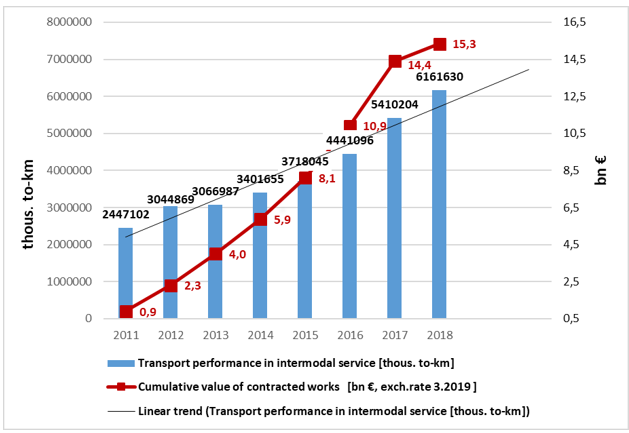

Figure no 08 presents the level of invested funds for the rail infrastructure. It totals over 65 bn

PLN – equivalent to Euro 15 bn.

The Central Transport Port (CTP) is the concept of a high-capacity logistics centre with good road

and rail access. A natural advantage of CTP, apart from its central location in Poland and good access to

motorways, would be the possibility of combining on the first and last miles of cargo transported by

different modes of transport between distant locations, taking into account the main transport corridors.

In addition, PKP Group companies have taken a number of initiatives aimed at removing transport

barriers, which have been highlighted by the Chinese side (Song, 2016).

In order to eliminate the risk of lack of container transport platforms, PKP CARGO announced on

4 September 2018 a tender for the purchase of 936 intermodal platforms; at the end of the year the

company also received EU funding for the purchase of another 220 container transport platforms

dedicated to international transport. In total, in the years 2018-2023, PKP CARGO S.A. planned to

purchase over 1000 wagons-platforms, which will improve the transport process and ensure greater

reliability of operation.

PKP CARGO has also taken important measures in terms of insufficient productivity of

information exchange. Mechanisms are being developed for providing information on wagons and

containers on trains travelling from China to Europe before their physical arrival at the border crossing

points, as well as railway and customs documentation necessary to cross the external customs border of

the European Union. This optimizes the use of resources and speeds up rail and customs formalities,

which has a significant impact on the total time it takes for containers to be transported by rail from China

to EU countries. Currently, efforts are being made to obtain the necessary data after the transshipment of trains at border crossings in China (1435 mm)/1520 mm railways (Kazakhstan, Mongolia, Russia), which would give at least a few days of reserve to prepare for the acceptance of the train to the network in Poland, customs and border clearance of shipments, transshipment of containers, and the formation of trains for their final transport to terminals of destination on the European rail network. A system for the mutual exchange of information between railways on container streams to be carried and in the event of unexpected obstacles to transport has also been developed, thus largely preventing congestion at 1520 mm and 1435 mm border junctions as well as at border and destination transshipment terminals. Moreover, in order to shorten customs procedures at the Polish-Belarusian border, which is the last of the operational barriers to the development of NSR transport indicated by Sinotras (Song, 2016), at the Terespol-Brest crossing point, a pilot “TORY-24” programme was introduced by the Ministry of Finance. Its aim is to streamline the processes of handling foreign trade in rail traffic carried out by services, inspectorates, carriers and other institutions operating in Małaszewicze. This tool enables all participants in the freight traffic management process to participate in the exchange of information. The duration of custom clearance of goods imported from third countries carried out by the services and inspections should not exceed 24 hours from the time when the goods are placed under control to the competent authorities. The implementation of the traffic management and control coordination mechanism (TORY-24, English: TRACKS-24) makes it possible to improve the handling of trade in goods through:

faster electronic exchange of information,

availability of information for users operating in different locations,

coordinating the place and time of the inspection of goods,

possibility of monitoring the process of handling the trade of goods.

How the impact of infrastructure investments on the railway routers of the New Silk Road can be measured

According to PKP PLK's declarations, the impact of investments carried out within National

Railway Programme on intermodal transport along the railway New Silk Road is significant. By 2030, as

a result of the modernization carried out, the maximum speeds for freight trains will be increased to

100 km/h and the permissible length of trains to 740 m for all modernized lines within the TEN-T

network. However, in order to confirm how this will actually affect the distribution of freight flows along

railway lines in Poland, PKP S.A., together with PKP PLK, plans a study using the Railway Traffic

Model, which will present forecasts of crossing times and volumes for a given line after taking into

account new (post-investment) parameters of railway lines. Railway Freight Model - the Traffic Model

allows to examine the reaction of the freight transport market to changes in traffic parameters introduced

in the network (Kaczorek et al., 2018). It is important for companies to be able to examine and

demonstrate the impact of the investment on the functioning of the transport market on a national scale

with the use of a tool based on a 3-step model:

1.loading onto vehicles - division of traffic into trainsets, taking into account the used train length,

2.distribution of traffic in the network,

3.calculation of the volume of transported goods on the basis of base traffic and differences in

effective network parameters (Kaczorek et al., 2018).

PKP S.A. and PKP PLK are planning to prepare an assessment of the impact of the infrastructure

investments mentioned in this paper - using the National Railway Model - on the distribution of freight streams along the railway routes of the New Silk Road running through Poland.

Summary

Since 2013, there has been a dynamic development of container railway freight between China and

the European Union. The railways transport 2% of the total volume of trade in goods between China and

the European Union, which translates into 4% of its value.

In the years 2010-2018 in Poland the annual growth rate of rail intermodal transport was over

15%, which was much higher than in the majority of the European Union Member States. Maintaining the

high growth rate of rail intermodal transport volume after 2020 will not be possible without large

investments in the development and modernization of logistics infrastructure supporting multimodal

transport with the participation of railways. The geographical structure of China-EU rail transit routes

and the use of individual transport corridors depend not only on the state of political cooperation and

consensus of all stakeholders along a given route, but also on the active involvement of numerous state

institutions. Apart from "soft" factors, such as simplified customs procedures or "information capacity",

the condition of both linear and nodal infrastructure, on which the price and time of transport largely

depend, and thus the scale of use of a given transport corridor, is crucial. The quickest and cheapest

freight land routes currently pass through China, Kazakhstan, Belarus and Poland. Over 80 % of the

volume of freight transported by rail in connections between China and the European Union is transported

by Polish routes crossing the border of the European Union via the Polish-Belarusian border in

Małaszewicze. The throughput capacity of the Polish section of the railway Silk Road strongly depends

on the activities of the PKP Group entities, as the development of linear and nodal railway infrastructure

in Poland lies within their competences. However, thanks to the actions undertaken by them, it should be

possible to increase the throughput capacity of railway routes on the main transport corridors, the

Małaszewicze reloading area and reloading terminals within a few years, which should allow for better

handling of the flow of goods and shortening the time of transport of goods through the territory of

Poland. Taking into account the above, there seem to be strong reasons for Poland to be an "intermodal

logistics hub" for the incoming commodity flows (supply chain) from China, covering both Central and

Western European countries. The realised and planned modernization of Polish railway infrastructure

seems to be sufficient to maintain very high attractiveness of Poland as a transit country for land freight

between China and the European Union in the coming years.

References

- Antonowicz, M.Warsewicz, C.Sikora, D.Jarzebowski, S. (2019). Impact of infrastructure investments in Poland on railway freight routes between China and the European

- Berger, R. (2017). What opportunities for freight stakeholders? UIC International Union of Railways, Study, Eurasian rail corridors, International Union of Railways (UIC). Retrieved from corridors_exe_sum2017_web.pdf European Commission (2011). WHITE PAPER Roadmap to a Single European Transport Area – Towards a competitive and resource efficient transport system. COM/2011/0144 final. Retrieved fromhttps://ec.europa.eu/transport/sites/transport/files/themes/strategies/doc/2011_white_paper/wh ite-paper-i {https://ec.europa.eu/llustrated-brochure_en.pdf European Commission (2018). EU steps up its strategy for connecting Europe and Asia. September 19. Retrieved from https://europa.eu/rapid/press-release_IP-18-5803_en.htm Eurostat & Comext (2019). Trade in goods by top 5 partners, European Union in 2018.. 2019, March 20, 2018, https://uic.org/IMG/pdf/

- php?title=Extra-EU_trade_in_goods García-Herrero, A.Kwok, K. C.Xiangdong, L.Summers, T.Yansheng, Z. (2017). EU–China Economic Relations to 2025: Building a Common Future. Joint Report, The Royal Institute of International Affairs, China Centre for International Economic Exchanges and The Chinese University of Hong Kong. September 6. 1-16. 170912_WEB.pdf Jakóbowski, J., Popławski, K., & Kaczmarski, M. (2018). Kolejowy Jedwabny Szlak.. Połączenia kolejowe UE-Chiny: uwarunkowania, aktorzy, interesy. [Railway Silk Road EU-China Rail Connections: conditions, actors, interests] Centre for Eastern Studies Papers, (72), 26-56, 2017, http://bruegel.org/wp-content/uploads/2017/09/CHHJ5627_China_EU_Report_

- (), Kaczorek, M., Klikowski, M., Konarski, A., Lenart, S., Mikulski, B., Mokrzański, M., & Pyzik, M.

- (2018). Kolejowy Model Towarowy – model ruchu na potrzeby PKP Polskich Linii Kolejowych SA [Railway Freight Model – traffic model for the Polish Railways Company].. Urban and Regional Transport, 20-26

- Koopman, R. (2018). World Trade Statistical Review 2018, WTO. Retrieved from www.wto.org/wtsr Polish Ministry of Development (2015). National Railway Programme by 2023, Resolution No. 162/2015 of the Council of Ministers of 15 September 2015, Poland. Retrieved from 90191/rm_111_165_15-pdf.html Polish Ministry of Development (2017). Strategy for responsible development by. 1-90, 308.. Retrieved from https://www.gov.pl/documents/33377/436740/SOR.pdf Steer Davies Gleave, 2020(with a perspective until 2030), http://mib.bip.gov.pl/fobjects/download/

- eu/ RegData/etudes/STUD/2018/585907/IPOL_ST, U. (2018). 585907_EN.pdf Song, D. (2016), New Eurasian Land Bridge: Achievements & Challenges. Presentation on 2nd Conference of the Ministers of Transport (TMM) and Business Forum.. October 26. : The State Council Information Office of the People's Republic of China (PRC), 2016

- The Annual 2018 , Report. (2019, January 4). The Belt and Road Portal. Retrieved on 18 from: xwzx/gnxw/76434.htm Vinokurov E., Lobyrev, V., Tikhomirov, A., & Tsukarev, T. (2018), Silk Road Transport Corridors: Assessment of Trans-EAEU Freight Traffic Growth Potential.. Euroasian Development Bank, Centre for Integration Studies, Report 49, 41, 2019(02), http://www.eng.yidaiyilu.gov.cn/

- Wolek, M. (2018). Transport and Tourism in Poland. Research for TRAN Committee. Publications of the European Parliament. 8.. Retrieved from 617496_EN.pdf, http://www.europarl.europa.eu/RegData/etudes/BRIE/2018/617496/IPOL_BRI(2018)

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 October 2019

Article Doi

eBook ISBN

978-1-80296-070-9

Publisher

Future Academy

Volume

71

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-460

Subjects

Business, innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Antonowicz*, M., Litewski, M., & Stopyra, R. (2019). Role Of The New Silk Road In Supply Chain Development In Poland. In M. Özşahin (Ed.), Strategic Management in an International Environment: The New Challenges for International Business and Logistics in the Age of Industry 4.0, vol 71. European Proceedings of Social and Behavioural Sciences (pp. 154-168). Future Academy. https://doi.org/10.15405/epsbs.2019.10.02.14