Abstract

Competition in local consumer markets has multifaceted and often contradictory nature. The reason for that is opposite competitive interests of various market players, as well as different treatment of the “competition” notion itself. Ambiguity of the term interpretation, in particular, in state decisions on competition regulation, may lead to contradictory and/or ineffective results. Need for state regulation and its nature require evaluation of possible alternatives of such influence. Evaluations based on objective statistical data are difficult, and often impossible, due to various reasons. In the paper we propose and operationalize estimation method for evaluating generalized alternatives of competition regulation on regional food industry market, based on a combination of analytic hierarchy process and poll methods to evaluate possible competition behavior of producers. Analytic Hierarchy Process in this context is used by competition regulation authorities for the initial choice of one of four alternatives: strengthen regional regulation; lessen is; leave without changes; or recommend higher level regulation state-wise. This choice is based on evaluation reflecting connection (using analytic hierarchy process) of end-up users expectations from competition development with competition development factors and regulation ways. The last, in its turn, are reflected in theoretical treatment of competition notion. The article also proposes to correlate evaluation of generalized alternatives of competition regulation, reflecting the perception of the need to regulate competition by the state, with identification of competition ways, considered by producers in the process of competition development. We present results of the implementation of these methods for Omsk region of Russia.

Keywords: Competitioncompetition evaluationcompetition regulationlocal market

Introduction

Consumer markets of food industry often have a distinct regional specificity. In many regions, especially with the developed agrarian sector, such as Omsk region of Russia, most of the food products consumed within the region are produced by companies of this region. As a consequence, it is extremely important to develop competition in such markets, because it provides not only stability and quality of food supply of regional population but is also an important part of its social and economic development.

Competition development in consumer markets, where we place the regional food industry market, has multifaceted nature. This is reflected both in content and parameters of competition, and in its influence (which is often mutually inconsistent) on interests of various groups of market players: consumers, industries and the state. For instance, reduction in price, which is traditionally considered as a positive consequence of competition from customers point of view, is rather negative from the position of producers.

In theory it is assumed that the “invisible hand” (Smith, 1975) will itself establish a balance of interests of customers and producers. But state involvement in regulation of competition development process is justified not only by deviation of real markets from theoretical models, but also by a special significance of the considered market.

Problem Statement

Regulating involvement of the state explicitly or implicitly relies on some theoretical understanding of competition, and also that the state fixes a side of the market (consumers or producers), on behalf of which such regulation is assumed to be.

Note also that a decision about relevancy and ways of state influence on competition development takes as a premise diverse and multifaceted information, which is weakly formalizable and subjective. This determines a need for its integration and generalization. And, consequently, making initial decisions, determining general nature of state involvement into market competition development in the current conditions. The core of possible decisions of general nature is in various treatments of competition: functional, behavioral, and structural.

Traditionally the following treatments of this notion are considered:

Functional interpretation, which defines competition as a mechanism providing opportunities for realization of the market functions. Intensity of competition is reflected in that companies have no stable competitive advantages. The main ways of competing are change management and strategic innovations.

Behavioral interpretation, which defines competition as a rivalry, that provides the best performance in the market. The main ways of competing are technological-production and marketing enhancement.

Structural interpretation takes as a premise that competition relies on existence of a sufficient number of producing companies, buyers, and infrastructural organizations in the market. Competition in this case is governed by member list structure and their market shares. Consequently, it is predefined that separate market players can (not) influence prices: price is controlled by the parameters of market equilibrium.

Development of certain actions to regulate competition development should be oriented at one of the solutions of general nature, taking into account regional specifics and resting on evaluation of competition factors. Such approach allows state authorities to reasonably influence competition development in the sector, and also let certain companies of food industry to work out strategy of their development.

Research Questions

What is the generalized decision to change the state regulation of competition development on local consumer market?

How to get this solution using the Analytic Hierarchy Process?

How does the choice of alternatives for competition regulation by the state correlate with the ways of competition, selected by firms?

Purpose of the Study

The purpose of the article is to justify method for evaluating generalized alternatives of competition regulation on regional consumer market and its implementation on local food industry market.

Research Methods

General model to evaluate aggregated alternatives of regional competition regulation

Approaches to regulate, and as a consequence, to evaluate competition are connected with the ambiguity of “competition” interpretation.

Competitive situation is of interest to various market players: producers, consumers, and the state - because it sufficiently predetermines their market/competitive behavior. But end up consumers are interested in competition results, reflected in relative price reduction, diversity enhancement, and improvement of goods and services quality, while producers and the state are also interested in competition processes, and possibilities to influence state and nature of competition.

So it is natural to evaluate competition in the context of its various interpretations. Evaluation of competitive situation - either formal analytical or subjective – supplies market players with some basis for structuring their market behavior. Depending on the interpretation of competition, chosen by a market player, this behavior will have different emphasis. In particular, the leading form of competition appearance in economic sector: companies have no stable competitive advantages (functional interpretation), rivalry for market and resources (behavioral interpretation), quantity and market shares of producers (structural interpretation) defines direction of state influence, required for the market (Table

The last column of the table shows major approaches to state market regulation, which are of interest to us. Depending on the evaluation of competition state in the sector and possible consequences of regulations, it is assumed that a primary decision will be made for each position of the last column: to intensify regional regulation, to loosen it, or leave without change. On top of that, there is a possibility, when regulations are required, but nationwide rather than regional.

Objects of such regulation are producing companies. So, we are talking not about regulation of competition in the consumer market itself (in our case on the food market) but rather about regulation of competition environment. This agrees with the interpretation of competition in the Federal Law of Russia “On competition development”, in which competition is understood as “rivalry of economic entities”. At the same time the “Standard of competition development in subjects of Russian Federation” adhere to the principle of customer priority (The Standard for the Development of Competition in the Russian Regions, 2015).

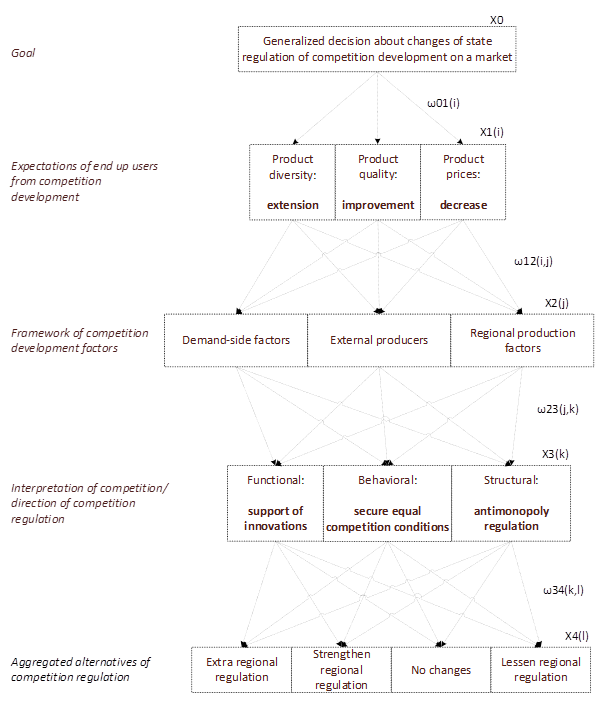

Therefore, it is possible to list several levels of decision-making (selecting aggregated alternatives) on state regulations of the market sector in the region (Figure

Analytic Hierarchy Process (AHP) as a method to evaluate aggregated alternatives of regional competition regulation

Saaty's (2008) Analytic Hierarchy Process is a simulation scheme for multiple criterion decision making problems, where factors are arranged in a hierarchic structure, which allows to numerically estimate the intensities of interaction between hierarchy elements, and produce an estimation of preference degree for each alternative with respect to a main goal.

A solution of decision-making problem using AHP consists of the following steps:

analyzing problem and building a hierarchy (see Figure

01 );calculating local priorities and checking the consistency of the alternatives;

synthesizing alternatives’ priorities with respect to a main goal and general evaluation of hierarchy consistency.

Calculating local priorities on each hierarchy level is conducted using paired-comparison method: elements of subsequent hierarchy level are compared in pairs with respect to the concept or property, expressed by elements of the higher level. A result of this comparison is the paired comparison matrix ω, whose elements are estimations of advantage of the element xn over the element xm with respect to elements of higher hierarchy. Estimation values in the following scale (Table

Questions needed to construct the matrix ω are created in the following way, showing the essence of hierarchy analysis:

ω01(i) – In which case regional authorities should make a decision to regulate competition in food market of Omsk region:

(i=1) when product diversity is decreasing;

(i=2) when product quality is deteriorating;

(i=3) when product prices are increasing?

ω12(i,j) – What has a stronger impact on change of (i=1,j) diversity; (i=2,j) quality; (i=3,j) product prices on food market of Omsk region:

(j=1) change in product demand;

(j=2) companies from other regions entering (leaving) regional market;

(j=3) change in regional conditions and factors of production?

ω23(j,k) – What may have a stronger impact on changes in (j=1,k) product demand; (j=2,k) activity of external producers; (j=3,k) business environment for local producers on food market of Omsk region:

(k=1) regional authorities support for innovation activities of companies;

(k=2) providing equal competition conditions for all companies of the market sector;

(k=3) regulating activities of monopolies in the market sector?

ω34(k,l) – What has a higher value in regulating competition in the food market of Omsk region (k=1,l) in supporting innovation activities of companies in the market sector; (k=2,l) in providing equal competition conditions for producers; (k=3,l) in regulating activities of monopolies in the market sector:

(l=1) the problem cannot be solved by regulations on regional level;

(l=2) regional authorities should strengthen competition regulation of the sector;

(l=3) existing regulation terms should not be changed by regional authorities;

(l=4) regional authorities should lessen competition regulation of the sector?

As a result of hierarchy analysis, using matrices of local priorities defined above, we construct the row vector, whose elements are required values of alternative priorities (lowest hierarchy level) with respect to decision making goal (top hierarchy level):

A = ω01(i) * ω12(i,j) * ω23(j,k) * ω34(k,l)

Possible violations in answers logic, shown up as transitivity of judgments violations, are estimated using corresponding consistency measures (Saaty, 2008), which are calculated in our case using © Mpriority program.

Evaluating possible competitive behavior of produces

Evaluation of aggregated alternatives of competition regulation, showing the perception of need for state regulation of competition, should be complemented by evaluation of competition means, considered by producing companies for their own development. In our case, we use polls of companies as the method to collect data for such evaluation. Therefore questions, aimed at highlighting various aspects (interpretations) of competition, were included in the model, and correspondingly to surveys (Table

We use factor analysis model to obtain numeric estimation for possible competitive behavior of companies, this allows us to detect latent characteristics of the investigated subject. They are determined as the result of generalization of elementary attributes and serve as integrated characteristics.

In our case elementary attributes are factors, influencing competition, as perceived by producing companies. The list of these factors is shown in the second column of the table (see Table

Besides the questions about competition perception, the survey includes questions, describing respondents (for end up users we ask for: age, gender, social background, place of living, etc.; for companies we ask how long they are on the market, size, location, etc.). The answers allow to discuss competition perception of respondents by various consumer segments and industry groups.

Findings

Results of aggregated alternatives evaluation

Involving experts and implementing AHP (using geometric average for expert answers) we obtained the following results (Table

Results show that regional regulation of food industry sector should be strengthened. From the state point of view (see Table

As was already stated, regulation is aimed at producing companies, therefore it is important to consider local priority estimation for regional production factors, provided in (Table

Therefore, the nature of regional food markets is such that in making practical decisions it is reasonable to focus more on behavioral nature of competition rather than on structural and functional approaches for the competition interpretation, which are widely used at the moment (see also Dobson, Clarke, Davies, & Waterson, 2001; Kokovikhin, Ogorodnikova, Williams, & Plakhin, 2018). Now, in the framework of functional approach, market system provides natural operating mechanism for companies, pushing companies-outsiders off the market, which corresponds to current situation in the food market in Omsk region. The conclusion also relies on a notice that there are no monopolies in the sector, which may distort the market.

Quantity analysis of companies in the regional food market and their dynamics (Report “The state and development of the competitive environment in the markets of goods, works and services of the Omsk region by the result of 2016”, 2016), state support for agricultural producers, infrastructure for state support, the big city in Omsk region, show that there are enough market participants to consider the structural interpretation of the term “competition”. Therefore, using these approaches, we may state that there is competition as such on the market, since the market is built, competition mechanism is working, a number of entities is sufficient, and market infrastructure is in place in Omsk region.

Another argument for the behavioral approach is that decision making process on companies’ behavior in consumers market is connected mostly not with factors coming from objective statistical data for the sector but with subjective perception of market by buyers and producers.

Evaluation results of possible competitive behavior of producers

From behavioral point of view one of the most important competitive factors is a way of computation, i.e. a complex of economic, management, and marketing variables (technologies, methods, tools), which can be used by a company to gain competitive advantages.

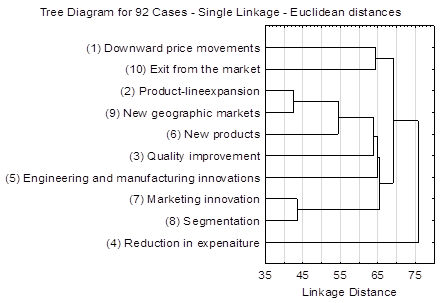

Research results of producers’ possible competition behavior are obtained in the form of aggregated weighted estimates in numerical scale, showing the influence type of supply and demand on competition perception by end up customers; and also in the form of clustering tree using Clustering Method to detect competition factors in producers’ perception, and split them into groups (Mamontov & Chernobaeva, 2017).

Further we present the results of competition perception by producers, which were obtained using factor analysis and clustering methods.

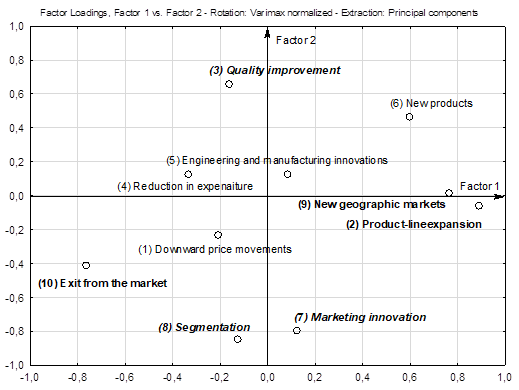

In view of load values of latent factors in two-factor model (see Table

Factor2 axis may be interpreted in the following way: positive direction shows orientation on quality competition. Note that load for these characteristics in latent factor (0.66) is not very high, even though much higher than other loads. Negative direction of this axis reflects marketing way of competition, including segmentation (correspondingly -0.80 и – 0.85).

Note that model factors explain no more than half (48%) of variance (Table

Detecting third latent factor (Table

It can also be noted that price competition and competition based on engineering and manufacturing innovations are not priority types of competition for the whole sector in general.

Group (complex) ways of competition, reflected as closeness of points in the space of factors (Figure

It can also be noted that understanding, that the proper way of competition is quality improvement, is increasing with company’s age (Table

Conclusion

Multiple ways of competition interpretation, seen in its various estimations, require approach to estimate competition with respect to its form of appearance, which in its turn is related with its interpretations.

A combination of analytic hierarchy process and surveying methods can be used for estimation. The first one is aimed to detect direction of competitive environment regulation, the second one is to specify competition ways in the context of behavioral approach (or, possibly, functional or structural for other sectors), suitable for customer markets, in particular, to the local food industry market.

The performed analysis allows us to state the necessity of regional regulation in the local market and to distinguish two main ways of companies’ competition in the market: a) search for new geographical markets in combination with increasing product diversity and product line in general; b) search and allocation of new target segments in combination with marketing improvements.

The results of both factor analysis and cluster analysis show that neither cost reduction, nor production and technological innovation, nor quality improvements to a great extent, are not considered by companies as the main means of competition. At the same time, if a company is leaving the market, that is related with the need to reduce prices.

Thus, one can draw a general conclusion that the local food industry market requires regulation in terms of providing equal condition of completion for resources and providing equal infrastructure conditions for competing but does not require strengthening or increasing of state interference in competition in the end product market. The latter is more adequate to natural free market interaction in the context of behavioral competition of producers.

Acknowledgments

The reported study was funded by RFBR and Omsk region Government according to the research project № 17-12-55007.

References

- Dobson, P. W., Clarke, R., Davies, S., & Waterson, M. (2001). Buyer Power and its Impact on Competition in the Food Retail Distribution Sector of the European Union. Journal of Industry, Competition and Trade,1(3), 247-281.

- Geroski, P. A. (2003). Competition in Markets and Competition for Markets. Journal of Industry, Competition and Trade, 3(3), 151–166.

- Kokovikhin, A., Ogorodnikova, E., Williams, D., & Plakhin, A. (2018). Assessment of the Competitive Environment in the Regional Markets. Economy of Region, 14(1), 79-94.

- Mamontov S., & Chernobaeva G. (2017). Evaluation of Competition in the Consumer Market of the Region as a Basis for Marketing Management. In 13th European Conference on Management, Leadership and Governance ECMLG 2017 (pp. 287-296). Sonning Common, UK: ACPI.

- Porter, M. (1998). On Competition. Boston: Harvard Business School.

- Report «The state and development of the competitive environment in the markets of goods, works and services of the Omsk region by the result of 2016». (2016). Retrieved from: http://mec.omskportal.ru/ru/RegionalPublicAuthorities/executivelist/MEC/ImplementationOfStandards/Information/Report.html, request date 25.08.2018) (in Russian)

- Saaty, T.L. (2008). “Relative Measurement and its Generalization in Decision Making: Why Pairwise Comparisons are Central in Mathematics for the Measurement of Intangible Factors – The Analytic Hierarchy/Network Process”. RACSAM (Review of the Royal Spanish Academy of Sciences, Series A, Mathematics), 102 (2), 251–318.

- Smith, A. (1975). The Theory of Moral Sentiments. Oxford: Oxford University Press.

- The Standard for the Development of Competition in the Russian Regions. (2015). Approved by the order of the Government of the Russian Federation of 5 September, № 1738-р (in Russian)

- Theory of Competition. (2010). Report on the results of the round table 19.05.2010. Modern competition, 3 (21), 4-37 (in Russian)

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Mamontov, S. (2019). Evaluating Generalized Alternatives Of Competition Regulation In Local Food Industry Market. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 395-407). Future Academy. https://doi.org/10.15405/epsbs.2019.04.44