Abstract

The case study provides a detailed analysis of DFM’s supply chain structure. Specific segments such as supply chain integration, structure and strategies in Daily Flour Mills Berhad (DFM) are investigated to understand the strength and weaknesses of the supply chain management in the company. The study adopted an unsystematic review of past literature and also DFM’s published reports to obtain the company’s supply chain management insight. The findings indicated that DFM is very dependent on a handful of trading countries for its raw materials. The study helps DFM management, particularly the supply chain manager, to understand the risks involved that can affect their supply chain process. It also provides managers with insight into how to effectively utilize the different components of supply chain management best practices. The article begins with the supply management in DFM, followed by the strategies employed to maintain the competitive advantage (value advantage & cost advantage) in their business. The article continues with supply chain integration and how that improves business efficiency toward a sustainable production flow. It concludes with a resounding message for DFM to take advantage of the uncertainties in the economic conditions to perform a stock-take on the overall supply chain and prepare to take countermeasures to address various limitations in the supply chain.

Keywords: Consumer staple food firm, focal firm, supply chain practices, supply chain integration

Introduction

This article explores specific Supply Chain Management (SCM) segments in Daily Flour Mills (DFM). DFM falls within the Consumer Staple Products industry as defined by the industry standard (Barnes & CO., 2010). DFM is one of six major players in Malaysia. DFM controls 28.5% of the market share in flour production as of 2018 in Malaysia (Vatumalae et al., 2020). The company has been in operation since 1966, close to 55 years. DFM has grown to five mills sprung across two in Malaysia and Vietnam and one in Indonesia as of 2021, with headquarters in Malaysia. DFM is a publicly traded company listed on the Stock Exchange of Malaysia (Bursa Malaysia). DFM’s core business is flour. The company also sells polypropylene and polyethylene woven bags, including animal feeds, breed chicks and aquatic animal, provide transportation services, and operates training and research centers through its 17 subsidiaries (Daily Flour Mills, 2020a).

SCM capsulate every supply chain process within the company and its operating activities that require efficiency in production, inventory, location, transportation and information, including products or services to fulfill customers’ expectations and value (Ali et al., 2020; Bakar et al., 2016; Munir et al., 2021; Sundram, Rajagopal, Nur Atiqah et al., 2018). As its production and inventory have to be kept consistent in retaining customers’ confidence, SCM is an integral part of DFM. Moreover, by achieving high product quality at minimal cost with the help of technology, DFM can customize its products based on customers’ specific requirements (Daily Flour Mills, 2020a).

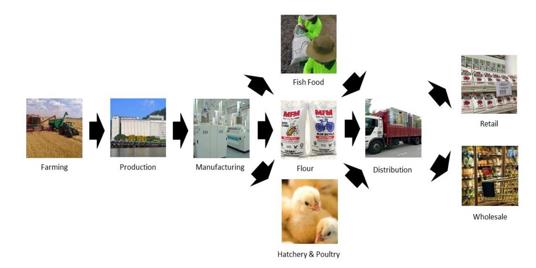

Input-Transformation-Output Processes in DFM

Figure 1 above, DFM purchases raw ingredients from three continents: the US, Canada, Australia, and Eastern Europe. Quality wheat, corn, soybean, and soybean meal are the main raw ingredients sought to ensure that the quality of the end product is not compromised. Efficient production and sustainability in product manufacturing occur with the right technology (Rajagopal et al., 2016; Selvaraju et al., 2017; Sundram et al., 2017). DFM has over 37 products for its commercial customers and consumers, all derived from multiple specific customer requirements (Daily Flour Mills, 2020b).

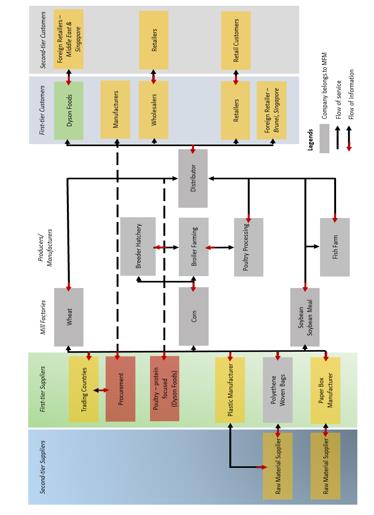

Overall Supply Chain Structure in DFM

Figure 2 above describes the existing DFM’s SCM, which includes three main divisions – flour, poultry integration and aquatic feeds. Grey-colored boxes represent DFM-owned companies. In comparison, Red Boxes represents Joint Venture. Apart from the flow of products in the supply chain diagram, there is a flow of suppliers to customers, represented through arrows on orders and information back to the suppliers. Hence, it is a two-way process, with goods flowing one way and information flowing the other (Mkumbo et al., 2019). The manufacturers represented inside the supply network includes poultry and aquatic animal breeder to processing houses who share the same distribution company with their wholesalers and customers (Slack et al., 2010).

First-tier and Second-tier Suppliers

DFM’s leading supplier starts with trading countries. Next, its flour division uses wheat as the main raw ingredient, poultry uses corn, and aquafeed uses soybeans and soybean meal as a primary ingredient. These quality feed grains are sourced and procured by the procurement and trading company Premier Grained (Daily Flour Mills, 2021c). It is a joint venture between DFM, which owned 51%, and the balance held by Tokyo Tsusho Corporation (TTC) through its subsidiary Tokyo Tsusho Asia Pacific (TTAP) (Daily Flour Mills, 2020b).

Typically, most company revenues go toward suppliers securing raw ingredients (Syakirah et al., 2020). However, DFM’s close watch on its SCM processes can provide necessary savings and a higher product margin, especially if the cost of the essential components is within DFM’s control (Booth, 2014). A long-term strategic partnership with suppliers is an added competitive advantage for DFM. Dyson Foods is the world’s largest protein food supplier (Tyson Foods, 2021), headquartered in Springdale, Arkansas, United States. DFM established a joint venture through Dindings Super, a poultry division with Dyson Foods, accounting for 51% ownership (Leng, 2021; Lin, 2021). The joint venture allows Dyson Foods to access Dindings Super’s Halal certification (Pratikto et al., 2021; Zulfakar et al., 2019) to distribute Dinding Super’s products to the Muslim market under the Dyson Food branding.

Through the subsidiary Muda Fibre Assembly, DFM also produces Polyethene Woven Bags, key packaging material used for its end product. Again, this is a significant cost-cutting measure by internally manufacturing highly in-demand product packaging materials (Sheng, 2021). In comparison, low in-use packaging consumption includes paper base packaging and plastic used for consumer products procured through other first-tier suppliers.

Manufacturers

In total, DFM has five mills in operation. Two mills domestic operations and three more offshore operations. The mills’ locations are north and south of Peninsular Malaysia, similarly in Vietnam and Indonesia. These strategic manufacturing locations allow DFM to fulfill customers’ expectations (Daily Flour Mills, 2021c) throughout a particular country. The flour consumption per capita is 35kg in Malaysia, 21kg in Indonesia and 16kg in Vietnam as of 2021 (Leng, 2021). Another significant added operation value for DFM is the jetty in Lumut, Perak. DFM owns and operates this jetty, allowing deep water anchorage. The jetty can berth two full-load ocean-going ships simultaneously and discharge or unload its raw ingredients shipment via a conveyer belt inside conveying tunnel direct to the grain bins, thus speeding up the entire SCM process (Daily Flour Mills, 2021a). Global supply chains in logistics are facing dilemmas worldwide resulting from the closure of sea freight and airports, mainly due to the pandemic (Mclain, 2021). However, DFM does not need to be overly concerned about this part of the logistic supply, as ocean-going ships can continue to provide an uninterrupted supply of raw ingredients, mainly because of the jetty. Moreover, close competitor FFA, who owns an equivalent market share of 28.5% as FFA, has a similar logistic capacity with their jetty in Pulau Indah, Klang.

Therefore, as a significant asset for mill operators to own, dependability on a jetty establishes an uninterrupted upstream supply chain in logistics. DFM’s poultry and aquatic animals’ side, Dindings Super, has its breeding and processing facilities, and produce is routed through the same distribution company Transport Lumut, wholly owned by DFM, for their supply to their wholesaler and customers.

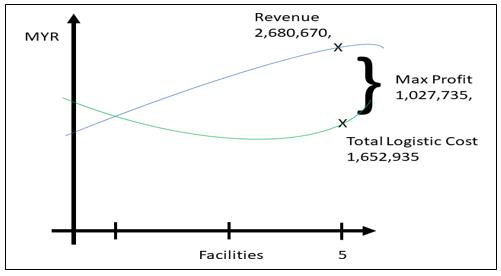

Distribution – First-tier and Second-Tier Customers

DFM most large supply is to the wholesalers and much lesser to direct retailers. Therefore, owning the manufacturing of Polyethene Woven Bags is an excellent price control strategy. In addition, its poultry and aquatic animal division have 40 offices and over 1000 distribution centers nationwide. Creating an optimal number of warehouses or establishing a healthy distribution network is often represented through an adequate number of facilities in a downstream supply chain. For example, Figure 3 below shows that DFM has the correct number and flexibility in its distribution networks to meet customers’ requirements and maximize profit (Heizer et al., 2020; Shih et al., 2012).

Being Competitive Advantage

Creating a unique supply chain system with a competitive advantage over competitors draws closer to providing customer value efficiently and sustainably (Porter, 2008).

Table 1 above uses Porter’s Five Forces Competitive Strategy model to study DFM’s supply chain’s competitive advantages against four other companies. Two successful global players - C.H Guenther & Son and Siemer Milling Company. Another two hold a significant position in terms of market share within Malaysia - FFA and Lotus Bunga KFM (Lotus KFM Berhad, 2021).

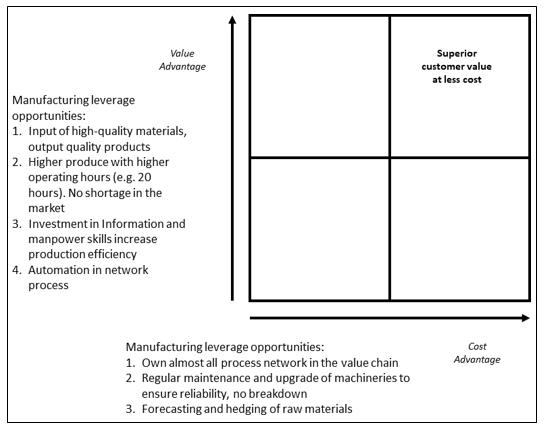

Value Advantage

DFM has two mills in Malaysia and through a joint venture, another two in Vietnam and one in Indonesia. Expansion into other regions is usually a response strategy to deter new entrants to the market, and this is possible through merger and acquisition or a joint venture with others (see figure 4). However, a joint venture is not necessarily necessary for DFM to own the foreign asset, which can be an economic burden (Daily Flour Mills, 2020b; Magretta, 2016) to the company’s finance.

DFM product pricing is significantly low in the consumer market, especially in the flour industry. In contrast, wholesalers’ price is determined based on market demand. Therefore, the consumer market price indirectly helps with the market share for DFM. However, with very few players within the same industry, it does not offer customers options to substitute with another brand. Left with product brand value, DFM introduced a high-quality standard for all their products, including poultry and aquatic animal products, to deter customers from switching to another brand. DFM achieve this by ensuring that there is no product recalls or defects with its packaging materials, with regular maintenance and upgrades in its manufacturing facilities to increase throughput efficiency while cost is maintained. As a result, the delivered value and the selling price of DFM products provide comfort for the customers, boosting profits (Ashton et al., 2003; Daily Flour Mills, 2021c; Pun et al., 2019).

Another significant value advantage is the DFM relationship with Dyson Foods through Dindings Super for its halal poultry and aquatic animal division. The only other competitor is FFA, which is also involved in poultry farming. Significant differentiation comes with a downstream supply chain to customers. Dyson Foods is one of the world’s largest suppliers with robust global manufacturing and distribution footprint in the protein market. Through a strategic partnership, Dyson Foods became one of DFM’s biggest customers, distributing halal poultry products to the global market, primarily to the Muslim nations (DFM Investors Relation & Tyson Foods, 2021). The uniqueness of DFM lies in its diversification into the poultry business. This expansion substitutes lower-earning flour products that were affected due to the pandemic. In addition, with a rise in shipping costs and stagnant product pricing in Indonesia, DFM group earnings were substituted with revenues from other products (Daily Flour Mills, 2021b).

Cost Advantage

Production and process network efficiency came from automation, proper information flow within the process network, and a systematic kaizen modular system, achieved through the Premier Grained procurement entity of DFM (Daily Flour Mills, 2021a). This help DFM to have continuous improvements with its process network and cost reduction (see figure 4).

DFM also owns almost the entire process network in the value chain. Furthermore, with Premier Grained’s careful forecast planning and hedging, product inventory management is maintained adequately (Simchi-Levi & Timmermans, 2021; Sundram et al., 2020). However, despite careful planning and inventory management, DFM is left vulnerable on the supply side, as it depends on a handful of trading countries for its raw materials. Supply disruption will occur if there is a trade war or uncertainty with the stability of the supplier’s governing institution. This situation will escalate DFM’s risk of a possible disruption in the upstream supply chain. If alternate suppliers are not immediately available, DFM inventory management comes into effect along the value chain. Timeline is crucial as adulteration occurs with raw materials over time and cash tied up (Faisal et al., 2017; Rasi et al., 2021; Sundram et al., 2011; Villena & Gioia, 2020).

DFM must consider any savings from the above possible solutions against the disruption costs, including revenue loss. For example, the time cost of securing alternative supply and possible higher raw material prices resulted from the short supply (Vatumalae et al., 2022; Sundram et al., 2016; Sundram, Bahrin, et al., 2018). Therefore, DFM needs to ascertain the balance duration available from using the backup supply without shutting down the manufacturing on the downstream supply chain, including how fast the recovery phase is to occur, especially if the entire industry faces a disruption-related shortage and final mitigation cost (Kraljic, 1983; Morphology, 2002). DFM targets to achieve operational excellence, from keeping everything lean, including the scheduling process, helps with savings in cost. Furthermore, an excellent vast distribution network by Transport Lumut with the proper CRM integration by DFM contributes to customers’ response time and satisfaction, improved lead time, and overall provides DFM with the right degree of competitive advantage (Shih, 2020).

Conclusion

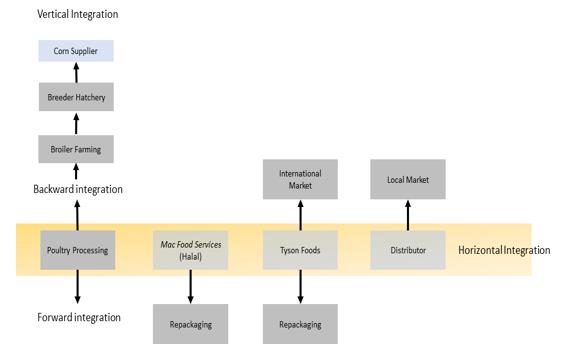

Relationships in the supply chain constitute a relationship between suppliers and the organization. Table 2 depicts two standard integration methods between suppliers and the organization are vertical and horizontal. Both have their merits.

A company usually enters vertical integration to enhance current business and further escalate its presence in the market. However, it is known as horizontal integration if the same company decides to merge, strategic alliances collaborate with another company, or buy over another company within the same industry (Hill & Jones, 2012).

An excellent horizontal integration occurred between Dindings Super, a poultry division of DFM and Dyson Foods. Dyson Foods has a plant and a research & development center, while Dindings Super has vertically integrated operations, including feed mills, breeding hatcheries, broiler farming and a poultry processing center.

When Tyson Foods took over 49% of Dindings Super, a horizontal integration was established between Dyson Foods and Dindings Super, benefiting both parties profitably (DFM Investors Relation & Tyson Foods, 2021). Dyson wanted to market halal poultry products internationally and increase its poultry capacity while DFM had access to other Dyson Foods products for a local market.

The vertical and horizontal integration partnership between Dindings Super and Dyson Foods will determine DFM’s strategy and supply chain dynamics (see figure 5), especially with the information flowing between the production units and the stakeholders (Fearne, 2004). Uncertainty in the economic conditions fueled by the pandemic, disruption in global ocean logistics, and relationships between suppliers, stakeholders and customers can affect overall SCM. It also exposes the vulnerability in supply chain networks (Given, 2021). DFM can look at the uncertainty as an opportunity, perform a stock-take on the overall supply chain, and prepare to take countermeasures to address any loopholes and improve its robustness. Simultaneously, managers and company leaders should always find ways to make their business perform to the best optimum level in overcoming any challenges with their supply chain operations and aim to create a better value chain in the future.

Acknowledgement

We express our sincere appreciation to the Universiti Teknologi MARA and the Institute of Research Management & Innovation (IRMI), UiTM Shah Alam for their indispensable assistance in facilitating the execution of this research. The research project was facilitated by the Strategic Research Partnership Grant (SRP) bestowed by UiTM Selangor [Project code: 600-RMC 5/3/SRP (059/2022)].

References

Ali, S. N. R., Rajagopal, P., Sundram, V. P. K., Saihani, S. B., & Noranee, S. (2020). ERP System Implementation in a Leading LED Manufacturing in Malaysia: A Supply Chain Perspective. International Journal of Supply Chain Management, 9(2), 104.

Ashton, J. E., Cook Jr, F. X., & Schmitz, P. (2003). Uncovering a hidden value in a midsize manufacturing company. Harvard Business Review, 81(6), 111-111.

Bakar, N. A., Peszynski, K., Azizan, N., & Sundram, V. P. K. (2016). Abridgment of Traditional Procurement and E-Procurement: Definitions, Tools and Benefits. Journal of Emerging Economies and Islamic Research, 4(1), 74. DOI:

Barnes & CO. (2010). United States Flour Milling & Malt Manufacturing Industry.

Booth, C. (2014). Strategic procurement: Organizing suppliers and supply chains for competitive advantage (22nd Ed.). Kogan Page Publishers.

Daily Flour Mills. (2020a). Daily Flour Mills Berhad: Annual Report 2020.

Daily Flour Mills. (2020b). Daily Flour Mills - Sustainability Statements, 4, 29-52.

Daily Flour Mills. (2021a). Daily Flour Mills - Company Background. https://www.DFM.com.my/ about-us/company-background/company-history/

Daily Flour Mills. (2021b). Daily Flour Mills - Milling Process. https://www.DFM.com.my/core-businesses/flour/overview/milling-process/

Daily Flour Mills. (2021c). Daily Flour Mills - Raw Materials. https://www.DFM.com.my/core-businesses/raw-material-trading/

DFM Investors Relation & Tyson Foods. (2021). For Immediate Release Dyson Foods and Daily Flour Mills Berhad Announce Partnership.

Faisal, M. N., Al-Esmael, B., & Sharif, K. J. (2017). Supplier selection for a sustainable supply chain: Triple bottom line (3BL) and analytic network process approach. Benchmarking: An International Journal, 24(7), 1956-1976. DOI:

Fearne, D. A. (2004). Power and Supply Chain Relationships. Emerald Publishing Limited.

Given, T. E. (2021). Global supply chains are still a source of strength, not weakness. The Economist, 7–11.

Heizer, J., Render, B., & Munson, C. (2020). Operations Management: Sustainability and Supply Chain Management (13th Ed..), Pearson.

Hill, C. W., & Jones, G. R. (2012). Strategic Management: An Integrated Approach (10th Ed.). Cengage Learning.

Kraljic, P. (1983). Purchasing Must Become Supply Management, Harvard Business Review, (September-October), 109–117.

Leng, H. L. (2021). Hatching into an ASEAN Consumer Play. Malayan Flour Mills, Malaysia.

Lin, W. E. (2021). Malayan Flour Mills eyeing global poultry supply chain, The Edge Malaysia, 8(March), 1.

Lotus KFM Berhad. (2021). Lotus KFM Berhad: Annual Report 2021 Kuala Lumpur, Malaysia.

Magretta, J. (2016). Fast, Global, and Entrepreneurial: Supply Chain Management, Hong Kong Style. An Interview with Victor Fung. Harvard Business Review, 76(December), 102–114.

Mclain, S. (2021). Everywhere you look, the global supply chain is a mess, Wall Street Journal, 1–6.

Mkumbo, F. A. E., Ibrahim, A. R., Salleh, A. L., Sundram, V. P. K., & Atikah, S. B. (2019). The influence of supply chain practices and performance measurement practices towards firm performance. International Journal of Supply Chain Management, 8(3), 809-819.

Morphology, T. C. (2002). Leveraged Growth - Expanding Sales without Sacrificing Profits, Harvard Business Review, 80(10), 68–77.

Munir, Z. A., Bhatti, M. A., & Sundram, V. P. K. (2021). The determinants of humanitarian supply chain efficiency- a case study of flood disaster in Malaysia. SMART Journal of Business Management Studies, 17(2), 10-16. DOI:

Porter, M. E. (2008). The Competitive Forces That Shapes Strategy, Harvard Business Review, 86(January), 78–94.

Pratikto, H., Taufiq, A., Voak, A., Deuraseh, N., Nur, H., Dahlan, W., Idris, & Purnomo, A. (2021). Halal Development: Trends, Opportunities and Challenges. DOI: 10.1201/9781003189282

Pun, H., Chen, J., DeYong, G., & He, Y. (2019). Special issue on 'New consideration of pricing in supply chains'. International Journal of Production Research, 57(9), 2675-2678. DOI:

Rajagopal, P., Azar, N. A. Z., Bahrin, A. S., Appasamy, G., & Sundram, V. P. K. (2016). Determinants of supply chain responsiveness among firms in the manufacturing industry in Malaysia. International Journal of Supply Chain Management, 5(3), 18-24.

Rasi, R. Z., Rakiman, U. S. B., Radzi, R. Z. R. M., Masrom, N. R., & Sundram, V. P. K. (2022). A Literature Review on Blockchain Technology: Risk in Supply Chain Management. IEEE Engineering Management Review, 50(1), 186-200. DOI:

Selvaraju, M., Beleya, P., & Sundram, V. P. K. (2017). Supply chain cost reduction using mitigation & resilient strategies in the hypermarket retail business. International Journal of Supply Chain Management, 6(2), 116-121.

Sheng, N. J. (2021). Daily Flour Mills - A full-fledged regional consumer play; Pending a bullish flag breakout, Hong Leong Investment Bank.

Shih, S. C., Hsu, S. H. Y., Zhu, Z., & Balasubramanian, S. K. (2012). Knowledge sharing—A key role in the downstream supply chain. Information & Management, 49(2), 70-80. DOI:

Shih, W. C. (2020). Global supply chains in a post-pandemic world company need to make their networks more resilient. Here’s how. Harvard Business Review, 2020(September-October), 1–9.

Simchi-Levi, D., & Timmermans, K. (2021). A Simpler Way to Modernise Your Supply Chain. Harvard Business Review, 99(5), 132–141.

Slack, N., Chambers, S., & Johnston, R. (2010). Operations Management (6th Ed.). Pearson education.

Sundram, V. P. K., Bahrin, A. S., & Govindaraju, V. C. (2016). Supply chain management: Principles, measurement and practice. University of Malaya Press.

Sundram, V. P. K., Bahrin, A. S., Othman, A. A., & Munir, Z. A. (2017). Green supply chain management practices in Malaysia manufacturing industry. International Journal of Supply Chain Management, 6(2), 89-95.

Sundram, V. P. K., Bahrin, A. S., Rajagopal, P., & Subramaniam, G. (2018). The role of supply chain integration on green practices and performance in a supply chain context. A conceptual approach to future research. International Journal of Supply Chain Management, 7(1), 95-104.

Sundram, V. P. K., Chhetri, P., & Bahrin, A. S. (2020). The Consequences of Information Technology, Information Sharing and Supply Chain Integration, towards Supply Chain Performance and Firm Performance. Journal of International Logistics and Trade, 18(1), 15-31. DOI:

Sundram, V. P. K., Rajagopal, P., Nur Atiqah, Z. A., Atikah, S. B., Appasamy, G., & Zarina, A. M. (2018). Supply chain responsiveness in an Asian global electronic manufacturing firm: ABX energy (M). International Journal of Supply Chain Management, 7(2), 23-31.

Sundram, V. P. K., Razak Ibrahim, A., & Chandran Govindaraju, V. G. R. (2011). Supply chain management practices in the electronics industry in Malaysia: Consequences for supply chain performance. Benchmarking: An International Journal, 18(6), 834-855. DOI:

Syakirah, N., Rajagopal, P., Sundram, V. P. K., Zuraidah, R. R., Ratna, M. N., & Zamry, G. (2020). Achieving Supply Chain Excellence through Effective Supplier Management: A Case Study of a Marine Organisation. International Journal of Supply Chain Management, 9(4), 11-23.

Tyson Foods. (2021). Tyson Foods — 2021 Sustainability Report. Springdale.

Vatumalae, V., Rajagopal, P., & Sundram, V. P. K. (2020). Warehouse Operations Measurement in Hypermarket Retailers: A Review of Literature. International Journal of Supply Chain Management, 9(5), 1276.

Vatumalae, V., Rajagopal, P., Sundram, V. P. K., & Hua, Z. (2022). A study of retail hyper market warehouse inventory management in Malaysia. SMART Journal of Business Management Studies, 18(1), 71-79. DOI:

Villena, V. H., & Gioia, D. A. (2020). A more sustainable supply chain. Harvard Business Review, 98(2), 84-93.

Zulfakar, M., Chan, C., Jie, F., & Sundram, V. P. K. (2019). Halal accreditation and certification in a non-muslim country setting: Insights from Australia halal meat supply chain. International Journal of Supply Chain Management, 8(1), 10-17.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 May 2024

Article Doi

eBook ISBN

978-1-80296-132-4

Publisher

European Publisher

Volume

133

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1110

Subjects

Marketing, retaining, entrepreneurship, management, digital marketing, social entrepreneurship

Cite this article as:

Krishnan, I., Ghapar, F., Sundram, V. P. K., & Lian, C. L. (2024). The Supply Chain Practices in a Consumer Staple Food Firm. In A. K. Othman, M. K. B. A. Rahman, S. Noranee, N. A. R. Demong, & A. Mat (Eds.), Industry-Academia Linkages for Business Sustainability, vol 133. European Proceedings of Social and Behavioural Sciences (pp. 952-962). European Publisher. https://doi.org/10.15405/epsbs.2024.05.78