Abstract

Ar-Rahnu is a type of financing product that has gained popularity due to its availability as a quick source of cash. Despite surging popularity as a quick cash solution, Ar-Rahnu, a Malaysian Islamic pawnbroking product, grapples with low customer retention. While initial user awareness focuses primarily on Shariah compliance, the drivers of sustained patronage remain enigmatic. This study aims to examine the relationship between religiosity and customer retention, and the role of awareness as a moderating factor. Data was collected from 327 customers through questionnaires and analyzed using Partial Least Squares Structural Equation Modelling. The results showed that religiosity had no effect on customer retention, and awareness did not moderate the relationship between religiosity and retention. Ar-Rahnu's appeal appeared to extend beyond religious motivations, highlighting the product's broader market potential. This suggests that awareness on its own can influence customers to continue using Ar-Rahnu products. These findings provide insights for the management of Ar-Rahnu to increase visibility and awareness of the product.

Keywords: Ar-Rahnu, awareness, customer retention, religiosity

Introduction

Financing has become a popular option for consumers to obtain goods, properties, or services (no citation needed). However, the increasing cost of these items has led to reduced purchasing power for consumers. To purchase necessary items, consumers often use cash or online banking methods such as fund transfer and QR code. When it comes to more expensive purchases, consumers may choose credit transactions due to a lack of sufficient cash on hand. Consumers often look for financing products, like personal loans, to obtain cash for their purchases. Another option is pawnbroking loans, which also provide customers with quick access to cash. In Malaysia, a short-term Islamic pawnbroking called Ar-Rahnu has gained popularity.

Ar-Rahnu industry has seen promising growth in recent years due to its increasing popularity among customers, which is expected to result in a 20 percent increase in disbursements (Birruntha, 2020). Ar-Rahnu allows individuals to secure short-term financing by pledging valuables like gold as collateral to banks or Islamic pawnshops. It is particularly popular among those with medium and lower incomes who need financial support, especially during times of economic uncertainty like the COVID-19 pandemic or recession (Muhamad et al., 2019). Advantages of Ar-Rahnu include low financing costs, shorter waiting periods, and lower service charges (Azman et al., 2020). However, the retention rate among users remains a concern as it is often only used in times of financial insecurity (Yahaya & Mohamad, 2019), unlike more mainstream financing products offered by commercial banks.

Previous research has investigated the factors that influence customer usage of the Ar-Rahnu financing product in Malaysia. Customer service has been identified as a key element that affects customers' intention to use Ar-Rahnu, with an efficient borrowing process being important for customer satisfaction (Baharum et al., 2015). Customers have also shown concern about the Shariah elements of the product to ensure that their transactions are ethical (Azim et al., 2018). The convenience of proximity to Ar-Rahnu branches emerged as a significant driver of customer acceptance in a recent study, particularly for low-income customers who prefer to have Ar-Rahnu locations nearby for easy access via public transportation, home, workplace, and malls (Indra et al., 2021). While these factors have been shown to increase usage of Ar-Rahnu products, it is unclear how they affect the retention of customers.

Building customer loyalty in Islamic financial contexts necessitates educating them about Ar-Rahnu principles, particularly regarding designated institutions for borrowing and the ethical sourcing of funds (Koe & Rahman, 2014). A strong faith and belief in Islam can increase interest in using the Ar-Rahnu service. Several recent studies have shown the role of religiosity in customer retention (D. W. I. Suhartanto et al., 2018; Kusumawati et al., 2020; Madun et al., 2022).

Having awareness about a product would give customers some edge in understanding the product before they decide to purchase it. In the case of the Ar-Rahnu facility in Malaysia, customers already had some awareness of the product, but only in regards to its Shariah-compliant nature. Previous studies have looked at factors that may increase awareness, such as customer service (Hamid et al., 2014), location (Indra et al., 2021), and advertisement (Amin et al., 2007). However, it is not clear how these factors would encourage customers to stay with Ar-Rahnu providers. Research has shown that awareness can have an impact on Ar-Rahnu retention, with previous studies indicating that awareness serves as a significant moderator for behavioral intentions (Daniali et al., 2022; Zhang & Ahmad, 2021). To solidify the relationship between awareness and retention in Ar-Rahnu, more empirical studies are crucial, specifically examining awareness as a potential moderator.

Building on the existing literature, this study investigates two key questions: How does religiosity influence customer retention? And does customer awareness moderate this relationship? The paper unfolds with a review of relevant research, followed by our methodology, results analysis, and contributions to both theory and practice. While recognizing remaining gaps, the study lays out compelling areas for further investigation.

Review of Literature

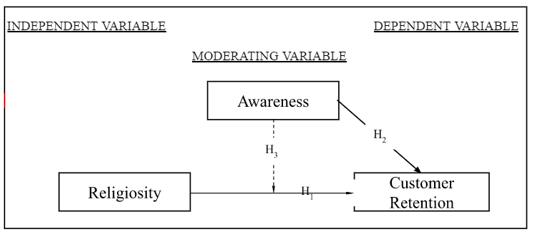

Drawing on principles of religiosity, this study explored the underlying mechanisms influencing customer retention. The core tenet is that adhering to religious values, such as obeying Allah's commands and avoiding prohibitions, fosters a sense of spiritual fulfillment, translating into loyalty towards businesses perceived as aligned with one's faith, encapsulating and traditions that contribute to ethical living, personal growth, and a strengthened relationship with the faith. (Al-Jawziyyah, 2001; Al-Muhasibi, 2003). Consequently, equipping themselves with the Islamic knowledge would boost their confidence in making appropriate decisions (Islam & Chandrasekaran, 2020). Other than the direct relationship of religiosity towards customer retention of Ar-Rahnu product, the moderating role of awareness was observed with the assumption that higher level of awareness could further strengthen the retention rate of customers subscribing an Ar-Rahnu facility.

Religiosity

Religious beliefs and practices demonstrably influence consumer behavior and choices regarding products and services (Agarwala et al., 2019; Suaidi & Raja Hisham, 2022). This factor's influence stretches across diverse settings, with examples documented in areas like Islamic products and services (D. W. I. Suhartanto et al., 2018), fashion stores (Kusumawati et al., 2020), halal products (D. Suhartanto et al., 2021; Madun et al., 2022), and employees of mamak restaurants (Suaidi & Raja Hisham, 2022). However, its role in customer retention for Ar-Rahnu financial institutions, a unique financial system rooted in Islamic principles, remains understudied. Building upon the aforementioned development, the following hypothesis emerges:

H1: Religiosity has a positive effect on customer retention.

Moderating Effect of Awareness

Awareness refers to a way one experiences themselves as a reaction to a situation. Previous research has identified a lack of awareness about Ar-Rahnu products among customers, leading to low acceptance and retention rates (Yahaya, 2020; Yahaya & Mohamad, 2019). However, increasing awareness about a product could lead to higher acceptance and retention rates (Azim et al., 2018). Awareness has emerged as a potential moderator in diverse contexts, impacting relationships like technology and 4.5G intention (Daniali et al., 2022) or CSR and purchase intention (Zhang & Ahmad, 2021). However, its role in rural farmers adopting mobile government services remains unclear (Mandari & Chong, 2018). This study builds on this evidence to explore awareness as a potential moderator between religiosity, reputation, and customer retention for Ar-Rahnu products. Therefore, this study hypothesizes that:

H2: Awareness has a positive effect on customer retention.

H3: Awareness moderates the relationship between religiosity and customer retention.

This study used the literature shown in Figure 1 as the basis for developing the research model.

Research Methods

This study employed a survey design for data collection. Researchers distributed questionnaires to existing customers of Ar-Rahnu Yayasan Pembangunan Ekonomi Islam Malaysia (YaPEIM) through convenience sampling, relying on their willingness to participate. With a unit of analysis focused on YaPEIM customers, researchers distributed 420 questionnaires, successfully collecting 350 for a response rate of 83.3%. Data screening procedures identified 23 influential outliers, which were excluded from the final dataset. Therefore, 327 observations were usable for further analysis of the research model.

The instrument's design is modular, comprised of five distinct sections: Section A, Section B, Section C, and Section D. Section A outlined respondent demographics: gender, age, marital status, education, job type, and income level. Section B refers to awareness scale with a total of five items that was adopted from (Ambali & Bakar, 2014). Section C refers to customer retention scale adapted from (Hanaysha, 2017; Woon et al., 2015), consisting of seven items. Section D refers to the religiosity scale which consist a total of five items adjusted from (Amin, 2011).

The analysis procedures unfolded in two stages. Initially, this study used SPSS for preliminary exploration before diving into advanced testing with PLS-SEM via SmartPLS 4 (Ringle et al., 2022). This involved evaluating the measurement model's internal consistency and validity (Hair et al., 2019; Ramayah et al., 2016), constructing a structural model with bootstrapping for path significance and in-sample prediction, and assessing the model's predictive relevance (Shmueli et al., 2019). Finally, this study employed moderation analysis to investigate the moderator's interaction effect on the target construct.

Findings

The study's participants painted a picture of: predominantly females (71.9%), concentrated in the 31-40 age bracket (45.6%), mostly married (80.4%), with secondary education as the most common (51.4%), employed primarily in the private sector (38.6%), and a significant portion (22.9%) earning under RM 1,500. Table 1 details the participant demographics.

Before jumping into model testing, this study assessed multivariate normality using skewness and kurtosis (Cain et al., 2017; Hair et al., 2017). Running the analysis through https//webpower.psychstats.org/models/kurtosis, revealed the non-normality in the data. Mardia's tests solidified this ( = 3.374, 0.001 for skewness; = 29.001, 0.001 for kurtosis). Due to this deviation, PLS-SEM emerged as the preferred approach for further analysis.

Given the risk of common method bias inherent in self-reported data, this study employed Harman's Single Factor test to assess its potential influence. The extracted variance of 43.1% remained well below the recommended threshold of 50% (Podsakoff et al., 2003), providing substantial evidence that CMB is not a major concern in this study's data. Consequently, common method bias is unlikely to significantly impact our findings, allowing for valid inferential analysis.

Measurement Model

To verify the model's ability to precisely reflect the defined constructs, this study performed a rigorous assessment of its psychometric properties: internal consistency reliability, indicator reliability, convergent validity, and discriminant validity (results in Table 2). Composite reliability values exceeded the 0.70 threshold recommended by Henseler et al. (2016), confirming satisfactory overall construct reliability. Additionally, each item demonstrated suitable loading onto its respective construct, as evidenced by outer loadings exceeding 0.50 (Ramayah et al., 2016). Furthermore, all constructs achieved an average variance extracted (AVE) exceeding 0.50, surpassing the widely accepted standard for convergent validity (Hair et al., 2013). This comprehensive evaluation provides compelling evidence for the model's strong reliability and validity. Consequently, given the adherence to CR and AVE requirements, no item deletions were required.

To ensure discriminant validity, constructs must differ statistically from one another. A common method for assessing discriminant validity involves comparing the relative magnitudes of square root AVE values and off-diagonal elements of the covariance matrix (Fornell & Larcker, 1981; Hair et al., 2014). Table 3 presents compelling evidence for discriminant validity. Following Henseler et al. (2015)'s recommendation, HTMT values below 0.85 were employed to verify the distinctness of the constructs. The current analysis confirms that all HTMT values fall within this acceptable range. This strengthens the overall validity and confidence in the model (Hair et al., 2017).

Structural Model

Addressing a potential threat to hypothesis testing, this study evaluated the possibility of multicollinearity within the model's predictors using VIFs. Thankfully, all VIFs fell below the stringent 3.3 threshold (Kock, 2015), mitigating concerns about inflated standard errors and potentially biased results due to collinearity. This absence of severe multicollinearity also reduces the likelihood of method bias influencing the model's findings.

The researchers assessed the model's accuracy and robustness through a combination of statistical techniques, including R-squared analysis, effect size estimation, bootstrapping, and predictive validity testing. By quantifying the proportion of variance in the target construct captured by the predictor variables, R² provided an overall assessment of the model's ability to explain the variation observed. In addition, f² assessed the effect size of individual predictors, providing insights into their relative influence on the target. Path coefficients, estimated via bootstrapping with 5,000 samples for enhanced reliability, delineated the strength and direction of relationships between variables within the model. Finally, The Stone-Geisser Q² statistic provided an estimate of the model's cross-validated predictive power, indicating its ability to replicate outcomes in real-world contexts. Refer to Table 4 for a detailed overview of the results.

The adjusted R2 for performance is 0.690, indicating that 69 percent of the variance in RET can be explained by RLG and AWA. This suggests that the model has a substantial strength. The f2 results show that awareness has the highest effect size (0.228), suggesting that AWA has the strongest impact on the variance of RET. AWA was found to have a positive effect on RET in the model ( = 0.338, t = 6.607), supporting H2. However, RLG did not exert a statistically significant effect on RET ( = 0.058, t = 1.547), indicating that H1 is not supported. A substantial Q2 value of 0.678, well above the minimum, points to the entire model's strong predictive capability.

The influence of RLG on RET was explored, focusing on AWA as a potential moderator. RLG stands out as a key driver of RET, with an adjusted R-squared of 0.613 in the absence of the moderator, signifying that it accounts for 61.3% of the observed variation. When the interaction term (RLG*AWA) was included, the adjusted R2 increased to 0.690, indicating an additional 7.7 percent of the variance in RET is explained. Table 5 shows that although the inclusion of AWA improved the R2 of the model, the path coefficients for the interaction effects were not significant for RLG ( = 0.012, t = 0.309), which means that there is no moderation effect of AWA in this study. This result does not support H3.

Discussion

Ar-Rahnu is a popular alternative for quick liquidity, but it is mostly used during financial turmoil rather than normal times. This study highlighted that religiosity and awareness are crucial in convincing customers to continue using Ar-Rahnu financing. The study's model and assumptions were validated and the in-sample variance had an adjusted R2 of 69 percent for customer retention, indicating that religiosity and awareness are major contributors. The findings align with a similar study by Baharum et al. (2015) in the context of Ar-Rahnu customers.

Contrary to some expectations, religiosity had little to almost no impact on customer retention in this study, which is inconsistent with the study's expectation that religiosity would at least increase the chance to retain its customers. The outcome suggests that many customers of Ar-Rahnu do not place a high level of importance on their religious beliefs when using the service, seeing it as a spiritual obligation that they are obliged to fulfil as Muslims. Similarly, a study on halal cosmetic products found that Ar-Rahnu customers also view the halal aspect as less important, as they are more focused on obtaining cash quickly for personal consumption (D. Suhartanto et al., 2021).

This study found that awareness has a direct and significant effect on customer retention, which aligns with Mandari and Chong (2018). The study also posits awareness as a moderator variable that might influence the relationship between religiosity and customer retention. It was hypothesized that a high level of awareness would further strengthen the impact of religiosity in retaining customers. Although awareness was not found to be a significant moderator of customer retention in this study, echoing the observations of Mandari and Chong (2018), other variables emerged as influential. This discrepancy could be attributed to the fact that direct initiatives to keep customers aware of Ar-Rahnu products may be sufficient to convince them to remain loyal. Additionally, the issue of low awareness may not be a pressing concern as providers have been consistently promoting Ar-Rahnu products on various platforms to reach existing and new customers.

Conclusion

This study expands the theoretical boundaries of customer retention research by introducing awareness as a moderator in the context of Ar-Rahnu products. Our findings deepen our understanding of the interplay between individual faith, product awareness, and long-term engagement within this specific Islamic banking setting. The outcomes of this study demonstrate that customer retention can be tremendously improved through regular efforts to increase awareness of the product. Providers should make sure that the public has access to comprehensive information about alternative sources of financing.

This study highlights key factors that practically contribute to better customer retention, particularly in the context of Ar-Rahnu financing. Today's Ar-Rahnu customers are increasingly aware of their options. This underscores the crucial role of awareness in customer retention – keeping Ar-Rahnu on their radar amidst a diversified market. To stand out, Ar-Rahnu management should move beyond brand reliance and prioritize innovative product offerings catering to diverse income levels, thus actively attracting new customers and keeping existing ones engaged. To this end, the study suggests maximizing the use of digitalization in order to facilitate the application process and increase visibility on social media platforms. Additionally, the study recommends conducting awareness campaigns by inviting personnel or influencers to act as ambassadors and promote Ar-Rahnu, highlighting its importance and the Islamic values that underpin the product.

This study raises two key points that call for further research in this field. Firstly, the research was unable to obtain a list of customers for the purpose of random sampling due to the confidentiality of customers under the Personal Data Protection Act 2010 (Act 7019). Secondly, this study presents awareness as a moderator in predicting customer retention, future research may consider exploring awareness as a mediator to understand its ability in predicting customer retention.

References

Agarwala, R., Mishra, P., & Singh, R. (2019). Religiosity and consumer behavior: a summarizing review. Journal of Management, Spirituality & Religion, 16(1), 32-54. DOI:

Al-Jawziyyah, I. Q. (2001). Ṭibb al-Qulūb. Susunan semula Ṣāliḥ Aḥmad al-Syāmī. Dār al-Qalam.

Al-Muhasibi, A. A. A. H. (2003). Tahqiq Abd al-Qadir Ahmad Ata’ (Al-Wasaya) [Verified by Abdul Qadir Ahmad Atti’ (The Commandments)]. Dar al-Kutub al-Ilmiah.

Ambali, A. R., & Bakar, A. N. (2014). People's Awareness on Halal Foods and Products: Potential Issues for Policy-makers. Procedia - Social and Behavioral Sciences, 121, 3-25. DOI:

Amin, H. (2011). Modelling ar-rahnu use in eastern Malaysia: Perspectives of Muslima. Journal of Islamic Economics, Banking and Finance, 7(3), 63–76.

Amin, H., Chong, R., Dahlan, H., & Supinah, R. (2007). AN AR-RAHNU SHOP ACCEPTANCE MODEL (ARSAM). Labuan e-Journal of Muamalat and Society (LJMS), 1, 82-94. DOI:

Azim, Z. A. Z., Ghazali, A. S. M., Mohamed, J., Kassim, A. A. M., & Hussain, H. I. (2018). Assessing the key success of Ar Rahnu usage in Malaysia. International Journal of Engineering & Technology, 7(4.29), 46–49.

Azman, N. H. N., Zabri, M. Z. M., Kassim, S. H., & Malim, N. A. K. (2020). Unleashing the Ar-Rahnu as a Micro-Financing Instrument for Micro-Entrepreneurs in Malaysia. International Journal of Academic Research in Business and Social Sciences, 10(6). DOI: 10.6007/ijarbss/v10-i6/7277

Baharum, N. N. B., Maamor, S., & Othman, A. (2015). Examining the Factors That Influence Customer's Intention to Use Ar-Rahnu at Post Office: A Case Study in Kedah. Journal of Islamic Economics Banking and Finance, 11(4), 86-99. DOI:

Birruntha, S. (2020). Bank Rakyat eyes 20% growth in Ar-Rahnu loan disbursement. The Malaysian Reserve. https://themalaysianreserve.com/2020/07/16/bank-rakyat-eyes-20-growth-in-ar-rahnu-loan-disbursement/

Cain, M. K., Zhang, Z., & Yuan, K.-H. (2017). Univariate and multivariate skewness and kurtosis for measuring nonnormality: Prevalence, influence and estimation. Behavior Research Methods, 49(5), 1716-1735. DOI:

Daniali, S. M., Barykin, S. E., Zendehdel, M., Kalinina, O. V., Kulibanova, V. V., Teor, T. R., Ilyina, I. A., Alekseeva, N. S., Lisin, A., Moiseev, N., & Senjyu, T. (2022). Exploring UTAUT model in mobile 4.5G service: Moderating social–economic Effects of gender and awareness. Social Sciences, 11(187), 1–13.

Fornell, C., & Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18(1), 39. DOI:

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2014). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). SAGE Publications, Inc.

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2017). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM): Second Edition. SAGE Publications, Inc.

Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. DOI:

Hair, J. F., Jr., Ringle, C. M., & Sarstedt, M. (2013). Partial Least Squares Structural Equation Modeling: Rigorous Applications, Better Results and Higher Acceptance. Long Range Planning, 46(1-2), 1-12. DOI:

Hamid, M. A., Rahman, I. A., & Halim, A. N. A. (2014). Factors affecting the acceptance on Ar-Rahnu (Islamic based pawn broking): A case study of Islamic banking in Malaysia. The Macrotheme Review, 3(4), 22–35.

Hanaysha, J. R. (2017). An examination of marketing mix elements and customer retention in Malaysian retail market. American Journal of Marketing Research, 3(1), 1–7.

Henseler, J., Hubona, G., & Ray, P. A. (2016). Using PLS path modeling in new technology research: updated guidelines. Industrial Management & Data Systems, 116(1), 2-20. DOI:

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115-135. DOI:

Indra, N. A. F. M., Mahussin, N., Ismail, K., Mustafa, H., Awang, M. D., & Abdullah, A. A. (2021). Ar-Rahnu Scheme Among Low-Income Civil Servants in Malaysian Public Universities. International Journal of Academic Research in Business and Social Sciences, 11(12). DOI:

Islam, T., & Chandrasekaran, U. (2020). Religiosity and consumer decision making styles of young Indian Muslim consumers. Journal of Global Scholars of Marketing Science, 30(2), 147-169. DOI:

Kock, N. (2015). Common Method Bias in PLS-SEM: A Full Collinearity Assessment Approach. International Journal of e-Collaboration, 11(4), 1-10. DOI:

Koe, W.-L., & Rahman, N. Z. A. (2014). The use of Ar-Rahnu by Islamic bank customers in Malaysia. In A. Kasim, W. S. A. Wan Omar, N. H. Abdul Razak, N. L. Wahidah Musa, R. Ab. Halim, & S. R. Mohamed (Eds.), Proceedings of the International Conference on Science, Technology and Social Sciences (ICSTSS) 2012 (pp. 11–18). Springer Singapore.

Kusumawati, A., Listyorini, S., Suharyono, & Yulianto, E. (2020). The role of religiosity on fashion store patronage intention of Muslim consumers in Indonesia. SAGE open, 10(2), 2158244020927035. DOI:

Madun, A., Kamarulzaman, Y., & Abdullah, N. (2022). The mediating role of consumer satisfaction in enhancing loyalty towards Malaysian halal-certified food and beverages. Online Journal of Islamic Management and Finance, 2(1), 1–20. DOI:

Mandari, H., & Chong, Y.-L. (2018). The Moderating Effects of Awareness on Antecedents of Behavioral Intention to adopt Mobile Government Services: The Moderating Effects of Awareness. International Journal of E-Adoption, 10(2), 50-69. DOI:

Muhamad, H., San, O. T., Katan, M. H., & Ni, S. W. (2019). Factors that influence the customers’ perception towards Ar-Rahnu (Islamic pawn broking product) in Selangor, Malaysia. International Journal of Academic Research in Accounting, Finance and Management Sciences, 9(2), 126–137.

Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879-903. DOI:

Ramayah, T., Cheah, J., Chuah, F., Ting, H., & Memon, M. A. (2016). Partial Least Squares Structural Equation Modeling (PLS-SEM) using SmartPLS 3.0: An Updated and Practical Guide to Statistical Analysis. Pearson Malaysia Sdn Bhd.

Ringle, C. M., Wende, S., & Becker, J.-M. (2022). SmartPLS 4. Oststeinbek: SmartPLS GmBH. https://www.smartpls.com/

Shmueli, G., Sarstedt, M., Hair, J. F., Cheah, J.-H., Ting, H., Vaithilingam, S., & Ringle, C. M. (2019). Predictive model assessment in PLS-SEM: guidelines for using PLSpredict. European Journal of Marketing, 53(11), 2322-2347. DOI:

Suaidi, A. M., & Raja Hisham, R. R. I. (2022). An empirical assessment of religiosity and motivation on employees’ job performance: The perspective of Indian Muslim (mamak) restaurants in Sarawak. International Journal of Islamic Business, 7(1), 51–60. DOI:

Suhartanto, D. W. I., Farhani, N. H., & Muflih, M. (2018). Loyalty Intention towards Islamic Bank: The Role of Religiosity, Image, and Trust. International Journal of Economics & Management, 12(1).

Suhartanto, D., Dean, D., Sarah, I. S., Hapsari, R., Amalia, F. A., & Suhaeni, T. (2021). Does religiosity matter for customer loyalty? Evidence from halal cosmetics. Journal of Islamic Marketing, 12(8), 1521-1534. DOI:

Woon, C. L., Kee, L. K., Hwee, T. G., Lee, T. L., & Cheng, T. S. (2015). Factors influencing customer loyalty in airline industry in Malaysia [Project Paper]. University Tunku Abdul Rahman.

Yahaya, S. (2020). Intrinsic Factors Affecting the Acceptance of Muslim Small Entrepreneurs in Kelantan Towards Ar-Rahnu. International Journal of Business and Society, 21(2), 507-520. DOI:

Yahaya, S., & Mohamad, S. S. (2019). Factors influence the acceptance of Al-Rahn among entrepreneurs. Academy of Entrepreneurship Journal, 25(2), 1–6.

Zhang, Q., & Ahmad, S. (2021). Analysis of Corporate Social Responsibility Execution Effects on Purchase Intention with the Moderating Role of Customer Awareness. Sustainability, 13(8), 4548. DOI: 10.3390/su13084548

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 May 2024

Article Doi

eBook ISBN

978-1-80296-132-4

Publisher

European Publisher

Volume

133

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1110

Subjects

Marketing, retaining, entrepreneurship, management, digital marketing, social entrepreneurship

Cite this article as:

Hisham, R. R. I. R., Yusuf, Y. H. M., & Nowalid, W. A. W. M. (2024). Religiosity Towards Ar-Rahnu Customer Retention: The Moderating Role of Awareness. In A. K. Othman, M. K. B. A. Rahman, S. Noranee, N. A. R. Demong, & A. Mat (Eds.), Industry-Academia Linkages for Business Sustainability, vol 133. European Proceedings of Social and Behavioural Sciences (pp. 151-161). European Publisher. https://doi.org/10.15405/epsbs.2024.05.13