Abstract

The article examines the results of financial support in the Russian Federation for the import substitution of agricultural raw materials and food, and suggests measures to improve and expand the forms and methods of financial support for the agro-industrial complex, including direct budget financing, lending, tax price regulation, investment, customs and tariff regulation. Over the past 6 years, over 1.6 trillion roubles have been allocated to support the import substitution of agricultural raw materials and food. As a result, 1.2 thousand projects were implemented, 80% of which reached the stage of mass production. Agriculture of the Russian Federation today is a steadily developing industry that is able to provide food and agricultural raw materials not only to residents of Russia, but also to residents of other countries. However, the agro-industrial complex is not without problems, which were especially evident during the spread of the coronavirus. The more products are produced, the more acute the question of their sale becomes. Financial support for the export of raw materials and finished products from the Russian Federation is needed to maintain the growth rate of production and ensure the return on investment. In Russia, it is necessary to adopt a centralized program for the creation of agro-logistics infrastructure, and the infrastructure of a new format based on digital technologies, which would include all the functionality of sales, logistics, as well as a single information space for the entire country.

Keywords: Agribusiness, export, financial support, import of agricultural raw materials and food, import substitution, incentives

Introduction

The relevance of this study is due to the fact that under the sanctions and the food embargo imposed by Western countries, import substitution has become the most important strategic task, by which the state can financially support Russian agribusiness. At the same time, the implementation of the strategy of financial support for import substitution involves various forms and methods of financial incentives for the Russian agribusiness. They increase the competitiveness of the industry through the introduction of innovations and the use of energy-saving technologies in the domestic market, including direct budget support, lending, tax price regulation, procurement and commodity interventions, customs and tariff regulation. Over the last 6 years, the dynamics of the agricultural raw material base has created the necessary prerequisites for the growth of food produce filling the domestic market with Russian products, and it has improved the structure of the country’s foreign trade balance.

The analysis of the production volumes of pork and poultry meat, sugar, vegetable oil, flour and cereals, confectionery, starch and a number of other industries has shown that in recent years there has been an overproduction in these industries. At the same time, the implementation of new investment projects in agribusiness is continuing. In order to maintain the accumulated growth rates of agricultural raw materials and foodstuffs and ensure the return on investment in agribusiness, it has become necessary to financially support the export of raw materials and finished products from Russia, in order to increase the export of domestic products to the countries of the near and far abroad. The issues of financial support for import substitution in the Russian Federation have been discussed in the works of Borodkina et al. (2015), Minakov (2017), Minakov and Sytova (2020), Kulikov et al. (2020), Petrikov (2016), Ivanova (2016), Drobot (2016), etc.

Problem Statement

Research of directions and forms of financial support for import substitution in the Russian Federation in modern conditions, development of effective mechanisms for stimulating agricultural producers, evaluation and application of best practices of financial support for import substitution in the production of domestic food. Modern conditions of formation of short-and long-term development strategy for financial support of import substitution of agricultural raw materials and food allowed one to perform administrative decisions of the state, and to determine the statistical data characterizing the process of import substitution. Besides, it allowed one to identify the main factors influencing the growth of domestic production of agricultural raw materials and food, to justify the increased role of the state in the implementation of financial support of import substitution and show conditions. These conditions are necessary for the formation of a favourable economic environment in Russia to change the development paradigm from import substitution to an export-oriented model.

Research Questions

Financial support for the import substitution of agricultural raw materials and food by the state during the period of sanctions from Western countries and the food embargo was a key factor in the modernization of the country's agro-industrial complex, which provided the necessary prerequisites for the growth of food production and filling the Russian market with domestic products. In the conditions of rapid globalization of the world market, it is possible to ensure food security and solve the problem of import substitution only by increasing the competitiveness of Russian agricultural products through the introduction of innovative and resource-saving technologies. In modern economic conditions, the development of the country and the world to maintain the momentum of growth of food and to provide a return-on-investment in agriculture, the need for financial support of export of agricultural raw materials and finished products from Russia.

Purpose of the Study

The purpose is to assess the value and significance of financial support for import substitution of agricultural raw materials and food during the period of sanctions from Western countries and the food embargo as a strategic task of the state to financially stimulate the domestic agro-industrial complex. The task is to identify the main financial and economic problems that hinder the process of import substitution of agricultural raw materials and food, the need to strengthen financial support from the state, as well as the rationale for the main forms and methods of state incentives for import substitution.

Research Methods

The research materials were statistical data and analytical information from ROSSTAT, the Ministry of Agriculture of the Russian Federation, the Federal Customs Service of the portal of foreign economic information. These also include regulatory legal acts of federal and regional authorities on financial support for the agribusiness and the implementation of the strategy for the development of import substitution of agricultural raw materials and food produce, as well as the authors’ considerations.

The methodological and theoretical basis of the study is the studies of domestic and foreign scientists on the theory and practice of financial support of the import substitution strategy in the country. The research used the methods of system analysis, economic-statistical methods, abstract-logistic methods, expert assessments, analysis and synthesis of the data obtained through the principles of interconnectedness, consistency and proportionality.

Findings

Over the eight years that have passed since the adoption of the strategic import substitution program in the Russian Federation for the period up to 2020, significant changes have taken place on the food market (2012). In August 2014, Russia imposed restrictions on the supply of products from the USA, the European Union, Canada, Australia and some other countries after the imposition of the embargo on products from these countries. Russia refused to buy meat and dairy products, fruits and vegetables from the above-mentioned countries (Kuzmin, 2014). Over the past 6 years, more than 1.6 trillion Russian roubles has been allocated in Russia to support import substitution. In August 2015, the Russian government created an import substitution commission by its decree. The government also identified a strategic list of products with the highest priority of import substitution in the key sectors of the agribusiness. This list was mainly of a recommendatory nature, but provided for the gradual replacement of imported products with Russian counterparts. It must be admitted that rather tough protective measures were immediately taken in agriculture: customs control at the border was strengthened, agricultural products from the United States, the European Union, Canada and Australia that entered the territory of Russia were subjected to destruction.

Over the past 8 years, 1.2 thousand projects have been initiated and implemented, 80% of which have been put into serial production. For example, the Tambov region over the past 6 years has risen from the 10th to the 2nd position in meat production in the Russian Federation. To achieve such results, more than 48 billion Russian rubles of investments were directed, which made it possible to build 7 large complexes for the production of livestock products. The third stage of pig-breeding complexes of Tambov Bacon LLC was built in Zherdevsky, Znamensky and Sampur districts with a capacity of 65 thousand tons of pork meat per year, the volume of investments amounted to 12 billion Russian rubles, 450 new jobs were created. The region produces 193 kilograms of pork for each inhabitant of the region at a medical consumption rate of 18 kilograms, which is 10.7 times higher than the consumption rate. Also, projects for the production of poultry meat by OOO Tambovskaya Indeyka and OOO Tokarevskaya Poultry Farm were implemented. The Tambov Region got the opportunity to produce up to 70 thousand tons of turkey meat per year, having secured its absolute leadership in this indicator in Russia. In addition, in the region over the past 6 years, modern dairy projects have been implemented: JSC “Golitsyno” in the Nikiforovsky region and LLC “Zolotaya Niva” in the Znamensky district, as well as fish farming businesses - LLC “Tambov sturgeon” in the Tambov region and LLC Agro-M in the Michurinsky region.

In 2019, the first phase of a greenhouse facility was commissioned in Michurinsk on an area of more than 30 hectares, the volume of investments amounted to 20 billion russian rubles, and the second phase is currently under construction. After the completion of all phases of construction, the area of the greenhouse facility will be about 100 hectares, and the total investment will reach 38 billion Russian rubles. Upon completion of the full construction, the facility will produce up to 85 thousand vegetables per year. At the same time, the second phase of the largest flour mill in the Russian Federation was built and put into operation on the territory of the region, which made it possible to increase the production of flour and cereal products from 600 thousand to 1,250 thousand tons, or more than 2 times. This makes it possible to process more than 1/3 of the grain produced in the region, which amounts to approximately 3.5 million tons of grain per year.

The construction of a wholesale distribution center for storage and primary processing of fruits and vegetables with a capacity of 500 thousand tons is nearing completion in the town of Kotovsk, the volume of investments will amount to more than 3 billion Russian rubles. Since 2015, more than 80 billion Russian rubles has been invested in the agribusiness of the region and more than 50 large business projects have been implemented.

In the Krasnodar Territory, since 2015, more than 200 large business projects have been implemented in the agribusiness; more than 120 billion Russian rubles of investments has been allocated for the implementation of these projects. Over the past six years, agricultural production in Kuban has grown by a quarter. During this time, about 300 new products appeared in the region: cheeses, wines, meat delicacies, confectionery and much more. Exports of agricultural products are also growing in the region, for example, exports of poultry meat increased eightfold, and confectionery exports quadrupled.

In Tatarstan, over the years of sanctions and embargo, grain production increased from 2.6 million tons in 2013 to 5.4 million tons in 2020, or 2.1 times, and fruit and berry products increased 1.4 times. Over the past 8 years, Tatarstan has made a great contribution to the development of seed production: over these years, 47 new varieties of agricultural crops have been created, 43 of them are included in the state register, 23 are undergoing state testing. In recent years, about 70% of the sown area in the republic has been occupied by varieties created in the region.

In the Astrakhan region, over the past 6 years, the production of vegetables has grown by 40%. The Astrakhan region began to export grain, meat, fish, vegetables to countries such as China, Iran, Turkey, Kazakhstan, Egypt and other states. Over the past six years, the volume of agricultural production has grown by a quarter.

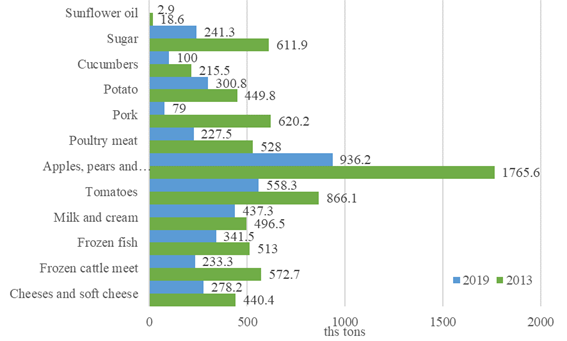

As can be seen from Figure 1, over six years of sanctions and food embargo on the food market, it was possible to significantly reduce the imports of most basic types of food.

Since 2013, Russia has reduced imports of pork almost 10 times, cattle meat – 2.5 times, poultry meat – almost 2 times, vegetables and dairy products – more than a third. At present, Russia 100% meets the needs of the domestic market for pork and for the first time in the last 30 years has stopped pork imports. Russia has become an exporter of pork to other countries. In 2020, pork exports amounted to about 200 thousand tons, which is twice as much as in the previous year. The main importers of Russian pork are the CIS countries and the Asian region countries. By the end of 2023, it is planned to bring pork imports from Russia to 500 thousand tons per year. Over the past six years, the volume of agricultural production in Russia has increased by 25%. The country is fully self-sufficient in basic foodstuffs. The country began to produce some agricultural products much more than it consumes. For example, Russia produces 1.75 times as much vegetable oil as it needs, grain - 1.5 times, sugar – by a quarter. The production volumes for all major types of agricultural products have grown. In 2013, 92.4 million tons of grain were produced, but in 2020 the gross grain harvest in net weight amounted to 133.03 million tons, soybeans were grown almost 3 times as much (4.4 million tons in 2020 against 1.5 million tons in 2013). The production of fruits and berries increased 5 times from 678 thousand tons in 2013 to 3.58 million tons in 2020, the amount of Russian greenhouse vegetables more than doubled (from 538 thousand tons to 1.14 million tons). Production of pigs for slaughter increased from 3.6 million tons in 2013 to 5.03 million tons in 2020, and poultry meat production, respectively, from 5.25 million tons to 6.7 million tons. According to Rusprodsoyuz, the share of Russian food in chain stores is currently over 80%, whereas five years ago, every third product on store shelves was imported.

The Russian Federation is fully self-sufficient in grain, vegetable oil, sugar, meat and many other products, but it does has not reached the required level of self-sufficiency in three areas: milk, potatoes and vegetables (Table 1).

In 2020, in Russia, domestic production of foods prohibited from import from the Eurozone countries was 2.6 times higher than the volume of imports from countries that did not fall under the sanctions. A significant increase in the cost of imports of products, also led to a significant increase in the cost of imported products, as well as to the indicated years (2013-2020) the increase was 24.5%, which resulted in a decrease in disposable cash incomes of the population. By the end of 2020, real disposable incomes were 11% lower than in 2013 (in 2020, incomes decreased by 5%). But prices increased not only for the foods imported into Russia, but also for most foods produced in the Russian Federation (Table 2).

Today, Russian agricultural producers are highly dependent on foreign suppliers. The share of imported goods in the price of Russian products may exceed 50%. This includes equipment, seeds, animal feed and additives, fertilizers and herbicides. The share of machinery and equipment in the structure of imports has remained practically unchanged over six years: according to Rosstat, in 2018 it amounted to 46.9% against 48 % in 2013.

Process for frozen fish increased most of all (201%) or more than 2 times, butter (98%), white cabbage (85%). Also flour and pasta rose in price by 25-35%, sunflower oil by 45%, which were produced in sufficient quantities before the sanctions. Therefore, although Russians began to buy more domestic products, they had to pay more for them.

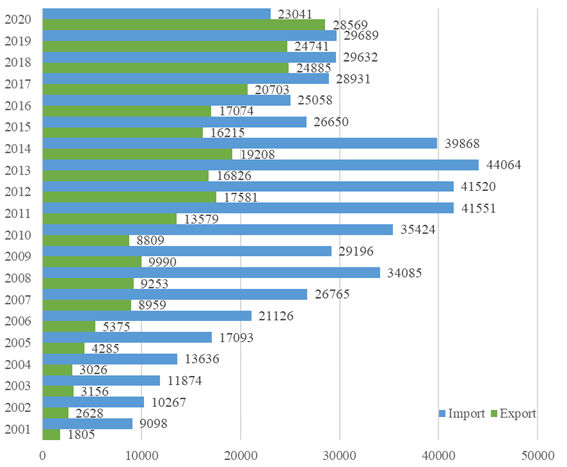

Over the past 6 years, the Russian Federation was not only able to ensure food security, but has also become one of the key players in the global food market. Before the imposition of sanctions and embargoes, Russia imported 2.5 times more agricultural products than it exported. At present, the situation has changed dramatically - exports from Russia of agricultural products and imports to Russia have practically become equal, and in 2020 export supplies of foods from Russia exceeded imports to Russia (Fig. 2).

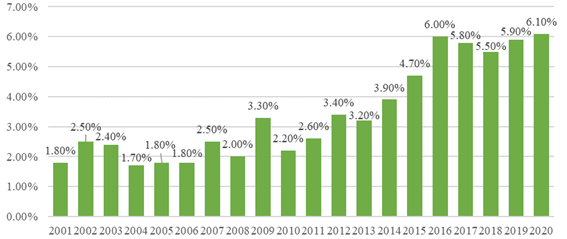

Exports of food and agricultural raw materials from Russia in 2020 reached $ 28,569.0 million, against $ 24,741.4 million in 2019 and increased by 16%, and for the first time in the last 30 years exceeded imports by almost a quarter. According to the AB-Center, the share of foods in the value of exports from Russia fluctuated at around 5.5-6.1%, while in 2009-2013 it was just over 3% or almost doubled.

The agribusiness in Russia is one of the few spheres of the real sector of the economy that supplies competitive products to the global market (Fig. 3).

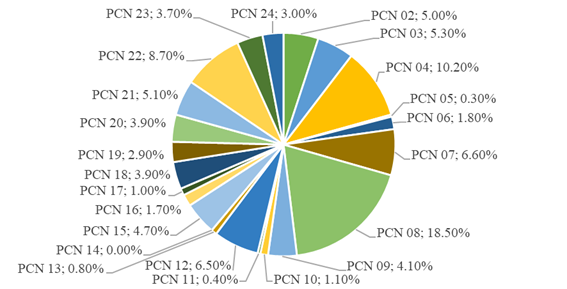

The past 6 years have marked an increase in export supplies of agricultural raw materials and food in Russia. In 2020, the export of agricultural raw materials and foodstuffs reached $ 28,569 million, which was 1.7 times more than in 2013. In 2020, the main export items of agricultural raw materials and foodstuffs from Russia were:

(1) Grain: mainly wheat, corn and barley. Grain exports from Russia in 2020 in value terms amounted to 45% of the total export of agricultural raw materials and food in the amount of 12,856.1 million dollars - 64,280.3 thousand tons.

(2) Seeds of oilseeds, vegetable oils, sprats and oilcakes. In 2020, the total value of exports from Russia of these goods amounted to 5,687.6 million dollars, which amounted to 18.5% of the total value of exports of agricultural raw materials and foodstuffs.

(3) Fish and seafood. In 2020, exports from Russia for this commodity group, according to Ab-Center's calculations, were estimated at $ 4,698.9 million, or 16.1% of the total export amount.

The TOP-3 of the above enlarged groups in 2020 accounted for 79.6% of all supplies of agricultural raw materials and food abroad. However, it should be noted that in recent years the share of products with higher added value has increased and, accordingly, the export of finished products and processed raw materials has grown significantly.

The following export positions of finished products have significantly increased:

(4) Meat (PCN-02): in 2020, meat exports amounted to 3.0% of all exports of raw materials and food, in 2019, respectively - 2.4%, 2018 - 1.6%, in 2013 - only 0.2%. This direction is actively growing; the export of meat compared to 2013 has grown 15 times.

(5) Finished products from cereals, flour, starch and milk; flour confectionery (PCN-19): in 2020 export was 3.2%, in 2019 - 2.8%, in 2013 - only 0.3%, an increase in comparison with 2013 by 10.6 times.

(6) Chocolate and other confectionery products, which include cocoa (PCN-18): in 2020, export was 3.0%, in 2019 - 2.9%, in 2013 - no data.

(7) Alcoholic and non-alcoholic drinks (PCN-24): in 2020, export was 2.7%, in 2019 - 2.5%.

(8) Sugar (PCN-17): in 2020, export was 2.5%, in 2019 - 2.1%.

(9) Tobacco (PCN-24): in 2020, export was 2.4%, in 2019 - 2.22%. (Calculations were made using the VEDLORD customs statistics database).

Over the past 6 years, not only the export of agricultural raw materials and foodstuffs from Russia has grown, but also the import of agricultural raw materials and foodstuffs to the country has significantly decreased from $ 44,064 million in 2013 to $ 23,041 million in 2020, or more than 1.9 times. The structure of import supplies in recent years has begun to change: domestic products are entering the market of Russia, and more and more of those products whose production in Russia is not profitable or inexpedient has begun to prevail. For example, the share of imports of meat and meat products (PCN-02) in 2013 amounted to 16.3% of the total production in the amount of 7,171.7 million USD, in 2019 this share decreased to 6.3%, and the cost decreased to $ 1,867.3 million. For 9 months (January-September) 2020, the share of meat imports to Russia amounted to only 5%. At the same time, the share of imports to Russia of those products that are practically impossible to produce in the country grew. Thus, the share of fruit imports (PCN-08) in 2013 in total supplies was 14.6%, but in 2019 it increased to 17%, and in nine months (January-September) of 2020 this figure reached 18.5% (Fig. 4).

Six years ago, skeptics argued that Russia would not be able to find a replacement for French camembert and Italian parmesan, American and German marbled beef and that cucumbers and tomatoes would not be on the shelves. But a year later, Russian cheeses appeared on the food market the quality was and no worse than that of imported ones, domestic tomatoes from greenhouses saturated the Russian market and turned to be better in quality than imported ones, the domestically produced marbled beef is likely to reach the benchmark in European countries. In addition, sanctions and pro-embargoes made it possible to ensure growth in those segments of food production in which Russia did not previously have great prospects. For example, the production of cheeses has been actively developed, vegetable growing in greenhouses and horticulture have achieved significant development, a basis has been created for the growth of production of organic products, the consumption of which has now become a global trend.

However, it must be admitted that not everything worked out, which was included in the adopted strategic program of import substitution. The Russian Federation, due to domestic production, was unable to replace the supply of many categories of imported products, including those prohibited from being imported into our country under the counter-sanctions adopted in August 2014. Manufacturers of these products from other countries have replaced European and American suppliers. According to many experts, in some cases it may not be about replacing imports from other countries, but about re-exporting the same products, mainly from European countries. For example, by the end of 2020, the strategic import substitution program should have reduced the import of dairy products by 30%. But in fact it decreased only by 20%, the import of fruit and vegetable products decreased only by 11% instead of the expected 20%. It was planned to reduce vegetable imports by the end of 2020 by 70.3%, but in fact, it was reduced only by 47.2%.

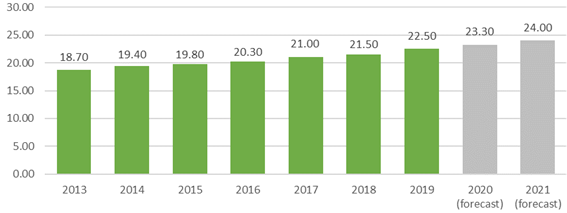

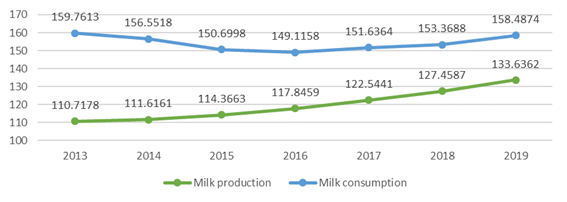

The consumption of milk and dairy products in Russia compared with the Soviet period has decreased by 45-50% and is 1.5-2 times lower than in Germany, Finland, Switzerland; it amounts to 230 kilograms per year per person (Kotilko & Vishnyakova, 2016). The current conditions can be explained by the insufficient volume of milk production due to a reduction in the number of cows, high prices for dairy products, which led to the inaccessibility of milk, butter, cheese and other dairy products for most citizens with low incomes. The decline in the number of cows has been going on continuously over the past 30 years, despite significant financial support from the state for the dairy industry. But there are also positive changes. Since 2005, milk yields per cow have ceased to decline and have grown over 15 years from 2.2 tons of milk (2005) to 4.6 tons (2020). The increase in milk yield per cow was due to foreign technologies and equipment, as well as the emergence of more efficient private companies and farmers. It should also be admitted that despite the reduction in the number of cows in general in Russia, milk production over the past three years has been growing by 700 thousand tons per year: in 2018 - 30.6 million tons, in 2019 - 31.3 million tons, in 2020 - about 32.0 million tons. At the same time, the volume of commercial milk also showed an increase in this total volume: in 2018, 21.5 million tons of commercial milk were supplied, in 2019, 22.6 million tons were already supplied, an in 2020 this figure reached 23 million tons, with the growth of 3.6% over three years (Fig. 5).

By 2025, while maintaining the annual growth rate of milk production in Russia, it is realistic to bring milk production up to 35 million tons per year, primarily due to the growth of commercial milk production in agricultural enterprises and peasant farms. The growth in milk production in Russia is primarily associated with an improvement in production indicators in the dairy industry due to modernization, the use of highly productive breeds of cows, modern technologies for keeping, feeding animals, reproducing cows and increasing demand for dairy products. Despite the decrease in the real money income of citizens over the past seven years, the consumption of milk and dairy products in Russia is growing (Fig. 6).

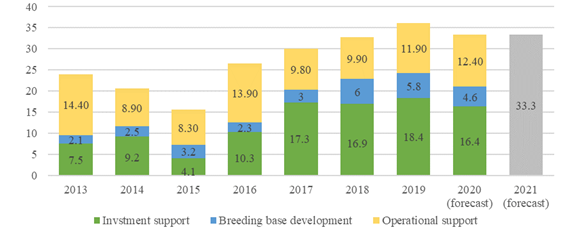

One of the main reasons for the growth in milk consumption was the adoption of measures by the state to control the market of dairy products in order to combat milk fat substitutes and counterfeits. Since July 1, 2018, the Mercury system has been introduced in Russia to track the flow of milk and dairy products. The rules for labeling dairy products containing milk fat substitutes have been changed and the rules for separate shelves in stores for products with milk fat substitutes have been introduced. It should also be noted that since 2015, state support for the dairy industry has been steadily growing and remains the main tool for maintaining the profitability of milk production, as well as providing investment activity in the industry. In 2020, all areas of support for the dairy industry were retained. In addition, during the pandemic, the government provided additional support to the dairy industry, in particular, additional soft loans were allocated, and part of the direct costs incurred was reimbursed.

In 2021, the list of areas of targeted preferential loans will be expanded, the preferential VAT rate on imports of breeding animals will be prolonged, the possibilities of using short-term and investment loans will be expanded (Fig. 7).

Fish production in Russia is also growing. In 2020, the country produced 4.00 thousand tons of salmon against 3.68 thousand tons in 2013, which amounted to an increase of about 10%. In 2014, the state program “Development of the fisheries sector in Russia” was adopted; but, as the auditors of the Accounts Chamber note, the program lacks clear criteria to check the quality of its implementation. There is no indicator by which to assess how the competitiveness of Russian fish products is ensured in the domestic and foreign markets, and what place the Russian Federation occupies in the rating of world exporters of fish and fish products. Also, the state program is poorly coordinated with other documents adopted by the government, for example, with the Maritime Doctrine adopted in 2015 or the strategy for the development of sea terminals.

Paradoxically, the Russian Federation has huge resources of wild fish in its waters, but today it is forced to import fish from Chile, Argentina and other states. Although three decades ago, fish was the most affordable and cheapest food in Russia. One of the problems is that Russian fishermen prefer to sell fish abroad (Japan, South Korea, China), without entering the port. Most fishing farms experience a chronic shortage of working capital, and therefore try to sell their catch for export directly to the sea, since they do not have access to cheap loans, they do not receive insurance from the state under concluded contracts. There are also problems with the transportation of fish from the Far Eastern regions to the central regions of Russia. One of the reasons is the high railway tariff for the transportation of fish and other biological resources. The Federal Agency for Fishery has calculated that to subsidize supplies to the central regions of only Pacific herring from the Far East, it will take about 0.5 billion roubles and these problems with the transportation of fish did not appear today. Back in 2009, a program was adopted that provides for the construction of 19 refrigeration terminals across the country with a total capacity of 140 thousand tons, spending about $ 300 million on the program. If the program had been implemented, then today the question would not have arisen where to get the money for import substitution of Atlantic herring. Russia has the ability to completely cover the needs of the domestic market with its own fish, while not reducing the volume of fish exports abroad.

Conclusion

Agriculture of the Russian Federation today is a steadily developing industry that is able to provide food and agricultural raw materials not only to the inhabitants of Russia, but also to residents of other countries. The past 2020 has once again confirmed the capabilities of the Russian agribusiness to increase agricultural production not only in grain crops, but also in other key categories.

Although the progressive development of the agribusiness in recent years is noticeable with the naked eye, this movement is not without problems. Many of them were especially evident during the spread of the coronavirus. In the spring of 2020, during the coronavirus pandemic, logistics was a challenge: when food imports from China were limited, food supplies were stopped, and it became obvious how the Russian Far East depends on the supply of Chinese products. Another problem has recently emerged in Russia: the more products are produced, the more acute the issue of their sales becomes.

The regions producing agricultural products are already oversaturated with their products and it is necessary to export their products to other regions of the country, as well as export to other countries. For example, Belgorod and Tambov pork should be supplied to the Urals and Siberia, Far Eastern fish - to Moscow and other central regions, Krasnodar apples - to the Urals and Siberia. In recent years, the Russian Federation has become a serious supplier of agricultural raw materials and food to foreign markets and, as a result, it has become embedded in world trade and the latter has begun to influence domestic food prices within the country.

Favourable exports, expensive imports and specific factors in the development of the coronavirus pandemic have had a significant impact on the rise in prices for food in the domestic market. Unfortunately, the Russian agribusiness is highly dependent on imports: machinery, seeds, feed and feed additives, herbicides and pesticides. In Russia, it is necessary to adopt a centralized program for creating an agrological infrastructure, moreover, infrastructure of a new format based on digital technologies, which would include all the functionality of sales, logistics, as well as a single information space for the entire country.

References

Borodkina, V. V., Ryzhkova, O. V., Ulas, Y. V., & Ushalova, A. A. (2015). Research of Import Substitution Development Programs in the regions of the Russian Federation. Creative Economy, 11, 1397-1414.

Drobot, Y. V. (2016). Features of the foreign economic activity of the Russian Federation in the context of the sanctions policy. Journal of Russian entrepreneurship, 16, 1879-1902.

Ivanova, V. N. (2016). Mutual trade of the member States of the Eurasian Economic Union with the countries of the free trade zone and their export potential. Economy of agricultural and processing enterprises, 1, 27-31.

Kotilko, V. V., & Vishnyakova, V. S. (2016). Analysis of the market conditions of the main types of meat and dairy products in the context of the import substitution policy. Food policy and security, 3, 163-179.

Kulikov, N. I., Kulikov, A. N., & Nazarchuk, N. P. (2020). Crisis in Russia: are the sanctions the only reason? Geplat: Caderno Suplementar, JUNHO, 2020, 3.

Kuzmin, V. (2014). Have your own. Retaliatory measures will allow Russia to strengthen food security. Retrieved from https://rg.ru/2014/08/07/pravitelstvo-site.html

Minakov, I. A. (2017). Prospects for import substitution in the regional agri-food market. Bulletin of the Michurinsk State Agrarian University, 1, 98-105.

Minakov, I. A., & Sytova, A. Y. (2020). Formation of an export-oriented agricultural economy. Science and Education, 3, 97.

Ministry of Agriculture of the Russian Federation (2020). Analytics. Retrieved from https://mcx.gov.ru/analytics/

Petrikov, A. V. (2016). The main directions and mechanisms of implementation of modern agri-food policy. Economy of agricultural and processing enterprises, 1, 11-18.

Rosstat (2020). Official statistics. Retrieved from https://rosstat.gov.ru/folder/10705

State program for the development of agriculture and regulation of markets for agricultural products, raw materials and food for 2013-2020. Approved by the Government Decree of July 14, 2012 No. 717. Retrieved from: http://government.ru/rugovclassifier/815/events/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Kulikov, N. I., Kulikova, M. A., & Parkhomenko, V. L. (2022). Financial Support Of Import Substitution And Its Outcomes. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 650-663). European Publisher. https://doi.org/10.15405/epsbs.2022.02.82