Abstract

The development of the Russian banking sector is not steadily progressive. It has various intensity and direction in various periods, which calls for a detailed analysis of the causes of uneven growth and reductions, as well as a comprehensive study and analysis of regular drops in the sector's key indicators and the reactions of its players to the events in the country and in the world that can be reflected, among other things, in the changes of their aggregate profitability. This article presents an assessment of the proportion dynamics for profitable credit companies. It is a component of preliminary banking sector development efficiency and sustainability assessment, as well as that of the financial situation of its players and their capabilities to extend the funding of the national economy. The authors identify the key factors influencing the trends, character, and steadiness of the changes that have been taking place over recent years. In this research, we used the methods of logical and statistical analysis, observation, generalization, and classification. The most important factors include the aftermath of the world financial crisis of 2008-2010, the regulator's policy to eliminate unsustainable banks from the financial market, the introduction and tightening of sanctions against the Russian financial sector by some foreign countries, and the introduction and development of a differentiated approach to regulating banking operations. The overall banking sector development dynamics are not negative and it requires further observation, detailed research, and analysis.

Keywords: Banking sector, dynamics, profitable credit companies

Introduction

Over recent years, the banking sector in Russia has gradually improved, which is manifested in its increased role in supporting the economic development of the country. The largely quantitative growth of the Russian banking system in recent years was replaced with a more balanced development despite the aftermath of the world financial crises and the complicated geopolitical situation. Over the last ten years, the Russian banking system experienced a quantitative reduction and, at the same time, some stages of qualitative transformation. The current trends in the world of finance indicate that it is necessary to attract even more attention to monitoring and assessing the sustainability of credit companies and the banking sector as a whole. The profitability of operations is one of the key components of these.

Problem Statement

The Russian banking sector underwent a lot of changes after the global economic crisis of 2008-2010, the elimination of unsustainable credit organizations from the financial market by the regulator, the introduction of sectoral sanctions by other countries, and the incremental introduction of a differentiated approach to assessing and regulating the operations of various credit companies. The assessment of the proportion dynamics for profitable banks is an important component of preliminary banking sector development efficiency and sustainability assessment, as well as that of the financial situation of its players and their capabilities to extend the funding of the national economy.

Research Questions

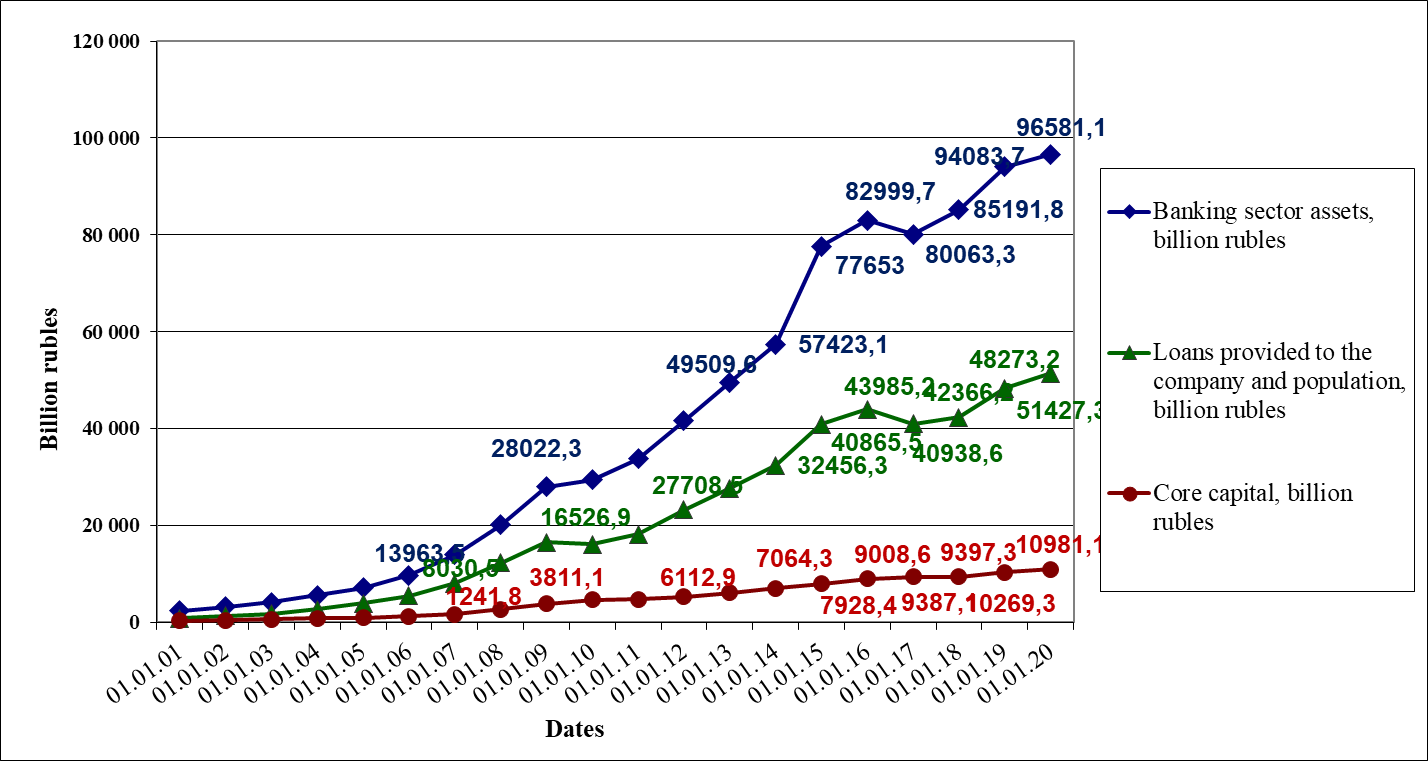

The aggregate assets of credit companies grew 40.9 times or up to 96.5 trillion rubles from 01.01.2001 to 01.01.2020, the capital resources of the system increased 38.3 times or up to 10.9 trillion rubles, and the aggregate credit portfolio for companies and residents grew 60.7 times or up to 51.4 trillion rubles. (Figure 01).

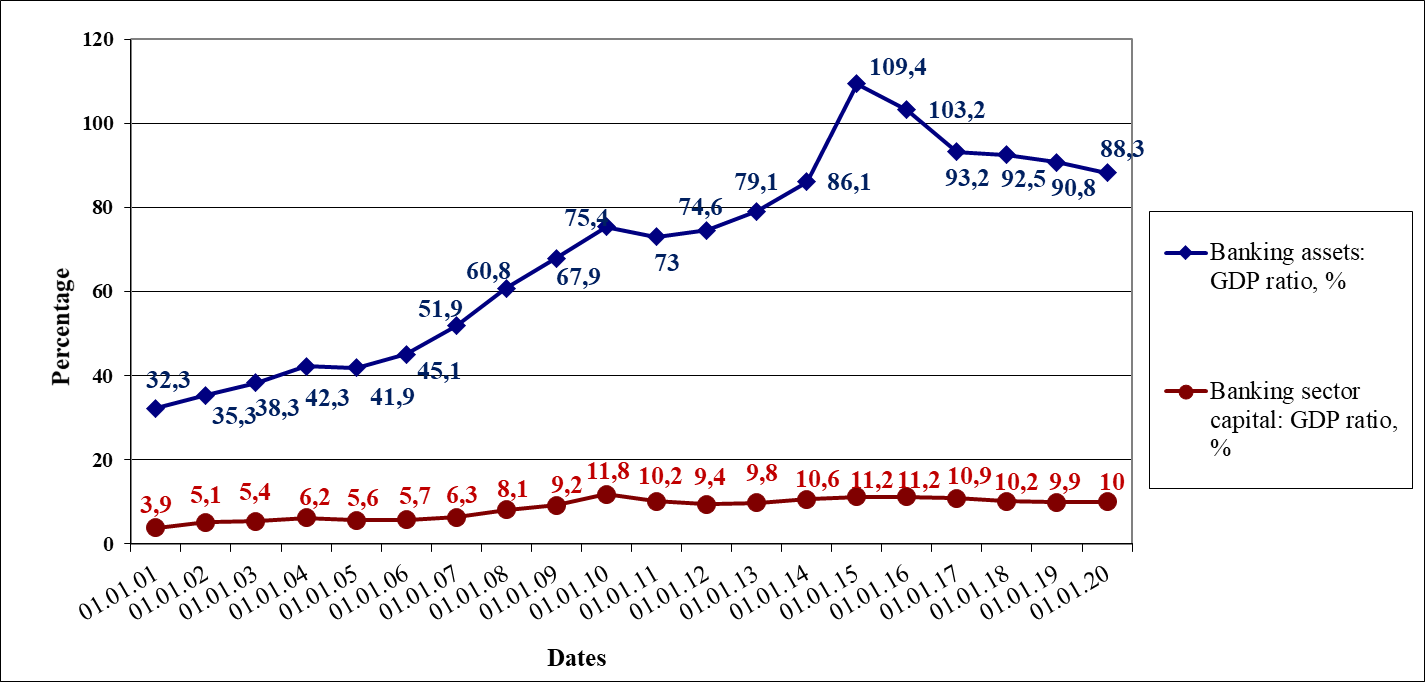

The Russian banking system developed over the recent years, and its significance and weight in the economy increased. The share of the banking assets in the GDP increased by 56% from 32.3% to 88.3% over the period between 2001 and 2020 (Figure 02). The share of the banking sector’s core capital in the GDP over the same period increased by 6.1%, from 3.9% to 10%.

The data in Figures 1 and 2 signify that over the last 19 years, the development of the Russian banking sector was not steadily progressive. Its intensity and direction fluctuated in different periods.

The development features of the Russian banking sector require a detailed analysis of the causes of uneven growth and reductions, as well as a comprehensive study and analysis of regular drops in the sector's key indicators and the reactions of its players to the events in the country and in the world that can be reflected, among other things, in the changes of their aggregate profitability.

Purpose of the Study

The goal of this article is to study and assess the dynamics of the share of profitable credit companies. It is a component of preliminary banking sector development efficiency and sustainability assessment, as well as that of the financial situation of its players and their capabilities to extend the funding of the national economy. To achieve this goal, it is necessary to identify the key factors that determine the trends, nature, and steadiness of the changes that have been occurring over recent years.

Research Methods

When studying the profitability of the Russian banking sector, we used the methods of logical analysis, observation, generalization, and data classification, as well as the abstract logic techniques; we calculated the specific shares of profitable credit companies and assessed their change dynamics within the Russian banking sector in the context of its transformation and development.

The official data from the Bank of Russia on the number of operating and profitable credit companies for the last 19 years show a significant reduction in the number of Russian credit companies and an uneven distribution of the proportion of profitable companies across different periods (Table 01).

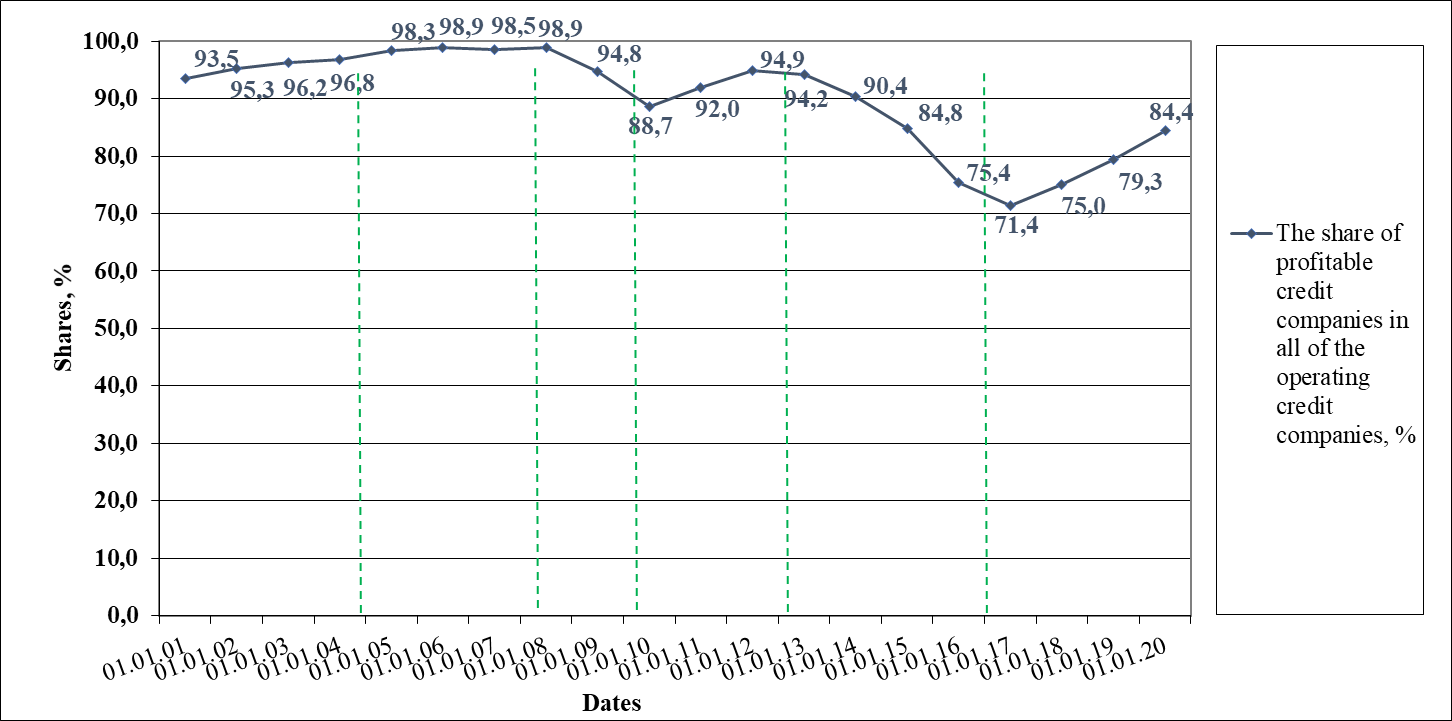

The verification of changes in the number of profitable credit companies and their share among all banks over time is required to promote better understanding and further detailed analysis of the changes that have been occurring, as well as their consequences for the banking sector and its efficiency (Figure 03). The observation and description of profitability dynamics in the Russian banking sector help identify some factors that condition the direction and unevenness of the sector's transformation in terms of profitability.

Firstly, the operation of Russian credit companies was influenced by the global financial crisis of 2008-2010, which can be seen in the respective period in Figure 3. The share of profitable credit companies reduced from 98.9% as of 01.01.2008 to 88.7% as of 01.01.2010. As a result of these events, the approaches to the capital sufficiency assessment for banks were reviewed, and profits began to be seen as one of the most significant capitalization growth drivers along with mergers and acquisitions using subordinated tools, etc (Fomenko, 2011). The capital sufficiency for the banking sector players determines their capacities in terms of providing financial support to non-financial organizations during and after crises (Karnaukh, 2011).

Secondly, starting with the fourth quarter or 2013, the Bank of Russia has been implementing an active policy to ‘clean’ the financial market of unsustainable banks (Larionova & Panova, 2014), which can also be seen in Figure 3. The regulator's actions accelerated the reduction of operating banks and caused an even more rapid drop in the numbers of profitable ones. The share of profitable credit companies reduced from 94.2% as of 01.01.2013 to 71.4% as of 01.01.2017. A large number of banking licenses were recalled from regional banks, many of which were classified as small and medium credit companies. While the goal of restoring the health of the economy could be justified, it could have had some negative impacts on the country's economy as a whole. The results of extensive research on the specifics of bank crediting by foreign experts employing various standpoints and tools signify that the banks that cannot be classified as large companies are better suited for servicing and funding the operations of the mentioned categories of economic agents (Berger & Black, 2011; Mkhaiber & Werner, 2020; Sedunov, 2020).

The research results show that Russian small and medium banks also tend to lend money to small and medium businesses. As the banks grow and expand their operations, the intensity of financing legal entities like small and medium businesses, as well as individual businesspeople, increases. However, the share of such entities in the crediting portfolio for legal entities decreases (Korolev, 2015).

The significant reduction of the share of profitable banks in 2013 can be explained by both the regulator's actions to sanitize the banking sector and the sectoral sanctions that were introduced in 2014 and then tightened by Europe and the USA. These sanctions covered, among others, the Russian financial sector. This influenced the redistribution of assets within the system, as well as the quantity and efficiency of Russian financial and banking markets as a whole and those of specific regions.

Figure 3, however, demonstrates that despite some factors that had adverse impacts on the share of profitable banks over the last 10 years, this value has been increasing steadily between early 2017 and 01.01.2020: from 71.4% to 84.4%. This can be explained by the introduction of the differentiated approach to regulating banking operations in Russia in 2017. This approach stipulates classifying all banks into two categories: banks with a general license and banks with a basic license (Korolev & Ranjushkin, 2017; Sofronova, 2018).

The first step in grouping and official differentiation of Russian credit companies was the identification of systemically important banks. They were subjected to special requirements and appropriate regulations adjusted to the international standards. This rationalized segmenting was not initiated by the Bank of Russia. After the global crisis of 2008-2010, a number of foreign national banking regulators used the criteria developed by the Basel Committee on Banking Supervision to identify a special group of systemically important banks among commercial credit companies, which were subjected to increased prudential requirements. The problems of improving and developing approaches to regulating and assessing the operations of large banks remain relevant and are discussed by professional and academic communities (Boyd & Heitz, 2016; Dávila & Walther, 2020; Lorenc & Zhang, 2020).

The sustainability of the financial sector requires not only restricting the operational risks for large banks but also supporting small and medium banks that ensure the stability of local economies in many countries. The insufficient attention paid to the latter categories of banks might lead to a shortage of financial services for small and medium businesses.

Up until January 1, 2019, Russian banks had to decide what type of license they wanted to claim. The regulator prepared some restrictions and some concessions for basic license banks as compared to general license banks (concerning reporting and management system requirements, regulatory limits, transfers to the compulsory reserve fund) (Korolev & Ranjushkin, 2017; Sofronova, 2018). These restrictions and concessions stipulate that the target client groups for the basic license banks are small and medium businesses (SMB) and natural entities. The business models of basic license banks must target the availability of banking services in regions to revitalize regional economies.

Findings

The factors behind the changes in the number of operating and profitable credit companies, as well as the share of the latter, have varying intensity and actual impact nature, and occur at uncertain times.

This is confirmed, among other things, by the values of linear correlation rates for the numbers of operating and profitable credit companies calculated for different periods and associated with the causes analyzed (Table 02).

The high linear correlation rate calculated over 19 years shows that despite the general trend for the reduction of the number of banking sector players, the share of profitable companies remains practically at the same level. This development can be seen as coherent despite the negative quantitative dynamics.

The rate calculated over three years from 01.01.2009 to 01.01.2012 is lower than both the 19-year value and the same rate calculated for the preceding three-year period. This reflects the negative impact of the global economic crisis on the share of profitable credit companies.

Relatively high rates for the three-year periods starting from 01.01.2014 and 01.01.2015 signify that the share of profitable banks reduced insignificantly despite the previously recorded drops in the share of profitable credit companies on specific dates after the regulator began actively recall licenses and impose sanctions and the further quantitative reduction of the banking sector over these three-year periods.

The high linear correlation rate value calculated for 01.01.2017-01.01.2020 confirms our previous assumption that the introduction of a differentiated approach to regulating and assessing banking operations might have a positive effect on the banking sector.

Conclusion

During the study of the dynamics of operating and profitable credit companies, as well as the share of the latter, we identified some factors that determine the trends, nature, and steadiness of the changes that have been occurring over the recent years. The most important factors include the aftermath of the world financial crisis of 2008-2010, the regulator's policy to eliminate unsustainable banks from the financial market, the introduction and tightening of sanctions against the Russian financial sector by a number of foreign countries, and the introduction and development of a differentiated approach to regulating banking operations. The factors behind the changes in the number of operating and profitable credit companies, as well as the share of the latter, as mentioned above, have varying intensity and actual impact nature, and occur at uncertain times. Nevertheless, the overall banking sector development dynamics are not negative and it requires further observation, detailed research, and analysis. This is especially relevant nowadays when the aftermath of the pandemic for the country and the world is not completely clear.

For example, we need a detailed profitability analysis for the banking sector as a whole and its specific segments, the factor analysis to determine the drivers behind extensive and intensive growth and efficiency drops that would consider the business models used by different banks or types of banks.

References

Berger, A. N., & Black, L. K. (2011). Bank size, lending technologies, and small business finance. Journal of Banking & Finance, 35(3), 724–735. DOI:

Boyd, J. H., & Heitz, A. (2016). The social costs and benefits of too-big-to-fail banks: A “bounding” exercise. Journal of Banking & Finance, 68, 251-265. DOI:

Dávila, E., & Walther, A. (2020). Does size matter? Bailouts with large and small banks. Journal of Financial Economics, 136(1), 1-22. DOI:

Fomenko, I. I. (2011). Osobennosti ocenki dostatochnosti kapitala bankov v ramkah kontrciklicheskoj modeli regulirovanija [Features assessing the capital adequacy of banks under the countercyclical model of regulation]. Vestnik RUDN [RUDN Bulletin], 2, 73-81. [in Russ.].

Karnaukh, Y. M. (2011). Prakticheskij opyt sovmestnoj raboty bankov i ih klientov v uslovijah finansovogo krizisa [Practical experience of banks and their client’s cooperation in the financial crisis]. Finansovaja analitika: problemy i reshenija [Financial Analytics: problems and solutions], 5(47), 39-42. [in Russ.].

Korolev, O. G. (2015). Bank Lending to Small and Medium Sized Business: Evidence from Russia. Asian Social Science, 11(14), 314-329.

Korolev, O. G., & Ranjushkin, A. S. (2017). Differencirovannyj podhod k organizacii bankovskogo nadzora za jeffektivnost'ju kreditnyh operacij [Differentiated approach to the organization of banking control over the effectiveness of credit operations]. Innovacionnoe razvitie jekonomiki. [Innovative development of economy], 2(38), 198–203.

Larionova, I. V., & Panova, G. S. (2014). «Ochishenie» finansovyh rynkov ot nezhiznesposobnyh bankov [“Clearing" financial markets of non-viable banks]. Bankovskoe delo [Banking], 2, 6-10. [in Russ.].

Lorenc, A. G., & Zhang, J. Y. (2020). How bank size relates to the impact of bank stress on the real economy. Journal of Corporate Finance, 62, article 101592. DOI:

Mkhaiber, A., & Werner, R. A. (2020). The relationship between bank size and the propensity to lend to small firms: New empirical evidence from a large sample. Journal of International Money and Finance, 110, article 102281. DOI:

Sedunov, J. (2020). Small banks and consumer satisfaction. Journal of Corporate Finance, 60, article 101517. DOI:

Sofronova, V. V. (2018). Regulirovanie bankovskogo sektora Rossii. Novye tendencii [Regulation of the Russian Banking Sector: New Trends]. Finansi I Kredit [Finance and Credit], 24(2), 335–350. DOI: 10.24891/fc.24.2.335 [in Russ.]

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 June 2021

Article Doi

eBook ISBN

978-1-80296-110-2

Publisher

European Publisher

Volume

111

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1168

Subjects

Social sciences, education and psychology, technology and education, economics and law, interdisciplinary sciences

Cite this article as:

Korolev, O. G. (2021). Dynamics Of Number Of Profitable Credit Companies In The Context Of Changes. In N. G. Bogachenko (Ed.), Amurcon 2020: International Scientific Conference, vol 111. European Proceedings of Social and Behavioural Sciences (pp. 476-483). European Publisher. https://doi.org/10.15405/epsbs.2021.06.03.64