Abstract

The possibility of using depreciation as a source of investment for the purpose of updating the active part of fixed assets of enterprises is investigated. Various functions of depreciation are distinguished and the elements of their prioritization in different economic conditions are considered, with subsequent ranking as the most important source of investment for the purpose of updating main fixed assets. The article examines the modern depreciation system in the conditions of digital economy formation, its main characteristics, directions of its improvement in relation to more effective performance of its reproductive function. The systematization of the characteristics of the depreciation system of the Russian Federation, which prevents the implementation of the reproductive function of depreciation, is presented. Calculations are made and the possibility of achieving a significant share of depreciation in the company's own investment resources is shown. The dependence of the possibility of achieving a high share of depreciation in the necessary investment resources for the purpose of updating fixed assets on the dynamics of the interest rate of cash accumulation is revealed. A model for the formation and implementation of depreciation policy in relation to industrial enterprises is proposed, which allows determining the sources of renewal of production capacity by target feature. The principles that the depreciation policy should meet, depending on the priority goals of its implementation, are formulated. It is indicated that the most important instruments of depreciation policy include regulatory, controlling, and incentive funds.

Keywords: Depreciationdepreciation functionsenterprisesfixed assetsinvestment

Introduction

The problem of attracting investment in basic industries to increase the pace of development is traditionally one of the most relevant and widely discussed in the world economic literature (see, for example, the works of Deli (2016), Samaniego and Sun (2019), de Rassenfosse and Jaffe (2018), and other authors). The peculiarities of the current state of the economies of many large countries, associated with the actions of a number of negative global factors, such as a decrease in economic activity as a result of the viral pandemic, sanctions and other non-market restrictions, and increasing strategic uncertainties, have increased the importance of searching for sources of funds necessary to restore and increase economic growth. Among them, the own funds of industrial enterprises are allocated, since this is the cheapest and most affordable source of investments for them. Depreciation is the most important element of enterprises' own funds allocated for technical development. Stimulating its use for the purpose of updating fixed assets is the most important task of the economic mechanism of any country. However, it requires a comprehensive study of the applied model of the depreciation system, its advantages and disadvantages, opportunities to increase the importance of depreciation in the total amount of investment resources, and ways to improve the depreciation policy.

These suggestions are of sufficient research interest. When studying them, it is worth highlighting: which function as a priority are they focused on and what level of management do they cover: the macro or micro level (of enterprise)? This determines the directions of its improvement, the composition of improving tools, and the construction of the necessary model for the formation and implementation of an effective depreciation policy on the scale of the Russian economy.

Problem Statement

Russian industrial enterprises in the manufacturing industries are currently characterized by a significant number of low competitiveness of products and fixed assets, and the backwardness of many technological processes. Only taking into account the existing depreciation rates for renovation, it takes about $ 42-47 billion annually to replace the disposal of machinery and equipment (Babaeva, 2014). In this regard, it appears that for Russian industry as for industries in other countries with obsolete, for the most part, the production apparatus in the present, according to this historical period, it is necessary to ensure the priority of the reproduction function of depreciation. In the future, with increasing competitiveness and efficiency of Russian industry, the priority may change.

However, to implement the depreciation policy of its reproduction function, it is necessary to study the existing characteristics of the depreciation system and determine the directions for its improvement. In conditions of increasing need, attracting investment resources for the purpose of high-quality reproduction and justification of fixed assets of industry, depreciation should become a significant and reliable source of own funds of enterprises mobilized for these purposes. This should be implemented on the basis of a well-functioning market mechanism for financing innovation and investment processes. To do this, it is necessary to form an effective state policy to activate investment activities, including an effective depreciation policy.

Research Questions

The possibility of using depreciation for the purpose of reproduction of fixed assets has been repeatedly discussed in the economic literature. Proponents of strengthening state regulation of the economy have always focused only on the reproductive function of depreciation, economists of more liberal views - on its financial role, on the ability to return the original investment costs to the owner, as noted by Chinloy et al. (2020) in terms of "investment, depreciation and obsolescence of research and development"), as well as Ohrn (2019) on the materials of business American economic practice. In this regard, the question arises: can depreciation in modern conditions be one of the main sources of investment in the renewal of fixed assets at enterprises?

To determine whether depreciation can play a significant role in the reproduction process, we will study the following calculation example. Let the cost of the volume of fixed assets is 100,000 rubles, its usable life expectancy is 10 years, respectively, the depreciation rate for the linear method is 10%. Let's look at how much depreciation can make up the total investment required to replace this object in 10 years. However, it should be considered that in 10 years the cost of a new vehicle for a similar purpose is likely to change. It may decrease, but it is more likely to increase due to inflation. Therefore, the calculation uses various options for the ratio of the possible future value of the means of labor to the original value of the existing object, namely: reducing the cost to 90% of the original (coefficient 0.9), maintaining the cost at the original level (coefficient 1.0), increasing the cost by 30%, 50%, 2 times, 2.5 times (coefficients 1.3; 1.5; 2.0; 2.5; respectively).

It was assumed that the company accumulates funds on the account for the purpose of subsequent replacement of the means of labor with a certain interest rate. The calculation was carried out with several options for the interest rate from 1% to 10%. As a result, the required annual payment (R) was determined for accumulating funds on the account for the purpose of replacing the means of labor based on the traditional formula of the compensation fund factor (SEP):

(1)

where is the interest rate;

n is the usable life expectancy;

D - the future value of the fixed assets object.

As a result of calculations for the options, different values of the annual payment are obtained for accumulating the amount necessary to replace an object of fixed assets in 10 years (Table

To determine whether depreciation can serve as a significant tool in financing the reproduction of fixed assets, let's consider its possible share in this annual payment, namely, the correlation of the annual amount of depreciation under the given initial conditions (10,000 x 0.1 = 10,000 rubles) and the above mentioned annual payment.

As shown by the calculations, even with a small interest rate of accumulation of funds (1%) with a decreasing or unchanged value of the newly built object of fixed assets, annual depreciation charges exceed the amount of the required annual payment for accumulating funds on the account (Table

Purpose of the Study

The purpose of the study is to consider the role of depreciation in the economic mechanism of the enterprise, its ability to serve as a significant source of investment in financing the renewal of fixed assets. There are various approaches to this problem in the economic literature. In this regard, it is advisable to identify various depreciation functions and features of their prioritization. It is necessary to investigate whether depreciation in modern conditions can be a significant source of financing for the reproduction of fixed assets. It is advisable to study the negative characteristics of the existing depreciation system of the Russian Federation. It is necessary to formulate directions for its improvement. An important goal of the research is to build a model for the formation and implementation of the depreciation policy of the Russian Federation, which allows to increase the efficiency of its implementation.

The analysis of the compliance of existing mechanisms, approaches, and priorities in the depreciation policy in the Russian industry with the above-mentioned goals and objectives allowed us to identify a number of characteristics that make it difficult for depreciation to perform its function as the most important source of investment for the purpose of updating fixed assets. They can be grouped according to three characteristics that characterize both the shortcomings of the existing depreciation system of the Russian Federation as such, and its relationship with individual elements of the economic mechanism (Table

Among the disadvantages of the existing depreciation system of the Russian Federation as such, we can distinguish regulatory characteristics. The first ones cover legislative norms and rules that, in the current version, do not direct industrial enterprises to use depreciation in full for the purpose of updating fixed assets. The second characterize the implementation by the state of measures of managerial influence and control over the course of the depreciation process.

From the point of view of regulatory characteristics, it can be noted that at present, enterprises are not interested in using the capabilities of existing depreciation methods allowed by law. Depreciation rates, which are determined by the useful life of fixed assets, have little connection with the rational life of their service at enterprises. Therefore, an indefinite number of rules may apply.

From the point of view of control and regulatory characteristics, it can be noted that there is no clearly defined goal setting in the depreciation policy at the state level and at the level of most industrial enterprises, there is no assessment of the effectiveness of its implementation and effective control over the use of depreciation deductions. All this leads both to underutilization of the opportunities available to industrial enterprises to increase their own investment resources, and to unjustified growth of prices and tariffs. For example, the use of accelerated depreciation in the so-called "natural monopolies" in the energy industry, oil and gas production, other commodity companies leads not only to increase in the cost of their products, reduce tax payments, but higher prices for their products for manufacturing enterprises, with a corresponding increase in the cost and prices of the latter, in general, contributes to reducing the competitiveness of their products, reduced gross revenues and tax payments.

From the point of view of the "embeddedness" of depreciation processes in the economic mechanism of the enterprise, two blocks of characteristics can be distinguished: by the ratio of the depreciation policy with the scientific and technical policy of the state and by the relationship of the depreciation policy with the tax policy. According to the first feature, it should be noted that the most effective use of depreciation for investment purposes is achieved if there are innovative technical and technological developments at enterprises or on the market that are ready for the conditions of introduction into industrial production. Currently, there are no such "breakthrough" projects in sufficient quantity of suitable for development in industrial production. This is due to many conditions, and, first of all, to the crisis conditions of domestic research institutes and project organizations in previous years. As a result, enterprises in many cases do not see promising areas for investment.

It can also be noted that science and technology policy is most effective in conditions of expanded reproduction. And due to inappropriate use and lack of accumulation for long-term purposes, depreciation is not enough even for the simple reproduction of fixed assets at enterprises. From the point of view of the relationship with tax policy, depreciation is part of the state's financial policy and, accordingly, is closely interrelated with tax policy. A number of characteristics can be noted here. Firstly, the instability of the tax system - changes in rates, types, order of payment of taxes, etc. In these conditions, it is difficult to plan depreciation policy for the long term. Secondly, there is a lack of full consistency between depreciation and tax policies in accounting and tax accounting.

Research Methods

The study used a retrospective analysis of the implemented policy of managing the productive forces of our country and foreign countries. Based on the requirements for modern production, we can distinguish the following group of laws for updating fixed assets: development, synergy, composition and decomposition, proportionality, and time saving. However, it should be borne in mind that the laws are objective in nature and will apply regardless of whether they are taken into account by the authors when updating or not. Therefore, to improve the efficiency of updating fixed assets in the process of modernization, it is necessary to identify and use these laws. In the specific economic mechanism of industrial enterprises functioning, it is necessary to take into account the differences in the development of the economies of different countries. Using the priority of a certain depreciation function that has developed in the economy of one country, for example, with developed market relations, developed industry, and competitive fixed assets, may be necessary for another country whose industry does not have such characteristics.

Findings

Depreciation plays a major role in the implementation of the reproduction process. Using different methods and depreciation norms changes the size of the depreciation fund that is used to finance the renewal of fixed assets. In essence, this is the release of part of the profit from taxation and its concentration in the depreciation fund. In other words, the depreciation policy is the basis for taxation of profits and property tax. In the latter case, its average annual cost. This requires clear coordination of depreciation and tax policies, which is reflected in the scientific position of various scientists. Thus, Zaslavskaya (2018) studied the advantages and disadvantages of the modern depreciation system of the Russian Federation, the ratio of individual regulatory documents, and noted possible inconsistencies between accounting standards and the tax code of the Russian Federation. The paper analyzes the comparative characteristics of the main concepts of depreciation. They formed recommendations for the formation of depreciation policy as part of the financial strategy of the company's owners (Kuter et al., 2009). Antonova and Antonov (2018) etc. consider the depreciation policy of the Russian Federation at the macro level and study the factors that affect the possibility of using depreciation for the purpose of reproduction of fixed assets (Antonova & Antonov, 2018). Savina (2015) based on studies of existing instruments of the company's depreciation policy formed proposals for its improvement based on changes in accounting instruments.

Despite the fact that depreciation is the most affordable and cheap resource for financing the renewal of fixed assets at the enterprise, its use for these purposes remains controversial in the economic literature. In practice, managers of enterprises also do not always use depreciation for the purpose of reproduction of fixed capital. In most Russian publications related to the economics of the enterprise, partly with financial management, it is noted that on the basis of depreciation charges, a so-called depreciation fund is created, which is used to update the fixed capital (Lukinov, 2015). At the same time, a fairly wide range of Russian authors, mainly related to accounting and reporting, deny the possibility of depreciation to form a depreciation fund and update the material and technical base of enterprises on its basis (Ivanov, 2017). In justifying their provisions, they cite three blocks of arguments: regulatory and legislative, technical and technological, and inflationary. For example, according to the first one, modern accounting instruments and accounting accounts do not provide a mechanism for forming a depreciation fund as a reserve for updating worn-out means of labor. According to the second, technical and technological dynamics make it difficult to predict the process of planning investments in the field of equipment, respectively, the need to accumulate depreciation charges is lost. According to the third, if a depreciation fund is created, most of its funds may be devalued due to inflation.

It seems that the argument of supporters and opponents of accumulation of depreciation charges in the depreciation fund has sufficient grounds and is associated with the complexity of such an economic phenomenon as depreciation. It traditionally has different functions: accounting, reproduction, financial, and tax. In different historical stages of economic development in different countries, with the objective existence of all these functions, priority has always been given to one or another of them. This is due to many factors: a certain degree of development of market relations, with respect to the feasibility of a specific industrial policy and the place of the state in its formation and implementation phases of the economic cycle in which the economy of the country, with the state of the industry, the degree of necessity of modernization and the availability of necessary financial means for this.

It turned out that there is an incomplete coincidence of accounting and tax accounting. Unlike accounting, in tax accounting, the number of methods for calculating depreciation is limited to two: linear and non-linear. In practice, as a rule, the linear method, which is the most irrational from the point of view of accumulation of investment resources, is used. This is determined by the fact that this method provides the same calculation algorithm in both accounting and tax accounting. It facilitates the accounting process, it is applicable to all depreciation groups of fixed assets, and calculations when using it are the simplest. In addition, not all depreciation methods allowed in accounting, accrued depreciation based on accelerated methods is accounted for as part of expenses in tax accounting.

Speaking about the relationship between the depreciation system and the macroeconomic conditions of business in the Russian Federation, we can distinguish a number of characteristics based on compliance with the goals of economic growth and the effectiveness of economic development. Among them, we can note the absence of any significant priorities for both industries, types of economic activity, and the susceptibility of innovations by fixed capital. In industrialized countries, the highest depreciation rates are always observed in the automotive, instrument-making, and electrical industries. It is in these industries that equipment and products based on it are updated most rapidly. These trends are not observed in the Russian industry. It should be noted in the depreciation policy and the absence of any preferred orientation on the degree of susceptibility of the enterprise, their main capital of innovations. In any economy, there are enterprises with relatively low and relatively high susceptibility to innovations. For the purposes of economic growth and improving the efficiency of economic development, it is necessary to accelerate depreciation processes at enterprises with a higher susceptibility to innovations.

It should also be taken into account that in the context of the need for modernization changes and limited investment resources, only the activation of innovation activities and the implementation of major innovation programs can significantly accelerate economic growth. Currently, the Russian depreciation policy is not aimed at this.

According to the relationship of depreciation policy in the context of macroeconomic stability, the following characteristics can be distinguished: "strict" financial policy and priority of taxation, including through depreciation, the presence of restrictions to maximize depreciation charges. Regulation of macroeconomic proportions based on a "tight" financial policy has had a significant role on the development of industry. As a result of its implementation, the volume of products produced and the competitiveness of Russian industrial enterprises decreased. Taking into account that depreciation is included in costs and has a conditionally permanent nature of deductions on the cost of production, with the fall in production volumes, it became economically profitable for enterprises to minimize the amount of depreciation in the cost price. The only exception to this were enterprises in the fuel and energy sector of the industry. This situation was aggravated by the fact that in order to replenish the budget and fulfill its social obligations, the state focused its tax policy on increasing the amount of tax payments, and not on accumulating free funds at enterprises.

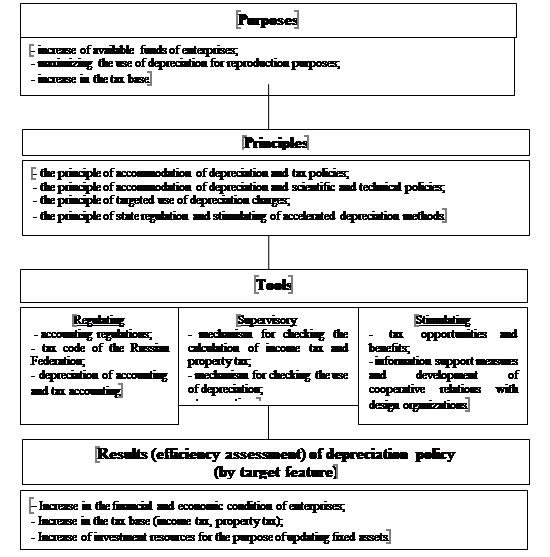

Secondly, due to the effect of these reasons, one more characteristic can be distinguished - the existing restrictions for maximizing depreciation charges. In conditions of low competitiveness of enterprises and limited high-paying demand, most industrial enterprises have a low level of profitability of production. As a result, companies strive to reduce their cost as much as possible, including by limiting the amount of depreciation charges. The state also contributes to this by introducing various restrictions on the use of accelerated depreciation methods in tax accounting. To improve the efficiency of the depreciation system of the Russian Federation, it is necessary to implement a number of measures. The most important element of any measures implemented by the state, including depreciation policy, is the assessment of their effectiveness. For depreciation policies, they should be closely linked to the initial goals that have been selected for their implementation. Accordingly, among the possible results to be evaluated should be identified: improvement of the financial and economic condition of the enterprise, increase in the tax base, increase in investment resources for the purpose of updating fixed assets. Thus, the model of formation and implementation of depreciation policy in relation to the industry of the Russian Federation can be presented as follows (Figure

The formation of a depreciation policy should begin with a clear identification of its main goal. At different stages of economic development, different prioritization of goals is possible: either increasing the available funds of enterprises and their owners (compensation for initially incurred or investment tasks), or maximizing the use of depreciation for the purpose of reproduction of fixed assets, or increasing the tax base (income tax, property tax). It seems that in the conditions of the need for radical modernization changes in the Russian industry, the advantage should now be given to the goal of maximizing the use of depreciation for reproduction.

Any depreciation policy should be based on certain principles. The analysis of possible set of these principles has allowed to allocate following principles of alignment of depreciation and tax policies, the principle of targeted use of depreciation charges, the matching principle depreciation and scientific-technical policies, the principle of state regulation and promoting the use of accelerated depreciation methods. An important element of the depreciation policy should be the differentiation of enterprises by the level of priority in the degree of use of its individual tools. This priority should be based on the most appropriate service life of equipment in various industries, the state of their fixed assets and their ability to modernize in a relatively short time, the availability of technical and technological reserves and innovative developments. This stage requires a separate analysis, however, it seems that these criteria will be met by many enterprises of the food, light industry, and a fairly large part of mechanical engineering.

The most important element of the depreciation policy is the set of tools used. Their composition is usually traditional, however, they should be clearly divided into: regulatory, controlling, and incentive funds. The use of these relationships and tools will increase the effectiveness of depreciation policy in the Russian industry, significantly increase the volume of enterprises' own investment resources for the purpose of updating fixed assets, and normalize the proportions of their reproduction.

Conclusion

Considering the possibilities of depreciation is a significant source of financing the reproduction of fixed assets of industrial enterprises, it is necessary to take into account the specifics of the country's economy and the state of its industrial complex. In a country with developed market relations and an efficient industry, it is possible to prioritize other depreciation functions found in comparison with reproduction. For the Russian Federation, whose industry is characterized by relatively low competitiveness and the need for radical modernization of technologies and equipment, it is advisable to prioritize the reproductive function of depreciation.

The study showed that depreciation can be a significant part of the necessary investment resources for the purpose of updating fixed assets. Its specific size depends on the percentage rate of accumulation of funds, but even if it is small, its share in the necessary resources is very significant. The existing depreciation system used in the Russian Federation has a number of serious drawbacks. They prevent depreciation from performing its reproductive function. In order to improve it, the paper proposes a model for the formation and implementation of depreciation policy, which will allow it to more fully perform its reproductive function in relation to industry.

References

- Antonova, N. L., & Antonov, L. A. (2018). Problems of extended reproduction of fixed assets: Depreciation or external investments. Management of Economic Systems: Scientific Electronic Journal, 11(117). http://www.uecs.ru/makroekonomika/item/5187-2018-11-08-07-48-08

- Babaeva, Z.Sh. (2014). Depreciation policies and taxation as factors enhancing the investment process. Russian Journal of Economy and Entrepreneurship, 3, 144–149.

- Chinloy, P., Jiang, C., & John, K. (2020). Investment, depreciation and obsolescence of R&D. Journal of Financial Stability, 49.

- de Rassenfosse, G., & Jaffe, A.B. (2018). Econometric evidence on the depreciation of innovations. European Economic Review, 101, 625-642.

- Deli, Y. D. (2016). Endogenous capital depreciation and technology shocks. Journal of International Money and Finance, 69, 318-338.

- Ivanov, A. V. (2017). Can depreciation be considered as source of financing? Accounting and Statistics, 4(48), 62-70.

- Kuter, M. I., Lugovskoy, D. V., & Mamedov, R. I. (2009). Depreciation policy is an element of an organization's accounting policy in ensuring the owner's financial strategy. Economic Analysis: Theory and Practice, 29(158), 17-23.

- Lukinov, V. A. (2015). The concept of targeted use of depreciation deductions for renovation of fixed assets. Naukovedenie, 7(3), 1-10.

- Ohrn, E. (2019). The effect of tax incentives on U.S. manufacturing: Evidence from state accelerated depreciation policies. Journal of Public Economics, 180.

- Samaniego, R. M., & Sun, J. Y. (2019). Uncertainty, depreciation and industry growth. European Economic Review, 120.

- Savina, O. N. (2015). Depreciation as an effective tool for forming investment resources of an enterprise in the conditions of financial instability of the Russian economy. Taxes and Financial Law, 7, 136-145.

- Zaslavskaya, I. V. (2018). Effect of depreciation calculation of fixed assets on profit tax optimization. Economics and Entrepreneurship, 7(96), 1126-1129.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Streltsov, A., Yakovlev, G. I., & Karsuntseva, O. V. (2021). Depreciation Policy And Ways To Improve It For Updating Industry' Fixed Assets. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1649-1659). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.197