Abstract

Formation of financial literacy of the population is one of the primary tasks in the modern world. Many aspects of human activity are closely related to the financial sphere. Therefore, the rational use of financial resources is so important for modern people. The easiest way to increase the level of financial literacy is through gradual, step-by-step training of the financial literacy basics. This determines the leading role of educational organizations on this issue. This leads to the main problem: how to develop high-quality educational programs for different stages of learning the basics of financial literacy. In order to conduct the research, the authors used methods of analysis and synthesis, induction and deduction, scientific abstraction, and the system-structural method. It was found that the main stages at which it is potentially possible to study financial literacy are pre-school education, general secondary education and vocational education. Based on the application of these methods, the main stages of training were identified and their specifics were considered. Based on the specifics, the methods used in teaching financial literacy at each stage of the educational process were determined. Studying the theoretical and practical aspects of the formation of financial literacy of the population, it was concluded that this educational discipline is highly important not only for the general development of a person, but also for the active application of knowledge in real life.

Keywords: Educationeducational programsfinancial educationfinancial literacy

Introduction

The great importance of the financial literacy level of the population is constantly being confirmed in the modern world. We can see the influence of this human activity aspect when a person reaches adulthood. However, in order to enter adulthood being completely ready, it makes sense to introduce financial education at the early stages of the formation of the knowledge base. Understanding the relevance of this issue, in 2011 Russia implemented the project "Promoting financial literacy and development of financial education in the Russian Federation "(Ministry of Finance of Russia, 2011). The target audience of the project is not only the adult population of the country, but also students, schoolchildren and preschool children. This makes it necessary to introduce new programs in educational processes. The specifics of improving the financial literacy of the population at various stages of education are reflected in the need to take into account previously accumulated knowledge and competencies (Davoli & Rodríguez-Planas, 2020). The development of the work program should be made considering this specificity. The very foundations are formed in the basis in preschool education through imitation of exchange relations, a more detailed study of the main aspects of the financial component of a person's life should be carried out within the framework of general secondary education, and highly specialized aspects of financial literacy are studied in higher education. In this regard, there is a question of personnel retraining, namely, professional development in terms of teaching financial literacy (Migunova et al., 2020). And, if representatives of the teaching staff have the necessary skills in higher education, there are not so many such specialists in preschool and secondary education. At the same time, the main questions are still what and how to teach at each stage of education. Only a clear and correct division of the issues studied in the course of improving financial literacy allows people to get the best quality result. All this explains the relevance of research on improving the financial literacy of the population through the education system.

Problem Statement

The main problem reflected in research on this topic is the lack of necessary skills from potential teachers. This does not mean that they are not financially literate. This fact reflects the need for their training in order to form an understanding of the structure of lessons and the skills that students should acquire. At present, the Institute of financial literacy in education is still insufficiently developed. Sometimes only a comparison of education and financial literacy levels is considered (Bitca et al., 2021). Some compare financial literacy and financial decision-making without applying educational aspects (Balasubramnian & Sargent, 2020; Indefenso & Yazon, 2020). It is important to consider this issue in the context of developing educational programs. They have to correspond to the core competencies that students need to develop. During the development of educational programs, the stages of the learning process should be taken into account.

Research Questions

This study allows us to answer not all problematic questions. This is due to the limited current information base on educational aspects. Therefore, it is assumed that the following answers will be given:

-there is a breakdown of the stages of financial literacy training programs;

-the specifics of teaching financial literacy at these stages are considered;

-the scheme of distribution of financial education according to the previously identified stages is presented;

-conclusions are drawn about the importance of improving financial literacy at various stages.

Purpose of the Study

Due to the identified problems, we can say that at present there is a need to develop or significantly refine financial literacy educational programs at different stages. Therefore, the authors' goal is to show the main directions for these programs. It is assumed that on the basis of these directions it will be possible to form a common vision of educational programs. This will allow developing a methodological unit and formulating the main received competencies. The structural breakdown of educational stages is important from the point of view of ensuring the continuity of the educational process. This will allow to avoid gaps in students' knowledge. This is the main task at this stage of financial education development.

Research Methods

In the process of writing the scientific article, such research methods as: induction, deduction, scientific abstraction, system-structural method, analysis and synthesis were used. The complexity of the application of these research methods allowed us to present the results in the form of a scientific article. Based on the analysis of information sources, these methods allow us to cover problematic issues quite extensively. The only limitation in this case may be the insufficient amount of available and reliable information. Then the authors can use their own experience in the field, or the real experience of other experts and colleagues. There may be problems with a complete and clear presentation of the results of a practical study. Therefore, the most correct option is to compare information obtained from scientific and other information sources and information available from the experience. In this case, the authors received scientifically based and as close to reality as possible results.

Findings

Currently, most young people face difficulties in becoming independent. Planning income and expenses, utility bills, and paying taxes are issues that can confuse any person at first. Therefore, it is important to prepare citizens to independent living from the very beginning. The basics of education and skills formation begin in the family, but this aspect is not possible to influence from the outside. Therefore, it makes sense to talk about three educational stages that most people go through. It is pre-school education, general secondary education and vocational education.

The opportunity to lay the foundations of financial education appears even in the framework of pre-school education. At this stage, it is possible to form competencies regarding the distribution of their own needs, the establishment of communications, working out the seller-buyer relationships, training in thrift, and much more. It is during pre-school education that children begin to prepare for adulthood through the play space: the bank games, store, and even family can lay the foundations for learning various market situations.

So, family games allow people to understand the distribution of their needs and the needs of other family members. The bank is considered as a system for storing and moving financial resources. The store acts as a demonstrator of the implementation of relations of financial resources exchange for goods. And, as another example, work. The child develops a perception of work as a source of financial resources used to meet their own needs. All this is the basis for the formation of further financial competencies.

The current state of this aspect in preschool education is characterized by the lack of programs that would allow the formation of economic competencies of children. Therefore, the first step towards improving financial literacy in preschool children should be the development of an economic education program. Within the framework of the program, it is possible to use such tools as story-role-playing games, didactic games, and the study of fiction with an analysis of the economic situations mentioned in it.

The next educational stage is general secondary education. It acts as a stage for strengthening basic knowledge and forming basic skills that a person may need in an independent life. Finishing school usually precedes the beginning of a person's independent life and is the last educational stage that they go through before they reach adulthood. Therefore, this stage of education is designed to prepare a person for financial independence as much as possible. As part of the educational process, along with the fundamental disciplines, it is possible to introduce the discipline "Financial literacy". In the course of its study, all aspects of human life can be considered to some extent related to financial resources. Even at this point, it makes sense to teach students how to plan the family budget based on basic needs, to create savings, to pay for utilities and tax payments, on opportunities for obtaining tax deductions, to choose ways to save existing financial resources, and to analyze existing banking products provided to the population Such knowledge is the basis for independent living and provides a framework for managing their own financial resources (Pandey et al., 2020). This knowledge can provide answers to basic household questions and other possible financial questions that may arise in adult life.

Even more questions on the methodology used to improve financial literacy arise in relation to general secondary education. First of all, the question is to develop a special training course in which it makes sense to consider real cases based on economic situations that people face in everyday life. This includes using electronic platforms that allow you to study the main forms and examples of economic relations (Mantulenko & Aleshkova, 2020).

The last stage is professional education. At this stage, it is necessary to talk about more narrow issues of financial resources management. Here we are talking about professional economic education. Currently, there are many economic specialties that consider different aspects of the economic entities activities. Accounting, banking, financial management, tax management, marketing and logistics, securities market. These and many other specialties allow us to study more specific aspects of emerging economic relations. Professional education provides an opportunity to study the features of the credit system, to consider various instruments for investment, to analyze their own solvency, to assess market opportunities, to determine the dependence of currency exchange rate fluctuations depending on the foreign economic activity of different countries.

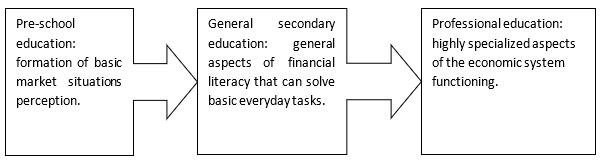

The situation is much simpler when forming economic competence and improving financial literacy in higher education. This is primarily due to the fact that professional education is initially focused on the formation of a narrow range of students' skills based on their specialty. It also becomes possible to apply more complex methods of information assimilation and its processing (Gunko & Dinukova, 2020). Recently, the most popular methods are open discussions, case studies, trainings, business tasks, and many others. As a result, you can create the following scheme for the distribution of financial education (Figure

As can be seen from the diagram, it is possible to effectively introduce financial education into the current education system. If you follow the above-mentioned stages and the distributed aspects, it becomes possible to solve a lot of issues that arise in economic terms during the transition to independent life. Basic information should be provided before the adulthood, and after that, in the course of professional education, there is an opportunity to study the needed areas of economic activity more narrowly. All this can significantly increase the financial literacy of the population.

Conclusion

Summarizing the results of the study, it can be noted that the importance of improving the level of financial literacy is out of question. Consistent study of financial management issues can significantly affect the level of education of the population. Therefore, it is important to introduce financial literacy training at all stages of education. Thus, pre-school education can lay the basic foundations of financial behavior. General secondary education can prepare students for the main aspects of an adult's financial life. Professional education prepares narrow specialists in the financial sphere, taking into account the specifics of a particular direction. Each of the stages has its own specific features that must be taken into account when preparing work programs and choosing a methodology. Consistent, systematic training in financial literacy will allow us to achieve qualitatively new results in matters of financial behavior of the population.

References

- Balasubramnian, B., & Sargent, C.S. (2020). Impact of inflated perceptions of financial literacy on financial decision making. Journal of Economic Psychology, 80, 102306.

- Bitca, I., Ellero, A., & Ferretti, P. (2021). Financial literacy and generation Y: Relationships between instruction level and financial choices. Smart Innovation, Systems and Technologies, 184, 357-367.

- Davoli, M., & Rodríguez-Planas, N. (2020). Culture and adult financial literacy: Evidence from the United States. Economics of Education Review, 78, 102013.

- Gunko, N. N., & Dinukova, O. A. (2020). Impact of education on the structure of youth employment. European Proceedings of Social and Behavioural Sciences, 82, 874-880.

- Indefenso, E. E., & Yazon, A.D. (2020). Numeracy level, mathematics problem skills, and financial literacy. Universal Journal of Educational Research, 8(10), 4393-4399.

- Mantulenko, V. V., & Aleshkova D.V. (2020). Comparison of leading business schools in Russia and in the world. European Proceedings of Social and Behavioural Sciences, 82, 1-6.

- Migunova, L. G., Kuregyan, A. L., & Gneushev, A. S. (2020). Optimization of specialists training structure by educational programs structuring. EpSBS, 79, 882-886.

- Ministry of Finance of Russia (2011). Project "Promoting financial literacy and development of financial education in the Russian Federation". https://minfin.gov.ru/ru/om/fingram/

- Pandey, A., Ashta, A., Spiegelman, E., & Sutan, A. (2020). Catch them young: Impact of financial socialization, financial literacy and attitude towards money on financial well-being of young adults. International Journal of Consumer Studies, 44(6), 531-541. 10.15405/epsbs.2021.04.02.1210.1111/ijcs.12583

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Dzhulai, O. A., Savchenko, O. G., & Popova, E. V. (2021). Formation Of Financial Literacy Of Population Through The Educational System. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 101-106). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.12