Abstract

Understanding the interaction between Carbon emissions and the components of financial development is of great importance in order to formulate proper sustainable development policies. More importantly, the assessment whether the status of financial development in Malaysia is green or not. The current study is different from the previous study in this area where this study taking into account 3 different types of financial development, i.e., foreign investment, domestic investment and private investment. Henceforth, the current study utilises quadratic model and F-bounds assessment based on the ARDL context to Malaysian Carbon emissions, foreign direct investment, domestic investment, and domestic credit to private sector time series over the period 1970-2018. Results from the F-bound co-integration analysis confirmed the existence of a significant U-shape inversion via quadratic correlation between the emissions of carbon and domestic investment in the long run; however, the role of other financial development indicators was found insignificant. These results imply that Malaysia is moving towards green financial development with the existence of technological effect on the development of Malaysia domestic investment in the near future.

Keywords: Carbon emissionsfinancial developmentARDLsustainable development

Introduction

Sustainable development is an important issue highlighted in the current era. According to the Brundland Commission Report produced in 1987, sustainable development is referring to development that meets the needs of the present generation as well as those of future generations (Bekhet & Latif, 2018; Jalil, 2010). Relatively, green development is a subset of sustainable development where one of the possible ways to being green is by narrowing the gap between the development of the economy and environmental pollutions. However, due to several reasons, Malaysia faces a few challenges to achieve green development as well as “reducing 45% GHG emissions intensity of GDP by year 2030 relative to the emissions intensity of GDP in 2005" (United Nations Framework Convention on Climate Change, 2015). First, because Malaysia is an energy-dependent country and almost 99% of its energy comes from highly polluted fossil fuels whereas the remaining 1% comes from renewable energy sources (Bekhet & Othman, 2017). Second, Malaysia has considerably changed itself from a country that mostly grounded on agriculture to manufacturing and modern services, which are relatively high-energy-intensive (Bekhet & Othman, 2017). Without any innovation or action, the environmental quality is expected to worsen from time to time and will affect people's lives.

Undoubtedly, fiscal growth is essential to many countries, especially to emerging countries like Malaysia. Its function on economic growth was undeniably received a great attention with the advent of the endogenous growth theory (Nasreen & Anwar, 2015). The importance of finance in economic activities was first explore by Schumpeter (1911), and then the study on finance-economic relationship stimulated after the seminal paper of King and Levine (1993). Past literatures suggested a number of ways on how financial development can influence economic activities and environmental quality. First, efficient and affluent financial institutions improve the process of obtaining loans, which may help people to buy domestic equipment such as automobiles, air conditioners, washing machine, houses refrigerators, and many more. Consequently, this will increase energy consumption, as well as, increase carbon emissions (Javid & Sharif, 2016). Second, financial development can provide efficient financial services to foreign banking markets and attract foreign direct investment (FDI) (Kahouli & Omri, 2017). The FDI permits unindustrialized nations the required prospect and motivation in improving worldwide and local ecological endurability via new technology, clean and environmentally friendly production gained from foreign firms / investment (Acheampong, 2019; Nasreen & Anwar, 2015). Third, financial development may generally encourage research and development (R&D) activities that will improve economic activities and quality of environment (Acheampong, 2019; Shahbaz, Solarin, et al., 2013). The motivation for this study stems from the desire to explore the links between the emissions of carbon and financial progress in Malaysia that can be considered in the infant stage.

Problem Statement

Albeit the world’s extensive focus on the connection between financial development and the environment, previously observed studies on the link between financial development and environmental quality is quite limited. Jensen (1996) reported that the financial development served as an engine to industrialisation, which increase industrial pollution and damage the environmental quality.

Table

Insofar, in Malaysia, the relationship study between these two variables is still at the infant stage. Specifically, the research of how financial development influences the environmental pollution is still ongoing. The motivation for this study stems from the desire to explore the links between carbon emissions and financial development.

Research Questions

-

Does co-integration relationship exist between financial development and environmental pollution?

-

Does “Environmental Kuznet Curve (EKC)” hypothesis apply to Malaysia’s financial development and carbon emissions?

Purpose of the Study

In relation to the above matters, the aim of this study is to examine the existence of co-integration correlation between financial development and environmental pollution, as well as to inspect the presence of “Environmental Kuznet Curve (EKC)” hypothesis via quadratic relationship between financial development and carbon emissions. With the presence of EKC hypothesis between aforesaid variables, it means the Malaysia financial development can be considered as green with the occurrence of technological effect [for detail read EKC hypothesis written by Grossman & Krueger (1991)]. This study offers a good understanding and bridges the gap between financial development and carbon emissions by taking into account the role of foreign direct investment, domestic investment, and national credit to private investors as components of financial development that are separated into 3 models. Furthermore, this study utilizes the theory of demand with the intention to deliver a complete comprehension of the impact of financial development on environmental pollution. Likewise, this study serves as a significant recommendation to policy makers in Malaysia’s pursuit of transitioning into a lower carbon nation.

Research Methods

In order to assess the connection between the emissions of carbon and financial development, the yearly data of the carbon emissions from “solid fuel consumption (C)”, “domestic investment (K)”, “foreign direct investment (F)”, “domestic credit to private sector (D)”, and “gross domestic product (Y)” are employed. All data are obtained from “World Development Indicator (WDI)”, issued by the “World Bank” which covers the years from 1970 to 2018 and its detail was present in Table

To remove the impact of the variable’s factor to stimulate the stationary process (Narayan & Smyth, 2005; Lau et al., 2014), and to decrease the likelihood of heteroscedasticity and existence of autocorrelation (Bekhet & Othman, 2014), natural logarithms are applied to all data. Then, the following quadratic multivariate models in econometrics form are used to evaluate the status of financial development in Malaysia whether it is green or not (Bekhet & Othman, 2017):

Where LC, LK, LF, LD and LY are carbon emissions, domestic investment, foreign investment, private investment and GDP after taking the natural logarithm, respectively. µt signifies the random error term; with the assumption of a normal distribution. The relationship coefficients are interpreted as elasticities of carbon emissions as a change in independent variables [see Ivy-Yap & Bekhet (2015)].

Respectively, the squared term of financial development component is included to inspect the status of nonlinear relationship between financial development and carbon emissions; either is inversed U-shape or not. To put it differently, there is a technological effect that is able to transform the positive relationship between financial development and the emissions of carbon to an inverse relationship among aforesaid variables and then change the status of financial development from non-green to green financial development.

The role of financial development indicators whether they are able to improve environmental quality or not can be measured through the signage of the above mention coefficients. This study anticipates the , as indication to the inverted U-shaped relationship between Carbon emissions and financial development’s components. Conversely, if , a U-shaped relationship between carbon emissions and financial development’s components exists which mean there could be technology obsolescence at the middle stage of financial development that worsen the environmental pollution condition.

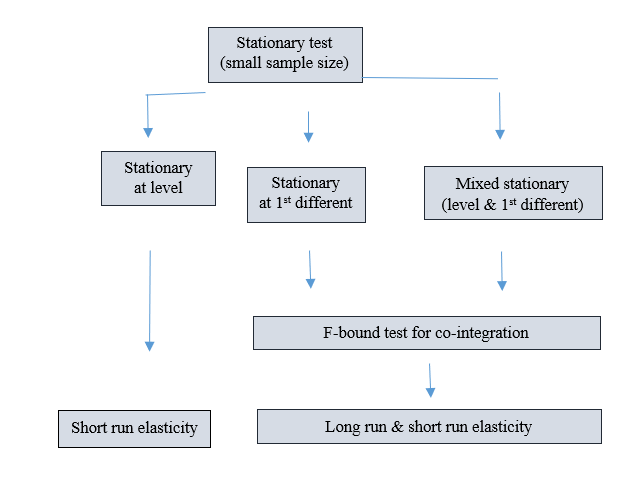

Next, the econometric procedures are used to test the hypothesis and to achieve the objectives of this study as shown in Figure

Findings

ADF test is utilized to measure the stationarity level. The results are presented in Table

Due to the combination of I (0) and I (1) level of stationarity, with the sample size being quite small (n=49), the most appropriate method to measure co-integration relationship is the F-bounds assessment. Nevertheless, prior to proceeding with the co-integration assessment, it is essential to ascertain the optimum lag extent to be applied in the F-bounds assessment (Matar & Bekhet, 2015; Sugiawan & Managi, 2016). Utilizing the “Akaike information criterion (AIC)”, the optimum lag extent for these models is 1 (refer to the Table

Table

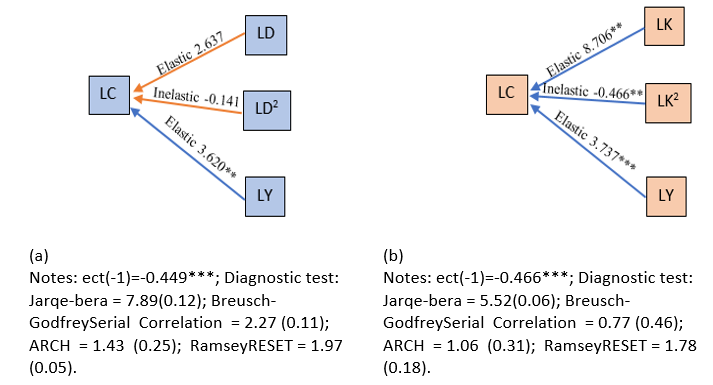

In relation to the above finding, the error correction model has been formulated to measure the long run elasticities via quadratic relationship between carbon emissions and financial development. The results are demonstrated in Figure

The coefficient of LK and LK2 are found to be significantly positive and negative respectively at a 5% level of significance and it maintained the inversed U-shape correlation between the emissions of carbon and domestic investment in due course. As suggested by the evidence, the emissions of carbon intensify during the early phase of development in domestic investment. However, at certain level of development of domestic investment, the carbon emission starts to decrease. This implies that domestic investment promotes typical environmental supervision procedures, as well as ecologically-friendly advancement into Malaysia’s economy, thus reducing the emissions of carbon. In essence, Malaysia’s domestic investment can be categorized as green.

To the contrary, the coefficient of LD and LD2 are found to be insignificantly positive and negative respectively, which rejected the existence of the inversed U-shape connection between the emissions of carbon and private investment in due course. The result is not consistent with Acheampong (2019), Al-Mulali et al. (2016), and Tamazian et al.’s (2009), but in line with Seetanah et al. (2019), indicating that private investment does not show any curvilinear impact on the emissions of carbon in Malaysia

Conclusion

The current study aims to measure the status of financial development in Malaysia, either it is green or not. To do so, the quadratic model and F-bounds assessment based on the ARDL context to Malaysian carbon emissions and financial development indicators are utilised for 1970-2018 period. It is different from the previous study in this area where this study taking into account 3 different types of financial development, i.e., foreign investment, domestic investment and private investment. Results from the F-bound co-integration analysis confirmed the existence of the significant inversed U-shape via quadratic connection between the emissions of carbon and domestic investment in due course, however, the role of other financial development indicators was found insignificant. These results imply that Malaysia’s domestic investment is moving towards green financial development with the existence of technological effect on its development in the near future.

Since 2010, Malaysia has been recorded almost 80% of the approved investment projects is coming from domestic investment, while the remaining 20% of the approved investment projects is coming from foreign investment (Hanif & Jalaluddin, 2013). The contribution of service sector to GDP increased from 51.2% in year 2010 to 55.5% in year 2018, and it was targeted to increase to 58% in year 2020 make a service sector as the largest contributor of approved investment (www.mida.gov.my). Judging from this, Malaysia has enormous amount of investment projects and the allocation of these project is moving towards green investment.

As for policy implication, policy maker has to continuously stay on this path by highlighting more energy efficient and renewable energy components in all the investment process starting from its approval process until the implementation of the project. Through this, the policy makers either it in the public or private sector able to support government mission and vision to ensure that the country is protected against any possible environmental pollution. However, this study did not measure the forecast threshold level via at which the carbon emissions start to decrease as a result of development of domestic investment. Due to this, future researchers are to measure the threshold level and explore more potential factor that can influence the environmental quality in Malaysia.

Acknowledgments

The authors would like to acknowledge IRMC UNITEN for awarding internal grant (UNIIG2018) for funding this research.

References

- Acheampong, A. O. (2019). Modelling for insight: Does financial development improve environmental quality? Energy Economics, 83, 156–179. https://doi.org/10.1016/j.eneco.2019.06.025

- Ahmad, N., Du, L., Lu, J., Wang, J., Li, H. Z., & Hashmi, M. Z. (2017). Modelling the CO2 Emissions and Economic Growth in Croatia: Is There any Environmental Kuznets Curve? Energy, 123, 164-172.

- Al-Mulali, U., Solarin, S. A., & Ozturk, I. (2016). Investigating the Presence of the Environmental Kuznets Curve (EKC) Hypothesis in Kenya: An Autoregressive Distributed Lag (ARDL) Approach. Natural Hazards, 80(3), 1729-1747. https://doi.org/10.1007/s11069-015-2050-x

- Bekhet, H. A., & Othman, N. S. (2017). Impact of urbanization growth on Malaysia CO2 emissions: Evidence from the dynamic relationship. Journal of cleaner production, 154, 374-388. https://doi.org/10.1016/j.jclepro.2017.03.174

- Bekhet, H. A., & Othman, N. S. (2014). Long-run elasticities of electricity consumption, FDI, export and GDP in Malaysia. International Journal of Economics and Finance, 6(8), 78-90. https://doi.org/10.5539/ijef.v6n8p78

- Bekhet, H. A., & Othman, N. S. (2011). Assessing the Elasticities of Electricity Consumption for Rural and Urban Areas in Malaysia: A Non-linear Approach International Journal of Economics and Finance, 3(1), 208-217.

- Bekhet, H. A., & Latif, N. W. A. (2018). The impact of technological innovation and governance institution quality on Malaysia's sustainable growth: Evidence from a dynamic relationship. Technology in Society, 54, 27-40. https://doi.org/10.1016/j.techsoc.2018.01.014

- Bekhet, H. A., & Mugableh, M. I. (2012). Investigating equilibrium relationship between macroeconomic variables and Malaysian stock market index through bounds tests approach. International Journal of Economics and finance, 4(10), 69-81. https://doi.org/10.5539/ijef.v4n10p69

- Brown, S. P. A., & McDonough, I. K. (2016). Using the Environmental Kuznets Curve to Evaluate Energy Policy: Some Practical Considerations. Energy Policy. 98, 453-456.

- Charfeddine, L., & Khediri, K. B. (2016). Financial Development and Environmental Quality in UAE: Co-integration with Structural Breaks. Renewable and Sustainable Energy Reviews. 55, 1322–1335. https://doi.org/10.1016/j.rser.2015.07.059

- Dogan, E., & Turkekul, B. (2016). Carbon emissions, Real Output, Energy Consumption, Trade, Urbanization and Financial Development: Testing the EKC Hypothesis for the USA. Environmental Science and Pollution Research, 23, 1203–1213. https://doi.org/10.1007/s11356-015-5323-8

- Grossman, G. M., & Krueger, A. B. (1991). Environmental Impacts of a North American Free Trade Agreement. NBER working paper (Vol. 3914). https://doi.org/10.3386/w3914

- Hanif, A., & Jalaluddin, S. (2013). FDI and domestic investment in Malaysia. International Proceedings of Economics Development & Research, 76, 15-20. https://doi.org/10.7763/IPEDR.2014.V76.4

- Ivy-Yap, L. L., & Bekhet, H. A. (2015). Examining the Feedback Response of Residential Electricity Consumption Towards Changes in its Determinants: Evidence from Malaysia. International Journal of Energy Economics and Policy, 5(3), 772–781.

- Javid, M., & Sharif, F. (2016). Environmental Kuznets Curve and Financial Development in Pakistan. Renewable and Sustainable Energy Reviews, 54, 406-414. https://doi.org/10.1016/j.rser.2015.10.019

- Jensen, V. (1996). The pollution haven hypothesis and the industrial flight hypothesis: some perspectives on theory and empirics. Centre for Development and the Environment (Working Paper 1996.5), University of Oslo, Oslo.

- Kahouli, B., & Omri, A. (2017). Foreign direct investment, foreign trade and environment: New evidence from simultaneous-equation system of gravity models. Research in International Business and Finance, 42, 353-364.

- Katircioglu, S. T., & Taspinar, N. (2017). Testing the Moderating Role of Financial Development in an Environmental Kuznet Curve: Empirical Evidence from Turkey. Renewable and Sustainable Energy Reviews, 68, 572-586.

- King, R. G., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The quarterly journal of economics, 108(3), 717-737.

- Lau, L. S., Choong, C. K., & Eng, Y. K. (2014). Investigation of the Environmental Kuznets Curve for Carbon Emissions in Malaysia: Do Foreign Direct Investment and Trade Matter? Energy Policy, 68, 490-497.

- Maji, I. K., Habibullah, M. S., & Saari, M. Y. (2017). Financial Development and Sectoral Carbon emissions in Malaysia. Environmental Science and Pollution Research, 24, 7160-7176. https://doi.org/10.1007/s11356-016-8326-1

- Matar, A., & Bekhet, H. A. (2015). Causal interaction among electricity consumption, financial development, exports and economic growth in Jordan: Dynamic simultaneous equation models. International Journal of Energy Economics and Policy, 5(4), 955-967.

- Mrabet, Z., & Alsamara, M. (2017). Testing the Kuznets Curve Hypothesis for Qatar: A Comparison between Carbon Dioxide and Ecological Footprint. Renewable and Sustainable Energy Reviews, 70, 1366–1375. https://doi.org/10.1016/j.rser.2016.12.039

- Narayan, P. K., & Smyth, R. (2005). Electricity Consumption, Employment and Real Income in Australia Evidence from Multivariate Granger Causality Tests. Energy Policy, 33(9), 1109-1116.

- Nasreen, S., & Anwar, S. (2015). The impact of economic and financial development on environmental degradation: An empirical assessment of EKC hypothesis. Studies in Economics and Finance, 32(4), 485-502. https://doi.org/10.1108/SEF-07-2013-0105

- Schumpeter, J. A. (1911). The Theory of Economic Development. Oxford University Press.

- Seetanah, B., Sannassee, R. V., Fauzel, S., Soobaruth, Y., Giudici, G., & Nguyen, A. P. H. (2019). Impact of Economic and Financial Development on Environmental Degradation: Evidence from Small Island Developing States (SIDS). Emerging Markets Finance and Trade, 55(2), 308-322. https://doi.org/10.1080/1540496X.2018.1519696

- Shahbaz, M., Hye, Q. M. A., Tiwari, A. K., & Leitao, N. C. (2013). Economic Growth, Energy Consumption, Financial Development, International Trade and Carbon emissions in Indonesia. Renewable and Sustainable Energy Reviews, 25, 109-121. https://doi.org/10.1016/j.rser.2013.04.009

- Shahbaz, M., Solarin, S. A., Mahmood, H., & Arouri, M. (2013). Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Economic Modelling, 35, 145-152. https://doi.org/10.1016/j.econmod.2013.06.037

- Shahbaz, M., Shahzad, S. J. H., Ahmad, N., & Alam, S. (2016). Financial development and environmental quality: The way forward. Energy Policy, 98, 353-364. https://doi.org/10.1016/j.enpol.2016.09.002

- Sugiawan, Y., & Managi, S. (2016). The Environmental Kuznets Curve in Indonesia: Exploring the Potential of Renewable Energy. Energy Policy, 98, 187–198. https://doi.org/10.1016/j.enpol.2016.08.029

- Tamazian, A., Chousa, J. P., & Vadlamannati, K. C. (2009). Does Higher Economic and Financial Development Lead to Environmental Degradation: Evidence from BRIC Countries. Energy Policy, 37, 246-253. https://doi.org/10.1016/j.enpol.2008.08.025

- Tamazian, A., & Rao, B. B. (2010). Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Economics, 32(1), 137-145. https://doi.org/10.1016/j.eneco.2009.04.004

- United Nations Framework Convention on Climate Change. (2015). Paris agreement. FCCCC/CP/2015/L. 9/Rev. 1.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Othman, N. S., Bekhet, H. A., Ibrahim, D., Harun, N. H., & Bakar, S. (2020). Is Financial Development in Malaysia Green? An Empirical Assessment of EKC Hypothesis. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 513-523). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.55