Abstract

The authors explore the problem of tax security formation as a system-forming element of financial security of the state. In the article they show its role in financial provision of the state to support the sustainable development of economy and society. The purpose of the study is to generalize scientific developments in the field of tax security, identify its main tools, indicator set for its assessment, identify threats and establish causal relationships between them. When disclosing the elements of tax security, the authors used methods of scientific search and generalization of literature, economic and statistical methods of analysis, comparison, graphical interpretation tools, dialectic method and system approach. They give reasons for the necessity of fixing the term and structural components of tax security at the legislative level. The article defines the tools and elements of tax security, identifies threats to tax security in the framework of tax administration functions, and suggests indicator set for assessing its state. The authors introduce the priorities of ensuring tax security associated with activization of tax authorities to prevent tax offenses in order to mitigate the possible causes of tax security threats, and introduction of modern information technologies used for analysis, control and interaction with taxpayers, improving citizens' literacy in tax matters.

Keywords: Tax securitytax policytax administrationthreatsfinancial security

Introduction

In conditions of geopolitical instability, intensification of globalization processes and intensification of competition between countries in terms of economic development level, issues of ensuring economic security of the state come to priority. An important component of economic security is financial security that ensures the efficient functioning of the financial system and is protected from threats of external and internal nature. The basis of the financial system is the state budget, the sufficiency of which allows the state to carry out its functions within the framework of spending powers and priorities of socio-economic development. The budget system of the Russian Federation at different levels of government is mainly based on tax revenues, the relative share of tax revenues over a long period is in the range of 83-90% of all revenues. In this regard, the financial support of the state, regions, municipalities and society as a whole depends on an effective and efficient tax policy that promotes both mobilization of tax revenues and increased activity of all participants in tax relations in the current period and in the future. In these conditions, special attention is paid to formation of tax security of the state, ensuring the sustainability of all its elements that can quickly respond to various changes in the external environment.

Problem Statement

The research is aimed at revealing the scientific problem of tax security ensuring, identifying threats to its functioning, indicators for assessing its condition and developing directions for tax administration improving.

The formation of tax security is a priority for the state and requires the development of a strategy for its provision. Currently, only the Strategy for ensuring the economic security of the Russian Federation for the period up to 2030 and the directions of the budget, tax and customs tariff policy for the medium term have been developed in Russia. The basic elements of ensuring tax security are not fixed by law, and indicators of its state are not highlighted. In this regard, the need for theoretical and methodological research on the formation of tax security elements is being updated.

Research Questions

The following questions were revealed in the research process.

What is the role of tax security in the financial security of the state and what is its essence?

What tax security tools are used in domestic and world practice?

What threats to tax security can harm the state, have a cumulative effect, and what are the causal relationships between them?

What indicators can be used to assess the state of tax security?

Approaches to the definition of the tax security essence

Researches of the tax security essence in the works of domestic and foreign scientists made it possible to distinguish two different areas: some scientists ( Kosova et al., 2019) consider tax security as an integrated system of economic security, others ( Elmendorf & Reifschneider, 2002; Saifieva et al., 2019) as a form of financial security. We consider attributing tax security directly to economic security as a controversial issue, since taxes are part of finance and therefore it is more appropriate to consider tax security as an element of financial security ( Popova et al., 2019).

Structural components of tax security

A significant aspect in the scientists’ research is the development of a strategy to increase tax security in the digital economy ( Fedotova et al., 2019). Russian authors pay attention to certain elements of ensuring tax security: tax potential ( Shemyakina et al., 2019), tax burden ( Musaeva et al., 2017). Mainly, scientists’ research is related to the analysis of threats and risks of tax security ( Shtiller et al., 2016; Vlasova, 2017), however, there is no single classification of them, and the main threats are associated with increase of shortfalls in income, decrease in tax revenues, growth of indebtedness and etc.

There are no comprehensive studies relating to indicators of tax security assessment ( Maslov, 2019); they mostly come down to indicators of tax administration ( Nasyrova, 2015) or indexes for assessing the level of tax security ( Afanasyeva, 2015).

Purpose of the Study

The purpose of the study is to generalize scientific developments in the field of tax security, identify its main tools, a set of indicators for its assessment, identify threats and establish causal relationships between them.

Research Methods

When disclosing the elements of tax security, the authors used the methods of scientific search and generalization of the literature to highlight approaches to the definition of “tax security” and formulate the author’s definition. The study used economic and statistical methods of analysis, comparison, tools for graphical interpretation of the results of assessing the tax security state. The dialectical method and systematic approach were used to identify threats to tax security and assess their impact at the macro and micro levels.

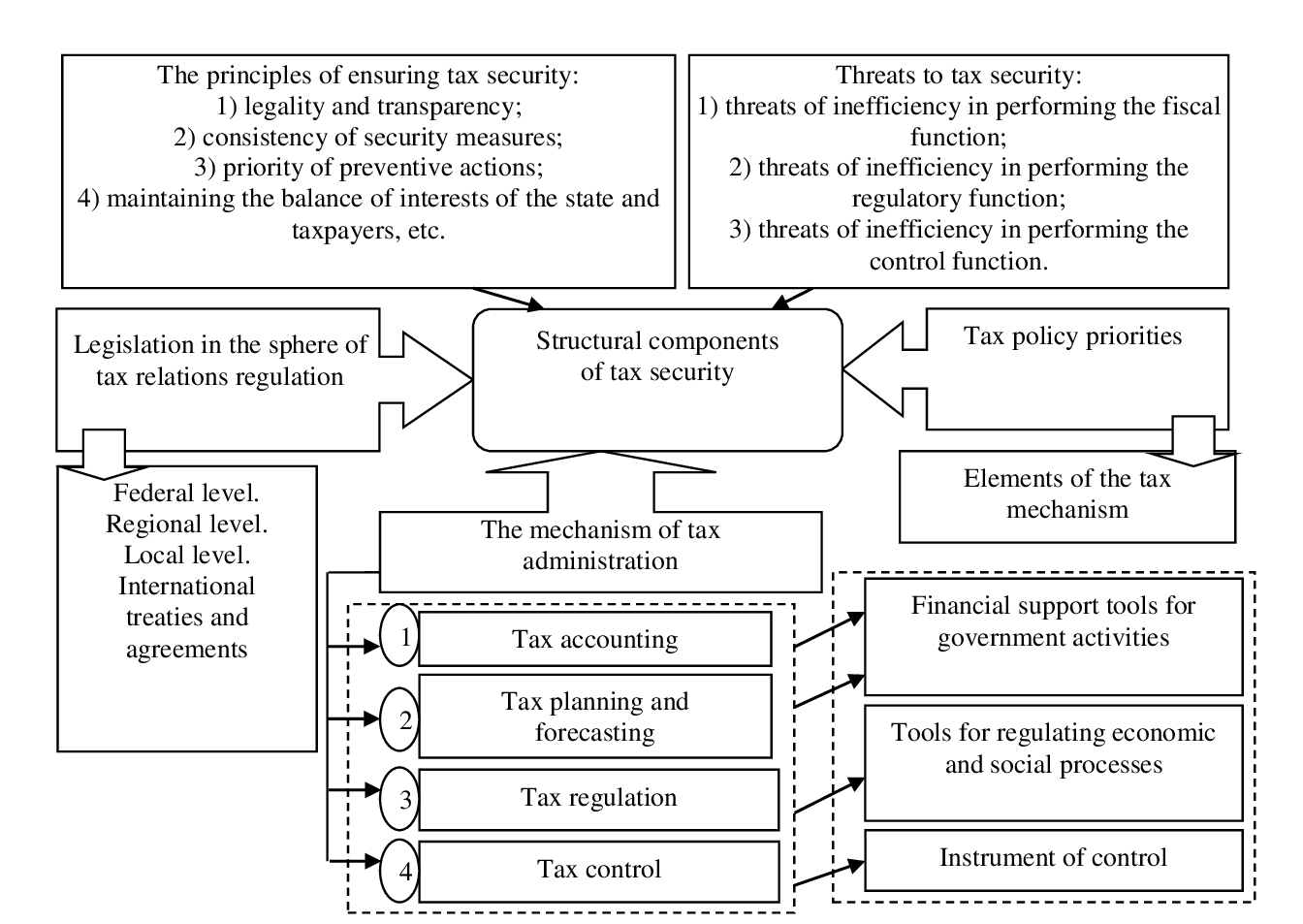

Tax security is defined as a system-forming element of financial security associated with ensuring the effective elements functioning of the tax mechanism and tax administration tools that provide protection from internal and external threats in order to achieve the priorities of sustainable development of the state. The proposed definition of tax security allows us to distinguish its main structural components (Figure

The basis for ensuring tax security is the efficient organization of tax administration. To assess the quality of tax administration in world practice we use ratings carried out by country. Thus, according to the World Bank Group and PwC (Paying Taxes 2020, 2019) rating, Russia ranks 58th in the world in terms of administrative costs associated with the calculation and payment of taxes. The country’s rating shows the most favorable conditions in the framework of payment administration. The USA takes 25th place in the ranking, and Germany – 46th place. If we consider the indicators that make up the rating, then Russia has 9 payments per year, the same indicator has Germany, and the USA – 11. The amount of time spent on reporting, maintaining records and transferring payments in Russia is 159 hours a year, in the USA – 175 hours, in Germany – 218 hours. The total tax and contribution rate in Russia is 46.2%, which shows the share of tax costs in the organizations’ profits. Improving the rating of Russia among other countries in the world is primarily due to the modernization of tax administration, aimed at the widespread use of electronic services, electronic document management and modern information technologies, which allows to reduce administrative costs.

The tools for ensuring tax security and implementation of tax administration are highlighted in the framework of the implemented functions and include instruments for financially supporting the state’s activities in the framework of expenditure powers fulfillment, instruments for regulating economic and social processes and instruments of control. Effective use of these tools is possible only with a balance of interests of the state and taxpayers. Any conflict of interest can lead to various threats to tax security. Moreover, we consider it appropriate to identify threats also within the framework of performed functions: threats to the inefficiency of the fiscal function; threats to the inefficiency of the regulatory function; threats to the inefficiency of the control function. The threats to the inefficiency of the fiscal function include reduction of tax revenues, occurrence of unplanned losses of revenue, failure to meet planned targets, etc. The threats to the inefficiency of the regulatory function include increase in the tax burden and in unsettled debt, inefficiency of tax benefits, and deterioration in the tax climate for priority sectors of the economy and types of activities, etc. The threats to the inefficiency of the control function include unjustified increase in costs over the results, declining collectability, increase in offenses, low efficiency and effectiveness of the controlling work, etc.

Each of the identified threats can arise individually and is in a close causal relationship, i.e. the threat of failure to perform one function may lead to threats of inefficient performance of all functions, that is, have a cumulative effect.

A variety of indicators are used to assess the tax security state ( Afanasyeva, 2015; Maslov, 2019; Nasyrova, 2015), which, of course, reflect individual aspects of the phenomenon under consideration. We suggest highlighting indicators as part of the assessment of the functions performed by tax administration (Table

At the same time, the costs of ensuring tax security should justify the results expressed in providing the financial component of the state to maintain sustainable development of economy and society, contribute to development of business activity and provide expanded reproduction by business entities.

Let us analyse some indicators of assessing tax security in Russia (Table

The analysis of the data presented allows us to conclude that there is an emerging growth trend for all the analyzed indicators of assessing tax security. In 2019, the share of taxes and other obligatory payments in GDP amounted to 30.17%, which is 2.97% more compared to 2016. During the analyzed period, the collection rate increased by 2.94% in 2019 compared to 2016, which is associated with the effective activities of tax authorities to control tax receipts. In 2019, the share of outstanding debts, i.e. impossible to recover, amounted to 0.04% in total tax revenues, and there is an unfavorable growth dynamic of this indicator, which requires increased control by the tax authorities on debt settlement.

Findings

Based on the study, the following results were obtained.

The authors determined the role of tax security as a system-forming element of financial security, the budgetary stability and balance, a favorable tax environment for the development of business entities and society as a whole depend on the effectiveness of its functioning. It is proved that at the legislative level it is required to introduce the term and consolidate the structural components of tax security, to develop a tax security strategy of the Russian Federation for the medium term.

The authors identified the tools and elements of tax security based on the principles of legality and transparency, the systematic nature of security measures, the priority of preventive actions, and maintaining the balance of interests of the state and taxpayers. Threats to tax security in the framework of the implemented functions of tax administration are identified and a causal relationship between them is established.

The study proposed groups of indicators for assessing the tax security state that are not exhaustive, they can be expanded or narrowed depending on the analysis objectives and are as the object of further research by the authors within the framework of this topic.

The authors introduced the priorities of ensuring tax security associated with the tax authorities work on prevention of tax offenses in order to mitigate possible causes of tax security threats, introduction of modern information technologies for analysis, control and interaction with taxpayers, improving citizens' literacy in tax matters.

Conclusion

Modern challenges of global economy and the need to develop digitalization processes require the formation of an effective state tax security system that can quickly respond to internal and external threats, ensuring the implementation of priority fiscal policies and introducing modern mechanisms of interaction with taxpayers. The proposed elements of tax security, based on the effectiveness of the tax administration functions, will form the foundation for a detailed analysis of the need to develop specific indicators of tax security that make it possible to conduct retrospective, current and perspective assessment, as well as inter-regional comparisons for the subjects of the Russian Federation.

References

- Afanasyeva, L. V. (2015). Fiscal security: G7 countries and Russia. News of Southwestern State University. Series: Economics. Sociology. Management, 1(14), 59-63.

- Elmendorf, D. W., & Reifschneider, D. (2002). Short run effects of fiscal policy with forward-looking financial markets. National Tax Journal, 55(3), 357-386.

- Fedotova, G. V., Ilyasov, R. H., Gontar, A. A., & Ksenda, V. M. (2019). The Strategy of Provision of Tax Security of the State in the Conditions of Information Economy. In I. Gashenko, Y. Zima & A. Davidyan (Eds.), Optimization of the Taxation System: Preconditions, Tendencies and Perspectives. Studies in Systems, Decision and Control, 182, (pp. 217-228). https://doi.org/10.1007/978-3-030-01514-5_25

- Federal Tax Service of Russia (2020). Statistics and analytics. https://www.nalog.ru/rn57/related_activities/statistics_and_analytics/

- Kosova, T., Slobodyanyuk, N., Steblianko, I., & Doroshkevych, V. (2019). Tax security of national economic systems in globalization conditions. Journal of Security and Sustainability Issues, 3(8), 493-505. https://doi.org/10.9770/jssi.2019.8.3(16)

- Maslov, K. V. (2019). Indicators of state tax security in the mechanism of state management of tax relations. Bulletin of Omsk University. Series “Law”, 4(16), 66-76. https://doi.org/10.24147/1990-5173.2019.16(4).66-76

- Musaeva, K. M., Isaev, M. G., Mirzabalaeva, F. I., Magomedova, R. M., & Alimirzoeva, M. G. (2017). Tax aspects of ensuring economic security. Ponte, 12(73), 181-189.

- Nasyrova, V. (2015). Estimation of the Quality of Tax Administration in the Russian Federation. Mediterranean Journal of Social Sciences, 6(1S3), 16-19.

- Paying Taxes 2020. (2019) World Bank Group and PwC. https://www.doingbusiness.org/en/reports/thematic-reports/paying-taxes-2020

- Popova, L. V. Selyukov, M. V., Varaksa, N. G., & Nazarov, M. A. (2019). The Regional Tax Security Mechanism Based on Reduction of Tax Risks and Use of Information Technologies. In V. Mantulenko (Ed.), 17th International Scientific Conference Problems of Enterprise Development: Theory and Practice 2018. SHS Web Conf., Vol. 62. https://doi.org/10.1051/shsconf/20196214003

- Rosstat (2020). Official statistics. https://www.gks.ru/folder/10705

- Saifieva, S. N., Shakhov, O. F., Nevmyvako, V. P., Chernavsky, M. Yu., & Vysotskaya, N. V. (2019). Taxation in the context of economic security: opportunities and technologies. International Journal of Recent Technology and Engineering, 2(8), 6089-6094. https://doi.org/10.35940/ijrte.B3816.078219

- Shtiller, M. V., Nazarova, V. L., Selezneva, I. V., Kogut, O. Yu., Bekenova, L. M., Jondelbayeva, A. S., & Korvyakov, V. A. (2016). Tax Risks int he Company’s Accounting System: Essence, Identification and Control. International Journal of Economics and Financial Issues, 6(4), 1791-1797.

- Shemyakina, M. S., Murzina, E. A., & Yalyalieva, T. V. (2019). Management of the territory tax potential to ensure its tax security. Regional Science Inquiry, 2(11), 59-72.

- Vlasova, Y. A. (2017). Risks of regional budgets of the Russian Federation. Espacios, 38(52), 10.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Varaksa, N., Korostelkina, I., Dedkova, E., & Konstantinov, V. (2020). Formation Of Tax Security As A System-Forming Element Of Financial Security. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 655-661). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.76