Abstract

The article contains the analysis of the current state of the insurance market against the Covid-2019 virus infection in the Russian Federation. The main problem points in terms of risks, terms and insurance amounts are considered, the examples of ineffective insurance contracts are presented. The article analyzes the model rules for insurance against accidents and diseases (on which the current insurance product against coronavirus infection is based) of the main participants of the insurance market of Russia in terms of exceptions to coverage, and the proposals have been made to standardize them and eliminate epidemics and other types of adverse events. The current statistics of morbidity and mortality in Russia and in a number of foreign countries are considered in order to substantiate the current insurance rates for this risk. The justification has been made to include a number of diseases in the list of risks, measures to correct the situation in terms of promotion of this product and the formation of its adequate filling have been offered, the mechanism to reduce corruption risks has been developed. Assumptions have been made on the further development of this type of insurance in the conditions of termination of the pandemic.

Keywords: InsuranceriskmarketaccidentCOVID-19epidemic

Introduction

In 2020, all over the world a complex epidemiological situation has formed which is associated with the pandemic of the influenza virus CoVID-2019. The influenza pandemic is a global epidemic caused by a new influenza virus against which the human population has no primary immunity or it is very low. Influenza pandemics cannot be predicted. They can be mild or characterized by severe forms of disease, up to those leading to death. The severe form of the disease occurs in certain risk groups that may coincide with similar risk groups for severe forms of seasonal influenza. However, healthy people who are not at risk are more likely to develop more severe forms of the disease during the pandemic as compared to seasonal influenza cases.

The current situation with coronavirus was described by the World Health Organization (WHO) as a pandemic. The last pandemic occurred in 2009 and was caused by influenza A virus (H1N1). Globally, it is estimated that the H1N1 pandemic caused 100,000 to 400,000 deaths in the first year alone.

According to WHO, as of April 19, 2020, there have been more, than 2,330,000 cases of CoVID-2019 worldwide, of which 161,000 have been fatal. The highest number of cases of the disease were registered in the United States (more than 735,000), Spain (more than 194,000), Italy (more than 175,000) and France (more than 152,000). As of April 19, 2020, 42,800 cases of coronavirus infection have been reported in Russia, and 361 people have died.

At the moment, the insurance companies do not have statistics on the overall incidence both in the world and in Russia, as the main problem lies in the volume of testing of the population and the quality of the tests. At the same time, some players of the insurance market are trying to take advantage of this situation and bring the products for insurance against coronavirus infection to the market in the conditions of general hysteria.

Problem Statement

In Russia, insurance companies are trying to use the current agenda and start selling insurance policies against coronavirus. The lack of statistics on the incidence of CoVID-2019 and its severity leads to the fact that the products brought to the market by the insurers, strongly differ on the risk formulation, exclusions from coverage and other significant insurance conditions. We can say that the main focus of these products is not so much providing adequate insurance coverage for insurers, as the use of the policy of "removing the cream" and trying to earn super profits on the fears of the population. It can be noted that the low insurance culture also imposes a certain imprint on the development of these products, as the population maintains poor awareness of the basic concepts of insurance and does not distinguish voluntary health insurance from accident insurance. This will lead to the fact that in the case of an insurance event associated with coronavirus infection, the insured (or the beneficiaries) have poor understanding of what s/he can really expect and what actions s/he should take. There is a need to standardize the conditions of these insurance policies and maximize the coverage, in order to ensure real insurance coverage of the insured, and ideally, everything should take place online with the minimum participation of the victim.

Research Questions

The following questions are the subject of the study:

What are the risks, terms and insurance amounts currently included in the basic coverage for coronavirus insurance?

What are the most critical risks in this product?

How is the insurance premium for this type of insurance formed in the market at the moment, what is the real mortality among the population in terms of age groups?

What is the dominant factor influencing the formation of the price for the product, and what are the sales channels of these policies?

How can the product content be improved while maintaining (reducing) the current price?

What exceptions from the insurance coverage should be removed from the model contract for coronavirus infection insurance?

It should be noted that the answers to the questions set must be agreed upon.

Purpose of the Study

The purpose of this study is:

Forming a list of risks

Highlighting the list of risks that are included in the insurance coverage on the present day, and forming a list of complex risks, most satisfying insurers and providing maximum insurance coverage. It is necessary, if possible, to choose the most complete definition of the basic concepts for infection insurance contracts and other insurance cases related to infectious diseases.

Identify and analyze opportunities to increase insurance coverage

Consideration of the current structure of the rate of insurers and identification of the extent of net pressure and the load of insurers. Performing a competitive analysis of the current rates of infection insurance CoVID-2019. Formation of the average competitive value of the tariff on this type of insurance.

Identify the patterns of the formation of the main list of epidemiological and other exceptions to insurance coverage

Forming a list of exemptions used to reduce the basic rate of insurers and reducing it to meet the needs of the insured and providing the most comprehensive coverage.

Forecasting and identifying the main trends in accident insurance

Considering the possibility of applying the obtained insurance product for further scaling to other industries, taking into account the addition of its modern information technologies for scoring risk assessment and protection of personal data of the insured.

Research Methods

Selection of the list of insurers

By April 2020, 8 insurers in Russia have brought a number of programs for insurance against coronavirus to the insurance market. (In respect of INCOR Insurance company product, the study of content does not make sense, as the Bank of Russia revoked all licenses for the implementation of insurance from this insurer by the Order No. OD-435 of March 16, 2020).

Comparison of the basic conditions for products is presented in the Table

Selecting the list of risks

It should be noted that insurance programs (risks, exceptions to the rules, insurance amounts, payment terms, period of insurance protection, etc.) differ significantly in different companies. At the moment, the insurer is free to choose the insurance program and insurance rules based on their preferences for the risk component and/or the price in different insurance companies that have the appropriate license for it. At the same time, due to the low insurance culture of the population, the price of the policy is currently a determining factor for the consumers of these insurance services. Coronavirus insurance is considered as, for example, compulsory auto-civil liability insurance (hereafter - OSAGO), where all the essential insurance conditions are the same for all the insurers.

There can be only one way out of this situation, which is the introduction of minimum standard requirements for this product, in order to stop the speculation on the fears of the population. First of all, it concerns the risk component. To begin with, the period of insurance should be the necessary condition: instead of the current spread from 90 days to 365, it is necessary to extent it to one year. In order to reduce their risks, the insurers introduce a "temporary" deductible, i.e. the policy begins to operate not at the time of signing, but 3-15 days after registration (Drozdov et al., 2011). The area of action should not be limited to the Russian Federation, as after the peak of the disease and the opening of the borders, the insured can become infected while staying in other countries, or on return from abroad during one year period. A number of companies have introduced a restriction on sports, and it is difficult to find any logical explanation for this measure, but it can be assumed that in a hurry, forming a product, the underwriters have simply forgotten to remove this exception, which stayed there from the standard insurance policy against accidents and diseases. Full coverage can be provided when all the following risks are included in the policy:

death as a result of coronavirus infection (including СoVID-19);

temporary incapacity for work as a result of the confirmed disease caused by coronavirus infection (including COVID-19);

first diagnosed disease from group X, Respiratory Diseases ICD-10 (International Classification of Diseases) in the presence of a positive response to a pathogen from the coronavirus family (including COVID-19);

hospitalization of the insured (it is possible to establish an increased percentage of insurance payment for the period of hospitalization rather than for incapacity for work);

I, II, III group disability confirmation for the insured in the result of a coronary virus disease (including COVID-19) that occurred during the contract period.

It is worth noting that some insurers state a specific strain of the virus, but only now three strains of coronavirus are known.

It is reasonable to establish a single definition of both an accident and a list of risks, so that it became the standard for all insurers and could be adjusted if necessary by the All-Russian Union of Insurers. At the moment, only the term "accident" is defined by the law in the Article 3 of the Federal Law of 24.07.1998 N 125-FZ "On compulsory social insurance against industrial accidents and occupational diseases". The full definition may look like this: an insurance case is an actually happened, sudden, unforeseen event, which is the result of external causes, which lead to a health disorder of the insured, resulting in temporary or permanent disability or death.

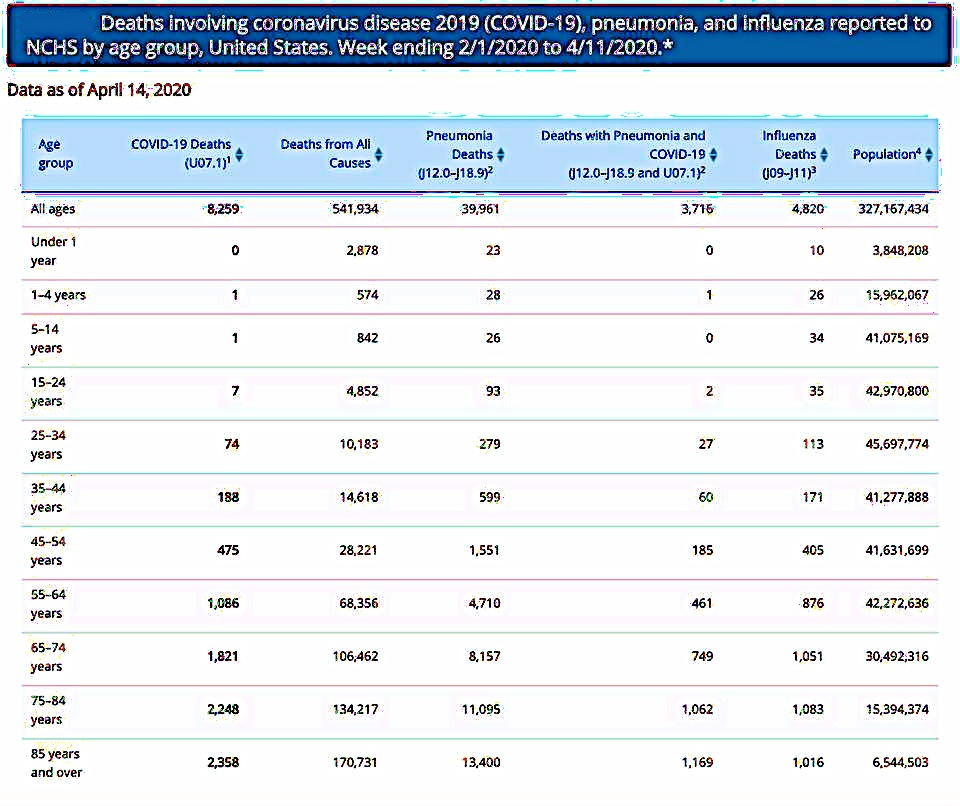

The above definition of an accident covers most of the risks, not just those associated with coronavirus infection. Currently, the mortality rate among those infected with coronavirus is about 2%, while mortality from pneumonia for example is 5 times higher (Figure

It can be assumed that after the peak of the epidemic, the demand for insurance policies against coronavirus infection will disappear. For the development of this branch, it makes sense to modernize this product, by including some specific but dangerous risks, the probability of which is quite low, but the consequences can be very severe and often incurable. For example, it makes sense to include the tick-borne encephalitis, tick-borne borreliosis (Lyme disease), tick-borne erlichiosis, etc. in the list of risks.As of June 2019, in St. Petersburg and the Leningrad region alone, the number of referrals to medical institutions due to tick bites exceeded 8,000, and for the whole 2018, according to the data of Rospotrebnadzor in Russia, there were more than 521,000 appeals of citizens to medical institutions with tick bites. Some of the cases (8,214 cases) were infected with the above-mentioned diseases, and the percentage of infected is significantly different depending on the region: in the European part it does not exceed a few percent, and in Siberia and the Far East it can reach up to 20%.

It also makes sense to add hemorrhagic fever with renal syndrome (mouse fever) to the insurance coverage, as soon as it is an acute infection that affects mainly the kidneys. According to statistics, about 7-10% of patients die from such sequela as kidney failure, internal bleeding, swelling of the lungs and so on. Thus, according to Rospotrebnadzor, in 2018 the number of people with the disease amounted to 5,855 people.

The inclusion of these infectious diseases in the standard list of risks does not significantly increase the risk part, but at the same time significantly improves the quality of the policy content.

Establishing coverage restrictions

Currently, insurance is usually accepted by persons under the age of 70. In a number of companies, the range is significantly shorter. As a rule, persons with disabilities of 1 and 2 groups and persons with cancer, chronic heart disease and respiratory diseases are excluded from insurance coverage. All these exceptions are of a discriminative nature and go against a number of basic civil norms, including the Constitution of the Russian Federation.

Currently, insurance companies do not have specialized rules for coverage against coronavirus infection and are trying to use model rules for accident and disease insurance. This leads to the fact that officially recognized cases of epidemics, pandemics, emergencies and emergencies also refer to exclusions from insurance coverage. At the same time, many countries have declared an emergency (e.g., USA, Italy, Spain, Czech Republic, etc.). The World Health Organization has now officially recognized the epidemic. It also raises the question of how the company will pay if, for example, the insured at the time of infection stayed in Europe, where the epidemic is officially recognized.

Some companies exclude the from coverage the cases when the insured stayed overtime in connection with quarantine or other preventive measures of the official authorities. Thus, according to the ruling of the Chief State Sanitary Doctor of the Russian Federation of March 18, 2020 No.7 "On the provision of an isolation regime in order to prevent the spread of COVID-19" all persons arriving in Russia should be placed in 14 days' quarantine. Accordingly, in order to receive the insurance reimbursement, the insured has to violate the Order of the Chief Sanitary Doctor of the Russian Federation.

Identifying the market dependencies between tariff size, load and net rate

In addition to the list of insurance events, it is necessary to deal with the insurance amount for this type of policy. The insurance amount is the amount of money defined by the insurance contract (can be set in rubles and in the ruble equivalent of foreign currency), on the basis of which the amount of the insurance premium and the amount of the insurance payment at the onset of insurance case are defined. It should be noted that the insurance amount is the maximum amount that the beneficiary can receive in the event of the death of the insured, and in case of disability or infection, the amount of insurance payment will be determined as a percentage of the insurance amount. There are currently no standards for coronavirus insurance amounts. Therefore, minimizing their costs, the insurers set insurance amounts of 300,000 - 500,000 rub. The most reasonable way is to set the minimum amount of insurance coverage of at least 2 million rubles (Klochkov et al., 2018a; Klochkov et al., 2016c). This amount will compensate the victims’ expenditures in the case of the placement of the infected in the ward of intensive therapy (Klochkov et al., 2018b).

According to the point 2, of the Article 954 of the Criminal Code of the Russian Federation, the "insurance premium" is defined as the fee for insurance, which the insurer (beneficiary) is obliged to pay to the insurer. It is also called gross premium, insurance premium, insurance payment, which includes net premium and burden. The burden is aimed at generating the profits and covering the business costs of the insurer. The burden provides funds for the salary, maintenance of buildings, the purchase of equipment, the costs of advertising, etc., as well as the formation of spare funds for risk insurance and financing of activities taken to prevent accidents and reduce the damage they cause. The burden can be used to finance and other insurer costs. Its amount is determined by the insurance policy, as well as by competition in the insurance market. The burden includes the commission, which the insurer pays to the intermediary for promotion of the insurance product. As a rule, it is from the commission load (which can reach up to 96% of the insurance premium at personal insurance) that can form a corrupt component of the insurance (Klochkov et al., 2018c).

Net premium is part of the of the insurance premium, intended directly to cover the damage. At the moment, it is difficult to accurately calculate the net rate on this type of insurance, but analyzing the current mortality, it can be assumed that it is no more than 100 rubles per year in case the insurance amount is no more than 100,000. In practice, we see that the insurance premium for these policies is no higher than 10,000 (Klochkov et al., 2016a). These high insurance premiums are related to the amount of the policy burden. When promoting this product, the insurers increased the commission of intermediaries to 50% and even more of the insurance premium (Bozhuk et al., 2019; Iskoskov et al., 2019). At the same time, a full-fledged product with a developed risk component and a large insurance amount with such a fee will be beyond the pocket of the vast majority of potential insurers. In this regard, the insurers now sell for relatively a small amount of money the product with a minimum set of risks, a minimum insurance amount, but a large commission.

There may be only one way out which is the standardization of minimum conditions for insurance against infectious diseases. Once these measures have been introduced, market mechanisms will come into play (Ljovkina et al., 2019).

In a situation where we start to fill the insurance product with a larger insurance amount and an additional set of risks, this will inevitably lead to an increase in the net premium. The insurers can start to make big payments, so the net premium will start to rise to cover them. At the same time, the demand for insurance services of this type is relatively constant and may even decrease after the pandemic, respectively, the insurer can not simply increase the premium as it will lead to the abandonment of insurance at all. The way out for the insurers will be an increase in net premiums by reducing the burden, and this will mainly affect the unreasonably inflated commission. We should note that it will not be possible to establish a scientifically sound and legally fixed ratio of net premium and load, as in the fight for the client insurers will start to pay commissions through other items of expenses, as it is done, for example, in the insurance of OSAGO (the obligatory motor third party liability insurance), the ‘green card’. In the case of fixing risks and insurance amounts, we get an insurance product at almost the same price, but with a wide coverage. It can be noted that it is the wide coverage that will be a better condition for sale than the agents who promote the product for a commission fee (Klochkov et al., 2016d).

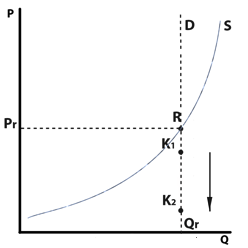

Viewing the market from the point of classical demand and offer theory is presented in the following figure (Figure

Where: P is the price of goods, Pr is the price of R goods; R is the equilibrium point; Q is the quantity of goods, Qr is the quantity of the R goods; S is the Supply curve; D is the demand straight; K1 and K2 are the points of net bet level in the premium structure.

So from the picture it is clear that the line S (supply) is a classic curve, at the same time line D (demand) a straight line, this is due to the fact that the volume of necessary insurance services is limited by the budgets of the people and almost does not depend on the price. It is more or less constant. In the current situation (without standardizing the risk component) in the structure of the insurance premium, the net bet level may be K1, with the increase in the content of the product, the net bet level will start to rise and reach K2. The insurer will not be able on the one hand to raise the price to maintain the previous level of motivation of the intermediary, because then his price will be significantly higher than that of the competitors, on the other hand, it will not be able to maintain the previous low net bid, because the funds are needed to cover the losses under the contract, which will increase and in addition, the insurer must comply with the requirements of the Central Bank of the Russian Federation on the normative ratio of own funds (capital) and accepted liabilities. The way out for the insurers will be an increase in net premiums by reducing the burden, and this will mainly affect the unreasonably inflated commission (Klochkov et al., 2016b). We should note that it will not be possible to establish a scientifically sound and legally fixed ratio of net premium and load, as in the fight for the client insurers will start to pay commissions through other items of expenses, as it is done, for example, in the insurance of OSAGO (the obligatory motor third party liability insurance), the ‘green card’ or OSGOP (the obligatory haulier third party liability insurance) (Ryzhova, 2019). In the case of fixing risks and insurance amounts, we get an insurance product at almost the same price, but with a wide coverage.

Findings

The findings of the research are described.

No underwriting risks associated with epidemics

At the moment, all coronavirus insurance policies can be classified as box products, i.e. there is no individual underwriting on insurers and their risks of being infected. The insurance companies are trying to regulate the projected loss by imposing restrictions on the insured (e.g., age, scope, expiration territory and period, etc.).

Poor content of insurance product

The risk component of today's insurance products guarantees the payment only in the event of the death of the insured, all the other content is more a market component than the real protection of the insured in case of infection CoVID-2019. Despite the fact that the mortality rate for this type of insurance is less than 2% of the number of infected, the insurance companies prefer to limit the amount of payments. The maximum insurance amount for all companies is limited to 1 million. rub. in case of death, by infection of up to 100,000. rub.

Targeting insurers to working with intermediaries rather than working directly with consumers

Having analyzed the component of the net bet and taking into account the fact that this new insurance product is based on the management of insurance against accidents and diseases, one can assume the increased commission of intermediaries for it (50% or more of the insurance premium). This is confirmed by the high-cost sales channels, which began to sell these insurance products among banks and insurance brokers (Baburin, 2011). It can be assumed that in the end this product may become just an additional financial burden for the recipients of loans in banks or insurers OSAGO in toxic regions (Krasnodar, Arkhangelsk, etc.). (Klochkov et al., 2016e).

The lack of the long-term strategy for the development of this product

The integration of a more serious list of infectious diseases into this product will ensure the existence and development of this product even after the pandemic ends.

Conclusion

The formation of a full-fledged insurance protection base, which would provide financial support is one of the components of the caring state, which cares about the health of its citizens. The introduction of risk, financial and legal standards, coupled with market mechanisms, is the way to form it.

References

- Baburin, V. A. (2010). Modernizaciya biznesa i obrazovaniya v usloviyah innovacionnogo reformirovaniya. Kollektivnaya monografiya [Modernization of business and education in the context of innovative reform. Collective monograph]. Saint-Petersburg state university of service and economy. [In Rus]

- Bozhuk, S., Krasnostavskaia, N., Pletneva, N., & Maslova, T. (2019). The problems of innovative merchandise in the context of digital environment. IOP Conference Series: Materials Science and Engineering, 497, 012115.

- Drozdov, G. D., Makarenko, E. A., & Pastuhov, A. L. (2011). Modelirovanie processov strahovaniy [Modeling of the insurance process]. Saint-Petersburg state university of service and economy. [In Rus]

- Iskoskov, M. O., Kargina, E. V., & Klochkov, Y. (2019). Innovative model of the organization of a marketing system at engineering enterprises. Paper presented at the Proceedings - 2019 Amity International Conference on Artificial Intelligence, AICAI 2019, 992-997. https://doi.org/10.1109/AICAI.2019.8701397

- Klochkov, Y., Gazizulina, A., & Golovin, N. (2016a). Assessment of organization development speed on based on the analysis of standards efficiency. In 2nd International Symposium on Stochastic Models in Reliability Engineering, Life Science, and Operations Management, SMRLO 2016 Proceedings (pp. 530-532). IEEE Computer Society.

- Klochkov, Y., Gazizulina, A., Ostapenko, M., Eskina, E., & Vlasova, N. (2016b). Classifiers of nonconformities in form and requirement. In 2016 5th International Conference on Reliability, Infocom Technologies and Optimization, ICRITO 2016: Trends and Future Directions 5, Trends and Future Directions (pp. 96-99). AUUP.

- Klochkov, Y., Klochkova, E., Alasas, B.M., Konakhina, N., & Kuzmina, T. (2018a). Development of external customer classification based on the analysis of interested parties. In 2017 International Conference on Infocom Technologies and Unmanned Systems: Trends and Future Directions, ICTUS 2017, 729-732.

- Klochkov, Y., Klochkova, E., Antipova, O., Kiyatkina, E., Knyazkina, E., & Vasilieva, I. (2016c). Model of database design in the conditions of limited resources. 2016 5th International Conference on Reliability, Infocom Technologies and Optimization, ICRITO 2016: Trends and Future Directions 5, Trends and Future Directions, 64-66.

- Klochkov, Y., Klochkova, E., Didenko, N., Frolova, E., & Vlasova, N. (2018b). Development of methodology for assessing risk of loss of a consumer through the fault of an outsourcer. Paper presented at the 2017 International Conference on Infocom Technologies and Unmanned Systems: Trends and Future Directions, ICTUS 2017, 719-724. https://doi.org/10.1109/ICTUS.2017.8286101

- Klochkov, Y., Klochkova, E., Krasyuk, I., Krymov, S., Gasyuk, D., & Akobiya, N. (2018c). An approach to decrease the risk of losing customers. Paper presented at the 2017 6th International Conference on Reliability, Infocom Technologies and Optimization: Trends and Future Directions, ICRITO 2017, 133-142. https://doi.org/10.1109/ICRITO.2017.8342414

- Klochkov, Y., Klochkova, E., & Vasilieva, I. (2016d). Forecasting of staff resistance level in the process of introduction of new standards. 2nd International Symposium on Stochastic Models in Reliability Engineering, Life Science, and Operations Management, SMRLO 2016 Proceedings, 533-535.

- Klochkov, Yu.S., Klochkova, E.S., Volgina, A., & Dementiev, S. (2016e). Human factors in quality function deployment. 2nd International Symposium on Stochastic Models in Reliability Engineering, Life Science, and Operations Management, SMRLO 2016 Proceedings, 466-468.

- Ljovkina, A. O., Dusseault, D. L., Zaharova, O. V., & Klochkov, Y. (2019). Managing innovation resources in accordance with sustainable development ethics: Typological analysis. Resources, 8(2) https://doi.org/10.3390/resources8020082

- Ryzhova, O. A. (2019). Innovacii v setevoj roznichnoj torgovle v period cifrovizacii ekonomiki [Innovations in network retail trade during the digitalizationof economy]. Innovacionnaya deyatel'nost' [Innovation Activity], 4(51), 60-69. [In Rus]

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Makarenko, E. A. (2020). The Management Of Innovative Personal Insurance Types In The Pandemic Period. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 342-352). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.39