Abstract

Recent trends in the global economy necessitate the active development of the economic security system of companies. Moreover, in the past few years, risks associated with environmental, social and governance factors (ESG risks) have become increasingly important for oil and gas companies. The most significant among are the following: natural resource depletion, high probability of industrial accidents etc. In the course of diagnosing potential crisis situations of companies, it is necessary to identify the most likely threats to economic security. This process needs a comprehensive analysis of oil and gas companies’ activity. Monitoring of possible threats (risks) to economic security should be carried out using a system of indicators. However, at present, a unified risk assessment system, including ESG risks, has not been developed yet. An analysis of disclosing information on ESG risks by Russian and foreign oil and gas companies showed that the absence of a risk assessment system negatively affects the transparency of reporting. A system of indicators has been developed as part of the study, the calculation of which allows assessing the level of ESG risks taking into account the specifics of oil and gas companies’ activity. The basis for the calculation is non-financial reporting data of companies published on their official websites. The grouping of indicators according to the main areas of risk simplifies the process of analyzing the company’s activity and makes it possible to control certain elements of economic security of oil and gas companies.

Keywords: Economic securitynon-financial reportingenvironmental riskssocial risksgovernance risksrisk assessment

Introduction

Under current conditions of the unstable world economy and the multidimensional nature of economic relations, business entities are forced to quickly adapt and seek ways to reduce threats to their functioning and development. Development of an effective economic security system is one of priority tasks for many companies.

There are many definitions of the concept of the economic security system in companies, summarizing which we can conclude that economic security is the system of the most efficient use of resources of the economic entity in order to protect it from effects of internal and external negative factors, as well as to minimize risks of significant deviations from the companies’ general business strategy. The definition of economic security as a way to counteract negative influence makes it necessary to consider various risks that arise in the process of companies’ activity as probable threats (negative consequences).

The issue of determining the impact of various risks on economic security of companies is urgent. The risks associated with sustainable development (social, environmental, governance) – ESG risks - are becoming increasingly important. The Report of the World Economic Forum on Global Risks notes that in 2008 only one social risk (pandemic risk) was among the five global risks that have the most significant impact on the economy and activities of organizations (World Economic Forum, 2019). According to 2019 data, four of the five most important global risks are social or environmental (risks of natural disasters, water crisis, dramatic climate change, etc.) (World Economic Forum, 2019).

In this regard, there are raised requirements from the largest stock exchanges (London Stock Exchange (LSE), Johannesburg Stock Exchange (JSE), etc.), major stakeholders, funds, regulatory bodies related to sustainable development of companies, social responsibility of business, information disclosure about various risks that have (can have) an impact on the organization. For example, since the beginning of 2019, the Swedish Alfred Berg Ryssland Foundation has been using the ESG filter when deciding whether to invest in the organization. International companies recognize that risks related to environmental protection, social issues, and corporate governance are of particular importance in developing a corporate strategy. Timely identification of risks is one of the most important tasks of ensuring economic security of the company.

Problem Statement

One of the main sources of risk information is the corporate reporting system, including sustainable development reports, environmental and social reports, integrated and annual reports. An analysis of the content of the public reporting of oil and gas companies showed that both Russian and foreign companies pay insufficient attention to the description of ESG risks, do not assess them in terms of impact on company’s safety, and do not rank risks according to their importance. The reason for this is the lack of a unified risk assessment system. In this regard, the urgent issue is to develop a system of indicators of environmental, social and governance risks based on non-financial reporting data, taking into account the specifics of oil and gas companies’ activity.

An analysis of scientific publications showed that the issues of the impact of environmental, social and governance risks on company performance are the subject of many studies by foreign scientists such as: Deng and Xiang (2019), Ionescu, Firoiu, Pirvu, and Vilag (2019), Bernardi and Stark, (2018), Khan (2019), Rodríguez-Fernández, Sánchez-Teba, López-Toro, and Borrego-Domínguez (2019) etc. The issues of economic security of companies were considered in the works of the following authors: Kalashnikova, Tatarovskaya, and Tselniker (2019), Na, Park,Yu, Kim, and Chang (2019), and others.

Research Questions

In view of the immaturity of issues on assessing ESG risks of oil and gas companies in the framework of the study, it is necessary to answer the following questions:

What are ESG risks?

Is information about ESG risks important in management and investment activities?

What indicators can be used to assess ESG risks?

Purpose of the Study

The purposes of the study are following:

To classify ESG risks;

To develop a system of indicators for assessing ESG risks based on corporate non-financial reporting data from oil and gas companies.

Research Methods

Research hypothesis formation

H1. Every year, company management and investors pay more attention to non-financial reporting and disclosing information about ESG factors in it.

H2. The non-financial reporting of the largest Russian and foreign oil and gas companies does not contain information on the ESG risk assessment system.

H3. There is no unified system of indicators for assessing various environmental, social and governance risks.

Research methodology

The research methodological base includes mathematical methods and general scientific methods, such as analysis and synthesis, induction and deduction, comparison, abstraction, detailing and generalization, and a systematic approach. The object of research is the system of ESG risks of oil and gas companies. The subject of the study is the issue of assessing ESG risks according to the non-financial reporting of oil and gas companies.

Research data collection procedure

The research was based on scientific publications on the subject under study, regulatory documents, materials of the international audit company EY, and the statements of Russian oil and gas companies published on their official websites. In order to ensure monitoring of the level of economic security in companies, a system of indicators for assessing environmental, social and governance risks taking into account the specifics of the oil and gas industry has been developed as part of the study.

Findings

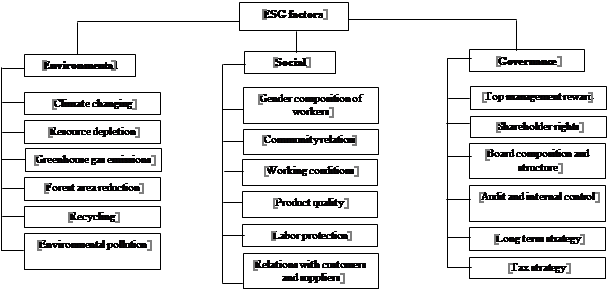

ESG risks are a set of non-financial environmental, social and governance risks that affect (may affect) the results of the company’s activity and are taken into account when making management decisions. ESG risks are determined by the influence of various ESG factors. Based on the analysis of authors’ various definitions of the concept of “ESG factors”, the main types of factors related to management, the environmental and social component of the companies’ activity are systematized (Figure

Source: authors.

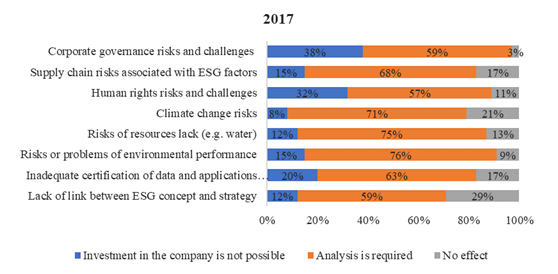

The growing demand for information related to sustainable development and ESG risks is confirmed by the results of numerous studies. EY annually conducts a survey of institutional investors regarding their interest in non-financial reporting (EY, 2019). Managers of 260 organizations of various types took part in the survey in 2008 and the findings of this survey demonstrated a significant increase in the share of investors who are ready to refuse to invest in view of risks associated with various ESG factors (Figure

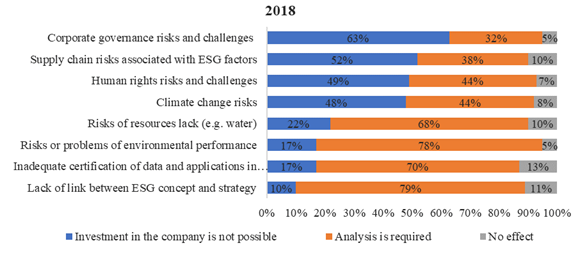

Source: compiled by authors based on (EY, 2019)

Source: compiled by authors based on (EY, 2019)

Especially significant growth is noticeable in indicators of supply chain and climate risks. The share of investors who are ready to immediately abandon investing in view to supply chain risks increased from 15 to 52%, to climate risks - from 8 to 48% of the total number of investors. The share of investors who are not ready to invest in a company with human rights risks has increased from 32 to 49%. In general, growth is noticeable in all other indicators.

In order to assess environmental, social and governance risks, a system of indicators has been developed as part of the study, the calculation of which is carried out according to non-financial reporting data. As an example, we calculated the indicators proposed in the study according to the annual reporting data of the largest Russian oil and gas company PJSC Gazprom.

To assess environmental risks, it seems appropriate to use information on the amounts of environmental costs. One of the types of such costs is the amount of the payment for the negative impact on the environment, which business entities, whose activities harm the environment, should transfer to the budget system of the Russian Federation (5% to the federal budget, 40% to the budgets of RF subjects, 55% to municipal or city budgets).

One of the characteristics of environmental risks is the dynamics of payments for the negative impact. The growth of this indicator over time indicates an increase in harmful emissions and, consequently, an increase in environmental risks.

According to Gazprom environmental reporting for the period 2014-2018, the amount of payment for negative impact on the environment decreased by three times (from 1,746.89 million rubles in 2014 to 615.76 million rubles in 2018) (PJSC Gazprom, 2019b). Such dynamics is explained by a decrease in the volume of harmful emissions from the flaring of associated petroleum gas at the company’s oil fields, with the exception of increasing indicators, as well as by offsetting previously unnecessarily paid amounts when making advance payments (PJSC Gazprom, 2019b).

To conduct the most effective risk assessment associated with the environmental component, it seems necessary to determine Environment Risk Rate for each type of negative impact (Formula 1).

(1)

(1)(1)(1)(1)In this case, the amount of payment for negative impact is determined by multiplying the quantitative indicator of each type of negative impact by the appropriate rate established by the Government of the Russian Federation, taking into account indicators (Decree of the Government of the Russian Federation of September 13, 2016 No. 913 (as amended on June 29, 2018) “On the rates of fees for negative impact on the environment and additional ratios”). The procedure for calculating Environmental Risk Rate indicators according to the reporting data of PJSC Gazprom is presented in Table

The data in the table indicate that the greatest threat is represented by emissions of pollutants into the atmosphere, among which the greatest risk is associated with hydrocarbons (including methane) emissions. The share of excess payments in the total amount of payment for negative impact was 32%. Such a high value of this indicator is associated with the late license and extension of environmental permits. A significant impact on the company’s safety has the size of production and consumption waste. Despite the fact that most of the company’s waste (97.6%) is classified as low-hazard (hazard class IV) and practically non-hazardous (hazard class V), it is necessary to ensure effective control over the volume of waste generation and its disposal.

It is proposed to assess social risks by calculating a number of indicators, one of which is Injury Frequency Rate (Formula 2), which characterizes the number of industrial accidents per 1000 workers.

(2)

However, this indicator does not provide a reliable data on accident rate in the organization. In this regard, it is necessary to calculate additional indicators, in particular, Lost Time Injury Frequency Rate (LTIFR) (Formula 3), which characterizes the number of injuries resulting in temporary disability, per 1 million hours worked.

(3)

Fatal Accident Rate (FAR) shows the number of fatalities due to industrial accidents per 100 million hours worked (Formula 4).

(4)

In connection with the development of infectious and occupational diseases, it is necessary to calculate Occupational Disease Rate (ODR) (Formula 5) and Lost Day Rate (LDR) (Formula 6).

(5)

(6)

A decrease in the above indicators illustrates a decrease in social risk and, as a result, increased security of the company. One of the important indicators of the company’s effective HR policy is the turnover rate (Formula 7), as well as the dynamics of the number of employees.

(7)

Values of the turnover rate in the range of 3% -5% indicate a natural renewal of the team and does not require measures on the part of the personnel department and the company’s management. Excessive staff turnover reduces motivation and loyalty of remaining employees, which contributes to an increase in social risk and a decrease in economic security of the company. For the most accurate assessment of social risk, it is necessary to consider the dynamics of the above indicators.

Calculation of social risk indicators according to the reporting data of PJSC Gazprom for 2014-2018 (PJSC Gazprom, 2019a, 2019c) is presented in Table

An analysis of social risk indicators in PJSC Gazprom (2019a, 2019b) allows us to conclude that the level of social risk in this company has remained at a low level over the past few years. Low values of Injury Frequency Rate indicate that accidents leading to temporary disability or death are rare. A slight increase in Injury Frequency Rate and Lost Time Injury Frequency Rate is associated with an increase in the number of accidents. However, the company is taking active measures to reduce road crashes. In particular, requirements for road safety for contracting organizations were established, all stages of control were regulated - from travel planning and to the return of vehicles to parking lots. The dynamics of Fatal Accident Rate indicates a reduction in the number of deaths due to accidents, which indicates a reduction in social risk. The decrease in the average headcount in 2018 was due to a change in the structure of companies included in the Gazprom group, as well as measures to optimize the personnel structure. The turnover rate is within the normal range. However, it has a negative tendency to increase.

Governance risks are closely related to the company’s performance, so it is possible to assess them by calculating the profitability of sales (ROS), equity (ROE), assets (ROA) and to analyze their dynamics. It is important to determine the profit before tax, the interest on loan and depreciation (EBITDA) rate, which is calculated as operating profit after deduction of depreciation and impairment loss on assets (excluding receivables, advances paid and prepayments). Table

The dynamics of profitability indicators illustrates improved financial position of the organization and increased profitability of its activities. In 2018, a record high EBITDA was achieved, which indicates the strengthening of economic security of the company. However, an increase in operating expenses, impairment losses on financial assets, as well as foreign exchange loss due to changes in the dollar and euro rates have a negative effect on the dynamics of the company’s profit indicator (PJSC Gazprom, 2019a, 2019c). In this regard, it is necessary to take measures to strengthen control over operating expenses. One of the important components of corporate governance is the dividend policy. The dividend rate per share has been steadily increasing over the past three years, which indicates an increase in the efficiency of the company’s dividend policy. In general, the dynamics of the above indicators testifies to sustainable development of PJSC Gazprom and the reduction of risks associated with corporate governance.

Conclusion

The processes of globalization, the increasing role of corporate social responsibility, the increasing influence of environmental factors increased the importance of presenting non-financial information in accounts of organizations and make it necessary to create an effective system of economic security in companies. The analysis of Russian and foreign practice of presenting information on environmental, social and governance risks in non-financial reporting indicate that the lack of risk assessment and ranking in terms of risk probability and impact on financial results complicates the process of analyzing and assessing the performance of oil and gas companies. The developed system of indicators allows an effective assessment of ESG risks according to non-financial reporting, which, in turn, makes it possible to exercise internal and external control and assess the level of economic security of oil and gas companies.

References

- Bernardi, C., & Stark, A. W. (2018). Environmental, social and governance disclosure, integrated reporting, and the accuracy of analyst forecasts. The British Accounting Review, 50(1), 16-31.

- Decree of the Government of the Russian Federation of September 13, 2016 No. 913 (as amended on June 29, 2018) “On the rates of fees for negative impact on the environment and additional ratios”. Retrieved from http://docs.cntd.ru/document/420375216 Accessed: 13.11.2019.

- Deng, X., & Xiang, C. (2019). Can ESG indices improve the enterprises’ stock market performance? An empirical study from China. Sustainability, 11(17), 4765. DOI: 10.3390/su11174765

- EY (2019). Does your nonfinancial reporting tell your value creation story? Retrieved from https://www.ey.com/en_gl/assurance/does-nonfinancial-reporting-tell-value-creation-story Accessed: 01.12.19.

- Ionescu, G. H., Firoiu, D., Pirvu, R., & Vilag, R. D. (2019). The impact of ESG factors on market value of companies from travel and tourism. Technological and Economic Development of Economy, 25(5), 820–849.

- Kalashnikova, E. B., Tatarovskaya, T. E., & Tselniker, G. F. (2018). Risk-oriented approach in the system of enterprise economic security. In V. Mantulenko (Ed.), International Scientific Conference "Global Challenges and Prospects of the Modern Economic Development". The European Proceedings of Social & Behavioural Sciences, 57 (pp. 677-687). London: Future Academy.

- Khan, M. (2019). Corporate Governance, ESG, and Stock Returns around the World. Financial Analysts Journal, 75(4), 103-123. DOI: 10.1080/0015198X.2019.1654299

- Na, O., Park, L. W., Yu, H., Kim, Y., & Chang, H. (2019). The rating model of corporate information for economic security activities. Security Journal, 32, 435-456.

- PJSC Gazprom (2019a). Annual Report 2018. Retrieved from https://www.gazprom.ru/f/posts/ 01/851439/gazprom-annual-report-2018-ru.pdf Accessed: 12.12.2019.

- PJSC Gazprom (2019b). Environmental Report 2018. Retrieved from: https://www.gazprom.ru/f/posts/72/ 692465/gazprom-environmental-report-2018-ru.pdf Accessed: 14.12. 2019.

- PJSC Gazprom (2019c). Sustainability Report 2018. Retrieved from https://www.gazprom.ru/f/posts/01/ 851439/sustainability-report-rus-2018.pdf Accessed: 14.12.2019.

- Rodríguez-Fernández, M., Sánchez-Teba, E. M., López-Toro, A. A., & Borrego-Domínguez, S. (2019). Influence of ESGC indicators on financial performance of listed travel and leisure companies. Sustainability, 11(19), 5529. DOI: 10.3390/su11195529

- World Economic Forum (2019). The global risks report 2019. 14th edition. Retrieved from https://www3.weforum.org/docs/WEF_Global_Risks_Report_2019.pdf Accessed: 20.12.2019.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 April 2020

Article Doi

eBook ISBN

978-1-80296-081-5

Publisher

European Publisher

Volume

82

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1004

Subjects

Business, innovation, management, management techniques, development studies

Cite this article as:

Korneeva, T., Kozhuhova, V., & Arkhipova, N. (2020). ESG-Risks Assessment As A Factor Of Oil And Gas Companies Economic Security. In V. V. Mantulenko (Ed.), Problems of Enterprise Development: Theory and Practice, vol 82. European Proceedings of Social and Behavioural Sciences (pp. 662-671). European Publisher. https://doi.org/10.15405/epsbs.2020.04.84