Abstract

Fundamental changes have taken place in all spheres of the economy in the last decade, the process of digitalization is actively under way, and the state control over the flow of individuals and legal entities’ funds is being tightened. Therefore, the success of the company’s development, the level of its profitability, as well as the quality of its assets depend directly on the existence of an effective management system, the important and necessary element of which is an internal audit. It allows you to detect and prevent errors, as well as to assess the enterprise efficiency. Staff payroll accounting for is one of the most responsible and labour-intensive areas of work, and therefore requires special attention from the internal auditor. The article contains normative acts regulating the accounting and control of wages analysis, an analytical section of the remuneration fund and recommendations to improve the rationality of its use. In addition, on the basis of them, additional parameters to evaluate the control environment of staff payroll section in conditions of outsourcing have been developed in order to reduce claims towards the contractor and increase the profitability of the services contract. It is planned to develop and implement the project "The organization of automated system of transactions control reflection in accounting systems" in order to form a control environment for the reflection of accounting transactions of the serviced companies, to develop and organize automatic control over the correctness of correspondence and analytical features in accounts in the software product 1C Accounting.

Keywords: Internal auditcontrolpersonnel settlementsremunerationoutsourcingcontrol environment

Introduction

Many questions concerning the settlement, improvement of methods of analysis, control, audit, technical support of the whole Russian accounting system despite a detailed study of the basics of accounting by many scholars, theorists and practitioners arise in accounting every day. The improvement of existing accounting systems, introduction of new audit and control techniques, the improvement of service quality of the companies in the conditions of outsourcing and strict competition in this sphere are all urgent tasks, which modern scientists, analysts, accountants face.

The success of the company in the market, the quality of its assets, the level of its solvency and profitability largely depend on its management system efficiency. The most important and necessary element of the management system in market conditions is operational internal control, one of the forms of which is an internal audit.

We will consider the organization of the system of staff payroll internal audit on the example of LLC "RN-Fire Safety," which is a subsidiary of the oil company "Rosneft" (Rosneft, 2018).

RN-Fire Safety LLC has a branch structure and has 6 branches with a parent organization in the city of Samara.

The Company's main activity is fire safety (including gas safety); as well as electrical works, technical tests, research, analysis and certification; emergency security and other activities.

For the conduct of business activities of LLC "RN-Fire Safety" have opened settlement accounts in Open Society "Russian Regional Development Bank," the main shareholder and strategic partner of which is "Rosneft."

Problem Statement

The purpose of the study is to study the theoretical and methodological bases of staff payroll accounting, the applied methods of internal audit of the site "staff payroll," as well as to improve the control environment and control means of the accounting process "staff payroll."

It should be noted that at present the theoretical approach to organizing the internal audit system at enterprises is not yet fully formed. In the scientific literature there are different points of view on the development of the internal audit system in enterprises. In particular, it is necessary to highlight significant works in this area recently published by the following scientists: Omolaye and Jacob (2017), Petraşcu and Tieanu (2014), Zou (2019), Mihret and Grant (2017), Engelbrecht, Yasseen and Omarjee (2018) and etc.

Research Questions

It is necessary to learn about organization’s staff payroll in order to get a full understanding of the operation of the internal audit system.

Accounting of LLC "RN-Fire Safety" is carried out by a third-party organization - a specialized organization, to which accounting and tax accounting are done on a contractual basis.

Accounting is carried out in machine-oriented form (partial automation) with the application of the standard information system "Software product of accounting and tax accounting of service enterprises".

Forms of primary documents used for registration of economic life facts are approved by a separate administrative document of LLC "RN-Fire Safety" ("Album of forms of primary accounting documents").

To reflect economic life facts the forms of primary accounting the company may apply documents intended to reflect similar economic life facts, if the application of such forms is provided for by the contract with the counterparty and provided that the forms of primary accounting documents executed within the framework of the contract execution are given as an annex to the contract and contain mandatory details provided for primary documents.

Accounting is carried out on the basis of TIS 1С program SP 8.2; staff payroll is calculated in the network program of PS "Boss-Kadrovik."

The methodological support of the process "staff payroll" is carried out by specialists of the methodology group in the city of Ryazan. Methodological support provides weekly legislation monitoring, which has been carried out on a cumulative basis since the beginning of the year. Monitoring results are sent to users on a regular basis. The monitoring results distribution list is updated as the demand arises in an application order.

The account and order of expenses formation in the company regarding staff payroll, namely definition of the expenses formation source, the determination of taxable base, base for insurance premiums payment and others, is carried out according to the uniform scenario with other subsidiaries of Rosneft with application of the universal corporate standard in the field of human resource management, compensation and social development of the enterprise.

In LLC "RN-Fire Safety" all staff payroll charges comply with the norms of the current legislation, but they are expanded and detailed.

Speaking about the accounting staff payroll of LLC "RN-Fire Safety," it can be stressed that all postings are made according to all accounting rules, but taking into account the specifics of the enterprise activity. Cost accounting is carried out according to the company's divisions.

The allocation of staff payroll costs to accounting accounts and production types is made in a direct way, depending on the functions performed by the employee and linked to a specific cost center.

At the moment the software product "Tax administration" is being implemented in order to streamline and systematize the work on monitoring settlements with the budget and extrabudgetary funds, achieve the maximum possible level of mobilization of funds when calculating with the budget and extrabudgetary funds, eliminate cases of suspension of transactions on settlement accounts in credit institutions and cause damage to the business reputation of the companies served, the implementation of the software product "Tax Administration" information system is being carried out at the moment.

The Tax Administration information system is designed to:

Creation and maintenance of the Company tax liabilities data;

Automation of business processes in the Company's departments responsible for accounting and control of tax liabilities, namely:

Maintenance of Budget Settlement Cards and reconciliation of calculations with the budget;

Follow-up of inspections (chamber, field) and trials;

Preparation of various types of reporting and analytical forms for analysis, monitoring and management decision-making procedures.

The objectives of the information system are:

Provision of high-quality information and analytical support for tax administration processes in the Company;

Reduction of tax risks and risk of claims by tax authorities against the Company;

Provision of proof of tax data on the state of settlements with the Company's budget.

The main tasks of Information System creation are aimed at automation of the following business functions:

Accounting for tax payers, Budget Settlement Cards, tax returns, updated tax returns and reasons for their submission, accruals/reductions on other grounds (court decisions, transfer of balance in reorganization, etc.), tax payment orders;

Analysis of the tax authorities' calculations correctness, the evidence base preparation for the correctness of Budget Settlement Cards calculations in the Company (calculation of balance by types of payments;

Calculation of penalties on updated calculations, additional contributions on inspections and vessels);

Preparation of various reports and analytical forms on available data on tax liabilities of the Company.

Purpose of the Study

The problem discussed in this paper is a small part of a huge amount of legal and economic regulation of labor and wages accounting. The organization of labor and wages accounting in LLC "RN-Fire Safety" is set at the high level, all the most important tasks are solved in a timely manner, namely:

Payments with personnel are made within the specified time limits. If there is a delay, compensation is paid;

Accurate registration of personnel is established;

The calculation of wages shall be carried out in accordance with legislation and domestic regulations;

Correct allocation of accrued wages and contributions to production and handling costs accounts.

Research Methods

Research methods used in writing included factor and structural analysis, observations and the study of regulatory frameworks.

The accounting procedure, quality assessment, period-end closing and preparation of the Russian Accounting Regulations and International Financial Reporting Standards reporting are recorded in the Control Procedures and Risk Matrix in the following main areas: Registration of hours worked. Reflect primary payroll documentation. Calculation of payroll accruals and deductions. Calculation of Incomes tax and insurance premiums from wages. Calculation of estimated obligations. Reflect payroll data in the accounting system. Transfers. Closing of the period.

This matrix allows assessing the quality of accounting in outsourcing conditions objectively and is aimed at minimization and complete elimination of customer claims, etc.

Next, we will consider the issue of the procedure for carrying out an inventory of settlements with personnel and valuation obligations formed by the Company for payment of remuneration on the results of work for the year and on the forthcoming holidays payment to employees.

The procedure for carrying out the inventory of assets and liabilities is established by the Methodological Instructions of the Company "Inventory of Assets and Liabilities."

On the basis of the results of the inventory of payroll of the Working Inventory Commission, the Central Inventory Commission shall be provided with the Certificate and Protocol - documents reflecting the results of the inventory.

At the final stage, the Company CEO signs an Order on the results of the inventory, reflecting the results of the inventory, and the control procedures presented in Table

Thus, an element of the accounting method inventory is used to ensure that the security of the business assets and in order to the accounting data to be fully consistent with the actual balances, it is also used to ensure the validity of the accounting figures, i.e. the determination of the actual availability of the funds and their sources, the costs incurred, etc., by recalculating the balances or by checking the records.

The next stage of the study is to study the process of forming valuation liabilities in terms of payrolls, their accounting and inventory. An estimated obligation is recognized as representing the most reliable estimate of the costs required to calculate the obligation. The actual settlement of the liabilities is charged against the recognized valuation liabilities, in correspondence with the debit of account 96 "Reserves of forthcoming expenses." The validity of the recognition and the value of the valuation obligation are subject to verification in accordance with the inventory schedule, as well as in the event of new events related to the obligation.

Due to the considerable labour intensity and in accordance with the principle of rationality, the estimated obligations for current bonuses (monthly and quarterly bonuses) are not recognized during the reporting year. At the same time, if at the end of the reporting year the company has outstanding obligations under the current bonus, estimated obligations are recognized under them in the general order with allocation to the current expenses of December.

The valuation obligation for upcoming holidays payments to employees is a homogeneous valuation obligation. Since this valuation obligation is recognized as one single reserve, no surplus occurs after the performance of the obligation to be transferred to homogeneous obligations.

Due to the uneven provision of holidays to employees during the year, the Accounting Policy of the Company established the creation of a reserve of forthcoming expenses for the payment of leave. Expenses for the formation of this reserve are charged to the accounts for labor expenses of the respective categories of employees. The recognition of the valuation obligation shall be made monthly.

In order to include the average salary the remuneration on the results of work for the year in the calculation equally, in a situation where the remuneration has not yet been paid, instead of the actual amount of remuneration, the amount of the estimated obligation recognized for the payment of remuneration on the results of work for the year, excluding insurance contributions to State extrabudgetary funds, is involved in the calculation.

In the case of legislative changes in the rates of insurance premiums, the planned effective rate shall be applied in the calculation. The planned effective rate can be calculated on the basis of new rules for calculation of insurance premiums on the basis of the year preceding the reporting one.

Recognition (addition) of the valuation obligation is based on the difference between the amount of the calculated valuation obligation at the reporting date and the value of the valuation obligation recognized at the previous reporting date, taking into account the actual calculations of the recognized valuation obligation in the reporting month:

C96 = BF96 – (BO96 – D96),

where:

C (Credit) 96 is the amount of additional assessment obligation as at the reporting date.

BF (Balance Final) 96 is the amount of the recognized valuation obligation as at the reporting date.

BO (Balance Open) 96 is the amount of the recognized valuation obligation on the previous key date (balance from account 96).

D (Debit) 96 is the sum of actual calculations of the estimated obligation in the reporting month (D96 C70, 69).

A negative balance is not allowed on the valuation liability account for forthcoming holidays payment because the valuation liability amount should not include "negative" (unearned used in advance) holiday days.

Prior to the preparation of annual accounts, an estimated leave liability is counted in a generally established manner.

If there is information on legislative changes in the rates of insurance premiums from the following year, the estimated obligation for the last day of the reporting year shall be calculated using the planned effective rate of insurance premiums, which will be established in the following year.

If from the year following the reporting year the rate of insurance premiums changes, the estimated liability at the end of the reporting year, as well as for the calculation of the estimated liability in the following year, should apply the planned effective rate, which is calculated on the basis of the new rates of insurance premiums on the taxable base of the previous year.

At the same time, if it is necessary to determine the planned effective rate for calculation of the estimated liability at the end of the reporting year, when it is impossible to apply the actual taxable base for December of the current year, the forecast information on the taxable base for December can be used in the calculation.

In this case, the planned effective rate used to calculate the amount of the valuation obligation to be carried forward to the following year would differ from the planned effective rate to be applied next year.

As employees go on holiday, the actual amounts accrued to them for the holiday period are written off to reduce the created reserve.

The amount of the obligation is determined taking into account the calculation of insurance contributions to extrabudgetary funds and contributions for insurance against accidents and occupational diseases in the amount of remuneration.

The obligation is recognized as it arises (monthly) and is recorded in the debit accounting record of the cost accounting accounts 20, 25, 26 in correspondence with the account "Reserves of forthcoming expenses." The amount of the monthly recognized obligation is determined by the Company independently on the basis of the amount approved in the Company's business plan for payment of remuneration on the results of work for the year. The amount of the monthly recognized obligation is determined by calculating the interest applied to the actual labour costs of the current month.

Actual settlements on recognized liabilities are recorded in the accounting records on debit of account 96 "Reserves of forthcoming expenses" and loans of accounts 70 "Settlements with personnel on remuneration" and 69 "Settlements on social insurance."

If the amount of the recognized estimated obligation is insufficient, the Company's expenses for payment of the performance compensation for the year are reflected in the general order (Debit 20, 25, 26 Credit 70, 69).

After each use of the reserve, a request is made to HR to confirm or update the reserve balance.

The validity of the recognition and the value of the recognized valuation obligation are subject to verification at the end of the reporting year, as well as if new circumstances appeared related to that obligation. Dates and terms of carrying out inventory of the estimated obligation are determined by the order (order) of Society on carrying out inventory of property and obligations approved by the head.

The procedure and rules for carrying out the inventory are given in Table

If, as a result of the inventory of the reserve of forthcoming holiday expenses, the amount of the calculated reserve in respect of unused holiday exceeds the actual balance of the unused reserve at the end of the year, the amount of excess shall be included in the labour costs.

If, as a result of the inventory of the reserve of forthcoming holiday expenses, the amount of the calculated reserve in respect of unused leave is less than the actual balance of the unused reserve at the end of the year, the negative difference is to be included in other income. The reserved amounts are charged to the debit of the same production cost accounts to which the accrued salary of the employees is charged and to the credit of account 96 "Reserves of forthcoming expenses".

Findings

Activities within the organization of special employees, aimed primarily at monitoring various aspects of the company's activities in order to provide full and reliable information to the management bodies (general meeting of participants, board of directors, executive body) in the future on the basis of the results of the control, and is the essence of internal audit activities.

There are no documents strictly regulating auditing at the enterprise. However, it is necessary to focus on the following prescribing documents. First of all, the activities of internal auditors, working procedures, goals and objectives are described in the international standards of internal auditors, as well as in the national standards of auditing activities. Besides, it is necessary to be guided also by the Federal law of 30.12.2008 No. 307-FZ "About auditor activity". The special feature of this procedure is that the order of its organization, verification processes, methodology should be determined by the regulations of the organization itself. It is an internal regulation that will determine the specific objectives of the inspection for a particular company. Personal internal audit standards may be detailed and very different from the rules of generally accepted standards, but should not contradict them.

The internal audit of the company is able to identify shortcomings and assess the overall efficiency of the company. The functions and types of internal audit may vary depending on the size of the company, its type of activity, but all of them are aimed at reducing the risks of the activity and increasing the efficiency of the specific organization.

In order to check the correctness of the organization of settlements in the accounting service with the employees of the company on accrual and payment of cash amounts on remuneration, the audit of settlements with personnel on remuneration is carried out. The purpose of the audit is to assess the applied methodology in the field of remuneration and to determine its compliance with the current legislation.

Documents confirming assessment for the calculation of wages, deductions from the accrued wages are subject to inspection in this type of audit. These are such documents as the Regulations on Bonuses and Incentives, Contracts, Staffing. Orders, personal cards of employees, outfits, sheets of temporary incapacity for work, payroll statements are subject to inspection. The balance sheet of the enterprise, the ledger, registration registers, annexes to the balance sheet and the report on financial results are checked.

During the audit, the following accounts are checked:

Correctness of tax deduction from the accrued salary - account 68 "Calculations on taxes and fees" is checked;

Correctness of calculation of insurance contributions to extra-budgetary funds - account registers 69 "Settlements on social insurance and security" are checked with examination of all sub-accounts;

Correctness of personnel payroll calculation and issue - account registers 70 "Payments with personnel on remuneration" are checked;

Correctness of settlements under other transactions - accounting registers 73 of the account "Settlements with personnel on other transactions";

Correctness of alimony settlements - account registers 76.41 "Settlements with different debtors and creditors."

The planned quality check of the accounting function of the serviced enterprises is organized in accordance with the plan approved by the CEO of the control measures schedule of the Service Quality Control Department for the current year.

During the inspection, specialists of the Service Quality Control Department request the necessary documentation. Specialists are given access to the automated accounting system of the audited Companies, as well as interaction with the employees responsible for creating accounting (financial) statements, maintaining accounting and tax accounting of the audited Company.

Verification implementation technique is shown in Table

During the inspection, defects, irregularities in the provision of accounting services may be found. Among the main:

Absence of agreements (collective and labor);

There are no applications of employees for benefits from personal income tax;

There are illegal inclusions in the cost of production of certain expenses for tax purposes;

Payments to employees, which are not specified in employment contracts, provisions;

Payments from own funds of the enterprise are not included in the base for calculation of insurance premiums.

Incorrect calculation of the average daily salary and the number of days of unused leave to calculate the reserve for leave.

Based on the results of the inspection, specialists of the Department of Quality Control of Services prepare a report on the inspection, develop recommendations, analytical reports. The development of recommendations is aimed at avoiding errors that were revealed during the evaluation of the enterprise's work in the field of wage settlements.

The recommendations refer not only to the methods used by the employees of the accounting department for labor accounting and its payment, but also to all personnel documentation of the enterprise.

-

Control procedures for accounting and closing of the period are carried out by specialists who enter information into the accounting system, without taking into account the principles of separation of powers and duties according to the Company Standard "Internal Control System";

-

The matrix of control procedures provides a method of complete check in 90% of cases, which in the absence of automation of controls leads to increase of labor costs of accounting specialists, risk of inefficiency of carried out controls;

-

Individual control procedures carried out by the HR Accounting Accountant may not be effective, as evidenced by claims made by Customer's Clients.

1. Make adjustments to approved risk matrices and control procedures:

Divide the process of control procedures into control procedures carried out during the closing of the reporting period and control procedures carried out within the framework of operational activities of specialists;

Update the list of control procedures covering the risks of errors in the calculation, transfer of salaries to the employees of the Customers, errors in unloading to the accounting system, taking into account the recommendations given by the methodological service, and the provisions of the Company Standard "Internal Control System".

2. To appoint the responsible agents for the execution of control procedures for each Customer, taking into account the principles of full responsibility, division of powers and responsibilities according to the Company Standard "Internal Control System." That is, to allocate responsibilities and powers in the conduct of control procedures between employees performing control procedures and employees carrying out monitoring and evaluation of carried out controls;

3. On a monthly basis, consolidated information on the settlement of facts of violations of record keeping of settlements with personnel reflected in claims received from Customers are to be sent to the Department of Quality Control of the accounting function, as well as a monthly analysis of the dynamics of incoming claims in the section "Settlements with personnel" is to be carried out;

4. In order to organize the work of calculations and operators, it is proposed to develop User Operating Instructions, which contain a step-by-step description of the process of checking primary documents for mandatory details, entering data into the accounting system, calculating a specific type of accrual. And ensure that the User Operating Instructions are updated in a timely manner on an ongoing basis.

Conclusion

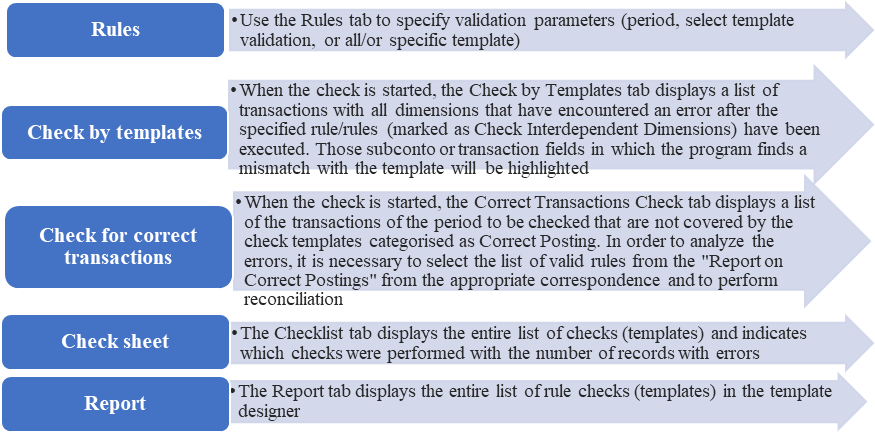

It is planned to develop and implement the project "The organization of automated system of transactions control reflection in accounting systems" in order to form a control environment for the reflection of accounting transactions of the serviced companies, to develop and organize automatic control over the correctness of correspondence and analytical features in accounts in the software product 1C Accounting.

One of the areas of improvement of internal audit can be automated system of correctness of correspondence control and analytical characteristics in accounts in the accounting system. The initial implementation and testing of this method of control procedures is expected only for specialists of the Department of Quality Control of the accounting function. Automated checks in 1C: Accounting will also be aimed at reducing the risks of errors in accounting and reporting of the Companies due to their timely and prompt identification and elimination.

The advantages of implementing this internal audit approach are:

1) Additional control environment in terms of business transactions for accounting areas by specialists of transaction unit. The correct entry templates allow you to match to the entries in the system (except for the entries created by the regulatory document to close unprofitable accounts) and the check will result in a list of incorrect entries.

2) The rules of the methodology of Standard Accounting and Tax Accounting Information System for 1С-Based Service Enterprises and Standard information system of accounting and tax accounting of oil supply enterprises on the basis of 1С are aimed at reducing the risks of error in the accounts of the Companies, such as: items of assets distortion, liabilities, capital or financial results report, non-compliance with accounting principles.

3) The existence of automated inspection rules is preferable to manual control procedures, as it minimizes the risk of errors in reporting. The Audit Rules are designed to cover possible risks in accounting and reporting.

One version of the layout of control procedures can be presented as follows: (Figure

Auditors who perform internal audits according to the rules of the methodology in addition to standard audit methods must also have access to this processing except for the user of a particular organizational unit.

Thus, the picture of accounting will be more transparent and holistic, that is, a qualified internal auditor will be able to assess the quality of accounting services by examining them in detail and correcting inaccuracies in a timely manner if they arise.

References

- Engelbrecht, L., Yasseen, Y., & Omarjee, I. (2018). The role of the internal audit function in integrated reporting: A developing economy perspective. Meditari Accountancy Research, 26(4), 657-674. DOI: 10.1108/MEDAR-10-2017-0226

- Federal law of 30.12.2008 No. 307-FZ "About auditor activity". Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_83311/ Accessed: 23.11.2019.

- Mihret, D., & Grant, B. (2017). The role of internal auditing in corporate governance: A Foucauldian analysis. Accounting, Auditing & Accountability Journal, 30(3), 699-719. DOI: 10.1108/AAAJ-10-2012-1134

- Omolaye, K. E., & Jacob, R. B. (2017). The role of internal auditing in enhancing good corporate governance practice in an organization. International Journal of Accounting Research, 6(1), 174. DOI: 10.4172/2472-114X.1000174

- Petraşcu, D., & Tieanu, A. (2014). The role of internal audit in fraud prevention and detection. Procedia Economics and Finance, 16, 489-497. DOI: 10.1016/S2212-5671(14)00829-6

- Rosneft (2018). Annual report 2018. Retrieved from https://www.rosneft.com/upload/site2/ document_file/a_report_2018_eng.pdf Accessed: 23.11.2019.

- Zou, J. (2019). On the role of internal audit in corporate governance. American Journal of Industrial and Business Management, 9(1), 63-71. DOI: 10.4236/ajibm.2019.91005

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 April 2020

Article Doi

eBook ISBN

978-1-80296-081-5

Publisher

European Publisher

Volume

82

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1004

Subjects

Business, innovation, management, management techniques, development studies

Cite this article as:

Tarasova, T. M. (2020). The Development Of An Internal Audit System For Personnel Settlements. In V. V. Mantulenko (Ed.), Problems of Enterprise Development: Theory and Practice, vol 82. European Proceedings of Social and Behavioural Sciences (pp. 86-98). European Publisher. https://doi.org/10.15405/epsbs.2020.04.12