Abstract

The article discusses methods for optimizing sources of financing for small and medium-sized businesses, taking into account the problems of the functioning of this sector of the economy. The paper analyzes management decisions, as well as statistical data characterizing the process of securing financing for small and medium-sized enterprises. It is indicated that the limitation of the possibilities of using rational financing is a multistage procedure for checking the borrower, requirements for the collateral base, high interest rates, limited terms and volumes of lending. The analysis revealed the main reasons that negatively affect the development of small and medium-sized businesses, substantiate the stages of optimization of funding sources based on a cognitive approach. Assessment of the current state of a small organization is based on a SWOT analysis, it is noted that factors of the external and internal environment with a positive impact can strengthen the organization’s position and, at the same time, negatively slow down development. The identification of factors affecting the effective functioning, the determination of cause-effect relationships and the construction of a cognitive map made it possible to propose a methodology for assessing the effectiveness of the used financial resources of small and medium-sized enterprises. In modern sources of financing of small and medium-sized businesses are highlighted: microfinance; venture financing; loan portfolio securitization; project financing; crowdfunding; factoring services; various types of leasing; franchising services and other mechanisms.

Keywords: Sources of financingsmall and medium businessesperformance indicatorsoptimizationcognitive approach

Introduction

Diversification of sources of financing for small and medium-sized businesses creates the opportunity to obtain the most appropriate financing conditions, provides the necessary amount of financial flows. Most business entities use traditional forms of financing: their own financial resources, bank lending, budgetary allocations, despite the fact that other forms are currently offered in the form of: project financing, leasing agreements, venture financing, crowdfunding, etc.

Studies on the financing of small and medium-sized businesses offer various approaches. Depending on regional and spatial perspectives, it is proposed to use sources of financing, such as: business angel, bank credit and credit card financing in the article (Ughetto, Cowling, & Lee, 2019). The work (Chong et al., 2019) shows the role of small and medium enterprises in the Dutch economy based on an analysis of resource use. In another study, emphasis is placed on the concept of the proposal of chain financing (SCF), as this can help small and medium-sized businesses overcome the problems associated with financing (Abbasi, Wang, & Alsakarneh, 2018). Economists (Yoshino & Taghizadeh-Hesary, 2014) in their work conduct risk analysis in the process of financing small and medium enterprises in Asia. The paper (Abdulsaleh & Worthington, 2013) analyzes the changes in the financing sources of small and medium enterprises depending on the development life cycle. The article (Karadag, 2015) explores the problems of financial management in small and medium enterprises based on a strategic approach to management using the example of Turkey. A study of small and medium-sized enterprises in Saudi Arabia identifies factors that have the greatest impact on performance (Al-Tit, Omri, & Euchi, 2019). Another article (Luo, Zhang, & Zhou, 2018) reflects the financial structure and financial constraints for small and medium enterprises in China.

The use of various sources of financing is difficult for small and medium-sized businesses due to the critical financial condition of many organizations in this sector of the economy. In this situation, organizations should choose the most appropriate, based on limited opportunities. Most organizations of small and medium-sized businesses require justification of the optimal structure of funding sources to ensure financial stability and solvency (Morozko, Morozko, & Didenko, 2018a).

Problem Statement

Currently, according to Federal Law No. 209-FZ dated 07.24.07 “On the Development of Small and Medium-Sized Enterprises”, “small businesses include business companies, partnerships, production and consumer associations, farms, as well as individual entrepreneurs registered in accordance with the law. This Law and the Decree of the Government dated 04.04.2016 No. 265 “On the limit values of income derived from entrepreneurial activity for each category of small and medium-sized enterprises” define the criteria for the number of employees and earned income. Small businesses include organizations “with a number of 16, but not more than 100 people, and from 101 one to 250 people inclusive for medium-sized organizations; annual income should not exceed 800 million rubles for small organizations and for medium-sized organizations – 2000 million rubles. The established criteria are two times higher in comparison with the originally established in 2014, which has a positive effect on business development.

Small and medium-sized businesses have problems in optimizing internal and external sources of financial resources. Access to borrowing is difficult for objective reasons. (Morozko, Morozko, & Didenko, 2018b). At the same time, organizations of small and medium-sized businesses are faced with problems in using internal sources of their own funds. The imperfection of the use of such a source is its limited size.

Research Questions

The organization’s ability to self-finance is influenced by a rational credit and depreciation policy.

When assessing the organization’s ability to self-finance in a certain period, profit, depreciation, taxes and payments to owners are taken into account:

SF = (EBIT - I) x (1 - T) + DA x T - PIO,

where: SF - Self-financing

EBIT - profit before interest and taxes;

I- average loan rate;

DA- depreciation amount;

T is the established income tax rate;

POI - established payments to owners of a share in the capital.

A limitation of the possibilities of using certain forms of lending is a multistage procedure for checking the borrower, rating indicators and the general reputation of the business entity are taken into account. High requirements for collateral and collateral base, and in its absence - high interest rates. Among the other limitations noted are: limited terms and volumes of lending. Concessional and long-term bank loans are still inaccessible to most Russian small organizations.

Based on the analysis of official state statistics, it can be concluded that the dominant source of financing for small and medium-sized organizations is their own funds (table

Small and medium-sized businesses do not use borrowed funds if it is possible to use internal sources of financing. With a lack of these sources, they are switching to using borrowed financing, starting with the most risk-free forms (table

In doing so, the following should be considered:

- advantages and disadvantages of sources of financing;

- the degree of compliance of the selected sources of financing with the target guidelines of the business entity;

- problems of optimizing sources of financing, to minimize their cost.

Purpose of the Study

The aim of the study is to identify rational sources of financing the activities of small and medium-sized enterprises based on a cognitive approach. The objectives of the study are: the identification of factors affecting the effective functioning, the determination of cause-effect relationships, the construction of a cognitive map, the assessment of the effectiveness of the financial resources used (Morozko, Morozko, & Didenko, 2018c).

Currently, the development of small and medium-sized organizations is possible only with the optimal combination of modern sources of financing activities. A well-grounded approach provides organizations with access to financial resources, while increasing the efficiency of decision-making based on cognitive methods. An adequate selection of specific sources of financial resources is the main task of the organization’s functioning tactics. There is a possibility of effective management using modern approaches.

Research Methods

An assessment of the current state of a small organization can be made based on a SWOT analysis. Factors of the external and internal environment with a positive impact can strengthen the organization’s position and at the same time with a negative impact slow down development (table

Analysis of the weaknesses of the activities of small organizations shows that in the first place there is a lack of financial resources, then inadequate access to sources of financing and a deficit of working capital.

In a period of economic downturn, significant use of domestic sources of financing is noted. At the stage of economic recovery, the use of external sources of financing is increasing.

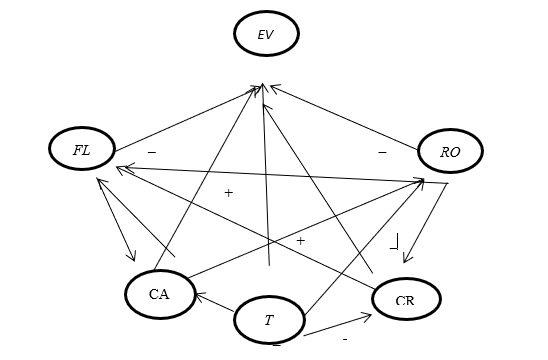

The structure of funding sources is significantly affected by the type of economic activity. If the business entity has assets that have the characteristics of highly liquid, then borrowed capital is more affordable for him (Morozko, Morozko, & Didenko, 2018d). When choosing a source of financing, small and medium-sized organizations are faced with the main problem of finding a balance between the cost of borrowed or attracted sources of financing and the profitability of equity. The correlation between these indicators is based on the fact that the return on equity will increase if the cost of borrowed or attracted capital used to finance activities is compensated by the generated profit. The positive dynamics of profit, on the one hand, reduce the dependence of the company on external sources of financing, and on the other hand allow the use of cheaper, but burdened with obligations. The indicator of the effectiveness of the used financial resources is the economic value added, which is affected by financial risks (FL), financial stability (CA), solvency of the organization (CR), tax burden (T), return on invested capital (ROI) (Morozko, Morozko, & Didenko, 2018e):

EVA - Economic Value Added;

FL - the ratio of borrowed and own funds (financial leverage);

CA - coefficient of autonomy;

CR - the solvency of the organization (current ratio);

T - is the tax burden;

ROI - Return on invested capital.

The EVA variable reflects the susceptibility to a certain set of factor-arguments, the function acts as the probability of a specific outcome, for a given set of factors.

For each indicator, a reasonable target value is established depending on the type of economic activity of the organization of small and medium-sized businesses, which must be achieved in order to meet the requirements of optimization of financing sources (Fig. 01).

The optimal level of financial leverage (FL) can vary significantly for different business entities. This may depend both on the field of activity and on the company's competitive position in the market and is manifested in a risk premium, which will lead to an increase in the cost of the required capital. To assess the effectiveness of the used financial resources in small and medium-sized businesses, it is recommended to use the minimum number of indicators characteristic of poorly structured systems (table

Optimization of funding sources includes a number of successive stages:

- at the first stage, the need for capital is determined to finance the assets the company needs;

- at the next stage, the necessary amount of own and attracted funds is established, available for financing the activities of the company. At the same time, a review is given of information on potential sources of financing that a small business organization can attract to cover needs. A variety of methods of financial support differ in terms of attraction: cost, timing, etc.

- Based on the assessment of positive and negative financing conditions, the most acceptable for a particular organization are identified.

- further, an analysis is made of the correspondence of the created capital structure of the company to the structure of the assets used and the impact of the ratio of borrowed and own funds on the financial condition of the company based on the calculation of the effect of financial leverage. At this stage, an assessment of the financial risk of capital use is made.

Findings

It is advisable to evaluate the costs of using the invested capital based on the calculation of the weighted average cost of capital (WACC) in order to establish the level of return on the capital used and determine the minimum (threshold) value of the return on invested capital, which affects the cost of the business and the income of the owners. At the same time, economic value added (EVA) acts as a criterion for the effectiveness of the use of borrowed funds. Small and medium-sized enterprises can cover financial needs not only through bank loans, but also using alternative financial services. In our country, these types of services are widely developing: microfinance; venture financing; loan portfolio securitization; project financing; crowdfunding; factoring services; various types of leasing; franchising services and other mechanisms.

Microfinance in some cases is the only way to cover the need for a shortage of financial resources. This type of financing is also used by entrepreneurs to start their own business, as they do not have a credit history to obtain a loan from a bank, and there is no collateral to secure a loan. Microfinance organizations organize their activities in accordance with Federal Law No. 151-FZ dated 2.07.2010 “On Microfinance Activities and Microfinance Organizations” on microfinance activities and microfinance organizations. It should be noted that in connection with the strengthening of control and supervision of the Central Bank of Russia, the number of microfinance organizations in recent years has decreased and amounts to “1994 organizations as of April 1, 2019, while the maximum allowable microloan for legal entities and individual entrepreneurs has been increased from 1 to 3 million rubles. "

The venture financing system is mainly used to finance innovative firms with a high risk of investments. The advantage of this type of financing for small and medium-sized businesses is: lack of collateral; short deadlines for considering applications; no interim payments required.

Recently, a system for financing small and medium-sized businesses in the form of securitization of a loan portfolio, i.e. bonds secured by a portfolio of loans to small and medium-sized businesses. Such bonds will allow credit organizations to more proactively deal with small and medium-sized businesses, since they provide additional liquidity for these purposes, since securities are sold on the market, they can be used as collateral in obtaining funds.

Abroad, small businesses use crowdfunding platforms to finance their business projects. It should be noted that in the Russian practice of entrepreneurial activity, a similar type of fundraising is also used. This type of financing is an option for collective investment online.

Conclusion

Financing of small and medium-sized businesses can be carried out using banking, commercial, leasing, factoring services, and using modern systems for attracting financial resources. The problem is to justify the position of optimizing these forms of financing for the effective use of a particular source. The proposed approach allows us to evaluate the effectiveness of the use of attracted financial resources, taking into account the costs of attracting these funds on the basis of a cognitive approach.

References

- Abbasi, W. A., Wang, Z., & Alsakarneh, A. (2018). Overcoming SMEs Financing and Supply Chain Obstacles by Introducing Supply Chain Finance. HOLISTICA – Journal of Business and Public Administration, 9(1), 7-22.

- Abdulsaleh, A., & Worthington, A. (2013). Small and medium-sized enterprises financing: A review of literature. International Journal of Business and Management; 8(14), 36-54.

- Al-Tit, A., Omri, A., & Euchi, J. (2019). Critical success factors of small and medium-sized enterprises in Saudi Arabia: Insights from sustainability perspective. Journal Administrative Sciences, 9(32), 1-12.

- Chong, S., Hoekstra, R., Lemmers, O., Van Beveren, I., Van Den Berg, M., Van Der Wal, R., …, & Verbiest, P. (2019). The role of small- and medium-sized enterprises in the Dutch economy: An analysis using an extended supply and use table. Journal of Economic Structures, 8(8), 1-24.

- Federal Law No. 151-FZ dated 2.07.2010 “On Microfinance Activities and Microfinance Organizations”. Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_102112/ Accessed: 15.10.2019. [in Rus.].

- Federal Law No. 209-FZ dated 07.24.07 “On the Development of Small and Medium-Sized Enterprises”. Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_52144/ Accessed: 15.10.2019. [in Rus.].

- Government Decision dated 04.04.2016 No. 265 “On the limit values of income derived from entrepreneurial activity for each category of small and medium-sized enterprises”. Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_196415/ Accessed: 15.10.2019. [in Rus.].

- Karadag, H. (2015). Financial management challenges in small and medium-sized enterprises: A strategic management approach. Emerging Markets Journal, 5(1), 25-40.

- Luo, S., Zhang, Y., & Zhou, G. (2018). Financial structure and financing constraints: Evidence on small- and medium-sized enterprises in China. Journal Sustainability, 10(6), 1-20.

- Morozko, N., Morozko, N., & Didenko, V. (2018a). Rationale for the development strategy of small business organizations using the real options method. Academy of Strategic Management Journal, 17(2). Retrieved from: https://www.abacademies.org/articles/rationale-for-the-development-strategy-of-small-business-organizations-using-the-real-options-method-7130.html Accessed: 15.10.2019.

- Morozko, N., Morozko, N., & Didenko, V. (2018b). Determinants of the savings market in Russia. Journal Banks and Bank Systems, 13(1), 196-208.

- Morozko, N., Morozko, N., & Didenko, V. (2018c). Financial management of small organizations based on a cognitive approach. International Journal of Economics and Business Administration, 6(2), 83-91.

- Morozko, N., Morozko, N., & Didenko, V. (2018d). Unbalanced liquidity management evaluation of the Russian banking sector. Journal of Reviews on Global Economics, 7, 487-496.

- Morozko, N., Morozko, N., & Didenko, V. (2018e). Modeling the process of financing small organizations. Journal of Reviews on Global Economics, 7, 774-783.

- Russian State Statistics Service (2017). Small and medium enterprises in Russia. Retrieved from: https://gks.ru/free_doc/new_site/business/prom/kol_yurr.htm Accessed: 15.10.2019. [in Rus.].

- Ughetto, E., Cowling, M., & Lee, N. (2019). Regional and spatial issues in the financing of small and medium-sized enterprises and new ventures. Journal of Regional Studies, 53(5), 617-619.

- Yoshino, N., & Taghizadeh-Hesary, F. (2014). Analytical framework on credit risks for financing small and medium-sized Enterprises in Asia. Asia-Pacific Development Journal, 21(2), 1-21.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Morozko*, N. I., Morozko, N. I., & Didenko, V. Y. (2020). Problems Of Optimization Of Sources Of Financing Of Small And Medium Businesses. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 640-648). European Publisher. https://doi.org/10.15405/epsbs.2020.03.92