Abstract

The contribution of the digital economy sector to Russia's GDP by the end of 2017 was only 2.7 %, while in many developed economies, the weight of the IT sector is 6-7% of GDP. Breakthrough areas in IT sphere (Big Data, Artificial Intelligence, Internet of Things, Blockchain Technology) are able to provide growth in traditional economy sectors. However, the introduction of this technology is not going very fast. The article includes key problematic aspects that are associated with the risk assessment in financing a new generation of enterprises in the information technology field. The IT-market is characterized by high growth potential and low barriers to entry into this segment. However, the transparency of the market is not high enough, which entails a high risk assessment by investors while financing. The authors try to investigate the current state of the IT-sector of enterprises, determine risks that are typical for this type of activity, and form approaches to their assessment and management. The article will be of considerable interest to analysts who are engaged in financial modeling, as it describes key features of the cash flow formation of enterprises that are engaged in the software development and system integration. The authors identified and systematized macroeconomic and sectoral factors that affect the financial model of enterprises in this area. It is proposed to calculate a risk premium in the method of cumulative construction of the discount rate, that is estimated according to the classification of risks for IT-enterprises proposed by the authors.

Keywords: Risk-managementIT companyvaluation of riskrate of discountcost of equity capitalcost of investment capital

Introduction

Digital technologies are a relevant and promising direction and can become one of the key drivers for the growth of the country's economy. Regarding the degree of using digital technologies by business in Russia compared to the EU countries, we can see that the share of organizations using already well-known resource management systems (ERP), customer service systems (CRM) and radio frequency identification (RFID) is 2 times lower than in European countries (Medovnikov, 2019). Among the key problems that hamper the development of the digital economy, experts note the opacity of the market, the imperfection of the legal regulation and mechanisms for the protection of the intellectual property in the country (Medovnikov, 2019). The opacity of the market (KPMG, 2019), in turn, does not allow attracting the necessary capital to ensure the growth of all directions of the digital economy.

Among the known forms of financing, we note the following ones: own funds; loans from third parties; informal (shadow) sources of financing; budget credit; business angels; venture funds; banking sector; corporate venture funds. For example, it is not always possible to attract a bank loan to a small company for a new project. The banking sector is reluctant to finance IT projects, especially those related to the underdeveloped market. At the same time, more and more large banks are members of IT companies, thereby increasing the level of the process automation and market share, turning their business into ecosystems and introducing IT into everyday business processes.

The shadow economy can also be a source of project financing because of its dualistic nature. The authors note two functions of the shadow economy: restraining, preventing the legal development of the economy and compensating – ensuring the survival of business (Burov, Atanov, Andrijanov, & Sudakova, 2014).

Interesting is the experience of the Chinese company P2P lending – one of the new types of digital financial services based on the mechanism of granting loans in small amounts directly from private creditors (individuals) without financial intermediaries. The total market of this company in China has increased rapidly and reached $ 41 billion in 2015 (Medovnikov, 2019). In addition to the development of alternative financing sources for the considered sector, the authors also find it expedient and reasonable to use traditional forms of lending, under the condition that the risks are correctly assessed. Limited access to the capital market (because of the opacity of the sector and thus increased risk assessment) can be avoided by solving one of the applied problems of risk management tools for this category of projects.

Problem Statement

The specificity of IT enterprises for traditional forms of financing is studied not fully. Lenders do not understand criteria for evaluating IT companies and their projects. There is no risk assessment system for financing IT projects at enterprises that plan to use digital technologies, as well as in the IT sector, which is one of the factors constraining financing.

Research Questions

The main research issues are:

specific features of IT companies (including financial portrait of IT companies);

macroeconomic and industry factors affecting the financial model of the IT enterprise;

identification of risks of IT companies and projects;

methodology of the cost assessment of risks of IT companies and projects.

Purpose of the Study

The purpose of the study is to develop approaches to the risk management by financing IT companies / borrowers, taking into account the real assessment of risks typical for borrowers / projects. It also means the development of a risk classification and an assessment methodology to evaluate risks of TI companies and increase the objectivity of the decision-making process on project financing.

Research Methods

The authors use general research methods: analysis, synthesis, comparison, as well as methods of financial-economic and system analysis. The use of these methods helps to answer the main research questions.

Findings

According to the research results covered 469 companies in the IT sector for 2017, we can make a conclusion about the low dynamics of sales growth in the industry (4.24%), a decrease in all types of profitability indicators (ROE – 31.5%, ROA – 11.36%), an increase in the repayment period of receivables (+13.3%) and payables (+10%). However, the internal rate of return of IRR investment projects on the software development is 34.5%.

The key features of IT enterprises in Russia are: a high state share in the IT sector (in the structure of the authorized capital – 35%); in the services sector, the lowest share of the state is 15.8%; the share of small and medium-sized businesses is 46% (by revenue in 2016); the state is the key customer of IT services; 25% of orders are received from the government sector (2018).

The main risks associated with the implementation of IT projects are identified: technological, market, legal, marketing, team balance, financial, managerial, macroeconomic, industrial and information ones. The technological risk is determined by approaches to the product development and support that are chosen by different teams. Errors that were made at the stage of writing a program can affect the performance, stability and accuracy of a product in the future. An important issue is the qualitative design of the load on the working server of the system, the correctness of technical calculations to ensure the required number of servers, etc. Some researchers suggest using the support vector technique (machine) SVW, one of the common machine learning methods (Chaudhary, Singh, & Sharma, 2016). In the BCG study (Brock, Gandhi, & Iyer, 2018), the authors suggest using a combination of a system platform and management techniques based on the Agile philosophy.

The market risk is also especially characteristic of IT companies. For some products, it may not be formed, or, on the contrary, saturated with competitors, even of lower quality, or counterfeit products are presented on the market, which entails legal risks. As it is noted in the study (Medovnikov, 2019), the application of IT is carried out by enterprises outside the legal field, which is logical, since the legal regulation of these relations is not well developed.

The authors (Medovnikov, 2019) focus on the following aspects that are characteristic for legal risks and their solution needs to be worked out at the state and business community level: unlawful use of results of the intellectual activity; development of special tax and other benefits for working in IT projects; revision of regulatory mechanisms.

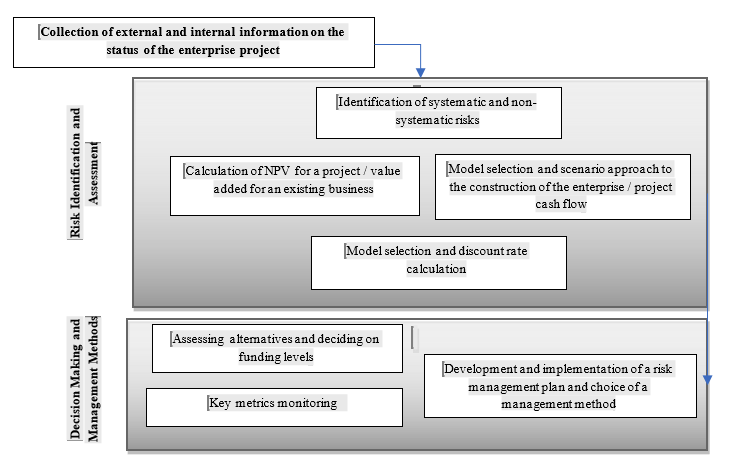

The team balance and management quality have a significant impact on a project and enterprise performance (Brock, Gandhi, & Iyer, 2018). It is assumed that the use of modern standards and management styles (Agile, Program-directed agile teams) will allow managing the project effectively and minimize risks. A skillful combination of these approaches depends on the experience and balance of the team. The authors developed the following approach to the risk management in financing IT projects (Figure

Key elements of a risk management scheme:

1. Collection of external and internal information about the state of the enterprise / project

It is necessary to answer a question about business prospects (key blocks in diagnosing a business), identify key drivers for its growth, examine in detail the business model of an enterprise, competitive advantages of a software product and its value for a client, market prospects, distribution channels, relationship ways with customers, organizational structure, technological aspects of the program development and their prospects, human resources in terms of skills and training prospects, the use of modern project management methods, business financing sources and the financial model itself.

2. Identification, mapping and valuation of risks

As for a classifier of risks, the authors took as a basis studies by Yaskevich (2015).. Criteria of Yaskevich (2015) are: development degree of RIA (results of intellectual activity); commercialization degree in business; degree of the market formation; availability of competitive counterfeit products on the market; degree of the market competition; advertising campaign; marketing policy; quality of the project management; project team.

The authors of this study offer additional indicators: the degree of elaboration of the MVP (market value) of the project; degree of use in business of key trending technologies in the industry (cloud platforms, Big Data, AL, IoT, VR, Block chain, etc.); degree of elaboration of the budget and organizational plan of the project; level of the quality management in the enterprise; level of the customer diversification, as a percentage of planned sales per customer; informational transparency of the project. Evaluation of these criteria is carried out by an expert from 1 to 5 points. To calculate the integral value, the average value of the estimates is calculated.

The choice of a cash flow model depends on a project stage. The approach is classic, depending on the implementation stage of the IT project and stakeholders: for owners (shareholders) - Equity Cash Flow or investors (lenders) – Capital Cash Flow.

The discount rate is determined depending on the interested parties: for ECF – CAPM (Sharpe, 1964), cumulative construction / ROE (Return on equity), for CCF – WACC (Kumar, 2016).

The formula for calculating the discount rate is:

Where:

RE – rate of return on equity;

RF – return on risk-free investments;

β – beta coefficient, a measure of systematic risk, reflects the amplitude of fluctuations in the profitability of the instrument compared with the overall profitability of the market as a whole;

ERP (MRP) – the market premium that an investor expects for the risk of investing in stocks, instead of investing in risk-free instruments;

P1 – additional premium for the risk of investing in a particular company.

The coefficient β as a measure of systematic risk is calculated by the following formula:

Where:

– covariance of the return i of the asset ri and the average market return rm.

– variation of the average market return rm.

Valuation of risk factors is reflected in the premium at a discount rate. In this case, the risks are reflected in the cost of the enterprise capital. According to the decision of the analyst, it is possible to use a scenario approach to building the cash flow of an enterprise and take into account a part of the macroeconomic, industrial, and commercial risks that are associated with changes in prices in the cash flow model. When choosing a discount rate, it is advisable to use the cumulative construction method. In this case, risks are taken into account in the cash flow model and are not reflected in the cost of the capital. It will be taken into account on the value of the cash flow and ultimately on the value of the enterprise. The next important step in the IT company’s risk assessment system is the creation of scenarios for the financial model, which the authors propose to form using the direct method of constructing key elements of the cash flow, taking into account the influence of macroeconomic and industrial factors (Table

Some researchers propose the use of statistical methods for constructing the operating cash flow (Lee & Kim, 2019), which is very difficult in the Russian economy and is applicable only to public companies. In our opinion, it is advisable to use a scenario-based approach for cash flow building.

The problematic aspect is the correct forecast of macroeconomic and industrial indicators. Authoritative sources on economic forecasts of the Ministry of Economic Development and Trade, consistent forecasts of analytical agencies Bloomberg, Thomson and other methods are used as information sources, which is an additional area of research. Based on the simulation results, the obtained data of the risk assessment and data of NPV (Net present value), (Kopacz, 2017), EVA (Economic Value Added) (Limarev, Petrov, Zinovyeva, Limareva, & Chang, 2019) are compared to assess the economic efficiency of a project, the degree of added value growth and to make a final decision on the feasibility and volumes of financing. To test the proposed risk assessment model for an IT company, we tested the discount rate calculations for Yandex (Table

From the calculations (Table

Conclusion

The authors’ approach is based on the proposed classification of IT project risks in a company and cash flow generation factors for Russian IT companies. It gives the result in a more accurate risk assessment and correct calculation of NPV. A differentiated approach to accounting macroeconomic and industrial risks in the cash flow reduces the cost of the capital and has a positive effect on the future value of an enterprise. The area for further research may be the formation of measures to develop and implement a risk management plan, hedging methods, the implementation of which will improve the business efficiency.

Acknowledgments

We express our gratitude to our near and dear people (wife Natalya, daughter Lisa and son Stepan) for understanding and support.

References

- Brock, J., Gandhi, R., & Iyer, S. (2018). Taking the risk out of digital projects. Retrieved from: https://www.bcg.com/publications/2018/taking-risk-out-digital-projects.aspx Accessed: 07.10.2019.

- Burov, V. Y., Atanov, N. I., Andrijanov, V. N., & Sudakova, T. M. (2014). Shadow economy and corruption as a form of economic crime. Criminology Journal of Baikal National University of Economics and Law, 2014(4), 65-74. [in Rus.].

- Chaudhary, P., Singh, D., & Sharma, A. (2016). Classification of software project risk factors using machine learning approach. In Berretti S., Thampi S., Dasgupta S. (Eds.), Intelligent Systems Technologies and Applications. Advances in Intelligent Systems and Computing, 385 (pp. 297-309). Cham: Springer. https://doi.org/10.1007/978-3-319-23258-4_26

- Damodaran, A. (2019). Country default spreads and risk premiums. Retrieved from: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html Accessed: 07.10.2019.

- Finam (2019a). Eurobonds. Retrieved from: http://bonds.finam.ru/trades/today/default.asp?resultsType=5�orId=1 Accessed: 05.09.2019. [in Rus.].

- Finam (2019b). Russian index RTSTL. Retrieved from: www.finam.ru/profile/moex-indeksy/rtstl/export/?market=91&em=420472&code=RTSTL&apply=0&df=16&mf=0&yf=2019&from=16.01.2019&dt=16&mt=8&yt=2019&to=16.09.2019&p=8&f=RTSTL_190116_190916&e=.csv&cn=RTSTL&dtf=1&tmf=1&MSOR=1&mstime=on&mstimever=1&sep=3&sep2=3&datf=1&at=1. Accessed: 05.09.2019. [in Rus.].

- Institute for Growth Economics named after Stolypin P.A. (2018). Russia: From digitalization to the digital economy. Retrieved from: stolypin.institute/wp-content/uploads/2018/09/issledovanie_tsifrovaya-ekonomika-14-09-18-1.pdf Accessed: 05.09.2019. [in Rus.].

- Kopacz, M. (2017). The impact of variability of selected geological and mining parameters on the value and risks of projects in the hard coal mining industry. Archives of Mining Sciences, 62(3), 545-564. https://doi.org/10.1515/amsc-2017-0040

- KPMG (2019). Digital technologies in Russian companies. Retrieved from: https://ru.investinrussia.com/data/files/sectors/ru-ru-digital-technologies-in-russian.pdf Accessed: 06.09.2019 [in Rus.].

- Kumar, R. (2016). Estimation of cost of capital. Valuation - Theories and Concepts, Chapter 4 (pp. 93-118). Elsevier, Academic Press. https://doi.org/10.1016/B978-0-12-802303-7.00004-8

- Lee, J., & Kim, E. (2019). Foreign monitoring and predictability of future cash flow. Sustainability (Switzerland), 11 (18), 4832. https://doi.org/10.3390/su11184832

- Limarev, P. V., Petrov, A., Zinovyeva, E. G., Limareva, J. A., & Chang, R. I. S. (2019). "Added economic value" calculation for the higher education providers' services. In D.B. Solovev (Ed.), Proceedings of the International Science and Technology Conference on Earth Science, ISTC Earth Science 2019. IOP Conference Series: Earth and Environmental Science, 272(3) (032147). Bristol: IOP Publishing. https://doi.org/10.1088/1755-1315/272/3/032147

- Medovnikov, D. S. (Ed). (2019). Digital economy: Global trends and practice of Russian business. Retrieved from: https://imi.hse.ru/pr2017_1 Accessed: 05.09.2019. [in Rus.].

- Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425-442. https://doi.org/ 10.2307/2977928

- Yaskevich, E. E. (Ed.) (2015). Reference book of calculated data for valuation and consulting (RCD№14). Moscow: LLC "Scientific and Practical Center for Professional Assessment". [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Pomulev*, A., & Selugina, O. (2020). Approaches To Risk Assessment In Financing Borrowers Of The Digital Economy Sphere. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 555-562). European Publisher. https://doi.org/10.15405/epsbs.2020.03.80