Abstract

The article presents tendencies for improving assessment methodology for efficient investment activities of energy companies based on the characteristics of industry risks. Regulatory sources and scientific literature on this issue have been elaborated, and methodological tools have been applied to analyze and summarize the data. The specific risks of energy companies were identified and options for assessing the investment activities effectiveness were proposed. The enterprises of the Russian energy industry were selected as the object of the research. In accordance with the Federal Law of the Russian Federation “On Energy”, energy sales companies are subject to mandatory licensing. In case of improper use of budget funds, there is a risk of failure to obtain license or decertification on energy sales activities. The company should be aware and assess the risks that they will face in the implementation of investment activities. Moreover, at the present stage there is no unified methodology for assessing these risks, since in each case it is necessary to take into account the fundamentals of organization’s functioning, its position at goods and services market, industry specific-sector issues. Evaluation of the effectiveness of investment activity is impossible without a qualitative risk assessment. This article studied the risks that a tariff-regulated company in the field of energy and housing-communal services can face carrying out investment activities of an energy company in the city of Samara.

Keywords: Investmentsinvestment programinvestment riskelectric power industryindustry specificssensitivity analysis

Introduction

Please replace this text with context of your paper. The basis of this work is the analysis of Russian energy sector, since today major structural changes in the Russian energy sector are targeted that can be implemented upon the availability of essential investments.

According to Russian and foreign scientists, today, one of the key and crucial issues is the development of renewable energy sources (RES). RES imply the alternative sources for generating electricity (Proskuryakova & Ermolenko, 2019; Collins et al., 2018; Capros et al., 2018).

So, today about 75% of all electric energy in Russia is generated at thermal power plants (TPPs), where the energy generated by burning organic fuel (coal, peat, gas, oil shale, fuel oil) is used as a source, their reserves in natural environment are limited. The need for change in this situation is confirmed by scientists’ research. (Kazakova & Zhilkin, 2016; Cooremans & Schönenberger, 2019).

Russia is still highly dependent on the sale of raw energy resources. However, in view of non-renewability of natural resources, the urgent issue is the development of other sectors of economy, that is represented in the theory of reindustrialization (Napolnov, 2016)

Thus, the volume of investments in the electric power industry is growing, however, energy companies often face the problem of low competitiveness in the field of attracting investments, which are directly related to specific features of investment activity within the industry.

Thus, energy companies, unlike most business entities, carry out investment activities aimed primarily at modernizing and improving their core business, and not to obtain speculative financial income. At the same time, when forming investment programs, energy companies need to take into account the following specific factors:

legal requirements not only in terms of investment, but also in industry legislation;

income dependence on state social policy;

additional control over state investment projects;

lack of valid system for evaluating the effectiveness of investment programs (Goryaeva, 2015).

These factors are the results of legislative acts. Consequently, for correct assessment of investment activities of energy companies, it is necessary to improve existing methodological approaches, considering specific features of the energy industry.

Problem Statement

One of the areas of methodology enhancement in the framework of this study is to identify possible risks of investment activities of energy enterprises, which are regulated by the state, to improve the quantitative assessment methods, as well as to formulate the main ways to reduce them.

In addition to the assessment of state influence, it is necessary to implement the research of the risks of investment activities related to the industry specific features of wholesale and retail electricity markets in the Russian Federation, as well as different power levels. The problem of low efficiency of internal control in energy companies or compliance control has to be studied in detail.

Research Questions

The main research issues are:

-What additional industry risks do energy sales companies face carrying out their activities?

-What quantitative impact do the identified risks have on investment performance indicators?

What are possible measures to reduce the risks?

Purpose of the Study

-

determine the characteristics of investment activities of energy enterprises;

-

identify possible risks of energy companies in carrying out investment activities;

-

develop practical recommendations for energy companies to improve investment assessments aimed at reducing identified risks of investment activities.

Research Methods

During the study, the following methods were used: observation; comparison; theoretical analysis of scientific literature to obtain theoretical justification of the problem; descriptive method of the characteristics of energy industry; data synthesis obtained in the analysis process; statistical methods of events probability; stochastic and simulation methods for risks evaluation; to assess the influence of identified risks the sensitivity analysis technique was used, using indicators that characterize the enterprise investment activity in the energy sector.

Findings

Based on the results of the study, the following industry risks for public energy companies were identified:

1) The risk of external control due to the regulation of the activities.

The investment activities of energy companies are regulated by the number of legislative acts. On-site inspections are conducted to control, the list of which is approved by the order of regulatory body, as well as unscheduled inspections. This implies not only additional time costs, but also an increase in administrative costs. This can also include corruption risk described in the works of Junxia (2019).

Energy companies are referred to tariff-regulated organizations, which means setting prices for products sold through regulatory bodies of regional or national scale. At the same time, the volume of necessary gross revenue (NVV) is agreed upon, which the energy organization will need to operate successfully in the framework of the next billing year.

2) Risk of license expiration

In accordance with the Federal Law of the Russian Federation “On Energy”, energy sales companies are subject to mandatory licensing. In case of improper use of budget funds, there is a risk of failure to obtain license or decertification on energy sales activities.

To reduce risks in investment planning, as a rule, they either increase project profitability or strengthen control over risk formation. Due to the sector-specific issues of the industry, it is not always possible to increase investment project profitability, since it is aimed primarily at improving the quality of customer service. Thus, energy organizations should work to reduce the risk component of investment activity by means of internal control as well.

In our opinion, to strengthen control over investment programs, it will be advisable to create a compliance control service within the organization. At the same time, internal control specialists need to rely on the legislative framework, which today operates within the regulations of investment activities of organizations in the electric power industry. The effectiveness of this project proposal was evaluated in previous studies (Aksinina, Naumova, & Tyugin, 2019).

Firstly, control over investment programs of tariff-regulated organizations, as well as timely and correct reporting to the regulatory authority, reduces field audits and penalties. This will also reduce the risk of external control. Secondly, to weaken the adverse effect due to the risk of low profitability, it is necessary to monitor the implementation of approved investment programs and, if necessary, to correct or modify them.

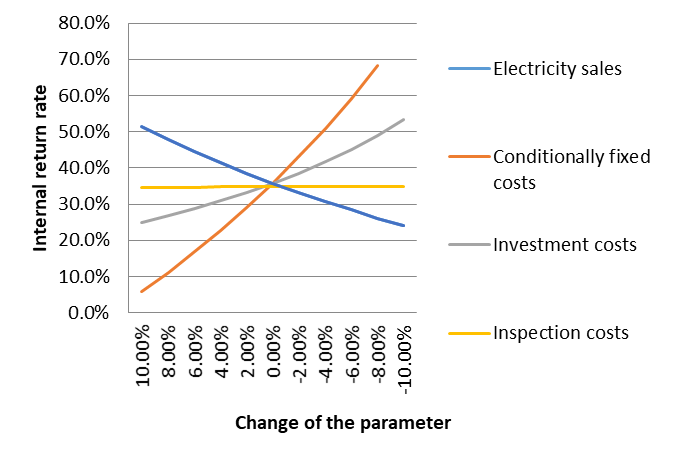

After the initial consideration of risk component of companies’ investment activities in the field of electricity, it is necessary to quantify the risks and consequences of their formation. To evaluate the influence of identified risks, the sensitivity analysis technique was applied, using indicators that characterize the investment activity of energy sector enterprises.

Based on data from energy companies in the Samara Region (Russia), the analysis of investment programs was carried out to improve the methodology regarding industry specifics. The time- period of the research is 10 years. The gross profit is used to reflect the impact of investment program results on company activities, since it reflects cost changes dynamics due to cost reduction by means of new equipment and revenues that result in overall level of electricity sales.

For further sensitivity analysis, cash flows from investment projects established by the investment program of company N for 2018-2027 were calculated. At the same time, a discount rate of 14.5% was used, which was calculated by the cumulative method.

We conducted sensitivity analysis of internal return rate on variable project parameters (Table

inspections costs (risk of control);

exclusion of investment costs from total NGP (required gross proceeds) (risk of low profitability)

The values of sensitivity coefficients, calculated as the ratio of the change of internal return rate of investment project to the change rate of variable parameters, were ranked by the degree of their influence on the resulting indicator from 1 (most significant) to 5 (less significant) and it is presented in the table

The graphical results of the study are presented in Figure

As a result, we found that the decrease in conditionally constant costs by 2% has the greatest effect on the change in IRR from selected variable parameters. This decrease can be achieved by optimizing the process of collecting consumer meter readings via the introduction of a new automated system.

The parameters introduced in this research into the calculation model for assessing investment project sensitivity in the energy industry take the 4th and 5th places in the ranked list of parameters; however, they cannot be taken into account because in this case the analysis picture will not be complete. In addition, the slope of the curve showing the dependence of internal return rate on the exclusion of investment costs from total NGP (Fig. 01). This allows us to judge that this parameter has the strongest effect on the resulting indicator at the inversely proportional dependence.

Conclusion

The company should be aware and assess the risks that they will face in the implementation of investment activities. Moreover, at the present stage there is no unified methodology for assessing these risks, since in each case it is necessary to take into account the fundamentals of organization’s functioning, its position at goods and services market, industry specific-sector issues.

Evaluation of the effectiveness of investment activity is impossible without a qualitative risk assessment. This article studied the risks that a tariff-regulated company in the field of energy and housing-communal services can face carrying out investment activities of an energy company in the city of Samara.

Risks of investment activity are associated in this case with industry specifics due to non-traditional operation of wholesale and retail electricity and capacity markets. Three risks were identified that a regulated organization can face and are not currently used in assessing the effectiveness of investment programs:

risk of inspections and penalties in case of failure to complete approved investment program of the organization;

withdrawal of necessary gross proceeds of future periods of financing amount of undeveloped investment projects;

decertification to carry out energy sales activities.

Possible ways to reduce investment risks are also formulated:

to monitor the terms and volumes of approved investment program of the guaranteeing supplier;

timely quarterly and annual reports to regulatory authorities on the implementation of investment program;

modify approved investment program;

by July 1, 2020, in the agreed amount, provide the documents necessary for obtaining a license to carry out energy sales activities.

Among other things, it was proposed to expand the methodology for quantifying the investment projects of energy companies by expanding the list of variable parameters used in the sensitivity analysis of investment projects. It is proposed to add the following parameters:

inspection costs arising from the risk of control;

exclusion of investment costs from total NGP, which is the consequence of low profitability risk.

The analysis showed that these parameters have a great influence on the internal return rate, which was chosen as a resulting indicator, and their non-inclusion in the analysis will lead to incomplete information and distorted research results.

References

- Aksinina, O. S., Naumova, O. A., & Tyugin, M. A. (2019). Impact of the compliance – control system on provision of financial security. In: V. Mantulenko (Ed.), Proceedings of GCPMED 2018 – International Scientific Conference "Global Challenges and Prospects of the Modern Economic Development". The European Proceedings of Social & Behavioural Sciences EpSBS, LVII (pp. 1032-1041). London: Future Academy. https://doi.org/10.15405/epsbs.2019.03.103

- Capros, P., Kannavou, M., Evangelopoulou, S., Petropoulos, A., Siskos, P., Tasios, N., …, & DeVita, A. (2018). Outlook of the EU energy system up to 2050: The case of scenarios prepared for European commission's “clean energy for all Europeans” package using the PRIMES model. Energy Strategy Reviews, 22, 255-263. https://doi.org/10.1016/j.esr.2018.06.009

- Collins, S., Saygin, D., Deane, J. P., Miketa, A., Gutierrez, L., Ó Gallachóir, B., …, & Gielen, D. (2018). Planning the European power sector transformation: The REmap modelling framework and its insights. Energy Strategy Reviews, 22, 147-165. https://doi.org/10.1016/j.esr.2018.08.011

- Cooremans, C., & Schönenberger, A. (2019). Energy management: A key driver of energy-efficiency investment? Journal of Cleaner Production, 230, 264-275. https://doi.org/10.1016/j.jclepro.2019.04.333

- Goryaeva, K. A. (2015). Investment activity of energy retail companies and its features. Innovation Science, 6, 66-68. [in Rus.].

- Junxia, L. (2019). Investments in the energy sector of central Asia: Corruption risk and policy implications. Energy Policy, 133 (110912). https://doi.org/ 10.1016/j.enpol.2019.110912

- Kazakova, K. V., & Zhilkin, O. N. (2016) Renewable energy. Prospects for the development of projects based on renewable energy in the world and in individual countries. Youth Scientific Forum: Social and Economic Sciences, 1(30), 180-186. [in Rus.].

- Napolnov, A. V. (2016). Russian energy in an era of change: Investment aspect. Investment Banking, 5. Retrieved from: http://www.reglament.net/bank/banking/2006_5.htm Accessed: 14.10.19. [in Rus.].

- Proskuryakova, L. N., & Ermolenko, G. V. (2019). The future of Russia’s renewable energy sector: Trends, scenarios and policies. Renewable Energy, 143, 1670-1686. https://doi.org/ 10.1016/j.renene.2019.05.096

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Naumova*, O., & Aksinina, O. (2020). Features Of Investment Risk Assessment In Energy Companies Of Russia. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 534-540). European Publisher. https://doi.org/10.15405/epsbs.2020.03.77