Abstract

Currently, the dairy industry is one of the sectors with a high share of imported equipment and accounts for 60-70%. At the same time, from 2015-2016, a high rate of import substitution has been observed. Domestic equipment manufacturers produce about 30-40% of the product range to satisfy most of the equipment needs of small and medium enterprises. According to the Ministry of Industry and Trade of the Russian Federation for 2017, about sixty-two domestic enterprises in different regions of the country operate on the Russian market. For many enterprises, the production of equipment for the dairy industry is not a primary activity, but an additional one. As part of the analysis of the financial condition and efficiency of enterprises, such results were obtained as the market share of domestic enterprises, as the volume of sales of the enterprise on the total sales volume, the maximum value of the value of enterprises, the income of the owner per invested rubble, the profitability of sales of enterprises. These indicators were obtained on the basis of the study of accounting (financial) statements for 2015-2017. The objects of research are over 30 Russian enterprises. The purpose of this research was to analyse the financial conditions of Russian manufacturers of equipment for the dairy industry in all regions of the Russian Federation.

Keywords: Competitivenessdairy industryfinancial analysisprofitabilityRussian industry

Introduction

The needs of the population for dairy products are growing day by day. Therefore, the role of equipment for the dairy industry in the state economy is huge. According to the Ministry of Industry and Trade of the Russian Federation, there are 62 enterprises located in different regions of Russia that produce domestic equipment (Ministry of Industry and Trade of the Russian Federation, 2019).

Currently, the dairy industry belongs to the industries with the largest share using imported equipment 60-70% (Strategies for the development of mechanical engineering for the food and processing industry of the Russian Federation for the period until 2030, 2019). At the same time, this industry is characterized by a high rate of import substitution. The production of equipment for the dairy industry is also characterized by a low share of the costs of research and development, the share of which is about 0.2% of all costs, while foreign companies spend about 2.0. Domestic equipment manufacturers produce about 30-40% of the product range to satisfy most of the equipment needs of small and medium enterprises.

The financial position of a business entity is considered a complex result of their entire performance. This result is presented through the ratio of indicators of activity, profitability, liquidity, debt and market value. These indicators reflect the complexity of the business of the entity's interpretative effectiveness (Baran & Pastýr, 2014; Alexander, Kusleika, & Walkenbach, 2018).

The objects of research are such enterprises as Generatory ledyanoj vody LLC, SOMZ LLC, TD Russkaya Bronya LLC, MNPP Iniciativa LLC, PROTEMOL LLC, Vologodskie mashiny LLC, Zavod molochnyh mashin LLC, Dagprodmash JSC, BLS engineering LLC, Grand LLC, KFTEKHNO LLC, ATF AGROS LLC, Agregat JSC, Selmash Molochnye Mashiny LLC, Cwet OJSC, COOLTECH LLC, Lenprodmash CJSC, Russkaya Trapeza LLC, Colaxm JSC, TECHNOKOM IKP, Molmash Plant JSC, KR-Tec LLC, NPO GIGAMASH LLC, Elf4M «Torgovyj Dom» LLC, VKP Signal-pack LLC, ZAVOD TEHTANK LLC, SLAVUTICH LLC, NMZ JSC and others.

Problem Statement

Dairy engineering is part of the food machinery industry. In this regard, there are very few statistics that are specific to this industry. The existing dairy enterprises are food-processing enterprises, and the dairy industry is an additional activity. This is due to the fact that the demand for Russian engineering products is low, as dairy enterprises are more interested in foreign equipment manufacturers. The import substitution program in the Russian Federation does not fully meet planned targets.

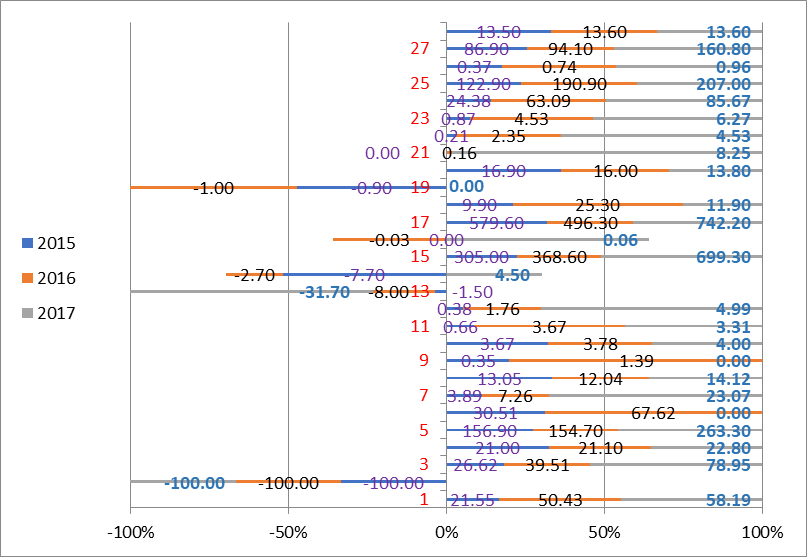

Let’s consider the market share of Russian enterprises (Catalog of Russian manufacturers of machinery and equipment for the food and processing industry), as the company's sales to total sales, presented in table

For the analysis of domestic equipment manufacturers, dairy enterprises were selected from the latest catalog of the Ministry of Industry and Trade of the Russian Federation for 2017. Due to the fact that for some enterprises this type of activity is optional and is not included in the main 10, they were not taken into account in the analysis, as well as those that, according to the register (the only state register of legal entities) do not have this type of activity in whole. In addition, closed joint stock company was not included in the samples, because due to the legal form, there is no access to accounting and financial information. Also, the catalog of the Ministry of Industry and Trade of the Russian Federation did not update data on enterprises that have not been operating for several years. These enterprises were also not included in the analysis (Ministry of Industry and Trade of the Russian Federation, 2018). In order to assess the real situation, VKP Signal-pack LLC was not included in the sample due to the fact that this company produces equipment only for packaging and packaging, as well as MiSSP CJSC, since the high revenue indicator is related with the production of elevators and does not operate in 2017.

Agregat JSC has a negative business value of 31.7 million rubles, and all bank accounts were blocked by decision of the Federal Tax Service dated 05/28/2018. Colaxm JSC Enterprise also has a negative business value of 1 million rubles. Account operations stopped on 02/14/2018. The company has not been operating since 2017.

Among domestic equipment manufacturers, taking into account all types of activities, the largest market share is occupied by such enterprises as Cwet OJSC (11.92; 12.14; 15.27), Lenprodmash CJSC in 2017 (10.19), Vologodskie mashiny LLC in 2016 (9, 63) and SOMZ LLC in 2016 and 2017 (5.28; 6.44).

According to the annual financial statements for 2017, such enterprises as Vologodskie mashiny LLC, BLS engineering LLC don’t conduct business. Due to the fact that FGUP Molmash JSC was declared bankrupt and all property was transferred to the Molmash Plant JSC was selected as an analysis.

Some of the enterprises represented occupy a small share within the entire territory of the Russian Federation, however, they occupy first place in the category of equipment and machinery production in their region.

According to data on equipment imports, it can be concluded that Russian manufacturers satisfy about 30% of total demand. One of the main financial indicators of companies is the market value of companies. We calculate how the maximum value of the value of enterprises in years.

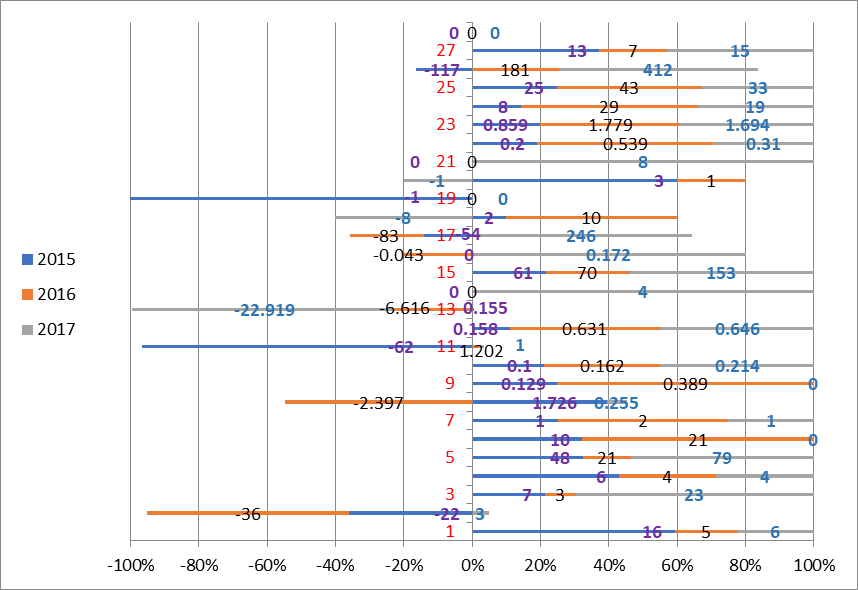

On the figure

ZAVOD TEHTANK LLC in two years improved Net profit to a positive trend in the amount of 412 million rubles. relative to 2016, when there was an uncovered loss of -117 million rubles. However, this enterprise is also specialized in products for the oil, beer, food industry and other products. A similar situation applies to Lenprodmash CJSC, which specializes in bottling lines. Net profit amounted to 246 million rubles. Agregat JSC generated an uncovered loss in two years and in 2017 amounted to -23 million rubles SOMZ LLC in 2017 minimized its costs and showed a profit of 3 million rubles. Cwet OJSC increased its net profit by 2 compared to 2016 due to a sharp increase in revenue by 244 million rubles. relative to 2016. PROTEMOL LLC, as well as Cwet OJSC, increased its net profit by 3 times compared to last year due to revenue growth of 190 million rubles (figure

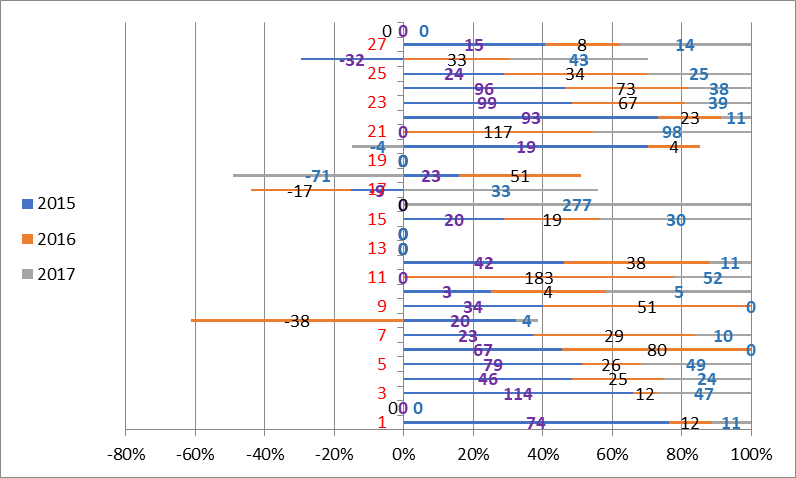

The company Russkaya Trapeza LLC lost the owner’s return on invested rubles by 122 kopecks compared to the previous year and amounted to - 71 kopecks in 2017 (figure

The profitability analysis includes several indicators/ratios, providing evidence on the profits/losses of the company, such as Gross profit indicator (Leventakos & Dagoumas, 2019; Labonaitė & Subačienė, 2019):

A return on sales indicator explains to us, how is the business subject able to use inputs for their effective operations. The final value of this indicator is directly influenced by the character of the business activity, price policy, production regulation, etc. A more accurate statement of this type of indicator provides us a ratio of partial results of the business subject's management to their revenues (Baran, 2015; Ivanets, I., 2018).

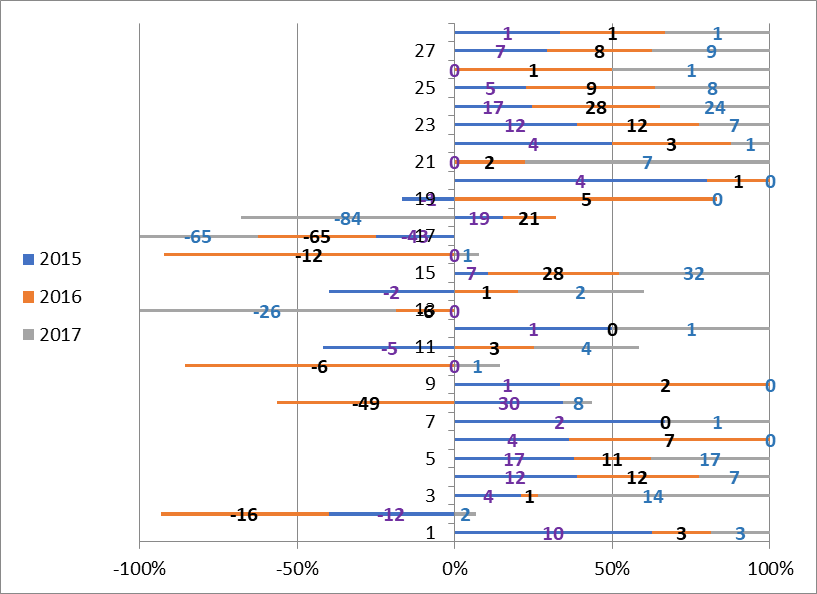

In figure

Research Questions

In the course of this study, the following questions are considered:

are there manufacturers of equipment for the dairy industry;

to assess their financial condition;

evaluate the effectiveness of the import substitution program for several years according to the accounting (financial) statements.

Purpose of the Study

The purpose of this study is to consider financial conditions of Russian manufacturers of equipment for the dairy industry in all regions of the Russian Federation and, based on the analysis, calculate the profitability of sales, find the indicators values for the net profit and enterprise efficiency, assess the effectiveness of the import substitution of considered enterprises.

Research Methods

To test the hypothesis, a number of methods were used that complement each other: - theoretical - analysis of the work of scientists who developed / are developing this problem; analysis of legal acts; personality-oriented approach; empirical - observation, compilation of tables, graphs; field studies. The study involved 62 enterprises. The next step was the analysis and systematization of the results.

Findings

According to the accounting (financial) statements of 62 enterprises in the Russian market, the financial climate is not healthy. They work in limited financial resources and only a few of them allocate funds for the development of R&D. Some enterprises do not purchase loans due to economic inexpediency. A number of manufacturers in recent years have lost their financial position in the market. FGUP Zavod Molmash, which was the leader in the production of food and dairy equipment in the Soviet Union, became bankrupt. Businesses show minimal profitability and efficiency.

Conclusion

The Ministry of Industry and Trade of the Russian Federation is recommended to update the list of existing enterprises producing Russian equipment for the dairy industry. Remove asymmetry information on manufacturers, that is, do not include enterprises in the general list of manufacturers of equipment for the dairy industry whose production of equipment for the dairy industry is an additional type of activity that is not included in the main 5 types of activity. It is recommended that, within the framework of the import substitution program, adjustments be made to the cost of loans for manufacturers of equipment for the dairy industry or the possibility of optimizing the tax burden on income taxes. Based on field research and financial analysis of the accounting (financial) puffiness of enterprises, it can be concluded that these indicators are more stable and an effective position in the market of equipment for the dairy industry in the period 2015-2017 is occupied by: Cwet OJSC and PROTEMOL LLC, as well as an insignificant level e development of the import substitution program.

References

- Alexander, M., Kusleika, D., & Walkenbach, J. (2018). Excel® 2019 Bible. Hoboken, New Jersey: John Wiley & Sons, Inc.

- Baran, D., & Pastyr, A. (2014). The business subject analysis by selected ratio indicators. In M. Števček (Ed.), Proceedings of the Scientific Papers in Economic and Managerial Challenges of Business Environment (pp. 5-18). Bratislava: Comenius University in Bratislava.

- Baran, D. (2015). Controlling. Bratislava: ES STU.

- Ivanets, I. (2018). Financial analysis of the activity of the enterprise. Problems of systemic approach in the economy, 4(66), 144-150. https://doi.org/10.32782/2520-2200/2018-4-22

- Labonaitė, G., & Subačienė, R. (2019). Methodology for net profitability analysis. Accounting: Theory and Practice, 16(7), 78-87. https://doi.org/10.15388/batp.2014.No16.7

- Leventakos, K., & Dagoumas, A. S. (2019). Financial analysis of European energy companies. Macro Management & Public Policies, 1(2), 29-40. Retrieved from: https://www.researchgate.net/publication/335518424_Financial_Analysis_of_European_Energy_Companies Accessed: 05.10.19.

- Ministry of Industry and Trade of the Russian Federation (2018). Catalog of Russian manufacturers of machinery and equipment for the food and processing industry. Retrieved from: http://minpromtorg.gov.ru/docs/#!katalog_rossiyskih_proizvoditeley_mashin_i_oborudovaniya_dlya_pishhevoy_i_pererabatyvayushhey_promyshlennosti Accessed: 11.10.19.

- Strategies for the development of mechanical engineering for the food and processing industry of the Russian Federation for the period until 2030 approved Government Order Russian Federation dated 30.08.2019 N 1931-r (2019). Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_332931/. Accessed: 11.10.19.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Kulumbegov*, M. M. (2020). Assessment Of The Financial Condition Of Russian Dairy Enterprises. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 504-511). European Publisher. https://doi.org/10.15405/epsbs.2020.03.73