Abstract

Information transparency is currently one of the key factors of competitiveness of a company especially if its assets are traded on the stock market. The requirements for information disclosure are growing annually, not only financial data become obligatory for disclosure, but also corporate news, peculiarities of the company social policy. Information transparency acting as the basic principle of the corporate management system is changing to a great extent in the conditions of digital modernization. It is now enough to get access to the information network, and an unlimited number of persons can get all available information about companies provided that the data are published in due time. The issues related to the definition of information transparency, means of raising it and its influence on capitalization of firms are relevant and demand close attention. The society demonstrates the need for carrying out of comprehensive research covering the issue of identification of the information transparency essence and functions as well as determination of the place and role of information transparency in the corporate management process in the conditions of digital modernization of the economy. The practical part of the research should cover the issue of how the information transparency index of a company correlates with its market capitalization level. Emphasis should be laid on the evaluation of information transparency of firms engaged in the development and deployment of digital technology in the economic life of the country.

Keywords: Information transparencycorporate managementdigitizationinformation disclosuremarket capitalization

Introduction

Information transparency is becoming one of the conditions of efficient operations of the corporate management system in conditions of modernization of the digital environment. Information disclosure has to comply with the main reliability and relevance requirements and the key corporate reporting tendencies: comprehensiveness (integrity), availability irrespective of the company location and understandability for all investor groups (Brandes & Darai, 2017). Only if such requirements are complied with, a firm may get an unquestionable competitive advantage on the market, expand the number of its potential investors and consequently acquire additional financial resources for its development.

Problem Statement

Insufficient information transparency is a serious problem for the majority of companies. This concerns data reliability as well as completeness. Qualified and unqualified investors may be uncertain about what issuer to select, which complicates the investment process and in some cases makes it impossible (Glaeser, 2018). The scientific community has come across the need for creation of a socially acceptable system enabling distribution and evaluation of possible corporate investment risks. Corporate transparency is one of the most efficient instruments. Generally speaking, it is understood as general information transparency of a company expressed in full information disclosure (OECD, 2015). External users may review the information in free access to make a justified investment decision.

Research Questions

Solution of the problem set in the course of the research stipulates fulfillment of the following tasks. The initial research stage requires study of the theoretical and methodological bases of information transparency, identification of its essence and content characteristics. Special attention should be paid to the review of the issues of information transparency of companies and the development of proposals for raising the same. The practical part of the research needs an analysis of the impact of the information transparency level on the market capitalization of firms resulting in a conclusion about the importance of information transparency growth as the most important condition of efficient operations of the corporate management system.

Purpose of the Study

The main purpose of the study is the development of theoretical and methodological provisions of the theory of information transparency of market players. In our opinion, the definition of information transparency, means of raising it and its influence on the market company value are insufficiently studied in the modern scientific literature, which accounts for a theoretical request for deeper research of the set problem, solution of which is not only theoretical but also practice-oriented. The developed recommendations for the advancement of transparency of issuers can facilitate attraction of new investors. Timely calculation of the information transparency index will result in reduction of transaction and transformation costs of a firm raising the efficiency of its market performance.

Research Methods

Standard methods of formal and dialectic logic as well as instruments of econometrics have been used in the course of the research. Methods of analysis, classification and economic and mathematical modelling can be singled out among the widely applied methods. These methods enabled to ensure the comprehensive character of the research and reliability of conclusions.

Findings

There is currently no unified opinion as to the definition of the information transparency concept. The majority of authors understand information transparency as aggregate of open information available to an unlimited number of persons (Hsu, Lai, & Li, 2016). The main information transparency elements are assembly of financial and non-financial reports; the information provision has to comply with the generally accepted standards and requirements.

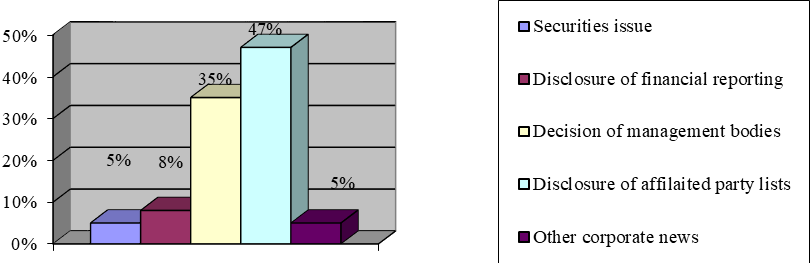

Strengthening of the role of non-financial reporting is a trend of the latest decades (Huang, Li, & Chen, 2019). It can be viewed in the daily statistic presentation of corporate information. Companies stably disclose the following information during the day (fig. 01).

Non-financial reporting together with financial reporting constitute integrated reporting. The need for integrated reporting is expressed by the change in the modern business paradigm. Strict corporate requirements are imposed on modern business across the globe, as a successful company is stable from the economic and social standpoint.

The flow of information obligatory for disclosure is growing annually. According to the EY analysts, the number of annual report sections has grown 4 times for the last 20 years due to the need for inclusion of new articles according to country laws. This tendency will continue with the improvement of laws and transfer of the majority of countries to the socially-oriented business model. As a result, the annual report sections will take up in aggregate about 500 pages as early as in 2032 (EY, 2013). The array of information will be difficult to analyze not only for unqualified investors, but also for professionals.

Let us not forget about the digitization process making a substantial impact on information transparency of a company. Today, anyone can view all available information about a company easily and free of charge. Digitization allows getting equal and unlimited access to data irrespective of location, controlling the data update process, leading an online dialogue with interested parties, analyzing statistics of company activities (Jacoby, Liu, Wang, Wu, & Zhang, 2019).

Updated information technology has affected the means of the development of available programming languages. Updated language of business reporting XBRL helps interconnect the main data. XBRL is a transparent international standard for creation of the unified digital business platform. XBRL reporting solves transparency issues in terms of reporting unification means, application of the unified methodological basis for compilation of the network database, foreign investor attraction possibility as the reporting is made under international standards. Information collection and processing are fully automated. Taxonomies serve as rules. They represent data models including information systems and information forming and control options.

Basic taxonomy able to regulate the company information transparency process on the international level has to include the following elements: supervision and statistic ratios of insurance entities, accounts according to the unified chart of accounts, IFRS, supervision and statistic ratios of private pension funds.

The general inter-country aim of transfer to XBRL is the procedure for regulation of the financial information and data exchange. For our country, the unified transfer will become a rather long-term but efficient procedure. According to the new reporting introduction concept developed by the Bank of Russia, the first two steps will be fully completed by the end of 2019, further implementation will be finished by 2021 (СBRF, 2019). Participants of the experiment on carrying out of this project in Russia note that this transfer is an important stage in the system of information transparency improvement in Russia.

The technologies of reporting submission and disclosure using XBRL can become a platform for open banking and application of distributed ledger (blockchain) technologies in the financial branch. Going back to the level of information transparency of Russian companies, we would like to focus on the importance of its evaluation. Investors aim at analyzing all available information about issuers before investing money in company assets to raise return on investment in the long run and lower any possible risk. The following complication occurs in their way: an analysis of open information consumes much time. Private and institutional investors can refer to professional evaluations and ratings to reduce the time of the information review procedure (Liew, 2019).

Unfortunately, our country so far has no fully opened models and instruments to determine the company transparency level (Kuzmin, Guseva, & Fomina, 2018). The rating of information transparency of the largest Russian companies annually made by the Russian Union of Industrialists and Entrepreneurs is one of the most popular tools. This union has been using a complex ratio since 2017 – the RSPP Index in the stable development, corporate liability and reporting sector consisting of a combination of qualitative and quantitative ratios. Based on the rating data for several years, the Russian Union of Industrialists and Entrepreneurs has determined TOP 20 companies that are currently competing following the results of the reporting period (RUIE, 2018).

Taking into account the international practice (Oxelheim, 2019) and small Russian experience in calculation of information transparency indices, we propose our own integral methodology for calculation of this ratio. The integral method of building of an information transparency index includes a scoring ratio, which characterizes the level of company transparency in relation to other business entities within the branch and simultaneously the degree of trust of potential investors in the company itself.

The peculiar feature of the integral index is that it is built based on surveys of economic entities and (or) independent study of company reporting, mass media and rating agency data, and it includes several components: the procedural transparency index, the economic transparency index, the operational transparency index (Grosman & Leiponen, 2018) and the social transparency index (table

Calculation of 230 integral ratios of information transparency of Russian companies acting as issuers at the Moscow exchange as of the end of March 2019 has become the result of the carried out research of information transparency of Russian companies. Thus, nine firms have taken the lead among hi-tech (innovative) Russian companies issuing ordinary shares (table

An econometric analysis has been carried out in the context of the study of the influence of company transparency on its capitalization; the results have shown that there is a 99% probability of the existence of a direct and linear link of a moderate nature between capitalization of companies of the selected industry sector and the information transparency level. Market capitalization of companies entering the Innovation and Investment Market sector of the Moscow exchange by 49% depends on their information transparency level, thus, the higher the degree of information disclosure by a company, the more attractive it is to invest in its securities (Beigi, Hosseini, & Qodsi, 2016).

Conclusion

The detailed analysis of the bases of the Russian and foreign practice of information disclosure by joint-stock companies, the methodology of calculation of the information transparency index of companies have made it possible to propose a set of tools for the improvement of approaches towards preparation of corporate reporting of companies. The proposed list of measures can not only raise the investment attraction of a company, but make a positive impact on its corporate management system. The following can be noted among the most important steps defining growth of information transparency of a company:

- corporate network development: timely update of information on the official company website, reflection of all significant events in the primary and other spheres of business;

- security control on all levels: the information resources of a company have to be protected, a high information security level has to be maintained;

- deployment of an integrated reporting system: the annual report should include all non-financial events of the year in addition to obligatory components;

- international standards: the obligatory transfer of companies desiring to undergo the listing procedure on the legislative level. Improvement of laws on company reporting to minimize investor risks;

- transfer of information to information agencies: development of the ‘single information window’ concept to allow linking professional participants, issuers and investors for free dialogue in the future;

- development of the fullest single methodology for the official calculation of the information transparency rating and its annual assignment to companies.

References

- Beigi, F., Hosseini, M., & Qodsi, S. (2016). The effect of the earning transparency on cost of capital common stock based on the fama-french and momentum factors. Procedia Economics and Finance, 36, 244-255. https://doi.org/10.1016/S2212-5671(16)30035-1

- Brandes, L., & Darai, D. (2017). The value and motivating mechanism of transparency in organizations. European Economic Review, 98, 189-198. https://doi.org/10.1016/j.euroecorev.2017.06.014

- СBRF (2019). The current status of activities of the Bank of Russia on the support and development of the XBRL format, the Central Bank of the Russian Federation. XBRL Bulletin, 1(9). Retrieved from: https://www.cbr.ru/static/publ/xbrl/longread/9/01_2019.html Accessed: 21.03.19. [in Rus.].

- EY (2013). The advantage of reporting in the stable development sector, EY and the Corporate Citizenship Center of the Boston College research. Retrieved from: https://www.ey.com/Publication/vwLUAssets/EY-Value-of-Sustainability-RUS/%24FILE/EY-Value-of-Sustainability-RUS.pdf Accessed: 25.04.19.

- Glaeser, S. (2018). The effects of proprietary information on corporate disclosure and transparency: Evidence from trade secrets. Journal of Accounting and Economics, 66(1), 163-193. https://doi.org/10.1016/j.jacceco.2018.04.002

- Grosman, A., & Leiponen, A. (2018). Organizational transparency and power in firm ownership networks. Journal of Comparative Economics, 46(4), 1158-1177. https://doi.org/ 10.1016/j.jce.2018.07.001

- Hsu, C. -H., Lai, S. -C., & Li, H. -C. (2016). Institutional ownership and information transparency: Role of technology intensities and industries. Asia Pacific Management Review, 21(1), 26-37. https://doi.org/10.1016/j.apmrv.2015.06.001

- Huang, Y. S., Li, M., & Chen, C. R. (2019). Financial market development, market transparency, and IPO performance. Pacific-Basin Finance Journal, 55, 63-81. https://doi.org/10.1016/j.pacfin.2019.03.007

- Jacoby, G., Liu, M., Wang, Y., Wu, Z., & Zhang, Y. (2019). Corporate governance, external control, and environmental information transparency: Evidence from emerging markets. Journal of International Financial Markets, Institutions and Money, 58, 269-283. https://doi.org/10.1016/j.intfin.2018.11.015

- Kuzmin, E. A., Guseva, V. E., & Fomina, A. V. (2018). Data on accessibility of corporate information and business transparency in Russia. Data in Brief, 20, 1890-1900. https://doi.org/10.1016/j.dib.2018.09.048

- Liew, A. (2019). Enhancing and enabling management control systems through information technology: The essential roles of internal transparency and global transparency. International Journal of Accounting Information Systems, 33, 16-31. https://doi.org/10.1016/j.accinf.2019.03.001

- OECD (2015). G20/OECD principles of corporate governance, OECD. DOI: 10.1787/9789264236882-en. Retrieved from: https://www.oecd-ilibrary.org/governance/g20-oecd-principles-of-corporate-governance-2015_9789264236882-en Accessed: 21.03.19.

- Oxelheim, L. (2019). Optimal vs satisfactory transparency: The impact of global macroeconomic fluctuations on corporate competitiveness. International Business Review, 28(1), 190-206. https://doi.org/10.1016/j.ibusrev.2018.05.011

- RUIE (2018). RSPP indices in the stable development sector. Russian Union of Industrialists and Entrepreneurs. Retrieved from: http://rspp.ru/document/1/3/6/36cc24102f6d45f988c6b293add28799.pdf Accessed: 25.04.19. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Kuzmina*, O. Y., Konovalova, M. E., & Pervoy, I. N. (2020). Information Transparency And Its Role In Corporate Management. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 213-219). European Publisher. https://doi.org/10.15405/epsbs.2020.03.30