Abstract

Informal employment has an increasing impact on the economic situation in the regions due to the increasing scale and lack of effective mechanisms of influence. The sector of the grey economy is difficult to carry out state control measures, as it is outside the legal field. The article examines the dynamics of small business development at the regional level in conjunction with the growth rate of tax revenues and their impact on employment. Based on analysis of the performance indicators of small businesses, the number of people employed in this sector and the amount of taxes assessed for special tax regimes in the Samara Region for 2010-2018, a pattern was revealed that indicates a change in the nature of the interaction, which may indicate, among other things, an increase in informal employment. The research interest is the analysis of the reasons for the increase in the growth rate of tax revenues with a decrease in the number of small businesses and the number of employees employed there. The analysis results allow us to identify a number of trends associated with possible changes in the structure of activities in small businesses, products and services that affect the forms of employment of employees. The study of the impact of the tax system can serve as a justification for the development of a methodology for assessing the scale and structure of informal employment in small businesses.

Keywords: Informal employmentsmall businesstaxationshadow economytax potentiallabor market

Introduction

The main source of budget formation at any level is tax revenues. In addition, taxes are a kind of indicator that reflects the state of the economy of the subjects of the Russian Federation and the economy as a whole. On the basis of data on tax revenues, the state administration makes forecasts for the further development of the region in one direction or another, the reliability and quality of which significantly affects the effectiveness of the state policy as a whole. The construction of an empirical model that includes elements of the informal sector of the economy is necessary to establish links between the determinants of impact and the result ( Petrova, 2016). As a consequence, the analysis result can be an assessment of the scale of the informal employment sector, which requires a qualitative justification of the factors influencing the forecast decisions, their comprehensive analysis and critical assessment.

The influence of tax and state regulation on the scale of the grey economy has been studied by many Russian and foreign scientists. In his work F. Schneider points to the growth of employment in the informal sector in most countries for the period from 1999-2007 ( Schneider, 2015). It seems necessary to strengthen control over the shadow economy and develop a system of measures to combat tax evasion, both in the European Union and in other countries ( Yuneva & Avdeeva, 2018). At the same time, there is a decrease in employment in the small business sector with an increase in the number of enterprises belonging to the small ones ( Kuznetsov & Fedin, 2018).

It should be noted that, at present, the vector of development of the economy of the Russian Federation maintains a tendency to expand the small business sector, but if the factors of the tax burden are not taken into account sufficiently, it entails an increase in the risks of growing informal employment. Small business development involves an increase in tax potential revenue side of the budget, however, a positive trend in the number of small business entities is not always indicative of the increase in tax potential of the country, therefore, we can assume that some entrepreneurs go into the shadow business partially or completely and, as a result, this factor also increases informal employment. In this case, the disproportionate dynamics of the growth rates of the studied objects may indicate an increase in informal employment in small businesses.

Problem Statement

The consequences of under-receipt of state revenues in the form of tax deductions are difficult to assess, since the informal activities of small businesses are outside the scope of state control. However, by comparing individual indicators that reflect the results of economic entities among themselves, it is possible to assess the impact of the studied factors on the economic system as a whole and analyze possible deviations to assess the extent of informal employment and their causes ( Simonova, Mirzabalaeva, & Sankova, 2019). The data obtained can be used to develop proposals to change the tax and preferential policies in the field of small business in order to reduce the volume of the shadow sector and reduce informal employment. In addition, the legislative system of the country is arranged in such a way that the administration of such entities is a time-consuming, costly process and does not always guarantee the result of a successful withdrawal of an entrepreneur from the shadow sector. In most cases, it is possible to estimate the size of informal employment only on indirect grounds, such as the increase in tax arrears for the reporting period, the indicators of per capita income of the population, as well as the assessment of the tax potential using the gross regional product ( Kolesnikova, 2017).

Research Questions

To understand the effectiveness of measures of the state and tax policy of the Russian Federation aimed at the development of the small business sector in terms of reducing informal employment, first of all, it is necessary to understand what is the dynamics of small businesses growth. Assuming that the growth in the number of small businesses has a beneficial effect on reducing unemployment and increasing employment, it is necessary to investigate the relationship between changes in the number of workers in small enterprises and their growth dynamics. The potential possibility of increasing tax revenues to the state budgets with an increase in the share of the small business sector determines the question of the existence of a relationship between the volume of tax payments of small businesses and the growth of their number ( Gunko, 2017). The key issue of this study will be the justification of the possibility to develop a methodology for assessing the scale of the informal sector of the small business economy through the parameters of the number of small businesses, taxation and employment indicators.

Purpose of the Study

Regulation of the impact on the informal sector of the economy in terms of tax policy norms and stimulation of activities should be considered from the point of view of solving key government tasks. The potential benefits of improving the efficiency of taxation of the informal sector can be significant in specific circumstances, but should not lead to adverse consequences ( Joshi, Prichard, & Heady, 2014). As a consequence, the purpose of this study is to analyze the possibility of developing a methodology for determining the scale of the "shadow" sector based on the analysis of the impact of small business taxation on the dynamics of informal employment in the region, focused, in particular, on the quality management of entrepreneurial activity, ensuring full employment, increasing budget revenues, and an effective strategy for the development of the state economy as a whole.

Research Methods

In modern economic science, there are various ways to assess the scale of the shadow economy. Thus, the monetarist method is based on the ratio of the volume of cash, Bank deposits and changes in cash in circulation. The Italian Palermo method is based on comparing the amount of declared income with the volume of purchases of goods and receiving paid services ( Yuneva & Avdeeva, 2018). Economists from Latin America and Asia demonstrate a method of measuring the size and properties of the shadow economy based on the use of a two-sector dynamic deterministic General equilibrium model with four different trends: hours worked, investment-specific productivity, formal productivity, and shadow productivity ( Solis-Garcia, & Xie, 2018). In the Russian Federation, studies were conducted that included the indicators of registered small businesses in relation to the indicators of the dynamics of jobs ( Kuznetsov & Fedin, 2018). The analysis also includes indicators of the number of small businesses, changes in the number of workers in this sector and the dynamics of the growth of calculated tax payments, on the basis of which the elements of the methodology for determining the scale of the informal economy are formed.

Findings

Let us consider, as an example, the regional situation in small business on the example of the Samara region, as one of the industrialized regions of the country, in which there are various forms of entrepreneurship, from large, transnational business to micro-enterprises. Strengthening incentives for small businesses entails a risk of growth in the informal sector of the economy and an increase in job instability. Analysis of statistical data of small and medium-sized enterprises ( Federal State Statistics Service, 2018) and data from the Unified Register of Small and Medium-Sized Enterprises ( Federal Taxation Service, 2018a,b) for the period from 2010 to 2018 allows us to conclude that the number of small and medium-sized enterprises in Samara region has increased by 70.35% (Table

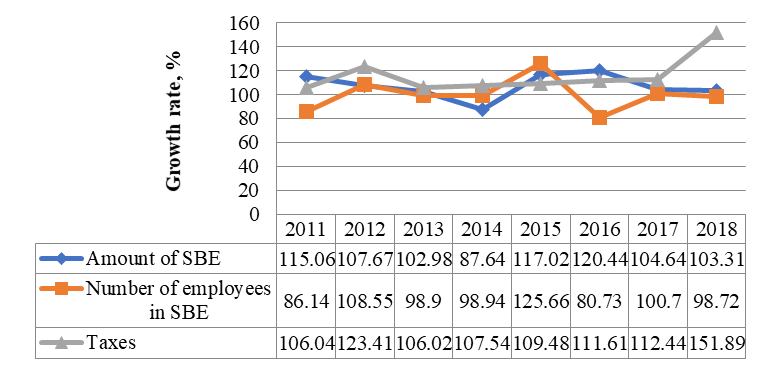

The legislation of the Russian Federation for the conduct of economic activity of small business entrepreneurs, various taxation modes are available that correspond to their type of activity and legal form. However, in order to simplify accounting and reduce the tax burden on small businesses, it is envisaged to use special tax regimes intended only for small businesses, taking into account the criteria provided for by law. These include the simplified tax system (STS), the unified imputed income tax (UIIT), the unified agricultural tax (UAT) for agricultural producers, the patent tax system (PST) for individual entrepreneurs. Analysis of growth rates of indicators of the number of small business entities (SBE), employment and the amount of taxes received in the Samara region show a significant change in the nature of interaction in recent years. (Figure

The analysis of the total tax data for the Samara region according to the reports of the Federal tax service for the period under study showed that the tax charges on these taxes increased more than twice. The growth rate of the studied population in relation to the base period was 139.46%. Comparing the study results, it can be concluded that the growth of the number of small businesses has a positive impact on the tax potential of the state, in consequence of which, the economy has a tendency to rehabilitation, but the reduction in the number of employees in the small business sector can indicate both negative and positive trends. The number of employees in the study period has the opposite dynamics of development in relation to two other analyzed factors, which can be caused by a number of reasons: the increase in informal employment and the departure of a significant part of the labor market into the shadow one; increase in labor productivity; the growth of the share of the innovative sector, other reasons. For a reliable assessment of the proposed assumption, it is necessary to conduct a structural analysis of small businesses by industry and the number of employees in certain industries. This will allow developing a methodology for assessing the number and structure of informal employment in small businesses.

Conclusion

Despite the fact that the dynamics of the growth of tax calculations under special tax regimes is positive, the decrease in the level of employment in small businesses, one way or another, may indicate tax losses of the state budget, only in relation to the tax on personal income and insurance contributions to social security. In addition, the increase in informal employment in the labor market in the small business sector may indicate the identification of elements of stagnation in the economy. Opinions of scientists on the causes of the growth of the shadow economy and methods of its control are very extensive. For example, there is a position that the "problem of impunity" in taxes, the so-called "stowaway problem" exists in Russia along with the alternative phenomenon of "free rider problem", which is based on unconscious, unintentional actions that violate tax laws due to financial ignorance ( Bogoviz, Rycova, Kletskova, Rudakova, & Karp, 2019). Dissatisfaction with the quality of services provided by the state, pension reforms carried out in Russia – these factors are also very influential arguments for workers to leave in the shadow sector. At the same time, the international experience of studying the problems of the shadow economy suggests that the tightening of control measures over entrepreneurs is a less effective measure of impact compared with the creation of a favorable climate for the voluntary transition of participants in the informal economy to the legal sector ( Kuznetsov & Fedin, 2018).

Thus, the analysis of the studied indicators showed that there is an increase in the tax potential of the region due to the expansion of the small business sector, but the joint analysis of quantitative data on employment does not allow unambiguously judging the reasons for the reduction of employment of workers in this sector. A detailed understanding of the employment structure of small businesses can be obtained by introducing additional determinants into the study, such as the industry affiliation of small businesses and the movement of personnel in these industries, performance indicators of the analyzed entities, innovative developments introduced by them, and so on. The expanded set of indicators in the developed methodology can be the basis for the adoption of certain measures in the state and tax policy to create conditions for reducing the volume of the shadow sector in small businesses and increasing the number of employees.

References

- Bogoviz, A. V., Rycova, I. N., Kletskova, E. V., Rudakova, T. I., & Karp, M. V. (2019). Tax awareness and “free rider” problem in taxes. In I.V. Gashenko, Y.S. Zima, A.V. Davidyan (Eds.), Optimization of the Taxation System: Preconditions, Tendencies and Perspectives. Studies in Systems, Decision and Control, 182 (pp. 117-123). Cham: Springer. https://doi.org/10.1007/978-3-030-01514-5_14

- Federal State Statistics Service (2018). Statistical collection «Small and medium-sized enterprises in Russia». Retrieved from: https://gks.ru/folder/210/document/13223 Accessed: 30.09.2019. [in Rus.].

- Federal Taxation Service (2018a). Reports on the tax base and structure of charges on taxes and fees in the context of the subjects of the Russian Federation (Samara region) 5-UTII, 5-USN, 5-ESKHN. Retrieved from: https://www.nalog.ru/rn63/related_activities/statistics_and_analytics/forms/ Accessed: 27.09.2019. [in Rus.].

- Federal Taxation Service (2018b). Unified register of small and medium-sized businesses. Retrieved from: https://rmsp.nalog.ru/ Accessed: 27.09.2019. [in Rus.].

- Gunko, N. N. (2017). Tax holidays for small businesses in Samara region: Opportunities for use and performance evaluation. Economy and Entrepreneurship, 12-4(89), 600-604. [in Rus.].

- Joshi, A., Prichard, W., & Heady, C. (2014). Taxing the informal economy: The current state of knowledge and agendas for future research. Journal of Development Studies, 50(10), 1325-1347. https://doi.org/10.1080/00220388.2014.940910

- Kolesnikova, O. S. (2017). The influence of shadow economy on the assessment of tax potential: Regional aspect (on the example of the Amur region). Regional Economics and Management: Electronic Scientific Journal, 1(49). Retrieved from: http://eee-region.ru/article/4926 Accessed: 05.09.2019. [in Rus.].

- Kuznetsov, A. A., & Fedin, A. S. (2018). On some problems of informal employment in Russia. Bulletin of modern Research, 12.12 (27), 249-253. [in Rus.].

- Petrova, K. (2016). Entrepreneurship and the informal economy: An empirical analysis. Journal of Developmental Entrepreneurship, 21(02), 1650010. https://doi.org/ 10.1142/S1084946716500102

- Schneider, F. (2015). In the shadow of the state – The informal economy and informal economy labor force. Danube: Law, Economics and Social Issues Review, 5(4), 227-248. https://doi.org/10.2478/danb-2014-0013

- Simonova, M. V., Mirzabalaeva, F. I., & Sankova, L. V. (2019). Differentiation of regional labor markets: New risks and opportunities for smoothing. In S.I. Ashmarina, M. Vochozka (Eds.), Sustainable Growth and Development of Economic Systems. Contributions to Economics (pp. 259-274). Cham: Springer. https://doi.org/10.1007/978-3-030-11754-2_20

- Solis-Garcia, M., & Xie, Y. (2018). Measuring the size of the shadow economy using a dynamic general equilibrium model with trends. Journal of Macroeconomics, 56, 258-275. https://doi.org/10.1016/j.jmacro.2018.04.004

- Yuneva, E. A., & Avdeeva, I. A. (2018). Measures to combat shadow economy in EU countries. Bulletin SGSEU, 2(71), 36-39. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Gunko*, N. N., Simonova, M. V., & Yashina, N. A. (2020). Small Business Taxation And Informal Employment. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 1294-1300). European Publisher. https://doi.org/10.15405/epsbs.2020.03.185