Abstract

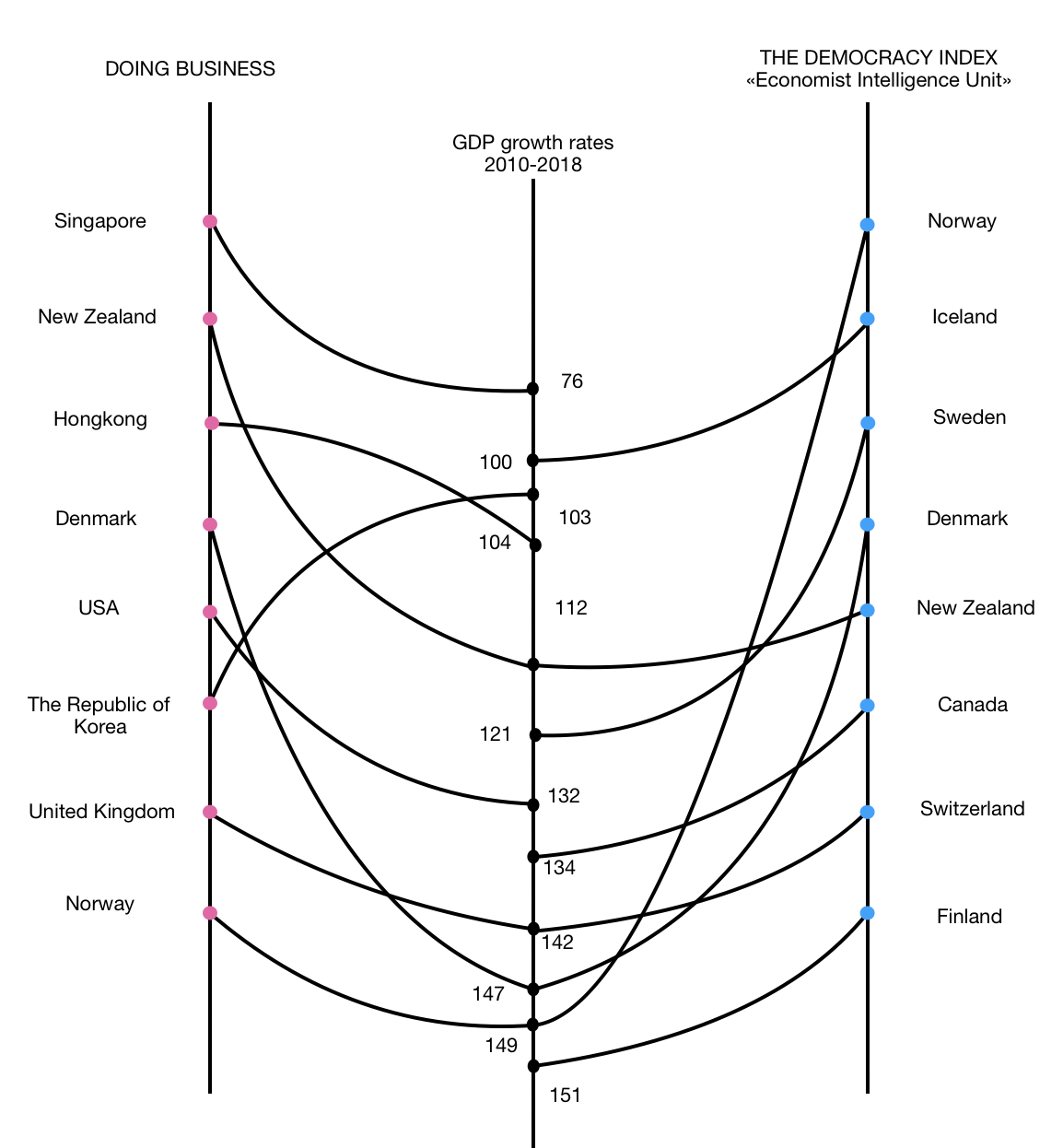

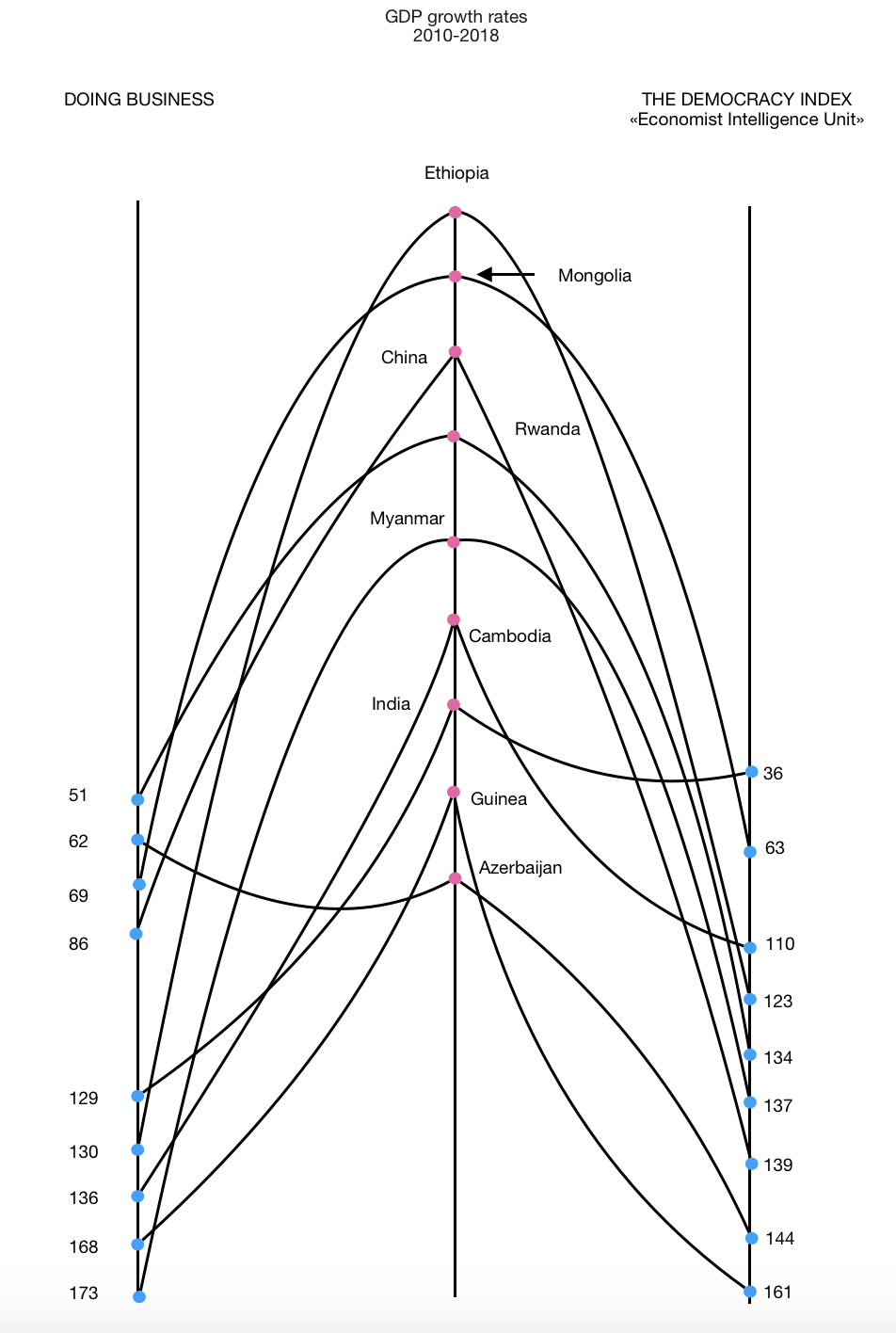

The authors test the hypothesis of interdependence between the quality of economic and political institutions and the economic growth in 2010-2018s. To measure the quality of economic institutions, the authors used the average for the nine years position of countries in the "Ease of Doing Business Index", and the average nine-year position of the country in the "Democracy Index" to measure the quality of political institutions. The economic growth rate is calculated as a nine-year average based on the World Bank data. On the basis of correlation analysis, it is proved that in the period after the global economic crisis of 2008-2009, the highest growth rates were shown by countries that occupy relatively low positions in both ratings. The leading countries in their positions in the "Democracy Index" and "Ease of Doing Business Index" occupy quite low positions in terms of the economic growth. This can be explained by the low base effect of a number of leading countries in terms of the economic growth and efficient economic policies carried out by the elites of these states. The Russian case demonstrates a direct correlation between a low position in the "Democracy Index" and a low position in the growth rates, an inverse correlation between a relatively good position in the "Ease of Doing Business Index" and a low position in the economic growth rates. The paradox of the Russian case can be explained both by significant negative effects of the global economic crisis, anti-Russian sanctions, and ineffective economic policy.

Keywords: Political institutionseconomic institutionseconomic growtheconomic developmenteconomic policy

Introduction

In the concept by North (1989) institutions are "rules of a game", mechanisms that ensure the implementation of rules, as well as norms of behavior that structure people's interactions. This broad interpretation of institutions was the basis of the neo-institutional approach. According to D.C. North, the economic growth is possible due to increased productivity under the influence of technological changes and institutional changes (both in the political and economic institutions) that protect property rights. The development of institutions (that facilitate transactions) leads not only to the expansion of production and trade, but also to the subsequent reduction of transaction costs. The dynamics of the economic growth depends on institutional changes that ensure the functioning of markets. Putnam, Leonardi, and Nanetti (1994) explains the economic growth by the influence of the civil society on the formation of institutions from a political standpoint. Communities, built on values of trust and cooperation, contribute to effective management and economic prosperity. The success of democracy requires mutual trust between citizens and a horizontal system of social governance. Putnam, Leonardi, and Nanetti (1994) notes that civil society creates wealth, and the wealth does not create a civil society.

Problem Statement

There is a consensus in the academic research that the economic growth is conditioned by the quality of institutions. Most studies prove that institutions determine the growth. Neo-institutionalists believe that development mechanisms of institutions generate solutions to socio-economic problems, and this contributes to the economic performance (Acemoglu, Johnson, & Robinson, 2005). Acemoglu (2009) argues that there is strong empirical support for the hypothesis that differences in economic institutions are something more than luck, geography, or culture, they cause differences in per capita incomes. Olson and Kähköhnen (2000) explained specific features of the economic development by different incentive structures that reflect significant differences in institutions. Initial improvements in institutions of public order build confidence and lead to the economic growth in market institutions (Bodoh-Creed, 2019). According to Savoia and Sen (2015) the effective public administration is recognized as an important element of a long-term economic development. Differences in the quality of institutions can explain differences in per capita incomes, so countries with inherently poor institutions can only slowly catch up with leaders (Savoia & Sen, 2016). Economic institutions determine the incentives, constraints, and outcomes of economic actors. A number of studies have used instrumental variable techniques to show causal relationships between institutions and economic indicators (Olson, Sarna, & Swamy, 1998). One such relationship in reality does not find convincing empirical evidence.

Research Questions

Efendic, Pugh, and Adnett (2011) on the basis of meta-regression analysis argue that studies based on the growth theory do not provide reliable empirical evidence of a genuine effect, finding more reliable evidence of a positive and significant institutional impact on the production level. The analysis of empirical data confirms only that the impact of the quality of institutions on the economic performance is positive. Comparative studies show that the impact of institutions on the growth in developed countries is relatively higher than in developing ones, and developed countries benefit from further improvements of the institutional quality (Nawaz, 2015). Some scientists note that within the framework of neo-institutional theory there is a division into two conceptual research directions. In one of these areas there was established that the institutional quality is the most important determinant of the economic growth. Another direction shows that countries tend to show convergence, and some of them are stuck in middle-and low-income traps (Kar, Roy, & Sen, 2019). However, the scientific community continues to be dominated by the opinion that improving the quality of institutions leads to a faster economic growth.

Purpose of the Study

There is now a need to verify the dominant view that the economic growth in each country is driven by the quality of institutions. The aim of this study is to determine the relationship between the growth of countries’ welfare and the quality of political and economic institutions.

Research Methods

The main research method is correlation analysis. To establish the interdependence of political and economic institutions with the pace of the economic growth, the "Democracy Index" of the British company "Economist Intelligence Unit" and the "Ease of Doing Business Index" of the World Bank were used. The first index measures the quality of political institutions. It includes assessment of electoral processes, government functioning, political participation, political culture, civil liberties. The second index assesses the quality of economic institutions. The following indicators are measured: time and money spent on opening and closing a business, obtaining a construction permit, connecting to infrastructure, registering property, securing contracts, and tax burden.

Findings

The countries' positions in accordance with their economic growth rates are calculated by the World Bank data as average values for 9 years (2010-2018). The period 2010-2018 is taken as the medium-term period after the global economic crisis of 2008-2009 (figures

If the correlation coefficient is negative, it means the opposite relationship: the higher the value of one variable is, the lower the value of another one is. The bond strength is also characterized by the absolute value of the correlation coefficient. Up to 0.2 – very weak correlation, up to 0.5 – weak correlation, up to 0.7 – average correlation, up to 0.9 – high correlation, over 0.9 – very high correlation.

Conclusion

The results of the study show a weak dependence of economic growth on the quality of institutions, which calls into question the basic provisions of neo-institutionalism. The findings contribute to the debate about whether political institutions cause the economic growth or, conversely, the growth and accumulation of human capital leads to better institutions. According to Glaeser, La Porta, Lopez-de-Silanes, and Shleifer, (2004), most indicators of the quality of institutions that confirm the functional relationship of institutions and the growth are conceptually inadequate, and the methods of instrumental variables are imperfect. A number of cases suggest that (a) the human capital is a more important source of the growth than institutions, (b) poor countries solve their problems through effective economic policies often carried out by dictators, and (C) political institutions subsequently improve. The research results obtained by the authors confirm the thesis by H.-J. Chang that the dominant discourse o institutions and development has a poor understanding of changes in institutions themselves, this fact often leads overly optimistic or pessimistic opinions about the possibility of institutional changes (Chang, 2011).

As a result, the reverse explanatory relationship is asserted: the economic development changes institutions. Our history shows that the causal link between the economic development and institutions may be even stronger than the link between institutions and the economic development. Increasing wealth as a result of the economic growth can increase the demand for better institutions and make them more accessible, i.e. the economic development creates new agents of changes that require new institutions. At the same time, a country's long-term economic performance depends crucially not only on its institutional environment, but also on the complementarity between different types of institutions (Gagliardi, 2017).

The researchers identify a pattern that institutional measures promote the economic growth in developed democracies and do not promote the economic development in democratically weak countries (Iqbal, & Daly, 2014). A comparison of the economic performance of different countries shows that a number of developing states are growing very fast, taking advantage of opportunities to "catch up". Russia seems to be a paradoxical case: progress in economic institutions and regression in democratic institutions occurred synchronously, while the average position in terms of the economic growth in 2010-2018 corresponded to such countries as Canada and the United States, and not to the neighboring countries in the "Democracy Index" and "Ease of Doing Business Index".

References

- Acemoglu, D. (2009). Introduction to modern economic growth. Princeton: Princeton University Press.

- Acemoglu, D., Johnson, S., & Robinson, J. A. (2005). Institutions as the fundamental cause of long-run growth. P. Aghion, S.N. Durlauf (Eds.) Handbook of Economic Growth, 1(A) (pp. 385-472). Amsterdam: Elsevier. https://doi.org/10.1016/S1574-0684(05)01006-3

- Bodoh-Creed, A. L. (2019). Endogenous institutional selection, building trust, and economic growth. Games and Economic Behavior, 114(C), 169-176. https://doi.org/10.1016/j.geb.2019.01.005

- Chang, H. -J. (2011). Institutions and economic development: Theory, policy and history. Journal of Institutional Economics, 7(4), 473-498. https://doi.org/10.1017/S1744137410000378

- Efendic, A., Pugh, G., & Adnett, N. (2011). Institutions and economic performance: A meta-regression analysis. European Journal of Political Economy, 27(3), 586-599. https://doi.org/10.1016/j.ejpoleco.2010.12.003

- Gagliardi, F. (2017). Institutions and economic change. Journal of Comparative Economics, 45(1), 213-215. https://doi.org/10.1016/j.jce.2016.04.003

- Glaeser, E. L., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2004). Do institutions cause growth? Journal of Economic Growth, 9(3), 271-303. https://doi.org/ 10.1023/B:JOEG.0000038933.16398.ed

- Iqbal, N., & Daly, V. (2014) Rent seeking opportunities and economic growth in transitional economies. Economic Modelling, 37(C), 16-22. https://doi.org/10.1016/j.econmod.2013.10.025

- Kar, S., Roy, A., & Sen, K. (2019). The double trap: Institutions and economic development. Economic Modelling, 76, 243-259. https://doi.org/ 10.1016/j.econmod.2018.08.002

- Nawaz, S. (2015). Growth effects of institutions: A disaggregated analysis. Economic Modelling, 45, 118-126. https://doi.org/10.1016/j.econmod.2014.11.017

- North, D. C. (1989). Institutions and economic growth: An historical introduction. World Development, 17(9), 1319-1332.

- Olson, M. (Jr), Sarna, N., & Swamy, A. V., (1998). Governance and growth: A simple hypothesis explaining cross-country differences in productivity growth. Public Choice, 102(3-4), 341-364. https://doi.org/10.1023/A:1005067115159

- Olson, M., & Kähköhnen, S. (Eds.) (2000). A not-so-dismal science. A broader view of economies and societies. Oxford: Oxford University Press.

- Putnam, R. D., Leonardi, R., & Nanetti, R. Y. (1994). Making democracy work: Civic traditions in modern Italy. Princeton: Princeton University Press.

- Savoia, A., & Sen, K. (2016). Do we see convergence in institutions? A cross-country analysis. The Journal of Development Studies, 52(2), 166-185. https://doi.org/ 10.1080/00220388.2015.1060315

- Savoia, A., & Sen, K. (2015) Measurement, evolution, determinants and consequences of state capacity: A review of recent research. Journal of Economic Surveys, 29(3), 441-458. https://doi.org/10.1111/joes.12065

- The Economist (2018). Democracy Index 2018. Retrieved from: https://www.eiu.com/topic/democracy-index Accessed: 16.09.2019.

- The World Bank (2018a). Ease of Doing Business Ranking & Ease of Doing Business Score. Retrieved from: https://www.doingbusiness.org/en/data/doing-business-score Accessed: 16.09.2019.

- The World Bank (2018b). GDP growth (annual %). Retrieved from: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG Accessed: 16.09.2019.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Rastorguev*, S. V., Pyrma, R. V., & Tyan, Y. S. (2020). Apparent Influence Of The Institutions Quality On Economic Growth In The World. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 699-706). European Publisher. https://doi.org/10.15405/epsbs.2020.03.100