Abstract

The relevance of the project management system is justified in the Decree of the Government of the Russian Federation “On the organization of project activities in the Government of the Russian Federation” dated 10.10.2016 No. 1050. Since 2017, it is priority direction in state and municipal government. The Novosibirsk Region is developing a system of project management. There are 14 direction of strategic development of the region have been singled out, among which are stand out the direction of “improving the investment climate of the NSO” and “international cooperation and export”. The research considers the issue of ensuring the economic security of the company through the financial component and the concept of sustainable development applicable to the micro-level. Objectives of the research: to prove that the financial health of a company is a backbone component of economic security and sustainable development; to classify the factors of financial health of a company, highlight the criteria that can be used in assessing the level of financial health; to investigate the reliability of financial security indicators for its disclosure to external users. To assess the dynamics of financial indicators of Russian companies according to financial statements, statistical methods are used in the paper: analysis of time series, etc. For determine the factors and criteria of financial health are used system analysis methods such as classification, analogies etc.

Keywords: Economic security strategyfinancial securitysustainable development

Introduction

The concept of sustainable development is recognized worldwide and is considered to have no alternative. For the first time the term “sustainable development” was officially applied in 1983 by the World Commission on Environment and Development (UN, Commission of G. H. Brundtland), in 1992 at the UN Conference on Environment and Development (Rio de Janeiro) identified problems and principles of sustainable development (The UN and sustainable development, n. d.).

Currently, there is no single definition of the term “sustainable development”. The United Nations treats sustainable development as the level of development of society, which satisfies the needs of current generations without prejudice to future generations to meet their own needs. According to the concept of the World Bank, sustainable development is based on management to goal to preserve and enhance human capabilities. Domestic legislation defines sustainable development as a balanced solution to socio-economic problems, the preservation of the environment and the natural resource potential (The Decree of the President of the Russian Federation, 1996).

Today, one of the directions for improving the mechanism for implementing the tasks of state and municipal government is the project management system. The relevance of this direction is justified in the Decree of the Government of the Russian Federation “On the organization of project activities in the Government of the Russian Federation” dated 10.10.2016 No. 1050. Since 2017, the Novosibirsk Region is developing a system of project activities. Currently, 14 areas of strategic development of the region have been singled out, among which the direction of “improving the investment climate of the NSO” stands out.

Obviously, the sustainable development of the company should be based on the balance of three key areas: economic, environmental and social.

In this paper, we will focus on assessing the financial component of the economic sphere, ensuring the sustainable development of the company.

The urgency of ensuring both economic and financial security at the macro- and micro-level is caused not only by financial crises, increased instability of external factors, but also a low level of innovation activity, a high degree of depreciation of fixed assets, and inefficient use of financial and information resources. The Strategy of Economic Security of the Russian Federation for the period until 2030, developed in 2017, is aimed at ensuring the counteraction of challenges and threats, preventing crises in the resource-based, industrial, science and technology and financial spheres, as well as preventing the reduction the quality of life of the population. In the same document, economic security is defined as “the security of the national economy from external and internal threats, which ensures the economic sovereignty of the country, the unity of its economic space, and the conditions for implementing the strategic national priorities of the Russian Federation” (The Decree of the President of the Russian Federation, 2017). Since the national economic security is formed by economic agents (companies), the results of its activities in conjunction with financial security are the subject of current research; the factors and criteria for its financial security are considered.

Two approaches in the world scientific literature to the understanding of economic security can be distinguished. Firstly, the tactical one: protection against threats, and the criterion of economic security is the security of all structural elements of a company against threats; secondly, the strategic one: the company's ability to function stably, the safety criterion is the achievement of the goal.

Thus, the specificity of the company's economic security lies in the fact that it consists of several components, which for each specific subject may have different priorities depending on the nature of the existing threats. All elements of the economic security system must comply with the strategic goals and ensure the financial and economic viability of the company.

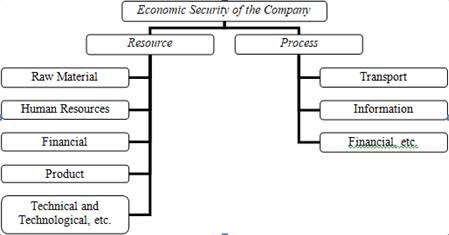

When structuring the economic security of the company according to the main elements, resource and flow (process) security can be distinguished (Figure

The importance of the financial component of the company's economic security lies in the fact that financial risks are directly related to the formation of its profits as the purpose of its operation and in an unfavorable case lead to losses not only of income, but also of capital, which can lead to irreversible consequences, that is, bankruptcy and liquidation of the company.

Modern companies operate under various external and internal risks, and the competitive economic environment hides numerous threats to financial and economic activities. Thus, according to official statistics, the number of bankrupt companies at the end of 2015 was 12,627, in 2016 - 12,364, and in 2017 - 13,408, which increased 6.2 % compared 2015 (Federal State Statistics Service, n. d.).

Problem Statement

Determination of a methodological approach to ensuring the economic security of business entities, according to which a necessary condition for ensuring the safe development of the regional economy is the identification and support of financially successful companies with the potential to form territorial centers of economic activity.

Research Questions

3.1. To prove the importance of the financial security of the company for sustainable development of the territory.

3.2. To classify the factors affecting the financial security of the company and their indicators are reflecting.

3.3. To develop a methodology for assessing the financial health of a company.

3.4. To test the methodology for assessing financial health according to the financial statements of a transport company.

Purpose of the Study

Purpose of the study - development of theoretical and methodological foundations for the implementation of the state socio-economic policy of sustainable growth of territories using the results of the company's financial health assessment.

Research Methods

5.1. to assess the dynamics of financial indicators of Russian companies according to financial statements, statistical methods are used in the paper: analysis of time series, etc.

5.2. for determine the factors and criteria of financial health are used system analysis methods such as classification, analogies etc.

Findings

Today financial security must be considered as the main system-forming component of the company's economic security. Without stable financial relationship and necessary financial support, the company cannot develop smoothly and survive.

The financial health of an organization is a state of financial and economic activity in which the organization uses modern achievements in science and technology, promotes itself in the market, not only ensures the return on its investment, but also aims to maximize the profit perspective.

The works of a large number of authors are devoted to the questions of the assessment of the sustainable development of organizations, among which Shalamova (2009), Gorshenina and Chumachenko (2011), Kolosova (2014), Gibadullin (2013), in addition, methods for assessing the financial condition of credit institutions are developed (Aniskin, 2015), etc.

After studying the proposed approaches to the assessment of sustainable organizations and summarizing the experience of the largest taxpayers in the Novosibirsk region, we came to the conclusion that the “financial health” monitoring system should include indicators divided into groups.

Table

The dynamics of indicators that characterize business sustainability, allows one to form an idea of the overall state of the organization and reflects the trend of its development. The direction of the trend (increase or decrease) can serve as a basis for forming the prospects for the development of the organization.

The value of the indicators that we included in the group of sustainable performance will allow us to conclude that the main activity, the effectiveness of using the founders' funds, and the level of profit received by the organization from investments in fixed assets. The positive dynamics of these indicators will be an objective indicator of the financial health of the organization.

The last group of indicators in the system of elements of the organization's financial health are indicators of financial stability. In this paper, financial stability means the organization's ability to develop steadily, preserving its financial security taking into account the threat.

In order to justify the implementation of the budgetary policy with regard to stimulating revenue growth, the relevance of the initial information on the basis of monitoring indicators, we consider it expedient to determine the integral indicator of “financial health” (IFHI) according to the generally accepted order.

Joint Stock Company “Siberia Airlines” was chosen as an example of assessing the financial health of the region-forming organization. The main activity of the company is transportation by air passenger transport, subject to the schedule (code according to OKVED 51.10.1). This company is a member of the oneworld global aviation alliance, bringing together the best airlines from all over the world. Together, the alliance airlines operate flights to 150 countries. In 2019, the company became one of the 10 largest taxpayers in the region of Siberian. The results of the method approbation are presented in Table

Based on the calculated indexes it can be concluded that indicators JSC “Siberia Airlines” have a positive trend.

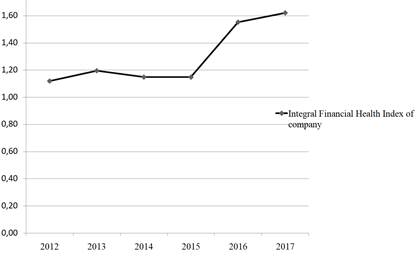

The dynamics of the integral indicator of financial health of Siberia Airlines JSC is positive (Figure

The dynamics of the integral indicator of financial health of Siberia Airlines JSC is positive. This company has all the prerequisites to maintain a leading position in the region and become a territorial centre of economic activity. The dynamics of the integral indicator of financial health of Siberia Airlines PJSC is positive. This company has all the prerequisites to maintain a leading position in the region and become a territorial centre of economic activity.

Conclusion

To a large extent, an adequate assessment of financial security is ensured by the reliability of those indicators that are presented in the financial statements of companies. Modern analysis of financial security indicators must necessarily be accompanied by a careful study of the explanatory notes to the annual accounts and key issues highlighted by the auditors in the audit report.

The results of the study: firstly, it was proved that the financial security of a company is a pivotal component of economic security and monetary flows must accompany the security of all other components; secondly, the factors of financial security of the company are determined and criteria that can be used to assess the level of financial security are highlighted.

References

- Aniskin, Y. P. (2015). Corporate management of business activity in non-equilibrium condition. Moscow: Omega-L.

- Federal State Statistics Service. (n.d.). RUSSIAN FEDERATION. Retrieved August 27, 2019, from http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/efficiency/#

- Gibadullin, A. A. (2013). Estimation of the stability of the industrial complex of the electric power industry. Bulletin of the Volga State University of Service, 1(27), 8-15.

- Gorshenina, E. V., & Chumachenko, N. (2011). Monitoring sustainable development of industrial enterprises. Journal of Russian Entrepreneurship, 1-2, 63-67.

- Kolosova, T. V. (2014). Comprehensive assessment of indicators of sustainable development of industrial enterprises. Economics and management in the XXI century: development trends, 19(1), 74-79.

- Shalamova, O. V. (2009). On the stability of the economic system. Bulletin of the South Ural State University. Ser.: Economics and management, 21, 27-33.

- The Decree of the President of the Russian Federation. (1996). About the Concept of transition of the Russian Federation to sustainable development. Approved 01.04.1996 N 440.

- The Decree of the President of the Russian Federation (2017). The Strategy of economic security of the Russian Federation. Approved May 13, 2017 № 208.

- The official website of Siberia Airlines, JSC. (n. d.) Retrieved August 30, 2019, from http://www.s7.ru/ru/about/investors.dot.

- The UN and sustainable development. (n. d.). Retrieved August 24, 2019, from http://www.un.org/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2019

Article Doi

eBook ISBN

978-1-80296-076-1

Publisher

Future Academy

Volume

77

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1056

Subjects

Industry, industrial studies, project management, sustainability, business, innovation

Cite this article as:

Prikhodko*, E. A., & Sannikova, I. N. (2019). The Companys Financial Health Is The Basis Of Sustainable Development. In I. O. Petrovna (Ed.), Project Management in the Regions of Russia, vol 77. European Proceedings of Social and Behavioural Sciences (pp. 811-817). Future Academy. https://doi.org/10.15405/epsbs.2019.12.05.99