Abstract

In the modern conditions of globalization and informatization of the economy, the emergence of a digital economy, both in Russia and around the world, the category of trust becomes of great practical importance. The growth of trust between economic actors is a reciprocal factor in interrelation with the economic growth of the country. Today, the study of the issue of trust and its influence on the social, economic, political and other spheres of an individual’s life has gained wide popularity in the work of both domestic and foreign studies. Loss of trust is a serious threat to the economic development of the country. A high level of trust helps to reduce uncertainty and risk, thereby minimizing the costs of firms, countries and households, helping to make decisions faster and more efficiently. Today the following issues become relevant: assessments of the level of interpersonal and institutional trust; methods and ways of interpreting the obtained values, as well as cross-country comparison of quantitative estimates of the level of trust and their impact on the economic growth of the country. The questions about what factors have the greatest influence on the economic development of the country and its financial institutions remain little studied. The purpose of the study is to explore different approaches to the category of trust. The main hypothesis is the assumption that trust is a condition for the growth of the Russian economy. To achieve this goal, data of trust levels in different countries were used.

Keywords: Economic developmentinstitutional trusttrust

Introduction

The object of attention trust in the research of domestic and foreign researchers has become more than once. This category received the greatest popularity in the conditions of the economic crisis of 2008–2009.

Modern society is peculiar to act in conditions of uncertainty. A high level of trust allows to smooth out existing fluctuations in the economic life of society, in business, which reduces transaction costs, whereas a high level of distrust leads to an increase in resources spent on insurance or legal costs, and an increase in the cost of searching and analyzing information. Thus, a low level of trust or a high level of distrust leads to a slowdown in business growth, and also inhibits a country's economic growth. It should be noted that with a high level of trust in the country, there is a stimulation of fraud in business operations, which entails economic losses, an increase in costs associated with an increase in the number of law enforcement agencies, and an increase in financial and legal literacy of the population.

At present, there is a high interest in the “trust” category in the scientific community. This term is widely applicable in the works of economists, sociologists, political scientists. However, for quite a long time, trust was a parameter of a subjective assessment of economic behavior and was not the object of a study by economists until the marginalist revolution. Smith (2007) mentions the category of trust, speaking about the content of precious metals in coins. So, we are talking about the abuse of trust subjects in connection with a decrease in the actual amount of metal in the money associated with the intentional damage of coins.

So, A. Smith raises the issue of trust in connection with the consideration of the structure of relative wages. He says that one of the five factors affecting wages is the trust placed in individuals who are engaged in a particular professional activity, where trust is a necessary element. He measures this trust with the value of objects that are entrusted to an employee from clients, firms: health, reputation, precious metals ... In order to gain and strengthen greater trust, representatives of the professions must have a high social status (and wages, respectively).

The shift of emphasis of economists' interest on consumer behavior, demand factors and a subjective assessment of utility was made by the marginalist revolution in the 70s. XIX century. The “economic man” model suggests that decision-making occurs only through rational calculation of benefits and costs. This made it possible to analyze trust in terms of utility, affecting the maximization of the objective function.

Marshall (1993), dividing personal wealth into a set of tangible, intangible, transferable and non-transferable goods, cites as an example the intangible non-transferable goods of a person that part of his business ties. Which depends on personal trust in him and which cannot be transferred as an integral part of his reputation. Thus, A. Marshall gave grounds for the concept of social capital, denoting such business relationships as a means of acquiring material benefits, and therefore the subject of economic analysis: success brings confidence, and trust brings success: trust and success help keep old customers and attract new ones.

Analyzing the “boundaries of trust”, Marshall (1993) speaks about the evolutionary nature of confidence building: The possibilities for fraud are now certainly more numerous than before, but there is no reason to believe that people use a larger share of such opportunities than before. On the contrary, modern trading methods include the habitual principles of trust, on the one hand, and on the other, the ability to resist the temptation to deceive, the ability unusual for backward peoples.

Another significant contribution to the study of the category of trust is the analysis of the relationship of trust with A. Marshall’s economic cycle. He says that if trust is undermined by bankruptcies, and capital does not have the potential to expand or establish a new company, then production cuts and unemployment will lead to economic recession: “The main reason for this evil is lack of trust. Most of it can be easily eliminated almost instantly and by touching all branches with its magic wand. This will force them to continue production and continue to impose demand on each other’s products <...> The growth of confidence would give rise to its further growth: the loan would give more and more means of payment and prices would therefore be restored.

French scientist Say (1971), exploring entrepreneurship as a factor of production, draws attention to the limitations of the supply factors of entrepreneurship in the market, speaking about the role of trust, especially in international trade: “on this expenditure, one must know the customs and laws governing the nations with which the trade is conducted. Finally, one needs to know people well, so as not to be deceived, giving them their confidence, placing certain tasks on them and generally maintaining any kind of relationship with them” (p. 22).

Today, modern researchers in the category of trust are researchers in various fields: economics, sociology, psychology, attributing these areas to different areas of knowledge about trust.

So, Fukuyama (1995) and a number of other foreign researchers consider trust as a kind of “social capital” – an integral part of social potential. Social capital is formed on the general norms and values shared by the majority of the subjects of society. Fukuyama (Fukuyama, 1995; Benz & Silova, 2014, Pletnev & Silova, 2015) uses the term “spontaneous socialization”, meaning by that the ability to create and develop new associations.

And this ability will be the higher, the higher the level of trust in the system. Today it is customary to attribute to countries with a high level of trust Japan, the United States, and Germany. F. Fukuyama classifies modern society with respect to the level of trust, highlighting societies with high and low levels of trust, explaining this division as the ability to communicate and unite, the ability to socialize and the natural propensity to social behavior.

According to Fukuyama (1995), the trust factor is necessary for the economic development of society. Trust has a strong impact on the development of institutions (economic, political), and on commercial structures. At the same time, the loss of trust is reflected in much more on the development of the state than the loss of individual trust.

The mathematical relationship between trust and economic success was investigated by Knack and Kiefer (1997). Thus, the researchers proved that in most countries (the analysis was carried out for 28 countries from 1960 to 1992), the percentage of economic growth was due to an increase in confidence. Moreover, the relationship between the share of investment in GDP and the level of trust turned out to be the strongest.

American economist Williamson (1993) classifies trust as: “calculated relative trust” and “personal trust”. He calls the “calculated trust” because trust is based on an analysis of benefits and costs. On the contrary, “personal trust” does not imply analysis and assessment of the degree of benefit for an individual, but is fully guaranteed by special personal relationships.

Sztompka (1999), author of the theory of culture of trus, concludes that the role of trust in the actions of individuals increases significantly with an increase in risk and uncertainty indicators. The author differentiates trust depending on the direction of waiting for trust. So, he emphasizes personal trust, that is, trust in relation to specific people. The influence of trust on institutions, as well as social roles and professions, he calls positional trust. Commercial trust refers to market structures, as well as to goods.

An analysis of trust aimed at evaluating institutional structures, as well as complex organizational systems in which various anonymous individuals can participate, he calls institutional trust. Technological confidence he calls trust in various technical systems. Thus, a different kind of trust, in his opinion, forms a culture of trust.

Sztompka (1999) and Giddens (1990) argue that since in the process of interaction it is impossible to avoid risk, trust can reduce the uncertainty in the actions or expectations of individuals.

Exploring the conceptual approaches of modern Western scholars, it can be noted that, in general, trust means “maintaining” the positive perception of a person or organization. Whereas trust in the authorities means, in Easton's (1965) opinion, citizens' confidence in the activities of government bodies whose actions are open and perceived by citizens clearly and clearly.

Thus, today we can distinguish the following types of trust: interpersonal – is trust between individuals, which depends on the cultural level of the individual, level of education and mentality of each specific individual and social group; institutional implies the relationship of different organizational systems; technological confidence is connected with the information openness and availability of the information provided to each specific consumer, the services provided, including the breadth of coverage of the information field provided by public authorities; commercial trust is formed as a result of the interaction of a particular individual to market structures. All these elements make it possible to build social capital and a culture of trust.

Problem Statement

Despite the great interest of representatives of the scientific and business environment to issues of trust, the problem of quantitative assessment of interpersonal and institutional trust still remains relevant. In world and Russian practice, there are attempts to assess the level of trust using quantitative indicators - confidence indices.

However, today the question remains whether the existing indices of consumer sentiment, consumer expectations, consumer confidence and the like can be considered indices of trust. The existing methods basically contain expert opinions, which indicates their subjective nature. Under these conditions, the search for quantitative indicators reflecting the degree of trust becomes a priority. With the help of quantitative indicators, it becomes possible to solve the problem of cross-country comparisons and to obtain an objective result.

Western researchers who study public administration distinguish the actual, that is, the real effectiveness of public authorities and “perceived”. Thus, at the conceptual level, there are two main elements on which to build trust in public authorities: “social trust” (social trust), implies the trust of citizens to each other and society; as well as political trust related to the assessment of the level of trust by citizens of public authorities and its institutions.

It should be noted that, according to Kampen (Kampen, DeWalle, & Bouckaert, 2006), the trust of citizens largely depends on the experience they gained in the provision of public services. Thus, to increase the efficiency and effectiveness of the implementation of government programs becomes possible with a sufficiently high level of trust in the government.

Research Questions

This study was conducted on the assumption that the level of trust in the country can influence the economic development of the country. Verification of this statement will help to identify new points of economic growth for the economies of various countries, as well as to determine the parameters that can be controlled.

Purpose of the Study

Using existing indicators of the level of trust, economists are trying to quantify its impact on various economic indicators. As a rule, such an analysis is carried out at several levels and makes it possible to assess the impact of the level of trust on the well-being of individuals (micro level), on the performance of organizations (meso-level), regions and the country as a whole (macro level). In world practice, among the most frequently encountered can be identified - economic growth, per capita income, level of education in the country, the share of investment in GDP, etc.

Among Russian economists, the work of Tatarko (2014), in which he conducts a study of the relationship of various types of trust with indicators of the socio-economic development of society. Natkhov (2011) reveals the relationship between the level of trust and the level of education, which in turn is an important factor in the social activity of the population.

It is worth noting that scientists recognize the fact that not only the socio-economic conditions in which an individual is located, but also personal-psychological (for example, negative experience of loss of confidence in the past) affect the level of trust. Currently, a large number of empirical studies have confirmed that trust must be considered as one of the factors for the economic development of any country. The study of the relationship of economic growth and trust on the example of 28 countries in the work of Knack and Kiefer (1997). revealed a close direct relationship between these indicators. With an increase in the level of trust by one-point, economic growth will amount to more than 0.5 points.

In his work, Tatarko (2014), analyzing the macroeconomic indicators of 57 countries, confirms the positive relationship between various types of trust and indicators of economic and political development. In particular, it reveals a direct relationship of trust with civil liberties and political rights, as well as the quality of the business environment and the index of economic freedom. Study Natkhov (2011), conducted in 68 regions of Russia, revealed a steady correlation between the average level of education and the level of trust. As a result of the analysis, it was found that each additional year of training of an individual increases the probability of a positive answer to the question of trust by 5%.

Research Methods

To analyze the relationship between the level of trust and key indicators of the country's macroeconomic development, a correlation analysis of the relationship between the indicator that measures the level of trust (Edelman Trust Barometer) and the value of foreign direct investment (Foreign Direct Investment) is made. The Edelman Trust Barometer shows the confidence of citizens to various institutions (government, business, non-governmental organizations and the media). The value of this index in countries differs significantly, due to different levels of trust in institutions in those countries that are even geographically located very closely, which eliminates the dependence of the indicator on the spatial relationship. The main indicator that has a significant impact on the country's economic growth is the indicator of foreign direct investment. Since this indicator has an impact on capital inflows into the country, it activates competition, thereby assisting the development of small and medium-sized businesses, as well as improves the level of welfare of the population, thanks to increased employment, etc. To identify the degree of influence of the level of confidence on economic growth, GDP growth rates and the Edelman Trust Barometer index are calculated, then a linear correlation coefficient is calculated. On the basis of these research methods, a hypothesis about the relationship of trust with key indicators of the country's macroeconomic development is being tested.

Findings

Thus, the relationship between the level of trust and key indicators of economic development has been confirmed in several papers by both Russian and foreign authors. Nevertheless, the question remains - is it possible to consider trust as a condition for the growth of the Russian economy? Is a higher level of trust a reason for increasing macroeconomic indicators? Or the growth of the economy, ensuring the improvement of not only macroeconomic indicators, but also the standard of living of the population leads to increased interpersonal and institutional trust. To answer these questions, it is worth noting several possible points of growth of the Russian economy.

The value of foreign direct investment (Foreign Direct Investment) (World Investment report, 2018) can be considered as an indicator of significantly influencing the growth of the economy, that is, a possible growth point. According to the definition of the International Monetary Fund, direct investments should be understood as a form of participation of foreign capital in the implementation of investment projects with a view to profit.

According to the IMF methodology, foreign investments are considered foreign direct investment if the investor acquires at least 10% of the company's share capital, which allows it to have a significant impact on the management of the enterprise and exercise partial (or full) control. Table

As part of the analysis, a linear correlation coefficient was calculated between the level of trust which is considered to be the indicator of The Edelman Trust Barometer (Edelman Trust Barometer Global Report, 2018) in the country and the volume of foreign direct investment. The obtained coefficient value equal to 0.603 indicates the presence of a direct connection of the average force between the indicators.

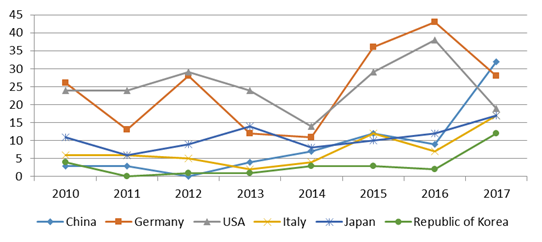

Speaking of the Russian economy, it is worth noting that, according to EY (Investigation of Investment attractiveness of European countries. Russia, 2018), based on the Global Location Trends database, the number of projects involving foreign direct investment, as a result of which new facilities and workers were created places (excluding portfolio investment and mergers and acquisitions), since 2005 (111 projects) increased more than 2 times by 2017 (238 projects). Among the country’s leaders in foreign direct investment in the Russian economy can be identified China, the United States, Germany, Italy, Japan, South Korea (Figure

Despite the positive dynamics of the volume of foreign direct investment in Russia over the past few years, it is worth noting their relatively small amount in comparison with other countries. Increasing the competitiveness of Russian enterprises in the international market and attracting foreign capital is a significant stimulus for the country's economic growth.

According to the World Bank, the growth rate of the world economy in 2018 will remain at 3.1%. To assess the relationship between GDP growth rates in various regions with a level of confidence, we will use the data from the Global Economic Prospects 2018 study (Global Economic Prospects, 2018) and the values of the Trust Barometer index (Edelman Trust Barometer Global Report, 2018). The specifics of calculating GDP growth rates imply their calculation by integrated regions, for example, the Eurozone (Euro Area). A significant difference in Trust Barometer’s indicators for countries in the Eurozone makes the calculation of averaged confidence level incorrect, therefore countries for which individual values of GDP growth rates are not presented in the review were excluded from further analysis.

To assess the impact, we calculate the growth rate of the level of trust in 2017 compared to 2016 for a sample of countries (table

The calculation of the linear correlation coefficient (equal to 0.76) revealed the presence of a direct strong relationship between the indicators, which allows to conclude that the level of trust has a significant effect on the GDP growth rate in the country.

Conclusion

Summing up the research, I would like to note that the influence of trust on various spheres of the country's socio-economic development is indisputable. In the modern world, analyzing the growth conditions of the national economy, the main attention is paid to macroeconomic indicators, rather than institutional ones. At the same time, the search for new factors can open up new opportunities for the growth of the country's economy, and the analysis confirms that trust can be viewed as one of these factors. The level of trust allows us to evaluate the effectiveness of the development of social institutions, as well as to develop a mechanism for improving their quality, which certainly affects the standard of living in the country. It should be noted that despite the positive dynamics of the volume of foreign direct investment in Russia over the past few years, their volume in comparison with other countries is relatively small. Increasing the competitiveness of Russian enterprises in the international market and attracting foreign capital is a new point of growth of economic development. So the calculation of the linear correlation coefficient revealed the presence of a direct strong relationship between the indicators, which allows us to conclude that the level of trust has a significant effect on the GDP growth rate in the country.

References

- Benz, D. S, & Silova, E. S. (2014). Trust as a factor in improving the sustainability of corporations. In Barkhatov V. I., Pletnev D. A. (Eds.), Sustainable development in an unstable world proceedings of the International 2014 Conference (pp. 23-27). Chelyabinsk, Russia: Izdatelstvo Pero.

- Easton, D. (1965). A Systems Analysis of Political Life. New York: John Wiley.

- Edelman Trust Barometer Global Report. (2018). Retrieved September 21, 2018, from http://cms.edelman.com/sites/default/files/2018-02/2018_Edelman_Trust_Barometer_Global_Report_FEB. pdf.

- Fukuyama, F. (1995). Trust: the Social Virtues and the Creation of Prosperity. New York: Free Press.

- Giddens, A. (1990). The Consequences of Modernity. Cambridge: Polity Press.

- Global Economic Prospects. (2018). World Bank Group. Retrieved September 23, 2018, from https://openknowledge.worldbank.org/bitstream/handle/10986/29801/9781464812576.pdf

- Investigation of investment attractiveness of European countries. Russia (2018). Retrieved September 25, 2018, from https://www.ey.com/Publication/vwLUAssets/ey-european-attractiveness-survey-2018/%24File/ey-european-attractiveness-survey-2018.pdf

- Kampen, J. K., DeWalle, S. V., & Bouckaert, G., (2006). Assessing the relation between satisfaction with public service delivery and trust in government: The impact of the predisposition of citizens toward government on evaluations of its performance. Public Performance and Management Review, Vol. 29(4), pp.387-404.

- Knack, S., & Keefer, P. (1997). Does social capital have an economic payoff? A crosscountry investigation. Quarterly Journal of Economics, 112 (4), pp. 1251-1288.

- Marshall, A. (1993). Principles of economic science: in 3t. M.: Progress. T.1. from http://files.libertyfund.org/files/1676/Marshall_0197_EBk_v6.0.pdf

- Natkhov, T. V. (2011). Education and trust in Russia. An empirical analysis. Economic Journal of the Higher School of Economics, 3, pp.353-373.

- Pletnev, D. A., & Silova, E.S, (2015). Trust in modern corporations: institutional failure. Management Sciences in the Modern World, 1(1), pp.546-550.

- Say, J.-B. (1971). A treatise on political economy; or the production distribution and consumption of wealth. New York: Augustus M. Kelley Publishers.

- Smith, A. (2007). An Inquiry into the Nature and Causes of the Wealth of Nations. The Glasgow Edition of the Works and Correspondence of Adam Smith, vol. II, edited by R. H. Campbell and A. S. Skinner. Oxford University Press, 1976. from https://www.ibiblio.org/ml/libri/s/SmithA_WealthNations_p.pdf

- Sztompka, P (1999). Trust: A Sociological Theory. Cambridge: Cambridge University Press.

- Tatarko, A. N. (2014). Interrelation of trust and economic development: cross-country analysis. Bulletin of the Leningrad State University. A.S. Pushkin, 2, pp.50-57.

- Williamson, О. E. (1993). Calculativeness, Trust and Economic Organization. Journal of Law and Economics, 36, pp.453-486.

- World Investment report. (2018). Retrieved September 20, 2018, from http://unctad.org/en/PublicationsLibrary/wir2018_en.pdf.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Bents, D., Barkhatov, V., Ayupova, S., & Kozlova, E. (2019). Is The Trust A Condition Of Russian Economy Growth?. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 310-319). Future Academy. https://doi.org/10.15405/epsbs.2019.04.35