Abstract

The new scientific concept of rent regulation of the production (agrarian), financial and budgetary relations by means of effective interaction of the state, public and corporate educations is considered in the article. The problem of interregional and interindustry social and economic differentiation is presented as a consequence of the rent disproportions constraining development of both regional economies and world economy. The analysis of productions in agriculture has confirmed high interdependence of factors in a linking of work, capital and the earth. Therefore, it is important to provide proportions between factor incomes. Disproportions in investment incomes lead to losses of resources. Overestimated interest rate leads to degradation of the capital, work and earth. Excess resources appear for the loss of which society should pay with wellbeing. The research is directed to the development of the concept of justification of the forms of investment income defining the maintenance of rent regulators, providing the balanced development of branches and regions. The results of the research come down to a conclusion about the necessity of recognition of distortions in the development of modern rent economy, its adverse effect on the production, social and economic sphere that obliges to the development of the system of rent regulators at all levels of management of branch and regional economies. Localization of productive forms of investment incomes in production becomes possible only in the conditions of socialization of unproductive forms of investment incomes that is a fundamental condition of the balanced development of branches and regions.

Keywords: Balanced developmentcompetitioninvestment incomesrent mechanismsocial and economic differentiations

Introduction

The aggarvation of the problem of socio-economic inequality revives a scientific interest in the theory of classical political economy and its rent concepts.

Problem Statement

Rental terminology makes it possible to most fully identify the factors of imbalance in system processes and substantiate the reasons for the restructuring of economic mechanisms.

Research Questions

The rent theory is subject to endless discussions, but its participation in the development of industries and regions confirms the fact that the rent has a controlling effect on economic relations by adjusting the behavior of economic actors at all levels of the economy.

Rent as super income from any socio-economic and production factor determines the motives and behavioral profile of economic entities.

Socially significant categories of rental order have the property of formatting economic interests, both at the level of the national economy and at the level of the world economy.

The rent paradigm of the development of modern world economy is due to the influence of the rental income structure of national economies on reproduction processes that implement the rent-oriented model of interaction between government and corporate structures.

A profile of interaction of government, public and corporate structures is formed depending on the degree of consistency of the structure of rental income, payments for resources and regulators of industrial growth.

The criterion for the realization of interests in the modern world economy is the capital amount, which ensures the process of increasing of economic rent and keeps the proportion of interests both in subsoil use and in other sectors. As a result, excess resources are formed, which are devalued and localized in non-production areas.

The economic rent rushes into the financial sphere and ensures the outflow of capital from the real sector to the detriment of the investment and innovation strategies for the development of the national economy.

Purpose of the Study

Disclose and justify the content of the elements of the rent mechanism, aimed at smoothing budgetary imbalances and contributing to the increase in the efficiency of interaction between government, public and corporate structures.

Research Methods

Post-industrial illusions about the denial of the leading role of material production broke about the realities of the global economic and financial crisis of 2007–2009 once again (Galbraith, 2017). The movement “on the other side” of material production turned into expansion of financial intermediation, which became the main factor in restructuring of investment income to the detriment of material production, which led to the devaluation of the real sector and the development of economic crisis.

Therefore, the method of studying the problem is reduced to rental rates, procedures and methods of structuring investment income in the basic sector of the economy.

A disproportionate increase in the finances of large corporations, already receiving a significant portion of investment income, which increases their transnational power and devalues other business entities operating in non-competitive conditions. It is possible to model various states of interdependencies using the obtained equations of linear or power functions using correlation-regression analysis.

Countries lagging behind in industrial development are losing rent, which is transformed into obstacles to the development of competition and market mechanisms, which necessitates clarifying the goal of interaction between government, public and corporate structures, which is reduced to creating equal starting conditions for economic management at the intersectoral and interregional levels.

Creating of a market mechanism requires, first of all, conditions for competition (Chamberlin, 1996). Development of competition, expansion of the scale of development of the sectors of the real sector and the involvement of resources in production, the method of justifying the system of rental regulators, ensuring a balance of key relationships between production, social and financial factors, was used for localization of investment income in the production sector.

Findings

Regulatory impact of the system of investment income manifests at the inter-sectoral level. So, if agriculture becomes rent-free, the capital from it goes to other industries and activities. Therefore, balancing the inter-sectoral interaction of government, corporate and public institutions depends on the structure of investment income in agriculture. Moreover, if the goal of effective interaction between government, corporate and public institutions is the productive use of resources and their full employment, ensuring the economic growth of industries, the production result is the carrier of rent determining plan targets.

Thus, the carrier of rent is the normal yield of grain crops in crop production

The power function in comparison with the linear dependence allowed us to build a model of normal yield with high confidence, as evidenced by the decrease in the mean square error from 2.8 to 0.3.

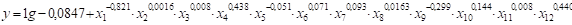

As a result of the correlation-regression analysis using a power function, we obtained the equation:

where:

y – grain yield, c/ha;

x1 – labor resources on 100 hectares, person-h.;

x2 – power capacities on 100 hectares, h.p.;

x3 – fixed production assets per 100 hectares, thousand rubles;

x4 – gross output per 100 hectares, thousand rubles;

x5 – the proportion of grain in the structure of commodity products, %;

x6 – costs per 1 hectare of grain, thousand rubles;

x7 – price of grain, thousand rubles;

x8 – gross income per 100 hectares, thousand rubles;

x9 – working capital on 100 hectares, thousand rubles;

x10 – cumulative soil index, rating;

x11 – potassium content in soil, mg per 100 g;

x12 – soil phosphorus content, mg per 100 g

The model revealed a decreasing marginal productivity of labor, working capital and a relatively low efficiency of grain farming.

A sufficiently high degree of influence was shown by resource factors, and, which is very importantly, by the quality indicators of the land.

Labor turns out to be less and less productive, the land is losing quality. Revolving funds in their structure make up more and more expenses for seeds, fuel and other materials, and not for fertilizers and soil and plant protection products.

Reducing labor productivity and working capital is the result of inefficient technology of grain production.

The yield model shows that the soil quality factors have the greatest impact on the grain yield. The regression coefficient for the aggregate soil indicator is maximum and is equal to 0.999.

The total soil index is calculated in points. It characterizes the quality of soils by the basic properties of fertility relative to the production of grain crops. The degree of participation of the soil indicator in the formation of the crop increases to 3%, by 7% together with phosphorus and potassium.

Reducing of the impact of basic production assets to 0.4% is due to a decrease in the level of technical progress in agriculture. This indicates a weakening of the mechanism for creating differential rent II, which is the basis for the competitiveness of agricultural producers under market conditions. As a result, there is a slowdown in the economic development of all industries.

There is an inevitable alignment of inter-sectoral and interregional socio-economic differentiation, the efficiency of national economies increases, the socio-economic differential decreases at the level of the world economy in the conditions of balanced development of industries.

A flexible system of rental regulators is needed to balance the key relationships between production, social and financial factors of the product created in the economy for localization of investment income in the manufacturing sector, development of competition, expansion of the development of the real sector and the involvement of resources in production.

Industrialization based on the development of the digital economy and the knowledge society as the main and only way to increase competitiveness is based on a high level of training of professional personnel, especially in the primary industries to which agriculture belongs, which contradicts the current structure of employment in the Russian Federation (Table

The main reason for the decline in the level of education of people employed in rural areas is a decrease in the degree of dependence of production factors and carriers of investment income. As a result of the monopolization of industries, a new term has appeared - “excess resources”. The product becomes less material, labor and capital intensive (Weingort, 2018).

Since the 1990s, rental imbalances in many countries of the world have led to social crises, which led to the creation of national social monitoring systems, but the fragile balance of power created in Europe continues to fall apart (Friedman, 2011).

Nevertheless, the economies of developed countries maintain a stable state due to the relatively low interest rate on capital, which, in turn, limits the growth of financial rent (Table

Financial rent under these conditions is suppressed and cannot show its replacement functions with respect to productive forms of rental income. Essentially, interest controls rent (Clark, 1992). This is the first stage of the regulatory impact, in which the interaction between financial and production structures is realized.

At the second stage, equal starting conditions for economic management are created through fiscal equalization, in which production, social structures and authorities interact at all levels. The experience of Germany is especially significant. According to the German fiscal tradition, changes in income and expenditure obligations at any of the three budget levels should be balanced by adjusting the VAT splitting standards between the federal government and the lands and can sometimes affect the finances of local governments (Tretner, 2003).

The overall fiscal equalization of income at the interregional level ensures the retention of the socio-economic prerequisites for the development of production and extraction of productive forms of investment income that realizes the effectiveness of interaction between society and authorities at all levels, which is relevant for the Russian Federation (Russia’s budget for 2017 and budget of other countries of the world: the obvious becomes clear, 2017; Official website of the Ministry of Finance of the Russian Federation, 2017), (Table

Interregional differentiation of budgetary security in the Russian Federation is growing, hindering the development of regions. The index of budget expenditures varies by 3.2 times, and the level of budgetary security by 4.3 times (Shirokov & Efimova, 2017). The trap of contradictions between industrial democracy and empowerment is triggered under these conditions, when the approach of joint power is violated (Humborstad, 2014).

Decrease in rights and opportunities leads to a decrease in job satisfaction, which leads to a lower level of organizational communication and the development of incentive motivation mechanisms in the real sector (Jiang & Probst, 2013; Pendleton & Robinson, 2017).

Conclusion

Insufficient development of scientific approaches to the management of rental economies hinders the development of not only countries with a high level of socio-economic differentiation, but also the entire world economy.

, (1)

where BR is budget rent, rubles;

AIi - the level of the estimated budget security of the Russian Federation;

AInp - average level of budgetary security of the Russian Federation;

AI- average budget provision in the Russian Federation per capita, rubles.

References

- Chamberlin, E. (1996). The Theory of Monopolistic Competition (Reorientation of the Theory of Value). Transl. by E. G. Leykin and L. Y. Rozovsky. Moscow: Economy.

- Clark, G. (1992). The distribution of wealth: translated from English. Scientific. Moscow: Economy.

- Friedman, G. (2011). The next 10 years. Friedman George. Moscow: Exmo.

- Galbraith, K. (2017). Return. Monograph. Moscow: Cultural revolution.

- Humborstad, S.I.W. (2014). When industrial democracy and empowerment go hand-in-hand: A co-power approach. Sage Publications economic & industrial democracy, 35 (3), 391-411.

- Jiang, L., & Probst, T. (2013). Organizational communication: A buffer in times of job insecurity? Economic and Industrial Democracy, 16, 557–579.

- Official website of the Ministry of Finance of the Russian Federation (2017). Retrieved May 19, 2018, from:http://minfin.ru/ru/document/?id_4=116795&area_id=4&page_id=2104&popup=Y#ixzz4ny56wvuy.

- Pendleton, A., & Robinson, A. (2017). The productivity effects of multiple pay incentives. Sage Publications economic & industrial democracy, 38 (4), 588-608.

- Russia's budget for 2017 and the budget of other countries of the world: the obvious becomes clear. (2017). [Electronic resource] electronic journal. Business life. Retrieved May 18, 2018, from http://bs-life.ru/makroekonomika/budzet2017.html.

- Shirokov, S. N., & Efimova, S. V. (2017). Rent disproportions in inter-budgetary relations between regions and industries of the Russian Federation. Proceedings Of SpbGAU, 49, 153-159.

- Tretner, C. H. (2003). The reform of intergovernmental fiscal relations in Germany. Finance, 1, 66-70.

- Weingort, V. L. (2018). Contradictions between urbanism of the new industrial society and housing policy in the post-Soviet space (on the example of Estonia). In Foresight "Russia": a new industrial society. Reload. Volume 2. Collection of reports of the St. Petersburg international economic Congress (SPEC-2017) (p. 874). Russia, Saint-Petersburg.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Efimova, G., Efimova, S., & Bulgakov, P. Y. (2019). Rent Mechanism Of Effective Interaction Of The Government, Public And Corporate Institutions. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 244-252). Future Academy. https://doi.org/10.15405/epsbs.2019.04.28