Strategic Entrepreneurial Posture, Entrepreneurial Orientation And Firm Performance Relationship In Family Businesses

Abstract

Many researchers have emphasized that companies should give importance to strategic posture in order to provide competitive advantage. In this study, the relationship between strategic entrepreneurial posture, entrepreneurial orientation and firm performance is investigated in family and non-family businesses. The research has been carried out on 695 senior managers from 235 Turkish manufacturing firms. The collected data were analysed in the SPSS program. It was provided to test the hypotheses designed for the purpose of the research by subjecting the research data to reliability, factor, correlation and regression analyses. As a result of the regression analyses, it was found that there are relationships between strategic entrepreneurial posture, entrepreneurial orientation and firm performance. Another point this study focused is the differences between the companies, which are family businesses and non-family businesses. According to the analyses, these relationships are different for family and non-family firms. The most striking result to emerge from data is that market performance mediates the relationship between strategic entrepreneurial posture and financial performance.

Keywords:

Introduction

Business environment is often characterized as complex and ambiguous because of the rapid globalization and change in information and communication technologies.

In an environment where businesses compete, companies can protect themselves by acting proactively and innovatively in terms of the service and product offered to the customers. Thus, companies can sustain existence in a competitive environment.

In entrepreneurship literature, it is surely beyond doubt that whatever the sector work in or whatever business size is, companies have to be innovative, risk taking and proactive.

Strategic posture represents a competitive direction of a company. The strategic posture of a firm take form by, its ability to compete with other companies and gain a competitive advantage by risk taking, change and innovation. These require the concept of entrepreneurial orientation. Firms that adopt an entrepreneurial orientation to their posture are open to innovativeness, more proactive and able to take more risks than conservative firms (Covin & Slevin, 1989).

There are various studies about strategic entrepreneurial posture-firm performance relationship and entrepreneurial orientation-firm performance relationship.

According to these researches, it can be said that there is an increasing scientific acceptance that firms with entrepreneurial strategic posture perform better than those with more conservative-conducted (Ireland, Kuratko, & Covin, 2003). However, no study has examined these three variables in detail. For this reason, it is desired to investigate strategic entrepreneurial posture, entrepreneurial orientation and firm performance relations in this study.

Another point in the research was the status of businesses. Family businesses have a number of advantages that will facilitate the creation of an appropriate climate that supports and encourages entrepreneurial efforts and activities in their organizations.

These are; rapid decision making, high level commitment to business, long-term orientation of thinking and acting, less bureaucracy, more freedom to act independently, family culture is a source of confidence, and such as more tolerance in difficult times (de Vries, 1993; Salvato, 2004; Short, Payne, Brigham, Lumpkin, & Broberg, 2009). So that, this study investigated, the differences between family-nonfamily firm status in the strategic entrepreneurial posture, entrepreneurial orientation and firm performance relationship. In the first part of the research, literature information about this research will be given. Then, metalogical information about sampling and data collection will be given. The hypotheses will be examined as a result of the analysis and the final state of the research model will be shared and the results of the research will be discussed.

Literature Review and Theoretical Framework

Family Business

Family businesses are businesses that belong to the family for at least two generations, the aims and benefits of the family and the business are one and which are reflected in the policies of the business (Donnelley, 1964).

Barry (1975) refers family businesses as businesses controlled by members of a family and whose profit policy is specified by the family. The common characteristics of family firm definitions are as follows (Neubauer & Lank, 1998); the majority of the business capital belongs to a certain family, employing family members which are the owners of the business, as managers and other positions, the management of the business by a family member or members, the existence of non-family members in the executive and staff positions, having a family of several generations to operate.

Work on family business in the world is increasing day by day. In addition, there is a growing interest in this subject (Sharma, 2004). The main reason for the increase in the importance given to these businesses is the recognition of the family businesses in the national economy. Family businesses have a significant place in the country's economy with regard to added value and employment created by them. According to the research conducted, %90 percent of all US businesses and %60-70 percent of small businesses are family businesses. More than %70 of all corporations in the world are family businesses (Scarborough, 2014). Proportionally, the country with the highest level of family business is Italy with %99. The proportion of family businesses in Turkey is about %95 and these businesses are a very important part of the economy (Findikci, 2014).

Strategic Entrepreneurial Posture (SEP)

Morris & Jones (1999), stated that entrepreneurship is the process of researching and exploring opportunities in the environment or creating new opportunities. Entrepreneurship requires businesses to have a vision of business opportunities and use their resources and skills to transform that vision into reality.

According to the literature of strategic management, entrepreneurship is considered as a process that contributes to the maintenance of the existence and performance of the enterprises (Miller, 1983; Covin & Slevin, 1989; Zahra, 1993; Lumpkin & Dess, 1996). Entrepreneurship which involves entrepreneurial posture and behaviors of businesses; focus on their internal dynamics and create new entities from these dynamics (Dess & Lumpkin, 2005). Strategic entrepreneurship, which emerges as a result of common themes and interdependence between entrepreneurship and strategic management thinking, is the simultaneous integration of an entrepreneurial action and a strategic action (Burgelman, 1983). In other words, strategic entrepreneurship is an action, aimed creating value through social and economic changes (Hisrich, 2010), with a view to maintaining its presence in the period, developing a sustainable competitive advantage and achieving return on average (Hitt, Ireland, Camp, & Sexton, 2001).

On the basis of strategic entrepreneurship, businesses should put a posture on entrepreneurship and shape its own internal dynamics into this cultural fit. In addition, this operation needs to be transformed into action. Moving from this, it is understood that entrepreneurship must be able to continue and transform the process into entrepreneurial activities by using existing resources (Gurkan, 2017). Therefore, it seems that strategic entrepreneurship is a combination of entrepreneurial orientation and entrepreneurial behavior. Entrepreneurial orientation is a tentative component; an individual is willing to adopt new opportunities and takes responsibility for creative

Entrepreneurial Orientation (EO)

Entrepreneurial orientation is the processes, implementations, decision activities that guide to a new venture or an entry to new markets. Entrepreneurial orientation is measured as a concept at the organizational level. By the way, entrepreneurial orientation; in general, assessing the behaviour and practices of the institution's managers as a measure of measuring their commitment to initiative orientation (Lumpkin & Dess, 1996). Miller (1983) classifies the entrepreneurial orientation as follows: (i)innovation, (ii)risk taking, and (iii)proactivity. Entrepreneurial orientation, which is thought to be three dimensions in the beginning phase, has been improved by adding different and independently varying dimensions. Lumpkin and Dess (1996) have supplemented autonomy and competitive aggressiveness to the Miller’s classification (1983), arguing that entrepreneurship orientation has a multidimensional nature. However, empirical measurement generally uses 4 dimensions: innovativeness, risk taking, proactivity and competitive aggressiveness (Dean, 1993).

Innovativeness shows the tendency of new ideas, innovations, experiences and creative operations that can result in new products, services and technological processes to be supported by a business (Lumpkin & Dess 1996). Risk taking indicates the tendency to move and attempt to capture an initiative without knowing whether the initiative will be successful. In order to be successful through entrepreneurship, businesses need to take more risky alternatives, even if they have to give up the methods and products they used in the past (Dess & Lumpkin, 2005). Risk taking can be defined as borrowing heavily, allocating a large share of resources to unfinished projects and entering or investing unknown markets (Lyon, Lumpkin, & Dess, 2000). Proactivity is defined as to take action before problems arise in the future by Lumpkin and Dess (1996). According to Miller (1983), proactivity means the firm is the fastest in making forward-looking innovations and presenting new products or services first. Here, besides making the innovation by anticipating the future, it is also the conditions of proactivity that it is the first to make this innovation. Proactivity can be defined as an act in a competitive manner by offering new products and services and to be decisive in the market; also looking for the advantage of the first move (Lyon et al., 2000). Competitive aggressiveness refers to the tendency of a firm to challenge its competitors directly and insufficiently to enter the market or improve its position. (Lumpkin & Dess, 1996). Aggressiveness is implemented by increasing the market share, by constantly weakening the competitors' power and by transferring resources to make direct attacks on the competitors in order to gain an advantage with offensive tactics (Hughes & Morgan, 2007).

Firm Performance (FP)

Firm performance indicates the level of success of business strategies at the end of a specific period (Porter, 1991). Another firm performance definition is done by Wheelen & Hunger (2000), as efficiency related to the evaluation of the activities related to the objectives to be realized. Determining the future direction of an enterprise, every firm requires accurate and flexible measurement. Therefore, performance measurement directly affects the performance of the company. In the design of performance measurement systems, two questions need to be answered, namely why we want to measure and what we want to measure. There are basically five reasons for directing business management to measurement. These reasons include providing information about the past situation, determining what the current situation is, provide support in the design of the activity plans and the determination of the objectives and targets, determine how to reach the designed action plans and the specified goals and objectives and provide information on the extent to which objectives and targets have been achieved. (Lebas, 1995).

There are various approaches to performance measurement. One of the performance measurement classifications is separated as qualitative and quantitative performance. Qualitative performance is largely related to the culture, environment, human resources and abstract outputs within the organization and includes criteria such as employee satisfaction, customer satisfaction, quality and innovation performance. Quantitative performance includes criteria such as turnover increase, market share increase and profitability increase, which are partly influenced by qualitative factors and moreover based on marketing and financial management success (Kirchoff, 1977; Hunt & Morgan, 1996). In this study, quantitative performance measures are used. The role of EO between SEP and FP relationship is investigated. Also, the effect of family firm and non-family business on performance is investigated in this study. To measure FP, financial performance (FiP) and market performance (MP) were measured.

Development of Hypotheses

It appears that there are various studies that have contributed significantly to the literature on SEP EO and FP. Covin & Slevin (1989) found that the strategic posture and organic organization structure were positively influencing business performance in a competitive environment. Dess, Lumpkin & Covin (1997) have shown that entrepreneurship has a strong impact on business performance in a situation where business strategy and environmental conditions are compatible. Kimuli (2011) found a strong positive relationship between SEP and performance. Zahra (1993) find that EO effects positively FP according to profitability and growth. According to the Wiklund’s research (1999), it was concluded that the EO has a direct effect on FP. According to the study conducted by Tajeddini in Switzerland in 2010, it has been found that EO has positive effects on the service performances of the hotels (Tajeddin, 2010). However, in the literature, there are also studies that find negative relations between posture and performance besides these positive relations (Covin, Slevin, & Schultz, 1994). Lumpkin & Dess (2001) considered the EO in the study they conducted two-dimensionally, found that these dimensions had different effects on firm performance. It has been determined that competitive aggressiveness has a negative impact on FP, while proactivity, has a strong impact on FP. This study wants to investigate, EO’s mediating role on the relationship between SEP and FP. Firm performance was measured by two dimensions: finance performance(FiP) and market performance(MP). That’s why our second thought is about SEP, MP and (FiP). So our study also examines, mediating role of MP on the relationship between SEP and FiP.

Also, there are various studies on family business and EO. For example, Zahra, Hayton and Salvato (2004) investigated the relationship between EO and family businesses in their work. Zahra (2005) examined that how ownership status influences risk taking in several family-owned companies. Naldi, Nordqvist, Sjöberg, & Wiklund (2007) have studied risk taking, one of the dimensions of EO, in family firms. Kellermanns, et. al. (2008) examined the influence of entrepreneurial tendencies in family businesses on performance. As a result of all these studies, it has come to the conclusion that the EO differs from non-family and family companies. Therefore, this study compared the companies which have different family business status (pure family, family and non-family businesses) in terms of the relationships between strategic entrepreneurial posture(SEP), entrepreneurial orientation(EO) and firm performance(FP). In accordance with the literature review, the research hypotheses are as follows:

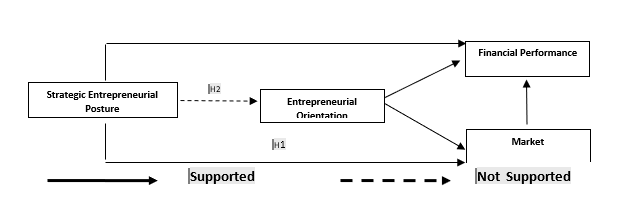

H1: Market performance(MP) mediates the relationship between strategic entrepreneurial posture(SEP) and financial performance (FiP).

H2: Entrepreneurial orientation(EO) mediates the relationship between strategic entrepreneurial posture(SEP) and financial performance (FiP).

H3: There is a difference between relationships among strategic entrepreneurial posture(SEP), entrepreneurial orientation(EO) and firm performance(FP) according to the business status(pure family, family and non-family business.

Research Method

Sample and Data Collection

The survey was conducted on 695 senior managers of 235 firms in Turkey. The distribution of these firms according to their establishment years are as follows: %4 of the firms established before 1950, %23 of the firms established between 1950-1980, %49 of the firms established between 1980-2000 and %24 of the firms established after 2000. The distribution of the firms according to their number of employees are as follows: %30 of firms have 0-50 employees, %34 of firms have 50-250 employees, %10 of firms have 250-500 employees, %10 of firms have 500-1000 employees and %15 of the firms have 1000 and over employees. The data were gathered from manufacturing sectors. According to the data obtained, the production of electronic machine tools and textile manufacturing firms were more in number. The distribution of the collected data according to gender is 39% female and 61% male. In this research, the businesses were grouped into 3 sections. The first was pure family businesses with only family members in the board of directors (number of them=130). The second one was also family businesses but where foreigners from outside the family can be in the board of directors (number of them=57). The last one consisted of non-family firms (number of them=48).

The data obtained were evaluated by using SPSS Statistical Package Program. Factor analysis was applied to questions where Likert type ordinal scales were used. For the reliability tests, Cronbach Alpha was used and to test research hypotheses regression analysis was used.

Analyses

To measure SEP, the 9-item scale which is constituted by Covin & Slevin (1989) was used. For EO measurement, a 17-item questionnaire was created. According to the scale which is adopted by literature, proactiveness was measured by 4 questions, competitive aggressiveness was measured by 4 questions, innovativeness was measured by 5 and risk taking was measured by 4 questions (Venkatraman, 1989; Li, Zhao & Liu, 2006). For the measurement of FP, 12 questions used by Rosenzweig, Roth, & Dean (2003) and Vickery, Droge, & Markland (1993) were asked to the participants. As a result of the factor analysis 5 questions were abstracted from SEP scale, 5 questions abstracted from EO scale and 2 questions abstracted from FP scale. The reason for performing these deletions is because they had a low factor load or multiple factor load. As a result, the variables were measured with 31 questions. Table

Findings

In our research, hypotheses were tested by regression and correlation analysis and the results have been showed in Table

Table

The research model that emerged as a result of the analysis demonstrated in Figure

Conclusion and Discussions

In this research, the primary focus was to find out whether there is a relationship among strategic entrepreneurial posture, entrepreneurial orientation and firm performance. According to correlation and regression tables, there are significant relationships between these variables, 9 regression models are significant (p=,000). In terms of model 1 and 3, there is a significant relationship between strategic entrepreneurial posture and firm performance. The result is consistent with the results of other studies in the literature (Covin and Slevin, 1989;. Dess, et. al., 1997). As a result of the analyzes, model 5 and 6 show a significant relationship between entrepreneurial orientation and firm performance. This consequence is also consistent with the literature (Zahra, 1993; Tajeddin, 2010). The first hypothesis of this study is about mediating role of market performance between strategic entrepreneurial posture and firm performance. According to the regression analyses strategic entrepreneurial posture has a meaningful effect on the dependent variable financial performance (Model 1) and lose this significant effect when the market performance is included in the regression as the independent variable (Model 7). That’s why H1 is supported. The second hypothesis of this study is about mediating role of entrepreneurial orientation between strategic entrepreneurial posture and firm performance. Regression analysis did not support H2. The last hypothesis of this study is about the difference between business status on strategic posture, entrepreneurial orientation and firm performance relationship. The results of the analysis show that the firms with different family business status differ in terms of the relationship among strategic entrepreneurial posture, entrepreneurial orientation and firm performance.

References

- Barry, B. (1975). The development of organisation structure in the family firm. Journal of General Management, 3(1), 42-60.

- Boru, D. (2006). Entrepreneurship Education. Marmara University Publication

- Burgelman, R.A. (1983). A Process Model of Internal Corporate Venturing in the Diversified Major Firm, Administrative Science Quarterly, 28, pp.223-244.

- Covin, J.G. & Slevin, D.P. (1989). Strategic management of small firms in hostile and benign environments. Strategic Management Journal,10(1), 75-87.

- Covin, J. G., Slevin, D. P., & Schultz, R. L. (1994). Implementing strategic missions: Effective strategic, structural and tactical choices. Journal of Management Studies, 31(4), 481-506.

- Dean, C. C. (1993). Corporate entrepreneurship: Strategic and structural correlates and impact on the global presence of United States firms. Unpublished doctoral dissertation, University of North Texas, Denton, TX.

- Dess, G. G., Lumpkin, G. T., & Covin, J. G. (1997). Entrepreneurial strategy making and firm performance: Tests of contingency and configurational models. Strategic management journal, 677-695.

- Dess, G.G. & Lumpkin, G.T. (2005). The role of entrepreneurial orientation in stimulating effective corporate entrepreneurship. Academy of Management Executive, 19 (1), 147-156.

- De Vries, M. F. K. (1993). The dynamics of family controlled firms: The good and the bad news. Organizational dynamics, 21(3), 59-71.

- Donnelley, R.G. (1964). The Family Business. Harvard Business Review, 42(4), 93- 105.

- Findikci, İ. (2014), Aile Şirketleri, İstanbul: Alfa Yayınları.

- Gurkan, N. (2017). Entrepreneurial Orientation Concept As A Strategic (Entrepreneur) Position. Business & Management Studies: An International Journal, 5(2).

- Hisrich, R. D. (2010). International Entrepreneurship.

- Hitt, M. A., Ireland, R. D., Camp, S. M. & Sexton, D. L. (2001). Strategic entrepreneurship: Entrepreneurial strategies for wealth creation, Strategic Management Journal, 22 (Special Issue), pp. 479–491.

- Hughes, M., & Morgan, R. E. (2007). Deconstructing the relationship between entrepreneurial orientation and business performance at the embryonic stage of firm growth. Industrial Marketing Management, 36(5), 651-661.

- Hunt, S. D., & Morgan, R. M. (1996). The resource-advantage theory of competition: Dynamics, path dependencies, and evolutionary dimensions. Journal of Marketing, 60(4), 107−114.

- Kellermanns, F. W., Eddleston, K. A., Barnett, T., & Pearson, A. (2008). An exploratory study of family member characteristics and involve- ment: Effects on entrepreneurial behavior in the family firm. Family Business Review, 21, 1-14.

- Kimuli, S. N. L. (2011). Strategic Entrepreneurship and Performance of Selected Private Secondary Schools in Wakiso District (Doctoral dissertation, Makerere University).

- Kirchoff, B. (1977). Organization effectiveness measurement and policy research. Academy of Management Review, 2, 347-355.

- Lebas, M.J. (1995). Performance Measurement and Performance Management , International Journal of Production Economics, Vol:41.

- Li, Y., Zhao, Y., & Liu, Y. (2006). The relationship between HRM, technology innovation and performance in China. International Journal of Manpower, 27(7), 679–697.

- Lumpkin, G. T., & Dess, G. G. (1996). Clarifying the entrepreneurial orientation construct and linking it to performance. Academy of management Review, 21(1), 135-172.

- Lumpkin, G. T., & Dess, G. G. (2001). Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. Journal of business venturing, 16(5), 429-451.

- Lyon, D. W., Lumpkin, G. T., & Dess, G. G. (2000). Enhancing entrepreneurial orientation research: Operationalizing and measuring a key strategic decision making process. Journal of management, 26(5), 1055-1085.

- Ireland, R.D., Kuratko, D.F. & Covin, J.G. (2003). Antecedents, elements, and consequences of corporate entrepreneurship strategy. Best Paper Proceedings: Academy of Management, Annual Meeting, Seattle Washington.

- Miller, D. (1983). The correlates of entrepreneurship in three types of firms. Management Science, 29 (7), 770-791.

- Morris, M.H. & Jones, F.F. (1999). Entrepreneurship in established organizations: The case of the public sector. Entrepreneurship Theory and Practice, 24 (1), 71-91.

- Naldi, L., Nordqvist, M., Sjöberg, K., & Wiklund, J. (2007). Entrepreneurial orientation, risk taking, and performance in family firms. Family Business Review, 20(1), 33-47.

- Neubauer, F. & Lank, A. (1998). The family business: its governance for sustainability, Nueva York.

- Porter, M.E. (1991). “Towards a Dynamic Theory of Strategy,” Strategic Management Journal, 12, 95-117.

- Rosenzweig, E. D., Roth, A. V., & Dean Jr, J. W. (2003). The influence of an integration strategy on competitive capabilities and business performance: an exploratory study of consumer products manufacturers. Journal of Operations Management, 21(4), 437-456.

- Salvato, C. (2004). Predictors of entrepreneurship in family firms. Journal of Private Equity, 7(3), 68–76.

- Scarborough N. M. (2014). “Essentials of Entrepreneurship and Small Business Management”, Pearson Education Limited.

- Sharma, P. (2004). An overview of the field of family business studies: Current status and directions for the future. Family business review, 17(1), 1-36.

- Short, J. C., Payne, G. T., Brigham, K. H., Lumpkin, G. T., & Broberg, J. C. (2009). Family firms and entrepreneurial orientation in publicly traded firms: A comparative analysis of the S&P 500. Family Business Review, 22, 9–24.

- Tajeddini, K. (2010). Effect of customer orientation and entrepreneurial orientation on innovativeness: Evidence from the hotel industry in Switzerland. Tourism Management, 31(2), 221-231.

- Venkatraman, N. (1989). Strategic Orientation of Business Enterprises: The Constrcut, Dimensionality, and Measurement. Management Science, Vol. 35, No.8.

- Vickery, S. K., Droge, C., & Markland, R. E. (1993). Production competence and business strategy: do they affect business performance?. Decision Sciences, 24(2), 435-456.

- Wheelen, T. L. & Hunger, J. D. (2000). Strategic Management and Business Policy–Entering 21st Century Global Society, 7-th edition.

- Wiklund, J. (1999). The sustainability of the entrepreneurial orientation—performance relationship. Entrepreneurship Theory and Practice, 24(1), 37-48.

- Zahra, S.A. (1993). Environment, corporate entrepreneurship and financial performance: A taxonomic approach. Journal of Business Venturing, 8, 319-340.

- Zahra, S. A., Hayton, J. C., & Salvato, C. (2004). Entrepreneurship in family vs. non-family firms: A resource based analysis of the effect of organi- zational culture. Entrepreneurship Theory and Practice, 28, 363-381.

- Zahra, S. A. (2005). Entrepreneurial risk taking in family firms. Family Business Review, 18, 23-40.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 January 2019

Article Doi

eBook ISBN

978-1-80296-053-2

Publisher

Future Academy

Volume

54

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-884

Subjects

Business, Innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Zehir, C., Can, E., & Urfa, A. M. (2019). Strategic Entrepreneurial Posture, Entrepreneurial Orientation And Firm Performance Relationship In Family Businesses. In M. Özşahin, & T. Hıdırlar (Eds.), New Challenges in Leadership and Technology Management, vol 54. European Proceedings of Social and Behavioural Sciences (pp. 487-499). Future Academy. https://doi.org/10.15405/epsbs.2019.01.02.41