Abstract

The purpose of this study is to research how resource dependence parameters of business organizations influence the producer-supplier relationships and firm performance. Moreover, how the relational norms between producers and suppliers affect the firm performance, from the viewpoint of resource dependence and transaction costs theories. The study was conducted with the data of the face-to-face and individual surveys carried out with the managers of business organizations (314 participants) employed in different sub-sectors in the manufacturing sector, between May – December 2017. The validity and reliability of the scales were studied with exploratory and confirmatory factor Analyses. The hypotheses were tested with the support of the Structural Equation Modelling technique. As a result of the study, it is observed that Resource dependency parameters have a statistically significant impact on relational norms between producer-supplier. Solidarity from producer-supplier relational norms, mutuality, and relational focus variables meaningly influence the firm performance. Moreover, asset specificity of resource dependency parameters meaningly influences the mutuality. Accordingly, Resource dependence parameters and the relational norms between producer and supplier explain 38% of the variance in firm performance.

Keywords: Resource dependence theoryfirm performancerelational norms between producer and supplierstransaction cost theory

Introduction

While possession of the fundamental skills and resources which will provide competitive advantage is very important in strategic management, (Barney, 1991), companies usually remain inadequate in supplying their required resources as well as sustaining the flow and thereby establish relationships with other organizations in order to meet their needs (Katila, Rosenberger, & Eisenhardt, 2008). Additionally, companies also need to continuously monitor the opportunities and threats which are to be created by the market dynamics and balances of power, in order to ensure that the flow of resources is maintained. For this reason, they tend to increase the level of coordination and control process (Mintzberg, 2003). Thereby they seek opportunities to decrease uncertainty and manage dependence by purposefully structuring their exchange relationships, establishing formal and semi-formal links with other businesses (Salam, Ali, & Seny Kan, 2017). In other words, with the help of strategic partnerships and the choice of exchange strategies, firms may increase operational and financial performance (Fink, Edelman, Hatten, & James, 2006). For this reason, business organizations have long been defined as political coalitions. It is also stated that firms can be seen as both a collectivity of transactions and as a bundle of resources. While organizations realize the transaction through exchange, they also transact resources. However, it is important to be able to understand this process of exchange in the context of the relationships between organizations, without making administrative mistakes in the market. The approach of resource dependence has been founded on these assumptions (Pfeffer & Salancik, 2003). Furthermore, the transaction cost approach also shapes economic activities, together with the resource dependence approach, in the shaping of the market mechanisms. The transaction cost approach draws attention to the opportunism which may appear as a result of limited rationality, within the framework of uncertainty, confusion and the specificity of assets (Williamson, 1981).

The uncertainty in finding resources or the flow of resources makes it more difficult for the company, which is in the position of the client, to manage its activities in line with its mission, within the scope of the resource dependence approach (Pfeffer & Salancik, 2003; Fink, Edelman, Hatten, & James, 2006). With the resources it provides companies, the supplier becomes a strategic asset, complementing and enabling firms to consolidate in-house competencies (Eisenhardt & Schoonenoven, 1996). Moreover, where the number of suppliers, which are able to obtain the resource is very low within the market, and where these companies perform a significant share of the production of the raw materials, the concentration of resources increases the asymmetry of power between the manufacturer and the supplier (Oliver, 1990). In market conditions where the uncertainty of resources and resource concentration is high, the mutual relationships between the producers and suppliers may turn into mutual dependence in time (Pfeffer & Salancik, 2003). Both sides are able to influence the profitability and behavior of each other with the resource interconnectedness which emerges between the client and the supplier, in order to be able to balance the behaviors related to power and the obtaining of control in the process of resource exchange (Sambharya & Banerji, 2006). In particular under the circumstances where the degree of asset specificity is high, and the level of uncertainty is above average, within the framework of the transaction cost approach, the producer is able to potentially trade with a lower number of suppliers, and while this results in the bargaining power of the producer company to fall, it also increases the risk of opportunism from the aspect of the supplier company (Bunduchi, 2005).

Companies, which are similar to each other under the same market conditions and pressures (DiMaggio & Powell, 1983) are only able to ensure organizational performance differences and sustainable competitive advantage, both within and across firm boundaries, through the governance skills they are able to exhibit (Madhok & Tallman, 1998). Within this context, the performance of the organization is able to be increased through the ability to effectively manage the relational norms which are shaped within the framework of the transaction cost approach (Fink et al., 2006). In the light of this perspective, the study focuses on how the resource dependence parameters of business organizations influence the producer-supplier relationships and the firm performance. Moreover, how the relational norms between producers and suppliers affect the firm performance, from the viewpoint of resource dependence and transaction costs theories.

Literature Review and Theoretical Framework

The Resource Dependence Theory

Resource dependence theory states that organizations need resources in order to sustain their existence in the long term. It is also stated that they are only able to obtain these resources from their own environment and that there are also other organizations which want to have the same resources in this environment (Pfeffer & Salancik, 1978). At the same time, it is emphasized that the strategies of change determined by organizations in the direction of obtaining resources increases their level of dependence on the environment / other organizations (Fink et al., 2006: 500), and as also stated by Emerson (1962), it will become necessary to manage the “relationships of dependence on power” correctly (Delke, 2015). When the literature concerning resource dependence theory is examined, it can be seen that social change theory (Emerson, 1962; Blau, 1964; Pfeffer, & Salancik, 1978) and theories related to power (Pfeffer, 2005; Werner, 2008) have been utilized.

Power is defined as the capacity of an actor to acquire control over the resources needed by others, within the framework of resource dependence theory (Harris & Holden 2001). As can be understood from this definition, the disproportionate power which emerges as a result of the relationships based on the resource, creates pressure on the organization which is dependent on the resource and brings with it the requirement to accept demands. Within this context, the uncertainty of resources is one of the most important of the environmental difficulties faced by organizations. The three sub-factors within the scope of resource dependence are resource concentration, the uncertainty of resource availability and resource interconnectedness (Pfeffer & Salancik, 2003; Fink et al., 2006). Pfeffer & Salancik (2003) define resource dependence as the dimensions of the power and authority which is widespread in the environment in which organizations are situated; the uncertainty of resource availability as the lack of, shortfall in or abundance of critical resources; and resource interconnectedness as the number and type of the relationships or connections between organizations.

As set out in the purpose for this study, the resource dependence parameters of business organizations have been studied from the viewpoint of the resource dependence and transaction costs theories, and it was seen that both of them are quite similar. From both approaches, it has been determined that the frequency of change, the characteristics of the resource and uncertainty are the fundamental logic behind the establishment of strategic alliances (Williamson, 1991; Fink et al., 2006). In general, when the manner in which resources shape the relationships of power within the framework of opportunities and needs during economic change (Williamson, 1981; Lin, 2006), is taken into account, two sub-dimensions of transaction costs – asset specificity and uncertainty / technological uncertainty – have been added to resource dependence parameters.

Asset specificity expresses important investments, which are few and far between or do not exist at all, outside of the respective transaction (Anderson & Dekker, 2005: 1741). Low asset specificity can be said to be present if the activity and / or product does not possess a structure which requires specific or technical skills or knowledge. As asset specificity increases, transaction cost also increases. Where the degree of asset specificity of the organization is high, this will result in it collaborating with a lower number of commercial partners and the reduction of its bargaining power (Bunduchi, 2005). Six types of specificity are mentioned in the literature. These are; site specificity, physical asset specificity, human asset specificity, brand names, dedicated assets and temporal specificity (Williamson, 1991). Another critical factor under transaction cost theory and resource dependence theory is environmental uncertainty – the fact that the incidents and circumstances of the future cannot be forecasted (Pfeffer & Salancik, 2003). The technological uncertainty of a product expresses the inadequacy in forecasting the technical aspects of the product changes, the technical requirements of clients and the changes in the future (Fink et al., 2006). It can be seen that strategic collaborations and mergers are more frequent in industries where the rates of dependence and uncertainty are higher (Pfeffer, 1972).

The Relational Norms Between Producers and Suppliers

While investigating how interactions between companies formed company and industry structure, it is suggested that mergers could be accepted as a response to threats by other companies and the market mechanism. Mergers were efforts to minimize the uncertainty, complexity, asymmetry and opportunism among other companies during the production and distribution process (Koedler, 1995). With this perspective, strategic partnerships, just like mergers, might be considered as a response to the market mechanism. When this is discussed from the perspective of resource dependence theory, it is stated that the uncertainty in reaching resources and ensuring continuity can be reduced and the continuation of the flow of resources can be ensured through alliances (Pfeffer & Salancik, 1978; Wisnieski & Dowling, 1997). Thus, companies are able to access resources, prevent their competitors getting stronger with the resources they have acquired and eliminate their shortcomings in being able to obtain resources (Mitchell & Singh, 1996).

Within the framework of resource dependence theory, it can be said that organizations are not autonomous within the scope of the relationships between organizations, and that as a result of the dependence between them, they have difficulties establishing the balance of power. As the basis for strategic collaborations is strategic needs and opportunities (Eisenhardt & Schoonhoven, 1996), dependence, uncertainty and balance of power relationships in connection with this, come into play within the framework of the transaction costs approach, in also the supplier – buyer relationship formed by the organizations which use the inputs and outputs of each other. The size of the organization has the potential to implement power over the other organization, with its potential for being / providing the resource (Oliver, 1990). It is important to mention that in the majority of customer–supplier / manufacturer- supplier relationships this asymmetric power distribution might arise. It is usually seen as the nature of the relationship. According to their exchange strategy each partner aims to satisfy their own specific objectives and to limit or manage their dependence on their suppliers (Fink et al., 2006).

In order to manage the customer- supplier / manufacturer- supplier partnerships it is essential to examine the operational processes in terms of a context of the contractual norms of behaviors (Fink et al., 2006), which regulate commercial exchange relationships (Kaufmann & Stern, 1988; Macedo & Pinho, 2006; Fink et al., 2006). The relational norms are defined as the unofficial mechanisms of governance which are supported by the trust between the partners (Fink et al., 2006). The associative norms between the manufacturer–supplier are in particular determined by dependence and uncertainty and encompass 6 dimensions (Fink et al. 2006). These are; (i) relational focus, (ii) restraint on power use, (iii) solidarity, (iv) role integrity, (v) mutuality, and (vi) flexibility. With the balancing of these dimensions within the framework of trust and requirements, the exchange continuum, in other words the long-term exchange relationships can be sustained.

Firm Performance

Organizational performance is an indicator which measures how an organization accomplishes its objectives (Ho, 2008). In order to increase organizational performance, firms use quantitative and qualitative criteria for measuring and evaluating organizational outcomes. In term of quantitative criteria, it is seen that they encompass generally; profitability, sales growth, productivity, cost efficiency, rate of new products and the number of new supply contracts (Awwad & Akroush, 2016:8).

According to Resource Dependence Theory, firms establish strategic collaborations in order to minimize their environmental dependence as well as uncertainty (Pfeffer & Salancik 1978) and focus on negotiating relationships of dependence (Johnson, 1995). Manufacturer–supplier relationships is an example of such relationship established within this framework and can be categorized into two major types: adversarial/transactional and collaborative partnership. The market exchange relationship is most likely the transactional type. It is generally characterized by short-term based contracts, in which each manufacturer purchases among many suppliers in order to create price competition among the suppliers (Petison & Johri, 2008).

When these relationships are managed properly, they can positively affect the financial performance of the firm. For this reason, nowadays developing enduring manufacturer– supplier relationships are now considered the most preferred style of relationship for manufacturer’s ability to gain competitive advantage (Petison & Johri, 2008:76). Strategic partnerships have been associated with significantly reduced costs, faster time-to-market, increased productivity, and enhanced product quality (Fink et al. 2006).

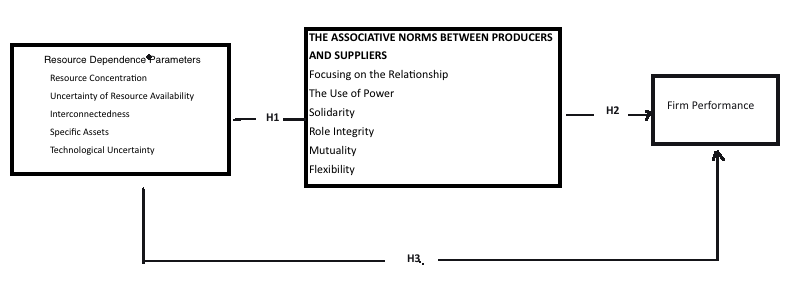

In the light of the literature, the following hypotheses are listed below:

H 1 : Resource dependency parameters have a statistically significant impact on relational norms between producer-supplier.H 2 : The relational norms between producer-supplier have a statistically significant impact on the firm performanceH 3 : Resource dependence parameters have a statistically significant impact on firm performance.

Research Method

Sample and Data Collection

The survey of this study was conducted on 314 managers of companies operating in different sub-sectors of the manufacturing industry in Turkey, between May - December 2017. The convenience sampling method was utilized in order to determine the sample for the study. The data was obtained from different business organizations in the different cities of Turkey, in person or by e-mail.

Analyses

Following the questions concerning the details of the organization, in the first section of the survey, the five dimensions of resource dependence (resource concentration, the uncertainty of resource availability, restrictions in the use of power, technological uncertainty and interconnectedness – 17 items) and the six dimensions of relational norms (Role integrity, solidarity, focus on relationships, specific assets, mutuality and flexibility – 23 items) prepared by Fink et al. (2006) were utilized in the second section. The eight statements of Ablulkareem Awwad (2016) were used in order to measure the firm performance. Overall, 48 items with 5 Likert-type scales were used to measure the variables. The Cronbach Alpha values for each of the factors exceed 0.70, which indicates the reliability of the scales used in the survey. Following the exploratory and confirmatory factor analyses in the study, the hypotheses were tested with the support of the structural Equation Modelling technique.

Findings

Factor Analysis- Validity and Reliability

In order to research whether the observed variables were theoretically loaded or not in factor structure, exploratory factor analysis was done by using Principal Component Analysis and Promax rotation method. Kaiser-Meyer-Olkin (KMO) sample adequacy test and Bartlett sphericity tests were applied to test the suitability of the data set for factor analysis. As a result of the analyses, it was found that the BMO value was 0.79 and above the desired level of 0.50 and the Bartlett test was significant at the significance level of 0.001. In addition, the diagonal values in the ‘’ anti-image correlation ‘’ matrix are examined and it is seen that these values are over 0.5 as it should be. Accordingly, it has been found that sample data is suitable for factor analysis (Hair, Black, Babin, & Anderson, 2010). In the exploratory factor analysis, the factor loadings and the lower limit of the ‘’Communality’’ values are accepted as 0.5. Variables that do not provide these values or do not load them into the theoretical predicted factor have been removed from the scale so as not to disturb the factor structure. The relevant factor structure is presented in the table below. The total variance of factors was 71%. The Cronbach’s Alpha value was used calculate the internal consistency of the factors. The Cronbach’s Alpha value of each factor was above 0.7. Confirmatory factor analysis was performed using the Maximum Likelihood estimation method to validate the results of the KFA and to analysis the validity and reliability of the research scales. In addition, the modification indices were examined and error values with high modification value of the factor are explored (Table

Since all factor loads are statistically significant in terms of the predicted factor (Bagozzi, Yi, & Lynn, 1991) and the factor loadings on the basis of structure averages are higher than 0.7, (Hair et al, 2010) the convergent validity and goodness-of-Fit indices are in a good level. For this reason, unidimensionality holds (Anderson & Gerbing 1988). Average Variance Extracted (Fornell & Larcker, 1981) and Scale Composite Relability) (Bagozzi & Yi 1988) values were used to test the validity and reliability of the factor structures. İt is possible to say that the validity and reliability of the relevant factor is provided when the AVE value is 0,5 and the CR value is over 0,7 (Bagozzi & Yi, 1988). The AVE and SCR values of the research factors are shown in Table

Average Variance Extracted (Fornell & Larcker 1981) and Scale Composite Relability (Bagozzi & Yi, 1988) values were used to test the validity and reliability of the factor structures. İt is possible to say that the validity and reliability of the relevant factor is provided when the ave value is 0,5 and the CR value is over 0,7 (Bagozzi & Yi, 1988). The AVE and SCR values of the research factors are shown in Table

Discriminant validity is shown in Table

The square root of the AVE value of the relevant variable is shown on the diagonal. As a result of the analysis, the validity and reliability of the factors was found to be desired level.

Research Model and Hypothesis Testing

Testing Hypotheses Based on Direct Effects

The hypotheses related to the study model were tested with the support of the Structural Equation Modelling technique. The research hypothesis that examines the relationship between Resource Dependency Parameters and Producer-Supplier solidarity and the results of the structural equation modelling for testing the hypothesis are shown in the table below.

The research hypothesis that examines the relationship between Producer-Supplier and firm performance and the relationship between Resource dependence parameters and firm performance and the results of the structural equation modelling for testing the hypothesis are shown in the table below. According to Table

According to the results of the structural equation model, solidarity from producer-supplier relational norms (;0,414, p<0,001), mutuality (;0,414, p<0,001), and relational focus variables (;0,414, p<0,001) that meaningly influence the firm performance.

Accordingly, H2 is relatively supported. Similarly, it has been observed that asset specificity of resource dependency parameters meaningly influences the mutuality. Accordingly, H3is relatively supported. Resource dependence parameters and the relational norms between producer and supplier explain 38% of the variance in firm performance. The goodness- of- fit indexes are X2 / dF = 1,652, GFI = 0,875, TLI = 0,907, CFI = 0,923, PNFI = 0,688, RMSEA = 0,046 for the Structural Equation Modeling.

Conclusion and Discussions

This study, which focuses on the relationship between the resource dependence parameters of business organizations and the relational norms between producers and suppliers and firm performance, has reached the following findings:

The resource concentration of business organizations influences the mutuality between producers and suppliers;

The uncertainty of resource availability influences the restriction on the use of power and the focus on the relationship between producers and suppliers;

The specific resources of business organizations influence the solidarity, the focus on the relationship, the mutuality and the role integrity between producers and suppliers;

The interconnectedness of the business organizations influences the restrictions on the use of power and the role integrity between producers and suppliers;

The technological uncertainty influences the solidarity, the restriction on the use of power and the role integrity between producers and suppliers.

The findings are similar to those of Fink et al. (2006). In addition to this, according to the findings, it can be seen that specific assets, from among the parameters of resource dependence, had more influence on the relational norms between producer and supplier, when compared to the other parameters.

Managerial and Further Research Implications

This study contributes to RDT body of knowledge from academic and practical perspectives. Academically, it enhances dependence theory-related researches that are currently very scarce. The results of the study emphasize the importance of developing rare and difficult to copy resources and skills. Thus, the companies which develop specific assets at the general and operational level will be able to increase company performance. It has been also revealed that, in the sectors where technologic uncertainty is dominant, company performance can be strengthened with the impact of the win-win strategy of the strengthening of the relationships between companies.

Several questions such as which scare resources Turkish companies have, which mechanisms they use to overcome these limitations as well as whether they develop specific strategic responses or not still exist as the problematics that need to be examined and explained.

References

- Anderson, S. W. & Dekker, Henri C. (2005). Management control for market transactions: The relation between transaction characteristics, incomplete contract design, and subsequent performance. Management Science, 51 (12), 1734-1752.

- Awwad, A. & Akroush, M. N. (2016). New product development performance success measures: an exploratory research. EuroMed Journal of Business, 11 (1), 2-29.

- Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the academy of marketing science, 16 (1), 74-94.

- Bagozzi, R. P., Yi, Y., & Phillips, L. W. (1991). Assessing construct validity in organizational research. Administrative science quarterly, 421-458.

- Blau P. M. (1964). Exchange and power in social life. New York: John Wiley And Sons., Retrieved October 26, 2018, from https://Academic.Oup.Com/Sf/Article-Abstract/44/1/128/2227895/Exchange-And-Power-In-Social-Life-By-Peter-M-Blau?Redirectedfrom=Pdf

- Bunduchi, R. (2005). Business relationship in internet-based electronic markets: The Role of Goodwill Trust and Transaction Costs, Information Systems Journal, 15 (4), 321-341.

- Delke, V. F. (2015). The Resource Dependence Theory: Assessment and evaluation as a contributing theory for supply management. Unpublished Bachelor's Thesis, University of Twente.

- DiMaggio, P. & Powell, W. W. (1983). The Iron Cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48, 147-160.

- Eisenhardt, K. M. & Schoonhoven, C. B. (1996). Resource-based view of strategic alliance formation: Strategic and social effects in entrepreneurial firms. Organization Science, 7 (2), 136-150.

- Emerson R. M. (1962). Power-dependence relations. American Sociological Review, 27 (2), 31-41, Retrieved October 29, 2018, from http://www.Jstor.Org/Stable/I336406

- Fink, R. C., Edelman, L. F., Hatten, K. J., & James, W. L. (2006). Transaction cost economics, Resource Dependence Theory, and customer–supplier relationships. Industrial and Corporate Change, 15 (3), 497-529.

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18: 39–51.

- Hair, J. F. J., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate Data Analysis (7th ed). Prentice Hall.

- Harris, H. & Holden, L. (2001). Between autonomy and control: Expatriate managers and strategic IHRM in SMEs. Thunderbird International Business Review, 43, 77-101.

- Hillman, A. J., Withers, M. C., & Collins, B. J. (2009). Resource Dependence Theory: A review. Journal of Management 35 (6), 1404-1427.

- Ho, L.A. (2008). What affects organizational performance? The linking of learning and knowledge management. Industrial Management & Data Systems, 108 (9), 1234-1254.

- Hu, L. T., & Bentler, P. M. (1999). Cut off criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural equation modeling: a multidisciplinary journal, 6 (1), 1-55.

- Ivens, S. B., Blois. J. K. (2004). Relational exchange norms in marketing: A critical review of Macneil’s contribution. Marketing Theory, 4 (3), 239-263.

- Johnson, B. L. (1995). Resource Dependency Theory: A political economy of organizations. New York: Holt.

- Katila R., Rosenberger J. & Eisenhardt K. (2008). Swimming with sharks: Technology ventures, defense mechanisms and corporate relationships. Administrative Science Quarterly, 53, 295-332.

- Kaufmann, P. J. & Stern, L. W. (1988). Relational exchange norms, perceptions of unfairness, and retained hostility in commercial litigation. Journal of Conflict Resolution, 32 (3), 534-552.

- Koedler, J. T. (1995). Transaction Cost Theories of business entreprise from Williamson and Veblen: Convergence, divergence, and some evidence. Journal of Economic İssues, 24 (2), 385-395.

- Künter, N. & Gürkol, Ö. (2016). Simbiyotik ilişki: Kaynak bağımlılığı ve örgütsel ekoloji perspektifi. 24. Ulusal Yönetim ve Organizasyon Kongresi, Sabancı Üniversitesi Kampüsü, İstanbul. Retrieved October 26, 2018, from http://yonorg2016.sabanciuniv.edu/

- Lin, J. (2006). An analysis of strategic alliance formation from resource-based view. Seminar in Business Strategy and International Business, 10-12 May, Helsinki, 1-22.

- Macedo, I. M. & Pinho, J. C. (2006), The relationship between resource dependence and market orientation: The specific case of non-profit organizations. European Journal of Marketing, 40 (5/6), 533-553.

- Madhok, A. & Tallman, S. B. (1998). Resources, transactions and rents: Managing value in interfirm collaborative relationships. Organization Science, 9, 326-339.

- Mitchell, W. & Singh, K. (1996). Survival of businesses using collaborative relationships to commercialize complex goods Strategic Management Journal, 17 (3), 169–196.

- Mintzberg, H, (2003). The strategy process: Concepts, contexts, cases. Upper Saddle River, NJ: Prentice Hall.

- Oliver, C. (1990). Determinants of interorganizational relationships: Integration and future directions. The Academy of Management Review, 15 (2), 241-265.

- Petison, P & Johri, L. M. (2008). Dynamics of the manufacturer-supplier relationships in emerging markets, Asia Pacific Journal of Marketing and Logistics, 20 (1), 76-96.

- Pfeffer, J. (1972). Merger as a response to organizational interdependence. Administrative Science Quarterly, 17, 382-394.

- Pfeffer J. (2005). Developing Resource Dependence Theory: How theory is affected by its environment. In K.G. Smith & M. A Hitt (Eds.), Great minds in management: the process of theory development (436-459). Newyork: Oxford University Press.

- Pfeffer, J, & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. Ny: Harper and Row

- Pfeffer, J., & Salancik, G. R. (2003). The external control of organizations: A resource dependence perspective. Stanford University Press.

- Salam, A. M., Ali, M. & Seny Kan, K.O. (2017). Analyzing supply chain uncertainty to deliver sustainable operational performance: Symmetrical and Asymmetrical Modeling approaches. Sustainability, 9 (2217), 1-17.

- Sambharya, R. B. & Kunal Banerji (2006). The effect of Keiretsu Affiliation and resource dependencies on supplier firm performance in The Japanese aotomobile industry. Management International Review, 46 (1), 7-37.

- Schumacker, R. E., & Lomax, R. G. (2012). A Beginner's guide to structural equation modeling. Routledge.

- Werner, N. (2008). Resource Dependence Theory: How well does it explain behavior of organizations? Management Revue, 19 (1-2). Retrieved October 29, 2018, from https://www.Uni-Due.De/Apo/Download/Mrev_1+2_2008_Nienhueser.Pdf

- Williamson, O. E. (1981). The economics of organization: The Transaction Cost Approach. American Journal of Sociology, 87 (3), 548–577.

- Williamson, O. E. (1991). Comparative economic organization: The Analysis of discrete structural alternatives. Administrative Science Quarterly (36), 269-296.

- Wisnieski J. M., & Dowling M. J. (1997). Strategic alliances in new ventures: Does governance structure affect new venture performance? In Frontiers of Entrepreneurship Research. Wellesley, MA: Bobson College. Retrieved October 30, 2018, from http://www.babson.edu/entrep/fer/papers97/wisniesk/wisni2.htm.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 January 2019

Article Doi

eBook ISBN

978-1-80296-053-2

Publisher

Future Academy

Volume

54

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-884

Subjects

Business, Innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Zehir, C., Findikli, M. A., & Çeltekligil, K. (2019). Resource Dependence Theory, Firm Performance And Producers-Suppliers Relationships. In M. Özşahin, & T. Hıdırlar (Eds.), New Challenges in Leadership and Technology Management, vol 54. European Proceedings of Social and Behavioural Sciences (pp. 160-172). Future Academy. https://doi.org/10.15405/epsbs.2019.01.02.14