Abstract

Low efficiency of state regulation becomes evident in expanding the range of addictive goods, an increase of negative effects of their consumption, institutionalization of shadow activity. The aim of the research is study of the impact of major determinants of supply and demand, consideration of which is important in designing of forms, methods and instruments of state regulation. The work is based on scientific methods of economic research: analysis and synthesis, induction and deduction, analogy, comparison, statistical, a model of an economic person. In markets of addictive goods, the increase of the number of buyers is limited in artificial and natural ways. A significant determinant of legal offers of addictive goods is the price in which more than 75% belongs to the state in the form of excise duty. Consumers carry excise burden as well. Between its change and the shadow activity, there is a direct dependence. The efficiency of the institutional power of the state is about 45 %. The state should differentially apply the methods and means of reducing demand in respect of consumers with different degrees of dependence. Interchangeability of addictive goods should be used to replace more harmful products with less harmful ones. We need to reorient a fiscal goal of the excise tax to compensatory and regulatory one. The time from the moment of origin of new drugs to their prohibition should be reduced.

Keywords: Addictive goods; determinants of demand and supplygovernment regulationinstitutional strength

Introduction

Expansion of the range of addictive goods, the growth of negative individual and social effects of their consumption, the institutionalization of shadow activities indicate a lack of efficiency of government regulation of supply and demand for addictive goods.

In order to solve the problems of government regulation of production, turnover, retail sale and consumption of addictive goods, it is necessary to take into account the peculiarities of formation of demand and supply in their markets, including elasticity of supply and demand, price affordability, non-price determinants of supply and demand, distribution of tax burden between producers and consumers, illegal trade, decline in income, etc.

Determinants of demand and government regulation

In practice, the main conclusion concerning economic studies of demand for basic addictive goods is demonstration of an inverse relationship between their acquisition and price growth. These studies involved a number of scientists: Andrienko and Nemtsov (2005), R. Kendell, M. de Roumanie and E. Ritson, K. Clements and E. Selvanathan, K. Quek, M. Salo, P. Cook and G. Tauchen, S. Ornstein and D. Hanssens, G. Becker and K. Murphy, F. Chaloupka and H. Saffer, E. Lewit and D. Coate, J. Caulkins, A. Bretteville-Jensen and M. Sutton, J. van Ours, J.T. Liu, J.L. Liu and S.Y. Chou.

Table

The operation of the law of demand for all types of alcoholic products is limited, as in many cases there is a direct relationship between their price and consumption. Demand is more often elastic. However, the levels of demand sensitivity to price changes differ according to types of alcoholic products. So the demand for wine, cognac and beer is more elastic than for vodka, liquors and spirits. The elasticity of demand for illegal vodka, liquors and spirits is noticeably higher than for legal products. The reason for this may lie in greater sensitivity of low-income population groups, who prevail in this segment, to price changes.

The contradictory nature of the obtained results confirms that the hypothesis of the inelasticity of consumption of addictive goods can be applied only to a group of totally addicted consumers (Sokolov, 2013).

Thus, the state increasing excise rates cannot always expect the growth of budget revenues or reduction of consumption and negative consequences, since aggregate demand may not change and the demand for legal products may decrease due to reorientation towards the illegal sector.

Let us consider the specificity of influence of non-price determinants of market demand on purchase of addictive goods.

1. Consumer income. Table

If you exclude from a monthly income expenses included in a living wage, it turns out that addictive goods are unavailable for 12-20% of the population. This low-income group of the population accounts for a significant proportion of consumption of addictive goods, as a rule, illegally produced or surrogates. Therefore, non-availability of legal alcoholic products because of administrative reasons or high prices leads to mass poisonings of low income consumers by alcohol surrogates, as it was in 2006 and 2016.

In the classical theory rational consumers experience budget constraints optimally choosing the combination of quantity and price of a good. An addictive consumer, when he loses the opportunity to increase his income by whatever legal means, resorts to criminal sources which are of special economic interest.

A pair of income-price determinants characterizes together price affordability of addictive goods. Table

Strong alcoholic beverages are less available in Russia than in many developed countries, including countries with similar consumption patterns (Room, 1993); however, the level of their consumption is higher.

2. Number and composition of customers. In the markets of addictive goods, the increase in the number of buyers is artificially and naturally limited. Artificial barriers are established by the government and public institutions. A natural way is related to objective reasons for the withdrawal of consumers from the market due to poisoning, overdose, suicides, death in criminal showdowns, entering prison, etc. The increase in the number of buyers as in the markets of ordinary goods is a challenge here too. For that reason, sellers use aggressive marketing (Ponomareva, 2009). The most vulnerable groups of the population are children, youth and women.

3. Prices for related products. Addictive goods are interchangeable and complementary. Will a change in the price of a related interchangeable good lead to an increase or a decrease in demand for the good depends on at what stage of painful addiction the consumer is?

4. Consumer preferences. In modern society, consumer tastes are significantly influenced by advertising, fashion. To suppress their stimulating effect on consumption of addictive goods, the government tightens administrative restrictions and bans on their advertising. Hereditary and other innate preferences play an important role in addictive behavior (Levin & Fenko, 2008) and deserve attention in the analysis of decision making.

5. Past consumption and expectations. Such factors of consumer expectations as future prices for goods, availability of goods and future consumer income are considered in the traditional economic theory and are able to change current demand should be expanded by the determinants of past consumption and future consequences of consumption in the markets of addictive goods. These determinants follow from the BGM model of a theory of rational addiction of Becker, Grossman, and Murphy (1994).

Determinants of supply and government regulation

Government regulation is the most significant determinant of the supply of an addictive good, since it may actively or passively influence virtually any of supply factors forcing the supply curve to shift.

In the markets of addictive goods, the price being the determinant of the offer serves as a direct indicator of economic interest not so much of an entrepreneur as in the markets of ordinary goods, but of a government that possesses a significant component in the price in the form of an excise (Skokov, 2014). The approach of formation of the price of goods in accordance with the two principles - marginal utility and production costs developed in the neoclassical theory is proposed to expand by the third principle – compensation and regulation of external costs for addictive goods.

In 2017 in the structure of a minimum selling price of a vodka producer (165 rubles per 0.5 liters), the share of indirect taxes (excise and VAT) is estimated to be about 76% (125 rubles), prime cost – about 18% (30 rubles), profit – about 6% (10 rubles). Therefore, the entire tax burden is automatically shifted onto the consumer's shoulders.

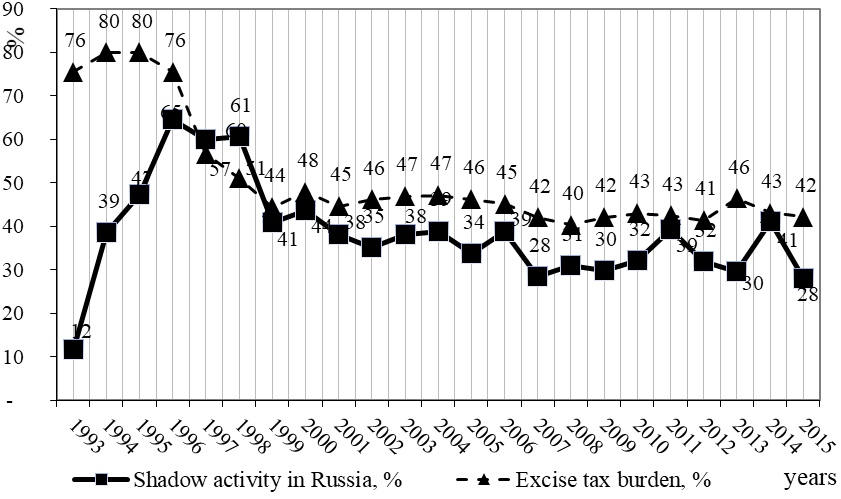

Figure

Throughout fourteen out of twenty-three years, there is a direct link between excise tax burden and hidden activity.

According to the studies based on the theory of A. Laffer, there will be a fall in tax revenues at a rate above t = 0.368 (Economics, 2003). In the last five years (2011-2015), excise tax burden has been on average 0.432.

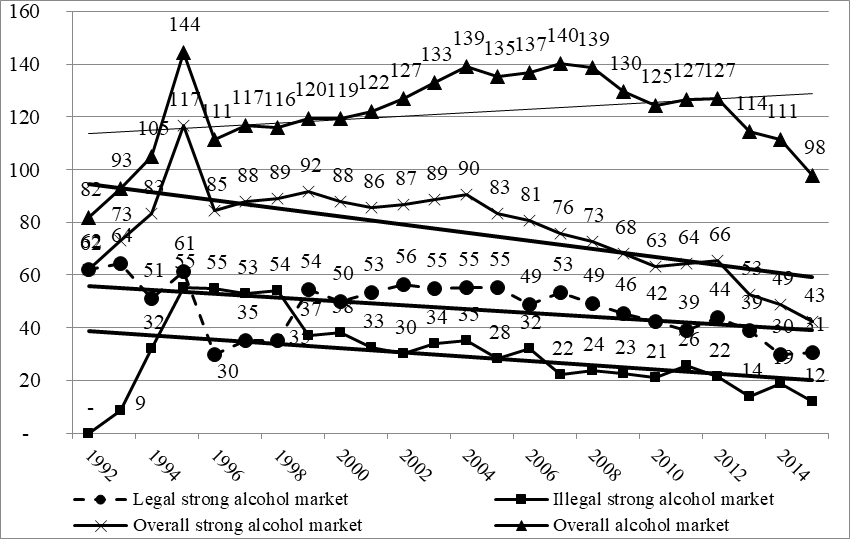

Figure

Consumption of strong alcoholic beverages consists of legally and illegally produced products. In 2011-2015 the average level of informal activity equaled 33% of strong alcoholic beverages consumption. In general from 1992 to 2015, strong alcoholic beverages consumption is reducing because of contraction of both legal and illegal markets. However, from 1992 to 2015, the overall alcoholic beverages consumption is increasing due to other types of alcohol products. The analysis of the changes in legal and illegal markets of strong alcohol products has shown that sixteen years out of twenty-three there is an inverse relationship between legal and illegal markets of strong alcohol products.

The indicator of institutional power of the government is an effective excise tax rate on strong alcohol products. The table

The calculation of the effective excise tax rate on strong alcohol products (EERab) is carried out according to the formula:

where GIF - gross excise revenue from strong alcohol products, RUB; RS – retail sale of alcohol products, l; сaa – absolute alcohol conversion rate.

From 1998 to 2015, the effective excise tax rate, i.e. which a consumer is able to pay, was on average 2.3 times lower than the current rate. Consequently, the government allows shadow structures to control more than 50% of the strong alcohol products market.

The position of the addictive goods supply curve undergoes changes under the influence of non-price determinants.

1. Prices for resources. There is a close relationship between production costs and supply in the markets of indifferent goods.

Prices for resources are determined by natural and climatic and soil conditions. The most important factor in the growth of opium poppy in Afghanistan, which according to the UN Office on Drugs and Crime accounts for more than 90% of opium entering the world market, is the extremely dry climate, the lack of irrigation for legal types of agriculture. The regions which are favorable for cultivation of grapes develops wine industry.

2. Technologies. The development of new technologies for the production of addictive goods allows one not only to produce products with lower costs, but also to bring new goods that the government has not yet added to the list of banned items in the market. So, energy drinks, caffeine inhalers, electronic cigarettes, alcohol sprays, smoking mixtures, etc. emerged. Therefore, we can talk about a direct relationship between the development of technologies and the change in supply.

3. Taxes. On the one hand, indirect taxes influence reduction in demand and as a consequence in supply of addictive goods; on the other hand, opportunities to evade and avoid them allow businesses to receive excess profit and, accordingly, to increase supply.

4. Expectations. Producers` expectations in the addictive goods markets are related with the annual indexation of excises and price increases, the introduction of new restrictive measures. The expected increase in excise rates is reflected in the increase in output at old rates, as a rule, accumulated in warehouses. Therefore, after the introduction of a new rate there is a decline in production for some time. Institutional instability in the addictive goods markets with sufficiently large amplitude of fluctuations complicates a long-term business development (Zhuk & Kizilova, 2014).

5. Number of sellers. The more the number of addictive goods suppliers, the greater the supply of addictive goods. This factor has the same impact on supply in both legal and shadow markets.

Problem Statement

Low efficiency of state regulation becomes evident in expanding the range of addictive goods, an increase of negative effects of their consumption, the institutionalization of shadow activity.

Research Questions

The study answers the following questions: determinants of demand and government regulation; determinants of supply and government regulation.

Purpose of the Study

The aim of the research is the study of the impact of major determinants of supply and demand, consideration of which is important in the designing of forms, methods and instruments of state regulation.

Research Methods

The work is based on scientific methods of economic research: analysis and synthesis, induction and deduction, analogy, comparison, statistical, model of economic person.

Findings

Insights for the practice of state regulation increase of the excise rate does not always lead to higher revenues and it is not able to reduce consumption, because it can be supplied with the expansion of the illegal sector. The state should differentially apply the methods and means of reducing of demand in respect of consumers with different degrees of dependence. Restriction of the supply of legal addictive goods can lead to an increase in criminal activities, mass poisoning with surrogate. Interchangeability of addictive goods should be used to replace more harmful products with less harmful ones. We need to reorient fiscal goal of the excise tax to compensatory and regulatory one. The time from the moment of origin of new drugs to their prohibition should be reduced.

Conclusion

The conducted research has shown that the change in standard price and non-price determinants has a specific effect on supply and demand of addictive goods in comparison with the conclusions of the traditional economic theory regarding ordinary goods that is to be taken into account in the practice of government regulation.

Acknowledgments

I am grateful to my supervisor, doctor of Economics, Professor Oleg V. Inshakov for invaluable assistance in the preparation of the study (30.06.1952-06.01.2018).

References

- Andrienko, Yu.V., Nemtsov, A.V. (2005). Estimation of individual demand for alcohol. Retrieved from: http://trezvenie.org/files/books/ocenka.pdf.

- Average salaries in Europe (2013). Retrieved from: http://btimes.ru/job/srednie-zarplaty-v-evrope.

- Becker, G. S., Grossman, M., Murphy, K.M. (1994). An empirical analysis of cigarette addiction. American Economic Review, 84. 396-418.

- Economics: textbook (2003). M. Economist.

- Levin, M. I., Fenko, A. B. (2008). The Economic models of addictive behaviour. Retrieved from: finbiz.spb.ru›download/4_2008_levin.pdf.

- Ponomareva, M. S. (2009). Alcohol abuse among young people: economic evaluation: the master's thesis.

- Room, R. (1993). The evolution of alcohol monopolies and their relevance for public health. Retrieved from: http://www.robinroom.net/evolutio.htm#N_1_

- Skokov, R. Y. (2014). Institutional development of addictive goods markets in modern Russia: monograph. Retrieved from: http://www.volgau.com/Portals/0/common/15/151023/skokov_ryu_monografiya_16032015.pdf?ver=2015-10-23-135625-650 date of access: 04.02.2017.

- Sokolov, I. A. (2013). Research of the excise tax burden on certain categories of alcohol products (wine, beer, strong alcohol) in different countries of the world. Retrieved from: www.docme.ru/doc/664777/polnaya-versiya---institut-e-konomicheskoj-politiki-imeni-e.t.

- Zhuk, A. A., Kizilova, E. A. (2014). Mechanisms of state regulation of the alcohol market in the countries of the Eurasian region. Retrieved from http://cyberleninka.ru/article/n/mehanizmy-gosudarstvennogo-regulirovaniya-rynka-alkogolnoy-produktsii-v-stranah-evraziyskogo-metaregona.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Skokov, R. Y. (2018). State Regulation And Determinants Of Demand And Supply Of Addictive Goods. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 1106-1114). Future Academy. https://doi.org/10.15405/epsbs.2018.12.135