Abstract

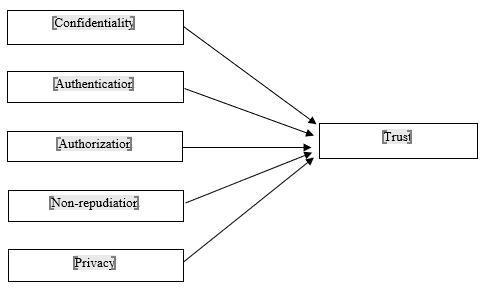

Financial Technology (FinTech) is the new technology and innovation in the delivery of financial services. The emergence of FinTech provides different benefits financial consumers and financial companies. For a consumer, FinTech carry weight in a way of global and online transaction, speedier transaction processing, among others. However, studies has shown that consumer trust is still low. Hence, this paper aims to investigate the impact of five variables, namely confidentiality, authentication, authorization, non-repudiation and privacy on consumer trust in the adoption of FinTech in online banking service. The research was an empirical investigation based on surveys completed by 200 students from higher educations in Muadzam Shah, Pahang. Using regression analysis, the paper found that confidentiality, authentication and privacy were found to be positively and significantly related to consumer trust. On the other hand, authorization was found to be negatively and significantly related to the consumer trust. Non-repudiation was found to have positive and insignificant relation to consumer trust. Hence, from this study its shows the importance of security mechanisms in building users perception of security. The study provides a deeper understanding into the impact of perceived security on consumer trust in the adoption of Fintech in online banking service.

Keywords: Trustconfidentialityauthenticationauthorizationnon-repudiationprivacy

Introduction

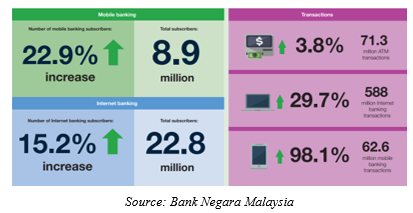

Financial Technology (FinTech) is the new technology and innovation in the delivery of financial services. Malaysian banking sector has greater internationalisation of the financial system as well as technological advancements. The objective of FinTech with a wider range of banking transactions is to deliver financial services saw a significant take-up. It was conducted increasingly through digital channels and self-service terminals for instance online banking, mobile banking and applications. By using smartphones for investing services and mobile banking, general public were more accessible to the financial services.

Furthermore, banking institutions also increasingly used artificial intelligence to support customer relationships as well as improve access to financial products. Communication technology continued to gain traction in the payments space and contactless payments. On the other hand, the compliance risks for banking institutions will be lower, and was remain challenging in efficiency gains. Mobile Automated Teller Machines (ATMs) and virtual teller machines would be key initiatives for rural communities for greater access to banking services.

According to a report presented by PricewaterhouseCoopers (2016), the acceptance of FinTech is increasing whereby 60% of financial companies’ clients will use mobile application within the next five years. Due to the high acceptance possibilities, six commercial banks in Malaysia, namely Maybank, RHB Bank, CIMB Bank, Ambank, Hong Leong Bank and Public Bank have been engage in joint partnership with FinTech companies.

Figure

Trust

Trust is the establishment of trade by crossing over any barrier between the client’s instabilities with respect to the administrations and their genuine cooperation in the exercises (Suh and Han, 2003). It assumes a pivotal part in the improvement of human related exercises crosswise over most enterprises including the managing an account industry (Grabner-Krautera and Kaluscha, 2003; Yousafzai et. al., 2005). Yu Hui Chen and Stuart Barner (2007), claims that online buyers build up their underlying trust and buy aims. It is discovered that apparent helpfulness, saw security, protection, great notoriety, and readiness to modify the imperative forerunners on consumer trust in online.

Confidentiality

Confidentiality is one of the innovation trust instruments to the insurance exchanges by mean of web administrations against unapproved perusing, duplicating or exposure utilizing encryption components (Ratnasingam, 2002). Henceforth confidentiality ought to be emphatically effect to saw security. This guarantees the correspondence between the client and the specialist organization closed to different gatherings (Suh and Han, 2003). Unapproved access of data ought to be avoided (Knorr and Röhrig, 2000). It’s should incorporate confidentiality of data that is disregarded the system within correspondence (Maijala, 2004).

Authentication

Authentication component give an exchange nature of being legitimate, substantial, genuine, real and deserving of acknowledgment or conviction by reason of adjustment to the way that the truth is available in web administrations (Ratnasingam, 2002). Consequently authentication must be decided effect to saw security. Claessens

Authorization

Authorization instrument is to ensure that customers are getting the privilege data as well as control the data (Maijala, 2004). This likewise incorporate assuring that customers of online banking application having the authorization to ask for the framework. Thus, authorization should be decided one of the factors affecting the security in online banking service.

Non-repudiation

Non-repudiation system secure suppliers, requesters and agents in web administration by mean of affirmation methodology. Henceforth, non-repudiation have to be emphatically effect to saw security. The purpose is to guarantee the gathering engaged with an exchange, sending data or getting data that cannot deny it in specific time period (Maijala, 2004).

Privacy

Privacy has been incorporated by many components of the security goals (Mukherjee and Nath, 2003; Nilsson et al., 2005; Patton, 2004). From a customers’ point of view, security and protection may not be detached ideas as a rule (Suh and Han, 2003). Protection is characterized as the need to ensure that the customers’ data is not available to unapproved customers and is not abused. Thus, privacy should be the factor that give an impact towards consumer trust to saw security.

Problem Statement

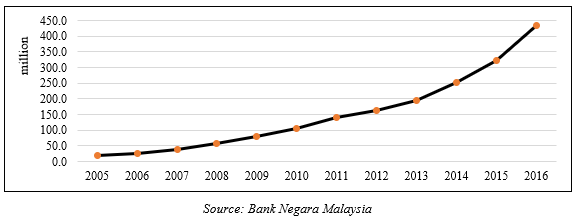

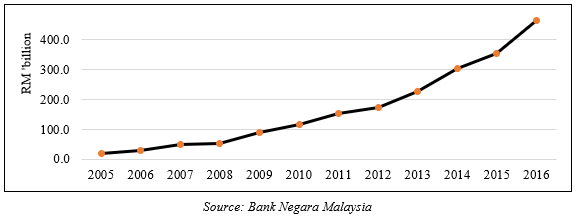

FinTech allows consumers to access the banking services without physical direct recourse to the bank premise. For instance, ATMs are widely used in rural and semi-urban areas. FinTech practise has been described as virtual banking. Thus, many banks were realized that more consumers like to do banking electronically. On the other hand, banks have implemented several important online banking applications that were benefited to consumers such as to pay bills, money transfer, check account history and download statement information.

Furthermore, perceived security is the key concerns on consumer trust in the adoption of online banking. However, consumer trust is extremely vital due to the lack of physical manifestation. Some of them are not feel comfortable to disclose personal information such as giving their bank account number; or doing transactions electronically such as to pay an invoice. It is because, consumers felt that transactions conducted through online banking were open to hackers and viruses, which are beyond their control. Other than that, consumers are lack of connectivity to the Internet due to financial constraints and lack of knowledge to use online banking.

Hence, consumer trust is recognized as the critical factor for the continued growth in the adoption of online banking. For the banks point of view, they need to understand the factors that influencing online consumers’ trust in online banking. This study will examine is there any impact of perceived security on consumer trust in the adoption of FinTech in online banking service.

Figure

Figure

Research Questions

Is there any impact of perceived security on consumer trust in the adoption of FinTech in online banking service?

Purpose of the Study

To examine the impact of perceived security on consumer trust in the adoption of FinTech in online banking service.

Research Methods

A survey questionnaire was designed to measure the conceptual framework. Each of the variables (e.g. confidentiality, authentication, authorization, non-repudiation and privacy on consumer trust in the adoption of FinTech in online banking service) was measured using multiple items. The samples were the student from two higher educations in Muadzam Shah, Pahang, Malaysia, namely Universiti Tenaga Nasional (UNITEN) and Politeknik Muadzam Shah. The samples were appropriate due to the facts that they are generation Y, that it is the most technically literate and technologically savvy generation. The convenience sampling method is used in this study. The researcher handed out the questionnaire if the student agreed to participate in the study. Originally, 300 questionnaires were distributed. However, only 200 returned questionnaires were used for the analysis for this study, providing a response rate of 66.67 percent.

Measure and questionnaire development

A survey questionnaire was designed to measure the conceptual framework. The questionnaire consists of 2 sections. Questions for Section A belongs to demographic profile such as gender, age, number of years of internet experience and number of years of online banking experience. On the other hand, section B consists of five point likert scale measurement questions ranging from strongly disagree (1) to strongly agree (5) to measure the impact of perceived security on consumer trust in the adoption of FinTech in online banking service. The construct of perceived security and consumer trust was measured with scales from Kritika Law (2007).

Conceptual framework of the study

Regression model

This study used multiple regression analysis to test the impacts of confidentiality, authentication, authorization, non-repudiation and privacy on consumer trust in the adoption of FinTech in online banking service. The regression models used in this study are as the following:

CT = α0 + β1(CON) + β2(AUT) + β3(AUZ) + β4(NP) + β5(PRI) + ε

Where:

CT = consumer trust; α = constant value; β = regression coefficient; CON = confidentiality; AUT = authentication; AUZ = authorization; NP = non-repudiation; PRI = privacy; and ε = residual term

Based on the preceding discussion, five hypotheses are developed:

H1: There is a positive and significant impact of confidentiality on consumer trust in the adoption of FinTech in online banking service

H2: There is a positive and significant impact of authentication on consumer trust in the adoption of FinTech in online banking service

H3: There is a positive and significant impact of authorization on consumer trust in the adoption of FinTech in online banking service

H4: There is a positive and significant impact of non-repudiation on consumer trust in the adoption of FinTech in online banking service

H5: There is a positive and significant impact of privacy on consumer trust in the adoption of FinTech in online banking service

Findings

Characteristics of the sample

Female made up 72% of the sample. For the entire sample, 83% of the respondents were age between 21 to 25 years old, while the remaining 17% age below 20 years old. About 40% having internet experience between 6 to 10 years, 33.5% having internet experience more than 10 years, 23.5% having internet experience between 1 to 5 years, while the remaining 3% having internet experience less than 1 year. For the entire sample, 51.5% having online banking experience between 1 to 3 years, 22% having online banking experience between 4 to 6 years, 21% having online banking experience between 4 to 6 years, while the remaining 5.5% having online banking experience more than 10 years. The descriptive statistics of the respondents are summarized in Table

Reliability analysis

Table

Regression analysis

Table

Adjusted R2 value for consumer trust is 0.941 indicating that 94.1 percent of the variation of determinants affecting consumer trust in the adoption of FinTech in online banking service from higher educations in Muadzam Shah, Pahang, could be explained by the five independent variables.

Conclusion

This research investigates the impacts of perceived security on consumer trust in the adoption of Fintech in online banking service. A total of 200 students from two higher educations in Muadzam Shah, Pahang, namely UNITEN and Politeknik Muadzam Shah, were used for the analysis for this study. Based on the findings, confidentiality, authentication and privacy were found to be positively and significantly related to consumer trust. On the other hand, authorization was found to be negatively and significantly related to the consumer trust. These results are consistent with the claimed by Law (2007); Sarrafiaghdam (2008); Chellappa and Pavlou (2002) and Al-Sharafi, et. al. (2016). Non-repudiation was found to have positive and insignificant relation to consumer trust. This result is consistent with the assertion by Law (2007).

Hence, from this study its shows the importance of security mechanisms in building users perception of security. The study provides evidence into the impact of perceived security on consumer trust in the adoption of Fintech in online banking service.

Limitations and future research

This study has several limitations. First, it focuses only on students from two higher educations in Muadzam Shah, Pahang; the results, therefore, cannot be generalised to the other states or citizens in Malaysia. Thus, there is a need to commence further studies in other states and will be used random sampling. Second, most of the respondents in the present study are youngsters, aged below 25. The study can be replicated in other age groups, particularly the middle-age users. In future, will be tested the other factors that may also influence of perceived security on consumer trust in the adoption of Fintech.

Acknowledgments

The authors would like to thank the anonymous reviewers who will give their extensive and thorough comments which had enormously helped us improved the quality of our paper. The perspectives and the positioning of our paper has certainly benefited from their valuable feedback and comments.

References

- Al-Sharafi, M., Arshah, R., Abu-Shanab, E., Fakhreldin, M., & Elayah, N. (2016). The Effect of Security and Privacy Perceptions on Customers’ Trust to Accept Internet Banking Services: An Extension of TAM. COMSCET 2016, 1-9.

- Chellappa, R. K., & Pavlou, P. A. (2002). Perceived Information Security, Financial Liability and Consumer Trust in Electronic Commerce Transactions. Logistics Information Management, 15(5/6), 358-368.

- Chen, Yu-Hui and Barnes, Stuart J. (2007). Initial Trust and Online Buyer Behaviour. Industrial Management and Data Systems, 107 (1), pp. 21-36.

- Claessens, J., Dem, V., De Cock, D., Preneel, B., & Vandewalle, J. (2002). On the Security of Today’s Online Electronic Banking Systems. Computers & Security, 21(3), 253-265.

- Cronbach, L.J. (1951). Coefficient Alpha and the Internal Structure of Tests. Psychometrika, Vol. 16, pp. 297-335.

- Grabner-Kräuter, S., & Kaluscha, E. A. (2003). Empirical Research in On-Line Trust: A Review and Critical Assessment. International Journal of Human-Computer Studies, 58(6), 783-812.

- Knorr, K., & Röhrig, S. (2000). Security of Electronic Business Applications: Structure and Quantification. International Conference on Electronic Commerce and Web Technologies, pp. 25-37. Springer, Berlin, Heidelberg.

- Law, K. (2007). Impact of Perceived Security on Consumer Trust in Online Banking. Doctoral dissertation, Auckland University of Technology.

- Maijala, V. (2004). Outlook of the Information Security in E-Business. Retrieved 11th.

- Mukherjee, A., & Nath, P. (2003). A Model of Trust in Online Relationship Banking. International Journal of Bank Marketing, 21(1), 5-15.

- Nilsson, M., Adams, A., & Herd, S. (2005). Building Security and Trust in Online Banking. CHI’05 Extended Abstracts on Human Factors in Computing Systems, pp. 1701-1704. ACM.

- Nunnally, J.C. (1978). Psychometric Theory. McGraw-Hill, New York, NY.

- Patton, M. A., & Jøsang, A. (2004). Technologies for Trust in Electronic Commerce. Electronic Commerce Research, 4(1-2), 9-21.

- PricewaterhouseCoopers. (2016). Customers in the Spotlight: How FinTech is Reshaping Banking. Retrieved from https://www.pwc.com/gx/en/financial-services/fintech/assets/fin-tech-banking-2016.pdf on 8 November 2017.

- Ratnasingam, P. (2002). The Importance of Technology Trust in Web Services Security. Information Management and Computer Security, Vol. 10 Issue: 5, pp.255-260.

- Sarrafiaghdam, A. (2008). Perceived Information Security and Consumer Trust in Electronic Commerce Transactions: A Survey of Internet Banking Adoption in Malaysia. Doctoral dissertation, University of Malaya.

- Suh, B., & Han, I. (2003). Effect of Trust on Customer Acceptance of Internet Banking. Electronic Commerce Research and Applications, 1(3), 247-263.

- Suh, B., & Han, I. (2003). The Impact of Customer Trust and Perception of Security Control on the Acceptance of Electronic Commerce. International Journal of Electronic Commerce, 7(3), 135-161.

- Yousafzai, S. Y., Pallister, J., & Foxall, G. R. (2005). Strategies for Building and Communicating Trust in Electronic Banking: A Field Experiment. Psychology & Marketing, 22(2), 181-201.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 July 2018

Article Doi

eBook ISBN

978-1-80296-043-3

Publisher

Future Academy

Volume

44

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-989

Subjects

Business, innovation, sustainability, environment, green business, environmental issues, industry, industrial studies

Cite this article as:

Ismail, N., Roslan, N. A., Fauzi, N. A. M., & Husin, M. M. (2018). Perceived Security And Consumer Trust In Adoption Of Fintech Service. In N. Nadiah Ahmad, N. Raida Abd Rahman, E. Esa, F. Hanim Abdul Rauf, & W. Farhah (Eds.), Interdisciplinary Sustainability Perspectives: Engaging Enviromental, Cultural, Economic and Social Concerns, vol 44. European Proceedings of Social and Behavioural Sciences (pp. 650-659). Future Academy. https://doi.org/10.15405/epsbs.2018.07.02.70