Abstract

It has become a common phenomenon in these days; a lot of Bangladeshi people are relaying on using online banking services and it has gained much credibility. For capturing market, focusing and attracting the potential clients and keeping prevailing clients, there are many initiatives are being taken by many financial and banking organizations. As the electronic banking customers heavily rely on internet base banking services that influence the banking policy makers to take more electronic banking services promoting initiative for current and potential customers in competitive banking market in Bangladesh. There is no significant research oriented work has not been yet, in Bangladesh though clients reliance and customer confident in online services are integrated part of internet banking. The statistical evidence may play an identical implication for retaining customer’s trust on electronic banking services in Bangladesh. A total of 250 respondents have been chosen from different government-owned and public banks following convenient sampling technique. While exploratory analysis has been used to fit the right items for each construct, structural modeling technique has been applied to assess the relationship between and among the constructs. From this revision it is observed that online services in the commercial banking sectors in Bangladesh have an impact towards loyalty of the customers. The research findings will be useful to the commercial banks of Bangladesh. Clients, bankers, managers, researchers, academicians will definitely be benefited from the present study.

Keywords: Commercial online bankswebsite designtrusthabitassurancereputation

Introduction

Online banking administers a client’s deposited money by means of a protected site which includes the utilization of the Internet as a remote conveyance channel? Banks offer Internet banking in two principle ways - either by physical workplaces or by "virtual," or "branchless," online banking. A severer is a core component of entire e-banking service mechanism and for installing such valuable source of information a legalized place is essential. With the help of e-service facilities like online banking activities a customer can utilizes their time properly that means it is very much time saving ways to use ATM or any other facilitates methods through this time which they can save with help of technology advancement of banking sectors clients can easily use their saved time for another purposes (Furst et al., 2000). According to Daniel (1999), using a E-banking services a client can able to get much more information to do their regular activities for their day to day banking purposes which are more reliable and also effective for customers that allows the customers to get a viable supplement of traditional banking using the resourceful online banking eservices. Subsequently, the customers are saving ample amount of time instant of going a physical presence in any particular branches of a bank. In addition, online banking allows a user to get access in their portal on 24 hours a day 7 days in a week in any established online banking services. In present days, time has become more important issues than anything else so that customers always try to find the ways how they can save their valuable time. As they can use their precious time doing some other valuable work, therefore they find online banking much more reliable and convenient.

Problem Statement

Providing a decent service quality is a noteworthy issue for all business particularly to bank industry. Consumer satisfaction and faithfulness may decide the achievement or come up short of a business. In present situation companies need to be taken bolder move in competitive e-banking market to fulfill their targeted clients bar. In any case, couple of associations seem to win with respect to making e-loyalty, and little is contemplated the frameworks required in making customer faithfulness on the web (Ribbink et al., 2004). For online connectivity having a computer and internet connection much more costly comparing to complete a traditional banking transaction and also evident that in some cases customer fail to retain their patience (Reichheld & Schefter, 2000). In a fast growing commercial market maintaining the ability to build customer trust considered as a vital gain in the entire competitive industry (Lin &Wang, 2006).

Research Questions

The research questions paintings on an assumption that coordination talents and balance are an overall performance precondition to the customer loyalty of online commercial banks. We advised that higher individuals have better evolved coordination and stability.

Purpose of the Study

The essential goal of this examination is to research the level of clients' reliability to web banking site in Bangladesh. Taking after the investigation inquiries to be replied in this article, there are many objectives of the study have been focused such as literature review, analyzing the quality of banking services, evaluating the features that matters to customer’s loyalty towards online banking services which directly make a link to evaluate the impact variables that lead the interest of perceiving internet banking services and last one is to determine if there exists any relationship between measuring services and loyalty of customers online banking system in Bangladesh.

Literature Review and Hypotheses

Customer satisfaction continues to draw the consideration of investigators and experts in disciplines such as psychology, technology, pharmaceutical and social science. In this research it is not so amazing because of there are lot of work on this particular subject having been already done like the association of clients of satisfaction and customer reliability (Christodoulides & Michaelidou, 2011; Cronin & Taylor, 2014; Dong, Ding, Grewal& Zhao, 2011). The theory of consumer satisfaction created by Oliver (1980) suggests that between of people expectation and getting on the basis of their demand when same or equal then it makes them satisfied in their performance area. There are various theories with respect to the fulfilment and administration display. Fulfilment happens when an item or administration is superior to anticipate. When all is said in done, fulfilment is the sentiment happiness or frustration achieved from observing on a products or services that a customers was expected on the basis of their demand. The customers may not get positive concern what they expected if there have some gaps between those it may create dissatisfaction. Various theoretical hypotheses have been used to clarify the connection amongst disconfirmation and fulfilment (Oliver, 2010). It can be the opposite for the customers when they can able to fulfill their expectation on what they desired; it is the reason s of satisfaction. Hoyer and MacInnis (2010) expressed that fulfillment can be related with sentiments of acknowledgment, bliss, help, energy and joy. Numerous hypotheses have been utilized to comprehend the procedure through which clients shape fulfillment judgment.

E-service quality

Quality of e-benefit is considered widely to consolidate all times of a customer's associations with a Web Site - how much a site supports profitable and intense shopping, purchasing, and transport (Parasuraman et al. 1988). Santos (2003) battles that e-benefit quality is a general customer's assessment and judgment of e-benefit movement in the virtual business focus. Online services are applauded by both retail customers and corporate clients because of its simplified accessibility to the e- banking services through internet which is much more convenient and hassle free comparing to the traditional banking services (Santos, 2003).Despite of having enormous potentiality of electronic banking services, but the questions is still remain how the significance of the services will be evaluated (Kenova & Jonasson, 2006).To measure the quality of services it is essential to formulate a certain standardized measuring criteria which will reflect quality of electronic services. Both the global and regional e- banking market development is essential for measuring the standard of quality in e-service (Mekovec et al., 2007). Many research have been conducted on various field of service quality of online banking

Trust

Studies have been conducted in the later, showed that trust has been formulated depending on various variables and researchers puzzle to give a particular shape of trans formulating issues (McKnight et al., 2002). It has been evidence from the previous studies, dealing with convictions against different gathering honesty generosity is essential to be trusted (Gefen, 2000). Small proportion of research has been conducted on the field of trust related issues of using online banking services (Doney & Cannon, 1997). There are researchers at present who are working on the concept of e-banking services and trust issues which are strongly integrated with various function of e-banking.

Habit

Previous researchers’ findings of past habitability attitudes have been rechecked by the (Chaudhuri, 1999). In his findings, most present habitual activity influence to commit action to more exclusively, comfortably and honestly and this tendency can lead a person to commit further similar kinds of activities. It is undeniable that the behavioral attitude stills a core source of measuring peoples’ habitual actions. Finally, as per Gefen (2003), proceeded with utilize or expectation is not the same as propensity. Propensity is the thing that one normally does; it is a behavioral feeling in the present, though planned utilizes shows the particular behavioral expectation alluding to future exercises. At the point when propensity is solid, individuals depend considerably more on propensity than they do on outer data and on decision techniques. Along these lines, inclination alluded as a behavioral slant in the present that what one typically does and it prompts to the continuation of a comparative sort of direct has been gotten in this examination.

Reputation

Reputation may be considered as a particular quality, for instance, relationship with investors (Herbig & Milewicz, 1993). Other than that, reputation may likewise be considered from a broader point of view pertaining it with the believability of the association. For this situation, reputation would be the result of the correlation between what the organization guarantees and what it in the end satisfies. In this manner, the reputation picture may pick up as an aftereffect of how genuine the organization is and the amount it looks after its surroundings. Besides, perceived reputation might be viewed as an outcome of the communications of business with its surroundings. This arrangement of cooperation’s between the organization and its clients will be a wellspring of data which empowers clients to acknowledge all the more profoundly the nature of the offer (Yoon, 1993). Herbig & Milewicz (1993) have characterized reputation as an estimation of the consistency after some time of a characteristic of a substance. An association can along these lines have various reputations (one on every property, for example, value, item quality, imaginativeness, administration quality) or a worldwide reputation.

Customer loyalty

Many researchers have found that there is a noticeable acceptance imbedded in using e-transection services and it has been shown in the finding of (Lynch et al., 2001). Devotion towards customers considered as a prime responsibility to promote a particular product or services for future sustainability. Having the possibility of shifting attitudes of purchasing because of strong influence of situational and marketing factors people develop an attitude to revert the previous preferred products or same-brand related perching (Oliver, 1999). In addition, the above mentioned perception can be applicable for online loyalty factors as well. This illustrate that loyalty is integrated booth punching habit and behavioral attitudes. Products or services purchasing decisions are formulated through based of loyalty concept (Ribbink et al., 2004).

Service quality and customer loyalty

Zahorik and Rust (1992) considered, perceived value has an strong influential effect to formulate customers trust which will developed noticeable level of measureable ability in any situational circumstance for formulating clients loyalty. An observation came from, Zahorik and Rust (1992) superiority of perceived products and services a decisive issue of making decision for any particular purchase which has been treated as a positive phenomenon. The study also reveals that there are two types of attitudes and there is a perpetual influence on products buying decision on the base of quality of products and entire products features of quality make a positive correlation on making a buying decision. So it is evident that there is a strong relationship between products quality and customers’ loyalty. As Zeithaml et al. (1996) stated that high level of relationship in between service quality and customer loyalty specifies a positive impact on particular customer behavior. It is also supported by the (Anderson & Sullivan, 1993) that high level of service quality makes positive purchasing perseverance (e.g. customer loyalty). On the other hand, negative purchasing attitudes are formulated form low quality service. As a result of the above discussion, the present study proposes the following hypotheses:

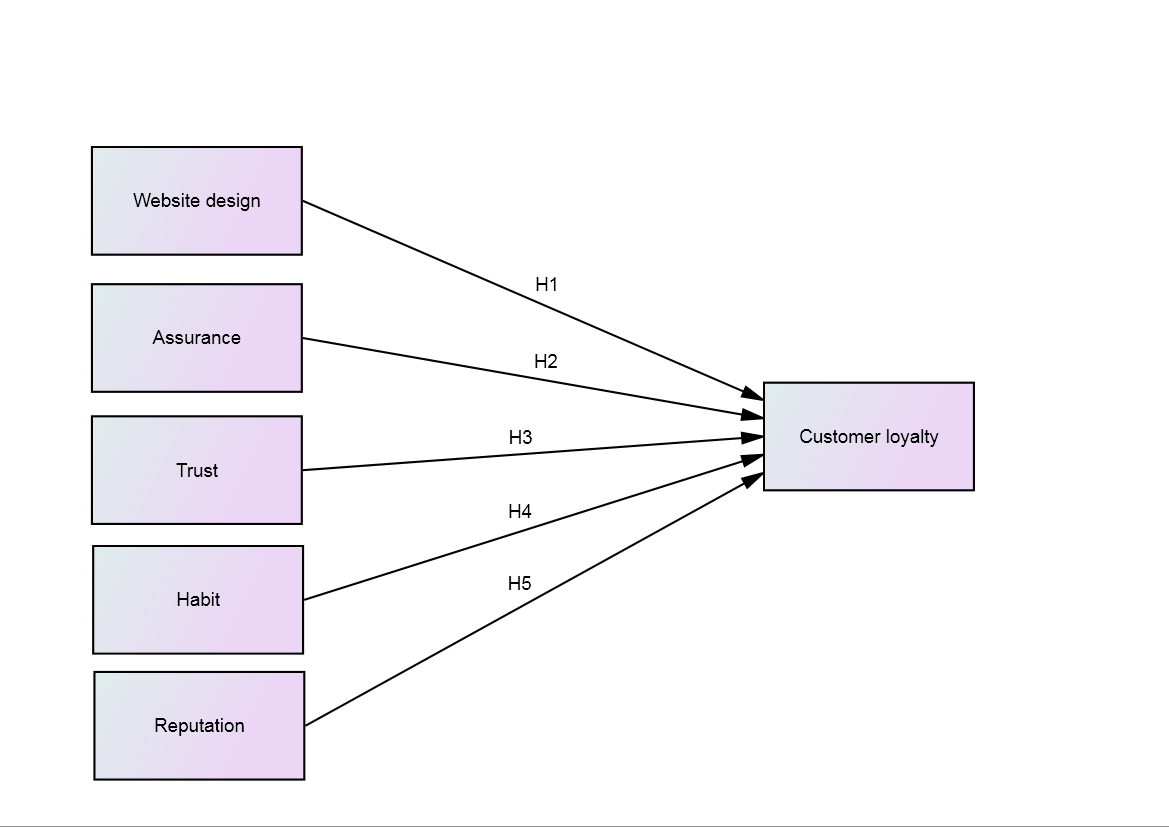

Research Framework

Above mention flow chart has been illustrated on the base of various previous research works.

Research Methods

Research Sample

Structured survey was created to acquire the reactions from web banking clients about their sentiments on different research factors. An aggregate number of 250 online banking clients (test estimate) have been randomly chosen from various public and private commercial banks in Bangladesh. The analysts established the survey which comprises of fundamentally two sections, 1) Respondent's demographic data and 2) Factors identified with consumer satisfaction and loyalty. 26 related questionnaires were taken as autonomous factors and general client loyalty as the needy variable. At that point the information was gathered through overview by utilizing that survey.

Data collection

This part first presents the research design, conceptual model and hypotheses to be tested. Then the examination strategy including the survey plan and estimation of the exploration factors (including website design, assurance, trust, habit, reputation and customer loyalty), inspecting and information investigation techniques are portrayed. The investigation grasped in this examination is a realistic report where the investigation is endeavored to depict the reactions to request of the segments in choosing customer reliability towards web managing an account website in Bangladesh and, which of the components expect the most basic part to finish customer dedication. Cross-sectional examination was driven by means of survey study to take a depiction of the population at a point in time as the examination is concentrating on in view of existing banking client and not concentrating on the effect of prior and then afterward a client getting to be web banking client.

Analysis

For the information accumulation reason, self-administration was performed the respondents were requested to use a 5-point Likert scale from 1 to 5 where while 1 demonstrated solid disagreement 5 meant solid agreement with a statement. The questionnaires included 7 areas, the initial 6 segments were committed to each of the factors and the last segment comprised the respondents' statistic attributes. The survey was produced by adjusting previous reviews they were altered so that to suit the current needs. It was done with a specific end goal to affirm the legitimacy issues (Zainudin, 2012). After the essential information required were accumulated, they were broke down through SPSS and SEM. Descriptive analysis was done comprised of several statistical tests, particularly, percentage, frequency, mean and standard deviation. Afterwards, SPSS was also used to run EFA. Finally, the conceptual model of the current study along with the hypotheses were verified thorough SEM.

Findings

Exploratory factor analysis (EFA)

Hair et al. (2009) have demonstrated that it is essential to standard figure examination, as it helps investigators in social event the data amassed from a specific blueprint of information. Regardless, before continuing with EFA, two tests, to be specific, Kaiser– Meyer– Olkin (KMO) and Bartlett's Trial of Sphericity, ought to be attested for checking the factorability of information (Pallant, 2007). Tabachnick, Fidell, and Osterlind (2001) have displayed that the estimation of the basic test (KMO) ranges from 0 to 1, and for a genuine examination it is central to have no not as much as an estimation of 0.6, and for the last indicated (Bartlett's Trial of Sphericity) it is essential to achieve a fundamental p respect (p < .05). In the wake of running both of these specific tests through SPSS, it was watched that the delayed consequences of both fell inside the commendable range, demonstrating that the pro can run EFA. The inevitable results of the tests are showed up underneath in Table

The estimations of the going with Table

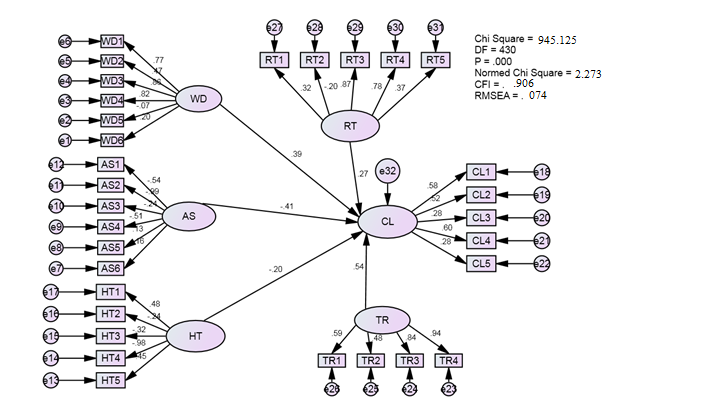

Evaluation of the Structural Equation Model

The aftereffect of the model revealed that the model is sufficient as it finished the required qualities for each of the records as takes after: root mean square error approximation (RMSEA) = .074, comparative fit list (CFI) = .906. Normed χ2 = 2.273 (Figure

Hypothesis testing

As showed up in Table

Validity Testing

Close by the gauge display, the audit needs to consider the general estimation model to test the legitimacy of the examination. To certify create legitimacy of the audit, it requires assessing joined, discriminant, and confronting legitimacy. Most of the component loadings for every factor (more than .70), ordinary chi-square esteem (AVE; more than .50), and develop legitimacy (more than .50) exhibit the joined legitimacy, while discriminant legitimacy is asserted with the positive difference among AVE and squared connection (r2) of the constructs. AVE is seen bigger that squared different relationship and give the indication of elegancy of each factor. Moreover, scholastic help of research arranged work gives the essential perception of factors.

Conclusion

This study was undertaken to examine and understand the consumers’ loyalty in selecting the online based commercial banks in Bangladesh to become loyal to the concern banking services. As a general notion, consumers’ loyalty widely varies in accordance with the influencing or the measuring factors like website design, assurance, trust, habit and reputation, etc. In addition, form the service providers’ perspective; the companies have realized that there is an immense e-banking market in Bangladesh. Therefore, every e-service provider, provide variety of offers to make their services more unique and reliable for their potential customers in a competitive banking market. It has been evident form different contemporary research that online commercial banking services in Bangladesh are more popular now than ever before. Money has been invested by the companies not only for updating online based services or network expansion but also offering different kinds of direct and indirect products or standard services to their potential new customers and for holding the remaining customers as well. Apps development, website designing, online customer care, this are one of the most important factors of overall online e-banking services mechanism. According to our study, it has been evident that trust assurance and reliability and reputation are one of the major decisive factors to gain customer faith on e-banking services in Bangladesh among many online commercial banking services. The findings of this study can help banking sectors especially the baking which is operating online basis services in their operation and strategic plan of marketing as well as to measure the factors which is most important to loyal customer to their services. The points that are discussed above under the category of website design, trust assurance, habit and reputation used and developed in the survey scale of this study can be considered reliable indicators of customers service of measuring the important factors and can be a training guideline for banking sectors organizations in Bangladesh. In addition, banking sectors should train their employees to be sensitive to the special needs and wants of customers. Therefore, this research recommends that providers enhance their all of the factors which are using to be satisfied and loyal of the customers of the online banking all are equally important.

The present study has considered just few measuring factors of online commercial banking services criteria such as website design, trust assurance, habit and last one reputation although there may be many more important components of online commercial banks in Bangladesh. On the other hand, past researchers considered too many measuring factors of banks, only some indicators of those have been considered in this study. Therefore, future research on the linkages of the remaining components that address more broadly will contribute towards a greater understanding of what actually are the reasons behind of the various choice criteria. Similarly, future research needs to be done on the overall measuring factors become loyal to understand it better.

References

- Anderson, E. W., & Sullivan, M. W. (1993). The antecedents and consequences of customer satisfaction for firms. Marketing science, 12(2), 125-143.

- Chaudhuri, P., & Marron, J. S. (1999). SiZer for exploration of structures in curves. Journal of the American Statistical Association, 94(447), 807-823.

- Cronin, E., Brand, B. L., & Mattanah, J. F. (2014). The impact of the therapeutic alliance on treatment outcome in patients with dissociative disorders. European Journal of Psychotraumatology, 5(1), 22676.

- Daniel, w. w., (1999). Biostatistics: A Foundation for Analysis in the Health Sciences. 7th edition. New York: John Wiley & Sons.

- Doney, P. M., & Cannon, J. P. (1997). An examination of the nature of trust in buyer-seller relationships. the Journal of Marketing, 35-51.

- Dong, S., Ding, M., Grewal, R., & Zhao, P. (2011). Functional forms of the satisfaction–loyalty relationship. International Journal of Research in Marketing, 28(1), 38-50.

- Furst, A. J., & Hitch, G. J. (2000). Separate roles for executive and phonological components of working memory in mental arithmetic. Memory & cognition, 28(5), 774-782.

- Gefen, D., Karahanna, E., & Straub, D. W. (2003). Trust and TAM in online shopping: An integrated model. MIS quarterly, 27(1), 51-90.

- Hair, J. F. (2010). Black, WC, Babin, BJ, & Anderson, RE (2010). Multivariate data analysis, 7.

- Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2009). Análise multivariada de dados. Bookman Editora.

- Hair, Joseph F., (2009). Multivariate Data Analysis: A Global Perspective. 7th ed. Upper Saddle River: Prentice Hall.

- Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2009). Análise multivariada de dados. Bookman Editora.

- Herbig, P., & Milewicz, J. (1993). The relationship of reputation and credibility to brand success. Journal of consumer marketing, 10(3), 18-24.

- Herbig, P., & Milewicz, J. (1993). The relationship of reputation and credibility to brand success. Journal of consumer marketing, 10(3), 18-24.

- Hoyer, W. D., MacInnis, D. J., & Pieters, R. (2010). Comportamiento del consumidor. México: Cengage Learning.

- Kenova, V., & Jonasson, P. (2006). Quality online banking services.

- Lin, P., & Jia, Y. (2009). Consensus of second-order discrete-time multi-agent systems with nonuniform time-delays and dynamically changing topologies. Automatica, 45(9), 2154-2158.

- Mekovec, R., & Kero, K. (2007, January). E-service quality: a case study of Varaždin County. In Creative organization.

- Michaelidou, N., & Christodoulides, G. (2011). Antecedents of attitude and intention towards counterfeit symbolic and experiential products. Journal of Marketing Management, 27(9-10), 976-991.

- Nelson, E. C., Rust, R. T., Zahorik, A., & Rose, R. L. (1992). Do patient perceptions of quality relate to hospital financial performance?. Marketing Health Services, 12(4), 6.

- Oliver, P. (2010). The student's guide to research ethics. McGraw-Hill Education (UK).

- Oliver, R. L. (1999). Whence consumer loyalty?. the Journal of Marketing, 33-44.

- Osterlind, S. J., Tabachnick, B. G., & Fidell, L. S. (2001). SPSS for Window Workbook to Acompany: Using Multivariate Statistics--4th.--Tabachnick and Fidell. Allyn and Bacon.

- Pallant, J. F., & Tennant, A. (2007). An introduction to the Rasch measurement model: an example using the Hospital Anxiety and Depression Scale (HADS). British Journal of Clinical Psychology, 46(1), 1-18.

- Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1988). Servqual: A multiple-item scale for measuring consumer perc. Journal of retailing, 64(1), 12.

- Reichheld, F. F., & Schefter, P. (2000). E-loyalty: your secret weapon on the web. Harvard business review, 78(4), 105-113.

- Reichheld, F. F., & Schefter, P. (2000). E-loyalty: your secret weapon on the web. Harvard business review, 78(4), 105-113.

- Ribbink, D., Van Riel, A. C., Liljander, V., & Streukens, S. (2004). Comfort your online customer: quality, trust and loyalty on the internet. Managing Service Quality: An International Journal, 14(6), 446-456.

- Ribbink, D., Van Riel, A. C., Liljander, V., & Streukens, S. (2004). Comfort your online customer: quality, trust and loyalty on the internet. Managing Service Quality: An International Journal, 14(6), 446-456.

- Santos, J. (2003). E-service quality: a model of virtual service quality dimensions. Managing Service Quality: An International Journal, 13(3), 233-246.

- Sathye, M. (1999). Adoption of Internet banking by Australian consumers: an empirical investigation. International Journal of bank marketing, 17(7), 324-334.

- Sathye, Milind. "Adoption of Internet banking by Australian consumers: an empirical investigation." International Journal of bank marketing 17, no. 7 (1999): 324-334.

- Wang, Z. L., & Song, J. (2006). Piezoelectric nanogenerators based on zinc oxide nanowire arrays. Science, 312(5771), 242-246.

- Yoon, E., Guffey, H. J., & Kijewski, V. (1993). The effects of information and company reputation on intentions to buy a business service. Journal of Business research, 27(3), 215-228.

- Zahorik, Anthony J., and Roland T. Rust (1992). Modeling the Impact of Service Quality on Profitability: A Review. Advances in Services Marketing, Vol. 1 [T. Swartz, et al. (eds.)]. JAI Press, 247-76.

- Zainuddin, A., (2012). Structural Equational Modeling Using AMOS Graphic, Penerbit Press, Universiti Technology MARA, ISBN: 978-967-363-418-7

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 May 2018

Article Doi

eBook ISBN

978-1-80296-039-6

Publisher

Future Academy

Volume

40

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1231

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Uddin, B., Haque, A., Nayeem, A. R., & Maruf, T. I. (2018). Online Services Of Commercial Banks Towards Customer Loyalty In Bangladesh. In M. Imran Qureshi (Ed.), Technology & Society: A Multidisciplinary Pathway for Sustainable Development, vol 40. European Proceedings of Social and Behavioural Sciences (pp. 718-729). Future Academy. https://doi.org/10.15405/epsbs.2018.05.59