Abstract

Intra-industry trade (IIT) has become prominent across Asia including Malaysia due to the greater influence of globalization in international trade and rapid economic growth. The growth of IIT occurred because of its characteristics which could result in gains from trade through better exploitation of economies of scale and product differentiation as well as enhance innovation. Since IIT is important in increasing the growth of an economy through trade earnings trade, therefore there is a need to study the determinants of IIT in Malaysia. This study is focused on the manufacturing sector especially the machinery and transport equipment (SITC 7) from 1994 to 2014. IIT is calculated by using the Grubel Lloyd (GL) index. Panel data is utilized in performing panel cointegration and panel Granger causality tests. The Hausman specification test shows that the fixed effect least square dummy variable (LSDV) model is better than the random effects model. These tests were used to determine the relationship between the levels of IIT and its determinants namely differences in per capita GDP, foreign direct investment, geographical distance and technological advancement. The results show that the variables are cointegrated in the long run, in addition to the existence of short run relationships between intra-industry trade with differences in per capita GDP and foreign direct investment.

Keywords: Intra-industry tradeCointegrationGranger Causality test

Introduction

International trade has been recognized for decades as long as economic theory itself. The traditional theory of international trade has been introduced by Adam Smith with his idea of absolute advantage (Schumacher, 2012). Later, it was improved by David Ricardo where he introduced the concept of comparative advantage. Yet, the theory of trade has been developed and refined further, such as the Hecksher-Ohlin (H–O) model. This model explains international trade by using the differences in factor endowments between countries, as the basis for comparative advantage which implies inter-industry trade (Kang, 2010).

Trade has also been known to be one of the most influential factors that could rapidly increase a nation’s economic growth. It may occur at many levels and categories of goods and services. Yet, in the last five decades, most of the developed countries have started to focus on exports and imports of particular products within the same industry, also known as intra-industry trade (IIT) (Jambol & Ismail, 2013). This type of trade is more advantageous compared to inter-industry trade as it encourages innovation and utilizes economies of scale (Ruffin, 1999). This evidence of IIT was contrary to the classical trade theory associating trade integration with specialization of countries (Viner, 1950). Thus, it brought about progressive shifts of research interests from inter-industry trade to IIT.

Malaysia has become one of the most successful country in Southeast Asia and has also become one of the world’s top 20 trading nations (Nik Muhammad & Che Yaacob , 2008). This was possible with the various policies and strategies implemented for each of its economic sectors since the 1990s. The development and utilization of advanced technologies have contributed to the increase in Malaysia’s economic growth rate, averaging about 5.5% per year from 2000 to 2008 (World Bank, 2015). The growth rate in 2014 has surpassed the 4.7% growth rate attained in 2013 as it is growing at 6.0% per annum, and it was one of the highest growth rates in Asia (MITI, 2015).

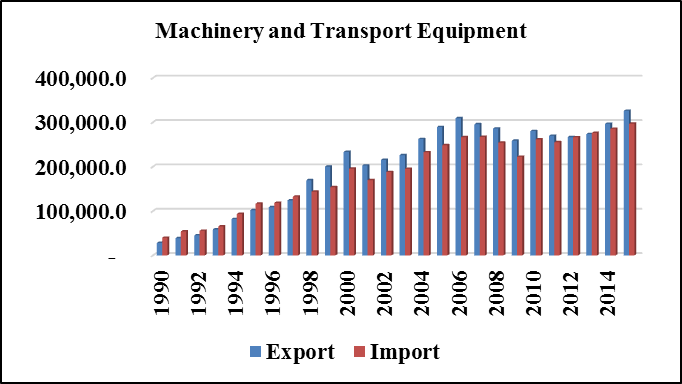

The substantial economic growth has been due to globalization through foreign direct investment and trade development which have led to the development of new channels for economic growth. Malaysia’s exports and imports in gross national product (GNP) has rose about 75% from 1980s and 1990s. The sector that contributed the most to this growth is the manufacturing sector (Yusoff et al, 2000). Based on the report by MITI (2015), exports rose by 6.4% (from RM46.14 billion to RM766.13 billion), easily overtaking the 2.4% growth achieved the year before. Imports also grew but at a slower rate of 5.3% (RM 34.32 billion) to RM 683.02 billion and resulting in a trade surplus of RM 83.11 billion. It has also improved competitiveness of the nation, where Malaysia has moved four places to the 20th position out of 144 countries according to the World Economic Forum (WEF) (WEF is a Swiss nonprofit foundation where it used to consider the major global issues of the day and to brainstorm on solutions to address these challenges, besides the forum is best known for its Annual Meeting in Davos-Klosters.) ranking. In terms of sectoral contribution to trade, the machinery and transport equipment industry was the major contributor, where it contributed about RM 296,735.4 million and RM 285,547.6 million in export and import respectively in 2014.

Source: Malaysia Department of Statistics

Figure

Malaysia has adopted an import-substitution policy in the 1960s in order to reduce its dependency on the primary sector such as rubber and tin as the main contributor to GDP (Abdullah & Muhammad, 2008). This lead to a shift in the economic structure from agricultural to manufacturing until the government introduced the export-promotion strategy in the late 1960s. The export-promotion strategy was used to attract the inflow of foreign direct investment (FDI) to Malaysia especially in the manufacturing sector, machinery and transport equipment as well as electrical and electronics product sectors.

This strategy has resulted in greater trade between Malaysia and other countries including ASEAN and EU countries especially trade involving the manufacturing sector. In 2013, Malaysia’s export share to ASEAN-member states (AMSs) of 28.1% was the highest followed by China (13.4%) and Japan (11.1%). The imports from AMSs also registered the highest share of 26.7% followed by China (16.4%) and EU-28 (10.8%). Therefore, ASEAN is Malaysia’s biggest merchandise trade partner. However, Malaysia was EU’s 23rd largest trading partner in goods and was the second trading partner in ASEAN, behind Singapore. The bilateral trade between the EU and Malaysia was also dominated by industrial products.

1.1 Problem Statement

International trade is one of the key factors of macroeconomic achievements for any country. It is due to the increase in demand of products within the countries either in terms of imports or exports. Previously, world trade was mainly trade between industries, which is known as inter-industry trade. However, today, there is a larger share of world trade which involves differentiated products rather than homogenous products. This has resulted, in greater IIT.

Total trade in Malaysia has continued to grow especially in the manufacturing sector. This sector has become one of the main contributors to Malaysia’s economic growth. The study of Malaysia’s experience in IIT is important as it has the highest IIT among ASEAN and EU countries. A high level of IIT can be a source of gain from trade due to economies of scale and product differentiation; hence, it is important to examine its determinants. Furthermore, there is not much published work on the determinants of Malaysia’s IIT. This was the main motivation for undertaking this research. This study will explore the determinants of IIT in the machinery and transport equipment industry between Malaysia and its trading partners, which consist of selected ASEAN and EU countries. In addition, it also investigates the relationship between IIT and the differences in per capita GDP, FDI, geographical distance and technological advancement. The study also examines the direction of the relationship between IIT and differences in per capita GDP, FDI, geographical distance and technological advancement.

Literature Review

The study of international trade consists of several theories such as absolute and comparative advantage theory, Heckscher - Ohlin theory, the New Trade Theory (NTT), and the Gravity Model. The theory of absolute advantage was first introduced by Adam Smith in his publication,

H-O theory assumes that countries will export goods that make intensive use of factors which are locally abundant and import goods that make intensive use of factors that are locally scarce. The only difference between countries is in terms of the availability of factors of production. Thus, the H–O theory attempts to explain the pattern of international trade. New trade theories are introduced as economists found that most firms were able to achieve economies of scale with important implications for international trade in 1970s (Hill, 2008).

The gravity model has been applied in bilateral trade studies. The model suggests that economic collaborations between two countries are directly related to their size and inversely related to the distance between them. Distance provides a strong impact on international trade and it will not diminish over time. Nevertheless, gravity models have incorporated borders and contiguity effects as well as more sophisticated interaction cost measures (Combes, 2008). In the other word, the volume of international trade between two countries is assumed to increase with their economic size, representing exporter’s production capacity and importer’s buying power, and to decrease with transportation cost, measured by the distance between their economic centers (Kandogan, 2003).

Differences in per capita income are used to measure the gap of income between a country and its trading partners. As a result, if the country has similarity with its trading partners in terms of demand pattern for differentiated products, this would mean both countries will have similar per capita incomes (Linder, 1961). According to Turkcan and Ates (2010), if there are greater differences in per capita income between the countries it will lead to lower relative levels of IIT. This is because of the greater inequality in the demand structure among the countries.

The IIT case study for Pakistan and its ten trading partners by Shahbaz and Leitão (2010) show that FDI was not significant. In a more detailed study by Hu and Ma (1999) for China and Leitão and Faustino (2007) for Portugal, a positive relationship was observed between FDI and vertical IIT. In addition, Leitão and Faustino (2007) also found a negative relationship between FDI with horizontal IIT. However, the study by Sharma (2000) on the pattern and determinants of IIT in the Australian manufacturing sector showed that FDI has a negative significant effect on IIT due to increased competition. Thus, these findings indicate that the effect of FDI on IIT is inconclusive. It depends on the type of industry and type of intra-industry trade that is being analyzed.

Most previous research has found that geographical distance has a negative impact on IIT. Clark and Stanley (1999) in their study on the determinants of intra-industry trade between developing countries and the United States, using panel data. It was found that distance has a negative effect on IIT, this is because difficulty in overcoming distance will deter trade proportionately more for closely substitutable non-standardized products than for standardized goods. This is also observed by Ito and Umemoto (2004) in their study on IIT in the ASEAN region for the case of the Automotive Industry. Geographical distance was negatively significant with IIT by using Tobit model regression. It was due to the transportation cost, as the larger the distance between the capital cities of trading partners, the more cost they will bear. In addition, Leitão and Faustino (2009) in examining the determinants of IIT in the automobile component sector in Portugal also stated that trade will increase if the transportation costs decreased.

Mulenga (2012) has contrasting results in a study regarding determinants of intra-industry trade between Zambia and its trading partners in the Southern African Development Community (SADC). The study was guided by a modified gravity model in a panel data framework for the years 1998 to 2006. The results from this study stated that distance also has a positive effect but insignificant because Zambia’s IIT is more noticeable with countries that are geographically further from it. This is because Zambia is a landlocked country and it has the cheapest mode of conducting trade through road transport. Umemoto (2005) stated that Korea and Japan could reduce their transportation costs because of the free trade area (FTA), resulting in a possible increase in the level of IIT between Korea and Japan. However, distance has also been found to be positively correlated with IIT, indicating lower search and transaction costs, hence increasing bilateral trade (Sunde, Chidoko, & Zivanomoyo , 2009).

Technology can be one of the important factors that could contribute to an increment of IIT. Abraham and Hove (2004) analysed the impact of technology in two ways, distinguishing between input and output measures of technology and technological spillovers in the country. Relative performance in terms of technology output (patents) was found to have no significant impact on IIT. However, the relative performance in terms of technology inputs (R&D expenditures) have a significant positive impact. In addition, they also found that global technological spillovers have a positive and significant impact on total intra-industry trade.

Measurement of Intra-Industry Trade

There are various alternative measures in calculating IIT such as the Balassa Index, the Grubel-Lloyd (G-L) Index, and the Aquino Index (Turkcan & Ates, 2010). However, the most commonly used measure of IIT is the G-L Index (Yoshida, 2008; Arip, Yee, & Satoru, 2011; Jambol & Ismail, 2013).

The G-L Index measures the difference between the country’s trade (export – import) against the country’s total trade (exports + imports) or intra-industry trade as a percentage of a country’s total trade. The G-L approach is based on measuring the trade overlap for a given industry. Based on the model by Greenaway

IIT ij = 1 - | X ij – M ij |x 100 , i = 1,…,n; j = 1,…N

X ij + M ij

where:

The value of G-L lies between 0 and 1, with values close to unity indicating a high rate of intra-industry trade for good

Econometrical Model

Panel data is used in this study. The dependent variable used is intra-industry trade (IIT) and data was collected from the Department of Statistics Malaysia. The data for the explanatory variables, differences in per capita GDP, distance, foreign direct investment and technological advancement are sourced from the World Bank Database, CEPII, and UNCTAD.

4.1 Explanatory Variables

In accordance with the theory, we have chosen the following explanatory variables:

4.1.1 Differences in per capita GDP

The difference in per capita GDP (PPP) between Malaysia and its trading partners is expected to have a negative effect on IIT. This is because Linder (1961) assumes that countries with similar demands will trade similar products. Besides that, Turkcan and Ates (2010) also stated that if there are greater differences in per capita income between the countries it will lead to lower relative levels of IIT. This is because of the greater inequality in the demand structure among the countries. Sawyer, Sprinkle, and Tochkov (2010) and Leitão and Shahbaz (2012) found a negative sign. However, Turkcan and Ates (2010) and Yuan (2012) found a positive sign. The differences in per capita GDP between Malaysia and its selected trading partners is measured as follows (Ito & Umemoto, 2004):

DGDP

ln 2

where:

GDP

Based on Linder’s Hypothesis, the greater the extent of trade in differentiated products, it is expected that the income levels of the trading countries are more similar. According to Ito & Umemoto (2004) countries with similar income levels will lead to similarities in demand structures, resulting in greater mutual trade in differentiated products. Therefore, it is negatively related to the volume of IIT.

4.1.2 Geographical Distance

Distance will increase transaction costs including insurance costs. This study adopted the method used by Hu and Ma (1999), Sharma (2000), and Veeramani (2007) which uses the weighted distance as a proxy for geographical distance between trade partners. This is to avoid overestimating the internal or external distance ratio, which will result in an upward bias in the border effect estimate:

WDISTkt = DISTk* GDPkt

∑

The distance, denoted as DIST

4.1.3 Foreign Direct Investment

The net inflow of FDI is used as a proxy to account for the role of export-oriented and intra-firm trade. FDI will also influence the share of IIT, although its effect on IIT is unclear and depends on the nature of the investments between countries. Markusen (1984) and later Aturupane

4.1.4 Technological Advancement

Technology can be measured in many ways including technological capital, technology spillovers, research and development expenditure, as well as research and development intensity. In this study technology is measured by research and development expenditure (R&D EXP).

4.2 Model Specification

In estimating the determinants of IIT, a linear-log function is employed to make the estimates less sensitive to extreme observations, besides to enable interpretation of the coefficient terms as elasticity. The logarithmic transformation of the estimated model is as follows:

IIT

( - )( - / + )( - ) ( + )

IIT

DGDP

FDI

DIST

TECH

Findings

In this section we present the results for the determinants of machinery and transport equipment between Malaysia and its selected trading partners from ASEAN and EU countries (Indonesia, Philippines, Singapore, Thailand, Vietnam, France, Germany, Ireland, Italy, and United Kingdom). In Table

The results for the Granger causality test, as shown in Table

This study has conducted panel tests which consist of pooled OLS, fixed effects LSDV model and random effect model. The results are presented in Table

There are three variables that are significant at the 5% level which are differences in per capita GDP, distance and technological advancement. The differences in per capita GDP shows a negative sign, which was also observed by Sawyer, Sprinkle, and Tochkov (2010) as well as Shahbaz, Leitão, and Butt (2012). However, in this study distance and technological advancement do not have the expected signs as it shows a positive sign for distance and negative sign for technological advancement. Nevertheless, the result for distance was in line with the findings by Mulenga (2012), where distance was found to have a positive but not significant effect.

Conclusions

This present study was designed to determine the determinants of IIT in the machinery and transport equipment industry between Malaysia and its selected trading partners, from ASEAN and EU countries by using a panel data approach for the period of 1994 until 2014. This study has focus on one main objective which is to analyze the relationship between IIT with differences in per capita GDP, foreign direct investment, geographical distance and technology advancement.

Based on the estimation results, the panel cointegration test found that there are long run relationships between these variables. Using the panel Granger causality test, it was found that only differences in per capita GDP and foreign direct investment have a short run relationship with IIT. It also indicates unidirectional relationships since IIT does not granger cause to both variables. These findings have fulfilled the objectives of the study, where it prove that in the long run, the differences in per capita GDP, foreign direct investment, geographical distance and technological advancement are the determinants of Malaysia’s IIT. However, only two determinants will influence the level of IIT in the short run which are differences in per capita GDP and foreign direct investment while the others determinants were not influence the level of IIT.

This study has also identified which of the variable is the most significant factor that influence the performance of IIT between Malaysia and its selected trading partners by using pooled OLS, fixed effect LSDV and random effect model. The fixed effect LSDV was found to be the best regression model. Technological advancement is the most significant contributor to the level of IIT. On the other hand, distance is the most important factor that contributed to the level of IIT between Malaysia and its selected ASEAN and EU countries. This means that Malaysia is highly dependent on distance with its trading partners in order to enhance the level of IIT.

References

- Abdullah, A. and Muhammad, S. (2008). The development of entrepreneurship in Malaysia: State‐led initiatives. Asian Journal of Technology Innovation, 16 (1), 101-116.

- Abraham, F. and Hove, J. V. (2004). Intra-Industry Trade and Technological Innovation: The Case of Belgian Manufacturing. EIIE Conference, 1-34.

- Arip, M. A., Yee, L. S., and Satoru, M. (2011). An Analysis of Intra-Industry Trade between Japan, Malaysia, and China. International Journal of Institutions and Economies, 3 (1), 1-30.

- Aturupane, C., Djankov, S., and Hoekman, B. (1997). Determinant of Intra-Industry Trade between East and West Europe. The World Bank Development Research Group, 1-40.

- Clark, D. and Stanley, D. (1999). Determinants of Intra-Industry Trade between Developing Countries and the United States. Journal of Economic Development, 2 (2), 79-95.

- Combes, P.P. (2008). Gravity Models. Retrieved from The New Palgrave Dictionary of Economics: http://www.dictionaryofeconomics.com/article?id=pde2008_G000103

- Greenaway, D., Lloyd, J. P., and Milner, C. (1998). Intra-Industry Trade Foreign Direct Investment and trade Flows: New Measures of Globalisation of Production. University of Nottingham Research Paper Series: Centre for Research on Globalisation and Labour Markets Programme , Research Paper 98/5.

- Helpman, E. and Krugman, P. (1985). Market Structure and Foreign Competition: Increasing Returns, Imperfect Competition and the International Economy. Cambridge, Massachusetts and London: MIT Press.

- Hill, C.W. (2008). International Business: Competing in the Global Marketplace. New York: McGraw-Hill Irwin.

- Hu, X. and Ma, Y. (1999). International Intra-Industry Trade of China. Weltwirtschaftliches Archiv (Review of World Economics), 135 (1), 82-101.

- Ito, K. and Umemoto, M. (2004). Intra-Industry Trade in the ASEAN Region: The Case of the Automotive Industry . The International Centre for the Study of East Asian Development, Kitakyushu, 1-36.

- Jambol, A. B. and Ismail, N. W. (2013). Intra-Industry Trade in Malaysia Manufacturing Sector. Prosiding PERKEM VIII, 119-129.

- Kandogan, Y. (2003). Intra-industry trade of transition countries: trends and determinants. Emerging Markets Review, 4 (3), 273-286.

- Kang, Y.D. (2010). Intra-industry Trade in an Enlarged Europe: Trend of Intra-industry Trade in the European Union and its Determinants . Korean Institute for International Economic Policy (KIEP), 1-55.

- Leitão, N.C. and Faustino, H. (2009). Intra-industry trade in the automobile components industry: an empirical analysis. Journal of Global Business and Technology, 5(1), 31-41.

- Leitão, N.C. and Shahbaz, M. (2012). Liberalization and United States’ Intra-Industry Trade. International Journal of Economics and Financial Issues, 2 (4), 505-512.

- Leitão, N.C. and Faustino, H.C. (2007). Country-Specific Determinants of Intra-Industry Trade in Portugal. Working Paper No. 27 of Technical University Of Lisbon, 1-24.

- Linder, S. B. (1961). An Essay on Trade and Transformation. Uppsala, Sweden: Almqvist & Wiksells.

- Markusen, J. R. (1984). "Multinationals, Multi-Plant Economies, and the Gains from Trade". Journal of International Economics, 16 (3–4), 205–26

- MITI. (2015). MITI Report 2014. Kuala Lumpur: Ministry of International Trade and Industry Malaysia.

- Mulenga, M. C. (2012). An Investigation of the Determinants of Intra-Industry Trade Between Zambia and its Trading Partners in the Southern African Development Community (SADC). Working Paper Series 2012-01 of Trade and Industrial Policy Strategies, 1-31.

- Nik Muhammad, N. and Che Yaacob, H. (2008). Export Competitiveness of Malaysian Electrical and Electronic (E&E) Product: Comparative Study of China, Indonesia and Thailand . International Journal of Business and Management , 65-75.

- Ruffin, R.J. (1999). The Nature and Significance of Intra-Industry Trade. Dallas: Federal Reserve Bank of Dallas.

- Sawyer, C.W., Sprinkle, L.R. and Tochkov, K. (2010). Patterns and determinants of intra-industry trade in Asia. Journal of Asian Economics, 21 (5), 485-493.

- Schumacher, R. (2012). Adam Smith’s theory of absolute advantage and the use of doxography in the history of economics . Erasmus Journal for Philosophy and Economics, Vol. 5, Issue 2, 54-80.

- Shahbaz, M. and Leitão, N. (2010). Intra-Industry Trade: The Pakistan Experience. International Journal of Applied Economics, 7 (1), 18-27.

- Shahbaz, M., Leitão, N.C., and Butt, M.S. (2012). Pakistan Intra-Industry Trade: A Panel Data Approach . International Journal of Economics and Financial Issues, 2 (2), 225-232.

- Sharma, K. (2000). Pattern and Determinants of Intra-Industry trade in Australian Manufacturing. Australian Economic Review, 33 (3), 1-23.

- Sunde, T., Chidoko, C., and Zivanomoyo, J. (2009). Determinants of Intra-Industry Trade between Zimbabwe and its Trading Partners in the Southern African Development Community Region (1990-2006). Journal of Social Sciences, 5, 16-21.

- Turkcan, K. and Ates, A. (2010). Structure and Determinants of Intra-Industry Trade in the U.S. Auto-Industry. Journal of International and Global Economic Studies , 15-46.

- Umemoto, M. (2005). Development of Intra-Industry Tade between Korea and Japan: The Case of Automobile Parts Industry. Center for International Trade Studies (CITS) Working Paper No. 03, 1-28.

- Veeramani, C. (2007). Industry-Specific Determinants of Intra-Industry Trade in India. Indian Economic Review, 42 (2), 211-229.

- Viner, J. (1950). The Customs Union Issue. New York: Carnegie Endowment for International Peace.

- World Bank (2015, April). The World Bank. Retrieved from Overview: Countries-Malaysia: http://www.worldbank.org/en/country/malaysia/overview

- Yoshida, Y. (2008). Intra-Industry Trade Between Japan and Korea: Vertical Intra-Industry Trade, Fragmentation and Export Margins. Discussion Paper No. 32 for Scientific Research , 1-21.

- Yusefzadeh, H., Hadian, M., Gorji, H.A., and Ghaderi,H. (2015). Assessing the Factors Associated With Iran’s Intra-Industry Trade in Pharmaceuticals . Global Journal of Health Science, 7 (5), 311-319.

- Yusoff, M., Abu Hasan, F. and Abdul Jalil, S. (2000). Globalisation, Economic Policy, and Equity: The Case of Malaysia. OECD Development Centre, 1-38.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 November 2016

Article Doi

eBook ISBN

978-1-80296-016-7

Publisher

Future Academy

Volume

17

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-471

Subjects

Business, management, behavioural management, macroeconomics, behavioural science, behavioural sales, behavioural marketing

Cite this article as:

Nathan, S. B. S., Kamaruzaman, N., & Ma’in, M. (2016). Intra-Industry Trade in Machinery and Transport Equipment: Malaysia and its Trading Partners. In R. X. Thambusamy, M. Y. Minas, & Z. Bekirogullari (Eds.), Business & Economics - BE-ci 2016, vol 17. European Proceedings of Social and Behavioural Sciences (pp. 262-273). Future Academy. https://doi.org/10.15405/epsbs.2016.11.02.25