Abstract

The rise of the internet and other technological advancement has completely altered how modern businesses conduct their daily operations. The key objective of this study is to evaluate the relationship between the TAM, perceived benefits, and perceived risks associated with mobile banking attitudes in Malaysia. Quantitative methods were used to develop this cross-sectional survey. The sample for the study was chosen using a method known as stratified sampling. In order to analyse the data, a PLS structural equation model is utilised (PLS-SEM). The findings demonstrated a significant association between the TAM, perceived benefits, and perceived risks associated with mobile banking use. Additional studies might concentrate on different groups of people, such as millennials or members of Generation Z. The findings of this research are significant due to the fact that they may encourage more widespread adoption of mobile banking in Malaysia by providing concrete recommendations on how financial institutions may improve the quality of their services in this area.

Keywords: Mobile banking, technology, TAM, perceived benefit, perceived risk

Introduction

Mobile banking is not typically the most popular mobile activity in Malaysia, and according to recent research, that is likely mainly because it is still viewed with scepticism. Malaysian consumer behaviour is becoming a significant challenge for banks to be activated in the mobile bank operating system and mobile banking clients are not willing to be marketplace leaders or pioneers; however, more choose to become supporters. Nevertheless, there are complex reasons for not conducting bank transactions via mobile, such as the device's small display screen grounds and having a less stable web connection being a problem (Shan, 2016). There has been a rapid expansion of m-banking in recent years, making it the most popular form of electronic banking. This change resulted from the emergence of m-banking services, which were necessary to satisfy the needs of today's more nomadic populace. M-banking is revolutionary since it facilitates a wide range of banking services with the touch of a finger. This change resulted from the emergence of m-banking services, which were necessary to satisfy the needs of today's more nomadic populace. M-banking is revolutionary since it facilitates a wide range of banking services with the touch of a finger. Improved client satisfaction is a direct result of mobile banking's many advantages. Also, as a client transaction service delivery channel, mobile banking generates "value" for the bank (wireless) (Munir et al., 2013).

The migration of Malaysia to e-payments, which also removes the use of paper-based resources such as checks and bank draughts, could theoretically save the country 1% of its Gross Domestic Product (GDP), which is around RM13 billion (Mustafa et al., 2022). However, there is a severe lack of equilibrium in the global expansion of mobile payment systems. Mobile payment is more advanced in some countries, like China, and less so in others, like Malaysia (Yong & Qiang, 2022). Adoption of mobile-based payment systems remains modest in both developing and developed countries, despite the benefits and convenience of use afforded by associated technology (Jung et al., 2020; Kapoor et al., 2021).

Yusoff et al. (2010) discovered that the respondents positioned security among the critical indicators every time embracing Internet banking. Essentially, most consumers are reluctant to use mobile banking because many people hold worries about security and privacy. Unauthorised third parties gain access to online financial institution accounts using essential login points that have been stolen, published online following an information breach on a specific financial institution, or extracted from the victims through social engineering (TheStar, 2016). On the other hand, a scholarly study confirming contradicts the end result, which is constant by the analysis carried out in Malaysia by Oly Ndubisi and Sinti (2006) have discovered that this hazard has become a vulnerable predictor due to the guarantee from the banking institutions for protection in their internet banking. Recognising client understanding with reference that the reliability of using this system will be able to offer essential suggestions to the application developer to get greater service from mobile banking centres.

Despite the abundance of literature, the Technology Acceptance Model (TAM) has rarely been utilised to investigate the pros and cons of internet banking in tandem with measures of perceived risk and value. The elements that affect a user's desire to use mobile banking must be analysed to comprehend the widespread acceptance of mobile banking. The results may help commercial banks and other businesses think through the repercussions of providing mobile banking services to clients. This article uses the TAM to analyse the connection between the advantages and disadvantages of mobile banking in Malaysia and the percentage of people who actually use it.

Literature Review

Technology acceptance model (TAM)

According to a large body of evidence, the Technology Acceptance Model (TAM) is the most influential and often used principle when dealing with data-structure related issues (Lee et al., 2003). With the "perceived usefulness" and "perceived ease of use" of mobile banking, TAM expected its widespread adoption (Hellstrand & Breckwoldt, 2016; Venkatesh et al., 2003). Thus, this research aims to investigate whether Gen Yers' positive attitudes toward mobile banking are related to their perceptions of TAM's usefulness and ease of use (Akturan & Tezcan, 2012).

Perceived usefulness is defined by Mathwick et al. (2002) as helping the customer to upgrade their performance level. Perceived usefulness also directly impacts the customer's motive to use more and above its effect on the virtue of attitude (Wixom & Todd, 2005). Perceived usefulness is the personal benefit of Generation Y and Generation Z that could improve how consumers complete the assignment given to them (Jaruwachirathanakul & Fink, 2005). Chau et al. (2013) tested the relationship of perceived usefulness toward the client's acceptance of mobile banking. Furthermore, there is a strong association between how perceived usefulness of mobile banking is thought to be and how often people use it, according to the research on mobile banking (Gefen et al., 2003; Gefen & Straub, 2000).

Perceived ease of use, as described by Hussain et al. (2017) is the degree to which a consumer is helped in their grasp of mobile banking. Perceived ease of use has been described in different ways by different academics, but generally, it refers to the point at which consumers learn about effective procedures that will not cost them anything (Gu et al., 2009; Stern et al., 2008). Similarly, Chitungo and Munongo (2013) argued that consumers are more likely to try out a new product if they believe it to be user-friendly. Previous research has shown that consumers' positive sentiments regarding mobile banking are significantly influenced by how easy it is considered to use (Al-Husein & Asad Sadi, 2015; Holden & Karsh, 2010; Karuppiah et al., 2014; Legris et al., 2003). In addition, consumers who view mobile banking as simple will be more likely to adopt the service (Akturan & Tezcan, 2012).

Perceived benefit

Perceived benefit is defined as a consumer's attempt to get advice from a service provider subject to perceptions regarding the ability and benefits gained from utilising and managing mobile banking (Chitungo & Munongo, 2013). Perceived benefits also refer to the degree to which an innovation gives more benefits and advantages than its precursor (Kim et al., 2008; Kim et al., 2009). Even though customer understands the potential advantage available for mobile banking user, the tendency to have numerous perception and trust toward mobile banking remain (Khasawneh & Irshaidat, 2017). For instance, Chen et al. (2017) concluded that perceived benefit is unique and genuine concerning the goal of using mobile banking. In addition, perceived benefit allows the user to use banking activities anytime and beyond boundaries (Lu et al., 2003; Venkatesh & Bala, 2008; Venkatesh et al., 2003). Benefits that users perceive to receive from utilising mobile banking are both personally beneficial and have a significant impact on their disposition toward the service. The importance of perceived benefit is highlighted in the study of internet banking.

Perceived risk

Although previous studies on customers' perceived risks were conducted within the context of mobile banking (Ismail & Masinge, 2011; Tan & Teo, 2000), the perceived risk variable has been modelled as one construct. Perceived risk is a function of the significance or extent of a goal a person attempts to attain and the seriousness of the atonement one must undergo while not achieving it (Mitchell, 1999). Liao et al. (2011), and De Ruyter et al. (1998) discovered that young people's apprehension about mobile banking's inherent security risks is a major roadblock to its continued mainstream acceptance. In a nutshell, Gen Y's attitude toward mobile banking usage is determined by their perception of the perceived risks. Consumers are more inclined to use mobile banking if they view the associated dangers as being minimal.

Attitude to use mobile banking

Indeed, buyer reactions to mobile banking are an important indicator of customer intention and use of mobile banking services. Grohmann and Bodur (2015) indicated that attitude refers to perspective as a useful or destructive bias toward conduct inside a given situation. Mindset is linked to at least one's behavioural purpose (Guriting & Oly Ndubisi, 2006). The remarkable expressions and contemplations set clarifies a benefactor's conduct expectations. Bansal and Taylor (1999) signifed that attitude is included with two factors related to interest and unity. Therefore, the usefulness of mobile banking induces users' attitudes to use them.

The following hypothesis is developed based on the literature above:

H1: There is a significant relationship between Technology Acceptance Model and Attitude to use mobile banking.

H2: There is a significant relationship between Perceived Benefit and Attitude to use mobile banking.

H3: There is a significant relationship between Perceived Risk and Attitude to use mobile banking.

Methodology

This is a quantitative study, and it uses a stratified random sampling technique to acquire its sample. A stratified sample is conducted by separating the population into two different age groups; where is this research, and we will be focusing only on young people in the southern part of Malaysia. Three hundred surveys were distributed; however, only two hundred were usable. The study's survey question was adapted from Akturan and Tezcan (2012). All questions were scored on a 5-point Likert scale. Those from Generation Y who are now using or considering using a mobile banking service constitute the sample for this study (Govender & Sihlali, 2014). Customers under the age of 37 now account for half of all mobile banking users, and this percentage is rising quickly. Using the Partial Least Squares Structural Equation Model (PLS-SEM) technique, we could quantify the connection between TAM, perceived benefit, and perceived risk and attitude, and IBM SPSS version 23 was used for the descriptive analysis.

Result and Discussion

Demographic profile

There were 195 respondents; 59 (or 30%) were male, and 136 (or 70%) were female. With a total of 167 responses, the 18–21 age group had a relatively high response rate (83.5 per cent). Further, 29 people, or (14.5 %), fell between the ages of 22 and 25, while 29 people, or (14.5 %), fell between the ages of 26 and 29 (2.0 %). 167 respondents were in the prime surveying age 18–21(83.5 %) 194 (78%) identified as a single (97.0 %). The majority of respondents had advanced degrees (144 or 74.0 %), while only 40 (26.0 %) held only a high school diploma (20.0 %). Among the 195 respondents, those identified as students made up the largest group (97.5 %). According to the statistics in the table below, 195 respondents (97.5 %) had monthly incomes of less than RM 2,000, while only one respondent (0.1 %) had monthly incomes of between RM 3,100 and RM 5,000 (0.5 %).

Measurement model analysis

As part of the structural model analysis required for assessing the measurement model, testing the consistency and correctness of the latent variables is performed. When determining the dependability of the instruments employed in this study, researchers relied on internal consistency analyses and indicators. Evaluating the measurement model for convergent and discriminant validity in this study necessitates conducting a structural model analysis, including checking the precision and reliability of the latent variables. An internal consistency analysis was conducted to test the indicators' reliability. The study's measuring model is validated for convergent and discriminant validity using methods from Chin (2010).

The first step in evaluating reliability was to look at how well it maintained its own consistency. When the CR for each variable is greater than the cut-off value of 0.6, we know that the measurement model is internally consistent. The CR values in Table I for all of the study's variables are higher than the cut-off value of 0.6, as recommended in the literature. Therefore, the results demonstrate that the parts employed to represent the variables have adequate internal consistency dependability.

Validity comes next. It involves looking at the data for both convergent and discriminant validity. Average extracted variance is a good measure of convergent validity (AVE) (Hair et al., 2010). According to this criterion, the construct with the greatest mean value of the squared loading is the most important. Table 1 shows the AVE results; while some of the values are lower than 0.5, they are all within the range that is considered acceptable. As stated by Fornell and Cha (1994) convergent validity of a construct is still considered adequate if the composite reliability is better than 0.6, but the AVE is less than 0.5. Therefore, the results showed that the constructs used in this study had convergent validity (AVE).

Additionally, the present research employs the Heterotrait-Monotrait (HTMT) ratio of correlations to evaluate discriminant validity (Henseler et al., 2015). The average correlation coefficient between indicators (HTMT) is a standard method of measuring this independent construct. According to Henseler et al. (2015), HTMT values greater than 0.90 are not particularly useful for classification purposes. A more conservative cut-off value of 0.85 appears to be necessary when the path model constructions are more clearly conceptually independent (Henseler et al., 2015). No values in Table 2 exceed 0.90, the threshold for HTMT, so discriminant validity is not an issue.

Structural model analysis

Direct effect testing

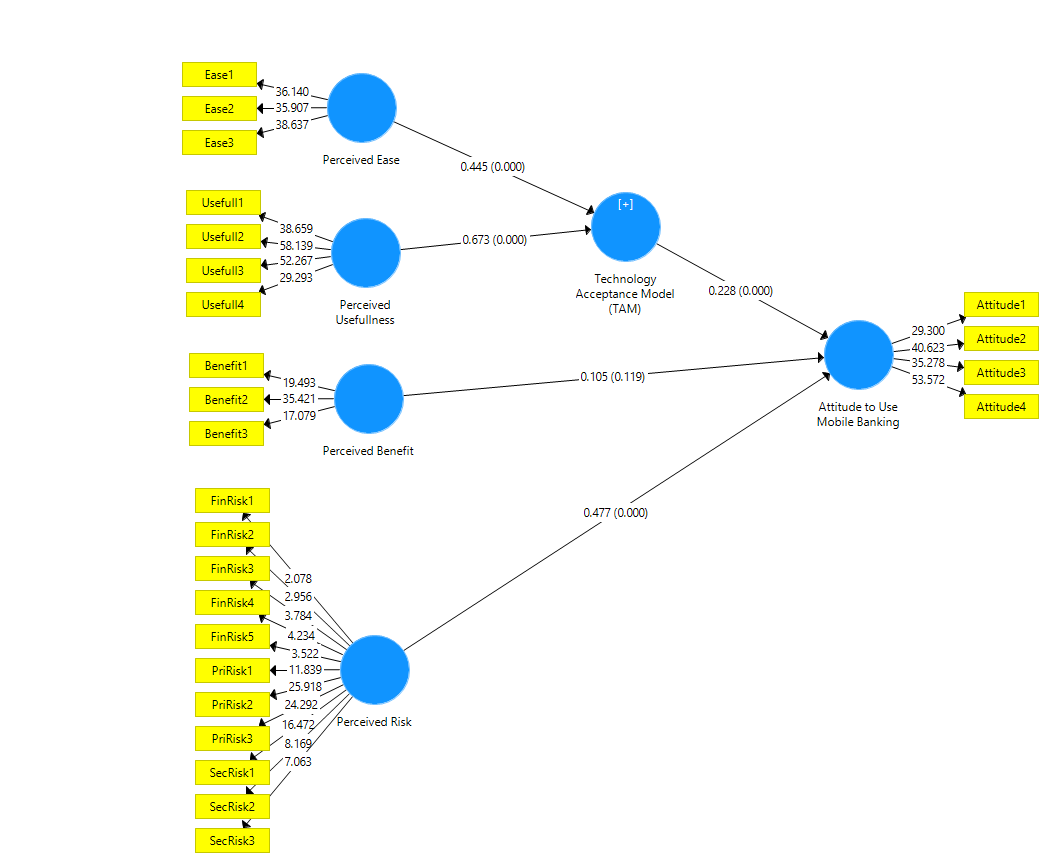

After the measurement has been validated, the next significant stage in SEM analysis is the structural model, also known as the route analysis. Using the structural model, we can evaluate how different factors in the study affect one another. The structural model defines all interrelationships between variables. It shows how the relationships between independent and dependent variables can impact one another (Hair et al., 2006). In order to interpret the path coefficients using t-statistics, bootstrapping is employed (Ringle et al., 2005). Figure 1 illustrates the structural model and Hypothesis 1 indicates a significant relationship between TAM and mobile banking attitude with β=0.228 and t-value=3.524**. TAM has a favourable, statistically significant impact on customers' willingness to use mobile banking, which is consistent with previous research (Akturan & Tezcan, 2012). Mobile banking users are more satisfied with the service and its ability to improve their work efficiency. As a result, members of the Millennial generation are the most likely to utilise and support mobile banking. Table 3 shows that there is a significant relationship between perceived advantage and mobile banking attitude, with a t-value of 1.795* and a p-value of =0.105 (Hypothesis 2). Similar results were found by Pikkarainen et al. (2004). Table 3 below shows that Hypothesis 3, perceived risk, has a significant relationship with β=0.477, t-value=7,974**, thus accepting the hypothesis. The result is constant with (Krishanan et al., 2015), who discovered a positive correlation between risk perception and mobile banking attitude.

Conclusions

In this study, we investigate how Gen Y's attitudes toward mobile banking relate to the Technology Acceptance Model's three dimensions of acceptance: perceived advantage, perceived danger, and technology itself. The Technology Acceptance Model, perceived advantage, and perceived risk all had positive correlations with millennials' views on mobile banking. Today's young people have the freedom to manage their finances whenever and whenever they choose, thanks to the widespread use of mobile banking. With this, they do not have to go to the bank and queue for almost an hour to make a single transaction because it is now possible with just a click away. This study delves into the mindsets and motivations of Millennials and Generation Z mobile banking users by investigating various factors. However, discussions and studies on the factors influencing Generation Y's attitude toward mobile banking persist. Future researchers should cover the whole population and places all over Malaysia instead of focusing on only several places and one region. With this, the researchers can know how Mobile Banking affects Malaysians as a whole and not only focus on specific states or communities. Other than that, this study is only focused on Generation Y. However, future researchers should conduct on the different sectors and not only emphasise on Generation Y. This research can be done to Generation X or focus on people that are currently working because they are also the people that use mobile banking in their daily life.

References

Akturan, U., & Tezcan, N. (2012). Mobile banking adoption of the youth market: Perceptions and intentions. Marketing Intelligence & Planning, 30(4), 444-459. DOI:

Al-Husein, M., & Asad Sadi, M. (2015). Preference on the perception of mobile banking: A Saudi Arabian Perspective. European Online Journal of Natural and Social Sciences, 4(1), 161-172.

Bansal, H. S., & Taylor, S. F. (1999). The service provider switching model (spsm) a model of consumer switching behavior in the services industry. Journal of service Research, 2(2), 200-218. DOI:

Chau, M., Sung, W.-k., Lai, S., Wang, M., Wong, A., Chan, K. W., & Li, T. M. (2013). Evaluating students’ perception of a three-dimensional virtual world learning environment. Knowledge Management & E-Learning: An International Journal, 5(3), 323-333. DOI:

Chen, W., Zhang, D., Pan, Y., Hu, T., Liu, G., & Luo, S. (2017). Perceived social support and self-esteem as mediators of the relationship between parental attachment and life satisfaction among Chinese adolescents. Personality and Individual Differences, 108, 98-102. DOI:

Chin, W. W. (2010). How to write up and report PLS analyses. In Handbook of partial least squares (pp. 655-690). Springer. DOI:

Chitungo, S. K., & Munongo, S. (2013). Extending the technology acceptance model to mobile banking adoption in rural Zimbabwe. Journal of Business Administration and Education, 3(1).

De Ruyter, K., Wetzels, M., & Bloemer, J. (1998). On the relationship between perceived service quality, service loyalty and switching costs. International journal of service industry management, 9(5), 436-453. DOI:

Fornell, C., & Cha, J. (1994). Partial least squares. Advanced methods of marketing research, 407(3), 52-78.

Gefen, D., Karahanna, E., & Straub, D. W. (2003). Trust and TAM in online shopping: An integrated model. MIS quarterly, 27(1), 51-90. DOI:

Gefen, D., & Straub, D. W. (2000). The relative importance of perceived ease of use in IS adoption: A study of e-commerce adoption. Journal of the association for Information Systems, 1(1), 8. DOI:

Govender, I., & Sihlali, W. (2014). A study of mobile banking adoption among university students using an extended TAM. Mediterranean Journal of Social Sciences, 5(7), 451. DOI:

Grohmann, B., & Bodur, H. O. (2015). Brand social responsibility: conceptualization, measurement, and outcomes. Journal of business Ethics, 131(2), 375-399. DOI:

Gu, J.-C., Lee, S.-C., & Suh, Y.-H. (2009). Determinants of behavioral intention to mobile banking. Expert Systems with Applications, 36(9), 11605-11616. DOI:

Guriting, P., & Oly Ndubisi, N. (2006). Borneo online banking: evaluating customer perceptions and behavioural intention. Management Research News, 29(1/2), 6-15. DOI:

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2006). Multivariate data analysis (Vol. 6). Pearson Prentice Hall.

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2010). Multivariate data analysis (Vol. 7). Pearson Prentice Hall.

Hellstrand, A., & Breckwoldt, M. (2016). Consumer acceptace of mobile banking in Germany. In.

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115-135. DOI:

Holden, R. J., & Karsh, B.-T. (2010). The technology acceptance model: its past and its future in health care. Journal of biomedical informatics, 43(1), 159-172. DOI:

Hussain, S., Ahmed, W., Jafar, R. M. S., Rabnawaz, A., & Jianzhou, Y. (2017). eWOM source credibility, perceived risk and food product customer's information adoption. Computers in Human Behavior, 66, 96-102. DOI:

Ismail, T., & Masinge, K. (2011). Working paper series mobile banking: innovation for the poor. In: Research and Training Support to Build African Capacity in Science.

Jaruwachirathanakul, B., & Fink, D. (2005). Internet banking adoption strategies for a developing country: the case of Thailand. Internet research, 15(3), 295-311. DOI:

Jung, J.-H., Kwon, E., & Kim, D. H. (2020). Mobile payment service usage: US consumers’ motivations and intentions. Computers in Human Behavior Reports, 1, 100008. DOI:

Kapoor, A., Sindwani, R., & Goel, M. (2021). Prioritising the Key Factors Influencing the Adoption of Mobile Wallets: an Indian Perspective in Covid-19 Era. Journal of Information Technology Management, 13(4), 161-182.

Karuppiah, N., Subramanian, U., Seng Hu, S., Basiuni, R. M., & Jefri, R. (2014). Customer acceptance of internet banking in Brunei Darussalam d. In 2022 1st International Conference on Technology Innovation and Its Applications (ICTIIA) (pp. 1-4). IEEE. DOI:

Khasawneh, M. H. A., & Irshaidat, R. (2017). Empirical validation of the decomposed theory of planned behaviour model within the mobile banking adoption context. International Journal of Electronic Marketing and Retailing, 8(1), 58-76. DOI:

Kim, D. J., Ferrin, D. L., & Rao, H. R. (2008). A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decision Support Systems, 44(2), 544-564. DOI:

Kim, G., Shin, B., & Lee, H. G. (2009). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, 19(3), 283-311. DOI:

Krishanan, D., Khin, A. A., & Teng, K. L. L. (2015). Attitude towards using mobile banking in Malaysia: a conceptual framework. Journal of Economics, Management and Trade, 306-315. DOI:

Lee, Y., Kozar, K. A., & Larsen, K. R. (2003). The technology acceptance model: Past, present, and future. Communications of the Association for information systems, 12(1), 50. DOI:

Legris, P., Ingham, J., & Collerette, P. (2003). Why do people use information technology? A critical review of the technology acceptance model. Information & management, 40(3), 191-204. DOI:

Liao, C., Liu, C.-C., & Chen, K. (2011). Examining the impact of privacy, trust and risk perceptions beyond monetary transactions: An integrated model. Electronic Commerce Research and Applications, 10(6), 702-715. DOI:

Lu, J., Yu, C.-S., Liu, C., & Yao, J. E. (2003). Technology acceptance model for wireless Internet. Internet research, 13(3), 206-222. DOI:

Mathwick, C., Malhotra, N. K., & Rigdon, E. (2002). The effect of dynamic retail experiences on experiential perceptions of value: an Internet and catalog comparison. Journal of retailing, 78(1), 51-60. DOI:

Mitchell, V.-W. (1999). Consumer perceived risk: conceptualisations and models. European Journal of marketing, 33(1/2), 163-195. DOI:

Munir, A. R., Idrus, M., Kadir, R., & Jusni, S. (2013). Acceptance of mobile banking services in Makassar: a technology acceptance model (TAM) approach. IOSR Journal of Business and Management, 7(6), 52-59. DOI:

Mustafa, M. A., Singh, J. S. K., & Ahmad, N. B. (2022). The Adoption Of E-Wallet By Generation Z In Kuala Lumpur, Malaysia. Electronic Journal of Business and Management, 7(2), 51-67.

Oly Ndubisi, N., & Sinti, Q. (2006). Consumer attitudes, system's characteristics and internet banking adoption in Malaysia. Management Research News, 29(1/2), 16-27. DOI:

Pikkarainen, T., Pikkarainen, K., Karjaluoto, H., & Pahnila, S. (2004). Consumer acceptance of online banking: an extension of the technology acceptance model. Internet research, 14(3), 224-235. DOI:

Ringle, C., Wende, S., & Will, A. (2005). Smart-PLS Version 2.0 M3. University of Hamburg.

Shan, Y. (2016). How credible are online product reviews? The effects of self-generated and system-generated cues on source credibility evaluation. Computers in Human Behavior, 55, 633-641. DOI:

Stern, B. B., Royne, M. B., Stafford, T. F., & Bienstock, C. C. (2008). Consumer acceptance of online auctions: An extension and revision of the TAM. Psychology & Marketing, 25(7), 619-636. DOI:

Tan, M., & Teo, T. S. (2000). Factors influencing the adoption of Internet banking. Journal of the Association for information Systems, 1(1), 5. DOI:

The Star. (2016, Jan 1). Mobile banking threats on the rise. https://www.thestar.com.my/tech/tech-news/2016/01/01/mobile-banking-threats-on-the-rise/

Venkatesh, V., & Bala, H. (2008). Technology acceptance model 3 and a research agenda on interventions. Decision sciences, 39(2), 273-315. DOI:

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS quarterly, 425-478. DOI:

Wixom, B. H., & Todd, P. A. (2005). A theoretical integration of user satisfaction and technology acceptance. Information systems research, 16(1), 85-102. DOI:

Yong, C., & Qiang, L. (2022). An Empirical Model of Acceptance of Mobile Payment in Malaysia. Global Journal of Management and Business Research.

Yusoff, Y. M., Ramayah, T., & Ibrahim, H. (2010). E-HRM: A proposed model based on technology acceptance model. African Journal of Business Management, 4(14), 3039-3045.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Mohamad, M., Wan Hanafi, W. N., & Toolib, S. N. (2023). Measuring Mobile Banking User Attitude In Malaysia. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 876-885). European Publisher. https://doi.org/10.15405/epfe.23081.80