Abstract

The purpose of this study is to examine the moderating influence of inflation on the link between dividend determinants and dividend pay-outs in Malaysia. This study investigates dividend determinants taken from Lintner's model and inflation rate as a moderating variable. Data and information were collected from selected organizations using relevant and trustworthy databases and annual reports. A total of 260 listed firms out of a population of 790 listed companies in 2019 data were analysed using panel data analysis with fixed and random effects, pooled least squares model, and robust standard errors on fixed effects and random-effects models. The research comprised assessments of multicollinearity, heteroskedasticity, and regression models and was based on a categorization of 177 firms during a ten-year period. The study found a clear correlation between Firm revenue and dividend pay-outs, as well as between inflation and dividend pay-outs. The significance of this study lies in examining the moderating influence of inflation rate on the connection between dividend determinants and dividend pay-outs of publicly traded corporations in a developing market. Its practical application is valuable for board managers in understanding the factors that influence determining an acceptable dividend policy. This study presents a conceptual and empirical investigation of the moderating influence of inflation rate on the link between dividend determinants and dividend pay-outs of publicly listed corporations in the developing market of Malaysia. The novelty and usefulness of this study lies in its expansion of empirical data on dividend determinants.

Keywords: Determinant of dividend, dividend pay-out, inflation rate, moderating effects

Introduction

The significance of the research on dividends is strengthened by empirical evidence, particularly in the area of corporate decision-making and dividends (Bhat & Pandey, 1994; Bhattacharyya, 2007; Lotto, 2020; Pandey, 2003). The impact of inflation on dividend payouts is a concern for market players and has received varying conclusions in previous research. Emerging markets, such as Malaysia, receive less attention compared to developed markets and the impact of inflation on dividend determinants and pay-outs is often neglected. This study focuses on the impact of inflation on the link between dividend determinants and pay-outs in the context of Malaysia's developing economy. The study will sample all publicly traded companies in Malaysia, excluding non-regularly listed and non-dividend paying firms and banking and real estate investment trust companies. The results of this study will provide valuable information for managers, researchers, and investors in finance to understand the impact of inflation on dividend decisions and investments.

Problem Statement

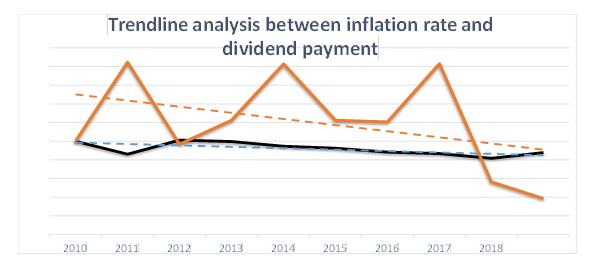

As seen in Figure 1, a preliminary study was conducted between the inflation rate and dividend payouts among the top 30 publicly traded companies on Bursa Malaysia.

24 companies were evaluated based on their consistency of dividend payments from 2010 to 2019, as shown in Figure 1. The rate of dividend distribution decreased during this period due to various factors, including the global economic slowdown and increased tensions in the US. Most companies in Asia have a set policy for dividend pay-outs, resulting in a reduction of dividends if earnings decline. Inflation has been identified as a factor that can influence dividend policies and pay-outs, as it affects the cost of obtaining funds and the profitability of a company. According to Pandey (2007), macroeconomic factors such as inflation have a significant impact on the choices made by dividend policymakers. Inflation can distort the pricing system, increase transaction costs, and impact the profitability of a company, as pointed out by Michael (2019). On the other hand, inflation also affects the strength and direction of the relationship between dividend determinants and payments. However, the role of inflation as a moderating factor in the dividend decision-making process remains unclear, as noted by Frankfurter and Wood (2002). The purpose of the research discussed is to examine the impact of inflation rate as a moderating variable in the relationship between dividend determinants and dividend payments, using panel data regression analysis on Malaysian businesses. The aim is to assess the stability of Malaysian enterprises and their dividend pay-outs, as well as to analyse the correlation between dividend determinants and dividend payments. This research contributes to the recent studies that evaluate the impact of inflation on the dividend decision-making process

Research Questions

In light of the above discussion, the study aims to address the following questions:

- What are the relationships between determinants of dividend and dividend payouts?

- What is the moderation effect of the inflation rate towards the relationships between determinants of dividend and dividend payouts?

Purpose of the Study

The significance of the study is to provide evidence on contextualized effects and precise results on influencing factors of dividend pay-out in Malaysia with consideration of moderating effect. Nevertheless, this study offers information to the board of stakeholders and board of directors for formulating and revising pay-out policy by taking into consideration the factors that prove to exercise significant influence on dividend pay-out more in-depth and precise with consideration inflation rate as moderating factor in decision making. The managers and shareholders can extract relevant outcomes from this research to strategize and find mutual interest to reduce the agency cost problem. They can further understand how the inflation rate moderate the effect between determinants of dividend and dividend payouts when they are deciding on dividend distributions. Furthermore, this study will contribute literature on inflation as a moderator variable between determinants of dividend and dividend payout. This area of research is dearth and unique in emerging countries and Malaysia's perspective. However, it will grant a body of knowledge in emerging country prospects. An additional dimension to support and contribute to the literature is the measurement of the variable that gives an impact to dividend payment might help in contributing the path to understand dividend riddle that exists over the decades while bringing new dimension that anticipates moderating variable factor in a new context to test their relations

Research Methods

This study conducted quantitative research using secondary data, quantifying, and statistically examining the data to support the presumptions. Financial ratios, dividend rate, and inflation rate were considered. Multi-dimensional time series analysis was used. Correlation, multiple regression, and dynamic panel data were also employed to ensure validity and reliability of results. The sample consisted of 290 firms from Bursa Malaysia, chosen using multistage sampling technique with 95% confidence level and 5% margin of error. The sample was stratified by sectors and chosen based on their highest market capitalization and history of paying dividends. The sample was the whole population of PLCs in Malaysia meeting certain criteria as stated below:

- Requires a full set of data from 2010 to 2019.

- Selection basis based on top market capitalization has also been used by several prior studies; Pandey (2003), Yusof and Ismail (2016);

- To be excluded, the firms have not been listed on Bursa Malaysia continuously from 2010 to 2019, the companies have not been paying dividends during the study period and the exclusion of financial and real estate investment trust firms (Yusof & Ismail, 2016).

The study made use of both primary and secondary data. The secondary data was collected from the Thomson Reuters Eikon Database and the financial statements of the publicly listed companies (PLCs) between 2010 and 2019. According to Zala (2010), secondary data is information gathered from existing records rather than directly from the researcher. Financial statements, including the balance sheet, income statement, and cash flow statement, were used to analyze the financial status of the companies. The data collected was used to calculate various financial ratios such as Dividend Pay-out Ratio (DPR), Free Cash Flow (FCF), Debt Ratio (DR), Price-to-Earnings Ratio (P/E Ratio) and Dividend Yield (DY). In addition, the study gathered inflation rate statistics from the Consumer Price Index (CPI) obtained from the International Monetary Fund's Report of World Economic Outlook and the Department of Statistics of Malaysia's Report of Malaysia Economic Statistics. The study made use of panel data analysis, which is a type of longitudinal data that has both cross-sectional and time series dimensions. The panel data analysis was performed to determine the relationship between dividend determinants and dividend modified by inflation rate. The baseline model proposed by the study is represented by the equation below:

𝐲𝐢𝐭 = 𝛃𝟏𝐃𝐃𝐏𝐢𝐭 + 𝛃𝟐𝐈𝐑𝐢𝐭 + 𝛃𝟑(𝐃𝐃𝐏𝐢𝐭 𝐗 𝐈𝐑𝐢𝐭) + 𝛃′𝐗𝐢𝐭 + 𝛆𝐢𝐭. (1)

Where:

𝐲𝐢𝐭 = natural logarithm of determinants of dividend (FCF, DF, FRG, IO)

DDP = dividend pay-outs

𝛃𝟏 = beta value used to measure the influence of the predictor variable on the criterion variable, measured in terms of standard deviation bi’s (i=1,2…n)

𝛃𝟐 = coefficient of the interaction between determinant dividend and inflation rate

X = vector of other control variables that affect efficiency

ɛ = error term

i = firm effect (i = 1, 2, …. N)

t = time effect (t = 1, 2, …, T)

IR = Interest rate

The study examined the impact of the determinants of dividend, such as FCF, DF, FG, and IO, on dividend distributions subject to inflation rate using dummy variables. The study used panel data analysis techniques such as fixed and random effects, pooled least squares model, robust standard errors on fixed effects, and random-effects models. The regression model and descriptive statistics were performed using Stata Statistical Software version 14.0.

Findings

This analysis demonstrates that data were accessible for all publicly traded companies throughout all times (strongly balanced). Table 6.1 contains details about the level of descriptive statistics and data in natural algorithm converted to log10/inverse/sqrt algorithm. It was done to simplify this study's normalcy testing

Descriptive analysis

Frequency tables are used in descriptive statistical analysis to describe the mean, standard deviation, variance, maximum, minimum, total, range, kurtosis, and distribution gap of processed data. Table 1 displays the outcome of the descriptive statistic.

For 177 publicly listed firms from 2010 to 2019, Table 1 shows the mean and standard deviation of the dependent variable, dividend payment. The independent variables in this research are the debt ratio, dividend yield, operational cash flow, and P/E ratio, with inflation serving as a moderating factor. Table 1 displays the sample of 1770 observations collected over a ten-year period from 177 organizations. However, it is important to note that only 177 out of 1127 publicly traded firms in this research distributed dividends for the entire 10-year period, and the data was sorted according to the stated criteria in the methodology. The data used in this research, from 2010 to 2019, is based on Table . According to the descriptive data, the lowest dividend payout ratio (DPR) for the years 2010 through 2019 was 0.03 and the highest DPR was 2.69. The mean value of the DPR is 1.59, while the standard deviation is 0.33. The first independent variable is debt financing, with a debt ratio varying from a minimum of -6.61 to a high of 0 throughout the period from 2010 to 2019. The debt ratio has a standard deviation of 0.81 and a mean value of -0.81. The second independent variable is investment opportunities, with the lowest dividend yield of -2.48 and the highest of 0 for the years 2010 through 2019. The dividend yield has a standard deviation of 0.58 and a mean value of -1.25. The third independent variable is free cash flow, with a minimum value of 0 and a maximum value of 6.67 for the years 2010 through 2019. The average operational cash flow is $2.27, with a standard deviation of $0.05. The fourth independent variable is firm revenue growth, with the lowest P/E ratio of 0 and the highest of 1.99 for the years 2010 through 2019. The P/E ratio has a mean and standard deviation of 1.02 and 0.41, respectively. In this investigation, the moderating element is the inflation rate, which ranges from 0.58 percent to -0.18 percent throughout the observation period from 2010 to 2019. The inflation rate has a standard deviation of 0.23 and a mean of 0.28. A classical assumption test was conducted to assess the data's heteroscedasticity, autocorrelation, multicollinearity, and normality before conducting a hypothesis test. This test was used to determine the suitability of the study's regression model. It is important to note that in-text citations should be added where appropriate to give credit to the sources used in the research. The normality test had been carried out prior to examining the connection between the four independent factors and the dependent variables. To ensure that the data is normally distributed, the normality test was carried out. With the value of VIF less, which is 1.01, there was no multicollinearity between the variables, nonetheless.

Regression analysis

Table 2 show the findings of regression analysis using fixed-effects models on variables affecting dividend pay-out. The fixed effects model is the most effective model to describe the factors that affect dividend pay-out, according to the Hausman test.

The maximum asymptote is the asymptotic degree of looking at the end of the time course of fixations. The crossover point is the point in time the function crosses the midway point between peak and baseline. The slope represents the rate of change in the function measured at the crossover. Mean parameter values for each of the analyses are shown for the 9-year-olds (n = 24) and 16-year-olds (n = 18), as well as the results of t tests (assuming unequal variance) comparing the parameter estimates between the two ages. Research was conducted that looked at five different criteria to examine the relationship between various factors and dividend pay-out. Three of the five criteria were free cash flow, debt financing, and investment possibilities, however, these three were not deemed important in the study. On the other hand, the study found a considerable correlation between firm revenue growth and inflation rate and dividend pay-out. The results showed that there was no significant link between free cash flow, debt financing, and investment opportunities with dividend pay-out as the p-values for each of these relationships were more than 0.05. However, the study found a negative significant link between firm revenue growth and dividend pay-out, with a p-value of 0.004, which is less than 0.05. The association between inflation rate and dividend pay-out was also found to be highly negative, with a p-value of 0.000, which is less than 0.05.

Moderating effects

Inflation rate has no moderating influence on the relationship between dividend pay-outs and dividend determinants. All the study's hypotheses were proven false. This shows that the connection between the independent and dependent variables as shown in Table 3 was not significantly influenced by the inflation rate as a moderator.

The results of our research show that there is no significant relationship between free cash flow and dividend payments (p-value = 0.791, higher than the threshold of 0.05). This aligns with previous studies by Yusof and Ismail (2016) and Sim (2011) and Kapoor et al. (2010) which found little correlation between cash flow and dividends. Lohonauman and Budiarso (2021) argue that many companies prioritize business expansion and debt repayment over dividend pay-outs. Rochmah and Ardianto (2020) found that as companies have more cash, they may increase their pay-out ratio. Our study also found no significant link between dividend payments and debt financing (p-value = 0.570, higher than 0.05), consistent with Makenzi (2018) who found little negative association between debt financing and the dividend pay-out ratio of NSE-listed manufacturing companies, although Yusof and Ismail (2016) found positive association. Rozeff (1982) noted that high financial leverage may result in lower payout ratios. Our sample excluded companies with considerable debt. Meanwhile, Hashemi and Kashani (2012) found a negative association between financial leverage and dividends. Our research found no significant relationship between investment opportunities and dividend pay-out (p-value = 0.822, greater than 0.05), supported by studies by Fauziah et al. (2022) and Salju et al. (2022) on Indonesian Stock Exchange companies. Myers (1977) suggested investment prospects rely on managers' discretionary spending. Companies with expanding quickly may have less cash and pay fewer dividends. There may be varying styles and philosophies leading to different effects, as suggested by Subramaniam et al. (2011). The p-value for firm revenue growth and dividend pay-out is 0.004, which is less than 0.05, indicating a significant negative correlation in our research, supported by Gill et al. (2010) and Ajanthan (2013), but Arnott and Asness (2003) suggested management's reluctance to cut pay-outs may also contribute. The p-value for the correlation between inflation rate and dividend pay-out is 0.000 (less than 0.05), indicating a strong negative correlation. Agustin (2019) found a link between dividend pay-out and inflation, despite inflation being modestly negative, which may be due to factors such as rising interest rates affecting retained profits. Basse and Reddemann (2011) found a positive correlation between dividend and inflation, but Elly and Hellen (2013) demonstrated that the dividend pay-out may depend on the target debt, which varies depending on various factors such as profitability, size, asset composition, and risk.

Conclusion

In respect to dividend pay-outs, this research examined the variables influencing dividend pay-out ratios. Business revenue showed considerable positive connections to dividend pay-outs, but the other three factors that were studied were determined to be non-significant. In addition, inflation rates have no influence on the relationship between the independent factors and the dependent variable. In this investigation, it was found that some of the correlations between the independent factors and the dependent variable were different. The flaw in this analysis is that it excludes Malaysia's financial sector and solely concentrates on publicly listed companies. As changes in the economic environment may influence the relationship between variables for future study, researchers may desire to look at the inflation rate as a mediating element and enhance the analytical approach on this connection. Future researchers must employ other techniques like threshold and demean or quantile analysis for their approach to be robust. Using this technology, the data may be clustered effectively to evaluate the robustness of the connections. By incorporating a finance corporation with the premise of dividend consistency and stability of other variables, future researchers may analyse the moderating effects. Moreover, mixed-mode qualitative and quantitative methodologies may be considered; nevertheless, the outcomes of employing combination data may differ.

Acknowledgments

We would like to extend our heartfelt appreciation to Universiti Teknologi MARA (UiTM) for granting us the opportunity to carry out this study as part of our efforts to augment the number of PhD graduates and enhance our publication agenda, with the ultimate goal of attaining Globally Renowned University by 2025. The work received financing from the Geran Insentif Penyeliaan, Universiti Teknologi MARA (600-RMC/GIP 5/3 (047/2021). The study would not have been possible without the financial support provided by the university through the Research Management Centre (RMC).

References

Agustin, D. (2019). Analysis of the Effect of Inflation, Interest Rate, Debt To Equity Ratio, Return On Assets, Firm Size, Earning Per Share, and Asset Growth on Dividend Payout Ratio (Study of Companies Listed in the Jakarta Islamic Index 2014-2017). Muhammadiyah Surakarta University.

Ajanthan, A. (2013). The relationship between dividend payout and firm profitability: A study of listed hotels and restaurant companies in Sri Lanka. International Journal of Scientific and Research Publications, 3(6), 1–6.

Arnott, R. D., & Asness, C. S. (2003). Surprise! Higher Dividends = Higher Earnings Growth. Financial Analysts Journal, 59(1), 70-87. DOI:

Basse, T., & Reddemann, S. (2011). Inflation and the dividend policy of US firms. Managerial Finance, 37(1), 34-46. DOI:

Bhat, R., & Pandey, I. M. (1994). Dividend Decision : A Study of Managers ’ Perceptions. Decision, 21(January-June), 67–86.

Bhattacharyya, N. (2007). Dividend policy: a review. Managerial Finance, 33(1), 4–13. DOI:

Elly, O. D., & Hellen, K. W. (2013). Relationship between inflation and dividend payout for companies listed at the Nairobi Securities Exchange. International Journal of Education and Research, 1(6), 1–8.

Fauziah, R. L., Norisanti, N., & Daniel, D. M. (2022). The Effect of Return on Investment, Basic Earning Power and Investment Opportunity Set on Dividend Payout Ratio (Study of Infrastructure Firm Listed at Indonesia Stock Exchange In 2017- 2021). Journal of International Conference Proceedings, 5(2), 564-573. DOI:

Frankfurter, G. M., & Wood, B. G., Jr. (2002). Dividend policy theories and their empirical tests. International Review of Financial Analysis, 11(2), 111-138. DOI:

Gill, A., Biger, N., & Tibrewala, R. (2010). Determinants of Dividend Payout Ratios: Evidence from United States. The Open Business Journal, 3(1), 8-14. DOI:

Hashemi, S. A., & Kashani, Z. F. (2012). The impact of financial leverage, operating cash flow and size of company on the dividend policy. Interdisciplinary Journal of Contemporary Research in Business, 3(10):264- 270.

Kapoor, S., Mishra, A., & Anil, K. (2010). Dividend Policy Determinants Of Indian Services Sector: A Factorial Analysis. Paradigm, 14(1), 24-41. DOI:

Lohonauman, H., & Budiarso, N. S. (2021). The Effect of Free Cash Flow And Profitability On Dividend Payout Ratio (Case Of Lq-45 Indexed Firms In Indonesia Stock Exchange For Period 2011-2018). Accountability, 10(1), 1. DOI: 10.32400/Ja.32071.10.1.2021.1-6

Lotto, J. (2020). On an ongoing corporate dividend dialogue: Do external influences also matter in dividend decision? Cogent Business & Management, 7(1), 1787734. DOI:

Makenzi, B. (2018). Effect of Debt Financing on Dividend Payout Ratio in Manufacturing Firms Listed at the Nairobi Securities Exchange. University of Nairobi.

Michael, H. R. (2019). The Effect Of Financial Ratio On Company Value With Inflation As A Moderation Variable. Jurnal Akuntansi, 23(1), 33. DOI: 10.24912/ja.v23i1.458

Myers, S. C. (1977). Determinants of corporate borrowing. Journal of Financial Economics, 5(2), 147-175. DOI:

Pandey, I. M. (2003). Corporate Dividend Policy and Behaviour: The Malaysian Experience. Asian Academy of Management Journal, 8(1), 17–32. DOI:

Pandey, I. M. (2007). Dividend behaviour of Indian companies under monetary policy restrictions. Managerial Finance, 33(1), 14-25. DOI: 10.1108/03074350710715782

Rochmah, H. N., & Ardianto, A. (2020). Catering dividend: Dividend premium and free cash flow on dividend policy. Cogent Business & Management, 7(1), 1812927. DOI: 10.1080/23311975.2020.1812927

Rozeff, M. S. (1982). Growth, Beta and Agency Costs as Determinants of Dividend Payout Ratios. Journal Of Financial Research, 5(3), 249-259. DOI:

Salju, S., Sapar, S., & Asrianti, A. (2022). The Influence of Ownership Structure, Capital Structure, Investment Opportunities on Dividend Policy and Company Value. Jurnal Mantik, 6(36), 89–101. https://iocscience.org/ejournal/index.php/mantik/article/view/2131

Sim, L. W. (2011). A study on leading determinants of dividend policy in Malaysia listed companies for food industry under consumer product sector. https://www.researchgate.net/publication/ 254399419_a_study_on_leading_determinants_of_dividend_policy_in_malaysia_listed_companies_for_food_industry_under_consumer_product_sector

Subramaniam, R., Devi, S. S., & Marimuthu, M. (2011). Investment opportunity set and dividend policy in Malaysia. African Journal of Business Management, 5(24), 10128-10143.

Yusof, Y., & Ismail, S. (2016). Determinants of dividend policy of public listed companies in Malaysia. Review of International Business and Strategy, 26(1), 88-99. DOI:

Zala, V. S. (2010). A Study of Productivity and Financial Efficiency of Textile Industry of India. Saurashtra University. https://www.researchgate.net/publication/279437334_A_Study_of_ Productivity_and_Financial_Efficiency_of_Textile_Industry_of_India

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 May 2024

Article Doi

eBook ISBN

978-1-80296-132-4

Publisher

European Publisher

Volume

133

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1110

Subjects

Marketing, retaining, entrepreneurship, management, digital marketing, social entrepreneurship

Cite this article as:

Osman, A., Pyeman, J., Jaafar, M. S., Sundram, V. P. K., & Zakaria, S. (2024). Impact of Inflation on Dividend Determinants and Dividend Payout. In A. K. Othman, M. K. B. A. Rahman, S. Noranee, N. A. R. Demong, & A. Mat (Eds.), Industry-Academia Linkages for Business Sustainability, vol 133. European Proceedings of Social and Behavioural Sciences (pp. 385-394). European Publisher. https://doi.org/10.15405/epsbs.2024.05.32