Abstract

The COVID-19 pandemic has negatively impacted the older population's financial satisfaction and well-being as health-related expenses deplete their retirement funds and family members lose their jobs or receive pay cuts. Older peoples may invest in riskier financial products or businesses to compensate for the loss of savings and financial aid. Hence, this paper intends to investigate the direct and indirect effects between financial satisfaction and financial risk tolerance among the Malaysian older population aged 60 and above. This primary data was collected in the third quarter of 2021 and employed purposive sampling through face-to-face interviews with a structured questionnaire. The results from Process Macro for SPSS and Model 4 (mediation analysis) show that older Malaysians’ financial risk tolerance is not directly influenced by their financial satisfaction, which indicates that older populations share similar risk tolerance during the pandemic regardless of their financial satisfaction. However, financial satisfaction indirectly affects financial risk tolerance, mediated by attitude and subjective norms. These results indicate that the older population, who are more family-orientated and have better financial situations, are more likely to take the lesser risk. In contrast, those with sound financial knowledge and skills, able to identify and invest in profitable financial products, and strongly influenced by their friends are more likely to take higher risks. This study is essential for financial institutions in developing investment products targeting the older population and for the financial planner to educate the elderly to take a reasonable level of financial risk to preserve and accumulate retirement funds.

Keywords: Financial satisfaction, older adult, risk averse, risk taker, theory of planned behaviour

Introduction

The impact of the COVID-19 pandemic on Malaysian populations, especially older people, is unprecedented. According to the Ministry of Health Malaysia (2020), individuals aged 55-64 are most vulnerable to COVID-19 per 100,000, and individuals aged 60 and above have the highest fatality rate. These statistics show that the elderly is at the highest risk of COVID-19 infections and deaths. Apart from physical well-being, the financial well-being of the older population also suffered a massive blow due to COVID-19. According to Malaysia Ageing and Retirement Survey (MARS, 2021) carried out in 2018-2019, about 80% of the older population aged 60-69 were not working. As the age increases, the older population depends lesser on salary income and more on the government’s aid, subsidies, and pensions to support their living (MARS, 2021). According to MARS (2021), about 42% of respondents aged 60-69 received salary incomes as compared to about 71% of respondents aged 50-59, while 47% of respondents aged 60-69 received government aid and subsidies as compared to about 36% of respondents aged 50-59. Moreover, it was found that the older population aged 55 and above received more financial support from family than giving financial support to family (MARS, 2021). In short, Malaysia’s elderly aged 60 and above largely depend on their savings and family financial transfers to support their post-retirement living (MARS, 2021). Therefore, their financial satisfaction is based on saving rather than earning capabilities.

Financial condition of elderly during COVID-19

In the normal period, the ability of the elderly population to save money will decrease as the average age of the population rises. The COVID-19 has had a detrimental effect on the ability of the elderly population to save money. Due to their increased susceptibility to infections, older people are required to make more outlays for health-related expenses such as disinfectants, sanitizers, soap, detergents, face masks, and medicines, which reduces the amount of money they have saved for their retirement. Besides, a series of national lockdowns, such as Movement Control Orders (MCOs) and Conditional MCOs, has resulted in the closure of business activities and created high unemployment. According to the Department of Statistics Malaysia (2020a), during MCO 1.0, the unemployment rate in March 2020 increased to 3.9% from 3.3% in February 2020, and subsequently rose to 5% in April 2020 and 5.3% in May 2020.

The unemployment rate of adults aged 25-64, which is the active working population, also recorded a rise of 1.3% in 2020 compared to 2019 (Department of Statistics Malaysia, 2020b). Besides, during the MCO 3.0 in June 2021, the unemployment rate also climbed by 0.3% to 4.8% as compared to May 2021 (Department of Statistics Malaysia, 2021). As a result, the older population may receive lesser or no financial support from their family member who lost their job or received a pay cut. According to Social Wellbeing Research Centre (SWRC), about 23% of older persons have lost their family financial support due to COVID-19 (Khan et al., 2021).

Financial Satisfaction and Financial Risk Tolerance

Generally, financial satisfaction is referred to as being contented and in the authority of own financial situation. Prior research has shown that financial satisfaction is correlated with individuals’ life satisfaction and well-being (Joo & Grable, 2004; Robb & Woodyard, 2016). According to Chong et al. (2017) and Chng and Hafinaz (2019), two components of financial satisfaction, earnings, and wealth, significantly correlate with financial risk tolerance. Previous research shows two versions of outcomes related to household wealth. Households with higher wealth are more likely to be risker in investment, as they know they can afford the potential losses. However, high-wealth families may also be conservative in choosing products for investment. Households with low wealth may be interested in high-risk investments with high returns for higher wealth accumulation. Researchers Suyam Prabha (2016) and Bertha et al. (2018) proved that an individual’s financial risk tolerance increases simultaneously with the individual’s level of income and wealth. Nonetheless, Rajesh (2018) found a negative relationship between financial satisfaction and risk tolerance, where lower wealthy people are willing to endure higher risks to accumulate wealth. The same goes for Abd Sukor et al. (2021), where study found that financial risk takers have lesser working experience and lower income than their counterparts.

Financial risk tolerance can be defined as how much risk a person can tolerate when deciding on financial investment or making financial decisions (Dickason & Ferreira, 2018). Yao et al. (2005) found that to accumulate wealth, the first place has a higher level of risk tolerance. Conversely, mismanaging the financial environment will lead to contrasting outcomes (Grable et al., 2008). Numerous researchers have studied the relationship between socio-demographic characteristics and financial risk tolerance. Some studies suggested that old adults are more adventurous when dealing with financial management. It was found that a higher proportion of the older generation held riskier stocks. This might be due to their experiences accumulated over the years (Christina, 2019; Zandri & Sune, 2018). However, many researchers learnt that risk tolerance decreases with age (Deakin et al., 2004; Ferreira & Dickason-Koekemoer, 2020; Finke & Huston, 2003; McInish, 1982; Morin & Suarez, 1983; Pålsson, 1996; Rolison et al., 2014; Wallach & Kogan, 1961). Generally, risk tolerance is believed to have a negative relationship with age since the younger generation has a longer time frame for investment; even if they incur losses from riskier assets, they still have a chance to rebound.

Abd Sukor et al. (2021) stated that financial risk-takers have higher levels of trust, overconfidence, maximisation and happiness than the risk-averse respondents. Financial risk takers, especially investors with less knowledge in investment, will tend to trust the more expert. Overconfident investors are more confident with the preciseness of their available information and analytical skills. Therefore, risk takers are more satisfied than risk averse. Not only that, maximisation urged the risk takers to aim for the best and to maximise their chances for the highest returns. Conversely, risk-averse investors tend to fear risks. Apart from this, they also found that risk-takers are more contented compared to their risk-averse counterparts. Prior research from Albaity and Rahman (2012) proved that an individual’s perceived wealth and the country’s overall wealth affected the relationship between happiness and risk.

H1: There is a significant positive relationship between financial satisfaction and financial risk tolerance (risk-averse).

Theory of Planned Behaviour

The Theory of Planned Behaviour (TPB) by Ajzen (1991) is widely applied in social psychology literature. Over the years, TPB has been studied in personal finance, healthcare, purchasing power, business, etc. Krishnadas and Renganathan (2021) applied TPB to examine the influence of attitude, subjective norms, and perceived behaviour control on farmers' decisions to purchase tractors in the Cauvery delta zone. Pillai et al. (2022) studied the factors influencing consumer attitudes and purchase intention by integrating TPB, the theory of perceived risks, and the elaboration likelihood model. Syarfi and Asandimitra (2020) indicate that risk tolerance and behavioural attitude substantially impact investing intention. In general, under the study of TPB, behaviour is ascertained by behavioural choices, which are influenced by attitudes, subjective norms and perceived behavioural control. It is common to utilise the TPB to explain behavioural patterns (Ajzen, 1991) and better comprehend how people make behavioural decisions because it offers a helpful conceptual framework for addressing the complexities of human social behaviour (Xiao & Wu, 2008). Also, TPB is used to study a person's inner beliefs that affect their financial behaviour (Zocchi, 2013). Therefore, techniques must be investigated and developed to assist people in acquiring good financial habits. Among the elements examined by Alleyne and Broome (2011) as likely to affect investors' decisions by TPB were attitudes, subjective norms, perceived behavioural control, and Sitkin and Weingart's (1995) risk inclination. Four variables—attitudes, subjective norms, perceived behaviour, and risk propensity—were the only ones used in their study, but they are not the only ones influencing investment intention. The analysis can account for additional factors, including personality qualities and level of financial contentment.

Attitude

A person's attitude can be viewed from a behavioural perspective as an affective or emotional assessment of a person, object, or event (Barki & Hartwick, 1994), which can influence how they act toward it (Eagly & Chaiken, 1993). In addition, the person's financial knowledge and self-confidence may reflex the person's attitude toward financial investment and financial risk tolerance (Raut et al., 2018). According to Raut et al. (2018), investing in the stock market could be a good idea and a wise choice for higher returns, and investors must equate with sound financial knowledge to make the right decision. In addition, the individual's perception of return on investment (ROI), investment risk, and internal and external forces that contribute to a decision could be included as part of the investing attitude (Sondari & Sudarsono, 2015). As a result, financial attitudes are the perceptions and viewpoints about money that indicate behaviour towards financial matters. Researchers have discovered different money attitudes to identify people's behaviour regarding money concerns (Harnish et al., 2018). Feelings and attachment influence attitude towards behaviour and then become an evaluation of a person's feelings that influence the decision to accept or reject the investment (Ajzen & Fishbein, 2005). Moreover, several studies showed a positive attitude towards behaviour influences investment intention (Dewi, 2018; Rahmawati & Maslichah, 2018; Raut et al., 2018; Sondari & Sudarsono, 2015; Taufiqoh et al., 2019). Besides, Nadeem et al. (2020) discovered that the correlation between money attitudes and stock market involvement is favourably modulated by the investor's financial knowledge and financial self-efficacy.

H2: Attitude has significant mediating effect on financial satisfaction and financial risk tolerance (risk-averse).

Subjective Norms

According to Liu et al. (2020), the subjective norms result from a person's sense of what other members of influential groups believe about a specific action and their motivation to conform to these opinions. Additionally, subjective norms are the combination of the aspirations to conform to the expectations of these significant individuals as well as the perceived expectations from relevant individuals. Understanding a person's beliefs can help one understand their attitude (Raut et al., 2018; Satsios & Hadjidakis, 2018). According to research by Raut et al. (2018), a person's intentions to make investments in the stock market are greatly influenced by the opinions of their family, friends and colleagues. Additionally, wealthy investors were drawn to sustainable investment due to the favourable perception of sustainable investment in society (Raut et al., 2018). It is reasonable to assume that perceived public pressure will encourage investment in sustainable projects and that subjective norms will promote the desire to pursue sustainable investment opportunities (Liu et al., 2020; Raut et al., 2018; Satsios & Hadjidakis, 2018). According to empirical research, subjective norms affect financial behaviours such as money management, financial investment and preparation for retirement saving (Croy et al., 2010; Liu et al., 2020). In addition, Ahmad Fauzi et al. (2017), the research on Malaysian employees' gold investment behaviour found that financial risk tolerance, gold investment attitude, subjective norms, and perceived behavioural control are positively associated with gold investment behaviour. Given this information, the TPB can be an efficient mediator in explaining the viewpoint of the gold investment behaviour framework (Rahies et al., 2022).

H3: Subjective norms has significant mediating effect on financial satisfaction and financial risk tolerance (risk-averse).

Perceived Behavioural Control

The theory of reasoned action has the drawback of only being able to anticipate voluntary behaviours, or behaviours that an individual has considerable control over (Ajzen, 1985). Ajzen (1985) added the element of perceived behavioural control (PBC) to the theory of reasoned action to improve the drawback. PBC, often measured by judgments of how easy or difficult behaviour is, represents a person's view of how much of that behaviour is within his/her control (Rahies et al., 2022; Raut et al., 2018). Research by Ahmad Sabri (2016) revealed that those who are financially literate and aware of the distinction between mutual funds and equities are more willing to accept risks when making investment decisions. According to Croy et al. (2010), risk tolerance is more related to PBC for investment strategy decisions than extra contribution decisions. In addition, Ahmad Fauzi et al. (2017) and Rahies et al. (2022) pointed out that the TPB, which includes attitude, subjective norms and perceived behavioural control, as well as financial risk tolerance, could be an indicator as a mediator to measure the person's investment intention.

H4: Perceived behavioural control has significant mediating effect on financial satisfaction and financial risk tolerance (risk-averse).

Problem Statement

Given the financial vulnerability of the older population to COVID-19 due to the depletion of their retirement savings and loss of financial supports from their families, they would be motivated to take a higher risk to seek a higher return to compensate for the loss of saving and financial support. This issue is vital to practitioners and policymakers in developing investment products targeting the older population and educating them about reasonable risk-taking to protect their wealth. To fill in the gap proposed by Chong et al. (2021), which only focuses on the Chinese elderly located in Klang Valley, Malaysia, this study expands the sample to include elderly of different ethnicity, namely Malay, Chinese, and Indian to identify the relationship between financial satisfaction and the financial risk tolerance of the elderly during COVID-19 by adopting the TPB. Hence, this study intends to address the following problem:

How the older population’s financial satisfaction during COVID-19 influence their financial risk tolerance directly, and indirectly through TPB.

Research Questions

To investigate the relationship between older population’s financial satisfaction and financial risk tolerance (risk-averse).

To examine the mediating effect of attitude, subjective norm, and perceived behavioural control between financial satisfaction and financial risk tolerance (risk-averse).

Purpose of the Study

The purpose of this work is to provide a further contribution by assessing the mediating impact of TPB between financial contentment and financial risk tolerance, using the elderly inhabitants of the Klang Valley in Malaysia as an example for the study.

Research Methods

Malaysians residing in the Klang Valley who were 60 years of age or older constituted the target sample. It is applied purposive sampling, a method of sampling that does not involve probability. During the third quarter of 2021, in-person interviews were utilised to gather the information. A sample of 601 completed cases was utilised for the survey. In this investigation, the dependent variable is the financial risk tolerance of elderly Malaysians. The results of an ordinal scale consisting of four statements where a score of high-risk tolerance signifies a propensity for risk aversion and a score of low-risk tolerance signifies a propensity for risk-taking among older adults (1 for strongly disagree and 5 for strongly concur). Additionally, the study incorporates four independent variables: perceived behavioural control (four statements), subjective norms (four statements), financial satisfaction (five statements), and attitude (five statements) (range: 1 for strongly disagree to 5 for strongly concur). Table 1 provides a comprehensive breakdown of the descriptive analysis conducted on the characteristics of the respondents.

Findings

The principal component analysis (PCA) with varimax rotation was applied to identify the older Malaysians' financial risk tolerance. As a result, four out of twenty-five statements were subsequently deleted from the scale to improve clarity, such as the Kaiser-Meyer-Olkin (KMO) measure of sampling adequacy of more than 0.8 and the cumulative percentage of variance explained (Denis, 2019; Henseler & Schuberth, 2020; Li et al., 2020; Shrestha, 2021). Lastly, twenty-one statements were used to formulate the final five variables (Dependent Variable: Risk Tolerance, RT; Independent Variables: Financial Satisfaction, FS; Attitude, ATT; Subjective Norms, SN; and Perceived Behavioural Control, PBC) based on PCA for the financial risk tolerance among older Malaysians in Klang Valley.

Table 2 shows that the KMO value was 0.868, exceeding the recommended value of 0.6 (Denis, 2019; Henseler & Schuberth, 2020; Li et al., 2020; Shrestha, 2021). Bartlett’s test of Sphericity reached statistical significance with a p-value of less than 0.01 level, supporting the factor ability of the correlation matrix (Li et al., 2020; Shrestha, 2021). The PCA shows five variables with Eigenvalues surpassing 1.0, illustrating 69% of the variance.

Besides, the method of rotated factor matrix was applied to name and describe the five variables. This study identified a total of 601 validated cases, and the factor loading greater than 0.4 is significant (Denis, 2019; Henseler & Schuberth, 2020; Li et al., 2020; Shrestha, 2021). In addition, Composite Reliability (CR) and Cronbach’s Alpha (Cronbach α) for each variable was above 0.7, which indicates that the scales' items have reasonable internal and external consistency reliability (Denis, 2019; Eisend & Kuss, 2019; Li et al., 2020; Nawi et al., 2020; Shrestha, 2021). Regarding validity, four out of five variables show that the average variance extracted (AVE) is more than 0.5 (FS 0.722, PBC 0.599, RT 0.545 and SN 0.573) and shows that the level of variance captured, except the "ATT" variable and recorded at 0.454. Even if the AVE value is less than 0.5, the condition AVE must be above 0.4, and reliability, i.e., CR and Cronbach α, is more than 0.7 is considered acceptable (Fornell & Larcker, 1981).

To identify the older Malaysians' financial risk tolerance intention towards risk taker or adverse. The PCA analysis discovered that the first variable, “Financial Satisfaction, FS”, had five loaded statements and could account for 31.2% of the variance, followed by “Perceived Behavioural Control, PBC” as the second variable with four loaded statements and demonstrated 15.3% of the variance. The third variable is called “Risk Tolerance, RT”, with four loaded statements and accounted for 9.9%. The “Subjective Norm, SN” is the fourth variable, consisting of four statements, demonstrating 7.2% of the variance. Lastly is "Attitude, ATT", which consists of four loaded statements and accounted for 5.4% of the variance. The five variables consist of twenty-one statements demonstrating 69% of the total variance.

Remark 1:

RT (Risk Tolerance), FS (Financial Satisfaction), ATT (Attitude), SN (Subjective Norms), and PBC (Perceived Behavioural Control)

Remark 2:

RT (Risk Tolerance) – Adapted from Chong et al. (2021)

FS (Financial Satisfaction) – Adapted from Chong et al. (2014)

ATT (Attitude) – Adapted from Raut et al. (2018), Sondari and Sudarsono (2015)

SN (Subjective Norms) – Adapted from Raut et al. (2018), Sondari and Sudarsono (2015)

PBC (Perceived Behavioural Control) – Adapted from Raut et al. (2018)

Empirical Results

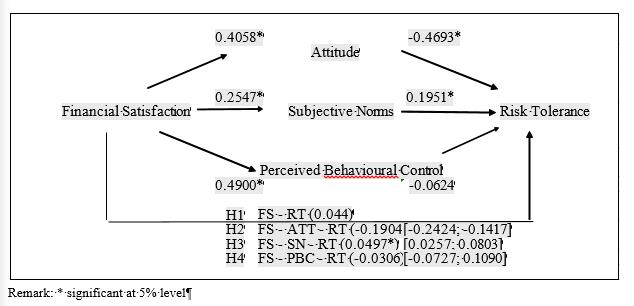

To examine mediating effects between financial satisfaction and financial risk tolerance. This study applied Process macro for SPSS version 4.0 and choices Model 4 to explore the mediating variables, i.e., attitude, subjective and perceived behavioural control between older adults' financial satisfaction and financial risk tolerance (Hayes, 2022). As seen in Figure 1 below, elderly financial satisfaction does not significantly affect their financial risk tolerance; the first hypothesis (H1) is not supported (FS- RT: 0.044 and p-value more than 5% level). This finding differs from previous studies, such as Chong et al. (2021) focused on the Malaysian Chinese in Klang Valley and discovered that financial satisfaction and risk tolerance are positively related. Besides, Rajesh (2018) on Indian households' financial literacy also encountered a negative relationship between economic satisfaction and risk tolerance. It may be because the previous studies were conducted before the COVID-19 pandemic and the people's financial status have a particular effect on their financial risk accepted level, whether they are risk-taker or risk-averse groups. In the United States, the COVID-19 pandemic shifted financial investors' risk preferences from risk-taker to risk-averse (Heo et al., 2021). However, from 18 March 2020 onward, the Malaysian Government implemented the Movement Control Order (MCO), or national lockdown, which significantly affected the economy, businesses shut down, and wage-earner lost their jobs and which means that more than three-quarters of Malaysians (Bottom 40% and Middle 40% income groups) are facing financial difficulty. As a result, the Top 20% (T20) Malaysians will preferably hold their cash flow rather than for investment purposes.

To test second hypothesis (H2), Figure 1 shows that attitude indirectly and negatively affect the elderly financial satisfaction and risk tolerance (FS-ATT-RT: -0.1904 within -0.2424 to -0.1417 and significance at a 5% level), which means that those older people claim that they have a good financial knowledge and skills, can quickly identify the profitable financial products, can invest in favourable financial products and strongly influenced by their friends are more likely to become risk-taker. As a result, those older adults with higher financial satisfaction and who scored high in attitude prefer to take higher financial risks. In summary, H2 is supported at a 5% level.

In the third hypothesis (H3), Figure 1 shows that older adults’ subjective norms indirectly affected (FS-SN-RT: 0.0497 within 0.0257 to 0.0803, which means a positive indirect effect and significance at a 5% level) financial satisfaction and risk tolerance. As mentioned earlier, financial satisfaction has no significant relationship with financial risk tolerance. However, those older adults are skewed toward family orientation, and the better-off financial situation will make them more preferred to become risk-averse persons. The family orientated means those more senior adults are likely to provide financial contributions to children's household expenses; the family has a significant influence on their decision in buying a vehicle or insurance policy, and family is the whole approach of life. In summary, H3 is supported at a 5% level.

For the fourth hypothesis (H4), Figure 1 shows that perceived behavioural control does not indirectly affect financial satisfaction and risk tolerance. Generally, during the COVID-19 pandemic, most listed companies need to perform better or get lost due to MCO implementation. As a result, the investment strategies, i.e., choosing records of earnings growth and avoiding investing in companies with poor earning histories, cannot work. In summary, perceived behavioural control does not mediate between financial satisfaction and risk tolerance. As mentioned earlier, in hypothesis 1, financial satisfaction has no significant direct association with financial risk tolerance.

Conclusion

Summary of Findings

This study adopts Process macro for SPSS version 4.0 and Model 4 (mediation analysis) to analyse the direct and indirect effects (mediated by the TPB) between financial satisfaction and financial risk tolerance among Malaysian elderly in Klang Valley, Malaysia. This paper extends the previous literature of Chong et al. (2021) by including Malaysian elderly of Chinese, Malay and Indian ethnicity. The results from this study have revealed that financial satisfaction does not significantly influence the elderly financial risk tolerance, which is inconsistent with the previous studies conducted before COVID-19 (Chong et al., 2021; Rajesh, 2018). This result suggests that the national lockdown during COVID-19 has resulted in a poor economy and financial difficulty among most Malaysians. Hence individuals have shifted to risk-averse and prefer to hold cash instead of investing regardless of whether they are satisfied with their financial status.

Next, attitude exhibits a negative mediating effect between financial satisfaction and risk tolerance, which postulates that older people with sound financial knowledge and skills, high self-confidence to identify and invest in profitable financial products, and strongly influenced by their friends are more likely to become risk-taker. On the other hand, subjective norms have been shown to have a beneficial mediating impact between a person's level of financial contentment and their tolerance for financial risk. Based on these findings, older persons who emphasise family more and have better financial positions are more inclined to avoid taking unnecessary risks. Lastly, perceived behavioural control does not mediate between financial satisfaction and risk tolerance. This finding suggests that investment strategies such as choosing records of earnings growth and avoiding investing in companies with poor earning histories did not work during the COVID-19 pandemic, as most listed companies were not performing well and were not profitable due to MCO implementation. To sum up, financial satisfaction does not directly affect the elderly financial risk tolerance. It does, however, have an indirect effect on older person's financial risk tolerance, and this effect is mediated by two significant TPB variables, namely attitude and subjective norms.

Limitations and Implication of Study

The primary end of this study is that the sample only consists of older persons located in Klang Valley, an urban area. Hence, this paper suggests that future researchers could study semi-urban or rural Malaysian regions. The older persons in these areas are less exposed to financial products and have lower financial literacy. Hence, different responses in urban areas are expected. Next, some other non-demographic variables that proved to affect financial risk tolerance, such as personality (Kannadhasan et al., 2016; Kubilay & Bayrakdaroglu, 2016; Naqvi et al., 2020; Rizwanulhassan et al., 2021; Thanki & Baser, 2019) can be incorporated into future studies to provide readers with a more comprehensive understanding of older person financial risk attitude.

The findings of this study will have important ramifications for a wide variety of different types of communities. The result indicates that older people's financial risk tolerance is no longer directly influenced by their level of financial satisfaction over the period covered by COVID-19 but somewhat indirectly through investment attitude and subjective norms. Those older investors, regardless of their level of wealth, have a distinct approach to accepting risks. Consequently, high-risk investment products cater to wealthier older investors with a solid understanding of finance and a higher level of self-confidence during COVID-19. New investment products need to be developed by financial institutions, such as higher ROI with higher risk or lower ROI with lower risk, so that they can cater to the varying degrees of risk tolerance that elderly investors have. Next, those who are older, have a better financial situation, and have a strong family orientation should be educated by financial planners to take more financial risks to accumulate wealth. On the other hand, financial planners should also counsel older individuals with financial abilities, confidence in investment selection, and who are highly influenced by friends to avoid taking the excessive financial risk to protect their fortune. Last but not least, the insignificance of the mediating effect of perceived behavioural control between financial satisfaction and financial risk tolerance indicates that proven investment strategies that were useful before the COVID-19 pandemic do not work during the COVID-19 pandemic. Therefore, older investors need to formulate alternative investment strategies to remain profitable.

References

Abd Sukor, M. E., Nasehi, P., & Koh, E. H. Y. (2021). Financial risk attitudes, demographic profiles, and behavioural traits: Do they interrelate? Asian Journal of Accounting Perspectives, 14(1), 27-43. DOI:

Ahmad Fauzi, A. W., Husniyah, A. R., Mohamad Fazli, S., & Mohamad Amim, O. (2017). Financial risk tolerance as a predictor for Malaysian employees’ gold investment behavior. In: Bilgin, M., Danis, H., Demir, E., Can, U. (Eds.) Regional Studies on Economic Growth, Financial Economics and Management. Eurasian Studies in Business and Economics (Vol. 7). Springer, Cham. DOI:

Ahmad Sabri, N. A. (2016). The relationship between the level of financial literacy and investment decision-making millennials in Malaysia. Taylor’s Business Review, 6, 39–47.

Ajzen, I. (1985). From intentions to actions: A theory of planned behavior. In: Kuhl, J., Beckmann, J. (Eds.) Action Control. SSSP Springer Series in Social Psychology. Springer. DOI:

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179-211. DOI:

Ajzen, I., & Fishbein, M. (2005). The influence of attitudes on behavior. The Handbook of Attitudes, 187–236. DOI:

Albaity, M., & Rahman, M. (2012). Behavioural Finance and Malaysian Culture. International Business Research, 5(11). DOI:

Alleyne, P., & Broome, T. (2011). Using the theory of planned behaviour and risk propensity to measure investment intentions among future investors. Journal of Eastern Caribbean Studies, 36(1), 1–20. https://www.researchgate.net/publication/299483632

Barki, H., & Hartwick, J. (1994). Measuring User Participation, User Involvement, and User Attitude. MIS Quarterly, 18(1), 59. DOI:

Bertha, S. S., Yohanes, K. N., & Putu, A. M. (2018). Demography factors, financial risk tolerance and retail investors. Advances in Social Science, Education and Humanities Research, 186, 80-83.

Chng, L. Q., & Hafinaz, H. (2019). The factors affecting Malaysian investment risk tolerance for retirement plans. International Journal of Recent Technology and Engineering, 7(5S), 181-189.

Chong, S. C., Heng, H. K., Lim, S. J., Navaratnam, V., & Neoh, A. Z. K. (2021). Financial risk tolerance: The case of older Chinese in Klang Valley, Malaysia 2020. International Journal of Financial Research, 12(2), 1-9. DOI:

Chong, S. C., Lim, C. S., & Wong, H. C. (2014). Financial satisfaction, resource transfers and bequest motives among Malaysia’s urban older adults. Australian Journal of Basic and Applied Sciences, 8(8), 15-33.

Chong, S. C., Sia, B. C., Cheong, W. W., & Jalaludin, F. W. (2017). Factors affecting attainment of ideal retirement income among retirees. Pertanika Journal of Social Science and Humanities, 25(S), 15-28.

Christina, H. W. (2019). The effect of demographic characteristics on an individual’s financial risk tolerance. 2019 Academic Research Colloquium for Financial Planning and Related Disciplines. DOI:

Croy, G., Gerrans, P., & Speelman, C. (2010). The role and relevance of domain knowledge, perceptions of planning importance, and risk tolerance in predicting savings intentions. Journal of Economic Psychology, 31(6), 860-871. DOI:

Deakin, J., Aitken, M., Robbins, T., & Sahakian, B. J. (2004). Risk-taking during decision-making in normal volunteers changes with age. Journal of the International Neuropsychological Society, 10(4), 590-598. DOI:

Denis, D. J. (2019). SPSS data analysis for univariate, bivariate, and multivariate statistics (1st Ed.). John Wiley and Sons, Inc.

Department of Statistics Malaysia. (2020a). Key Statistics of Labour Force in Malaysia, May 2020. https://www.dosm.gov.my/v1/index.php?r=column/cthemeByCat&cat=124&bul_id=L2NnM0h0bFc2SGFaRGZEeGxETCtuZz09&menu_id=U3VPMldoYUxzVzFaYmNkWXZteGduZz09

Department of Statistics Malaysia. (2020b). Labour Force Survey Report, Malaysia, 2020. https://www.dosm.gov.my/v1/index.php?r=column/cthemeByCat&cat=126&bul_id=dTF2dkJpcUFYUWRrczhqUHVpcDRGQT09&menu_id=Tm8zcnRjdVRNWWlpWjRlbmtlaDk1UT09

Department of Statistics Malaysia. (2021). Key Statistics of Labour Force in Malaysia, June 2021. https://www.dosm.gov.my/v1/index.php?r=column/pdfPrev&id=SkFRMTJ0d1RIR3BrdG1aUTBsUmw2Zz09

Dewi, I. G. A. A. P. (2018). People's intention to invest in peer to peer lending: Analisis theory of planned behavior. Jurnal Ilmiah Akuntansi & Bisnis, 3(2), 118–132. DOI:

Dickason, Z., & Ferreira, S. J. (2018). The effect of gender and ethnicity on financial risk tolerance in South Africa. Gender & Behaviour, 16(1), 10851 – 10862. https://hdl.handle.net/10520/EJC-fcd32eba2

Eagly, A. H., & Chaiken, S. (1993). The psychology of attitudes. Psychology and Marketing, 12, 459–466. DOI:

Eisend, M., & Kuss, A. (2019). Research methodology in marketing: Theory development, empirical approaches, and philosophy of science considerations. Springer Nature Switzerland AG. DOI: 1007/978-3-030-10794-9

Ferreira, S., & Dickason-Koekemoer, Z. (2020). A structural equation model of financial risk tolerance in South Africa. Cogent Business & Management, 7(1), 1811595. DOI:

Finke, M. S., & Huston, S. J. (2003). The brighter side of financial risk: financial risk tolerance and wealth. Journal of Family and Economic, Issues, 24, 233-256. DOI:

Fornell, C., & Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18(1), 39. DOI:

Grable, J. E., Britt, S., & Webb, F. (2008). Environmental and biopsychosocial profiling as a means for describing financial risk-taking behavior. Journal of Financial Counselling and Planning, 19(2), 3-18

Harnish, R. J., Bridges, K. R., Nataraajan, R., Gump, J. T., & Carson, A. E. (2018). The impact of money attitudes and global life satisfaction on the maladaptive pursuit of consumption. Psychology & Marketing, 35(3), 189-196. DOI:

Hayes, A. F. (2022). Introduction to mediation, moderation, and conditional process analysis: A regression-based approach (3rd Ed.). Guilford Press.

Henseler, J., & Schuberth, F. (2020). Using confirmatory composite analysis to assess emergent variables in business research. Journal of Business Research, 120, 147-156. DOI:

Heo, W., Rabbani, A., & Grable, J. E. (2021). An Evaluation of the Effect of the COVID-19 Pandemic on the Risk Tolerance of Financial Decision Makers. Finance Research Letters, 41, 101842. DOI:

Joo, S.-h., & Grable, J. E. (2004). An Exploratory Framework of the Determinants of Financial Satisfaction. Journal of Family and Economic Issues, 25(1), 25-50. DOI:

Kannadhasan, M., Aramvalarthan, S., Mitra, S. K., & Goyal, V. (2016). Relationship between Biopsychosocial Factors and Financial Risk Tolerance: An Empirical Study. Vikalpa: The Journal for Decision Makers, 41(2), 117-131. DOI:

Khan, M. A., Chin, K. S., & SPR, C. R. (2021). The Impact of the COVID-19 Pandemic on the Financial Well-being among Older Adults in Malaysia. International Journal of Management, Economics and Social Sciences, 10(2-3). DOI:

Krishnadas, R., & Renganathan, R. (2021). Withdrawn: Examining the theory of planned behaviour in determining the farmers intention to purchase tractors. Materials Today: Proceedings. DOI:

Kubilay, B., & Bayrakdaroglu, A. (2016). An Empirical Research on Investor Biases in Financial Decision-Making, Financial Risk Tolerance and Financial Personality. International Journal of Financial Research, 7(2). DOI:

Li, N., Huang, J., & Feng, Y. (2020). Construction and confirmatory factor analysis of the core cognitive ability index system of ship C2 system operators. PLOS ONE, 15(8), Article e0237339. DOI:

Liu, Q., Xu, N., Jiang, H., Wang, S., Wang, W., & Wang, J. (2020). Psychological Driving Mechanism of Safety Citizenship Behaviors of Construction Workers: Application of the Theory of Planned Behavior and Norm Activation Model. Journal of Construction Engineering and Management, 146(4). DOI:

Malaysia Ageing and Retirement Survey (MARS) Wave 1- 2018/2019. (2021). https://swrc.um.edu.my/img/files/MARS%20Wave%201%202018-2019%20Full%20Report%20v3%20FINAL190423.pdf

McInish, T. H. (1982). Individual investors and risk-taking. Journal of Economic Psychology, 2(2), 125-136. DOI:

Ministry of Health Malaysia. (2020). Updates on the Coronavirus Disease 2019 (COVID-19) Situation in Malaysia. https://www.moh.gov.my

Morin, R. A., & Suarez, A. F. (1983). Risk aversion revisited. The Journal of Finance, 38(4), 1201-1216. DOI:

Nadeem, M. A., Qamar, M. A. J., Nazir, M. S., Ahmad, I., Timoshin, A., & Shehzad, K. (2020). How investors attitude shape stock market participation in the presence of financial self-efficacy. Frontiers in Psychology, 11, 553351. DOI:

Naqvi, M. H. A., Jiang, Y., Miao, M., & Naqvi, M. H. (2020). Linking biopsychosocial indicators with financial risk tolerance and satisfaction through macroeconomic literacy: A structural equation modeling approach. Cogent Economics & Finance, 8(1), 1730079. DOI:

Nawi, F. A. M., Tambi, A. M. A., Samat, M. F., & Mustapha, W. M. W. (2020). A Review on The Internal Consistency of a Scale: The Empirical Example of The Influence of Human Capital Investment on Malcom Baldridge Quality Principles in TVET Institutions. Asian People Journal, 3(1), 19-29. DOI:

Pålsson, A.-M. (1996). Does the degree of relative risk aversion vary with household characteristics? Journal of Economic Psychology, 17(6), 771-787. DOI:

Pillai, S. G., Kim, W. G., Haldorai, K., & Kim, H.-S. (2022). Online food delivery services and consumers' purchase intention: Integration of theory of planned behavior, theory of perceived risk, and the elaboration likelihood model. International Journal of Hospitality Management, 105, 103275. DOI:

Rahies, M. K., Khan, M. A., Askari, M., Ali, Q., & Shoukat, R. (2022). Evaluation of the impact of risk tolerance and financial literacy on investment intentions of securities investors in Pakistan using the theory of planned behavior (TBP). Empirical Economic Review, 5(1), 104-137. DOI:

Rahmawati, N., & Maslichah, M. (2018). Minat berinvestasi di pasar modal: Aplikasi theory planned behaviour serta persepsi berinvestasi di kalangan mahasiswa [Interest in investing in the capital market: Application of the theory of planned behavior and perceptions of investing among students]. Jurnal Ilmiah Riset Akuntansi, 07, 41–54.

Rajesh, M. (2018). Financial literacy, risk tolerance and stock market participation. Asian Economic and Financial Review, 8(12), 1457-1471. DOI:

Raut, R. K., Das, N., & Kumar, R. (2018). Extending the Theory of Planned Behaviour: Impact of Past Behavioural Biases on the Investment Decision of Indian Investors. Asian Journal of Business and Accounting, 11(1), 265-291. DOI:

Rizwanulhassan, M., Mehboob, A., Hussain, M., & Ali, S. (2021). Effects of demographic factors and personality traits on financial risk tolerance: A case study of Pakistan. International Journal of Management, 12(2), 883-893.

Robb, C. A., & Woodyard, A. S. (2016). Consideration of financial satisfaction: What consumers know, feel and do from a financial perspective. Journal of Financial Therapy, 7(2), 41–61. DOI:

Rolison, J. J., Hanoch, Y., Wood, S., & Liu, P.-J. (2014). Risk-Taking Differences Across the Adult Life Span: A Question of Age and Domain. The Journals of Gerontology: Series B, 69(6), 870-880. DOI:

Satsios, N., & Hadjidakis, S. (2018). Applying the Theory of Planned Behaviour (TPB) in Saving Behaviour of Pomak Households. International Journal of Financial Research, 9(2), 122. DOI:

Shrestha, N. (2021). Factor Analysis as a Tool for Survey Analysis. American Journal of Applied Mathematics and Statistics, 9(1), 4-11. DOI:

Sitkin, S. B., & Weingart, L. R. (1995). Determinants of Risky Decision-Making Behavior: A Test of the Mediating Role of Risk Perceptions and Propensity. The Academy of Management Journal, 38(6), 1573–1592. DOI:

Sondari, C. M., & Sudarsono, R. (2015). Using theory of planned behavior in predicting intention to invest : Case of Indonesia. International Academic Research Journal of Business and Technology, 1(2), 137–141. DOI:

Suyam Prabha, R. (2016). Financial risk tolerance and the influence of socio-demographic characteristics of retail investors. ISBR Management Journal, 1(1), 65-79.

Syarfi, S. M., & Asandimitra, N. (2020). Implementasi Theory of Planned Behavior dan Risk Tolerance terhadap Intensi Investasi Peer to Peer Lending. Jurnal Ilmu Manajemen, 8(3), 864. DOI:

Taufiqoh, E., Diana, N., & Junaidi, J. (2019). Pengaruh norma subjektif, motivasi investasi, pengetahuan investasi, persepsi return dan literasi keuangan terhadap minat mahasiswa berinvestasi saham di pasar modal [The influence of subjective norms, investment motivation, investment knowledge, perception of return and financial literacy on students' interest in investing in shares in the capital market]. Jurnal Ilmiah Riset Akuntansi, 08(01), 1–13.

Thanki, H., & Baser, N. (2019). Interactive Impact of Demographic Variables and Personality Type on Risk Tolerance. Emerging Economy Studies, 5(1), 42-54. DOI:

Wallach, M. A., & Kogan, N. (1961). Aspects of judgment and decision making: Interrelationships and changes with age. Behavioral Science, 6(1), 23-36. DOI:

Xiao, J. J., & Wu, J. (2008). Completing debt management plans in credit counseling: An application of the theory of planned behavior. Journal of Financial Counseling and Planning, 19(2), 29–45. http://afcpe.org/journal-articles.php?volume=382&article=339

Yao, R., Gutter, M. S., & Hanna, S. D. (2005). The financial risk tolerance of Blacks, Hispanics and Whites. Journal of Financial Counselling and Planning, 16(1), 51-62. https://ssrn.com/abstract=2740156

Zandri, S., & Sune, J. F. (2018). The effect of age and gender on financial risk tolerance of South African investors. Investment Management and Financial Innovations, 15(2), 96-103. DOI:

Zocchi, P. (2013). Why do Italian households prefer adjustable rate mortgages? Journal of European Real Estate Research, 6(1), 90-110.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 May 2024

Article Doi

eBook ISBN

978-1-80296-132-4

Publisher

European Publisher

Volume

133

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1110

Subjects

Marketing, retaining, entrepreneurship, management, digital marketing, social entrepreneurship

Cite this article as:

Chong, S. C., Chai, Z. K., Loo, B. W., Lee, S. C., & You, H. L. (2024). Financial Risk Tolerance During Post-Pandemic: A Case Study Among Urban Older Malaysians. In A. K. Othman, M. K. B. A. Rahman, S. Noranee, N. A. R. Demong, & A. Mat (Eds.), Industry-Academia Linkages for Business Sustainability, vol 133. European Proceedings of Social and Behavioural Sciences (pp. 343-358). European Publisher. https://doi.org/10.15405/epsbs.2024.05.29