Abstract

The ASEAN firms’ contribution to the worldwide CBMA sales is irrefutable evidenced by the increase in ASEAN CBMA sales for two consecutive years–2014 and 2015. Nevertheless, the challenge of achieving success in CBMA holds significant importance, particularly within the Asia-Pacific area, where the completion rate for such agreements stands at a mere 50%. Based on the market for corporate control theory and spillover effects from corporate governance, this study aims to examine the success rate of CBMA involving ASEAN target firms and to determine whether country-level governance standards play an important role in the CBMA success. This study analyse CBMA involving firms inside the ASEAN region, spanning from 2002 to 2013. The success rate of the CBMA, as measured by the occurrence of a positive return on assets (ROA) change, amounted to only 40.7% out of a total of 246 CBMA transactions.. The country-level corporate governance is an important determinant of the ASEAN target firms’ CBMA success as it creates value through positive spillover.

Keywords: ASEAN Target, CBMAs, Corporate Governance Spillover, CBMA Success

Introduction

The attractiveness of cross-border mergers and acquisitions (CBMAs) in creating value to the firms by increasing the market share and acquiring target firms’ competitive advantages has made it a preferable internationalisation strategy for firms worldwide. This was evidenced by the 28% increased of worldwide CBMA in the year 2014 with a value of almost USD 400 billion (United Nations Conference on Trade and Development, 2015). A similar trend was observed in CBMA sales and the most interesting fact is the upsurge of CBMA sales value in the year 2014 was mainly contributed by the increase in developing countries CBMA sales (52%) as opposed to developed countries (16%). One of the main contributors is the emerging Asian countries who are members of Association of Southeast Asian Nation (ASEAN).

The popularity of firms from the ASEAN member countries as CBMA target is irrefutable. The World Investment Report 2016 reported that the ASEAN countries CBMA sales value increased for two consecutive years, 13.2% (2014) and 15.0% (2015) (United Nations Conference on Trade and Development, 2016). The statistic indicated that the establishment of ASEAN Economic Community (AEC), which focused on the regional integration among ASEAN member countries (The ASEAN Secretariat & United Nations Conference on Trade and Development, 2015) boosted the inbound investment by firms from foreign countries through CBMAs. The ASEAN firms’ CBMA sales value in the year 2015 is almost USD 10 billion.

The issue of CBMA success is crucial, specifically in the Asia-Pacific region because only one out of two deals is successfully completed (Thomson One Banker, 2016). Since one third of merger and acquisition (M&A) in Asia-Pacific took place in ASEAN (Yang, 2014), the CBMA success involving ASEAN target firms is at risk. With the extensive involvement of ASEAN firms as target in CBMA, does it creates value to the ASEAN target firms; hence, a successful CBMA? The question on CBMA success is important because the failure of CBMA deals is not only detrimental to the ASEAN target firm itself but also to the attractiveness of ASEAN as an investment hub. Therefore, it is imperative to determine the influencing factors of ASEAN target firm’s CBMA success.

A CBMA main feature, which is the cross-border transaction, expose firms to risks related to country characteristics; for instance, the difference between ASEAN target country and bidding country in various aspects, such as corporate governance, currency, culture or geography. Since ASEAN countries are emerging countries and one of the features of emerging market is poor corporate governance (Lebedev et al., 2015; Yen et al., 2013), does the country-level corporate governance difference between the ASEAN target and bidding countries hinders or facilitates CBMA success? This question has not been explored despite the expansive involvement of ASEAN firms as CBMA target.

Grounded on the market for corporate control theory and corporate governance spillover introduced by Martynova and Renneboog (2008), this study used the CBMA transactions involving six most active ASEAN CBMA target countries from the year 2002 to 2013, to examine the performance impact of CBMA on ASEAN target firms as a measure of CBMA success. Additionally, this study also examines the role of differences in country-level corporate governance as the driver to CBMA success for ASEAN target firms.

This current study differs from previous studies in a few aspects. First, this study focus on the long-term performance impact of CBMA instead of the short-term wealth effect, which was used extensively in the extant CBMA literature. Second, the focus on the country-level difference (corporate governance) as determinants of CBMA success diverges from previous studies, which mainly examined the firm-specific or deal characteristic factors. Lastly, this study provides a new insight of whether corporate governance spillover is applicable in ASEAN emerging countries.

The remainder of this paper is organised as follows: the subsequent section offers the literature review and research hypotheses, followed by the description of data, sample, and research design. The succeeding section presents the results and discussion, and the last section concludes the paper.

Literature Review and Hypothesis Development

There are two elements of CBMA drawing the attention of CBMA researchers; the firms’ performance following CBMA and the determinants of the firms’ performance. The investigation of the firms’ performance following CBMA is vital because it represents the value creation as a result of CBMA. The creations of value manifested through the improvement in firms’ performance alongside the completion of a deal signify the CBMA success.

The majority of previous CBMA literature (Ahouansou, 2010; Bris & Cabolis, 2008; Dang & Henry, 2016; Ferreira et al., 2010; Goergen & Renneboog, 2004; Gregory & O’Donohoe, 2014; Harris & Ravenscraft, 1991; Martynova & Renneboog, 2008; Smimou, 2015; Williams & Liao, 2008; Zhu & Jog, 2012) focused on the value creation following CBMA by examining the target shareholder wealth effect surrounding the date of CBMA announcement. Cumulative abnormal returns accrued to the shareholders represent value creation as a result of CBMA announcement.

On the other hand, Kaczmarek and Ruigrok (2013) suggested that the value of management decision such as CBMA would be better reflected in the accounting performance. However, little attention (Chari et al., 2010; Song et al., 2010a; Song et al., 2010b) was allotted to the investigation of accounting performance as a measure for CBMA success of target firms. Therefore, this present study utilised the long-term firms’ accounting performance to measure the ASEAN target firms’ CBMA success. This measure is deemed more appropriate as the synergy will take years to materialise in CBMA (Rao-Nicholson et al., 2015).

This study posits that there will be an improvement in the ASEAN target firms’ long-term accounting performance following CBMA, hence a high CBMA success rate. According to the market for corporate control theory, CBMA is undertaken to discipline the target firm’s management or to an extreme extent, to remove an incompetent target manager. The market for corporate control through CBMA is more pronounced in ASEAN member countries where there is a poor corporate governance (Lebedev et al., 2015; Yen et al., 2013). The reason for this occurrence is because ASEAN countries are emerging countries with a less developed institutional environment (Boubakri et al., 2005; Grigorieva & Petrunina, 2015).

Second, since Mat Rahim and Ali (2016) found that the majority of the bidder for ASEAN target firms are from countries with a higher corporate governance standard, it is expected that CBMA will lead to an improvement in the ASEAN target firms’ corporate governance standard as suggested by positive spillover hypothesis. Consequently, these two factors will lead to an improvement of the ASEAN target firms’ performance following CBMA and hence, a CBMA success. In fact, previous studies by Song et al. (2010b) and Song et al. (2010a) examined the ASEAN firms which have recorded a marginal improvement in the target firms’ performance following CBMAs. The above arguments lead to the following hypothesis:

H1: There is an improvement in the ASEAN target firms’ performance following CBMAs.

On top of examining the firms’ performance following the CBMA as a measure of CBMA success, the CBMA literature also examined the factors or determinants of firms’ performance after CBMA. Evidently, the firms spent an enormous amount of fund for the acquisition, thus it is vital to distinguish the causative factors to the CBMA success. So far, previous studies of CBMA literature had explored the firm-specific factors and deal characteristics factors to ascertain the determinants of firms’ performance. There is limited evidence available for the country-specific factors even though they are plausibly the main factors affecting firms’ performance in CBMA. The reason is because there are risks attributed to a cross-border transaction such as CBMA due to the countries differences, namely the corporate governance, exchange rate, culture, and geography (Koerniadi et al., 2015; Lobo et al., 2015).

For the ASEAN target firms, the country-level corporate governance would undoubtedly be influencing the firms’ performance following CBMA, hence a CBMA success. This is due to the fact that even though the corporate governance in emerging countries such as the ASEAN member countries is poor, they have been a popular target for merger and acquisition by foreign firms. Martynova and Renneboog (2008) asserted that the country-level corporate governance can create value and positively affect the firms’ performance following CBMA in two ways – positive spillover and bootstrapping – subject to the differences between the target and bidding firms’ country-level corporate governance.

The positive spillover could only occur when the bidder’s country-level corporate governance is stronger that the target’s country-level corporate governance. When the bidding firm acquired a target, the bidding firm will “spillover” its’ good country-level corporate governance to the target firm. This would result in a positive improvement in the target’s corporate governance and thus create value to the target which then improves the firms’ performance and eventually result in a CBMA success. Chari et al. (2010) posited that the improvement in a target’s corporate governance could occur in the target’s legal and accounting standard when it adheres to the bidding’s country corporate governance requirement.

In regard to ASEAN target firms with a poor corporate governance standard, the bidding firms from a better-governed country willingness to acquire them suggested that the acquisition purpose is related to the market for corporate control. The market for corporate control theory is consistent with the positive spillover hypothesis because both mechanisms would result in a better target firms’ corporate governance practice. For instance, the market for corporate control through CBMA would discipline the target firms by removing the incompetent managers or by aligning the managers and shareholders interest due to fear of being CBMA target (Hillier et al., 2011).

The positive spillover hypothesis was supported by numerous studies (Ahouansou, 2010; Basuil, 2011; Jory & Ngo, 2011; Yen et al., 2013) but the debate on its’ effect on the firms’ performance following CBMA persist. Martynova and Renneboog (2008) reported an improvement in the firms’ performance for both the target and bidding firms as a result of positive spillover. However, Danbolt and Maciver (2012) stated that only target firms benefited from positive spillover in CBMA. Meanwhile, Thenmozhi and Narayanan (2016) suggested that the difference magnitude between the target and bidder country-level corporate governance (governance gap) plays an important role in determining whether positive spillover could transpire or otherwise. A target’s too poor country-level corporate governance could pose a challenge for the bidding firm to instill good corporate governance practice in the target firm.

Mat Rahim and Ali (2016) reported that there is a wide range of an average corporate governance score for ASEAN member countries – from the lowest at −0.57 (Indonesia) to the highest at 1.5 (Singapore). Therefore, based on the contention made by Thenmozhi and Narayanan (2016) it would be difficult to discipline the target from Indonesia because of the wide governance gap. In fact, it would impose a negative effect on the CBMA success as the bidder would have to incur a substantial cost to execute a corporate control. However, the same bidding firm would experience fewer difficulties to spillover its good country-level corporate governance when acquiring the target firm from Singapore as the governance gap is small; it will create value by improving the firms’ performance and positively impact on the CBMA success. These arguments suggest an inverted-u relationship between governance gap and CBMA success, thus, the second hypothesis is:

H2: For CBMAs where the bidding country-level corporate governance is better than the target, there is a non-linear relationship between governance gap and CBMA success.

Another means the country-level corporate governance could affect the firms’ performance in CBMA is through bootstrapping hypothesis (Martynova & Renneboog, 2008). Bootstrapping occurs when the bidding firm is from a country with a poorer corporate governance than the target. Similar to positive spillover hypothesis, the bootstrapping hypothesis could be explained by the market for corporate control theory. When the bidder from a poorly governed country acquired a target with good country-level corporate governance, the control obtained by the bidder would result in adherence (bootstrapping) to the target country’s good corporate governance standard. This is corroborated by the censoring-based hypothesis by Wang and Xie (2009) who argued that the bidder willingness to pay a high premium to acquire a better-governed target implies the expectation of a higher return from the acquisition, which possibly could outweigh the acquisition cost. Therefore, both bootstrapping hypothesis and censoring-based hypothesis would result in value creation, thus positively affect the CBMA success.

Even though the bootstrapping hypothesis was supported by previous studies (Bhagat et al., 2011; Yen et al., 2013), Thenmozhi and Narayanan (2016) claimed that a bidder would be unable to bootstrap itself to the target’s country-level corporate governance if the standard is too high and the distant is too wide from the bidder’s country-level corporate governance. High compliance cost needs to be incurred by the bidder indicating the negative impact of a large governance gap on the firms’ performance and CBMA success. On the other hand, a small governance gap would facilitate the bidder to adhere to the target’s better country-level corporate governance standard. Consequently, bootstrapping would take place, create value to the firms and positively affect the CBMA success. Owing to the wide range of average corporate governance score of the ASEAN member countries (Mat Rahim & Ali, 2016), it is expected that there is an inverted-u relationship between governance gap and CBMA success for CBMA involving a better-governed ASEAN target and a bidder from poorer country-level corporate governance. Therefore, the third hypothesis of the study is:

H3: For CBMAs where the target country-level corporate governance is better than bidder, there is a non-linear relationship between governance gap and CBMA success.

Data and Methodology

Sample

The CBMAs sample involving ASEAN member countries as target firms were extracted from the population of all CBMAs involving ASEAN firms in Thomson One Banker Database. This study focused on target from six ASEAN member countries (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) because they are the most active CBMA players in this region. The selected CBMA involving ASEAN firms as the target were announced and completed between the years 2002 and 2013. The selection of sample ends in the year 2013 to enable the computation of long-term (three years) accounting performance following CBMA, as the proxy for CBMA success.

Other criteria for the final sample selection are the completion of the deal by the end of the sample period and ASEAN target firms are public listed companies which are not classified under financial industries. Additionally, the CBMA in which the target completed more than one transaction in the same financial year is also excluded. The last criteria is the availability of financial data in Thomson Reuters DataStream for one year prior to the completion year and three years following completion year.

The total numbers of CBMA transactions which satisfy the sample selection criteria are 246 transactions. Table 1 presents the sample distribution by the country of target firms. Table 1 suggests that Indonesia is the most popular target country among ASEAN member countries, followed by Singapore and Malaysia. Even though the Philippines is the least popular target country, its average value of transaction is the highest at USD 217.06 million. The top 5 bidder nations indicated that the majority of bidding firms are from developed countries, such as the United Kingdom, Japan, and the United States. This also suggests the possibility of a positive spillover of country-level corporate governance standard to the ASEAN target firms.

The 246 sample is then segregated into two mutually exclusive sub-samples. The first sub-sample comprised CBMA where the bidding country has a better corporate governance standard than the ASEAN target country (positive spillover sub-sample, with a sample size of 185) and the second sub-sample comprised CBMA where the bidding country has a poorer corporate governance standard than the ASEAN target country (bootstrapping sub-sample, with a sample of size 61).

CBMA Success

CBMA success is the dependent variable of this study. A CBMA is considered a success not only when it is completed, but also when it created value to the ASEAN target firms through an improvement in the firms’ performance following CBMA as compared to before CBMA. Therefore, in this study, the changes in the ASEAN target firms’ performance after CBMA is the proxy for the CBMA success.

This study utilised the return on assets (ROA) as the measure of the firms’ performance as it is internationally comparable (Klimek, 2014; Song et al., 2010b). ROA is calculated by deflating earnings before interest, taxes, depreciation, and amortisation (EBITDA) by the total asset. The changes in the ASEAN target firms’ ROA is calculated by deducting ROA in the financial year prior to the completion of the CBMA transaction from the average ROA of the target firms three years following CBMA completion (Jory & Ngo, 2011; Wang & Xie, 2009).

Country-level Corporate Governance (CGI)

This study utilised the World Governance Indicator (WGI) as the measure for country-level corporate governance. WGI was developed by Kaufmann et al. (2011) and it has been used in many studies (Chen et al., 2009; Ellis et al., 2011; Hur et al., 2011; Jory & Ngo, 2011; Lim et al., 2016; Tunyi & Ntim, 2016) as a measure for country-level corporate governance due to the consistent measurement throughout the country. Additionally, WGI would result in a more accurate measurement because the index is time-variant.

WGI index comprises six governance indicators, namely the Voice and Accountability, Political Stability, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption. These indicators are the result of combination views of numerous enterprises, citizen, and expert survey respondents in the industrial and developing countries (The World Bank Group, 2015). The six governance indicators scores fell between −2.5 and +2.5 and a higher score indicates a stronger corporate governance environment. Since there is a high correlation between the six governance indicators for a particular country, a country-level corporate governance index (CGI) was constructed based on the summation of all scores (Chen et al., 2009; Lim et al., 2016). The CGI score range is between −15.00 and 15.00. Another variable, namely the governance gap (CGIG) was constructed by calculating the difference between the target and bidding country-level corporate governance.

Control Variables

Previous CBMA literature reported that the firm-specific factors and deal characteristic factors are important determinants of CBMA success. These factors are firm’s size (Basuil, 2011; Du & Boateng, 2015; Martynova & Renneboog, 2008; Sharma & Raat, 2016; Song et al., 2010a; Wu et al., 2016), firm’s leverage (Thao Ngo et al., 2014), firms’ financial advantage (Changqi & Ningling, 2010; Du & Boateng, 2015; Song et al., 2010a), transaction size (Aybar & Ficici, 2009; Aybar & Thanakijsombat, 2015; Bhagat et al., 2011), advisor (Lowinski et al., 2004), and relatedness (Aybar & Ficici, 2009; Corhay & Rad, 2000; Jory & Ngo, 2011; Song et al., 2010a). Therefore, this study aims to examine the impact of country-level corporate governance on CBMA success, controlling the firm-specific and deal characteristic factors.

Methodology

This study uses cross-sectional regression to examine the impact of country-level corporate governance on CBMA success, controlling the firm-specific and deal characteristic factors. Specifically, this study regresses the ASEAN target firms’ performance change (ROA):

(1)

For the robustness test, the market-based performance change namely the Tobin’s Q is used as the measurement of the ASEAN target firms’ performance. Tobin’s Q is calculated by deflating the sum of market capitalisation, preferred stock, and total liabilities by the total asset.

Results and Discussions

Table 2 and Table 3 present the descriptive statistic of CGI for positive spillover and bootstrapping sub-sample. Based on Table 2, the mean CGI for bidding firm (CGIB) of positive spillover sub-sample is 7.41 is much higher than the mean CGI of ASEAN target firm (CGIT), which is −1.37. The paired sample t-test indicated that the difference is 8.78, which is significant at 1% level, as shown in Table 4. The result indicates that ASEAN target firms were acquired by bidding firms from countries with a significantly better country-level corporate governance. This further indicates that there is a possibility of positive spillover occurrence which could lead to an improvement of the ASEAN target firms’ performance, hence a CBMA success.

Table 3 presents the descriptive statistic of bootstrapping sub-sample. In contrast with positive spillover sub-sample, the mean CGI of bidding firm (CGIB) is much lower than the mean CGI of ASEAN target firm (CGIT). Table 4 reports the difference of 5.21 is significant at 1% level. This means that the bidding firms from country with poor country-level corporate governance acquired target firms from ASEAN countries with significantly better country-level corporate governance, which implied the possibility of bootstrapping occurring.

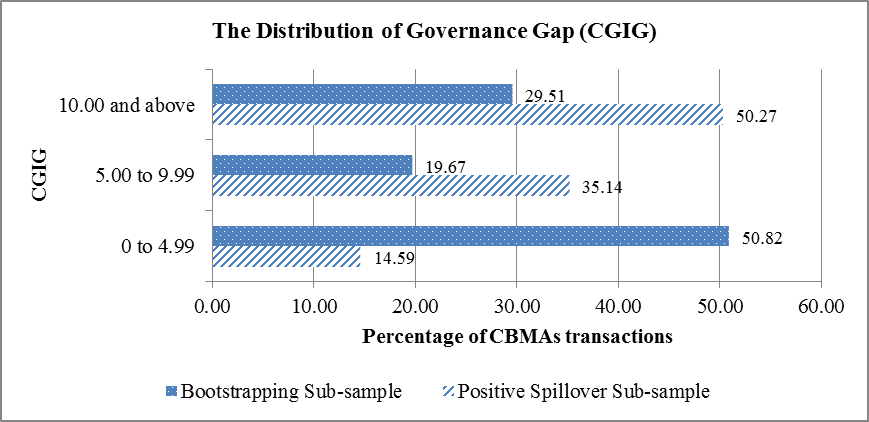

Table 2 and Table 3 also present the mean of governance gap (CGIG) for both sub-samples. The mean CGIG for positive spillover sub-sample which is 8.78 is higher than bootstrapping sub-sample, i.e. 5.21. Figure 1 depicts the distribution of governance gap (CGIG) for both sub-samples, divided into three categories. There is a significant difference in the distribution of CGIG for both sub-samples. For the positive spillover sub-sample, half of the ASEAN target firms (50.27%) were acquired by bidder from countries with much better country-level corporate governance, evidenced by the classification in large governance gap (CGIG) which is “10 and above” category. In contrast, for the bootstrapping sub-sample, half of the ASEAN target firms (50.82%) were acquired by bidder from poorly governed countries, which is quite identical to ASEAN country-level corporate governance.

The CBMA success of ASEAN target firms

Table 5 presents the return on assets (ROA) of ASEAN target firms a year prior to CBMA completion and the average of three years following CBMA completion. Prior to the completion of CBMA deal, the mean of ROA is 11.60. However, the result indicated that the long-term performance of ASEAN target firms deteriorate following CBMA completion with the average ROA for three years following CBMA completion is 7.40. The mean ROA change (−4.20) was tested for significance using both the t-test and Wilcoxon Signed Rank Test. The result from t-test and Wilcoxon Signed Rank Test indicates that the deterioration in ASEAN target firms’ performance after CBMA as compared to before CBMA completion is significant at 10% level and 1% level respectively. In addition, only 40.7% (100) of the CBMA transactions recorded a positive ROA change while the remaining 59.3% (146) recorded a negative ROA change.

Therefore, Hypothesis 1, which posited that there is an improvement in ASEAN target firms’ performance following CBMAs, is not supported. This result contradicts with the findings by previous Asian countries studies (Song et al., 2010a, 2010b). Nevertheless, it is important to note that the improvement in target firm’s performance in one of the studies is marginal with less than 1 threshold (Song et al., 2010b).

The impact of country-level corporate governance on the CBMA success

Table 6 and Table 7 present the result of cross-sectional regression analysis for positive spillover and bootstrapping sub-samples, respectively. The change in ROA is the dependent variable and each of the country-level corporate governance indexes is the independent variables. The indexes are (1) bidding country corporate governance index (CGIB), (2) target country corporate governance index (CGIT), (3) the difference between target and bidding country corporate governance index, which is the governance gap (CGIG), and (4) the square of governance gap (CGIG2).

The correlations between variables are presented in Table 2 and Table 3. Both Table 2 and Table 3 reported a significant correlation between CGIG and CGIG2 and this is expected as CGIG2 is the square term of CGIG. Another significantly high correlation was found between CGIG and CGIB in Table 3. However, these two variables were tested separately in different regression. All the regression models reported a Durbin-Watson statistic of approximately close to 2.0. Therefore, there is no autocorrelation issue in the regression analysis. The heteroscedasticity issue in the estimation of regression model has been addressed using White’s adjustment procedure.

The result for positive spillover sub-sample is presented in Table 6. The bidder country-level corporate governance index (CGIB) is the independent variable in the first regression model (Model 1.1) test. The coefficient of CGIB is negative and this is contrary to the positive spillover hypothesis, though it is not significant. The coefficient of CGIT is negative (Model 1.2). Even though the coefficient is not significant, the negative coefficient implied that positive spillover could occur because a lower CGIT suggests a higher possibility of CBMA success. When CGIG is tested in Model 1.3, the coefficient is positive and not significant. Nevertheless, it indicates that it is possible for positive spillover to occur and positively affect CBMA success.

Since this study hypothesised a non-linear relationship, CGIG2 was added in Model 1.4. The result shows that there is a significant positive relationship between CGIG2 and ROA change, at 5% significant level. This indicates that positive spillover occurs in CBMA involving ASEAN firms as the target and positively affects the CBMA success. Therefore, the result suggests that when a firm from a better-governed country acquired ASEAN firms, there is a spillover of better corporate governance from bidding to ASEAN target firms. Consequently, it improves the ASEAN target firm’s corporate governance, resulting in an improvement in firms’ performance following CBMA completion and CBMA success.

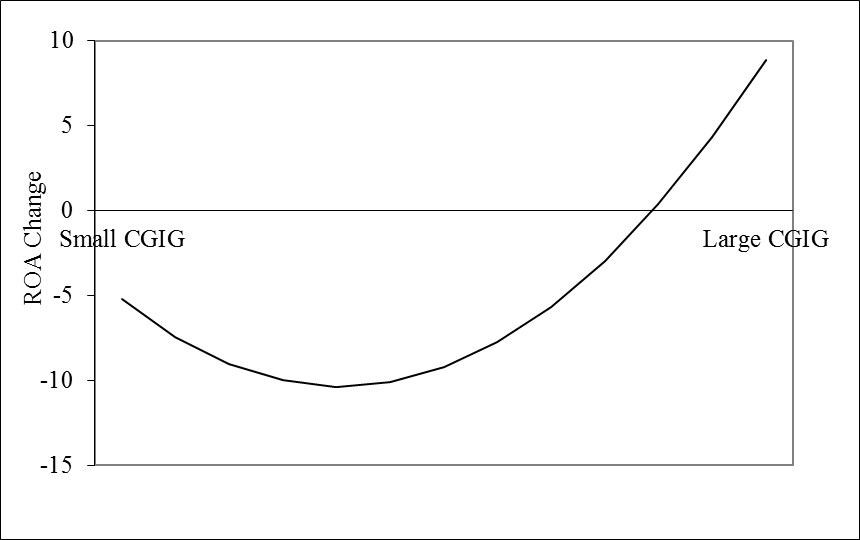

This study hypothesised a non-linear relationship (inverted-u shape) between governance gap and CBMA success. However, the results suggest a u-shaped relationship between governance gap and CBMA success, as depicted in Figure 2. Therefore, hypothesis 2 is not supported. This contradictory result might be due to the magnitude of the governance gap (CGIG) itself. According to Table 2, the maximum CGIG value is only 15.79, half of the possible maximum gap of 30 (the difference between the maximum of 15 for the bidder and minimum −15 for the target). Therefore, this study could not capture the negative impact of ‘large’ governance gap (20 and above) as hypothesised in hypothesis 2.

However, it is important to note that this study demonstrates that the acquisition of ASEAN firm by a firm from better country-level corporate governance could drive CBMA success by creating value through positive spillover. In addition, according to Figure 2, the magnitude of CGIG should be substantial enough because a small corporate governance improvement could adversely affect CBMA success.

The result for bootstrapping sub-sample is presented in Table 7. It is interesting to note that the coefficient of CGIT in Model 2.2 is significantly positive, at 10% level. The positive coefficient suggests that the better the ASEAN target country-level corporate governance, the higher the possibility of CBMA success and this could have resulted from the bootstrapping effect. This is corroborated by the positive coefficient of CGIG in Model 2.3. Even though the results are insignificant, they suggest that the better the target country-level corporate governance, the higher the ROA change due to bootstrapping effect and thus, the higher the possibility of CBMA success.

In Model 2.4, the square of governance gap (CGIG2) was added to the regression to test the non-linear effect as posited in Hypothesis 3. The result contradicted with the hypothesis, where a small governance gap (CGIG) negatively affects the ROA change while a large governance gap (CGIG) positively impacts the ROA change. In addition, both coefficients are insignificant. Therefore, Hypothesis 3 is also not supported.

The insignificant and contradictory result might be due to the magnitude of the governance gap (CGIG) itself. According to Table 3, the maximum CGIG value is only 13.55, less than half of the possible maximum gap of 30 (the difference between the maximum of 15 for target and minimum −15 for bidder). Furthermore, Figure 1 indicated that half of the CGIG value for bootstrapping sub-sample is less than 5.0. Therefore, the compliance cost that a bidder would have to spend to bootstrap itself to the ASEAN target country-level corporate governance would outweigh the minimal improvement in bidder’s corporate governance as the difference in governance gap is very small. However, bootstrapping could take place when the CGIG is large enough to give a sufficient improvement in the bidders’ corporate governance.

Robustness test

Table 8 presents the robustness test for the positive spillover of the sub-sample, using Tobin’s Q changes as the dependent variable. The result is consistent with the earlier regression model. However, it is interesting to note that the coefficient for CGIG in Model 3.3 is positive, though it is not significant. This result indicates that there is a possibility for spillover of bidder country-level corporate governance to ASEAN target firms and this positive spillover could positively affect the Tobin’s Q change and hence, a CBMA success. For the bootstrapping sub-sample, the results presented in Table 9 are consistent with an earlier regression model with ROA change as the dependent variable. However, the result in regression Model 4.3 and Model 4.4 signify that a large governance gap could adversely affect CBMA success for bootstrapping sub-sample.

Conclusion

The increase in CBMA sales by ASEAN firms for two consecutive years indicates the popularity of CBMA as an external growth strategy among the ASEAN firms. However, the low percentage of deal completion and the CBMA failure in creating value trigger an interest in examining whether CBMA conducted by ASEAN firms will succeed or otherwise. The fact that ASEAN member countries are emerging countries with inferior corporate governance made it even more interesting to examine whether the country-level factor could affect the success of CBMA involving ASEAN target firms.

CBMA transactions involving ASEAN firms as target which was announced and completed from the year 2002 to 2013, were analysed. The empirical results reported that there is a significant decline in the ASEAN target firms’ performance as measured by the long-term accounting performance, namely the ROA. The CBMA success rate in which there was a positive ROA change, was only 40.7% out of 246 CBMA transactions.

The role of country-level corporate governance in influencing CBMA success was examined by segregating the sample into two sub-samples – positive spillover and bootstrapping. The results indicate that the difference in country-level corporate governance between bidder and ASEAN target country could create value and thus positively affect CBMA success through positive spillover. There is no evidence of value creation through bootstrapping and therefore, no significant impact on CBMA success.

This study contributes to the CBMA literature by examining the country-level factor of corporate governance, instead of focusing on firm-specific or deal-specific factors, as determinants of CBMA success, which have been widely discussed in M&A literature. Additionally, companies seeking to acquire firms from other countries to improve their corporate governance should ensure that an appropriate governance gap exists (i.e., not too small of a gap) to ensure they can capture the benefits from the corporate governance differences between the two countries of the bidder and the target.

This study comes with limitation. No segregation of samples was made between ASEAN and non-ASEAN or developed and emerging country bidding firms. Perhaps a segregation of the samples could provide more insight on how country-level corporate governance could create value in CBMA, thus affect the CBMA success. Further research should be undertaken to provide an additional insight into the limited CBMA literature on the role of country-level corporate governance in CBMA success.

References

Ahouansou, L. (2010). The performance of cross-border acquisitions in emerging and developed markets [Doctoral dissertation, Concordia University].

Aybar, B., & Ficici, A. (2009). Cross-border acquisitions and firm value: An analysis of emerging-market multinationals. Journal of International Business Studies, 40(8), 1317-1338.

Aybar, B., & Thanakijsombat, T. (2015). Financing decisions and gains from cross-border acquisitions by emerging-market acquirers. Emerging Markets Review, 24, 69-80.

Basuil, D. A. (2011). Firm governance and shareholder value creation: A study of cross-border acquisitions by U.S. acquiring firms. In ProQuest Dissertations and Theses. The University of Texas at Arlington.

Bhagat, S., Malhotra, S., & Zhu, P. (2011). Emerging country cross-border acquisitions: Characteristics, acquirer returns and cross-sectional determinants. Emerging Markets Review, 12(3), 250-271.

Boubakri, N., Cosset, J.-C., & Guedhami, O. (2005). Liberalization, corporate governance and the performance of privatized firms in developing countries. Journal of Corporate Finance, 11(5), 767-790.

Bris, A., & Cabolis, C. (2008). The Value of Investor Protection: Firm Evidence from Cross-Border Mergers. Review of Financial Studies, 21(2), 605-648.

Changqi, W., & Ningling, X. (2010). Determinants of cross-border merger & acquisition performance of Chinese enterprises. Procedia - Social and Behavioral Sciences, 2(5), 6896–6905.

Chari, A., Ouimet, P. P., & Tesar, L. L. (2010). The value of control in emerging markets. Review of Financial Studies, 23(4), 1741–1770.

Chen, Y.-R., Huang, Y.-L., & Chen, C.-N. (2009). Financing Constraints, Ownership Control, and Cross-Border M&As: Evidence from Nine East Asian Economies. Corporate Governance: An International Review, 17(6), 665-680.

Corhay, A., & Rad, A. T. (2000). International acquisitions and shareholder wealth Evidence from the Netherlands. International Review of Financial Analysis, 9(2), 163–174.

Danbolt, J., & Maciver, G. (2012). Cross-Border versus Domestic Acquisitions and the Impact on Shareholder Wealth. Journal of Business Finance & Accounting, 39(7-8), 1028-1067.

Dang, M., & Henry, D. (2016). Partial-control versus full-control acquisitions: Does target corporate governance matter? Evidence from eight East and Southeast Asian countries. Pacific-Basin Finance Journal, 40, 251-265.

Du, M., & Boateng, A. (2015). State ownership, institutional effects and value creation in cross-border mergers & acquisitions by Chinese firms. International Business Review, 24(3), 430–442.

Ellis, J., Moeller, S. B., Schlingemann, F. P., & Stulz, R. M. (2011). Globalization, Governance, and the Returns to Cross-Border Acquisitions. In National Bureau of Economic Research (No. w16676).

Ferreira, M. A., Massa, M., & Matos, P. (2010). Shareholders at the Gate? Institutional Investors and Cross-Border Mergers and Acquisitions. Review of Financial Studies, 23(2), 601-644.

Goergen, M., & Renneboog, L. (2004). Shareholder Wealth Effects of European Domestic and Cross-border Takeover Bids. European Financial Management, 10(1), 9–45.

Gregory, A., & O’Donohoe, S. (2014). Do cross border and domestic acquisitions differ? Evidence from the acquisition of UK targets. International Review of Financial Analysis, 31, 61–69.

Grigorieva, S., & Petrunina, T. (2015). The performance of mergers and acquisitions in emerging capital markets: new angle. Journal of Management Control, 26(4), 377–403.

Harris, R. S., & Ravenscraft, D. (1991). The Role of Acquisitions in Foreign Direct Investment: Evidence from the U.S. Stock Market. The Journal of Finance, 46(3), 825.

Hillier, D., Pindado, J., Queiroz, V. D., & Torre, C. D. L. (2011). The impact of country-level corporate governance on research and development. Journal of International Business Studies, 42(1), 76-98.

http://info.worldbank.org/governance/wgi/index.aspx#home

Hur, J., Parinduri, R. A., & Riyanto, Y. E. (2011). Cross-border m&a inflows and quality of country governance: Developing versus developed countries. Pacific Economic Review, 16(5), 638–655.

Jory, S. R., & Ngo, T. N. (2011). The wealth effects of acquiring foreign government-owned corporations: Evidence from US-listed acquirers in cross-border mergers and acquisitions. Applied Financial Economics, 21(24), 1859–1872.

Kaczmarek, S., & Ruigrok, W. (2013). In at the Deep End of Firm Internationalization: Nationality Diversity on Top Management Teams Matters. Management International Review, 53(4), 513–534.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2011). The worldwide governance indicators: Methodology and analytical issues. Hague Journal on the Rule of Law, 3(2), 220–246.

Klimek, A. (2014). Results of cross-border mergers and acquisitions by multinational corporations from emerging countries - the case of Poland. Eastern European Economics, 52(4), 92–104.

Koerniadi, H., Krishnamurti, C., & Tourani-Rad, A. (2015). Cross-border mergers and acquisitions and default risk. International Review of Financial Analysis, 42, 336–348.

Lebedev, S., Peng, M. W., Xie, E., & Stevens, C. E. (2015). Mergers and acquisitions in and out of emerging economies. Journal of World Business, 50(4), 651–662.

Lim, J., Makhija, A. K., & Shenkar, O. (2016). The asymmetric relationship between national cultural distance and target premiums in cross-border M&A. Journal of Corporate Finance, 41, 542-571.

Lobo, G. J., Paugam, L., & Stolowy, H. (2015). The association between expected synergies and post-acquisition performance in cross-border mergers and acquisitions. XI Workshop on Empirical Research in Financial Accounting. University of Loyola.

Lowinski, F., Schiereck, D., & Thomas, T. W. (2004). The effect of cross-border acquisitions on shareholder wealth—evidence from Switzerland. Review of Quantitative Finance and Accounting, 22, 315–330.

Martynova, M., & Renneboog, L. (2008). Spillover of corporate governance standards in cross-border mergers and acquisitions. Journal of Corporate Finance, 14(3), 200–223.

Rahim, N. M., & Ali, R. (2016). Cross-border mergers and acquisitions (CBMAs): A review on top Six Asean Country CBMA players. Asian Academy of Management Journal of Accounting and Finance, 12(December), 123–158.

Rao-Nicholson, R., Salaber, J., & Cao, T. H. (2015). Long-term performance of mergers and acquisitions in ASEAN countries. Research in International Business and Finance, 36(January 2016), 373–387.

Sharma, A., & Raat, E. (2016). Acquiring control in emerging markets: Foreign acquisitions in Eastern Europe and the effect on shareholder wealth. Research in International Business and Finance, 37, 153–169.

Smimou, K. (2015). Regional equity market conditions and cross-border mergers and acquisitions (M & A): Evidence from the BRIC, Eastern Europe, and Africa. International Journal of Emerging Markets, 10(3), 535-559.

Song, S. I., Kueh, C. C., Abdul Rahman, R., & Chu, E. Y. (2010b). Performance of cross–border mergers and acquisitions in five East Asian countries. International Journal of Economics and Management, 4(1), 61–80.

Song, S.-I., Abdul Rahman, R., Chu, E.-Y., & Cheok-Choo Kueh. (2010a). Determinants of cross-border mergers and Acquisitions (CBMAs) performance in five East Asian countries. 2010 International Conference on Science and Social Research (CSSR 2010).

Thao Ngo, M., Durand, R. B., & Laing, E. (2014). The Disciplinary Role of Leverage: Evidence from East Asian Acquirers. SSRN Electronic Journal.

The ASEAN Secretariat & United Nations Conference on Trade and Development. (2015). ASEAN Investment Report 2015 - Infrastructure Investment and Connectivity. chrome- http://unctad.org/en/PublicationsLibrary/unctad_asean_air2015d1.pdf

The World Bank Group. (2015). Worldwide Governance Indicator. Retrieved January 8, 2016, from

Thenmozhi, M., & Narayanan, P. C. (2016). Rule of law or country level corporate governance: What matters more in emerging market acquisitions? Research in International Business and Finance, 37, 448–463.

Thomson One Banker. (2016). Deals. Retrieved on January 20, 2016, from http://banker.thomsonib.com/ta/TAdashboard.aspx

Tunyi, A. A., & Ntim, C. G. (2016). Location Advantages, Governance Quality, Stock Market Development and Firm Characteristics as Antecedents of African M&As. Journal of International Management, 22(2), 147–167.

United Nations Conference on Trade and Development. (2015). World Investment Report 2015. United Nations Conference on Trade and Development (UNCTAD) World Investment Report (WIR).

United Nations Conference on Trade and Development. (2016). Investor nationality: Policy challenges. World Investment Report 2016, 124-189.

Wang, C., & Xie, F. (2009). Corporate governance transfer and synergistic gains from mergers and acquisitions. Review of Financial Studies, 22(2), 829–858.

Williams, J., & Liao, A. (2008). The Search for Value: Cross-border Bank M&A in Emerging Markets. Comparative Economic Studies, 50(2), 274-296.

Wu, X., Yang, X., Yang, H., & Lei, H. (2016). Cross-border mergers and acquisitions by Chinese firms: Value creation or value destruction? Journal of Contemporary China, 25(97), 130–145.

Yang, K. (2014). M&A deals soar in Southeast Asia. China Daily Asia. http://www.chinadailyasia.com/asiaweekly/2014-07/04/content_15146522.html

Yen, T. Y., Chou, S., & André, P. (2013). Operating performance of emerging market acquirers: Corporate governance issues. Emerging Markets Finance and Trade, 49(SUPPL.3), 5–19.

Zhu, P., & Jog, V. (2012). Impact on target firm risk-return characteristics of domestic and cross-border mergers and acquisitions in emerging markets. Emerging Markets Finance and Trade, 48(4), 79–101.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Rahim, N. M., Chu, E. Y., & Ali, R. (2023). ASEAN Cross-Border Mergers and Acquisitions (CBMAs) Success: Corporate Governance Spillover. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 1211-1229). European Publisher. https://doi.org/10.15405/epsbs.2023.11.97