Abstract

Tax professionals are agents of taxpayers who act as a middle person between taxpayers and tax authority. The use of tax professional services could be seen as an influence to preserve current taxpayers’ fulfillment of their tax responsibilities or encourage future taxpayers to comply with tax laws and regulations. This study tested potential factors associated with taxpayers’ judgements on tax compliance behaviour using customer citizenship behaviour model and to evaluate whether the value co-creation has an intervening effect between customer citizenship behaviour and tax compliance behaviour of taxpayers or tax professionals. While the taxation services aim to provide quality services to taxpayers by way of mutual value creation to generate revenue, profit, competitiveness and sustainability of the business, the taxpayer, through mutual value creation also expects to receive quality and satisfying services from tax professionals in accordance with their needs and requests. Higher satisfaction level of services between the taxpayers and tax professionals gives the impression on the existence of value creation amongst them which will later provide more evidence on customer citizenship behaviour. The study may contribute to the development of the relationship commitment with taxpayers is in terms of not only its impacts, but also strengthening the customer citizenship behaviour by providing feedback, tendency to advocate the tax services business, tolerance to the faults of the tax services business that express the belongingness of taxpayers to the experience and tax services business and, thereby, improving the taxpayer’s satisfaction, while at adhering to the tax compliance requirements.

Keywords: Customer Citizenship Behavior, Tax Compliance, Tax Professionals, Value Co-Creation

Introduction

One of the ways a country can generate cash for its government while also creating conditions favourable to the growth of its economy is through taxation. Due to its significance, tax noncompliance behaviour may have far-reaching effects on the nation and its people. For a development project to be carried out, the government will need to secure sufficient financing. The Inland Revenue Board of Malaysia (IRBM) works to improve the country's dismal tax compliance rates. The Edge (2018) reports that just 2.27 million of Malaysia's employed population actually paid income tax in 2018. The 2021 budget for Malaysia estimates that taxes would bring in 54.1% of government revenue, down from 63.9% in 2020. Lack of clarity in tax rules or regulations, unregistered taxpayers, failure to file tax returns, and intentional tax evasion are all possible causes of a revenue shortfall. It is the policy of the Inland Revenue Board of Malaysia (IRBM) to discourage taxpayers from seeking tax advice from anyone other than legally authorised tax agents. Some taxpayers may require the assistance of tax specialists in order to properly administer their tax submission in order to remain in compliance with tax legislation.

Since completing a tax return annually necessitates the participation of both taxpayers and tax specialists, the emergence of this connection is not a recent phenomenon. Taxpayers are increasingly reliant on tax specialists, who play a vital role in encouraging voluntary compliance. In many countries that use a self-assessment system, taxpayers are required to submit their return with the help of a tax professional. In order to avoid making mistakes or ignoring regulations because of inadequate tax advice, it is critical for taxpayers to work with legitimate tax professionals. It is not always easy for tax professionals to balance their responsibility to their client's (the taxpayer's) best interests with their responsibility to uphold the law. The relationship established may have an impact on taxpayers' propensity to comply with tax laws in either a direct or indirect fashion.

The importance of value co-creation and customer citizenship conduct in shaping taxpayers' compliance behaviour is explored. It aims to learn how interactions between taxpayers and tax experts affect compliance behaviours so that more efficient methods can be developed to improve tax compliance. The influence of service quality in encouraging taxpayer compliance and the effect of value co-creation on compliance decisions are two areas where more study is needed. This research fills in those blanks by looking at how the services provided affect long-term commitment and happiness. Taking into account the roles of taxpayers and tax professionals, this research seeks to establish the connection between citizenry behaviour on the part of customers and tax compliance. To provide useful clues regarding taxpayer conduct that may aid in tax compliance, it is critical to ascertain the impact on the service output of a tax professional. Eventually, it is hoped that this research will be useful to the Malaysian tax authority by providing insight into taxpayers' tax compliance behaviours and allowing for the development of an appropriate tax compliance strategy to boost taxpayers' compliance rates.

Literature Review

Tax compliance

In order to maximise their tax position while mitigating risk and minimising cash flow effect, businesses and individuals alike must carefully manage their tax affairs. Increasing taxpayers' willingness to voluntarily comply with tax laws is a top priority for tax authorities and governments everywhere, as tax money is used to finance government spending. Tax evasion poses a serious risk to national economies and can destabilise government budgets (Chong & Arunachalam, 2018). Taxpayer cooperation in meeting their responsibility to comply with tax rules is crucial to the effectiveness of the self-assessment system. The number of individual tax audits increased by 12% in 2017 to 1,768,867 (1,322,704 of which were salaried individuals) from 1,576,709 in 2016 (IRBM, 2016, 2017). The Inland Revenue Board of Malaysia (IRBM) works to improve the country's dismal tax compliance rates.

The issue of taxpayers failing to pay their fair share of taxes has become a major headache for tax authorities around the world, particularly in developing countries (McKerchar & Evans, 2009). Policymakers, tax administrations, and society all need to pay close attention to the issue of non-compliance because it can lead to a decrease in tax revenue, which could harm individuals in indirect ways (including those who voluntarily comply) (Mohdali et al., 2014). The government must spend a lot of money on taxes, especially on tax compliance, to deter tax cheats and punish tax offenders. Perceived behavioural control has been shown to have both a direct and indirect impact on taxpayer compliance, according to the studies on this topic. Perceived behavioural control can have either a direct or indirect effect on tax compliance behaviour, depending on whether or not behavioural intention acts as a mediator (Al-Zaqeba & Al-Rashdan, 2020; Bobek & Radtke, 2007; Bobek et al., 2010; Kusumawati et al., 2014).

Professional tax preparation is more common among high-income filers than among those in the middle class or lower (Gangl & Torgler, 2020). Maintaining public finances and ensuring social equality between the wealthy and the poor rely heavily on tax compliance (Gangl & Torgler, 2020; Saad et al., 2021). A few reported cases found that non-compliance of tax law was due to dishonest tax agents who provided bad tax advice to their client (Malaysian Institute of Accountants, 2019), highlighting the need to review licencing and enforcement of law. According to a news statement issued by the IRBM in June 2022, the agency has tallied 31,598 eligible taxpayers who have failed to file their tax returns, resulting in a potential revenue loss of RM665 million. If the government keeps losing the money every year, it could have a negative effect on the country's infrastructure and economic development.

Customer citizenship behaviour

Customer citizenship behaviour study is known as an important element for organisation to evaluate and manage the increasing role behaviours of customers today as well as means of promoting the survival of organisation in a rapidly increasing competitive environment. Customer citizenship behaviour is defined by Groth (2005) as “voluntary and discretionary behaviours that are not required for the successful production or delivery of the service but that, in the aggregate, help the service organization overall” (p. 11). Customer citizenship behaviour provides significant benefits to firms, the customers themselves and other customers through enhanced relationships among participants in the service encounter (Bove et al., 2009; Yi et al., 2011). Customers can get benefit from it by feeling more a part of the community and more useful, getting relief from friends and family or other responsibilities, interacting socially by helping and meeting other customers, treating employees with respect, and helping out without expecting to be paid back directly (Rihova et al., 2018; van Doorn et al., 2010).

According to Assiouras et al. (2019), some customer initiatives are described by the citizenship behavior of the consumers, such as when the customers take on additional obligations outside of their co-creation role and take certain behaviors toward other customers, employees, and/or businesses. It was later discovered in the study that customer citizenship is connected to how tourists behave when there are issues with the service, how they help the business and other tourists solve issues, how they behave when information about the business is shared online and offline, and how they behave before, during, and after an experience. According to Arıca and Çorbacı (2020), the value co-created with customers had a two-dimensional structure made up of the individual value and the experience quality value, which is in line with earlier research by Yi and Gong (2013), Arıca and Kozak (2019), and Assiouras et al. (2019). Many scholars also agree that there is a significant relationship between customer citizenship behaviour and gaining competitive advantage to sustain an improved performance by the service provider (Chan et al., 2010; Chen, 2016; Nadiri & Tanova, 2010). Some of its antecedents, including loyalty (Zoghbi-Manrique-de-Lara et al., 2014), emotional experience (Zhang et al., 2018), and some of its outcomes, including customer satisfaction, loyalty, and perceived value (Liu & Tsaur, 2014; Tung et al., 2017), have been the subject of a few studies. However, other research has shown a negative correlation between customer citizenship behavior and the customer's intention to leave (Revilla-Camacho et al., 2015).

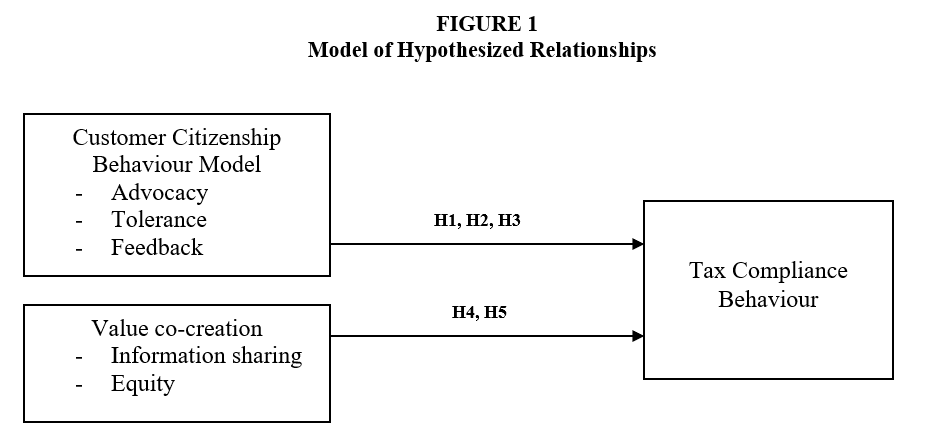

This study will cover the effect of the relationship between customer citizenship behaviour with tax compliance behaviour. We use the framework setting of Yi and Gong (2013) to be applied in taxpayers and tax professional service setting, and the hypotheses of the study was developed as follows:

H1: There is a significant relationship between advocacy behaviour and tax compliance behaviour.

H2: There is a significant relationship between tolerance behaviour and tax compliance behaviour.

H3: There is a significant relationship between feedback behaviour and tax compliance behaviour.

Value co-creation

Customers and businesses work together to create value, and their fundamental expectation is to profit from the process. Customers' belonging to the process increases in direct proportion to how well their benefit expectations are satisfied during the process of creating mutual value (Assiouras et al., 2019; Ford & Heaton, 2000; Groth, 2005). Customers who exhibit high levels of citizenship behavior are more likely to return to the business, provide feedback, and promote it on both online and offline platforms (Barnes et al., 2014; Groth, 2005). Additionally, customers that exhibit good citizenship tend to be more likely to assist other customers during the experience process (Assiouras et al., 2019; Groth, 2005; Gong & Yi, 2021). Additionally, customers that exhibit good citizenship tend to be more likely to assist other customers during the experience process (Assiouras et al., 2019; Groth, 2005; Gong & Yi, 2021). One of the business techniques that enables productions to be in line with client requests and wants is value co-creation with customers (Prebensen & Xie, 2017; Phi & Dredge, 2019). Practicing the strategy of value co-creation with customers will help the businesses in differentiating their services and ensuring the customer satisfaction in the tourism market and make significant contributions to the competitiveness and continuity of the businesses (Arıca & Çorbacı, 2020).

While professional tax services strive to offer their client, the taxpayer, quality services through the creation of mutual value in order to increase revenue, profit, competitiveness, and business sustainability, the taxpayer also expects, through the creation of mutual value, from receiving quality and satisfying services from tax consultants in accordance with their requests and needs. Thus, value co-creation with clients is expected to improve the citizenship behaviour of taxpayers. By identifying the client demands, requests, and requirements that are challenging to foresee and meet, value co-creation with customers can increase customer satisfaction (Assiouras et al., 2019; Etgar, 2008; Namasivayam & Guchait, 2013; Prebensen & Xie, 2017). However, it is also claimed that depending on the circumstances, the impact of value co-creation with customers on satisfaction may change (Chan et al., 2010; Prebensen et al., 2016). But the value that is jointly created with taxpayers may also have both immediate and long-term effects on satisfaction. Ford and Heaton's (2000) assertion that an organization may experience discontent at the conclusion of the engagement process if it disregards the information and skills provided by the consumers during the process of value co-creation with them supports this. This study would like to also test whether the value co-creation has direct or indirect effect between customer citizenship behaviour and tax compliance behaviour. Accordingly, the hypothesis to measure the relationship was developed as follows:

H4: There is a significant relationship between value co-creation element information sharing and tax compliance behaviour.

H5: There is a significant relationship between value co-creation element of equity and tax compliance behaviour.

Tax professional services

The Income Tax Act (ITA) 1967 outlines the duties of tax professionals as providers of services in Malaysia. These duties include advising their clients on records to be kept, assisting in filing clients' tax returns, advising clients on their obligations to pay their dues as mandated by law, attending the audit at their clients' premises if they are being audited, attending an investigation, negotiations, and proceedings on their clients' behalf, and filing application forms. They can be regarded as important gatekeepers of tax compliance by facilitating taxpayers in their tax related matters and at the same time upholding the integrity of the tax system and provision of tax law. They can provide guidance on the scope of tax and the expenses that are available for tax deduction, benefits, and exemptions available to individuals as well as business owners. In addition to preparing income tax returns, they may also represent their clients during negotiations with tax authorities. According to earlier research, the main reasons why most taxpayers hire tax professionals are to deal with the complexity of tax rules, a lack of time, apprehension about fines, and the need to complete an accurate return (Collins et al., 1990; Hite & McGill, 1992; Hite et al., 1992; McKinstry & Baldry, 1997). The purpose for appointing a tax agent is not primarily motivated by the desire to avoid paying taxes, but more importantly the intention to report correctly to the tax system environment (Kirchler, 2007).

There could be other reasons such as minimizing the problems of being audited, tax savings, risk management, reducing tax compliance costs, submission of accurate tax return and resolving uncertainties, keeping up with the updates of tax information and requirements for tax planning, the depth of technical knowledge and complexity of income tax law (Hite et al., 2019; Isa et al., 2014; Sapiei, 2014; Tan & Sawyer, 2003). In order to feel more secure about the services they are receiving, taxpayers are eager to establish a long-term professional connection with their tax advisor (Danaher et al., 2008). Through a long-term relationship with a tax professional, a client's income history is better understood, which raises the quality of the service. However, it is sometime challenging for the tax professional to determine the boundaries as advocates and to always maintain their professionalism (Bobek et al., 2010). Most taxpayers simply preferred more conservative advice and chose a tax professional that reflected their own attitude towards compliance (Sakurai & Braithwaite, 2003). This is further reinforced by Kirui's (2016) study, which found that tax professionals support taxpayers' tax avoidance techniques when the law is vague but urge tax compliance when it is clear-cut.

Applying to the taxpayers’ context, many taxpayers’ desires for good and satisfying tax planning and administration of their tax return after engaging with the tax professional services. Taxpayers would prefer to have a lower tax payable but at the same time reduce their risk of being audited by the Inland Revenue Board Malaysia (IRBM). This situation indirectly could undermine their tax compliance behaviour and satisfaction of the services from the tax professional. It can be stated that the lower the level of satisfaction, potentially the higher level of tax non-compliance.

Research Methodology

The pilot study relied on a survey as its primary method of data collection. Sixty possible respondents were contacted and online questionnaires were issued; this served as the major data source. Study participants will be local taxpayers who have used the services of tax preparers who are members of IRBM. The study's sample population will consist of clients of the tax expert community. There were 44 responses to the survey, for a response rate of 67%. The questionnaire's focus will be on gathering demographic information and respondent feedback on the study questions. The questionnaire will have four (4) distinct parts. Information requested in Section 'A' includes respondents' ages, sexes, levels of education, occupations, marital statuses, and household incomes. Statements in Section 'B' quantify the connection between taxpayers' civic behaviour and tax compliance by merging the models developed by Yi and Gong (2013) and Assiouras et al. (2019). Using the models created by Chan et al. (2010) and Flores and Vasquez-Parraga (2015), the statements in Section 'C' assess the mediating effect of value co-creation on the relationship between customer citizenship behaviour and tax compliance behaviour.

A five-point Likert scale was used to create the survey's questions. The five-point Likert scale for statements of opinion (5 = extremely agree, 1 = extremely disagree). Customer citizenship behaviour, value co-creation, and tax compliance were estimated using a simple linear regression model. The statistical significance of the study variables was analyzed using t-tests. We modified existing literature and research to provide us with the items we used to measure our dependent and independent variables as shown in Figure 1 below.

Results and Discussion

Validity of the measures for the relationship constructs was checked before any analysis was performed. The online survey data was stored in Excel and then transferred to SPSS. Related items were added to get an individual's total score for the constructs. The reliability of the scales was calculated by averaging the correlations among the survey questions using the Cronbach alpha. If the value of alpha is high, then the measurement can be trusted. Reliability was high (0.70 or greater) across the board for all measurement scales, as reported by Hair et al. Exploratory factor analysis was used to verify the reliability and validity of the scales by ensuring that the items were significantly related to one another and not to the items that make up the other constructs as per shown in Table 1 below.

Demographic effects

Section A of the survey dealt with demographics including gender, age, education level, income level, ethnicity, residency and main job category. The result shows that majority of the respondents (61.4%) were female, (45.5%) in the 30 – 39 age group and had graduated university first degree or higher (79.6%). The respondent's annual household income differs as well. Given that the majority of respondents fall under Malaysia's T20 income group category and file individual tax returns annually, it is not surprising that the majority of them (47.8%) earn more than RM8,701 per month. 18.2% of respondents are entrepreneurs, and 56.8% of respondents have management or higher-level positions. Being in multiracial country, it is also found out that 84.1% of the respondents are Malays and 29% of the respondents resided in Selangor. Overall, the survey's sample was generally representative, according to the frequency of demographic data, and all of the respondents used tax professionals, which increased the depth of the data.

Results

The composite measure for all variables (dependent and independent) was calculated for the pilot project by averaging all items on a scale, which is predicated on the idea that all items contribute equally to the construct. An ordinal scale was used to gauge the respondents' evaluation. Tables 2 and 3 below indicate correlations for dependent and independent variables.

Note: N = 44;

The information relating to correlations in Table 3 shows that variables related to value co-creation have a moderate significant relationship with tax compliance. Meanwhile variables related to customer citizenship behaviour may not have significant contribution towards tax compliance.

The model summary in Table 4 indicates a lower degree of correlation. R2 is 0.29 (29%) shows that 29% of tax compliance attitude can be explained by customer citizenship behaviour elements namely advocacy and feedback together with value co-creation elements such as information sharing and responsible behaviour. Based on Table 5 above, the tolerance variable could not be seen as a strong element to explain the attitude of taxpayers towards tax compliance while in the engagement services with the tax professional. The standardized coefficient provides information on each predictor variable which is required to predict tax compliance attitude from feedback, information sharing and responsible behaviour. As hypothesized, the standard coefficient for all other variables (except for advocacy and tolerance) significantly contribute to tax compliance.

The result establishes that customer citizenship behaviour appears to display no effect on their relationship with tax professionals towards tax compliance. The study demonstrates that value co-creation enhances tax compliance under conditions of satisfaction with tax professional services provided by tax professionals. In addition to its effects, the study is anticipated to strengthen value co-creation processes like information sharing and equity that express taxpayers' belongingness to the experience and tax professional services, increasing taxpayer satisfaction while upholding tax compliance regulations.

Conclusions and Recommendations

This preliminary study is thought to provide a substantial contribution to the literature on the topic of the connection between customer citizenship conduct and value co-creation in the context of tax compliance based on customers' prior interactions with tax professionals. This research set out to learn how characteristics like taxpayers' sense of civic duty and their willingness to collaborate with tax experts affect the taxpayers' likelihood of complying with tax laws and the quality of their working relationship with tax experts. The first part of the research examined the correlation between tax compliance and three aspects of good citizenship displayed by customers: advocacy, tolerance, and feedback. Second, it made an effort to characterise the outcomes of yet another variable: the combination of value creation and tax adherence.

Several caveats apply to this investigation. Although future research would benefit from statistically evaluating the causality, this study relies on theory and existing literature to determine the direction of causal linkages between variables. A bigger scale study is recommended for the future to acquire a new perspective, as the results of the current study may not be generalizable to the community at large due to the fact that only a small sample of respondents completed the questionnaire for pilot testing. Given that accounting and tax services are among the most strictly regulated industries, it is suggested that a third variable be included in future research to examine whether or not there is a correlation between taxpayer behaviour and the quality of services provided by tax professionals. Careful item selection is required to measure the control items in the accounting and tax industries since the approach utilised in this study is typically applied in the hospitalisation or marketing industries. The exploratory study is vital for the advancement of knowledge and the enrichment of the literature because this is a relatively new field of testing for the accounting and tax business.

Despite these caveats, the study's overall findings support the idea that transparency and fairness in the exchange of data between individuals and tax experts are critical factors in boosting tax compliance. The findings of this research could be used by tax experts to provide even better services that cater specifically to taxpayers' wants and needs. This has the potential to improve communication between taxpayers and tax experts, increase taxpayer compliance, and result in more satisfied customers who are willing to suggest and refer other customers in the future. The findings of this study will aid taxpayers, tax experts, tax agencies, and tax organisations. It's important for both taxpayers and tax experts to have a firm grasp on the dynamics between their respective customer citizenship behaviours in order to pinpoint who exactly is responsible for what in terms of tax compliance operations. Customers who are also taxpayers can help service providers by relieving them of some of their workloads and ensuring that tax regulations are followed. There is undeniably a need for additional study in this sector.

Acknowledgments

The authors would like to express their gratitude to the MARA University of Technology of Malaysia for funding the research project through the under the Special Research Grant Number 600-TNCPI 5/3/DDF (AKAUN) (006/2022). Our appreciation also goes to the Faculty of Accountancy for facilitating the research project.

References

Al-Zaqeba, M. A. A., & Al-Rashdan, M. T. (2020). The effect of attitude, subjective norms, perceived behavioral control on tax compliance in Jordan: The moderating effect of costums tax. International Journal of Scientific & Technology Research, 9(4), 233-238 https://ssrn.com/abstract=3614298

Arıca, R., & Çorbacı, A. (2020). The Mediating Role of the Tourists' Citizenship Behavior Between the Value Co-Creation and Satisfaction. Advances in Hospitality and Tourism Research (AHTR), 8(1), 125-150.

Arıca, R., & Kozak, R. (2019). Co-production behaviors of travel agencies customers: A research on local cultural tourists visiting Istanbul. Journal of Tourism and Hospitality Management, 7(1), 84-98.

Assiouras, I., Skourtis, G., Giannopoulos, A., Buhalis, D., & Koniordos, M. (2019). Value co-creation and customer citizenship behavior. Annals of Tourism Research, 78, 102742.

Barnes, S. J., Mattsson, J., & Sørensen, F. (2014). Destination brand experience and visitor behavior: Testing a scale in the tourism context. Annals of Tourism Research, 48, 121-139.

Bobek, D. D., & Radtke, R. R. (2007). An experiential investigation of tax professionals' ethical environments. Journal of the American Taxation Association, 29(2), 63-84.

Bobek, D. D., Hageman, A. M., & Hatfield, R. C. (2010). The role of client advocacy in the development of tax professionals’ advice. Journal of the American Taxation Association, 32(1), 25-51.

Bove, L. L., Pervan, S. J., Beatty, S. E., & Shiu, E. (2009). Service worker role in encouraging customer organizational citizenship behaviors. Journal of business research, 62(7), 698-705.

Chan, K. W., Yim, C. K. B., & Lam, S. S. K. (2010). Is Customer Participation in Value Creation a Double-Edged Sword? Evidence from Professional Financial Services across Cultures. Journal of Marketing, 74(3), 48-64.

Chen, W.-J. (2016). The model of service-oriented organizational citizenship behavior among international tourist hotels. Journal of Hospitality and Tourism Management, 29, 24-32.

Chong, K. R., & Arunachalam, M. (2018). Determinants of enforced tax compliance: Empirical evidence from Malaysia. Advances in Taxation, 25(4), 147-172.

Collins, J. H., Milliron, V. C., & Toy, D. R. (1990). Factors Associated with Household Demand for Tax Preparers. Journal of the American Taxation Association, 12(1), 9–25.

Danaher, P. J., Conroy, D. M., & McColl-Kennedy, J. R. (2008). Who Wants a Relationship Anyway?: Conditions When Consumers Expect a Relationship With Their Service Provider. Journal of Service Research, 11(1), 43-62.

Etgar, M. (2008). A descriptive model of the consumer co-production process. Journal of the Academy of Marketing Science, 36(1), 97-108. https://doi.org/10.1007/s11747-007-0061-1

Flores, J., & Vasquez-Parraga, A. Z. (2015). The impact of choice on co-produced customer value creation and satisfaction. Journal of Consumer Marketing, 32(1), 15-25.

Ford, R. C., & Heaton, C. P. (2000). Managing the Guest Experience in Hospitality. Delmar.

Gangl, K., & Torgler, B. (2020). How to Achieve Tax Compliance by the Wealthy: A Review of the Literature and Agenda for Policy. Social Issues and Policy Review, 14(1), 108-151.

Gong, T., & Yi, Y. (2021). A review of customer citizenship behaviors in the service context. The Service Industries Journal, 41(3-4), 169-199.

Groth, M. (2005). Customers as good soldiers: Examining citizenship behaviors in internet service deliveries. Journal of management, 31(1), 7-27.

Hite, P. A., & McGill, G. A. (1992). An examination of taxpayer preference for aggressive tax advice. National Tax Journal, 45(4), 389-403.

Hite, P. A., Stock, T., & Cloyd, C. B. (1992). Reasons for preparer usage by small business owners: How compliant are they? National Public Accountant, 37, 20-26.

Hite, P., Hasseldine, J., Al-Khoury, A., James, S., Toms, S., & Toumi, M. (2019). Tax Practitioners and Tax Compliance. Contemporary Issues in Taxation Research, 17-43.

Inland Revenue Board Malaysia. (2016). Annual Report 2016. https://phl.hasil.gov.my/pdf/pdfam/annual_report_2016.pdf

Inland Revenue Board Malaysia. (2017). Annual Report 2017. https://phl.hasil.gov.my/pdf/pdfam/annual_report_2017.pdf

Isa, K. M., Yussof, S. H., & Mohdali, R. (2014). The Role of Tax Agents in Sustaining the Malaysian Tax System. Procedia - Social and Behavioral Sciences, 164, 366-371.

Kirchler, E. (2007). The economic psychology of tax behaviour. Cambridge University Press.

Kirui, B. K. (2016). Tax Practitioners: Advocates of Compliance or Avoidance? (No. 04). ATRN working paper. http://hdl.handle.net/10419/172487

Kusumawati, A., Halim, A., & Said, D. (2014). Effects of intention mediation towards attitude, subjective norms and perceived behavioral control on taxpayers' behavior. Journal of Research in Business and Management, 2(10), 26-32.

Liu, J. S., & Tsaur, S.-H. (2014). We are in the same boat: Tourist citizenship behaviors. Tourism Management, 42, 88-100.

Malaysian Institute of Accountants. (2019). Driving Tax Compliance. Retrieved on 16 August 2021 from https://www.at-mia.my/2019/09/11/driving-tax-compliance

McKerchar, M., & Evans, C. (2009). Sustaining growth in developing economies through improved taxpayer compliance: Challenges for policy makers and revenue authorities. eJournal of Tax Research, 7(2), 171-201. https://www.proquest.com/openview/784a76aced22b9b82cca34d783f0b51c/1?pq-origsite=gscholar&cbl=106013

McKinstry, K., & Baldry, J. (1997). Explaining the growth in usage of tax agents by Australian personal income taxpayers. Austl. Tax F., 13, 135. https://search.informit.org/doi/abs/

Mohdali, R., Isa, K., & Yusoff, S. H. (2014). The Impact of Threat of Punishment on Tax Compliance and Non-compliance Attitudes in Malaysia. Procedia - Social and Behavioral Sciences, 164, 291-297.

Nadiri, H., & Tanova, C. (2010). An investigation of the role of justice in turnover intentions, job satisfaction, and organizational citizenship behavior in hospitality industry. International journal of hospitality management, 29(1), 33-41.

Namasivayam, K., & Guchait, P. (2013). The role of contingent self-esteem and trust in consumer satisfaction: Examining perceived control and fairness as predictors. International Journal of Hospitality Management, 33, 184-195.

Phi, G., & Dredge, D. (2019). Critical issues in tourism co-creation. Tourism Recreation Research, 44(3), 281-283.

Prebensen, N. K., & Xie, J. (2017). Efficacy of co-creation and mastering on perceived value and satisfaction in tourists' consumption. Tourism Management, 60, 166-176.

Prebensen, N. K., Kim, H. L., & Uysal, M. (2016). Cocreation as Moderator between the Experience Value and Satisfaction Relationship. Journal of Travel Research, 55(7), 934-945.

Revilla-Camacho, M. Á., Vega-Vázquez, M., & Cossío-Silva, F. J. (2015). Customer participation and citizenship behavior effects on turnover intention. Journal of business research, 68(7), 1607-1611.

Rihova, I., Buhalis, D., Gouthro, M. B., & Moital, M. (2018). Customer-to-customer co-creation practices in tourism: Lessons from Customer-Dominant logic. Tourism Management, 67, 362-375.

Saad, N., Mas’ud, A., Aziz, S. A., Manaf, N. A. A., & Mashadi, M. A. (2021). Tax Noncompliance of High Net-Worth Individuals (HNWIS) in Malaysia: Perspectives of Tax Professionals. Jurnal Pengurusan, 63, 85-98.

Sakurai, Y., & Braithwaite, V. (2003). Taxpayers' perceptions of practitioners: Finding one who is effective and does the right thing? Journal of Business Ethics, 46, 375-387. https://link.springer.com/article/

Sapiei, N. S. (2014). Tax agents perceptions of the corporate taxpayers' compliance costs under the self-assessment system.

Tan, L. M., & Sawyer, A. J. (2003). A synopsis of taxpayer compliance studies: Overseas vis-a-vis New Zealand. New Zealand Journal of Taxation Law and Policy, 9(4), 431-454.

The Edge. (2018). The State of the Nation: Considerations in Reforming Malaysia’s Tax System. Retrieved on 9 August 2021 from https://theedgemalaysia.com/node/427511

Tung, V. W. S., Chen, P.-J., & Schuckert, M. (2017). Managing customer citizenship behaviour: The moderating roles of employee responsiveness and organizational reassurance. Tourism Management, 59, 23-35.

van Doorn, J., Lemon, K. N., Mittal, V., Nass, S., Pick, D., Pirner, P., & Verhoef, P. C. (2010). Customer Engagement Behavior: Theoretical Foundations and Research Directions. Journal of Service Research, 13(3), 253-266.

Yi, Y., & Gong, T. (2013). Customer value co-creation behavior: Scale development and validation. Journal of Business research, 66(9), 1279-1284.

Yi, Y., Nataraajan, R., & Gong, T. (2011). Customer participation and citizenship behavioral influences on employee performance, satisfaction, commitment, and turnover intention. Journal of Business Research, 64(1), 87-95.

Zhang, H., Gordon, S., Buhalis, D., & Ding, X. (2018). Experience value cocreation on destination online platforms. Journal of Travel Research, 57(8), 1093-1107.

Zoghbi-Manrique-de-Lara, P., Suárez-Acosta, M. A., & Aguiar-Quintana, T. (2014). Hotel guests’ responses to service recovery: How loyalty influences guest behavior. Cornell Hospitality Quarterly, 55(2), 152-164.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Latif, N. E. A., Ismail, I. S., Hamid, N. A., & Yunus, N. (2023). Customer Citizenship Behaviour, Value Co-Creation and Tax Compliance: Malaysian Perspective. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 1123-1135). European Publisher. https://doi.org/10.15405/epsbs.2023.11.91