Abstract

This review paper aims to provide an overview of the role of financial performance in Chinese high-tech companies. A systematic literature search was conducted to identify relevant articles published in academic journals and other sources. The selected articles were critically evaluated and synthesized to identify common themes and trends related to financial performance in Chinese high-tech companies. The findings suggest that financial performance is a critical factor in the success and growth of Chinese high-tech companies, with several factors contributing to financial performance, including innovation, tax incentives, government funding, and innovation effectiveness. The review highlights the importance of understanding the multifaceted interplay between financial performance and other organizational factors in Chinese high-tech companies. A number of implications have been listed at the end of this review. The paper concludes by providing recommendations for future potential researchers who are interested to be involved in improving such stated variables discussed in reviewed literature.

Keywords: Chinese High-Tech Companies, Companies’ Financial Performance, Financial Performance, Hi-Tech Firms, High-Tech Companies, Tax İncentives

Introduction

China's rise to the forefront of technical innovation and entrepreneurship has resulted in a surge of interest in Chinese tech startups in recent years (Lissillour et al., 2020; Liu et al., 2021). Rapid technological advancement, international rivalry, and fluctuating customer preferences all contribute to an extremely fluid and competitive business climate for these firms (Lissillour et al., 2020; Liu et al., 2021). Therefore, their ability to attain and maintain financial performance is crucial to their success and growth (Duan et al., 2020).

Profitability, growth in share value, and the attainment of strategic goals are all indicators of a company's financial performance (Xu & Liu, 2021). The success of Chinese high-tech companies depends on a number of factors, including innovation, organisational culture, strategic management, and external market conditions (Ichsan et al., 2021). Financial performance in Chinese high-tech enterprises is vital for regulators, investors, and managers who want to help the company grow and flourish (Rababah et al., 2020).

By addressing these two research topics, this review study seeks to provide a summary of the significance of financial performance in Chinese high-tech firms. When it comes to the financial success of Chinese high-tech enterprises, what internal factors are most important, such as innovation and talent management? And 2) How do factors like market demand, competition, and regulatory environments affect the bottom lines of Chinese IT firms? Our goals are to (1) examine the impact of internal factors like innovation and talent management on Chinese high-tech firms' financial performance and (2) look into the ways in which external factors like market demand and competition affect those firms' financial results. To further understand the factors that contribute to financial success in this setting, we will also undertake a comprehensive literature review. We will do an in-depth analysis of the chosen papers to determine the most important elements influencing the financial performance of Chinese high-tech businesses, and then we will analyse the significance of these findings for policymakers, investors, and managers.

The following is the structure of the review: Section 2 provides an in-depth explanation of the methodology used to choose articles. The literature review is summed up in Section 3. The findings from the literature review are presented and discussed in Section 4. Section 5 contains suggestions for further reading. Several ramifications are detailed in Section 6. Section 7 contains the discussion, while Section 8 contains the conclusion.

Method

According to PRISMA 202 for systematic review, this review has gone through its steps. Selection process for the papers reviewed, papers collections, inclusion and exclusion criteria are briefly described. Applied steps for the method applied for the selection procedure criteria are listed as follows:

Research questions have been defined in order to design inclusion and exclusion criteria for study selection.

A systematic search of relevant literature in multiple databases and sources, was applied and conducted to the search strategy, including keywords, dates, and filters.

Keywords used: “Hi-tech firms”, “high-tech companies”, “financial performance”, “Chinese high-tech companies”, “tax incentives + companies’ performance”

Databases used: Google scholar, Scopus, SpringerLink.

Date of search: December 2022 – February 2023

Screen titles and abstracts of all identified articles, and select full-text articles based on pre-defined inclusion and exclusion criteria.

First stage produced 1259 articles.

Second stage produced 1023.

In this stage, titles’ screening has been applied then; results obtained were 1023.

The third stage had been applied.

Full-text articles have been considered; results obtained were 129.

Quality of the selected articles has been assessed, where a number of criteria have been applied:

The English language has been considered.

Date of publication is almost recent.

Results in the selected articles to be clearly discussed.

Study design, sample size, outcomes, and other relevant variables to be also stated, mentioned, and defined.

Results in this stage had produced 57.

Literature Review

Chinese high-tech companies

High-tech firms, according to the literature, are those with a focus on innovative research and development. Hi-tech companies are defined as those that devote a disproportionate amount of resources to research and development (R&D) and innovation (Lin et al., 2022; Yu et al., 2021). The effectiveness of the high-tech industry is a major determinant of the quality of economic development in China (Lü & Zhang, 2022), and hi-tech companies are often considered as the leading drivers of innovation in the country (Bronzini & Piselli, 2016). China's State Council Information Office conducted a press conference on October 21, 2020, to discuss the country's rapid transformation into an inventive nation through the widespread implementation of the innovation-driven development plan. In order to speed up the formation of a new development pattern, the Ministry of Science and Technology will prioritise resolving the tension between the need for excellent development and inadequate technological innovation capabilities (Lü & Zhang, 2022).

Financial performance

It is measured utilising a variety of business-related formulas that allow users to compute precise data predicting the future effectiveness of an organisation (Xie et al., 2022).

Financial performance role

The importance of the financial performance in general lies in the fact that it aims to crown the firm’s performance from several angles and in a way that serves stakeholders who have financial interests in firms to determine the strengths and weaknesses of the firm and take advantage of the data provided by the financial performance to rationalize the financial decisions of firm (Xiang et al., 2019). Financial performance is used, in particular, in the process of following up on the firm’s business, examining its behavior, monitoring its conditions, evaluating its performance levels, identifying obstacles and stating their causes, and then directing performance and proposing the necessary corrective measures in accordance with the general objectives of the firm and contributing to making peaceful decisions to preserve the investment and survival of the firm (Dekoulou & Trivellas, 2017).

The evaluation of financial performance helps in measuring the development achieved by the firm during a specific period, by following up the actual results of performance, and comparing them with other periods or compared to other firms (Xie et al., 2022). The ability of an organisation to continuously innovate has a positive impact on financial outcomes, so innovation can be a critical component in improving financial outcomes (Dekoulou & Trivellas, 2017), because it allows an organisation to significantly differentiate its products and services from those of competitors (Xiang et al., 2019).

Tax incentives issue in China

As it moves from a planned to a market economy, China has experienced rapid growth. Although progress was being made until recently, it has slowed significantly in recent years (Weinland et al., 2019). Investments in R&D to spur innovation are a key growth factor, according to Lü and Zhang (2022). China has adopted an innovation-driven development strategy that actively promotes and assists businesses in increasing their research, development, and innovation activities (Lin et al., 2022). Although the effectiveness of tax incentives is uncertain, particularly in emerging economies (Dai & Chapman, 2022), they have played an essential role in this strategy.

"an element of a country's tax code designed to incentivize or encourage a specific economic activity by reducing tax payments for a company in said country" (Wikipedia, 2022). In 2006, the Chinese government loosened the "% eligibility criterion," which had previously stated that businesses could only receive a 50% tax break if their R&D spending had increased from the previous year by 10% or more (Tian et al., 2020). Investment in technical innovation rose as a result of these tax advantages, and a greater number of patents were filed in China. The overall number of new patent applications acknowledged under the Patent Cooperation Treaty (PCT) increased by 3% year over year in 2018, according to data from the World Intellectual Property Organisation (WIPO). Patent applications are most common in the United States and Japan. China is currently in third place, but it hopes to overtake the leaders by 2035 thanks to its rapid economic expansion (B. Yang & Cao, 2019). The innovation levels of Chinese companies have risen dramatically, which comes as no surprise. At a compound annual growth rate of 36% (Tian et al., 2020), the amount of patent applications filed by domestic corporations increased from 1,725 in 1995 to more than 582,512 in 2015. The key factor in China's development in this area is the country's ever-improving innovation tax policy.

Government funding in China

Government funding refers to “grants in various forms from the government” (Zhu et al., 2006, p. 60). Government funding is defined as “a public instrument used to correct market failure, increase private R&D effort, optimize resources allocation, and facilitate innovation” (Ghazinoory & Hashemi, 2021). Facilitating enterprise innovation has grown in importance as a means of achieving high-quality economic growth ever since China adopted the innovation-driven development model. The Chinese government is consistently expanding its support for innovation. National spending on science and technology reached CNY 776.1 billion in 2016, representing an average yearly growth rate of 14.2 percent since 1981. It is widely accepted that the goal of creative business behaviours and the fundamental component of the modern economy are value creation (Goede, 2018; Viviani & Maurel, 2019). Therefore, to increase the effectiveness of government resource allocation, it may be beneficial to research how Chinese government innovation financing affects a firm's ability to create value (Zhu et al., 2019).

Innovation effectiveness impact on hi-tech companies

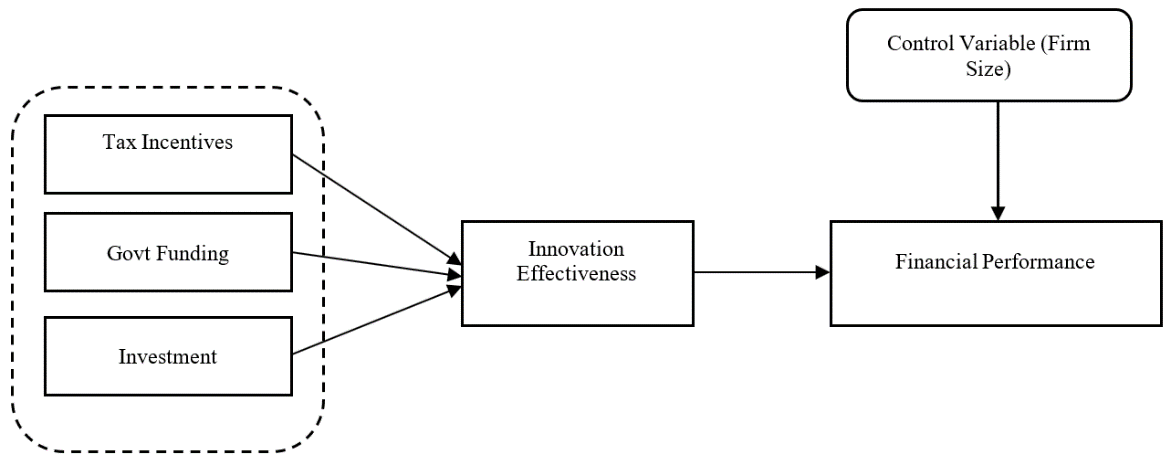

Today, the major source of competitive advantage and superior performance for hi-tech enterprises has shifted from efficiency and quality to innovation effectiveness; as a result, innovation effectiveness is the key to high-tech industries' success (Wang, 2019). The ability to innovate is the foundation of technological strength (Yang et al., 2020). Innovation effectiveness has the potential to boost productivity, and technical advancement in the hi-tech industry (Hong et al., 2016; Zhou et al., 2021), as well as support the industry's core competitiveness (Chen & Li, 2018). To answer the fundamental issue, “What might increase innovation effectiveness in hi-tech firms?” several research studies have been conducted. Many factors including (i) tax incentives interventions that can stimulate increases in firm R&D and patenting, thus improving innovation effectiveness (Dai & Chapman, 2022), (ii) government funding that can correct market failure, increase private R&D effort, optimize resource allocation, and facilitate innovation effectiveness in hi-tech firms, and (iii) R&D investment which can positively affect R&D intensity and in turn enhance innovation effectiveness (Yang et al., 2019), all these factors were found to be important in a review of relevant studies (Ghazinoory & Hashemi, 2021).

Table 1 is a summary of previous studies on tax incentives, government funding, investment, innovation and financial performance in the context of hi-tech firms. In the following, this study reviews some of these studies.

Results Obtained From Reviewed Literature

Importance of financial performance towards firm’s businesses’ enhancement

"A subjective measure of how well a firm can use assets from its primary mode of business and generate revenues," according to financial performance. The phrase is typically used as a general measure of a company's long-term financial health (Wang, 2019, p. 230).

It is also known as the performance of business that is expressed using financial indicators such as profitability, for example, or represents the main basis for the various activities that organizations carry out (Akter et al., 2021).

Akter et al. (2021) underline the undeniable importance of innovation for improving products and processes as well as for creating strong competitiveness and superior financial performance. As a result, innovation-based organisations significantly improve all performance factors, including client relationships and financial results (Xie et al., 2022). Zhang et al. (2014) argues that the incentives and funding received by firms will advance R&D input and thus improve financial performance. In hi-tech companies, innovation is the most vital source of technical strength (Yang et al., 2020). It has the potential to boost productivity (Zhou et al., 2021) and technical advancement in the hi-tech industry (Hong et al., 2016), as well as support the industry's core competitiveness (Chen & Li, 2018). According to a growing body of evidence, innovation is critical for generating significant financial performance and long-term competitive advantages (Chen et al., 2018).

Performance indicators in China

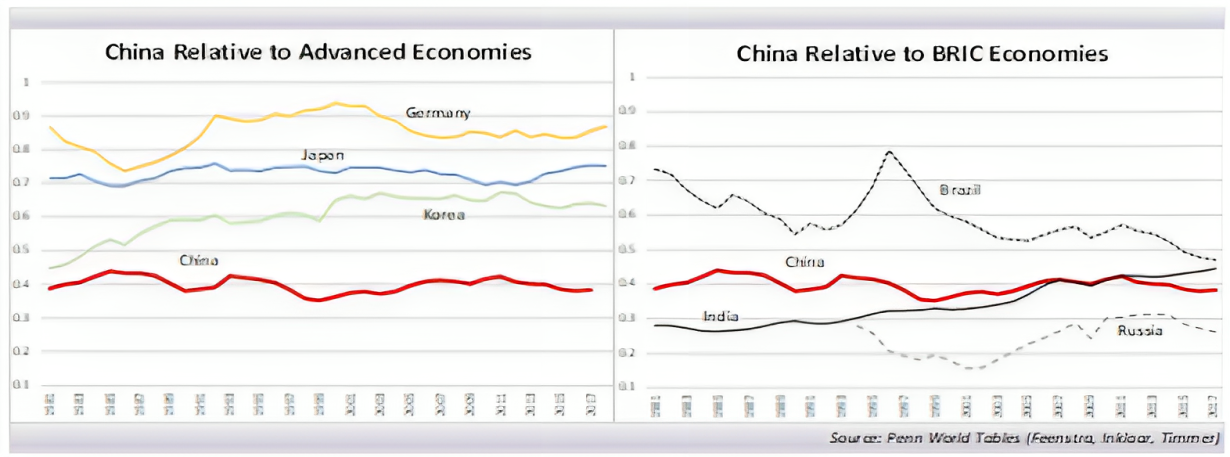

China's innovation growth rate showed a strong indicator in Global Innovation Index (GII) in the first decade of the twenty-first century (Table 2) and it is rapidly narrowing the gap with several high-income countries, including the US (Hammer & Yusuf, 2020). However, China's own performance rate and productivity improvements have been dropping even as its GII rankings have climbed, it is unclear if such innovation capability would result in improved financial performance of hi-tech firms (Cao et al., 2020). During the last decade, China's economic performance (Total factor productivity-TFP) has slowed, and performance of hi-tech firm has remained stagnant, and capital stock additions were beginning to offer declining returns, which began to stifle the country's economic growth. TFP is treated as the measure of the aggregate performance measure in China (Zhou et al., 2021).

China's total factor productivity (performance indicator in China) has remained low in comparison to high-tech economies such as the United States, Japan, and South Korea, as seen in Figure 1, which compares nations' TFP levels compared to the United States. In comparison to middle-income nations like Brazil and, more lately, India, TPF in China has stayed low (Kennedy, 2020). The instance of India presents an interesting contrast, as well as a suggestion that something unique is going on in China's R&D expenditure patterns. Despite the fact that China's R&D spending has been approximately ten times more than India's in recent years, China looks to be falling behind its Indian neighbour in terms of productivity (Performance) in recent years (Hammer & Yusuf, 2020).

There are several probable explanations for the disparity between China's rapid technological breakthroughs in high-tech firms and its slow performance levels.

First, a significant portion of Chinese patenting in high-tech enterprises has been financed by the Chinese government through direct funding and tax incentives, and it is generally known that patent data are utilised as performance measures in China. This shows that patent applications may reflect a focus on feeding the authorities' view of inventive activity rather than on innovative activity itself (Lin et al., 2022). To put it another way, given the significant investments being made in experimental R&D, which focuses on the most applied forms of innovation research, such as process improvements and consumer-based product innovation, it's quite possible that such advancements do not represent pathbreaking enough innovation to have a significant impact on performance levels (Hammer & Yusuf, 2020).

Second, it's probable that sensitivity to government directives has steered innovation toward incremental rather than radical innovations (Wan et al., 2022). Third, it's likely that China's financing arrangements encourage local enterprises to choose safer investments with assured returns, as opposed to the “high risk, high reward” strategy typified by venture capital firms in the United States and other advanced countries. The empirical findings of Yu et al. (2021) shows that various Chinese high-tech enterprises perform differently in terms of innovation, resulting in inefficient performance sources in high-tech firms. Because of these factors, future research must prove a causal link between innovation and financial performance (Lu & Chesbrough, 2022).

Hi-tech industry in China

Deployment of high-tech characteristics

To provide China high-tech a first-mover advantage, the focus is on strengthening forward-looking deployment and energetically developing a new generation of high-tech characteristics typified by smart technology and nanotechnology. Furthermore, to expedite the development of new high-tech sectors and to maintain the new development momentum (Kennedy, 2020).

Hi-Tech firms are motivated to develop new goods, services, and operational procedures in a competitive market, which affect sales growth, market share, customer satisfaction, market development, and net financial profits. Hi-Tech firms can use innovation efforts to achieve a competitive edge with higher returns (Howlett, 2018), maintain market share, and increase future firm profitability (Wang, 2019). In a high-tech market with shortening life cycles of product, severe pricing pressure, fast technical development, and market turmoil, the impact of innovation activities on businesses is intensified (Zhou, 2021). Given the severe market rivalry in the high-tech industries, companies who lag in product/process innovation will be soon forced out of business (Zhou et al., 2022).

Tax incentives in China

Design an effective tax program is essential for successful tax incentive interventions (Howlett, 2018). However, creating efficient tax incentive program is difficult. Policymakers must decide on the (maximum) value of the incentive, its length, who is eligible, and whether to target specific firms in the face of substantial information asymmetry over what works to promote R&D and innovation and maximise the use of public resources. (Akcigit et al., 2021). Tax incentives have been widely used by the Chinese government as a crucial tool in their innovation strategy mix. The most well-known tax incentive programme is the high and new technology businesses (HNTE) programme, which was implemented as part of a large revision to the Corporate Income Tax Law in 2008. Instead of the standard 25 percent rate, the HNTE offers qualified enterprises a 15 percent corporate income tax rate. According to the plan, innovation and the expansion of high-tech firms are encouraged (Dai & Chapman, 2022).

The Medium- and Long-Term science and technology (S&T) Strategic Blueprint 2006–2020 (MLP) was released by the State Council in 2006, laying out a comprehensive plan for China's S&T growth over the following 15 years (Tian et al., 2020). The MOF issued the Circular on Preferential Policies for Enterprise Income Taxes on Technical Innovation Enterprises on September 8, 2006, which provided larger tax benefits for R&D operations (Yang & Cao, 2019). According to the 2007 Corporate Income Tax Law, high and new technology businesses (HNTEs) across the country are eligible for a 15% preferential tax rate rather than the usual 25% rate (Yang et al., 2020). In terms of concept and implementation, the HNTE program is unique. Rather than credits, it decreases payable taxes based on R&D expenditures by lowering corporate income tax rates for qualified enterprises. Rather than being neutral or non-discriminatory, it is extremely selective on firm characteristics. The HNTE scheme combines tax incentives and subsidies into one package (Dai & Chapman, 2022).

The high and new technology enterprise (HNTE) incentive and the R&D spending super deduction, both of which were introduced in 2008, are two of the country's most important innovation tax incentives. The Chinese tax authority announced amended administrative measures on January 29, 2016, that simplify the process and qualifications for claiming R&D tax benefits, provide greater tax advantages for small and medium-sized businesses, and provide new tax benefits to foreign-owned subsidiaries in China. In summary, China has built a tax structure that is S-T orientated. Many of the R&D tax benefits that were previously solely accessible to HNTEs have recently become open to all businesses, regardless of ownership or location (Tian et al., 2020). After increasing from 150 percent to 175 percent for small enterprises in 2017, the super deduction has been applied to 175 percent of incurred R&D costs across the country from 2018. Many local tax authorities actively promote applications for R&D tax incentives, and the overall amount claimed continues to climb (Walter et al., 2022). Furthermore, China announced in May 2019 that the 'two-year exemption and three-year 50% reduction' corporate income tax (CIT) incentive, which has now been extended, can continue to assist integrated circuit design and software enterprises. The Science and Technological Innovation Board (STAR Board) of the Shanghai Stock Exchange, which governs the stock listing of technological businesses, was also established in early 2019. This provides another crucial entry point to the financial markets for China's high-tech and critical growth sectors (Zhou, 2021).

The HNTE program's unique features offer a fresh perspective on the efficiency of tax incentives for innovation (Dai & Chapman, 2022). The HNTE program is a targeted tax incentive program with certain conditions. Enterprises' R&D intensity must meet a criterion based on their size: 3% for big firms with sales >200 million RMB, 4% for medium-sized firms with 50 million > sales 200 million RMB, and 6% for small firms with sales less than 50 million RMB. At least 60% of R&D spending must be carried out in China. The applicant companies must possess the proprietary intellectual property rights to the essential technologies that underpin their principal goods and services, which must be in high-tech fields. At least 30% and 10% of staff must be college graduates and dedicated to R&D activities, respectively, according to the program. The company must be registered and have been in business in mainland China for at least a year. The HNTE is valid for three years, and businesses can renew at the end of the year in which it expires (Howlett, 2018).

According to the China Statistical Yearbook on Science and Technology, from 2012 to 2015, China's hi-tech enterprises received “52.75 billion RMB in tax reductions and exemptions, 58.55 billion RMB in 2013, 61.31 billion RMB in 2014, and 70.23 billion RMB in 2015, while R&D expenses plus tax deductions and exemptions totaled 29.85 billion RMB, 33.37 billion RMB, 37.98 billion RMB, and 44.93 billion RMB” (Wan et al., 2022). As a result, China has experienced a surge in R&D and innovation during the previous two decades. For instance, R&D spending has increased at a rate of more than 18% annually, from 89.6 billion RMB in 2000 to 2173.7 billion RMB in 2019. Domestic innovation patent applications increased dramatically from 51,000 in 2000 to 1401,000 in 20191, surpassing Japan and the US to become the world's largest patent filing country in 2011.

Government funding in China

Because hi-tech companies are typically more dynamic and have a stronger focus on R&D, they spend a significant portion of government support to retain talented researchers and pay R&D salaries. In fact, the majority of R&D expenditures in the private sector are tied to R&D wages (Zhang et al., 2014). Mostly, the main objective of the funding policy embedded in the law for supporting hi-tech firms is to meet the costs of prototyping development and mass production, thus, can contribute to increase the capacity of research, investments in R & D, and production in hi-tech firms (Ghazinoory & Hashemi, 2021). According to Walter et al. (2022), public funding also increases patenting probability and the share of innovative products. In some cases, the effect of funding on R&D investment was more than that of tax incentives, like be found by the study of (Ghazinoory & Hashemi, 2021).

Government intervention, like as R&D financing, intellectual property protection, and other development initiatives, can encourage the creation of new knowledge and enhance R&D investment (Walter et al., 2022). The findings of Mina et al. (2021) revealed the most critical aspects that affected innovation success at the selected enterprises in the evaluation process, with funding being the most essential component. According to the findings of Zhu et al. (2019), 43 percent of the SMEs in China that received funding did not produce value effectively owing to a lack of government funding, implying that the government should reduce the funding threshold and boost funding intensity. The argument was that, in order to improve the efficiency and inclusiveness of resource allocation, China's government may suitably cut the funding percentage for heavily supported firms and assist enterprises with lower financing.

Innovation effectiveness role towards hi-tech companies’ improvement

Innovation is significant to the success of firms (Yu et al., 2021). In general, innovation is defined as “a process of improving a firm’s capability and performance by generating and putting new ideas into action” (Xiao et al., 2023, p. 7). Meanwhile, innovation effectiveness refers to “the use of scientific and technological knowledge to create new technologies that form the basis of new products or processes within the firm” (Li, 2022, p. 1289). Innovation effectiveness also refers to “the strength or proficiency of a bundle of interrelated organizational routines for developing new products/processes” (Xie et al., 2022, p. 3). Scholars have viewed that innovation effectiveness can depart from current technological or market competencies because it focuses on processes and routines related to search, experimentation, discovery and implementation, which are more likely to create significant changes (Arshi et al., 2021). Innovation capabilities are described as large-scale radical changes (Farooq et al., 2021), by developing new knowledge or changing the existing skills (Yang et al., 2019). Innovation effectiveness stems from both cognition of new technological developments, and the ability to adapt and apply these new technologies to create opportunities that are consistent with customer needs (Xie et al., 2022). Thus, scholars have suggested that innovation effectiveness is related to superior performance (Xiao et al., 2023).

The RBV asserts that firms may attain superior performance through innovation effectiveness (Porter, 1990; Rothaermel, 2008; Teece et al., 1997). In fact, innovation effectiveness is made up of a variety of outputs, some of which are intangible and pertain to process innovation, while others are more tangible and pertain to product innovation (Crespi et al., 2016). For example, innovation effectiveness can be shown in a new product design, a new production process, a new marketing strategy, or a new training method (Porter, 1990). According to strategy specialists, continuous innovation is the key to achieving a long-term competitive advantage that sustains superior performance (Porter, 1990; Rothaermel, 2008; Teece et al., 1997). To do this, they must continually introduce fresh products or services, as well as new technologies and methods of operation (Porter, 1985), as well as improvements to their manufacturing and business processes, such as lean manufacturing and re-engineering, which can help them lower their cost structure (Rothaermel, 2008).

Given the importance of tax incentives and government funding in high-tech enterprises' innovation effectiveness. A review of relevant empirical studies reveals that focusing on implementing public interventions (i.e., tax incentives and government funding) alone cannot provide managers and practitioners with convincing scenarios for improving innovation (Nazari et al., 2021). As a result, it's critical to investigate how and under what circumstances tax incentives and government funding effect innovation (Ghazinoory & Hashemi, 2021; Nazari et al., 2021). R&D investment is a critical metric that contributes to making innovation effective and impacts firm performance (Arshi et al., 2021). Yang et al. (2019) argued that a firm's investment in R&D in line with the government interventions (i.e., tax incentives and government funding) can provide the broader picture of determinants of innovation effectiveness. For example, the findings of (Chen et al., 2018), showed that the eastern region of China plays a leading role in the high-tech innovation process when considering R&D investment and commercialization variables, support this argument, the reason for this is primarily a set of preferential public policies aimed at recruiting more trained workers and qualified businesses, resulting in hi-tech firms in these eastern regions becoming innovators.

A number of business-related formulas to compute financial performance

Example 1: Revenue Growth Rate

The revenue growth rate measures the percentage increase in a company's revenue over a specific period, indicating its ability to expand its top line.

This formula helps quantify the company's growth trajectory, a critical aspect of its financial performance.

Example 2: Operating Profit Margin

The operating profit margin assesses a company's profitability from its core operations, excluding interest and taxes.

Incorporating this formula provides insight into the efficiency and effectiveness of the company's operations in generating profits.

Example 3: Earnings Per Share (EPS)

Earnings per share measures the amount of profit attributable to each outstanding share of common stock.

Incorporating this formula helps illustrate the company's profitability from a per-share perspective, aiding in understanding its financial performance on a per-investor basis.

Recommendations

Reviewed literature and studies have been outlining the following considerations:

It has been concluded that there is an immediate connection between tax Incentives and effectiveness of innovation.

A tax incentive in this study is regarded as “an aspect of a country's tax code designed to incentivize or encourage a particular economic activity by reducing tax payments for a company in the said country” (Wikipedia, 2022). Since 2000, the government of China has provided income tax deductions for income paid by businesses in the research and development (R&D) of innovative products, technology, and processes (Lin et al., 2022). Persistence of R&D tax credits is seen to be a key factor in a company's ability to innovate new products and maintain market competitiveness (Labeaga et al., 2021).

In reviewed literature, it is concluded that the tax incentives scheme could contribute to ensure innovative technical solutions

China's tax incentives scheme works to ensure innovative technical solutions or advancements in the process of innovation (Dai & Chapman, 2022). There is a large deal of uncertainty in R&D processes, which exposes businesses to more R&D sunk risk. Preferential tax policy lowers the tax burden on hi-tech sectors, thus preferential tax policy by government reduces the risk associated from R&D process failure, and boosts R&D efficiency process (Wan et al., 2022).

Literature have stated that there is a significant relationship between government funding and innovation effectiveness for high-tech companies

Government funding in this study is regarded as “a public instrument used to correct market failure, increase private R&D effort, optimize resources allocation and facilitate innovation” (Ghazinoory & Hashemi, 2021, p. 19). Because government funding in China primarily targets finished goods on the hi-tech manufacturing side, the policies frequently have a direct impact on corporate product innovation (Sun et al., 2020). Government money may be available to assist high-tech companies in turning technology into lucrative goods and patents (Zhu et al., 2019). This is because increasing government assistance through funding, particularly for smaller businesses, would boost the production and manufacturing level of high-tech firms by introducing high-quality items, hence increasing product sales (Lü & Zhang, 2022). Greater R&D staff skills, increased patenting likelihood, and improved product innovation outputs in the form of number of new goods and sales of new products may all be attributed to government direct funding for hi-tech enterprises (Ghazinoory & Hashemi, 2021).

Literature has mentioned that there is a significant positive relationship between innovation effectiveness and financial performance of Chinese high-tech companies

In this study (Li, 2022, p. 1289), innovation effectiveness is defined as using scientific and technological knowledge to develop new technologies for creating new products or processes within a company. Innovation effectiveness according to this definition is the efficiency with which new goods are developed, resulting in increased firm sales and new product revenue (Yu et al., 2021). According to Zhang and Lee (2021), financial performance may be accomplished by continuing to introduce innovative products while concentrating resources selectively. Innovation effectiveness, which includes the invention of new goods and services, the use of new opportunities within a new market, and the development of new distribution channels, is positively related to financial performance in hi-tech enterprises (Wan et al., 2022). In the same vein, profits earned from enhancing innovation effectiveness are also the ultimate goal of innovation efforts (Yu et al., 2021). According to Walter et al. (2022), innovation effectiveness, which includes the availability of resources, collaborative structures, and problem-solving procedures, may lower the cost of innovation and increase revenues for businesses. Companies that use innovation to efficiently decrease waste and optimize R&D operations have a better chance of achieving improved financial performance (Xie et al., 2022). Firms that embrace low to medium levels of innovation effectiveness, on the other hand, may see a drop in profitability and poor financial performance (Chen & Li, 2018). A number of these recommendations are presented in Figure 2

Implications

There are a number of key implications utilized by this review paper. They are described briefly as follows:

First, policymakers can use the insights gained from our review to develop policies that encourage high-tech industries development of in China and promote financial performance in these companies.

Second, investors can use the information provided in this review to make informed decisions about investing in Chinese high-tech companies, taking into account the factors that contribute to financial performance.

Finally, managers of Chinese high-tech companies can use the findings from our review to develop strategies that enhance financial performance and improve overall organizational performance.

Discussion

Several major contributors to the success of Chinese high-tech firms are explored.

The success of China's high-tech sector can be directly attributed to the country's innovative spirit. These businesses put a lot of money into R&D to come up with innovative goods and services. They stay ahead of the competition by constantly testing the limits of possibility. This aspect includes not just technological advancement but also the capacity for successful product commercialization. Faster time to market for their research results in greater financial success for many high-tech enterprises.

It is crucial to comprehend the dynamics of market demand if one is to successfully navigate the competitive landscape. Chinese high-tech firms are better able to meet market demands if they keep an eye on shifting customer preferences and trends. Here, flexibility in adapting to market changes and adjusting product offerings is key. Furthermore, preserving a competitive edge is essential. Companies in the high-tech sector that create and maintain compelling value propositions—whether through innovative products, superior customer service, or industry-leading prices—tend to do well financially.

Financial success can be attributed in large part to strategic decision-making and well-positioned market entry. Financial results for high-tech businesses can be improved by strategic planning of growth, focus on niche markets, and product differentiation. Choosing the correct markets to penetrate, developing products that meet those needs, and establishing a distinct brand identity all fall under this category. Companies who are able to adapt their strategy to the ever-evolving needs of their target market are more likely to see financial success.

Conclusion

The importance of financial success in Chinese high-tech enterprises has been highlighted in this review. We conducted a comprehensive literature study and found that various themes and aspects, such as innovation, tax incentives, government support, and the effectiveness of innovation, all contribute to financial performance. Our results imply that financial performance is crucial to the development and expansion of Chinese high-tech firms, and that it is impacted by a number of different organisational elements. The authorities, investors, and management of Chinese high-tech enterprises can all benefit greatly from this assessment. First, our analysis can help policymakers in China foster the growth of the country's high-tech industries while also improving the financial performance of the enterprises operating in those sectors. Second, by considering the aspects that affect financial performance, this analysis will help investors decide whether or not to put money into Chinese high-tech enterprises. Finally, the conclusions from our analysis can be used by managers at Chinese high-tech firms to improve financial performance and productivity. To fully grasp the complex processes at play, more study is needed, and this review paper makes a significant contribution to the literature on Chinese high-tech enterprises and financial success.

References

Akcigit, U., Hanley, D., & Stantcheva, S. (2021). Optimal taxation and R&D policies. https://doughanley.com/files/papers/ahs_rd_policies.pdf

Akter, S., Wamba, S. F., Mariani, M., & Hani, U. (2021). How to Build an AI Climate-Driven Service Analytics Capability for Innovation and Performance in Industrial Markets? Industrial Marketing Management, 97, 258-273.

Arshi, T. A., Rao, V., Viswanath, S., & Begum, V. (2021). Measuring innovation effectiveness: a SEM-based cross-lagged analysis. International Journal of Innovation Science, 13(4), 437-455.

Bronzini, R., & Piselli, P. (2016). The impact of R&D subsidies on firm innovation. Research Policy, 45(2), 442-457.

Cao, C., Baas, J., Wagner, C. S., & Jonkers, K. (2020). Returning scientists and the emergence of China's science system. Science and Public Policy, 47(2), 172-183.

Chen, M.-C., & Li, H.-Y. (2018). The effects and economic consequences of cutting R&D tax incentives. China Journal of Accounting Research, 11(4), 367-384.

Chen, X., Liu, Z., & Zhu, Q. (2018). Performance evaluation of China's high-tech innovation process: Analysis based on the innovation value chain. Technovation, 74-75, 42-53. https://doi.org/10.1016/j.technovation.2018.02.009

Crespi, G., Giuliodori, D., Giuliodori, R., & Rodriguez, A. (2016). The effectiveness of tax incentives for R&D+i in developing countries: The case of Argentina. Research Policy, 45(10), 2023-2035.

Dai, X., & Chapman, G. (2022). R&D tax incentives and innovation: Examining the role of programme design in China. Technovation, 113, 102419.

Dekoulou, P., & Trivellas, P. (2017). Organizational structure, innovation performance and customer relationship value in the Greek advertising and media industry. Journal of Business & Industrial Marketing, 32(3), 385-397.

Duan, Y., Wang, W., & Zhou, W. (2020). The multiple mediation effect of absorptive capacity on the organizational slack and innovation performance of high-tech manufacturing firms: Evidence from Chinese firms. International Journal of Production Economics, 229, 107754. https://doi.org/10.1016/j.ijpe.2020.107754

Farooq, R., Vij, S., & Kaur, J. (2021). Innovation orientation and its relationship with business performance: moderating role of firm size. Measuring Business Excellence, 25(3), 328-345.

Ghazinoory, S., & Hashemi, Z. (2021). Do tax incentives and direct funding enhance innovation input and output in high-tech firms? The Journal of High Technology Management Research, 32(1), 100394.

Goede, M. (2018). The Corporation: A circular process of value creation. Archives of Business Research, 6(5).

Hammer, A. B., & Yusuf, S. (2020). Is China In A High-Tech, Low-Productivity Trap? https://www.usitc.gov/publications/332/working_papers2020-07_chinainnovationwphammeryusuf.pdf

Hong, J., Feng, B., Wu, Y., & Wang, L. (2016). Do government grants promote innovation efficiency in China's high-tech industries? Technovation, 57-58, 4-13.

Howlett, M. (2018). The criteria for effective policy design: character and context in policy instrument choice. Journal of Asian Public Policy, 11(3), 245-266.

Ichsan, R. N., Suparmin, S., Yusuf, M., Ismal, R., & Sitompul, S. (2021). Determinant of Sharia Bank's Financial Performance during the Covid-19 Pandemic. Budapest International Research and Critics Institute (BIRCI-Journal): Humanities and Social Sciences, 4(1), 298-309. https://doi.org/10.33258/birci.v4i1.1594

Kennedy, S. (2020). China’s Uneven High-Tech Drive: Implications for the United States” in China’s Uneven High- Tech Drive: Implications for the United States. Center for Strategic and International Studies, Febuary, 2020.

Kim, M., Kim, J.-e., Sawng, Y.-w., & Lim, K.-s. (2018). Impacts of innovation type SME's R&D capability on patent and new product development. Asia Pacific Journal of Innovation and Entrepreneurship, 12(1), 45-61.

Labeaga, J. M., Martínez-Ros, E., Sanchis, A., & Sanchis, J. A. (2021). Does persistence in using R&D tax credits help to achieve product innovations? Technological Forecasting and Social Change, 173, 121065.

Li, H. (2022). Effects of innovation modes and network partners on innovation performance of young firms. European Journal of Innovation Management, 25(5), 1288-1308.

Lin, G., Takahashi, Y., Nomura, H., & Yabe, M. (2022). Policy incentives, ownership effects, and firm productivity—Evidence from China's Agricultural Leading Firms Program. Economic Analysis and Policy, 73, 845-859.

Lissillour, R., Rodríguez-Escobar, J. A., & Wang, Y. (2020). A strategic alignment to leverage the role of corporate universities: A longitudinal case study of Chinese high-tech company ZTE. Gestion 2000, 37(3), 39-65.

Liu, L., & Dong, C. (2022). The more funds the better? External funds, R&D investment and firm innovation: critical role of firm leaders' international experience. European Journal of Innovation Management, ahead-of-print(ahead-of-print).

Liu, s.-m., Hu, r., & Kang, t.-w. (2021). The effects of absorptive capability and innovative culture on innovation performance: Evidence from Chinese high-tech firms. The Journal of Asian Finance, Economics and Business, 8(3), 1153-1162.

Lu, Q., & Chesbrough, H. (2022). Measuring open innovation practices through topic modelling: Revisiting their impact on firm financial performance. Technovation, 114, 102434.

Lü, Z., & Zhang, M. (2022). Evaluation on financial support efficiency of new generation high-tech industry in China. Procedia Computer Science, 199, 254-261.

Mina, A., Minin, A. D., Martelli, I., Testa, G., & Santoleri, P. (2021). Public funding of innovation: Exploring applications and allocations of the European SME Instrument. Research Policy, 50(1), 104131. https://doi.org/10.1016/j.respol.2020.104131

Nazari, F., Rahimipour Anaraki, A., Taghavi, S. S., & Ghasemi, B. (2021). The relationship among knowledge-based dynamic process capabilities, innovation processes and innovation performance: an empirical study of knowledge-based high-tech companies in Iran. Kybernetes, 50(5), 1379-1404.

Oltra, M. J., Flor, M. L., & Alfaro, J. A. (2018). Open innovation and firm performance: the role of organizational mechanisms. Business Process Management Journal, 24(3), 814-836.

Porter, M. E. (1985). Competitive Advantage: Creating and Sustaining Superior Performance. Free Press.

Porter, M. E. (1990). The Competitive Advantage of Nations. (cover story). Harvard Business Review, 68(2), 73-93. http://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=9005210820&site=ehost-live

Rababah, A., Al‐Haddad, L., Sial, M. S., Chunmei, Z., & Cherian, J. (2020). Analyzing the effects ofCOVID-19 pandemic on the financial performance of Chinese listed companies. Journal of Public Affairs. https://doi.org/10.1002/pa.2440

Rothaermel, F. T. (2008). Competitive advantage in technology intensive industries. Advances in the Study of Entrepreneurship, Innovation and Economic Growth, 18, 201-225.

Song, M., Wang, S., & Zhang, H. (2020). Could environmental regulation and R&D tax incentives affect green product innovation? Journal of Cleaner Production, 258, 120849.

Sun, C., Zhan, Y., & Du, G. (2020). Can value-added tax incentives of new energy industry increase firm's profitability? Evidence from financial data of China's listed companies. Energy Economics, 86, 104654.

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509-533. https://doi.org/10.1002/(sici)1097-0266(199708)18:7<509::aid-smj882>3.0.co;2-z

Tian, B., Yu, B., Chen, S., & Ye, J. (2020). Tax incentive, R&D investment and firm innovation: Evidence from China. Journal of Asian Economics, 71, 101245.

Viviani, J.-L., & Maurel, C. (2019). Performance of impact investing: A value creation approach. Research in International Business and Finance, 47, 31-39.

Walter, C. E., Au-Yong-Oliveira, M., Miranda Veloso, C., & Polónia, D. F. (2022). R&D tax incentives and innovation: unveiling the mechanisms behind innovation capacity. Journal of Advances in Management Research, 19(3), 367-388.

Wan, Q., Chen, J., Yao, Z., & Yuan, L. (2022). Preferential tax policy and R&D personnel flow for technological innovation efficiency of China's high-tech industry in an emerging economy. Technological Forecasting and Social Change, 174, 121228.

Wang, D. S. (2019). Association between technological innovation and firm performance in small and medium-sized enterprises: The moderating effect of environmental factors. International Journal of Innovation Science, 11(2), 227-240.

Wang, T., Yu, X., & Cui, N. (2020). The substitute effect of internal R&D and external knowledge acquisition in emerging markets: An attention-based investigation. European Journal of Marketing, 54(5), 1117-1146.

Weinland, D., Yu, S., & Liu, X. (2019). Slowing Chinese growth delivers blow to global economy. https://www.ft.com/content/396e67be-f0b5-11e9-ad1e -4367d8281195

Wikipedia. (2022). Tax incentive. https://en.wikipedia.org/wiki/Tax_incentive

Xiang, D., Chen, J., Tripe, D., & Zhang, N. (2019). Family firms, sustainable innovation and financing cost: Evidence from Chinese hi-tech small and medium-sized enterprises. Technological Forecasting and Social Change, 144, 499-511.

Xiao, T., Yang, Z., & Jiang, Y. (2023). The different effects of venture capital and the trade-off between product innovation effectiveness and efficiency. European Journal of Innovation Management.

Xie, X., Hoang, T. T., & Zhu, Q. (2022). Green process innovation and financial performance: The role of green social capital and customers' tacit green needs. Journal of Innovation & Knowledge, 7(1), 100165.

Xu, J., & Liu, F. (2021). Nexus between intellectual capital and financial performance: An investigation of Chinese manufacturing industry. Journal of Business Economics and Management, 22(1), 217-235.

Yang, B., & Cao, N. (2019). R&D tax incentives: Continuous encouragement and enhanced supervision. https://www.internationaltaxreview.com/article/b1j8xg2jkh68rz/rampd-tax-incentives-continuous-encouragement-and-enhanced-supervision

Yang, L., Xu, C., & Wan, G. (2019). Exploring the impact of TMTs' overseas experiences on innovation performance of Chinese enterprises: The mediating effects of R&D strategic decision-making. Chinese Management Studies, 13(4), 1044-1085.

Yang, Z., Shao, S., Li, C., & Yang, L. (2020). Alleviating the misallocation of R&D inputs in China's manufacturing sector: From the perspectives of factor-biased technological innovation and substitution elasticity. Technological Forecasting and Social Change, 151, 119878.

Yu, A., Shi, Y., You, J., & Zhu, J. (2021). Innovation performance evaluation for high-tech companies using a dynamic network data envelopment analysis approach. European Journal of Operational Research, 292(1), 199-212.

Zhang, G., & Lee, Y. (2021). Determinants of Financial Performance in China's Intelligent Manufacturing Industry: Innovation and Liquidity. International Journal of Financial Studies, 9(1), 15.

Zhang, H., Li, L., Zhou, D., & Zhou, P. (2014). Political connections, government subsidies and firm financial performance: Evidence from renewable energy manufacturing in China. Renewable Energy, 63, 330-336.

Zhang, S., Wang, Z., Zhao, X., & Yang, J. (2022). Impacts of R&D investment on absorptive capacity and firm innovativeness: contingent roles of dysfunctional competition. International Journal of Operations & Production Management, 42(10), 1630-1652.

Zhou, Q. (2021). What Are the Tax Incentives in China to Encourage Technology Innovation? China Briefing. https://www.china-briefing.com/news/tax-incentives-china-to-encourage-technology-innovation/

Zhou, Q., Li, T., & Gong, L. (2022). The effect of tax incentives on energy intensity: Evidence from China's VAT reform. Energy Economics, 108, 105887.

Zhou, X., Cai, Z., Tan, K. H., Zhang, L., Du, J., & Song, M. (2021). Technological innovation and structural change for economic development in China as an emerging market. Technological Forecasting and Social Change, 167, 120671. https://doi.org/10.1016/j.techfore.2021.120671

Zhu, P., Xu, W., & Lundin, N. (2006). The impact of government's fundings and tax incentives on industrial R&D investments—Empirical evidences from industrial sectors in Shanghai. China Economic Review, 17(1), 51-69.

Zhu, W., Tian, Y., Hu, X., Ku, Q., & Dai, X. (2019). Research on relationship between government innovation funding and firms value creation using clustering-rough sets. Kybernetes, 49(2), 578-600.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Tian, L., Hamid, N. A., & Ismail, I. S. (2023). A Review on Chinese High-Tech Companies: Antecedents or Determinants of Financial Performance. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 1074-1095). European Publisher. https://doi.org/10.15405/epsbs.2023.11.88