Abstract

This study uses information technology as a moderating variable to investigate how professionalism and independence affect audit quality in a public sector auditing context. This is a quantitative study utilising a survey in the form of questionnaires. The respondents are the auditors at the Indonesian Supreme Audit Institution (BPK). The data analysis method used in this study is descriptive analysis and hypothesis testing using Structural Equation Modelling (SEM). The findings of this study suggest that independence and professionalism have a beneficial impact on audit quality. Additionally, this study discovered that information technology, when used as a moderating variable, can enhance the importance of the independent auditor's good impact on audit quality but not the independent auditor's favourable impact on professionalism. This study contributed to the field of public sector auditing by helping auditors create information technology-based audit methodologies and keep improving them in order to generate audits that are more accurate and up-to-date.

Keywords: Audit Quality, Independence, Information Technology, Professionalism, Public Sector

Introduction

Audit quality is affected highly on personal qualities of auditors including their independence and professionalism (Dwimilten & Riduwan, 2015; Knechel et al., 2013; Mardijuwono & Subianto, 2018). Independence is the mindset of an auditor who is unaffected by outside influences (BPK Law, 2006; Mardijuwono & Subianto, 2018). Professional auditors, according to Baotham (2007), speak of professional aptitudes and attitudes. Professional scepticism holds that the auditor should exercise caution right away since a potential customer may try to distort the financial statements by tricking the auditor (Tuanakotta, 2015). A number of situations that have gained international notoriety, such the Enron and Satyam scandals, demonstrate that the lack of auditors independence and professionalism harmed the interests of stakeholders (Amyar et al., 2019).

In the Indonesian context, the Indonesian Supreme Audit Institution (BPK) has been established as a free, independent, and professional auditing institution to help create a government that is clean and free from corruption, collusion, and nepotism (BPK Law, 2006). People have high expectations for the quality of audits conducted by BPK. However, the rise of some of the biggest financial statement scandals such as Jiwasraya and ASABRI has raised questions regarding the BPK's quality of audits (Muthmainah, 2023). Even though the BPK found irregularities in Jiwasraya and ASABRI, the public questioned why this scandal could only be disclosed after the accumulation of huge state losses of US$ 2.64 billion (Solichin, 2021). The emergence of this scandal raises questions related to the professionalism and independence of the BPK auditors (Muthmainah, 2023).

There is a growing question regarding whether, by using a budget from the government and its status as a government employee, the BPK auditor can be independent (Amyar et al., 2019). Furthermore, the number of problematic financial reports and reports of corruption in a ministry even though they have received WTP has made the public question the professionalism of BPK auditors (Budiman, 2021).

In addition, digital information technology has advanced at an exponential rate over the past 20 years (Nagy et al., 2013). Our daily lives have changed greatly as a result of this change's rapidity (Yan et al., 2021). The Covid-19 pandemic, which compelled people to quickly acclimatise to digital technology, expedited this transition. One such instance is the widespread usage of virtual meetings, which we could not have predicted even two years ago. The majority of corporate operations were conducted virtually throughout the pandemic using platforms for remote video technology (Yi & Moon, 2021). The supervision, inspection, and audit of government financial institutions must evolve in order to accommodate this transition. The use of big data analytics to support audit efforts is one of the important changes (Dagilienė & Klovienė, 2019; Joshi & Marthandan, 2019). Auditors can profile auditees using big data analytics, learn more about the business networks of businesses, and identify anomalies and red flags using trend analysis. Big data analytics can assist auditors in minimising judgement errors during audits (Ahmad, 2019). Big data analytics can be utilised to create a variety of analytical models that are then used to support audit findings, conclusions, and opinions (Newman et al., 2021). Additionally, it is employed to gather audit evidence, document the continuing audit process, which includes the quality control process, and track the online procedure for following up on audit results recommendations (Dagilienė & Klovienė, 2019). Use of digital information technology is one of the most crucial components of successful audits. In situations where there are physical meeting limits during pandemic, digital information technology is particularly beneficial to auditors. Utilization of information technology will benefit the auditor, obtaining and testing audit evidence and implementing audit procedures will be more effective (Dewi & Badera, 2015).

The aim of this research is to explore how auditors professionalism, independence, and information technology affect audit quality in the context of public sector auditing in Indonesia. This research fills the research gap in the field of public sector auditing by using information technology moderation variables in the relationship between auditor independence, professionalism, and audit quality. There has been research linking auditor independence and professionalism with audit quality (In & Asyik, 2019; Laksita & Sukirno, 2019; Mardijuwono & Subianto, 2018). However, the novelty of this research is that there is an information technology moderating variable, and it is conducted in the context of public sector audits in Indonesia. This research provides a practical contribution to the BPK and its examiners in developing information technology-based audit techniques and continuing to refine them to produce audits that are of higher quality and in line with the times.

Literature Review, Theories, Hypothesis Development, Research Framework, And Measurement

Literature Review, Theories and Hyphothesis Development

According to Jensen and Meckling (1976) agency theory, there will be issues with agencies as a result of the separation of corporate owners (principals) and managers (agents). Information asymmetry between owners and managers is a component of the agency dilemma (Destriana, 2015). Owners/shareholders/stakeholders (principals) and managers/management (agents) have various perspectives and pursuits. Issues between principals and agents are frequently brought on by these disparities. This information disparity in financial reporting ought to be reduced by auditing. This is due to the fact that an audit allows for the disclosure of information in a more thorough manner through an audit report, information that was previously undisclosed or unknown to the owner (principal).

Aspects of an auditor's behaviour have a big impact on how motivated and committed the auditor is to doing his job well. According to Vroom (1964) expectancy theory, a person will be more motivated to execute a particular action if they believe that doing so will help them realise their hopes and objectives. According to Indrayanti et al. (2017), motivation is a catalyst for a person's behaviour to achieve goals. A person's behaviour will be influenced by a variety of internal and external circumstances. As the public's expectations for the quality of BPK audit reports rise, the BPK must enhance both its performance and reputation through the findings of the audits it conducts. BPK auditors are also thought to have expectations of receiving social recognition and gratitude from Indonesian citizens for the findings of their audits. This will have an impact on the BPK auditors' drive to conduct high-quality audits, including by preserving and enhancing their professionalism and independence.

Achieving high-quality audit results will aid decision-making by stakeholders. Based on the auditor's capacity to identify abnormalities or mistakes in financial statements and expose them to users of financial statements, audit quality is evaluated. The ability to find inconsistencies and imprecision depends on the auditor's skill and bravery in revealing flaws in the financial accounts (Idawati, 2018). Numerous elements, including internal and external auditors, affect how well an audit is produced by the auditor. In this study, the auditors' professionalism, independence, and use of information technology are all elements that are thought to affect the quality of the audit.

Auditor professionalism, according to Baotham (2007), refers to expert abilities and conduct. In order to maintain the public's trust, auditors must possess a variety of abilities, including education, experience, adaptability, technical proficiency, and a thorough understanding of and command over technology (Idawati, 2018). Professionalism has a favourable and considerable impact on audit quality (Mardijuwono & Subianto, 2018). Auditors that are dedicated to their work can raise the standard of their audits and make their clients happy. Additionally, Mardijuwono and Subianto (2018) discovered that scepticism can raise the calibre of audits. The auditor will be increasingly demanding in gathering audit evidence while examining financial statements as the level of scepticism rises. The development of better and more accurate opinions will be a result of auditors' improving competence. The auditor will be helped in developing audit processes that will raise the calibre of the audit results produced by using the right audit methods (Junaid et al., 2021).

H1: Auditor's Professionalism has a significant positive effect on audit quality

Expectation theory highlights the significance of having faith in one's ability to achieve objectives in order to increase motivation and dedication to every action. This hypothesis is thought to be pertinent to the auditor's independent mindset. The desire to be recognised for their efforts, to be regarded as honourable and responsible individuals, and to contribute to the achievement of good governance would further encourage the auditor to uphold his conduct, especially his independence. The auditor will refrain from actions that would restrict his right to free speech, such as turning down facilities and bribes from organisations.

According to Kasidi (2007), an auditor's independence is their ability to examine management's financial reports without being swayed by the interests of any one party. The auditor must be truthful not only with management but also with other parties who utilise financial reports, such as creditors, owners, and potential owners, when conducting an audit. Users of financial statements must have faith in the independence of auditors in order to trust their work (In & Asyik, 2019). Auditors must uphold this independence in whatever they do.

H2: Auditor's Independence has a significant positive effect on audit quality

The agency theory that explains the existence of information asymmetry between owners and managers is seen as relevant to the use of information technology. The use of information technology is expected to minimize the information asymmetry. At least the delivery of information owned by the manager becomes faster, easier and realtime through the information system to the owner. Thus the use of information technology is expected to assist owners in digging up the information they need. This can also be applied in the audit process, because with the use of information technology, auditors can obtain data and audit evidence more easily and quickly, so that audits are more efficient and effective. Furthermore, the results of the audit can be used to minimize information asymmetry between owners and managers, as well as assist in the decision-making process.

According to the Big Indonesian Dictionary (KBBI, 2023), information technology is the use of technology such as computers, electronics and telecommunications to process and distribute information in digital form. Through information technology, it is hoped that the process of data acquisition, data processing, distribution of data processing results for further use by various parties can be faster, easier and transparent.

Research by Valsafah et al. (2021) shows that information technology has a significant role in supporting audit quality and processes. Information technology will encourage the development of new methods for the audit process (Dagilienė & Klovienė, 2019; Joshi & Marthandan, 2019). The rapid development of technology has resulted in the implementation of the audit process carried out using a computerized system (Newman et al., 2021). Through the use of information technology, it is hoped that the auditor will become more professional in carrying out his audit because the audit process is computerized and accountable, and more independent because he is free from a very high dependence on data acquisition and audit evidence from the examined entity.

H3: Information Technology strengthens the positive influence of professionalism on audit quality

H4: Information Technology strengthens the positive influence of independence on audit quality

Hypothesis Development and Measurement

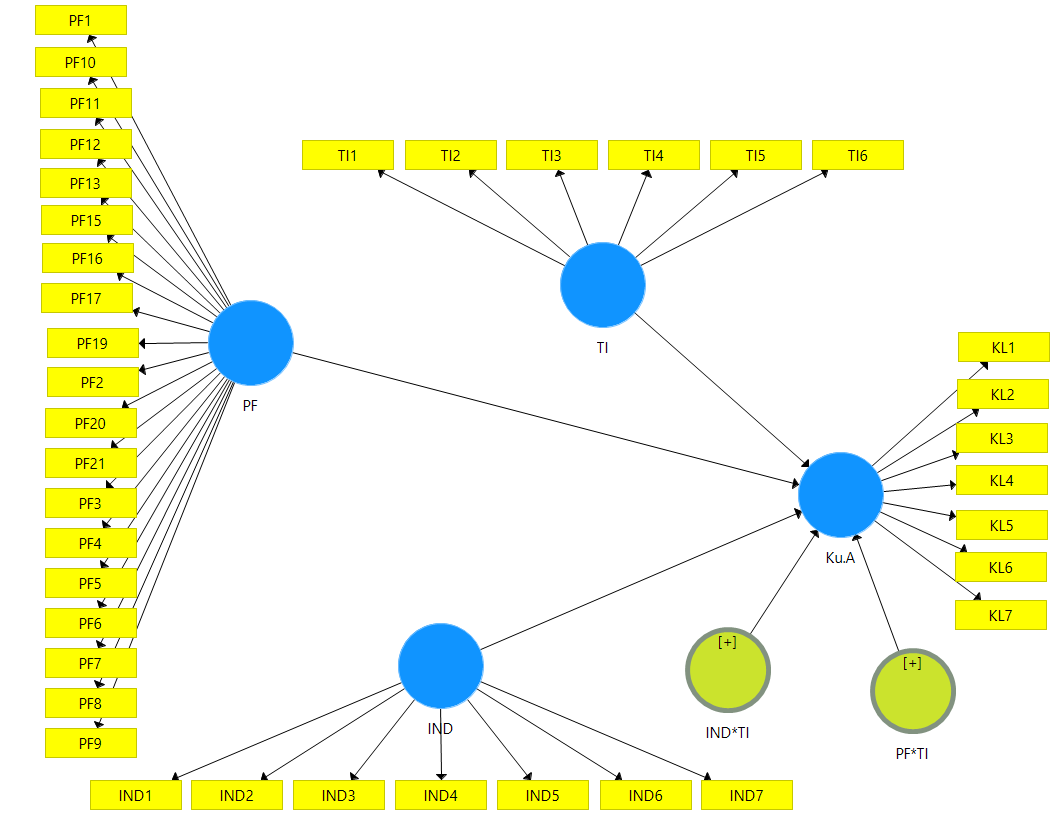

The hypothesis developed in this study was obtained from agency and expectancy theory as well as previous literature. The research framework for this research is described in Figure 1. The measurement of variables was developed based on previous studies and developments in the latest audit practises. The professionalism, independence, audit quality, and information technology variables were measured using four indicators obtained from previous studies (Baotham, 2007; Idawati, 2018; Idris, 2011; Mardijuwono & Subianto, 2018; Piserah et al., 2022; Sihombing & Triyanto, 2018; Wijayanto, 2017; Valsafah et al., 2021). Auditors who have high awareness regarding dedication to the profession, professional scepticism, independence, and good competence will be able to carry out their duties properly and produce good-quality audits as well. Good audit quality will result from the implementation of audit assignments while maintaining the principle of independence free from bias. Based on the measurement of previous research, the authors examine whether an understanding of the benefits of information technology can strengthen or not the relationship between professionalism and audit quality and between independence and audit quality.

PF : Professionalism

IND: Independence

TI: Information Technology

Ku.A/KL: Audit Quality

IND*TI: Independence moderated by Information Technology

PF*TI: Professionalism moderated by Information Technology

Research Method

The subject and locus of this research is one of the audit functions at BPK, which specifically conducts social security program audits for labor. The reason why this specialized audit function was chosen was because this function is responsible for one of the government programs with a large budget and has become important after the COVID-19 pandemic. Therefore, the public really hopes that the BPK auditors will really maintain the quality of their audits in examining this program, which is in line with agency and expectancy theory.

The total number of auditors in this audit function is 40 people. The sample size calculation in this study uses the Slovin sample formula as follows:

N is the number of population, n is the number of minimum samples, and e is the error margin. Based on the Slovin formula, with a population of 40 and a margin of error of 0.5 (the level of confidence is 95%), the minimum number of samples that must be obtained is 36.36 (rounded to 36).

The questionnaires were distributed to 40 respondents via the WhatsApp group using the Google form at the link https://s.id/1HNJY. Of the 40 respondents who received the questionnaire filling link, 38 questionnaire entries (more than the minimum of 36) were sent back by the respondents, and all were declared valid (95%).

The data analysis method used in this study is descriptive analysis and hypothesis testing using Structural Equation Modeling (SEM). Structural Equation Modeling (SEM) is a multivariate analysis used for complex analyses of relationships between variables (Hair et al., 2014). Validity and reliability tests were used, and a Likert scale ranging from 1 to 6 was used to measure indicators. A Likert scale is a scale or method that measures attitudes by giving statements of agreement or disagreement about a particular issue, object, or event.

This research uses professional and independence variables as independent variables, information technology as moderating variables, and audit quality as dependent variables. The independent variables used in this study are professionalism and independence.

Audit quality, the dependent variable, is defined as the auditor's capacity to identify abnormalities or mistakes in their reports, resulting in aiding decision-making by stakeholders (Dwimilten & Riduwan, 2015; Idawati, 2018; Knechel et al., 2013; Mardijuwono & Subianto, 2018). The quality of audit reports is the indicator of audit quality, following and modifying the questionnaire statement items created by previous studies, particularly Sihombing and Triyanto (2018).

Independence is the mindset of an auditor who is unaffected by outside influences (BPK Law, 2006; Mardijuwono & Subianto, 2018). This variable indicator is the independence of the assignment compiled and developed by adopting and modifying Wijayanto (2017) questionnaire. Auditor professionalism refers to expert abilities and conduct (Baotham, 2007). Professionalism variable indicators used in this study adopted and modified the indicators and questionnaires of Idris (2011), Wijayanto (2017), and Piserah et al. (2022). The moderating variable used in this study is information technology, with an indicator of understanding the benefits of information technology compiled and developed by the author from previous studies (Piserah et al., 2022).

The questionnaire is organized into four main sections: professionalism, which consists of 21 statements; independence, which consists of seven statements; information technology, which consists of six statements; and audit quality, which consists of seven statements.

Result And Discussion

Result

Respondents in this study were BPK auditors specializing in the social security program for labor consisting of 20 people with the position of First Auditors, 14 people with the position of Junior Auditors, and 4 people with the position of Senior Auditors.

Characteristics of respondents based on gender consisted of 25 male respondents and 13 female respondents. Characteristics of respondents based on age divided into respondents aged 20-30 years (2 people), 30-40 years (21 people), 40-50 years (12 people), and over 50 years (3 people). Respondents' characteristics based on length of service at BPK can be seen in Table 1 as follows:

These conditions indicate that respondents are dominated by team member positions, men, respondents with very productive ages (30-40 years) and 10-15 years of service at BPK. The characteristics of these respondents are very relevant to the variables to be analyzed, because these respondents are examiners who can have a career in auditing at BPK for a long time to come.

The entire questionnaire answers received are valid and usable, and are then analyzed using the Structural Equation Model (SEM) method using the SmartPLS application. The results of the validity test of the questionnaire items are presented in Table 2, and several questionnaire items with a loading factor below 0.6 are considered invalid and not used.

PF : Professionalism

IND: Independence

TI: Information Technology

Ku.A/KL: Audit Quality

IND*TI: Independence moderated by Information Technology

PF*TI: Professionalism moderated by Information Technology

Furthermore, the reliability test results are presented in Table 3, and show Cronchbach's Alpha and Composite Reliability values above 0.7 or AVE values above 0.5 (Hair et al., 2014) for all latent variables used. Thus the latent variable is declared reliable.

The results of the descriptive statistical tests for the professionalism variable are presented in Table 4 below.

Based on Table 4, the minimum score for the professionalism indicator is 2 for questionnaire item number 1, which indicates that there are still respondents who consider it not too important to make optimal use of their knowledge, abilities and experience to carry out examinations. The highest score on the professionalism questionnaire item is 6. The table above shows that the standard deviation is below 1 and the average value is known so that the majority of respondents fill out the questionnaire items for the professionalism variable at scores 5 and 6.

Furthermore, the results of the descriptive statistical test on the independence variable are presented in Table 5 as follows.

Based on Table 5, the minimum value of the independence indicator is 1 for questionnaire item number 6, which indicates that there are still respondents who think there is no freedom for the examiner/auditor to express opinions and provide considerations on the results of the examination. The highest score on the independence questionnaire item is 6. Based on the table above it is known that the standard deviation is below 1 and the average value indicates that the majority of respondents filled out the questionnaire items for the independence variable at scores 5 and 6.

The results of descriptive statistical tests on information technology variables are presented in Table 6 as follows.

Based on Table 6, the minimum value for information technology indicators is 3 for questionnaire item number 6, which indicates that there are still respondents who do not agree to invite and encourage colleagues in the team to use applications and information systems in carrying out examinations. The highest score on the independence questionnaire item is 6. Based on the table above it is known that the standard deviation is below 1 and the average value indicates that the majority of respondents filled out the questionnaire items for the independence variable at scores 5 and 6.

Furthermore, a summary of the results of the hypothesis testing is presented in Table 7 below.

The table above shows the original sample values for all variables are positive. Thus all variables affect audit quality positively. The independence and professionalism variables have a p-value less than 0.1 which indicates that the two independent variables have a positive effect on audit quality. Furthermore, the relationship between the independent variable is moderated by information technology on audit quality, which has a p-value smaller than 0.1. This shows that information technology strengthens the positive influence of independence on audit quality. Meanwhile, the relationship between professionalism moderated by information technology on audit quality shows a p-value greater than 0.1. This can be interpreted that information technology does not strengthen the positive influence of professionalism on audit quality.

Discussion

Relationship between Professionalism and Audit Quality

Based on the results of the hypothesis testing as outlined in Table 7, it is known that the p-value of professionalism on audit quality is 0.024, which means that professionalism has a positive effect on audit quality. The higher the professionalism of an auditor, the better the resulting audit quality will be. This is in line with the research results of Mardijuwono and Subianto (2018) and Idawati (2018).

According to Baotham (2007), auditor professionalism refers to professional skills and behavior. The skills in question include knowledge, experience, adaptability, skills, and technological capabilities. This allows additional elements such as transparency and accountability in the auditor's professional behavior, which automatically helps maintain public trust (Idawati, 2018). The higher the ability and professional behavior of an auditor, the better the resulting audit quality. The higher the auditor's awareness of dedication to his profession, the more optimally he will use all of his knowledge, abilities, and experience in the inspection or audit process. The higher the professional skepticism of an auditor, the better the auditor's critical attitude towards the existing audit evidence. The higher the self-confidence and understanding of the standards of an auditor, the higher the auditor's ability to process, validate, and analyze data and audit evidence. The higher the competence of an auditor, the better his understanding of audit procedures and the business processes of the entity. And all of these things will support the improvement of the resulting audit quality.

The results of this study indicate that respondents are aware of the importance of professionalism to the resulting audit quality. Professionalism has a positive influence on audit quality. Therefore, it is important for auditors (both private and government auditors) to maintain an attitude of professionalism when conducting audits. Thus, the audit process and audit results produced are also of high quality and can meet the public's expectations for the creation of good governance. Auditors who are aware of the importance of their profession for the nation and society, apply the principle of prudence in assignments, are critical, and apply professionalism will improve the auditor's ability to detect fraud and violations in the management of state finances and their reporting. Therefore, the auditor is obliged to avoid anything that can affect his professionalism, such as refusing bribes from the examined entity. Maintaining professionalism will help the auditor carry out a quality audit. In this way, the actions of government officials that are detrimental to state finances will be clearly disclosed, and accountability for the management and reporting of state finances can be continuously improved. This will improve the image of the BPK, and the level of public trust in the quality of audits by BPK auditors will also increase.

Relationship between Independence and Audit Quality

Based on the results of the hypothesis testing as outlined in Table 7, it is known that the p-value of independence on audit quality is 0.095, which means that independence has a positive influence on audit quality. The high or low level of independence of an auditor will affect whether or not the resulting audit quality is good. This is in line with the research results of Dwimilten and Riduwan (2015), Nadi and Suputra (2017), Laksita and Sukirno (2019), In and Asyik (2019), and Junaid et al. (2021). So far, there has not been any research that gives independence results that have a negative effect on audit quality.

Auditor independence is a free attitude and is not pressured by anyone's interests in carrying out audits of a management's financial statements (Kasidi, 2007). With conditions in which the auditor is free from anyone's interests, the auditor (both private and government auditors) will be free to carry out inspections/audits in accordance with standards and free to give opinions on all conditions found through such inspections/audits. The auditor can carry out fair risk mapping, carry out thorough tests according to standards, and draw the right conclusions based on the results of the tests carried out. No interference from other parties, no pressure or conflict of interest from anyone, will result in a quality audit. Quality audit results will provide fair information for management and stakeholders, minimize asymmetric information between management and stakeholders, and assist stakeholders in making appropriate and quality decisions as well.

The results of this study indicate that independence has a positive influence on audit quality. Therefore it is important for auditors (both private auditors and government auditors) to maintain and maintain their independence so that the audit process and audit results are also of high quality. The auditor must have the courage to firmly reject the practice of bribery from any party, so that his independence is not compromised. Government auditors who are free to disclose problems of fraud and violations in the management of state finances, without conflicts of interest, without pressure and interference from parties who have personal or group interests, will improve the oversight and accountability function of government financial reporting. Thus problems related to the independence of government auditors which reduce the quality of audit results and the level of public trust as revealed in social media will be minimized.

Information Technology: Moderated Independence Relations To Audit Quality

Based on the results of the hypothesis testing as outlined in Table 7, it is known that the p-value of independence moderated by information technology on audit quality is 0.036, which means that information technology strengthens the positive influence of independence on audit quality. Understanding of the benefits of information technology further strengthens auditor independence in improving audit quality.

With the use of information technology, the auditor can obtain audit evidence that is more reliable, valid, transparent and real time through the information system used by the entity. Furthermore, the process of testing and analyzing audit evidence carried out through the use of information technology will also provide results and a basis for drawing conclusions that are faster, more accurate and accountable. In other words, the use of information technology provides benefits for the auditor to improve the quality of the audit he conducts. The results of this study indicate that the use of information technology actually strengthens the positive influence of independence on audit quality. By utilizing information technology, the auditor is free from entity pressure regarding space and time, because the use of information technology is no longer too dependent on meeting face to face, spending time, in terms of data acquisition and audit evidence. The auditor is also more free in disclosing all the audit results he obtains and minimizes pressure from various parties outside the entity that may influence the auditor's decision and the audit results obtained because all audit procedures performed, results obtained, and the audit supervision process are recorded digitally. Information technology will be able to strengthen the positive influence of independence on the resulting audit quality.

Relationship of Professionalism: Moderated by Information Technology on Audit Quality

Based on the results of the hypothesis test as outlined in Table 7, it is known that the p-value of professionalism moderated by information technology on audit quality is 0.387, which means that information technology does not strengthen the positive influence of professionalism on audit quality. Understanding of the benefits of information technology does not strengthen auditor professionalism in improving audit quality.

The use of information technology is expected to strengthen the positive influence of professionalism on audit quality. This is because understanding and using information technology can improve the auditor's ability to carry out audits. However, the results of this study indicate the opposite condition. Information technology does not strengthen the positive influence of professionalism on audit quality. In other words, whether there is an understanding of the use of information technology does not affect the professionalism of the auditor. This may be due to the fact that in carrying out audits, one must apply professional skepticism, mitigate existing risks to the entity, test the validity of the audit evidence obtained and always adhere to standards. The implementation of the audit process is not too dependent on the presence or absence of information technology. Information technology does not strengthen the positive influence of professionalism on audit quality The considerations and factors above may influence the respondents so that the use of information technology does not strengthen the positive influence of an auditor's professionalism on audit quality.

Conclusions, Limitations And Implications

The test results show that professionalism has a positive influence on audit quality. The quality of the resulting audit is better the more professional the auditor is in attitude. In addition, it is also concluded that independence has a positive influence on audit quality. The higher the independence of the auditor, the better the quality of the resulting audit. When these variables are moderated by information technology, this study concludes that information technology strengthens the positive influence of independence on audit quality. However, information technology does not strengthen the positive influence of professionalism on audit quality.

This study has limitations, namely the very short survey period and the limited number of respondents. Subsequent research is expected to increase the number of samples in a larger pupulation, not only for the auditors carrying out audits relating to the social security program for labor, so that the results of subsequent research can describe more comprehensive results.

The results of this study contribute to the body of knowledge and practice. This study gives insight into the role of information technology on audit quality in the context of public sector auditing. The use of agency and expectancy theory in this study may also give a new understanding of the applicability of these theories in the public sector audit discipline. From a practice point of view, the findings suggest that the BPK should further improve the ability and competence of its auditors in utilizing information technology in carrying out audits so that the independence of auditors will increase and at the same time improve the quality of the audits conducted.

References

Ahmad, F. (2019). A systematic review of the role of Big Data Analytics in reducing the influence of cognitive errors on the audit judgement. Revista de Contabilidad, 22(2), 187-202.

Amyar, F., Hidayah, N. N., Lowe, A., & Woods, M. (2019). Investigating the backstage of audit engagements: the paradox of team diversity. Accounting, Auditing & Accountability Journal, 32(2), 378-400.

Baotham, S. (2007). The Impact of Proffesional Knowledge and Personal Ethics on Audit Quality. International Academy Bisnis & Ekonomi.

BPK Law. (2006). Undang-undang Nomor 15 Tahun 2006 tentang Badan Pemeriksa Keuangan [Law No. 15 of 2006 concerning Indonesian Supreme Audit Institution]. https://peraturan.bpk.go.id/Details/40184/uu-no-15-tahun-2006

Budiman, M. A. (2021). The effect of audit opinions, implementation of audit recommendations, and findings of state losses on corruption levels within ministries and institutions in the Republic of Indonesia. Jurnal Tata Kelola Dan Akuntabilitas Keuangan Negara, 7(1), 113-129.

Dagilienė, L., & Klovienė, L. (2019). Motivation to use big data and big data analytics in external auditing. Managerial Auditing Journal, 34(7), 750-782.

Destriana, N. (2015). Pengaruh Debt to Equity Ratio, Dividen, and Faktor Non Keuangan Terhadap Agency Cost [The Influence of Debt to Equity Ratio, Dividends, and Non-Financial Factors on Agency Costs]. Jurnal Bisnis dan Akuntansi, 17(2), 125-133.

Dewi, I. G. A. A. P. H., & Badera, I. D. N. B. (2015). Teknik Audit Berbantuan Komputer Sebagai Prediktor Kualitas Audit [Computer-Assisted Audit Techniques as Predictors of Audit Quality]. E-Jurnal Akuntansi Universitas Udayana 12(1). 20–34. https://ojs.unud.ac.id/index.php/akuntansi/article/view/10311

Dwimilten, E., & Riduwan, A. (2015). Faktor-Faktor yang Mempengaruhi Kualitas Audit [Factors Affecting Audit Quality]. Jurnal Ilmu & Riset Akuntansi, 4(4), 1-20. http://jurnalmahasiswa.stiesia.ac.id/index.php/jira/article/view/3419.

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2014). Multivariate data analysis. Pearson Education Limited Harlow.

Idawati, W. (2018). Analisis Karakteristik Kunci yang Mempengaruhi Kualitas Audit [Analysis of Key Characteristics that Influence Audit Quality]. Jurnal Akuntansi, XXII(01), 33-50.

Idris, M. (2011). Pengaruh Profesionalisme, Karakteristik Personal Auditor, dan Batasan Waktu Audit Terhadap Kualitas Audit : Studi Empiris pada Kantor Akuntan Publik di DKI Jakarta [The Influence of Professionalism, Auditor Personal Characteristics, and Audit Time Limits on Audit Quality: Empirical Study at Public Accounting Firms in DKI Jakarta]. [Thesis, UIN Syarif Hidayatullah Jakarta]. https://repository.uinjkt.ac.id/dspace/bitstream/123456789/21775/1/MOCHAMAD%20IDRIS-FEB.pdf

In, A. W. K., & Asyik, N. F. (2019). Pengaruh Kompetensi dan Independensi Terhadap Kualitas Audit dengan Etika Auditor Sebagai Variabel Pemoderasi [The Influence of Competency and Independence on Audit Quality with Auditor Ethics as a Moderating Variable], Jurnal Ilmu dan Riset Akuntansi, 8(8), 1-15, http://jurnalmahasiswa.stiesia.ac.id/index.php/jira/article/view/2451

Indrayanti, S. M. A., Suprasto, H. B., & Astika, I. B. P. (2017). Pengaruh Kompetensi pada Kinerja Auditor Internal dengan Motivasi, Komitmen Organisasi dan Ketidakpastian Lingkungan Sebagai Pemoderasi di Inspektorat Kabupaten Tabanan [The Influence of Competency on Internal Auditor Performance with Motivation, Organizational Commitment and Environmental Uncertainty as Moderating at the Tabanan Regency Inspectorate]. E-Jurnal Ekonomi dan Bisnis Universitas Udayana, 6(11), 3823 - 3856.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

Joshi, P. L., & Marthandan, G. (2019). The Hype of Big Data Analytics and Auditors. EMAJ: Emerging Markets Journal, 8(2), 1-4.

Junaid, A., Haeruddin, S. H., & Sari, N. W. (2021). Pengaruh Kompetensi, Independensi, dan Teknologi Informasi terhadap Kualitas Audit pada Masa Pandemi Covid-19 [The Influence of Competence, Independence and Information Technology on Audit Quality during the Covid-19 Pandemic], YUME: Journal of Management, 4(3), 536 - 550, https://journal.stieamkop.ac.id/index.php/yume/article/view/1604

Kasidi. (2007). Faktor-Faktor yang Mempengaruhi Independensi Auditor [Factors Affecting Auditor Independence]. [Thesis, Universitas Diponegoro]. http://eprints.undip.ac.id/18045/1/Kasidi.pdf

KBBI. (2023). Kamus Besar Bahasa Indonesia [Indonesian Big Dictionary]. https://kbbi.kemdikbud.go.id/

Knechel, W. R., Krishnan, G. V., Pevzner, M., Shefchik, L. B., & Velury, U. (2013). Audit Quality: Insights from the Academic Literature. Auditing: A Journal of Practice & Theory, 32 (Supplement 1), 38542.

Laksita, A. D., & Sukirno, S. (2019). Pengaruh Independensi, Akuntabilitas, dan Objektivitas Terhadap Kualitas Audit [The Influence of Independence, Accountability and Objectivity on Audit Quality]. Jurnal Nominal 8(1), 31-46.

Mardijuwono, A. W., & Subianto, C. (2018). Independence, professionalism, professional skepticism: The relation toward the resulted audit quality. Asian Journal of Accounting Research, 3(1), 61-71.

Muthmainah, D. A. (2023, August 18). Kementerian BUMN Minta BPK Transparan soal Jiwasraya [Ministry of State Owned Enterprises asks Indonesia Supreme Audit Institution to be transparent about Jiwasraya]. CNN Indonesia. https://www.cnnindonesia.com/ekonomi/20200107203147-92-463280/kementerian-bumn-minta- bpk-transparan-soal-jiwasraya

Nadi, I. M. P. P., & Suputra, I. D. G. D. (2017). Pengaruh Kompetensi, Pengalaman, Independensi, dan Motivasi Auditor pada Kualitas Audit [The Influence of Auditor Competency, Experience, Independence and Motivation on Audit Quality], E-Jurnal Akuntansi Universitas Udayana, 18(2), 942–964. https://ojs.unud.ac.id/index.php/akuntansi/article/view/21807

Nagy, B., Farmer, J. D., Bui, Q. M., & Trancik, J. E. (2013). Statistical Basis for Predicting Technological Progress. PLoS ONE, 8(2), e52669. https://doi.org/10.1371/journal.pone.0052669

Newman, W., Muzvuwe, F., & Stephen, M. (2021). The impact of the adoption of data analytics on gathering audit evidence: a case of KPMG Zimbabwe. Journal of Management Information and Decision Sciences, 24(5), 1-15. https://www.abacademies.org/articles/the-impact-of-the-adoption-of-data-analytics-on-gathering-audit-evidence-a-case-of-kpmg-zimbabwe-11062.html

Piserah, M., Sutjipto, V. F., Firmansyah, A., & Trisnawati, E. (2022). Perilaku Fraud Detection pada Auditor: Professionalis Skepticism, Whistleblowing, Integritas, Time Pressure [Fraud Detection Behavior in Auditors: Professional Skepticism, Whistleblowing, Integrity, Time Pressure]. Jurnal Ilmiah Akuntansi Kesatuan, 10(1), 17–28.,

Sihombing, Y. A., & Triyanto, D. N. (2018). Pengaruh Independensi, Objektivitas, Pengetahuan, Pengalaman Kerja, Integritas Terhadap Kualitas Audit (Studi Pada Inspektorat Provinsi Jawa Barat Tahun 2018) [The Influence of Independence, Objectivity, Knowledge, Work Experience, Integrity on Audit Quality] (Study at the Inspectorate of West Java Province in 2018)]. Jurnal Akuntansi 9(2), 141-160.

Solichin, R. A. (2021). Legal Protection towards the Beneficiaries of PT Asuransi Jiwasraya due to Payment Defaults of the Jiwasraya Savings Plan: A Critical Review. Jurnal Hukum Universitas Negeri Semarang, 7(2), 257-286.

Tuanakotta, T. M. (2015). Audit Kontemporer (International Standards on Auditing) [Contemporary Audit (International Standards on Auditing)]. Salemba Empat.

Valsafah, M. M., Prasetiyo, I. A., Indrawati, M., Ambarwardani, L., & Putri, D. M. (2021). Peranan Teknologi Informasi dalam Menunjang Kualitas dan Proses Audit di Era Digital [The Role of Information Technology in Supporting Quality and Audit Processes in the Digital Era]. Prosiding National Seminar on Accounting, Finance, and Economics (NSAFE), 1(2). http://conference.um.ac.id/index.php/nsafe/article/view/810

Vroom, V. H. (1964). Work and Motivation. Wiley.

Wijayanto, P. A. (2017). Pengaruh Kompetensi, Independensi, Profesionalisme Auditor Internal Pemerintah Terhadap Kualitas Audit [The Influence of Competency, Independence, and Professionalism of Government Internal Auditors on Audit Quality]. [Thesis, Universitas Negeri Yogyakarta]. http://eprints.uny.ac.id/55608/1/Skripsi%20full.pdf

Yan, Z., Gaspar, R., & Zhu, T. (2021). How humans behave with emerging technologies during the COVID -19 pandemic? Human Behavior and Emerging Technologies, 3(1), 5-7.

Yi, Y., & Moon, R. H. (2021). Sustained Use of Virtual Meeting Platforms for Classes in the Post-Coronavirus Era: The Mediating Effects of Technology Readiness and Social Presence. Sustainability, 13(15), 8203.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Meliala, R. N. B., Pratama, A. A., Firmansyah, A., & Amyar, F. (2023). How Auditor's Professionalism, Independence, and Information Technology Influence Audit Quality. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 963-979). European Publisher. https://doi.org/10.15405/epsbs.2023.11.79