Tax Officers’ Scepticism and Professional Judgment: The Mediation of Client Fraud Indicators Intensity

Abstract

Tax officers are subjected to risk assessment, particularly in tax fraud risk. In performing their duties, tax officers are required to exercise their professional judgment throughout the audit and investigation. This study aims to examine the relationships between scepticism, client’s fraud indicators intensity, and tax professional judgment. A total of 176 tax officers of the Inland Revenue Board of Malaysia (IRBM) took part in this experimental study. The data was analysed using Partial Least Squares (PLS) Structural Equation Modelling. The results show that scepticism has a direct and indirect significant influence on tax professional judgment. This experiment data also provides evidence of a mediation effect of client’s fraud indicators intensity on the relationship between scepticism and tax professional judgment. This study enriches the existing body of knowledge in the tax fraud risk discipline. The findings of this study are also valuable for professionals in tax audit and investigation, as they offer additional guidance for the development and improvement of tax fraud risk assessment programs and training. This can ultimately enhance the quality of judgment among tax professionals.

Keywords: Fraud Indicators Intensity, Risk Assessment, Scepticism, Tax Professional Judgment

Introduction

Despite the importance of the tax collection income to the government, the number of tax fraud cases in the corporate sector is high and they must be curtailed (Kasipillai & Chen, 2014). The amount of government’s lost tax revenue can be significant and to some extent, is considered alarming with ever-increasing loss estimates over the years. This is despite various measures being taken by the tax authorities to ensure more tax compliance (Zakaria et al., 2013), and an equitable contribution from the corporate citizens of their fair share to the nation’s tax pool. As tax fraud cases receive greater attention in recent years, the spotlight on the efficacy of tax officers' professional judgment when determining the client’s potential tax fraud risk has become more apparent (Klassen et al., 2016; Lederman, 2019). This is because an outcome of a flawed assessment of the tax fraud risk is detrimental beyond the tax authority domain (Miriam Ladi & Henry, 2015). Arguably, a flawed tax fraud risk assessment can lead to a deficit in trust in the tax system which eventuates from a negative public perception. As such, responsible tax officers are required to exercise an appropriate level of professional judgment based on evidential audit findings (Nadiah et al., 2018).

Tax officers interact with a wide range of taxpayer behaviours and effectively become the ‘public face’ of the tax authorities (Muhammad, 2013). Regardless of the varied tax behaviour, they are trained professionals in whom the public has a reasonable expectation that they are able to adequately exercise a professional judgment when determining client's tax risk (Favere-Marchesi, 2006). More than so, such assessment has been associated with the success of tax audit objectives in tax fraud prevention.

When undertaking the task of assessing tax fraud risk, factors such as the severity of a client's fraud indicators can serve as a crucial link connecting individual factors like scepticism to the judgments made by tax professionals (Cao et al., 2020; Slovic et al., 2004). The gravity of these fraud indicators used by tax officers heightens their awareness of the potential for tax fraud (Krambia-Kapardis et al., 2010). Consequently, tax officers must invest more effort into actively searching for and identifying these fraud indicators, as most signs of fraud cannot be discerned with a mere glance at the financial data. This necessitates the tax officers' diligence in gathering comprehensive information regarding potential symptoms of fraud that might be present within the client's business environment, indicating an elevated risk of deliberate misrepresentation of financial statements, especially in intricate tax fraud cases (Cao et al., 2020; Malaysian Institute of Accountant, 2022; Moyes et al., 2013). Within the intricate landscape of tax fraud, marked by its ever-growing complexity, the tax officers are expected to embody certain individual attributes, notably scepticism. This requirement aligns with established standards of an acceptable level of judgment which is crucial for ensuring the effective management of associated tax risks (Inland Revenue Board of Malaysia, 2022, 2023; Malaysian Institute of Accountant, 2022). The tax officers’ scepticism in exercising a sound professional judgement demonstrates their intrinsic capability to manage obstacles when conducting tax audits fieldwork. A lack of this professional trait can potentially limit a thorough assessment of the client’s tax fraud risk (Fullerton & Durtschi, 2005; Popova, 2012; Quadackers et al., 2014). Thus, a deficiency in scepticism can impair a professional judgment, and the quality of the tax fraud risk assessment. Together, these deficiencies have broader implications, as they can mar the reputation of the tax officers and erode public confidence and trust in their professional credibility (Muhammad & Salikin, 2013).

Generally, tax professional judgement is under-researched in the tax fraud risk domain. For example, existing studies on the tax fraud risk mainly focus on contributing factors of tax fraud at the organisational-based level (Fukofuka, 2013; Mohd Nor et al., 2010; Tabandeh et al., 2013), tax fraud indicators (Md Noor et al., 2012; Mohd Yusof & Lai, 2014; Nawawi & Salin, 2018) and compliance behavioural characteristics of the taxpayers (Pui Yee et al., 2017; Samuel & Dieu, 2014; Serim et al., 2014). However, some early work on the enforcement side has found that there were concerns about poor judgement exercised by tax officers (Choong & Lai, 2009). This is further supported by Isa and Pope (2011) who found that more than 30% of tax officers failed to provide adequate justifications for tax adjustments. They also reported that most tax officers lean toward generalising a modus operandi of a client as a basis of their assessment although each client’s business transactions can vary significantly from one company to another.

Similarly, in the context of scepticism, there are also limited studies concerning individual-based factors related to the tax officer’s professional judgement (Hurtt et al., 2013; Muhammad & Salikin, 2013; Nadiah et al., 2018). Nevertheless, there are studies that help to build a foundation for scepticism. For example, several studies were devoted to the validation of scepticism scale (Hurtt, 2010; Sayed Hussin & Iskandar, 2014, 2015) and the dynamics of scepticism (Carpenter & Reimers, 2013; Chadegani et al., 2015; Kang et al., 2015; Payne & Ramsay, 2005; Zarefar et al., 2016). These studies align to a notion of the importance of scepticism in performing risk assessment which is highlighted in many international auditing standards such as ISA 200 and ISA 240. This is further emphasised by the IRBM Competency Profile.

The absence of rich literature on the scepticism and professional judgment in the tax fraud risk is further compounded by limited work that examines the effect of client’s fraud indicators intensity (Jaffar, 2008; Kadous & Magro, 2001; Paino et al., 2014). While the intensity in general has been studied to affect job performance (e.g., Kidwell et al., 2010; Morris, 2009), the literature is deprived of work that focuses on the professional judgement of the tax officers. Further, many of the existing studies examine the effects of scepticism and client’s fraud indicators intensity separately neglecting the association of these two intertwined dynamics and ignoring the notion that professional judgment is contingent on the intensity (DeZoort et al., 2006; Jaffar, 2009; Mohd Iskandar & Mohd Sanusi, 2011).

Given the limited scope of prior research in this specific domain, this study thus seeks to make a valuable contribution by providing additional empirical insights into the relationship under examination. Considering the aforementioned research gap, this investigation endeavours to address several key aspects. Specifically, it aims to analyse the influence of scepticism on the professional judgment of tax professionals and the intensity of a client's fraud indicators. Additionally, it seeks to assess how the intensity of these fraud indicators, as exhibited by the client, impacts the judgment of tax professionals. The current study also aims to evaluate the mediating role played by the client's fraud indicator intensity in shaping the connection between scepticism and the professional judgment of the tax officers.

Subsequent sections of this research delve into a comprehensive review of relevant literature, the formulation of hypotheses, the description of the research methodology, and the presentation of the study's findings. Finally, the concluding segment summarizes the results, elucidates theoretical and practical contributions, and acknowledges the study's limitations.

Literature Review and Hypotheses Development

Tax Professional Judgment

In the complex process of conducting tax audits or investigations, tax officers have the responsibility to use prudent judgement at every step. Their role is pivotal in carefully analysing the taxpayer's business records and financial statements to ensure the accuracy of the income declaration and the correctness of the tax computed and paid in accordance with the Inland Revenue Board of Malaysia (IRBM) tax laws and regulations (Inland Revenue Board of Malaysia, 2022, 2023). The current global business landscape is characterised by rapid expansion, resulting in a marked increase in transactional complexity. According to Trotman (2006), the increase in fraudulent activities has created a pressing demand for tax officials to enhance their level of assurance to counteract potential financial fraud. The methodology entails a comprehensive evaluation of potential risks and uncertainties. A lower tax risk rating has the potential to suggest a reduced level of document scrutiny, which could result in a recommendation to conclude an audit or investigation without imposing tax adjustments or penalties. However, a higher tax risk rating requires a thorough audit involving more stringent procedures. This often leads to substantial findings and additional tax liabilities for taxpayers (Onuoha & Dada, 2016).

Despite its crucial role in the risk assessment process, there is little empirical research that addresses the assessment of tax fraud risk (Hybka, 2020; Murorunkwere et al., 2022). A review of the current body of literature indicates a scarcity of research on the individual perspective of tax officers' professional judgement. Most research in tax fraud assessment is predominantly organisational in nature, addressing issues such as tax compliance, tax fraud indicators, prevention tools, legal requirements, and public perceptions of tax authorities (Ismail et al., 2014; Md Noor et al., 2012; Mohd Yusof & Lai, 2014; Nawawi & Salin, 2018; Stankevicius & Leonas, 2015; Stuebs & Wilkinson, 2010). Kogler et al. (2016) and Muhammad and Salikin (2013) emphasised that there is an urgent need to focus research on the behaviour and assessment of tax officers or tax authorities. This is because tax officers are the frontline representatives who interact directly with taxpayers and carry out control measures, as well as impose fees and penalties. Therefore, to fill the gaps in the existing literature and promote a deeper understanding of tax officers' judgement processes in assessing fraud risk, this study aims to focus on their critical role in this important task.

The Effect of Scepticism on Tax Professional Judgment

Scepticism is ‘an attitude that includes a questioning mind and a critical assessment of audit evidence’, a very important element in making sound audit judgements (Nolder & Kadous, 2018). The importance of scepticism to the audit profession is also highlighted in the auditing literature by its prominence throughout auditing standards (Carpenter & Reimers, 2013; Nelson, 2009; Peytcheva, 2013; Popova, 2012; Sayed Hussin & Iskandar, 2015; Sun et al., 2022). Scepticism reduces the risks of overlooking unusual circumstances, over-generalizing when making judgements from the audit observations, and using inappropriate assumptions in determining the nature, timing and extent of the audit procedures and evaluating the results thereof (Nolder & Kadous, 2018). Thus, scepticism can be viewed as the force that drives auditors to recognize potential errors and irregularities as well as to investigate whether any misstatements or fraud exist.

Prior studies on auditors’ scepticism have shown that high scepticism leads auditors to get more information, execute greater amounts of audit work, assess a greater possibility of fraud and attribute more encumbrance to fraud evidence (Fullerton & Durtschi, 2005; Popova, 2012; Quadackers et al., 2014; Ratnawati, 2020; Said & Munandar, 2018). A greater understanding of scepticism could assist auditors to acquire and maintain adequate levels of scepticism, which in turn could improve the quality of their audit judgement (Khan & Harding, 2020; Popova, 2012).

In relation to tax professional judgement, the sceptical attitude of tax officers is crucial (Ngah et al., 2022) in every stage of conducting a tax audit or investigation particularly when assessing tax fraud risks, as well as the extent of the tax officers’ search for evidence or planning of additional audit procedures. Moreover, tax officers would also adhere to professional standards while assessing taxpayers’ tax returns and financial statements (Glover & Prawitt, 2014). For instance, sceptical tax officers should presume that there are significant risks of fraud in revenue recognition regardless of experience in auditing revenue at an entity and regardless of the assessed competency and integrity of management (Alfatah & Tobing, 2020; Hashim et al., 2020). In addition, the application of scepticism assumes some level of carelessness, incompetence, or dishonesty in the preparation of tax returns or financial statements. As tax fraud is becoming more complicated, tax officers should also adopt an elevated attitude of scepticism in assessing potential tax fraud in every tax audit or tax investigation assignment. Thus, based on the preceding discussion, the following hypothesis is to be tested.

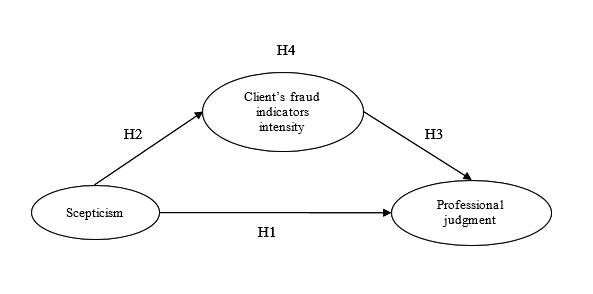

H1: Scepticism has a significant positive effect on tax professional judgement.

The Effect of Scepticism on the Client’s Fraud Indicators Intensity

This study aims to investigate the influence of scepticism on the degree of a client's fraudulent indicators, acknowledging the crucial function of scepticism in shaping the professional judgement of tax officers. Numerous empirical studies indicate that scepticism motivates individuals to allocate greater effort towards their audit responsibilities. For instance, those auditors who were more sceptical demonstrated a significantly heightened inclination to broaden their information search concerning potential fraud symptoms (Fullerton & Durtschi, 2005; Jarah et al., 2022; Noch et al., 2022). The assertion can be made that those tax officers who demonstrate a higher level of scepticism are more inclined to exhibit a greater degree of diligence when assessing fraud indicators during their tax audit or tax investigation duties.

The observation gives rise to a hypothesis that tax officers who adopt a sceptical approach are more inclined to respond with greater vigour or distinctiveness by seeking supplementary details regarding potential fraudulent conduct (i.e., indicators of fraud) in contrast to their less sceptical colleagues. The proposition is by the directive expounded in ISA 240, which urges auditors to systematically scrutinise whether the data and audit substantiation they collected indicates a significant misrepresentation attributable to fraudulent activities.

The significance of incorporating scepticism in evaluating fraud risks has been highlighted by various scholars such as Grenier (2010) and Kang et al. (2015). The utilisation of this approach has the potential to mitigate the occurrence of substantial misstatements that may arise from fraudulent activities. The present investigation involves an interpretation of the magnitude of a client's fraud indicators as the additional effort undertaken by tax officers to comprehensively evaluate the pervasiveness of fraud indicators within the audited or investigated organisation. Although tax officers may not be subject to the same limitations as external or internal auditors, their responsibilities include verifying that the financial statements and annual returns submitted by taxpayers are free of any significant errors or fraudulent behaviour. Thus, the following hypothesis is to be tested:

H2: Scepticism has a significant positive effect on client’s fraud indicators intensity.

The Effect of Client’s Fraud Indicators Intensity and Tax Professional Judgment

Over the years, effort has been considered as an important factor in job performance (Kidwell et al., 2010). The effort of an employee is characterized by three components which lead to an increase in job performance namely effort duration, effort intensity and effort direction (Cloyd, 1997). Specifically, the amount of cognitive effort spent on a task can be improved either through effort intensity (i.e., working harder) or effort duration (i.e., working longer time), or through both. Prior research has revealed that work effort has positively influenced performance by explaining the effort intensity employed by workers (De Cooman et al., 2009; Dickinson & Villeval, 2008; Morris, 2009).

Previous studies in the field of auditing have demonstrated that the level of effort exerted by auditors is positively correlated with audit performance. This finding has been supported by various scholars, including (Alissa et al., 2014; Dye, 1995; Johari et al., 2014; Mohd Iskandar et al., 2012; Mohd Sanusi & Mohd Iskandar, 2007; Usman et al., 2021). The effort of auditors during audit work has a significant impact on the probability of detecting any prevailing issues or problems (Caramanis & Lennox, 2008; Persellin et al., 2019). This factor has emerged as a crucial component in the formation of a high-quality audit judgement (Johari et al., 2014). Within the scope of this investigation, the degree of fraud indicators exhibited by clients is utilised as a measure of the level of effort exerted by tax officials during the process of conducting tax audits and investigations. The tax officers' level of initiative to diligently identify fraud risk indicators, also known as "red flags," in each audit case assigned to them is reflected in the intensity of the client's fraud indicators. The increasing apprehension regarding fraudulent occurrences in business operations, compounded by the intricate nature of such frauds involving multiple parties, coupled with the crucial role played by auditors in evaluating and detecting fraud in financial statement audits, has led to the incorporation of fraud indicators in auditing standards. This inclusion is aimed at aiding auditors in identifying potential fraud likelihoods (Moyes, 2011).

The International Federation of Accounts (IFAC) has implemented the International Standard for Auditing - AI240, which outlines the auditor's obligation to address fraudulent activity during a financial statement audit. The application of AI240 was approved by the Council of the Malaysian Institute of Accountants in July 2005, within the context of Malaysia. As per the auditing standard, the auditor has the authority to detect events or circumstances that suggest the presence of pressures or incentives that may prompt individuals to engage in fraudulent activities, opportunities that may facilitate the execution of such activities, or attitudes and rationalizations that may be employed to justify fraudulent actions.

As tax fraud is increasing and growing more complicated, increased tax regulations, as well as the number and complexity of audit tasks, are rising, there is a requirement for the tax officers to execute more effort by enhancing their client’s fraud indicators intensity during fraud risk assessment. The direct relationship between the client’s fraud indicators intensity and tax professional judgement can be demonstrated by the execution of tax officers’ official duties as required by the job, combined with their additional voluntary effort that would lead to better performance (De Cooman et al., 2009). Subsequently, for those tax officers who are more intense in their effort in checking and assessing the taxpayers’ fraud indicators, the likelihood of tax fraud that goes unnoticed and undetected is minimized. Taken together with prior literature on the relationship between work effort on the auditors’ performance, and the nature of tax officers’ work that requires them to intensify their effort in assessing tax fraud risks, the following hypothesis is to be tested:

H3: The client’s fraud indicators intensity has a significant positive effect on tax professional judgment.

The Mediation Effect of Client’s Fraud Indicators Intensity on the Relationship Between Scepticism and Tax Professional Judgment

Within the scope of this study, the intensity of a client's fraud indicators refers to the effort expended in identifying or acknowledging taxpayers' potential tax fraud risks. This intensity is heightened by the degree of scepticism held by tax officers, thereby establishing a link between the indirect effect of scepticism on tax professionals' judgement. In the case of tax officers, the intensity of a client's fraud indicators corresponds to their level of scepticism in detecting potential tax fraud risks among audited taxpayers. Their scepticism regarding the risk induces a heightened level of vigilance regarding potential fraud risks, causing them to invest additional effort in identifying potential fraud indicators, thereby informing their decision-making.

This suggests that the intensity of a client's fraud indicators mediates the relationship between the level of scepticism of tax officers and their assessment of tax fraud risk. Moreover, according to the Behavioural Decision Theory, a cognitive process mediates the relationship between the individual and the environment (Morton & Fasolo, 2009). As the theory recognises the mediating role of cognitive processes, it provides a framework to assist tax officers' judgement when assessing taxpayers for potential tax fraud risks in the course of their professional duties.

The present research suggests that the degree of effort exerted by a client in detecting fraud indicators plays a mediating role in determining the potential risk of fraud associated with the taxpayers they are engaging with. Although previous research has examined the relationship between scepticism and audit judgement, the role of client’s fraud indicators intensity as a mediator between these variables has received little attention. This study proposes that scepticism increases the intensity of a client's fraud indicators, which in turn influences the professional judgement of tax officers. Thus, the following hypothesis is proposed:

H4: Client’s fraud indicators intensity mediates the relationship between scepticism and tax professional judgement.

Theoretical and Conceptual Framework

The theoretical framework of this study is based on the Behavioural Decision Theory (BDT) which provides a fundamental explanation of the factors that influence tax professional judgment. The theory advocates that individual judgment is dependent upon cognitive behaviour (internal) and environmental factors (external). Figure 1 depicts the conceptual framework of this study. The framework presents hypothesized linkages between scepticism (internal factor), client’s fraud indicators intensity (external factor), and tax professional judgement. The straight lines represent the direct effect of the variables, whereas the thick black line represents the mediating effect of the variables.

Research Methodology

This study adopts a 2 x 2 between-within-subjects experimental research design. It generates four quadrants of treatment, and for each quadrant, a minimum of 30 participants is required. Hence, the minimum sample size required is 4 x 30 = 120 samples. The populations of participants are the tax officers of the IRBM who are involved directly in assessing tax fraud risk while conducting corporate tax audits or investigation activities at the IRBM’s branches and headquarters all over Malaysia.

Measurement of Variables

Tax professional judgment - Tax professional judgement was measured directly by asking the participants to respond on their level of agreement to the four statements provided. In each case scenario, participants were asked to indicate their level of agreement regarding the statement on a seven-point Likert scale (1=strongly unlikely, 7=strongly likely). Similar to previous studies, the seven-point Likert scale was used to measure the likelihood of responses (Carmeli, 2003; Jaffar et al., 2011; Johari et al., 2014).

Scepticism - The items for this construct are adopted from the (Hurtt, 2010) scepticism scale. The scepticism construct was measured based on the six elements which comprised self-confidence (five items), self-determining (six items), suspension of judgement (five items), search for knowledge (six items), questioning mind (three items) and interpersonal understanding (five items). Responses to the scepticism were made on a seven-point scale (1 = strongly disagree; 7 = strongly agree). Individuals scoring higher on the scale are inferred to be more sceptical than individuals scoring lower on the scale.

Client’s fraud indicators intensity - The client’s fraud indicators intensity was measured based on the risk factors relating to misstatements arising from the Fraudulent Financial Reporting adopted from International Auditing Standard (ISA) 240. The fraud indicators are comprised of three categories which are pressure, opportunity and rationalisation or management attitude. Responses to the fraud indicators were made on a seven-point scale (1 = not important; 7 = very important). High scores of perceived importance of client’s fraud indicators indicated greater client’s fraud indicators intensity whereas low scores indicated lesser client’s fraud indicators intensity.

Result

Demography of Participants

The sample in this study comprised 110 tax auditors and 66 tax investigators. For tax auditors, there are 42 males and 68 females. While for tax investigators, participants are 46 males and 20 females. 50 per cent of the participants are from central region branches, while 50 percent have working experience as a tax officer ranging from 1 to 5 years, 23 per cent have 6 to 10 years of experience, 18 per cent with experience ranging from 7 to 15 years and 9 per cent have more than 16 years of working experiences in tax audit and investigation field.

Assessment of Measurement Model

The reliability and validity of the measurement model of this study were evaluated by four main criteria: indicator reliability, internal consistency, convergent validity, and discriminant validity. Overall, the reliability and validity tests on the measurement model are satisfactory.

Evaluation of Structural Model (Hypotheses Testing)

There are three hypotheses (H1, H2, and H3) that represent a direct effect and one hypothesis (H4) that illustrates an indirect effect in this study. These hypotheses are developed to examine the relationship between scepticism, client’s fraud indicators intensity, and professional judgement. Based on the assessment of the path coefficient as shown in Table 1, H1, H2, and H3 are supported at a 95% confidence level (< .05). The corresponding significant levels (at 2.5% and 97.5%) for the supported hypotheses also show homogenous signs, hence confirming the significance of these path relationships. In addition, the client’s fraud indicators intensity significantly mediates the relationship between scepticism and tax professional judgement. The bootstrapping analysis has shown that the result of indirect effects (mediating), β = 0.158, is significant with a t-value of 3.643 (p<0.01). In addition, the indirect effect 95% Boot CI Bias Corrected: (LL=0.082, UL=0.252) does not straddle a zero ‘0’ in between which indicates the mediation effect existed. Hence, we can conclude that the mediation effect is statistically significant, supporting hypothesis H4.

Conclusion

Discussions of Findings

It can be interpreted that tax officers’ professional judgement in assessing tax fraud risk is variably different on the level of their scepticism. It implies that tax officers exercise better professional judgement when they have a sceptical mindset when performing a tax risk assessment. One of the possible reasons for the significant effect of scepticism on tax officers’ professional judgement is their years of experience working as tax officers. In this study, 50.6 per cent of the participants have more than 6 years of experience working as a tax officer. This presumes that experienced tax officers with sufficient relevant knowledge and skills will enhance their ability to be more sceptical in conducting tax risk assessments. In addition, experienced tax officers have more exposure in dealing with various types of client behaviour and attitude which require them to not fully trust the information given by the clients without further investigation.

Moreover, scepticism has a strong influence on the client’s fraud indicators intensity. The result promotes that applying scepticism, will lead tax officers to execute greater amounts of audit work to get more information, conduct more risk assessments of the likelihood of fraud as well as attribute more impediments to fraud evidence (Fullerton & Durtschi, 2005; Popova, 2012; Quadackers et al., 2014). Thus, it can be concluded that scepticism has a strong influence on both tax professional judgement and the client’s fraud indicators intensity.

The results also show that the client’s fraud indicators intensity exhibited the expected positive relationship with tax officers’ professional judgement (p-value <0.01). This significant result is supported by previous studies that proved the more effort a person puts into a particular task, the better performance he or she will achieve (Dickinson & Villeval, 2008; Krambia-Kapardis et al., 2010; Morris, 2009; Pokorny, 2008).

Likewise, in this study, it is proven that the more intensified the efforts put in by the tax officers in searching for client fraud indicators, would lead them to perform better tax professional judgement. The client’s fraud indicators intensity, which signifies the extent of effort devoted by the tax officers in searching and identifying the client’s fraud indicators, could mean that tax officers have met the minimum requirement of tax risk assessment (Inland Revenue Board of Malaysia, 2022, 2023) or could even expand above and beyond their job descriptions. Generally, there are no specific guidelines for the tax risk assessment process, but, when the tax officers dedicate more effort to searching and identifying client’s fraud indicators or ‘red flags’, the more information can be gathered, the more tax officers’ sensitivity to the likelihood of tax fraud that may be committed by the client (Krambia-Kapardis et al., 2010). This would effectively mean the effort in searching for client’s fraud indicators should be proportionate to the client risk profiles, by focusing more resources on high-risk exposures and lesser resources on low-risk exposures. Failure to proportionately dedicate the right extent of the client’s fraud indicators intensity would leave the tax officers having a limited amount of information to assess client risk profiles for tax fraud risk effectively. Hence, it is justified that the more intensified client fraud indicators, the tax officers would be in a better position to identify clients with tax fraud risk.

Client’s fraud indicators were also found to be statistically significant in mediating the relationship between scepticism and tax professional judgment. In essence, this finding suggests that the impact of scepticism on tax professional judgment is better understood when considering the intensity of the client's fraud indicators. In simpler terms, scepticism, being the central focus in this relationship, influences the degree of intensity with which tax officers search for and identify client-specific fraud indicators. This, in turn, has implications for the quality of judgment rendered by tax professionals. Therefore, tax officers with higher levels of scepticism tend to exhibit greater diligence in uncovering and analysing detailed information related to the client's potential fraud indicators. This enhances their ability to make more informed judgments regarding the level of risk associated with the client's financial affairs and ultimately contributes to improved professional judgment.

Theoretical and Practical Contributions

The findings of this study mark a noteworthy extension of the tax professional judgment literature, particularly within the context of the IRBM as a tax regulator. This study provides compelling evidence regarding the intricate interplay among the constituent elements of a complex and interdependent relationship between scepticism, the intensity of a client's fraud indicators, and the exercise of tax professional judgment. Notably, a thorough review of the existing literature has indicated a dearth of similar investigations, highlighting that this study represents one of the early attempts to empirically explore the connections between all three factors and their impact on tax professional judgment.

Furthermore, this study carries significant theoretical implications concerning the application of Structural Equation Modeling with Partial Least Squares. It offers a unique approach by concurrently assessing the impact of these factors on tax professional judgment. Prior studies focusing on behavioral judgment have typically demonstrated limited utilisation of PLS-SEM as a method for testing relationships among variables. The approach used in this study thus brings about a valuable methodological contribution that enriches the literature of the field.

Limitation of The Study

While this research provides several valuable theoretical and practical contributions, several limitations should be noted. First, the use of survey questions in this study requires participants to self-rate in response to the statement provided in the studies. Consequently, the results may not represent their actual value as they may give answers to what they should have or should do rather than their actual ability. Second, as the case scenarios were being deployed, the possibility of misinterpretation by the participants while reading the different scenarios could have arisen.

Acknowledgments

The authors would like to thank the Accounting Research Institute (HICoE) grant “Integrated Model on Digital Competency, Audit Quality and Audit Performance In Digital Transformation” 600-RMC/ARI 5/3(004/2023) and Ministry of Higher Education, Malaysia for providing the necessary financial assistance for this study.

References

Alfatah, Q., & Tobing, N. A. L. (2020). Implementation of Fraud Risk Assessment To Mitigate The Fraud Risk in Tax Audit Process. AFEBI Accounting Review, 4(02), 77. DOI:

Alissa, W., Capkun, V., Jeanjean, T., & Suca, N. (2014). An empirical investigation of the impact of audit and auditor characteristics on auditor performance. Accounting, Organizations and Society, 39(7), 495–510. DOI:

Cao, J., Luo, X., & Zhang, W. (2020). Corporate employment, red flags, and audit effort. Journal of Accounting and Public Policy, 39(1), 106710. DOI:

Caramanis, C., & Lennox, C. (2008). Audit effort and earnings management. Journal of Accounting and Economics, 45(1), 116-138. DOI:

Carmeli, A. (2003). The relationship between emotional intelligence and work attitudes, behavior and outcomes: An examination among senior managers. Journal of Managerial Psychology, 18(8), 788-813. DOI:

Carpenter, T. D., & Reimers, J. L. (2013). Professional Skepticism: The Effects of a Partner's Influence and the Level of Fraud Indicators on Auditors' Fraud Judgments and Actions. Behavioral Research in Accounting, 25(2), 45-69. DOI:

Chadegani, A. A., Mohamed, Z. M., & Iskandar, T. M. (2015). The Influence of Individual Characteristics on Auditors' Intention to Report Errors. Journal of Economics, Business and Management, 3(7), 710-714. DOI:

Choong, K. F., & Lai, M. L. (2009). Tax audit in Malaysia: Survey Evidence from Professional Accountants in Tax Practice.

Cloyd, C. B. (1997). Performance in Tax Research Tasks. The Accounting Review, 72(1), 111-131.

De Cooman, R., De Gieter, S., Pepermans, R., Jegers, M., & Van Acker, F. (2009). Development and Validation of the Work Effort Scale. European Journal of Psychological Assessment, 25(4), 266-273. DOI:

DeZoort, T., Harrison, P., & Taylor, M. (2006). Accountability and auditors' materiality judgments: The effects of differential pressure strength on conservatism, variability, and effort. Accounting, Organizations and Society, 31(4-5), 373-390. DOI:

Dickinson, D., & Villeval, M. C. (2008). Does monitoring decrease work effort? The complementarity between agency and crowding-out theories. Games and Economic Behavior, 63(1), 56–76.

Dye, R. A. (1995). Incorporation and the audit market. Journal of Accounting and Economics, 19(1), 75–114. DOI:

Favere-Marchesi, M. (2006). The Impact of Tax Services on Auditors' Fraud-Risk Assessment. Advances in Accounting, 22, 149-165. DOI:

Fukofuka, P. (2013). The contextual framework of corporate income tax evasion. Journal of Accounting and Taxation, 5(2), 27-37. DOI:

Fullerton, R. R., & Durtschi, C. (2005). The Effect of Professional Scepticism on the Fraud Detection Skills of Internal Auditors (Issue 435).

Glover, S. M., & Prawitt, D. F. (2014). Enhancing Auditor Professional Skepticism: The Professional Skepticism Continuum. Current Issues in Auditing, 8(2), P1-P10. DOI:

Grenier, J. H. (2010). Encouraging Professional Scepticism in the Industry Specialization Era: A Dual- Process Model and an Experimental Test. University of Illinois.

Hashim, H. A., Salleh, Z., Shuhaimi, I., & Ismail, N. A. N. (2020). The risk of financial fraud: a management perspective. Journal of Financial Crime, 27(4), 1143-1159. DOI:

Hurtt, R. K. (2010). Development of a Scale to Measure Professional Skepticism. AUDITING: A Journal of Practice & Theory, 29(1), 149-171. DOI:

Hurtt, R. K., Brown-Liburd, H., Earley, C. E., & Krishnamoorthy, G. (2013). Research on Auditor Professional Scepticism: Literature Synthesis and Opportunities for Future Research. AUDITING: A Journal of Practice & Theory, 32(Supplement 1), 45-97. DOI:

Hybka, M. M. (2020). Evaluating risk-based selection methods for tax audits in Poland. International Journal of Business & Economic Development, 08(02). DOI:

Inland Revenue Board of Malaysia. (2022). Tax Audit Framework. https://phl.hasil.gov.my/pdf/pdfam/RK_Audit_Cukai_2022_1.pdf

Inland Revenue Board of Malaysia. (2023). Tax Investigation Framework. https://www.hasil.gov.my/media/vjln5w12/rangka-kerja-siasatan-2023.pdf

Isa, K., & Pope, J. (2011). Corporate Tax Audits : Evidence from Malaysia. Global Review of Accounting and Finance, 2(1), 42–56.

Ismail, R., Rihan, W., & Nsouli, F. (2014). Value Added Tax Evasion and Illegal Recovery Cases in Lebanon. Procedia - Social and Behavioral Sciences, 109, 527-530. DOI: 10.1016/j.sbspro.2013.12.501

Jaffar, N. (2008). The Effect of the External Auditors ’ Ability to Assess Fraud Risk on Their Ability to Detect the Likelihood of Fraud. International Journal of Management Perspectives, 1(1), 49–70.

Jaffar, N. (2009). Fraud Detection: The Moderating Role of Fraud Risk Level. Journal of Business and Public Affairs, 3(1), 1–15.

Jaffar, N., Haron, H., Mohd Iskandar, T., & Salleh, A. (2011). Fraud Risk Assessment and Detection of Fraud: The Moderating Effect of Personality. International Journal of Business and Management, 6(7). DOI:

Jarah, B. A. F., AL Jarrah, M. A., Al-Zaqeba, M. A. A., & Al-Jarrah, M. F. M. (2022). The Role of Internal Audit to Reduce the Effects of Creative Accounting on the Reliability of Financial Statements in the Jordanian Islamic Banks. International Journal of Financial Studies, 10(3), 60. DOI:

Johari, R. J., Sanusi, Z. M., Isa, Y. M., & Ghazali, A. W. (2014). Comparative Judgment of Novice and Expert on Internal Control Tasks: Assessment on Work Effort and Ethical Orientation. Procedia - Social and Behavioral Sciences, 145, 352-360. DOI:

Kadous, K., & Magro, A. M. (2001). The Effects of Exposure to Practice Risk on Tax Professionals' Judgements and Recommendations*. Contemporary Accounting Research, 18(3), 451-475. DOI:

Kang, Y. J., Trotman, A. J., & Trotman, K. T. (2015). The effect of an Audit Judgment Rule on audit committee members' professional skepticism: The case of accounting estimates. Accounting, Organizations and Society, 46, 59-76. DOI:

Kasipillai, J., & Chen, L. E. (2014). Relevant Areas for Research to Gain Insight into Taxation Issues - MTRF Report (Issue March).

Khan, J., & Harding, N. (2020). Facilitating the application of auditors’ underlying sceptical disposition: The relationship between trait scepticism and basic human values. Accounting Research Journal, 33(1), 34-56.

Kidwell, R., Bennett, N., & Valentine, S. (2010). The limits of effort in understanding performance: what employees "do" and what might be done about it. IEEE Engineering Management Review, 38(4), 62-75. DOI:

Klassen, K. J., Lisowsky, P., & Mescall, D. (2016). The Role of Auditors, Non-Auditors, and Internal Tax Departments in Corporate Tax Aggressiveness. The Accounting Review, 91(1), 179-205. DOI:

Kogler, C., Mittone, L., & Kirchler, E. (2016). Delayed feedback on tax audits affects compliance and fairness perceptions. Journal of Economic Behavior & Organization, 124, 81-87. DOI:

Krambia-Kapardis, M., Christodoulou, C., & Agathocleous, M. (2010). Neural networks: the panacea in fraud detection? Managerial Auditing Journal, 25(7), 659-678. DOI:

Lederman, L. (2019). The Fraud Triangle and Tax Evasion. In SSRN Electronic Journal (Issue 3).

Malaysian Institute of Accountant. (2022). The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements (ISA 240). https://mia.org.my/wp-content/uploads/2022/09/ISA-240-Updated-2022.pdf

Md Noor, R., Abdul Aziz, A., Mastuki, N. A., & Ismail, N. (2012). Tax Fraud Indicators. Malaysia Accounting Review, 11(1), 43–57.

Miriam Ladi, O., & Henry, I. T. (2015). Effects of Tax Audit on Revenue Generation: Federal Inland Revenue Service, Abuja Experience. Journal of Good Governance and Sustainable Development in Africa (JGGSDA), 2(4), 67–80.

Mohd Iskandar, T., & Mohd Sanusi, Z. (2011). Assessing the effects of self-efficacy and task complexity on internal control audit judgment. Asian Academy of Management Journal of Accounting and Finance, 7(1), 29–52.

Mohd Iskandar, T., Nelly Sari, R., Mohd-Sanusi, Z., & Anugerah, R. (2012). Enhancing auditors' performance: The importance of motivational factors and the mediation effect of effort. Managerial Auditing Journal, 27(5), 462-476. DOI:

Mohd Nor, J., Ahmad, N., & Mohd Saleh, N. (2010). Fraudulent financial reporting and company characteristics: tax audit evidence. Journal of Financial Reporting and Accounting, 8(2), 128-142. DOI:

Mohd Sanusi, Z., & Mohd Iskandar, T. (2007). Audit judgment performance: assessing the effect of performance incentives, effort and task complexity. Managerial Auditing Journal, 22(1), 34–52.

Mohd Yusof, N. A., & Lai, M. L. (2014). An integrative model in predicting corporate tax fraud. Journal of Financial Crime, 21(4), 424–432.

Morris, R. J. (2009). Employee Work Motivation and Discretionary Work Effort. In the Queensland University of Technology (Issue December).

Morton, A., & Fasolo, B. (2009). Behavioural decision theory for multi-criteria decision analysis: a guided tour. Journal of the Operational Research Society, 60(2), 268-275. DOI:

Moyes, G. D. (2011). The Differences In Perceived Level Of Fraud-Detecting Effectiveness Of SAS No. 99 Red Flags Between External And Internal Auditors. Journal of Business & Economics Research (JBER), 5(6). DOI:

Moyes, G. D., Young, R., & Din, H. F. M. (2013). Malaysian internal and external auditor perceptions of the effectiveness of red flags for detecting fraud. International Journal of Auditing Technology, 1(1), 91. DOI:

Muhammad, I. (2013). An Exploratory Study of Malaysian Tax Auditors' Enforcement Regulatory Styles. Procedia Economics and Finance, 7, 188-196. DOI:

Muhammad, I., & Salikin, N. (2013). Tax Auditors’ Behaviour: A future focus for tax researchers. 5th Islamic Economics System Conference (IECONS 2013), September, 4–5.

Murorunkwere, B. F., Tuyishimire, O., Haughton, D., & Nzabanita, J. (2022). Fraud Detection Using Neural Networks: A Case Study of Income Tax. Future Internet, 14(6), 168. DOI:

Nadiah, A. H., Siti Hajar, A. M., & Zarinah, A. R. (2018). The influence of core competency skills of IRBM tax auditors towards their performance. Journal of Fundamental and Applied Sciences, 9(5S), 958. DOI: 10.4314/jfas.v9i5s.68

Nawawi, A., & Salin, A. S. A. P. (2018). Capital statement analysis as a tool to detect tax evasion. International Journal of Law and Management, 60(5), 1097-1110. DOI:

Nelson, M. W. (2009). A Model and Literature Review of Professional Skepticism in Auditing. AUDITING: A Journal of Practice & Theory, 28(2), 1-34. DOI:

Ngah, Z. A., Ismail, N., & Abd Hamid, N. (2022). A cohesive model of predicting tax evasion from the perspective of fraudulent financial reporting amongst small and medium sized enterprises. Accounting Research Journal, 35(3), 349-363. DOI:

Noch, M. Y., Ibrahim, M. B. H., Akbar, M. A., Kartim, K., & Sutisman, E. (2022). Independence And Competence On Audit Fraud Detection: Role of Professional Scepticism as Moderating. Jurnal Akuntansi, 26(1), 161-175.

Nolder, C. J., & Kadous, K. (2018). Grounding the professional skepticism construct in mindset and attitude theory: A way forward. Accounting, Organizations and Society, 67, 1-14. DOI:

Onuoha, L. N., & Dada, S. O. (2016). Tax audit and investigation as imperatives for efficient Tax Administration in Nigeria. Journal of Business Administration and Management Sciences Research, 5(5), 66–076.

Paino, H., Hadi, K. A. A., & Tahir, W. M. M. W. (2014). Financial Statement Error: Client's Business Risk Assessment and Auditor's Substantive Test. Procedia - Social and Behavioral Sciences, 145, 316-320. DOI:

Payne, E. A., & Ramsay, R. J. (2005). Fraud risk assessments and auditors' professional skepticism. Managerial Auditing Journal, 20(3), 321-330. DOI:

Persellin, J. S., Schmidt, J. J., Vandervelde, S. D., & Wilkins, M. S. (2019). Auditor Perceptions of Audit Workloads, Audit Quality, and Job Satisfaction. Accounting Horizons, 33(4), 95-117. DOI:

Peytcheva, M. (2013). Professional skepticism and auditor cognitive performance in a hypothesis-testing task. Managerial Auditing Journal, 29(1), 27-49. DOI:

Pokorny, K. (2008). Pay—but do not pay too much. Journal of Economic Behavior & Organization, 66(2), 251-264. DOI:

Popova, V. (2012). Exploration of skepticism, client-specific experiences, and audit judgments. Managerial Auditing Journal, 28(2), 140-160. DOI:

Pui Yee, C., Moorthy, K., & Choo Keng Soon, W. (2017). Taxpayers' perceptions on tax evasion behaviour: an empirical study in Malaysia. International Journal of Law and Management, 59(3), 413-429. DOI:

Quadackers, L., Groot, T., & Wright, A. (2014). Auditors' Professional Skepticism: Neutrality versus Presumptive Doubt. Contemporary Accounting Research, 31(3), 639-657. DOI:

Ratnawati, V. (2020). Factors affecting tax auditors' performance: the moderating role of locus of control. Problems and Perspectives in Management, 18(2), 36-45. DOI:

Said, L. L., & Munandar, A. (2018). The Influence of Auditor's Professional Skepticism And Competence On Fraud Detection: The Role Of Time Budget Pressure. Jurnal Akuntansi dan Keuangan Indonesia, 15(1), 104-120. DOI:

Samuel, M., & Dieu, R. J. D. (2014). The impact of taxpayers’ financial statements audit on tax revenue growth. International Journal of Business and Economic Development, 2(2), 51–60.

Sayed Hussin, S. A. H., & Iskandar, T. M. (2014). Exploratory Factor Analysis on Hurtt's Professional Skepticism Scale: A Malaysian Perspective. Asian Journal of Accounting and Governance, 4(1), 11-19. DOI:

Sayed Hussin, S. A. H., & Iskandar, T. M. (2015). Re-Validation of Professional Skepticism Traits. Procedia Economics and Finance, 28, 68-75. DOI:

Serim, N., Inam, B., & Murat, D. (2014). Factors Affecting Tax Compliance of Taxpayers : The Role of Tax Officer The Case of Istanbul and Canakkale*. Business and Economics Research Journal, 5(2), 19–31.

Slovic, P., Finucane, M. L., Peters, E., & MacGregor, D. G. (2004). Risk as Analysis and Risk as Feelings: Some Thoughts about Affect, Reason, Risk, and Rationality. Risk Analysis, 24(2), 311-322. DOI: 10.1111/j.0272-4332.2004.00433.x

Stankevicius, E., & Leonas, L. (2015). Hybrid Approach Model for Prevention of Tax Evasion and Fraud. Procedia - Social and Behavioral Sciences, 213, 383-389. DOI:

Stuebs, M., & Wilkinson, B. (2010). Ethics and the Tax Profession: Restoring the Public Interest Focus. Accounting and the Public Interest, 10(1), 13-35. DOI: 10.2308/api.2010.10.1.13

Sun, Y., Jia, W., & Liu, S. (2022). Is auditors' professional scepticism a "double-edged sword"? Accounting Forum, 46(3), 241-263. DOI:

Tabandeh, R., Jusoh, M., Md. Nor, N. G., & Zaidi, M. A. S. (2013). Causes of Tax Evasion and Their Relative Contribution in Malaysia : An Artificial Neural Network Method Analysis. Jurnal Ekonomi Malaysia, 47(1), 99–108.

Trotman, K. (2006). Professional judgment: are auditors being held to a higher standard than other professionals?

Usman, A., Kusumawati, A., & Mannan, A. (2021). He Effect of Work Experience, Motivation, and Culture On Auditor Performance With Mediation Self Efficacy. International Journal of Advanced Research, 6(12), 432-445. DOI:

Zakaria, M., Ahmad, J. H., & Noor, W. N. B. W. M. (2013). Tax evasion: A financial crime rationalized. Scientific Research Journal, 2(1), 1-4.

Zarefar, A., .Andreas, & Zarefar, A. (2016). The Influence of Ethics, Experience and Competency toward the Quality of Auditing with Professional Auditor Scepticism as a Moderating Variable. Procedia - Social and Behavioral Sciences, 219, 828-832. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Khalid, N. H., Sanusi, Z. M., Rafidi, M. M., Shafie, N. A., & Roni, S. M. (2023). Tax Officers’ Scepticism and Professional Judgment: The Mediation of Client Fraud Indicators Intensity. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 739-754). European Publisher. https://doi.org/10.15405/epsbs.2023.11.62