Computerized Accounting Information System and Task Characteristics in Indonesian Islamic Microfinance

Abstract

Indonesia as the nation with the largest Muslim population globally possesses significant potential as a prominent centre for economic and Islamic finance development on a global scale by the year 2024 as outlined in the Indonesian Islamic Economic Masterplan. The growth and proliferation of Islamic finance enterprises requires the adoption of technological advancements, particularly considering that over 70% of the Indonesian population utilizes digital technology. The utilization of digital technology presents a promising opportunity for Islamic Microfinance to enhance the sustainable performance. The objective of this study is to examine the effects of the Computerized Accounting Information Systems (CAIS) and task characteristics adoption on the task technology fit model. The empirical methodology employed in this study involves conducting a survey among a sample of 226 managers from the accredited Indonesian Islamic Microfinance. The collected data is then subjected to analysis using SEM-PLS techniques. The findings indicate that the integration of Computerized Accounting Information Systems (CAIS) characteristics, such as information and system quality, along with task characteristics, namely task analyzability have an impact on Task Technology Fit. This research provides a comprehensive understanding of TTF model in the context of accredited Indonesian Islamic Microfinance, with a specific focus on the integration of technology inside accounting information systems and the influence of task characteristics on its efficacy. The advancement of technology in Accounting Information Systems and the influence of task characteristics serve as drivers for enhancing cost efficiency, quality, and effective decision-making within the context of Indonesian Islamic Microfinance.

Keywords: Computerized Accounting Information System (CAIS), Islamic Microfinance, Task Characteristics, Task Technology Fit

Introduction

In Indonesia, Islamic Microfinance institutions had a function to conduct a triple-bottom-line mission, which was to develop the economy, empower the community, and preach (da'wah). It was aligned with Sustainable Development Goals (SDGs) program to improve formal living and public welfare based on Maqashid Sharia to protect five main interests: deen (faith), nafs (life), ‘aql (intellect), nasl (posterity) and maal (wealth) (Bin Syed Azman & Engku Ali, 2016). The recommendations of KNEKS (2019) suggested that empowering Islamic Microfinance institutions required improving the institutions, operations, finance, and microfinance technology or fintech. The usage of technology in Islamic Microfinance has become a requirement to sustain in globalization and the pandemic era.

The development of information technology has experienced rapid advancement and caused changes in the financial sector globally. Information technology became a challenge and requirement for the financial sector to overcome economic, globalization, tight competition, and the global environment (Davoren, 2019). One of the financial sectors which should follow the changes was Islamic Microfinance. The organization required an information system to support decision-making and survive in the competitive industry (Kelton et al., 2010). Therefore, it required a suitable information system, user’s task and technology.

Task-Technology Fit (TTF) was a significant and prominent theory to understand how far technology helped individuals and organization finish their task. Goodhue and Thompson (1995) stated that task technology fit had a high influence on producing performance if the information system suits the user’s task requirement. Basak et al. (2016) found the equality in TTF had potential for system usage and impacting the organizational performance. The previous research had examined TTF and had impacted performance, for instance Management Information System (Oliveira & Tam, 2016), Learning Management System (McGill & Klobas, 2009), Knowledge Management System (El Said, 2015), ERP Continuance (Cheng, 2018), and Internet Banking (Rahi et al., 2021).

Based on the previous research, the researcher analyzes the relationship between TTF on Islamic microfinance. The TTF model stated the importance of task technology fit toward impact performance with the antecedent variables (Computerized Accounting Information System (CAIS) and Task Characteristics). CAIS is the current system used in many organizations to collect, administer, process, protect, and report financial data and information by accountants, investors, consultants, managers, and other users. CAIS and Task Characteristics played an important role in designing a digitalized accounting information system which could ease users to finish their task so that it would impact on individual, team, and organizational performances (Goodhue & Thompson, 1995). The significant suitability of Computerized Accounting Information System (CAIS) and task characteristics required by users encouraged the requirement of research about task technology fit (TTF) performance. Therefore, this research examined a research model on applying TTF in Islamic Microfinance to fill the research gap related to the suitability of Computerized Accounting Information System (CAIS) and task characteristics. This research model argued about CAIS design based on the typical contingency variables: technology and organizational form (Dagiliene & Šutiene, 2019).

Literature Review

Task Technology Fit Model (TTF)

Goodhue and Thompson (1995) introduced the theoretical framework of TTF raised in this study to develop the research model. Based on the TTF model, the information system would significantly affect performance if the usage fitted with the user’s task requirement. Three primary levels explored in TTF are namely individual (Goodhue & Thompson, 1995), group (Drazin & de Ven, 1985), and organizational performances (Khazanchi, 2005). The current research centered on individual performance to measure how the suitability factors affected organizational performance. This research also provided an initial standard for a new theory of corporate technology fit for organizational performance (Alamri et al., 2020; Awad, 2020; Basak et al., 2016; Cheng, 2018; El Said, 2015; Liu et al., 2011; Oliveira & Tam, 2016; Rahi et al., 2021; Shuhidan, 2020; Staples & Seddon, 2004).

Task-Technology Fit Model was used to evaluate the suitability between Computerized Accounting Information System (CAIS) and task characteristics. Task Technology Fit has been able to help users to do their job task efficiently (Oliveira & Tam, 2016). It indicated that the suitability of Computerized Accounting Information System (CAIS) and task characteristics were two important things related to the adoption model of information systems on impact performance. The factors that established the TTF model were task characteristics, Computerized Accounting Information System (CAIS) characteristics, TTF and the usage (Yoo & Park, 2007). The TTF model presented knowledge and insight into how technology, user’s task characteristics and usage could influence user performance (Goodhue & Thompson, 1995). TTF suggested that task characteristics and Computerized Accounting Information System (CAIS) characteristics would influence user’s response about the suitability of CAIS impacted on individual, team, and organizational performances.

Computerized Accounting Information System (CAIS)

Harash (2015) revealed that organizations had changed their manual information system to Computerized Accounting Information Systems (CAIS) for financial reporting. A Computerized Accounting Information System (CAIS) is a technical device which associates the information system with economic function or organizational finance (Hosain, 2019). CAIS not only functioned to protect data but also had a broader role in collecting primary data and changing the data into valuable information for policy making or managerial decisions (Salehi & Arianpoor, 2021). Computerized Accounting Information System (CAIS) becomes necessary for achieving competitive advantage. Three factors could measure a successful Computerized Accounting Information System (CAIS): information, system, and service qualities (DeLone & McLean, 2003; Gorla et al., 2010; Nelson et al., 2005). The three dimensions used to measure Computerized Accounting Information System (CAIS) became an antecedent variable of task technology fit (TTF).

Task Characteristics

Task was a system user behavior to change an input into an output. Task characteristics would be interdependent with task and information requirements from an organization. Goodhue and Thompson (1995) defined task characteristics to empower the user to depend more on the information technology. Task characteristics became the source of information required to design Computerized Accounting Information System (CAIS) and answer many questions related to organizational operation. In this case, it forced its user to depend on the Computerized Accounting Information System (CAIS) in processing the operational information data. Task characteristics had two elements namely task variability and task analyzability (Goodhue & Thompson, 1995). Research by Shuhidan (2020) explained that task variability and task analyzability focused on the volume influence of information required to fill the unexpected situation and analyzed the information impact needed to end the ambiguity and overcome the uncertainty and non-clarity (Shuhidan, 2020).

Research Methodology

Research Model

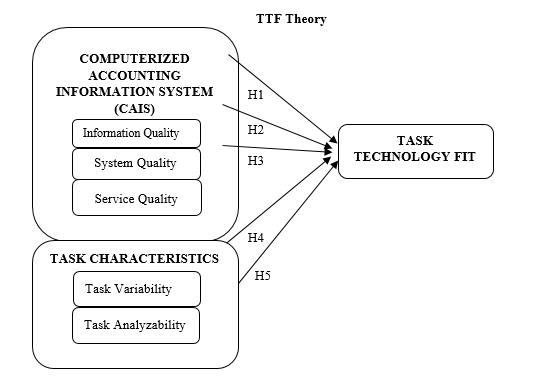

The research model for this study focused on the antecedent variable of TTF, namely the Computerized Accounting Information System (information, system, and service qualities) and task characteristics (task variability and task analyzability). The research model could be seen in Figure 1.

Based on the research model in Figure 1, the dependent variable was Task Technology Fit (TTF), whereas the independent variable was Computerized Accounting Information System (CAIS) and Task Characteristics. The relationship explored in this study and the related hypotheses were categorized as follows: (1) the influence between antecedent of Computerized Accounting Information System (CAIS) variable and TTF; and (2) the influence between antecedent of Task Characteristics variable and TTF. The researchers further discussed the above detail in the following Sub-Section.

Antecedents of Computerized Accounting Information System (CAIS) and Task Technology Fit (TTF)

The three fundamental assessments of information, system, and service qualities serve as a function of the characteristics of accounting information systems. DeLone and McLean (1992) created a comprehensive taxonomy based on analyzing 180 experimental studies in one of the earlier research projects to establish information system success indicators. The researchers used the model of information system (IS) from DeLone and McLean (2003) as the framework for information system research. Following that, the researchers developed a model of interdependencies between "temporal and causal" factors about six classifications that stand for the success of an information system, system quality, information quality, use and user satisfaction, individual and organizational impacts.

In the digital era, the Accounting Information System should transform into a Computerized Accounting Information System (CAIS). CAIS was a technical device connecting the information system with economic function or organizational finance (Hosain, 2019). CAIS was not only functioned to save data but also had a wider function to collect primary data and to change the data into useful information for decision or policy making by managers (Salehi & Arianpoor, 2021). Information system features are a strong predictor of TTF (Baghersefat et al., 2013; O’Donnell & David, 2000; Soudani, 2012). Additionally, earlier research has predicted that TTF is improved by accounting information system characteristics (Elbarrad, 2012; Mollanazari, 2012; Onaolapo & Odetayo, 2012). The previous research had also predicted that Computerized Accounting Information System (CAIS) characteristics could improve TTF (Shuhidan, 2020; Tam & Oliveira, 2016).

Accordingly, the previous analysis presumed that CAIS (information, system, and service qualities) positively related to TTF. Thus, it produced the following hypotheses:

Hypothesis 1: A significant positive relationship existed between information quality and TTF.

Hypothesis 2: A significant positive relationship existed between system quality and TTF.

Hypothesis 3: A significant positive relationship existed between service quality and TTF.

Antecedent of Task Characteristics and TTF

The previous research explained that task characteristics were a significant predictor of TTF (Awad, 2020; Rahi et al., 2021). Task characteristics represented the function of two fundamental determinants: task variability and task analyzability. The factors influencing each determinant should produce successful performance (Petter et al., 2013). Moreover, it had been expected that task characteristics improved TTF (El Said, 2015; Staples & Seddon, 2004; Tam & Oliveira, 2016).

Therefore, referring to the above explanation, the researchers expected that task characteristics (task variability and task analyzability) were positively related to TTF. Thus, the researchers formulated the hypotheses:

Hypothesis 4: A significant positive relationship existed between task variability and TTF.

Hypothesis 5: A significant positive relationship existed between task analyzability and TTF.

Methods

This research was conducted by a quantitative method by distributing survey questionnaires online. The target population in this study were Computerized Accounting Information System (CAIS) users as Top and Middle level Managers in accredited Islamic Microfinance under Indonesian BMT Association (PBMTI). The sampling process used a Purposive sampling method with the criteria of Islamic Microfinance. It used the Computerized Accounting Information Systems (CAIS) in its operational system, such as Mobile BMT (M-BMT), to serve members and to communicate all Islamic Microfinance activities using the digitalized system. The data analysis method used in this research was the statistical procedure of Structural Equation Modeling (SEM) using Smart PLS.

Result and Discussion

The researchers conducted the data analysis using Structural Equation Modeling (SEM) and calculated using Partial Least Square Test (PLS), selected as an instrument in the information system field research (Chin et al., 2003). The researchers chose PLS because: (1) not all items in the data were distributed normally (p < 0.01 based on Kolmogorov-Smirnov’s test); (2) there have yet to be researchers tested the research model in the literature; (3) it was a complex research model; (4) PLS calculation required ten times the most significant number of structural paths directed at a particular construct in the model. Smart PLS was the software used to analyze the relationship defined by the research model. The respondent characteristics for this research can be seen in Table 1.

This research was empirical research investigating the influence of Task Technology Fit on the usage of Computerized Accounting Information System (CAIS) and task characteristics in Islamic Microfinance. The hypothesis result indicated that all variables of Computerized Accounting Information System (CAIS) except system quality had significant influences on task technology fit as represented in H1, H2, and H3. Furthermore, one of the variables in Task characteristics called Task analyzability significantly influenced Task technology fit, as represented in H4. Meanwhile, the Task variability variable did not considerably affect TTF, as described in H5.

Hypothesis Testing

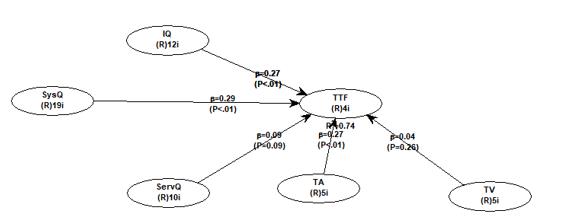

Figure 2 presents the hypothesis testing of this research model.

Based on Figure 2, the hypothesis testing result could be summarized as presented in Table 2.

H1 Testing: Information quality positively influenced the task technology fit (TTF)

, in which information quality positively influenced task technology fit. The testing result indicated that the total effect coefficient of information quality toward task technology fit was 0.27, significant at a p (probability) value of <0.01.

H2 Testing: System quality positively influenced the task technology fit (TTF)

in which system quality positively influenced task technology fit. The testing result indicated that the total effect coefficient of system quality toward task technology fit was 0.29, significant at the p (probability) value of <0.01.

H3 Testing: Service quality positively influenced the task technology fit (TTF)

, in which service quality had no positive influence on task technology fit. The testing result indicated that the total effect coefficient of service quality toward task technology fit was 0.09, non-significant with the p-value = 0.09 (p>0.05).

H4 Testing: Task analyzability positively influenced the task technology fit (TTF)

, in which task analyzability positively influenced task technology fit. The testing result indicated that the total effect coefficient of task analyzability toward task technology fit was 0.27, significant at the p (probability) value of <0.01.

H5 Testing: Task variability positively influenced the task technology fit (TTF)

, in which task variability had no positive influence on task technology fit. The testing result indicated that the total effect coefficient of task variability toward task technology fit was 0.04, non-significant with the p-value = 0.26 (p>0.05).

Conclusions

The elements of Task Technology Fit are the foundation of essential organizational needs in the digital era, including Islamic Microfinance, to be sustainable. The antecedent of TTF consists of Computerized Accounting Information Systems and Task Characteristics. The researchers investigated Computerized Accounting Information Systems with information, system, and service qualities. The researchers elaborated information quality with accuracy, format, completeness, and currency. System quality was elaborated with flexibility, easiness of usage, accessibility, response time, reliability, and integration aspects. Service quality was elaborated with responsiveness, assurance, and empathy aspects. Task Characteristics was measured by task variability and task analyzability. This research contributes to the Task Technology Fit literature by providing empirical evidence about using Computerized Accounting Information Systems (CAIS) and task characteristics in Islamic Microfinance. This research has a significant practical implication for managers to enhance cost reduction, quality improvement, and effective decision-making to achieve the organization’s competitiveness.

We concede that inherent limitations hampered our research. However, this should be an opportunity for future research. The first concession is the need for more support for Service quality and task variability variables which the data collection could not explain. The result indicated that the Indonesian Islamic Microfinance surveyed needs to improve the service quality regarding responsiveness, assurance, and empathy to CAIS users. Furthermore, task variability needs to increase regular use of standard procedures by the employees and the amount of information needed to tackle unexpected tasks. Therefore, future research can analyze the impact performance of TTF models such as cost efficiency and sustainability in Indonesian Islamic Microfinance.

Acknowledgment

The authors are grateful to the Accounting Research Institute, (ARI- HICoE), Universiti Teknologi MARA, Shah Alam, Malaysia, and the Ministry of Higher Education for providing research funding.

References

Alamri, M. M., Almaiah, M. A., & Al-Rahmi, W. M. (2020). The Role of Compatibility and Task-Technology Fit (TTF): On Social Networking Applications (SNAs) Usage as Sustainability in Higher Education. IEEE Access, 8, 161668–161681. DOI:

Awad, H. A. H. (2020). Investigating employee performance impact with integration of task technology fit and technology acceptance model: The moderating role of self-efficacy. International Journal of Business Excellence, 21(2), 231–249. DOI:

Baghersefat, M. J., Zareei, M. H., & Bazkiai, M. J. (2013). I NTERDISCIPLINARY J OURNAL O F C ONTEMPORARY R ESEARCH I N B USINESS Estimate Role of Accounting Information Systems in Presentation Managers Required Information.

Basak, S. K., Govender, D. W., & Govender, I. (2016). Examining the impact of privacy, Security, and trust on the TAM and TTF models for e-commerce consumers: A pilot study. 2016 14th Annual Conference on Privacy, Security and Trust, PST 2016, 19–26. DOI:

Bin Syed Azman, S. M. M., & Engku Ali, E. R. A. (2016). Potential role of social impact bond and socially responsible investment sukuk as financial tools that can help address issues of poverty and socio-economic insecurity. Intellectual Discourse, 24, 343–364.

Cheng, Y. M. (2018). A hybrid model for exploring the antecedents of cloud ERP continuance: Roles of quality determinants and task-technology fit. International Journal of Web Information Systems. DOI:

Chin, W. W., Marcolin, B. L., & Newsted, P. R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information Systems Research, 14(2). DOI:

Dagiliene, L., & Šutiene, K. (2019). Corporate sustainability accounting information systems: a contingency-based approach. Sustainability Accounting, Management and Policy Journal, 10(2), 260–289. DOI:

Davoren, J. (2019). The Three Fundamental Roles of Information System in Business. In LCC. https://smallbusiness.chron.com/three-fundame

DeLone, W. H., & McLean, E. R. (1992). Information systems success: The quest for the dependent variable. Information Systems Research, 3(1), 60–95. DOI:

DeLone, W. H., & McLean, E. R. (2003). The DeLone and McLean model of information systems success: A ten-year update. Journal of Management Information Systems, 19(4), 9–30. DOI:

Drazin, R., & de Ven, A. H. V. (1985). Alternative Forms of Fit in Contingency Theory. Administrative Science Quarterly, 30(4), 514. DOI:

El Said, G. R. (2015). Understanding Knowledge Management System antecedents of performance impact: Extending the Task-technology Fit Model with intention to share knowledge construct. Future Business Journal, 1–13. DOI:

Elbarrad, S. S. (2012). Rationalizing the Investment Decision in Computerized Accounting Information Systems - An Applied Study on Saudi Arabian Companies. International Journal of Economics and Finance, 4(8), 42–58. DOI:

Goodhue, D. L., & Thompson, R. L. (1995). Task-Technology Fit and Individual Performance. MIS Quarterly, 19(2), 213. DOI:

Gorla, N., Somers, T. M., & Wong, B. (2010). Organizational impact of system quality, information quality, and service quality. Journal of Strategic Information Systems, 19(3), 207–228. DOI:

Harash, E. (2015). The Role of Environmental Uncertainty in the Link between Accounting Information System and Performance Small and Medium Enterprises in Iraq. Global Journal of Management And Business Research, 15(2).

Hosain, M. S. (2019). The Impact of Accounting Information System on Organizational Performance: Evidence from Bangladeshi Small & Medium Enterprises. Journal of Asian Business Strategy, 9(2), 133–147. DOI:

Kelton, A. S., Pennington, R. R., & Tuttle, B. M. (2010). The effects of information presentation format on judgment and decision making: A review of the information systems research. Journal of Information Systems, 24(2), 79–105. DOI:

Khazanchi, D. (2005). Information technology (IT) appropriateness: The contingency theory of “FIT” and IT implementation in small and medium enterprises. Journal of Computer Information Systems, 45(3), 88–95. DOI:

KNEKS. (2019). Sharing Platform Keuangan Mikro Syariah Berbasis Baitul Maal Wat Tamwil (BMT) [Sharing Islamic Microfinance Platform Based on Baitul Maal Wat Tamwil (BMT)]. Komite Nasional Ekonomi Dan Keuangan Syariah. https://kneks.go.id/isuutama/8/sharing-platform-keuangan-mikro-syariah-berbasis-baitul-maal-wat-tamwil-bmt

Liu, Y., Lee, Y., & Chen, A. N. K. (2011). Evaluating the effects of task-individual-technology fit in multi-DSS models context: A two-phase view. Decision Support Systems, 51(3), 688–700. DOI:

McGill, T. J., & Klobas, J. E. (2009). A task-technology fit view of learning management system impact. Computers and Education, 52(2), 496–508. DOI:

Mollanazari, M. (2012). The Effects of Task, Organization and Accounting Information Systems Characteristics on the Accounting Information Systems Performance in Tehran Stock Exchange. International Journal of Innovation, Management and Technology, 3(4). DOI:

Nelson, R. R., Todd, P. A., & Wixom, B. H. (2005). Antecedents of information and system quality: An empirical examination within the context of data warehousing. Journal of Management Information Systems, 21(4), 199–235. DOI:

O’Donnell, E., & David, J. S. (2000). How information systems influence user decisions: A research framework and literature review. International Journal of Accounting Information Systems, 1(3), 178–203. DOI:

Oliveira, T., & Tam, C. (2016). Performance impact of mobile banking : Using the task-technology fit (TTF) approach. International Journal of Bank Marketing, 34(4). DOI:

Onaolapo, A. A., & Odetayo, T. A. (2012). Effect of Accounting Information System on Organisational Effectiveness: A Case Study of Selected Construction Companies in Ibadan, Nigeria. American Journal of Business and Management, 1(4), 183–189. DOI:

Petter, S., Delone, W., & McLean, E. R. (2013). Information systems success: The quest for the independent variables. Journal of Management Information Systems, 29(4), 7–62. DOI:

Rahi, S., Khan, M. M., & Alghizzawi, M. (2021). Extension of technology continuance theory (TCT) with task technology fit (TTF) in the context of Internet banking user continuance intention. International Journal of Quality and Reliability Management, 38(4), 986–1004. DOI:

Salehi, M., & Arianpoor, A. (2021). The relationship among financial and non-financial aspects of business sustainability performance: evidence from Iranian panel data. TQM Journal, 33(6), 1447–1468. DOI:

Shuhidan, S. M. (2020). Accounting Information System as Determinant of Cost Management Efficiency Among Managers in Malaysian Higher Education Institution. Thesis.

Soudani, S. N. (2012). The Usefulness of an Accounting Information System for Effective Organizational Performance. International Journal of Economics and Finance, 4(5). DOI:

Staples, D. S., & Seddon, P. (2004). Testing the technology-to-performance chain model. Journal of Organizational and End User Computing, 16(4), 17–36. DOI:

Tam, C., & Oliveira, T. (2016). Understanding the impact of m-banking on individual performance: DeLone & McLean and TTF perspective. Computers in Human Behavior, 61, 233–244. DOI:

Yoo, D. K., & Park, J. A. (2007). Perceived service quality: Analyzing relationships among employees, customers, and financial performance. International Journal of Quality and Reliability Management, 24(9), 908–926. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Wijayanti, P., Mohamed, I. S., & Daud, D. (2023). Computerized Accounting Information System and Task Characteristics in Indonesian Islamic Microfinance. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 461-471). European Publisher. https://doi.org/10.15405/epsbs.2023.11.39