Abstract

This research intends to examine and explore the impact of financial elements, specifically derivatives, debt shifting, and transfer pricing, on tax avoidance, taking into consideration the moderating variable of financial difficulty. The focus of the study revolved around the examination of banks and non-bank financial firms that were listed on the Indonesia Stock Exchange (IDX) during the period spanning from 2015 to 2020. The study selected 69 institutions as samples, employing precise selection criteria. It is essential to acknowledge that the study did not encompass financial institutions that have experienced losses within the designated timeframe, as these entities are exempt from tax obligations. The study's findings indicate that using E-views 12 software for data processing revealed a negative relationship between debt shifting and tax avoidance. Furthermore, the analysis demonstrated that financial derivatives do not significantly impact tax avoidance. Transfer pricing has a positive influence. Moreover, it is shown that financial difficulty does not influence the fluctuation of tax avoidance concerning variables such as debt shifting, derivatives, and transfer pricing.

Keywords: Derivatives, Debt Shifting, Tax Avoidance, Transfer Pricing and Financial Distress

Introduction

Tax receipts, which contribute around 80 percent of state revenue on average, are a stable and persistent source of income for Indonesia. The predicted realization of tax collections in Indonesia from 2015 to 2022 is roughly eighty percent of the predetermined objective. His report highlights the inadequate utilization of tax revenue in Indonesia, despite its significant potential for generating income, given its large population and thriving commercial sector. According to the Republic of Indonesia Law Number 17 of 2003 on Indonesian State Finances, state revenues encompass all income derived from tax revenues, non-tax state revenues, and grants from both domestic and international sources. As defined by Law Number 16 of 2009, which outlines the General Provisions and Tax Procedures, taxes are obligatory payments made by individuals or entities to the state, made without any corresponding compensation, and are directly allocated by the state for the purpose of improving the general welfare of the population.

Yustinus Prastowo, the respected Executive Director of the Center for Indonesia Taxes Analysis (CITA), emphasizes the need to recognize that tax collection in 2020 fell short of its intended target due to various factors. The commencement of deteriorating global economic conditions has significantly impacted commodity prices. The prevailing global economic conditions have led to a noticeable reduction in import activity, resulting in a decrease in value-added tax. The augmentation of non-taxable income and the magnitude of government tax incentives, such as tax holidays and tax deductions. Insufficient utilization of data and information about potential tax revenue sources. Due to the ongoing political climate, the state has been compelled to temporarily suspend access to data and delay various departments' operations related to the collection of taxes.

The company's tax burden is ascertained by evaluating the disparity between its profit and taxable income, commonly referred to as the book-tax difference. One potential strategy for mitigating tax liabilities involves minimizing the disparity between book and tax values, as Evers et al. (2016) discussed. Positive book taxation is an intriguing subject that warrants further exploration. The observed disparities can be attributed to the diligent endeavors of the taxpayer in minimizing the frequency of tax disbursements. This action results in a reduction in the amount of tax income collected by the state (Dyreng et al., 2019).

Despite being legal and not in violation of any laws, tax avoidance practices have a significant impact on government revenue. Consequently, the engagement in tax avoidance practices may lead to detrimental consequences for the government, particularly when it culminates in excessive tax avoidance. This, in turn, can have an adverse impact on the state's revenue generation. According to Kovermann and Velte (2019), there are three advantages that firms can obtain by refraining from tax payment, which are as follows: In this study, we aim to investigate the effects of a particular intervention on a specific population The decrease in the tax burden imposed on enterprises by the government. One potential advantage that managers may have, either directly or indirectly, is the opportunity to receive compensation from company owners or shareholders for their actions while also avoiding tax obligations (Blaufus et al., 2019). Managers are presented with many alternatives to address rent collection in light of the availability of perks. The concept of action refers to the process of engaging in a specific behavior or undertaking a particular Rent extraction, which refers to the behavior exhibited by managers when they prioritize personal interests over maximizing benefits for owners or shareholders. This behavior can manifest in several ways, such as engaging in aggressive financial statement preparation or conducting transactions with a specific party. The following instances exemplify scenarios in which rent extraction may take place.

Furthermore, Putri and Putra (2017) have identified many financial losses that organizations may experience as a direct consequence of their involvement in tax avoidance strategies. The potential imposition of monetary penalties by the appropriate tax authorities in the event of an audit and the identification of fraudulent tax-related activities. Subsequently, the company's standing is adversely affected due to audits performed by the pertinent tax authorities. Additionally, it is worth noting that other shareholders were cognizant of the managers' engagement in tax avoidance practices conducted to extract rent. These factors collectively contributed to the decline in share prices.

The banking and financial sectors exhibit a heightened vulnerability to criminal operations due to their inherent intricacies, posing significant challenges for law enforcement organizations in terms of identification and investigation. Tax avoidance is a frequently utilized approach in which individuals proactively plan to circumvent existing tax legislation. Numerous financial transactions and commercial activities occur inside the banking industry and financial organizations. This also suggests that multiple streams of tax collection will be contingent upon transactions. The potential for tax avoidance in the banking industry may be observed through two primary avenues: (i) Banks assuming the role of tax avoidance agents by implementing diverse schemes, and (ii) Banks functioning as intermediaries for third parties, facilitating tax avoidance activities.

Tax avoidance through the inclusion of unjustified expenditures is frequently noticed among senior management in banks and financial firms. This strategic maneuver seeks to present increased expenses, decreased earnings, or potential losses leading to reduced or nonexistent tax liabilities. As a result, Indonesia experiences an annual financial deficit ranging from 10 to 12 trillion rupiah due to tax avoidance practices carried out by banks and financial institutions. The tax avoidance matter can be exemplified at BCA Bank in Indonesia. Bank BCA employs tax avoidance tactics through tax loopholes to enhance managerial remuneration and perks, in addition to participating in non-standard expenditures to bribe officials. The claim above is supported by a study undertaken by Vania et al. (2018), wherein empirical data suggests that Islamic banks operating in Indonesia use profit management practices to engage in tax avoidance strategies. Taxation is a significant aspect that motivates enterprises to partake in profit management activities.

Transfer pricing is a strategic approach used to manipulate the effective tax burden by transferring the costs of goods, services, and the pricing of intangible assets to subsidiaries, affiliated companies, or entities with specific connections across different jurisdictions (Horngren et al., 2012). The process of determining transfer prices aims to establish fair transaction values between related entities, commonly referred to as transfer pricing. However, it has been observed that companies strategically divert their profits to subsidiaries in countries with lower tax rates (Richardson et al., 2013). The practice of transfer pricing can have a negative impact on the government's revenue, leading to an unfavorable view of it. A study has examined how transfer pricing affects the adoption of aggressive tax avoidance strategies by companies that employ transfer pricing techniques.

Treaty shopping, in conjunction with transfer pricing, is a frequently utilized tax avoidance method by multinational corporations. This practice can be viewed as a means to exploit tax-related vulnerabilities. Many countries adopt the strategy of taxing profits and interest payments directed to foreign corporations to achieve this objective. In anticipation of such practices, the Indonesian government enacted Indonesian Taxation Law No. 36 of 2008, which permanently reduced the dividend rate for individual domestic taxpayers from 15% to 10%. Additionally, the Indonesian government has chosen to terminate its tax treaties with countries identified as tax havens. The government's primary objective in employing this strategy is to make it more challenging for corporations to evade their tax obligations.

The Organization for Economic Co-operation and Development (OECD) (2019) and the Group of Twenty (G20) have jointly introduced an innovative initiative aimed at tackling the issue of climate change, known as Base Erosion and Profit Shifting (BEPS). The foundation of this program is rooted in a substantial empirical study that has identified the primary mechanisms through which Base Erosion and Profit Shifting (BEPS) occurs. One of the techniques employed by these channels involves the utilization of debt, which capitalizes on the tax-deductible nature of interest payments. The banking sector in numerous nations contributes approximately 25% of the total corporate tax income. Tax deductions can be claimed for interest payments, allowing for the potential occurrence of base erosion and profit shifting. When a financial institution obtains a loan from an external entity, the interest payments it accrues serve to decrease its taxable earnings.

Buettner et al. (2012) conducted a previous study examining bilateral internal debt data. This study observed significant beneficial effects of the bilateral tax rate differential, which they identified as the most precise indicator of incentives for debt shifting. Moreover, the practice of debt shifting is employed by multinational corporations to transfer their tax liability by utilizing loans from parent companies and overseas debt. Extensive research conducted by Koivisto et al. (2021) and Dharmapala and Riedel (2013) has substantiated the prevalence of debt shifting among multinational corporations operating in Germany. These corporations strategically engage in debt-shifting activities to diminish their indebtedness by redirecting profits from jurisdictions with high tax rates to those with lower tax rates, thereby alleviating their tax burden. Additionally, it is advisable to relocate the loan to a country that imposes minimal tax burdens.

Another study by Chang et al. (2013), Devi and Efendi (2018), and Lau (2016) have suggested that the use of financial derivatives can effectively mitigate a company's earnings volatility. This reduction is attributed to the direct impact of financial derivatives on a firm's cash flow, subsequently influencing its profitability. In addition to their role in revenue management, derivatives are also employed as a strategy for tax avoidance. According to Donohoe (2015), financial derivatives may be regarded as intricate mechanisms for tax avoidance. The complex nature of derivative arrangements provides companies with the opportunity to exploit inconsistencies in tax laws. Previous research has indicated a negative correlation between the Cash Effective Tax Rate (Cash ETR) and the fair value of hedged derivative assets, as demonstrated in the 2018 study by Devi and Efendi (2018). Additionally, there is a positive correlation between the derivative-transaction and the Cash Effective Tax Rate (ETR). This implies that to lower their income tax obligations, businesses purposefully postpone realising gains from non-hedging derivatives and recognise their losses sooner.

Transfer pricing refers to systematically allocating firm earnings to reduce or circumvent tax liabilities. Transfer pricing can also be denoted as intracompany price, intercorporate price, interdivisional price, or internal price. This term encompasses the pricing mechanism management employs to regulate the movement of goods and services inside a group of affiliated enterprises. Transfer pricing is a commonly discussed topic in accounting, defined as a strategic approach employed by associated organizations to allocate expenses and revenues among their divisions, subsidiaries, and joint ventures. Richardson et al. (2013).

Transfer pricing strategies are developed with the intention of taking advantage of opportunities to manipulate values, thereby maximizing individual profits, all the while evading the responsibility of paying taxes to the government. It is common practice for multinational enterprises (MNEs) to shift their earnings from high-tax jurisdictions to those with lower tax rates (Dharmapala & Riedel, 2013).

The primary goal of this study is to explore the connections between governance elements, which include debt shifting, derivatives, transfer pricing, and tax avoidance within the banking sector. Additionally, this study seeks to investigate the potential impact of financial distress on the relationship between governance variables and tax avoidance. The research aims to provide valuable insights into the factors that drive tax avoidance activities in the banking sector and to shed light on how financial difficulties can influence the link between governance characteristics and tax avoidance behavior.

Literature Review

Stakeholder Theory

According to Goyal (2022), stakeholder theory argues that the purpose of a firm should extend beyond mere profit generation and should also encompass the provision of benefits to all stakeholders. Financial institutions encompass a broad spectrum of individuals who have a vested interest in the organization and play an active role in its daily operations. These stakeholders include shareholders, management, employees, consumers, creditors, investors, regulators, and the government. They exhibit a strong connection with the institution and hold a significant role in shaping how financial resources are allocated and utilized within the institutions.

In order to ensure its survival and maintain a competitive edge, the firm's primary objective is to address the needs and concerns of its stakeholders effectively. This is consistent with the application of stakeholder theory. In the present era, enterprises must possess advanced technology to effectively compete and optimize profits for the betterment of their stakeholders. As a stakeholder with a vested interest, the government stands to gain significant benefits when a firm diligently fulfills its tax duties. Therefore, by acting as a shareholder, the state government can effectively get tax income that can be utilized to fund various developmental initiatives (Hanlon et al., 2014).

Positive Accounting Theory

The positive accounting theory, developed by Schroeder et al. (2019), elucidates the correlation between managerial or financial report creator conduct and distinct economic factors. This theory facilitates the elucidation and prediction of accounting procedures (Watts & Zimmerman, 1986). As a result, managers will exhibit greater caution and adopt a more conservative approach while engaging in tax avoidance strategies.

The Positive Accounting Theory is a field of study that delves into understanding what drives management's attitude toward accounting standards, as well as the company's involvement in lobbying efforts aimed at influencing these standards. In essence, it seeks to uncover the factors that shape a company's financial reporting practices and its response to accounting regulations. Within this theory, three central hypotheses are put forth: the bonus plan hypothesis, which suggests that managers may manipulate accounting figures to align with their compensation incentives; the debt covenant hypothesis, which asserts that companies might engage in earnings management to avoid breaching debt agreements; and the political cost hypothesis, which posits that organizations may use accounting methods strategically to reduce the perceived negative impact of their actions on society or regulatory authorities. These hypotheses collectively offer a framework for understanding the driving forces behind financial reporting practices in various organizations.

Tax Avoidance

Graham et al. (2014) claimed that Tax Avoidance is a strategic business practice employed by management to achieve organizational goals. According to Payne and Raiborn (2018), tax avoidance refers to strategically utilizing ambiguities within tax legislation to gain advantages for the corporation. According to Wang (2019), tax avoidance refers to the lawful circumvention of tax regulations to minimize business tax liability by leveraging tax provisions. Previous research has utilized various measures to assess Tax Avoidance, with one indication being the Effective Tax Rate (Hanlon & Heitzman, 2010). The effectiveness of the Effective Tax Rate (ETR) as a metric for assessing the level of Tax Avoidance can be determined when a company's ETR is lower than the average ETR within its industry. The Effective Tax Rate, is a financial metric that quantifies the proportion of a company's tax obligation to its pretax income. This is determined by dividing the tax expense by the pretax income..

Debt Shifting

Debt shifting refers to the strategic maneuver of generating interest income in jurisdictions with low tax rates and retaining it in jurisdictions with high tax rates, thereby exploiting the disparity between tax deductions in high-tax jurisdictions and the obligatory tax payments in low-tax jurisdictions, leading to tax savings (Ruf & Weichenrieder, 2012). The leverage ratio in multinational firms tends to exhibit greater sensitivity to taxation due to fluctuations in foreign debt. Local taxing practices influence the corporate debt policy of a nation. Multinational firms commonly relocate their debt to jurisdictions with higher tax rates to mitigate their tax liabilities. This phenomenon leads to a decrease in profit margins for businesses and a reduction in their tax obligations. Multinational corporations strategically transfer their Intellectual Property assets to subsidiaries located in jurisdictions with lower tax rates, intending to reallocate profits and thus reduce their tax liabilities.

Financial Derivative

Zang (2012) argues that leveraging derivative trades offers a viable avenue for managing earnings. Given the significant uptick in derivative transactions in recent years, businesses have increasingly turned to derivative trades as a strategy to alleviate their tax burden (Wyman, 2013). Consequently, derivative transactions serve as a means to reduce tax liabilities.

The use of derivatives-transaction for tax avoidance stems from the ambiguous nature of tax regulations governing derivative transactions, a point highlighted in Donohoe's (2012) research findings. Companies take advantage of this lack of clarity as a legal opening to avoid their tax responsibilities. In their research, Oktavia and Martani (2013) noted a substantial correlation between financial derivative variables and the practice of tax avoidance.

Transfer Pricing

Transfer pricing is fundamentally a concept that emphasizes fair transactions within affiliated companies to establish transfer prices. However, in practice, corporations often strategically shift profits to entities with specific affiliations in countries that offer low tax rates, as highlighted by Richardson and colleagues in 2013. This maneuvering can potentially harm government revenues, and transfer pricing has acquired a negative reputation. Numerous research endeavors have sought to investigate the impact of transfer pricing on the adoption of aggressive tax avoidance tactics by companies utilizing these mechanisms. Earlier studies conducted by Sikka and Willmott (2010) and Amidu et al. (2019) shed light on the strategies employed by corporations engaged in such practices, both in emerging and developed economies.

Financial Distress

One of the aims pursued by established businesses is the maximizing of financial hardship, as it has been argued that a heightened state of financial distress might lead to an increase in shareholder wealth. According to Subramaniam et al. (2011), financial distress serves as a reflection of a firm's market value, representing the collective assessment made by investors regarding the overall performance of the company. The interdependence between a company's success and the occurrence of financial distress suggests a strong association between firm performance and financial distress (Tarmidi & Murwaningsari, 2019). Moreover, firms commonly engage in cost minimization strategies, specifically targeting tax expenses, as taxes do not have a direct impact on firm performance. Hence, it is common for corporations to employ tax avoidance strategies in order to mitigate their tax liability.

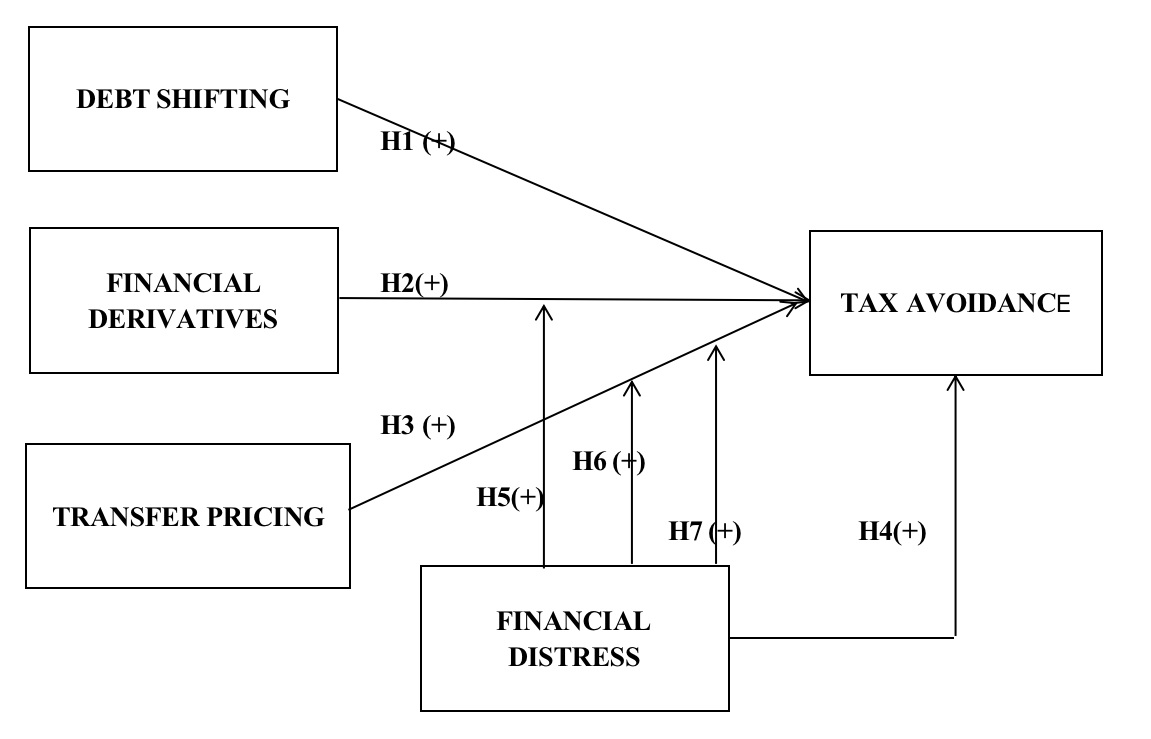

Framework

The research framework presented in Figure 1 explains the theoretical underpinnings of this study. The subsequent research framework aligns with the proposed hypothesis.

Hypothesis

H1 : Debt Shifting has a significant and positive effect on Tax Avoidance.

H2: Financial Derivatives have a significant positive and effect on Tax Avoidance.

H3 : Transfer Pricing has a significant positive effect on Tax Avoidance.

H4 : Financial Distress has a significant and positive effect on Tax Avoidance.

H5 : Financial Distress has significant interaction effect between debt shifting on tax avoidance.

H6 : Financial Distress has significant interaction effect between Financial Derivatives on tax avoidance.

H7 : Financial Distress has significant interaction effect between tatransfer pricingon tax avoidance.

Research Method

Secondary data sources will be used to acquire data for the study. Secondary data is research data collected from a third party or gained indirectly from a second party (Saunders et al., 2012). This research aims to identify Indonesian banks that have gone through the process of becoming publicly traded companies. From 2015 to 2020, the financial accounts of conventional banks and non-bank financial enterprises will be examined. The study will use a purposive sampling technique that considers specific criteria.

The sample criteria are as follows:

This study investigated financial institutions that were listed on the Indonesia Stock Exchange between 2015 and 2020.

The investigation excluded Sharia banks, regional banks, and Islamic non-bank financial entities listed on the Indonesia Stock Exchange-IDX from 2015 to 2020.

.The Operational Definition of Variables

The study's goal is to look into the impact of three element of finance on tax avoidance in a specific context: debt shifting, financial derivatives, and transfer pricing. These variables are considered independent, whereas tax avoidance is dependent. An interaction variable is also included to assess the moderating effect of financial distress on the link between these independent variables and tax evasion. The independent and dependent variables will be thoroughly discussed in the following sections.

The following is the measure of each variable used in this study (Table 1):

Analysis and Discussion

After applying a filtration technique, we found only 69 financial institutions that met all the necessary criteria for purposive sampling. These 69 institutions were then selected as the samples to accurately represent the study's population (Table 2).

Descriptive statistics

Table 3 presents the processed model's values for each variable, including the mean, maximum, and minimum values, along with their corresponding standard deviation (sd). The descriptive statistics of each research variable are explained below.

Debt Shifting (DS)

The data about the debt shifting variable reveals a mean value of 0.035887, accompanied by a standard deviation of 0.041501. Based on these findings, it can be inferred that the mean value is comparatively lower than the standard deviation, implying that the data about this variable does not exhibit a normal distribution. Consequently, the data shows heterogeneity and encompasses diverse values, posing challenges in establishing conclusive inferences regarding the variable's significance within the research investigation.

Financial Derivative (DERV)

Data analysis performed with Eviews 12 software shows that the DERV variable has an average value of 0.000908 and a standard deviation of 0.002914. The results show that the values of this variable are distributed unevenly, with an average value lower than the standard deviation. However, the data are also heterogeneous, which implies that there may be a wide range of values for this variable which can influence its significance in research studies.

Transfer Pricing (TP)

The transfer price variable exhibits a mean value of 0.045371 and a standard deviation of 0.124923, suggesting that the distribution of data for this variable is non-uniform. The observation that the mean value is smaller than the standard deviation implies that the transfer pricing variable exhibits a substantial range of values. Consequently, the reliability of the data may be compromised, thereby hindering the ability to derive accurate and definitive findings on the influence of the variable in the research investigation.

Financial distress (FD)

The financial distress variable exhibits a wide range of values, with a mean of 1.786 and a standard deviation of 4.8361. The findings indicate that the distribution of data for this variable is non-uniform, specifically about the values of the financial distress variable that may potentially impact the overall findings of the research study.

Panel Data Regression Analysis

Determine which model is best suited to the research, taking into account the standard effect model, fixed-effect model, and random-effect model.

The Chow Test

In order to determine the appropriate choice between a common or fixed effect in the study model, we conducted the Chow test. The cross-section probability value of the Chi-Square test was determined to be 0.2366, surpassing the significance threshold of 0.05. In this investigation, the common-effect model was employed for the regression equations, and the Hausman test was utilized.

The Hausman Test

The Hausman test was employed to determine the appropriate model for the research, either fixed or random effects. The test generated a probability value 0.0174, which falls below the significance threshold of 0.05. The regression equation results in this investigation were derived from a fixed effect model.

Lagrange Test

The Lagrange test was performed on the processed data, resulting in a probability of 0.6215 for the Breusch-Pagan cross-section. Nevertheless, it is worth noting that this value surpasses the conventional significance threshold of 0.05, a widely employed criterion in statistical analysis for assessing the confidence level in the obtained outcomes. The investigation utilized the Common Effect Model, a statistical model commonly used to estimate an independent variable's impact on a dependent variable. To ensure the attainment of precise and dependable estimates utilizing this model, it is imperative to ascertain the suitable regression parameters contingent upon the distinctive attributes of the data under analysis.

Normality Test

A normality test aims to assess whether the sample used in the research adheres to the characteristics of a normal distribution. The dataset needs to display a normal distribution at a significance level of 0.05 or 5% to construct an appropriate regression model. This requirement is necessary to apply panel data regression analysis effectively. After conducting the analysis using Eviews 12, it was determined that all variables in the dataset indeed follow a normal distribution. This finding is further supported by the Jarque-Bera probability value of 0.554, which surpasses the predefined significance level of 5%. Thus, the data conforms to a normal distribution based on a sample size of 388 observations.

Heteroscedasticity Test

The purpose of the Heteroscedasticity test is to identify whether there is a relationship between the independent variables in the regression model. When the probability value is greater than 0.05, it indicates that the regression model does not suffer from heteroscedasticity. After analyzing the data using EViews 9 and the Glejser test, as presented in Table 4, it was observed that none of the probability coefficients had a value less than 0.05. This finding implies that the data lack heteroscedasticity, which means that the variability of the errors in the regression model is consistent across all levels of the independent variables.

The Multicollinearity Test

To test for the presence of multicollinearity, one must examine the value of the correlation coefficient. If the correlation coefficient between independent variables exceeds 0.80, based on Table 5, the result implies that multicollinearity may impact the model. Conversely, if the correlation coefficient between independent variables is less than 0.80, the model is free from multicollinearity issues. However, in the table presented above, the correlation coefficient for the interaction variable is 0.958, indicating that the model is affected by multicollinearity. This issue often arises due to the interaction or multiplication of two or more independent variables, as noted by Gujarati (2022).

The Autocorrelation Test

The autocorrelation test is employed in a linear regression model to assess whether there is a link between the error in period t and the confounding error in period t-1. The Durbin-Watson test was employed in this investigation to detect autocorrelation (DW test). According to Table 6, the Durbin-Watson statistic value of 1.501657 is between the upper limit value (dU) 1.7813 and the lower limit value (dL) 1.5762, and the regression model in this study does not demonstrate negative autocorrelation.

Panel Data Regression Analysis

This study employs regression analysis panel data from 69 organizations collected over six years, yielding 388 samples that fit the conditions in the equation below:

ETR i,t = α0 +β1DSi,t +β2DERVi,t + β3TPi,t + β4FDi,t + β5FD*DSi,t + β6FD*DERVi,t + β7FD*TPi,t e

Description :

ETR: Tax Avoidance

α0 : Constant

Β : Regression coefficient

DS : Debt Shifting

DERV : Financial Derivative

TP : Transfer pricing

FD: financial distress

E : Error term

ETR i,t = 0.168 + 0.6476DSi,t + 17.475DERVi,t - 0.1663TPi,t - 0.008FDi.t + 0.074FD*DSi,t - 12.326FD*DERVi,t + 0.0191FV*TPi,t + e (2)

The interpretation of the regression equation results in Table 7 is as follows:

The initial insight derived from the regression equation in Table 7 indicates that the Effective Tax Rate (ETR) becomes zero when the independent variable remains constant.

The regression coefficient of 0.647 implies a positive relationship between Debt Shifting (DS) and Effective Tax Rate (ETR). This implies that for each additional unit of DS, there is a corresponding increase of 0.647 in the ETR. This observation suggests that a higher level of Debt Shifting (DS) might potentially lead to an increase in the explanatory and theoretical richness (ETR).

The regression coefficient for the Financial derivative (DERV) is estimated to be 17.476, suggesting that a one-unit increase in Financial derivative is associated with a corresponding increase of 17.476 in the Effective Tax Rate (ETR).

The regression analysis shows that Transfer Pricing (TP) has a negative regression coefficient of -0.166325. This means that for every unit increase in Transfer Pricing, the Effective Tax Rate (ETR) is expected to decrease by 0.166325.

Financial distress (FV) has a regression coefficient of -0.008, which means that if financial distress increases by one unit, the Effective Tax Rate (ETR) decreases by 0.008.

The regression coefficient for the interaction between financial distress and debt shifting is 0.074. In practical terms, this indicates that, with all other factors held constant, a one-unit increase in the interaction between financial distress and debt shifting results in a 0.074 percentage point increase in the effective tax rate.

The regression coefficient for the interaction between financial distress and financial derivatives is -12.326. This implies that, while keeping all other variables unchanged, a one-unit increase in the interaction between these two variables leads to a decrease of 12.326 in the Effective Tax Rate (ETR).

Furthermore, the interaction coefficient between financial distress and transfer pricing is 0.019. This suggests that if the interaction between financial distress and transfer pricing increases by one unit while all other variables remain constant, the effective tax rate will rise by 0.019 percentage points.

Hypothesis Test

Partial Test (t-Test)

The analysis was conducted with a significance level (α) of 5% to assess the significance of the dependent, independent, and moderating variables (α = 0.05). Table 7 provides an overview of the results from the panel data regression. Upon reviewing the findings presented in Table 7, the outcomes of the partial t hypothesis testing were derived, leading to the following conclusions:

The first hypothesis of this study (H1) examines the association between debt shifting and tax avoidance. According to the regression results in Table 8, the p-value for debt shifting is less than or equal to 0.001. Furthermore, the regression coefficient related to the debt-shifting variable is determined to be 0.645. This indicates that as the level of debt shifting increases, there is a corresponding rise in the Effective Tax Rate (ETR), resulting in a decrease in tax avoidance. Consequently, the practice of debt shifting hurts tax avoidance. As a result, it can be inferred that the null hypothesis (H1) is rejected.

The second hypothesis of this study (H2) investigates the impact of financial derivatives on tax avoidance. According to the regression results in Table 8, the p-value associated with financial derivatives is 0.134, which exceeds the predetermined significance level of 0.05. Additionally, the obtained regression coefficient for the financial derivatives variable is 17.475. Consequently, it can be inferred that financial derivatives have an inconsequential influence on tax avoidance. Thus, hypothesis H2 is considered unverified or unsupported.

The third hypothesis of this study (H3) aims to analyze the effect of transfer pricing on tax avoidance. The findings from the regression analysis, as presented in Table 7, demonstrate that the probability value for transfer pricing is statistically significant at the 0.05 level, with a p-value of 0.0196. Furthermore, the regression coefficient for the transfer pricing variable is estimated at -0.167. Consequently, it can be deduced that an increase in transfer pricing results in a reduction in the effective tax rate (ETR), indicating the presence of tax avoidance. Therefore, transfer pricing has a favorable impact on tax avoidance. Based on the available evidence, the hypothesis H3 is accepted.

The present study posits Hypothesis 4 (H4), which proposes that financial distress strengthens the influence of debt shifting on the practice of tax avoidance. The observed probability of financial distress is shown to have a significant interaction effect on the association between debt shifting and effective tax rate (ETR), with a value of 0.1091. This probability is above the predetermined significance level of 0.05. The estimated regression coefficient for the variable representing financial distress is 0.074. Nevertheless, the t-test results suggest no significant moderation effect of the company's financial difficulty on the relationship between debt shifting and tax avoidance. H4 is rejected.

The research in question examines the fifth hypothesis (H5), which aims to explore the potential worsening of the influence of financial derivatives on tax avoidance by economic distress. The variable in question exhibits a regression coefficient of -12.326. Furthermore, the probability value associated with the interaction between financial derivatives and ETR in financial distress is 0.223, above the predetermined significance threshold of 0.05. The t-test results suggest no significant amplification of the association between financial derivatives and tax avoidance by financial difficulty. The null hypothesis H5 is rejected.

The sixth hypothesis (H6) of the study posits that financial suffering amplifies the influence of transfer pricing on the practice of tax evasion. The p-value indicating the importance of the moderation effect of financial distress on the relationship between transfer pricing and effective tax rate (ETR) exceeds the threshold of 0.05. The coefficient of regression for the variable above is 0.0191. Nevertheless, the t-test results indicate that financial difficulty was not a moderating variable in the relationship between transfer pricing and tax oidanceav. The hypothesis H6 is rejected

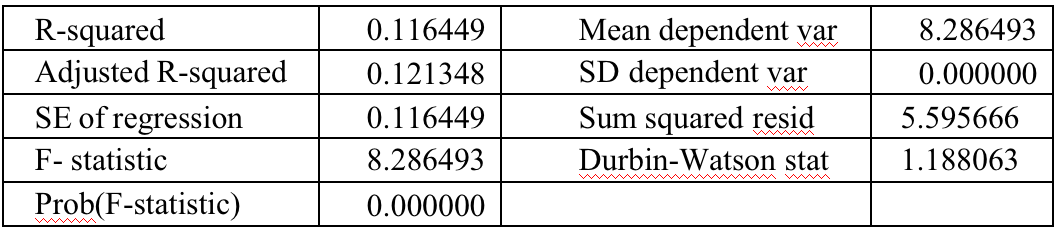

Coefficient of Determination Test (Adjusted R2)

The Adjusted R2 is a metric used to evaluate the model's capability to explain the connection between the variations in the dependent and independent variables in the study. The adjusted R2 value falls within the range of 0 and 1. The outcomes of the panel data regression are displayed in the table below:

Based on the data provided in Figure 8, it can be deduced that the adjusted R2 value amounts to 0.122, equivalent to 12.122% in percentage terms. This finding implies that the variables related to ownership structure, such as debt shifting (DB), financial derivatives (DERV), transfer pricing, and financial distress, collectively explain 12.122% of the variation in tax avoidance. Nevertheless, it is worth noting that the remaining 87.878% of the variance can be attributed to other variables that were not encompassed within the scope of this particular study.

Finding and Discussion

Debt Shifting has a significant positive effect on Tax Avoidance

The principal aim of this research is to examine the impact of financial variables, specifically debt shifting, on the practice of tax avoidance within the banking sector and non-bank financial institutions in Indonesia over the span of 2015 to 2021. Debt-shifting refers to a tax avoidance tactic that encourages corporations to decrease their taxable income by means of deducting interest expenses (Taylor & Richardson, 2013). Corporations’ effort to optimize the allocation of debt costs through the utilization of debt shifting strategies, which aim at reducing their earnings and subsequently mitigate the associated tax liability. While it is true that engaging in this practice can potentially alleviate the tax burden, scholarly research has demonstrated that debt increasing the avoidance of taxes. This implies that the tax avoidance strategies employed by corporations tend to diminish when they partake in debt shifting activities. The inference can be made that the tax liabilities of the company will be reduced. According to a study conducted by Boubaker et al. (2022), an examination was undertaken to explore the correlation between debt shifting and tax avoidance within the context of European banks. The empirical evidence suggests that the practice of debt shifting has the potential to alleviate the tax liability of banks. However, it is important to note that this effect is not particularly pronounced in jurisdictions characterized by more stringent tax regulations. The statement suggests that within specific circumstances, the act of debt shifting may not effectively result in the avoidance of taxes.

Financial Derivatives have a significant positive effect on Tax Avoidance

The objective of research is to analyse the influence of financial derivatives on the practice of tax avoidance. The research findings suggest that there is no substantial impact of financial derivatives on tax avoidance within banking institutions. In their study, Lim (2011) conducted an investigation into the potential influence of derivative-transaction on the practice of tax avoidance within publicly listed companies in the context of South Korea. Their research findings indicate that the utilization of financial derivatives does not substantially impact the practice of tax avoidance within these corporations. The preceding outcome aligns with the research conducted by Oktavia and Martani (2013) in Indonesia. Their study similarly indicated a lack of statistically significant correlation between the utilization of financial derivatives and tax avoidance among manufacturing firms listed on the Indonesia Stock Exchange. It is imperative to acknowledge that divergent studies have identified a positive correlation between financial derivatives and the practice of tax avoidance. Chyz et al. (2019) conducted a comprehensive study on companies operating within the United States, presenting compelling evidence supporting a positive correlation. The divergent findings observed in this study indicate that the association between financial derivatives and tax avoidance is subject to contextual factors and influenced by various factors that may differ across regions or industries. Therefore, it is imperative to conduct additional research in order to acquire a comprehensive comprehension of the mechanisms that underlie this correlation and its implications for tax avoidance strategies employed by financial institutions, including banks.

Transfer Pricing has a positive effect on Tax Avoidance

The key goal of this study is to evaluate the impact of transfer pricing on tax avoidance within the banking industry, with a particular emphasis on comprehending the correlation between transfer pricing and the prevalence of tax avoidance strategies employed by banks. The empirical findings of this study elucidate a positive correlation between the escalation of transfer pricing within banking institutions and the concomitant proliferation of tax avoidance strategies. This finding aligns with the outcomes of a study conducted by Sikka and Willmott (2010), which examined the influence of transfer pricing on tax avoidance within the context of manufacturing firms in Indonesia. It is important to acknowledge that transfer pricing activities are frequently observed in multinational corporations with affiliated entities in countries that provide comparatively lower tax rates (Richardson et al., 2013).

Financial Distress has a positive effect on tax avoidance

The primary objective of this research is to investigate the impact of financial distress on tax avoidance within 369 publicly listed companies in Vietnam from 2008 to 2020. The findings demonstrate a positive association between financial distress and tax avoidance, suggesting that companies facing higher capital risk are more likely to engage in tax avoidance practices. This result is consistent with the study conducted by Dang and Tran (2021), which also found a positive relationship between financial distress and tax avoidance, highlighting that companies with greater capital risk are more inclined to resort to tax avoidance. Furthermore, the study finds that smaller businesses are more likely to evade paying taxes. Additional research into the relationship between financial distress and tax evasion can bring further insights into this field.

Furthermore, Mao and Wu (2019) discovered that economic suffering impacts tax avoidance in their Taiwan study. According to the findings, financially troubled enterprises are more prone to participate in tax avoidance. On the other hand, Zhao (2023) investigated the relationship between perceived auditor quality and the earnings response coefficient. According to their findings, the perceived quality of auditors determines the market's reaction to a company's earnings statements. Richardson et al. (2015) found a positive correlation between financial distress and tax aggressiveness and a positive correlation between the global financial crisis and tax aggressiveness. Furthermore, the positive relationship between financial distress and tax aggressiveness was amplified during the crisis.

Financial Distress interaction between Debt Shifting on Tax Avoidance

The primary goal of this study is to look into the impact of financial distress and debt shifting on tax avoidance. Avoiding taxes has become a significant topic of discussion in recent years, attracting the attention of the Indonesian government. Business strategy is listed as one of the primary elements affecting tax avoidance, alongside financial distress as another significant cause. Swandewi and Noviari (2020) found that the financial distress variable had a significant positive effect on tax avoidance in Indonesia setting. The research sample consists of 292 companies listed on the Indonesia Stock Exchange in the manufacturing, trade, and construction sectors from 2015 to 2018, with 1168 data points collected. The analysis used multiple linear regression, revealing that the prospector's business plan positively impacts tax avoidance.

In contrast, the defender's company strategy has no meaningful impact on tax avoidance. Surprisingly, the findings show that the financial crisis did not significantly impact tax avoidance in the enterprises studied. These findings shed light on the complex link between financial distress, debt shifting, company tactics, and tax avoidance methods in the Indonesian environment.

Financial Distress interaction between Financial Derivatives on Tax Avoidance

This study investigates the impact of financial distress and transfer pricing on tax avoidance. Oktavia et al. (2019) found no association between the level of financial derivatives usage and the level of tax avoidance in their study. This result implies that financial derivatives can be used to implement tax avoidance tactics. Furthermore, their data show that the influence of financial derivatives on tax avoidance is less evident in countries with competitive tax structures vs. those with less competitive tax environments. This finding means that in countries with strict tax laws, the use of financial derivatives for tax avoidance may be substituted by the government's tax breaks and benefits.

On the other hand, Dang and Tran (2021) studied the impact of financial difficulty on tax avoidance in Vietnamese listed companies. From 2008 to 2020, their findings show no substantial association between financial difficulties and tax avoidance among 369 listed firms in Vietnam. According to the report, corporations are more likely to participate in tax evasion methods as they confront greater capital risk and financial difficulties. Furthermore, the statistics show that smaller businesses are more likely to avoid paying taxes.

Financial Distress interaction between Transfer Pricing on Tax Avoidance

The research conducted by Maulana et al. (2018) revealed no significant interaction between financial distress and transfer pricing on tax avoidance. The study found that financial distress does not influence the use of transfer pricing as a tax avoidance strategy. In other words, companies experiencing financial distress do not resort to transfer pricing to avoid taxes. However, this study highlights the possible influence of financial distress in shaping the relationship between transfer pricing and future tax avoidance. It emphasizes the importance of considering both factors in understanding tax avoidance behavior in a business context.

Additionally, Nadhifah and Arif (2020) investigated the impact of transfer pricing, fiscal loss compensation, and financial distress on tax aggressiveness in mining sector companies listed on the Indonesia Stock Exchange between 2016 and 2020. The research selected a sample of 70 companies from the mining sector using purposive sampling. The data were analyzed using panel data regression with Eviews 12. The findings indicate that financial distress has a positive influence on tax aggressiveness. However, the study did not find a significant effect of transfer pricing and fiscal loss compensation on tax aggressiveness in the examined companies (Pamungkas & Nurcahyo, 2018). These results shed light on the factors influencing tax aggressiveness in the mining sector and contribute to a better understanding of tax behaviors in the context of the Indonesia Stock Exchange.

Conclusions and Recommendations

The primary objective of this study is to examine the impacts of debt shifting, financial derivatives, transfer pricing, and financial distress on tax avoidance within publicly traded banking and non-bank financial institutions on the Indonesia Stock Exchange. The study utilized a sample size of 69 businesses. According to the study's findings, debt shifting negatively affects tax avoidance, financial derivatives have no impact on tax avoidance, and transfer pricing positively affects tax avoidance. Furthermore, the study observed that financial distress does not interact with the relationship between debt shifting and tax avoidance, nor does it interact with the relationship between financial derivatives and tax avoidance.

Limitations and Suggestions

The present study has identified limitations that provide valuable opportunities for future researchers to achieve more precise and comprehensive outcomes. Firstly, the study's scope was restricted to conventional banking firms publicly listed on the Indonesia Stock Exchange (IDX) between 2015 and 2020, with a relatively limited sample size of 69 companies selected through purposive sampling. To enhance the generalizability of findings and enrich future research, it is advisable to include a broader range of participants, encompassing not only conventional banking institutions but also Islamic banking entities and non-bank financial enterprises.

Secondly, this study primarily focused on independent variables related to the financial aspects, such as debt shifting, financial derivatives, transfer pricing, and distress as interaction variable. While these variables were analyzed, the corrected R-squared value of 12.121348 percent suggests that additional factors might also significantly influence tax avoidance behaviors. Future investigations could extend their analyses to encompass other crucial financial factors, such as profitability, leverage, bond rating, company size, and growth rates, as potential independent variables. By considering these additional variables, researchers can gain a more comprehensive understanding of the underlying drivers of tax avoidance within the banking industry.

Addressing these limitations will pave the way for future research that contributes to a more robust and insightful exploration of tax avoidance practices in the banking sector. Researchers can better understand the complexities and specifics of tax avoidance practices in this sector by expanding the scope of participants and investigating a broader range of financial issues, giving significant information to policymakers and practitioners alike.

Significance of the research

This research is crucial for policymakers, regulators, and the industry to develop targeted measures to address loopholes and ensure fair tax practices. By suggesting the inclusion of Islamic banking institutions and non-bank financial enterprises in future research, the study improves the generalizability of findings, allowing for a comprehensive analysis of tax avoidance across different banking institutions. Diversifying the sample beyond conventional banking firms listed on the Indonesia Stock Exchange ensures a more representative analysis, benefiting policymakers and practitioners seeking insights into tax avoidance. Exploring additional independent variables, like profitability, leverage, bond rating, size, and growth, provides valuable insights into the drivers of tax avoidance, guiding policymakers in designing interventions to discourage aggressive tax avoidance and promote compliance. The research's comprehensive findings can inform informed policies, helping policymakers develop effective measures that address tax avoidance while supporting economic growth. Additionally, the study's insights into banking firms' financial practices and their impact on tax liabilities and profitability are valuable for investors, aiding them in making informed investment decisions in the banking industry.

Acknowledgments

The authors are grateful to the Accounting Research Institute, (ARI- HICoE), Universiti Teknologi MARA, Shah Alam, Malaysia, and the Ministry of Higher Education for providing research funding. This paper is part of Indonesia Banking School's repository, which is stored for evaluating lecturer performance in the even semester 2023.

References

Amidu, M., Coffie, W., & Acquah, P. (2019). Transfer pricing, earnings management and tax avoidance of firms in Ghana. Journal of Financial Crime, 26(1), 235-259. DOI: 10.1108/jfc-10-2017-0091 DOI: 10.1108/jfc-10-2017-0091

Blaufus, K., Möhlmann, A., & Schwäbe, A. N. (2019). Stock price reactions to news about corporate tax avoidance and evasion. Journal of Economic Psychology, 72, 278-292. DOI:

Boubaker, S., Derouiche, I., & Nguyen, H. (2022). Voluntary disclosure, tax avoidance and family firms. Journal of Management and Governance, 26(1), 129-158. DOI:

Buettner, T., Overesch, M., Schreiber, U., & Wamser, G. (2012). The impact of thin-capitalization rules on the capital structure of multinational firms. Journal of Public Economics, 96(11-12), 930-938. DOI: 10.1016/j.jpubeco.2012.06.008

Chang, F.-Y., Hsin, C.-W., & Shiah-Hou, S.-R. (2013). A re-examination of exposure to exchange rate risk: The impact of earnings management and currency derivative usage. Journal of Banking & Finance, 37(8), 3243-3257. DOI:

Chyz, J. A., Gaertner, F. B., Kausar, A., & Watson, L. (2019). Overconfidence and Corporate Tax Policy. Review of Accounting Studies, 24(3), 1114-1145. DOI:

Dang, V. C., & Tran, X. H. (2021). The impact of financial distress on tax avoidance: An empirical analysis of the Vietnamese listed companies. Cogent Business & Management, 8(1). DOI: 10.1080/23311975.2021.1953678

Devi, B., & Efendi, S. (2018). Financial Derivatives in Corporate Tax Aggressiveness. The Indonesian Journal of Accounting Research, 21(2). DOI: 10.33312/ijar.360

Dharmapala, D., & Riedel, N. (2013). Earnings shocks and tax-motivated income-shifting: Evidence from European multinationals. Journal of Public Economics, 97, 95-107. DOI: 10.2139/ssrn.1629792

Donohoe, M. (2012). Financial Derivatives in Corporates Tax Avoidance: Why, How, and Who? Working Paper, University of Illinois at Urbana-Champaign. DOI: 10.2139/ssrn.2076858

Donohoe, M. P. (2015). The economic effects of financial derivatives on corporate tax avoidance. Journal of Accounting and Economics, 59(1), 1-24. DOI: 10.1016/j.jacceco.2014.11.001

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2019). When Does Tax Avoidance Result in Tax Uncertainty? The Accounting Review, 94(2), 179-203. DOI: 10.2308/accr-52198

Evers, M., Meier, I., & Finke, K. (2016). The implications of book-tax differences: A meta-analysis. ZEW-Centre for European Economic Research Discussion Paper, (17-003). DOI: 10.2139/ssrn.2910308

Goyal, L. (2022). Stakeholder theory: Revisiting the origins. Journal of Public Affairs, 22(3). DOI: 10.1002/pa.2559

Graham, J. R., Hanlon, M., Shevlin, T., & Shroff, N. (2014). Incentives for tax planning and avoidance: Evidence from the field. The Accounting Review, 89(3), 991-1023. DOI: 10.2308/accr-50678

Gujarati, D. N. (2022). Basic econometrics. Prentice Hall..

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of accounting and Economics, 50(2-3), 127-178. DOI: 10.1016/j.jacceco.2010.09.002

Hanlon, M., Hoopes, J. L., & Shroff, N. (2014). The effect of tax authority monitoring and enforcement on financial reporting quality. The Journal of the American Taxation Association, 36(2), 137-170. DOI: 10.2139/ssrn.1691158

Horngren, C., Harrison, W., Oliver, S., Best, P., Fraser, D., & Tan, R. (2012). Financial accounting. Pearson Higher Education AU.

Koivisto, A., Musoke, N., Nakyambadde, D., & Schimanski, C. (2021). The case of taxing multinational corporations in Uganda: Do multinational corporations face lower effective tax rates and is there evidence for profit shifting? WIDER Working Paper. DOI:

Kovermann, J., & Velte, P. (2019). The impact of corporate governance on corporate tax avoidance—A literature review. Journal of International Accounting, Auditing and Taxation, 36, 100270. DOI:

Lau, C. K. (2016). How corporate derivatives use impact firm performance? Pacific-Basin Finance Journal, 40, 102-114. DOI:

Lim, Y. (2011). Tax avoidance, cost of debt and shareholder activism: Evidence from Korea. Journal of Banking & Finance, 35(2), 456-470. DOI:

Mao, C.-W., & Wu, W.-C. (2019). Moderated mediation effects of corporate social responsibility performance on tax avoidance: evidence from China. Asia-Pacific Journal of Accounting & Economics, 26(1-2), 90-107. DOI:

Maulana, M., Marwa, T., & Wahyudi, T. (2018). The Effect of Transfer Pricing, Capital Intensity and Financial Distress on Tax Avoidance with Firm Size as Moderating Variables. Modern Economics, 11(1), 122-128. DOI:

Nadhifah, M., & Arif, A. (2020). Transfer Pricing, Thin Capitalization, Financial Distress, Earning Management, dan Capital Intensity Terhadap Tax Avoidance Dimoderasi oleh Sales Growth. Jurnal Magister Akuntansi Trisakti, 7(2), 145-170. DOI:

Oktavia, O., & Martani, D. (2013). Level of disclosure and use of financial derivatives in tax avoidance activities. Jurnal Akuntansi dan Keuangan Indonesia, 10(2), 129-146.

Oktavia, O., Siregar, S. V., Wardhani, R., & Rahayu, N. (2019). The role of country tax environment on the relationship between financial derivatives and tax avoidance. Asian Journal of Accounting Research, 4(1), 70-94. DOI:

Organisation for Economic Co-Operation and Development. (OECD). (2019). Model Tax Convention on Income and on Capita. Article 9 Concering The Taxation Of Associated Enterprises. OECD

Pamungkas, T. N., & Nurcahyo, B. (2018). The Role of Multinationality and Transfer Pricing on the Effect of Good Corporate Governance (GCG) and Company's Performance in Tax Avoidance. Journal of Global Economics, 06(04). DOI:

Payne, D. M., & Raiborn, C. A. (2018). Aggressive tax avoidance: A conundrum for stakeholders, governments, and morality. Journal of Business Ethics, 147(3), 469-487. DOI: 10.1108/14720701011069605

Putri, V. R., & Putra, B. I. (2017). The influence of leverage, profitability, company size and the proportion of institutional ownership on tax avoidance. Jurnal Manajemen Dayasaing, 19(1), 1-11. DOI: 10.23917/dayasaing.v19i1.5100

Richardson, G., Lanis, R., & Taylor, G. (2015). Financial distress, outside directors and corporate tax aggressiveness spanning the global financial crisis: An empirical analysis. Journal of Banking & Finance, 52, 112-129. DOI:

Richardson, G., Taylor, G., & Lanis, R. (2013). Determinants of transfer pricing aggressiveness: Empirical evidence from Australian firms. Journal of Contemporary Accounting & Economics, 9(2), 136-150. DOI: 10.1016/j.jcae.2013.06.002

Ruf, M., & Weichenrieder, A. J. (2012). The taxation of passive foreign investment: lessons from German experience. Canadian Journal of Economics/Revue canadienne d'économique, 45(4), 1504-1528. DOI:

Saunders, M., Lewis, P., & Thornhill, A. (2012). Research methods for business students (6. utg.). Harlow: Pearson.

Schroeder, R. G., Clark, M. W., & Cathey, J. M. (2019). Financial accounting theory and analysis: text and cases. John Wiley & Sons.

Sikka, P., & Willmott, H. (2010). The dark side of transfer pricing: Its role in tax avoidance and wealth retentiveness. Critical Perspectives on Accounting, 21(4), 342-356. DOI:

Subramaniam, V., Tang, T. T., Yue, H., & Zhou, X. (2011). Firm structure and corporate cash holdings. Journal of Corporate Finance, 17(3), 759-773.

Swandewi, N. P., & Noviari, N. (2020). Pengaruh Financial Distress dan Konservatisme Akuntansi pada Tax Avoidance. E-Jurnal Akuntansi, 30(7), 1670. DOI:

Tarmidi, D., & Murwaningsari, E. (2019). The influence of earnings management and tax planning on financial distress with audit quality as moderating variable. Research Journal of Finance and Accounting, 10(4), 49-58. DOI: 10.7176/rjfa/10-4-06

Taylor, G., & Richardson, G. (2013). The determinants of thinly capitalized tax avoidance structures: Evidence from Australian firms. Journal of International Accounting, Auditing and Taxation, 22(1), 12-25. DOI: 10.1016/j.intaccaudtax.2013.02.005

Vania, A. S., Nugraha, E., & Nugroho, L. (2018). Does earning management happen in Islamıc bank?(Indonesia and Malaysia comparison). International Journal of Commerce and Finance, 4(2), 47-59

Wang, T. (2019). Product market competition and efficiency of corporate tax management. Asian Review of Accounting, 27(2), 247-272. DOI:

Watts, R. L., & Zimmerman, J. L. (1986). Positive accounting theory. Prentice-Hall Inc.

Wyman, O. (2013). The Asian OTC Derivatives Market. A Study Prepared for ISDA.

Zang, A. Y. (2012). Evidence on the Trade-Off between Real Activities Manipulation and Accrual-Based Earnings Management. The Accounting Review, 87(2), 675-703. DOI:

Zhao, L. (2023). The Effect of Tax Authority Enforcement on Earnings Informativeness. European Accounting Review, 32(1), 197-216. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Çavuşoğlu, F. S., Said, J., & Erum, N. (2023). Leadership Contribution for Spiritual Well-Being of Remote Workers Post Pandemic. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 262-271). European Publisher. https://doi.org/10.15405/epsbs.2023.11.21