Abstract

The financial statements provide an analysis of the effectiveness that management uses to control the resources available to the organisation. In preparing financial statements, management has discretion over which accounting methods to use. According to agency theory, managers manipulate earnings to present financial performance and financial position in a favourable manner. In tax reporting, the objective of companies is to reduce their tax burden in order to increase the value of the company through tax planning strategies. However, aggressive tax avoidance can lead to corporate tax avoidance, which has a negative impact on government revenues. This situation prompted the researcher to investigate whether financial factors influence corporate tax avoidance. Hence, this paper examines the extent to which financial manipulation, leverage, firm size, and profitability influence tax avoidance. The final sample of 470 firm-year observations was analysed using a fixed effects regression model. Using the dataset of trading and service companies listed on Bursa Malaysia from 2016 to 2021, the results suggest that financial manipulation is associated with higher corporate tax avoidance. In addition, there is a positive relationship between companies with high profitability and corporate tax avoidance. Further analysis shows that tax avoidance is lower for firms with higher leverage. However, corporate tax avoidance is not affected by company size. The results suggest that financial variables play an important role in explaining differences in corporate tax avoidance.

Keywords: Corporate Tax Avoidance, Effective Tax Rate, Financial Manipulation, Financial Manipulation, Return On Asset

Introduction

The tax system is crucial to a country's economy. Entrepreneurs, government employees, service providers, and other organizations in both developed and developing countries have always been required to pay taxes to the government (Kassa, 2021). It is essential for governments to collect taxes from their citizens to fund the provision of quality social services to the community. Tax revenues are needed to support both the government's development agenda and the country's economic growth. However, from the perspective of corporate taxpayers, the tax is a burden; moreover, they do not receive any direct rewards, while the payment of corporate income tax is deducted from corporate income (Desmiranti & Sulhendri, 2019), so it is considered as a cash outflow for the company. Hence, managers are motivated to increase book income for financial reporting and decrease taxable income for tax reporting.

As a business entity, the goal of companies is to maximize profits and increase the value of the company. Contrary to the tax authority's goal of increasing public funding, managers are working to reduce their tax liability (Koubaa & Jarboui, 2017). Most studies show that companies choose accounting policies that are beneficial for either financial or tax reporting by applying relevant laws and regulations. In certain cases, managers therefore manipulate profits to reach a certain threshold by exercising greater discretion in financial reporting. Management of publicly traded companies often has a strong incentive to exaggerate reported results to entice investors to invest in their company through the public markets. However, the flexibility of accounting principles provides loopholes for opportunistic managers to practice tax avoidance.

Several accounting scandals have shown that companies are able to both increase their accounting income and decrease their taxable income by taking advantage of tax shelters. This is made possible by the ability of companies to achieve both goals simultaneously. This is illustrated by the case of Mini-Enron in Malaysia, where Transmile Group Berhad overstated its profits through invoices and deferred taxes. As a result, users can no longer rely on the financial information as it does not reflect the actual performance of the company or its current financial status. These phenomena provide examples of managers who have increased their profits through tax avoidance strategies. Thus, the purpose of this study is to examine the relationship between financial manipulation and other financial factors such as leverage, firm size, and profitability with respect to corporate tax avoidance.

The paper is organised as follows: Section 2 discusses the literature on corporate tax avoidance and its financial determinants. Section 3 discusses the research methodology. Section 4 presents the empirical results and the regression model, and Section 5 draws conclusions.

Literature Review and Hypothesis Development

Corporate tax avoidance

Tax planning theory by Hoffman (1961) explained that companies have the right to establish financial plans to reduce their tax liabilities as long as their actions are not prohibited by the authorities or the law. Corporate tax avoidance can be achieved by taking advantage of tax exemptions and allowable deductions in business terms and conditions, as well as by exploiting loopholes in existing tax rules (Pattiasina et al., 2019). Tax avoidance is thus any practice that aims to reduce the amount of tax payable without violating the limits of what is permissible and legal under the standards established by the relevant authorities.

The manager's decision in choosing accounting policies to shape financial and tax reporting may be influenced by different interests of the principal and the agent. This can be explained by agency theory, which is based on the separation of ownership and control (Jensen & Meckling, 1976). According to Ado et al. (2021) there is a conflict of interest between the principal (shareholder) and the agent (manager) due to different motives. To maximise profits and present good performance to shareholders, managers may manipulate financial reporting. Companies benefit from this intentional tax avoidance through a lower overall tax burden. This contradicts the main objective of financial reporting, which requires transparency and accountability.

Corporate tax avoidance can take various forms, ranging from the use of statutory tax provisions to reduce corporate tax burdens to breaking the law (Wang et al., 2020). The extent of tax aggressiveness depends on the strategies that companies adopt. Yee et al. (2018) opined that tax avoidance is considered an acceptable tax planning activity that does not violate applicable rules and regulations. However, companies will pay less tax than the tax rate enacted by the government. In this study, the effective tax rate (ETR) is used as a proxy for corporate tax avoidance to measure the actual taxes paid by the companies. A lower ETR means that firms pay less tax, indicating aggressive tax avoidance by firms. A higher ETR, on the other hand, indicates a lower level of tax avoidance.

Financial manipulation

Financial manipulation is the part of creative accounting strategies that aims to make a company's financial statements reflect desired performance rather than actual performance. According to Beneish (1999), financial manipulation is the practice by managers of violating accounting standards in order to improve the financial performance of the company. This is an attempt to give the company the appearance of a better financial position. According to Houcine and Halaoua (2017), the desire to minimise taxable income may lead managers to shift profits to periods with lower tax rates. Based on studies in 10 Asian countries, Warsini et al. (2019) found that financial manipulation was positively related to aggressive tax avoidance. Hence, this study hypothesizes that:

H1: There is a positive relationship between financial manipulation and corporate tax avoidance.

Leverage

Leverage refers to the use of assets or sources of funds that obligate the firm to bear fixed costs or pay fixed expenses (Murni et al., 2016). Companies can use debt to finance operational needs and business investments, but debt comes with fixed costs, known as interest costs. Due to the tax incentives for interest on debt, this results in lower taxable profits. Companies that choose equity financing cannot deduct dividend payments from tax, while companies that choose debt financing have tax incentives to deduct interest costs from tax. This is supported by Jaffar et al. (2021), where the higher the leverage ratio, the lower the ETR, and therefore the greater the tax avoidance activities of firms. Therefore, this study hypothesizes that:

H2: There is a positive relationship between the leverage and corporate tax avoidance.

Size

Company size is a measure of how big the company is and how well the company manage their business to generate total assets. The larger a company is, the more likely it is to have better management and a better source of funding. Whereas companies with substantial assets and high sales tend to have more consistent and reliable profit margins. A large company has more resources to do good tax planning for tax avoidance. This is consistent with the positive accounting hypothesis, which asserts that businesses tend to utilise accounting methods that have the potential to reduce their profits in the current period to minimise the tax burden (Rani et al., 2018). Therefore, the larger a company is, the more likely it is to engage in tax avoidance (Sonia & Suparmun, 2019). Therefore, this study hypothesizes the following:

H3: There is a positive relationship between size and corporate tax avoidance.

Profitability

The ultimate goal of a business is, among other things, to make a profit. High performance increases shareholder wealth, improves product quality, and leads to new investments. Profitability ratios are ratios used to evaluate the ability of companies to generate profits. This ratio is also a measure of management efficiency in a company. From the study of Desmiranti and Sulhendri (2019), it evident that profitability has a significant impact on tax avoidance, which means that higher profitability of the company further minimises the amount of ETR, which shows the possibility of high tax avoidance. Therefore, this study hypothesizes that:

H4: There is a positive relationship between profitability and corporate tax avoidance.

Method

Sample selection and data collection

The sample for this study consists of trading services companies listed on Bursa Malaysia from 2016 to 2021, with a total population of 191 companies. The trading and services sector were chosen because it has become increasingly important in the Malaysian economy in recent years and accounts for the largest share of GDP (Alavi, 2018). The financial data was retrieved from Thomson Datastream. The main objective of this study is to investigate the determinants of corporate tax avoidance, therefore, companies with negative pre-tax income are removed from the final sample. Next, companies with missing data were also excluded because they are not sufficient to measure the variables in this study. After excluding the companies that were no longer listed on Bursa Malaysia during the study period, only 71 companies remained in the sample. Finally, the sample decreased by one company because it changed its accounting period. By eliminating the outliers, the final sample of this study consists of 70 companies with 420 firm-year observations. A summary of the final sample can be found in Table 1.

Variable measurement and model specification

The effective tax rate (ETR) is used as a dependent variable indicating corporate tax avoidance. The ETR has been used extensively by previous researchers to measure tax avoidance (Desmiranti & Sulhendri, 2019; Gita et al., 2021; Rani et al., 2018). Financial manipulation, profitability, leverage, and size are used as independent variables to examine the determinants of corporate tax avoidance. Table 2 provides a comprehensive summary of the measurements for each variable.

Financial manipulation is calculated based on the Beneish model, which is based on the M-score. The M-score is composed of eight variables that can be calculated based on the information contained in the financial statements of companies (Beneish, 1999).The eight financial ratios were: Days Sales Outstanding Index (DSRI), Gross Margin Index (GMI), Asset Quality Index (AQI), Sales Growth Index (SGI), Depreciation and Amortisation Index (DEPI), Selling, General and Administrative Expenses Index (SGAI), Total Accruals to Total Assets Ratio (TATA), and Leverage Ratio Index (LVGI). These ratios were calculated using the following formula:

M =−4.84 + 0.92 × DSRI + 0.528 × GMI + 0.404 × AQI + 0.892 × SGI + 0.115 × DEPI − 0.172 × SGAI + 4.679 × TATA − 0.327 × LVGI

As for leverage, the debt-equity ratio is calculated to measure the long-term debt used to finance the company's assets. To measure the size of the company, it can be calculated using total assets, since the size of the company is formulated by natural log of total assets. For profitability, the return on assets is used as an indicator of a company's ability to generate profits. It is the ratio between net profit and total assets at the end of the period. In achieving the objective of this study, regression analysis is performed to investigate the influence of the independent variables on the dependent variables. The regression equation is estimated as follows:

CTA it = β + β1FM it + β2LEV it + β3SIZE it + β4PROFIT it + ε

Where: i = company, t = company’s financial years between 2016 – 2021, CTA = Corporate Tax Avoidance, FM = Financial Manipulation, LEV = Leverage, SIZE = Firm Size, PROFIT= Profitability, β is the coefficient of regression, ε is the error term.

Result and Discussion

Table 3 presents summary data for all variables in the study, including mean, standard deviation, median, minimum, and maximum from 420 firm-year observations. Regarding corporate tax avoidance, the mean value of the ETR is 29.54%, which is higher than the statutory tax rate. This is consistent with the findings of Salaudeen and Eze (2018) that firms in the trading and services sectors face high ETR. The maximum and minimum values of ETR are 100% and 0%, indicating that some companies do not engage in corporate tax avoidance while the others aggressively minimize their tax liability and pay almost no taxes. Meanwhile, the financial manipulation has mean value of -1.01. Based on Beneish's (1999) model, companies with a mean M-score greater than -2.22 during the study period indicated that they were likely to manipulate their profits. In contrast, if the M-score is below the threshold, a company is unlikely to be involved in financial manipulation.

The results of the Breusch-Pagan test and the Hausman test are used to select the best estimation model, as shown in Table 4. The Breusch-Pagan test showed that REM with a P value less than 0.05 is more suitable than POLS. According to the result of Hausman test, the p-value is less than the significance level of 5% because it has a probability value of 0.00. Therefore, the null hypothesis is rejected, which means that the fixed effects model is preferable.

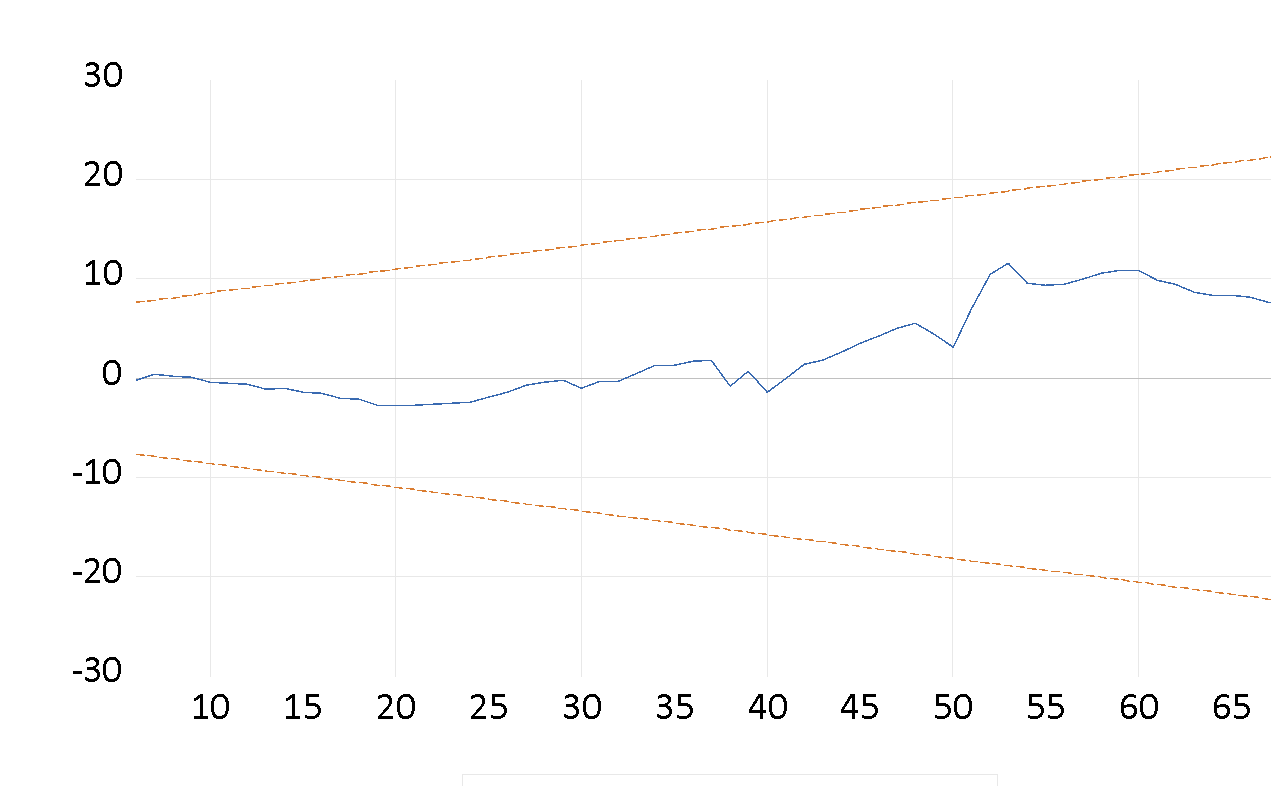

As shown in Figure 1, cumulative sum tests (CUSUM) were used to determine the stability of the model parameters. The lines represent the upper and lower bounds of the 5% confidence interval. The plots show that the parameters are stable with the sum of squared residuals falling below the 5% significance threshold. The CUSUM plot shows that the model is stable at a significance level of 0.05 and that the financial data are significant for further investigation.

The regression analysis used to test the model is shown in Table 5. The regression model is significant in explaining the factors affecting ETR, with an adjusted R-squared of 26%. The adjusted R-squared of this study is higher than that of the study by Jaffar et al. (2021) on the tax aggressiveness of companies listed on the Access, Certainty, Efficiency (ACE) Market in Bursa Malaysia ($not-found(0.1964).1964), the study by Mocanu et al. (2021) on Romanian companies (0.2301), and the study by Hazir (2019) on Turkish listed companies (0.093). Moreover, the Durbin-Watson value of 2.35 indicates that there is no autocorrelation. Moreover, the probability of F-statistic of 45.59082 with the p-value of 0.0000 indicates that the regression result is statistically significant as it is below the significance level of 5%.

The regression results show a negative relationship between financial manipulation and ETR, suggesting that firms with a high manipulation score have a significant impact on aggressive corporate tax avoidance. This result underpins agency theory by Jensen and Meckling (1976), which states that managers act unethically to maximize their own financial gain because of a conflict of interest. The results support the empirical findings in Savira et al. (2019) and support H1.

As for the leverage, there is a significant relationship between debt ratio and ETR. Thus, H2 is accepted. The results suggest that firms with high debt have a positive significant effect on the level of ETR. In contrast to previous research, the findings indicate that a higher debt ratio for trading and service firms reduces the likelihood that they engage in corporate tax avoidance. As supported by Koh and Lee (2015), tax avoidance is likely to be the main concern of companies with more long-term debt financing. The researchers contend that companies with high debt levels are eager to comply with tax rules and regulations to avoid large penalties. This could be related to the fact that firms facing financial distress have higher shareholder expectations about their cash flows. Therefore, they show that they have sufficient cash flow to pay a higher tax.

Further, the results however revealed that there is no relationship between firm size and ETR, implying that a firm’s ETR is not related to its size. This is in line with the study by Salaudeen and Eze (2018) and Gita et al. (2021). It can be concluded that that the extent of corporate tax avoidance was not influenced by the size of the companies involved. Consequently, H3 is rejected.

In terms of profitability, the results show that there is a negative relationship between ROA and ETR. As profitability increases, ETR decreases, which means that corporate tax avoidance increases and supports H4. The findings in this study are consistent with Irianto et al. (2017) and Rani et al. (2018). This suggests that higher profitability leads to lower ETR, which implies that firms with high profits adopt tax avoidance measures to reduce tax payment. This could be related to the fact that more profitable firms try to avoid cash outflows to maintain profitability.

Conclusion

This paper analyzes the impact of financial variables on tax avoidance of listed trading and service companies during 2016-2021. The regression result shows that financial manipulation and profitability have a negative impact on ETR. This suggests that companies manipulate their income as a strategic tool for tax avoidance. The study also found evidence that highly leveraged firms face higher ETR. The results suggest that financial data can influence the extent of tax avoidance by companies. This is because managers use different accounting methods to measure their income, which may lead to differences in the extent of tax avoidance across companies. Consequently, companies can use the reported financial information for their tax planning strategies to reduce the tax burden. Therefore, good corporate governance such as board structure and audit quality is needed to curb aggressive corporate tax avoidance, which may have a negative impact on tax collection by the government.

However, this study has several limitations. The sample includes only trading and service firms, so the result cannot be generalized to all firms listed on Bursa Malaysia because different industries may receive different tax incentives, which may affect the level of ETR and firms' tax planning strategies. Therefore, other factors such as ownership structure, corporate restructuring leading to merger or acquisition, or managerial impact that may affect ETR can also be included in this study. Further research should also consider these aspects.

References

Ado, A. B., Rashid, N., Mustapha, U. A., & Lateef, S. A. (2021). The Impact of Corporate Tax Planning on the Financial Performance of Listed Companies in Nigeria. International Journal of Economics, Management and Accounting, 273-297.

Alavi, R. (2018). Services Sector Reforms in Malaysia. Malaysia’s Trade Governance at a Crossroads, 111.

Beneish, M. D. (1999). The Detection of Earnings Manipulation. Financial Analysts Journal, 55(5), 24-36. DOI:

Desmiranti, D., & Sulhendri, S. (2019). Determinant Tax Avoidance. KnE Social Sciences, 3(26), 921–947. DOI:

Gita, I. A. M. A., Partika, I. D. M., & Suciwati, D. P. (2021). Effect Firm Size, Profitability and Inventory Intensity Against Effective Tax Rate (ETR). Journal of Applied Sciences in Accounting, Finance, and Tax, 4(1), 9-15.

Hazir, Ç. A. (2019). Determinants of Effective Tax Rates in Turkey. Journal of Research in Business, 4(1), 35-45. DOI:

Hoffman, W. H. (1961). The Theory of Tax Planning. The Accounting Review, 36(2), 274–280.

Houcine, A., & Halaoua, S. (2017). Do Tunisian firms manage earnings to attain thresholds? International Journal of Managerial and Financial Accounting, 9(1), 19. DOI:

Irianto, B. S., Sudibyo, Y. A., & S.Ak, A. W. (2017). The Influence of Profitability, Leverage, Firm Size and Capital Intensity Towards Tax Avoidance. International Journal of Accounting and Taxation, 5(2). DOI: 10.15640/ijat.v5n2a3

Jaffar, R., Derashid, C., & Taha, R. (2021). Determinants of Tax Aggressiveness: Empirical Evidence from Malaysia. Journal of Asian Finance, 8(5), 179–0188. DOI: 10.13106/jafeb.2021.vol8.no5.0179

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. DOI:

Kassa, E. T. (2021). Factors influencing taxpayers to engage in tax evasion: evidence from Woldia City administration micro, small, and large enterprise taxpayers. Journal of Innovation and Entrepreneurship, 10(1). DOI: 10.1186/s13731-020-00142-4

Koh, Y., & Lee, H.-A. (2015). The effect of financial factors on firms' financial and tax reporting decisions. Asian Review of Accounting, 23(2), 110-138. DOI:

Koubaa, R. R., & Jarboui, A. (2017). Direct and mediated associations among earnings quality, book-tax differences and the audit quality. Journal of Financial Reporting and Accounting, 15(3), 293–316. DOI: 10.1108/JFRA-06-2016-0052

Mocanu, M., Constantin, S.-B., & Răileanu, V. (2021). Determinants of tax avoidance - evidence on profit tax-paying companies in Romania. Economic Research-Ekonomska Istraživanja, 34(1), 2013-2033. DOI: 10.1080/1331677x.2020.1860794

Murni, Y., Sudarmaji, E., & Sugihyanti, E. (2016). The role of institutional ownerships, board of independent commissioner, and leverage: Corporate tax avoidance in Indonesia. IOSR Journal of Business and Management, 18(11), 79-85. DOI:

Pattiasina, V., Tammubua, M. H., Numberi, A., Patiran, A., & Temalagi, S. (2019). Capital intensity and tax avoidance. International Journal of Social Sciences and Humanities, 3(1), 58–71. DOI: 10.29332/ijssh.v3n1.250

Rani, S., Susetyo, D., & Fuadah, L. L. (2018). The effects of the corporate’s characteristics on tax avoidance moderated by earnings management (Indonesian evidence). Journal of Accounting, Finance and Auditing Studies, 4/3(2018), 149-169.

Salaudeen, Y. M., & Eze, U. C. (2018). Firm specific determinants of corporate effective tax rate of listed firms in Nigeria. Journal of Accounting and Taxation, 10(2), 19-28.

Savira, O., Fuadah, L. L., & Azwardi, A. (2019). Do female directors moderate the association between financial reporting aggressiveness and tax aggressiveness? A study of listed mining companies in Indonesia Stock Exchange, Eurasia: Economics & Business, 5(23), 1-10. DOI: 10.18551/econeurasia.2019-05

Sonia, S., & Suparmun, H. (2019). Factors Influencing Tax Avoidance. Proceedings of the 5th Annual International Conference on Accounting Research (AICAR 2018) DOI:

Wang, F., Xu, S., Sun, J., & Cullinan, C. P. (2020). Corporate Tax Avoidance: A Literature Review and Research Agenda. Journal of Economic Surveys, 34(4), 793–811. DOI: 10.1111/joes.12347

Warsini, S., Siregar, S. V., Martani, D., & Sensi W, L. (2019). The Effect of Family Ownership on the Relationship Between Aggressive Financial And Tax Reporting: Evidence From 10 Asian Countries. Proceedings of the First International Conference on Technology and Educational Science. DOI: 10.4108/eai.21-11-2018.2282297

Yee, C. S., Sapiei, N. S., & Abdullah, M. (2018). Tax avoidance, corporate governance and firm value in the digital era. Journal of Accounting and Investment, 19(2), 160-175. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 November 2023

Article Doi

eBook ISBN

978-1-80296-131-7

Publisher

European Publisher

Volume

132

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-816

Subjects

Accounting and finance, business and management, communication, law and governance

Cite this article as:

Nasir, N. E. M., Zainazor, Z., Rashid, N., Yaacob, N. M., & Kamarudin, S. N. (2023). Corporate Tax Avoidance: Evidence From Trading and Services Companies. In N. M. Suki, A. R. Mazlan, R. Azmi, N. A. Abdul Rahman, Z. Adnan, N. Hanafi, & R. Truell (Eds.), Strengthening Governance, Enhancing Integrity and Navigating Communication for Future Resilient Growth, vol 132. European Proceedings of Social and Behavioural Sciences (pp. 416-425). European Publisher. https://doi.org/10.15405/epsbs.2023.11.02.31